Arvinas, Inc. (Nasdaq: ARVN), a clinical-stage biotechnology

company creating a new class of drugs based on targeted protein

degradation, today reported financial results for the second

quarter ended June 30, 2024, and provided a corporate update.

“During the second quarter, we continued making meaningful

progress across our entire portfolio, with upcoming milestones that

will further support our mission to improve patient lives with

pioneering therapies from our revolutionary PROTAC® protein

degradation platform,” said John Houston, Ph.D., Chairperson, Chief

Executive Officer and President at Arvinas. “The readout of

VERITAC-2, our first Phase 3 clinical trial, will be a landmark

event for Arvinas. We are on-track to complete enrollment in the

fourth quarter of the year, with topline data anticipated in either

the fourth quarter of 2024 or first quarter of 2025. If positive,

we believe these results will support our first new drug

application filing and our transition to a commercial-stage

company, assuming regulatory approval.”

“We are well on our way to becoming a multi-product,

commercial-stage organization with strong leadership and a robust

pipeline across several indications,” continued Dr. Houston. “Our

first PROTAC degrader with the potential to treat neurodegenerative

diseases, ARV-102, was recently cleared to initiate the multiple

ascending dose portion of our Phase 1 clinical trial. In addition,

we initiated the first-in-human Phase 1 clinical trial in patients

with B-cell lymphomas with our PROTAC BCL6 degrader ARV-393. I’m

excited by the progress we have made and the ongoing confidence we

have in our PROTAC platform, which was further validated by our

recent strategic transaction with Novartis. We believe Novartis

will accelerate and broaden the development of ARV-766 as a

potential best-in-class treatment for patients with prostate

cancer.”

Recent Developments and 2Q Business

Highlights

Vepdegestrant

- Evaluated enrollment and blinded event rates in the ongoing

VERITAC-2 Phase 3 monotherapy clinical trial (NCT05654623) in

patients with metastatic breast cancer.

- The trial is on track to complete enrollment in 4Q24.

- Based on current trial status, the primary completion date has

been reprojected to November 2024, with topline data now

anticipated in 4Q24/1Q25.

- Completed enrollment of the study lead-in for the VERITAC-3

Phase 3 clinical trial of vepdegestrant in combination with

palbociclib as a first-line treatment in patients with estrogen

receptor (ER) positive/human growth epidermal growth factor 2

(HER2) negative (ER+/HER2-) locally advanced or metastatic breast

cancer.

- Continued enrollment globally in multiple clinical studies of

vepdegestrant in ER+/HER2- metastatic breast cancer.

- Presented updated clinical data from a Phase 1b clinical trial

combination cohort evaluating vepdegestrant in combination with

palbociclib in heavily pre-treated patients with locally advanced

or metastatic ER+/HER2- breast cancer at the 2024 European Society

for Medical Oncology (ESMO) Breast Cancer Annual Congress.

- After six months of additional follow-up, updated data from the

trial continued to demonstrate an encouraging clinical benefit

rate, objective response rate and progression-free survival, and a

consistent safety profile as previously reported at the San Antonio

Breast Cancer Symposium (SABCS) in December 2023.

- The clinical benefit rate across all dose levels (n=46) was

63%; the objective response rate in evaluable patients with

measurable disease at baseline (n=31) was 42%; median

progression-free survival based on 27 (59%) events across all dose

levels was 11.2 months (95% CI: 8.2 – 16.5) and the safety profile

of vepdegestrant in combination with palbociclib were consistent

with data previously reported at SABCS in December 2023.

- Patients receiving the recommended Phase 3 dose of

vepdegestrant (200mg) in combination with palbociclib 125mg (n=21),

achieved a median progression-free survival of 13.9 months (95% CI:

8.1-NR).

Strategic Transaction with Novartis

- Entered into a license agreement and asset purchase agreement

with Novartis (NYSE: NVS) for the exclusive, worldwide development,

manufacture and commercialization of ARV-766, Arvinas’ second

generation PROTAC® androgen receptor (AR) degrader for patients

with prostate cancer, and the sale of Arvinas’ preclinical AR-V7

program, which closed on May 28, 2024.

- Arvinas received a one-time, upfront

payment in the aggregate amount of $150.0 million in accordance

with the terms of the license agreement and the asset purchase

agreement. Under the terms of the license agreement, Arvinas is

also eligible to receive up to an additional $1.01 billion as

contingent payments based on specified development, regulatory, and

commercial milestones for ARV-766 being met, as well as tiered

royalties based upon worldwide net sales of ARV-766.

Pipeline

ARV-102: Oral PROTAC LRRK2 degrader

- Presented preclinical data at the Biennial International LRRK2

Meeting further supporting the potential of PROTAC-induced

leucine-rich repeat kinase 2 (LRRK2) degradation as a potential

treatment for neurodegenerative diseases. Key findings included:

- With Arvinas' PROTAC LRRK2 degrader, near-complete LRRK2 target

engagement, as well as LRRK2 degradation, in mouse and non-human

primate lung and brain.

- Differing effects of the LRRK2 PROTAC degraders in the lungs

compared to kinase inhibitors, suggesting reduced pulmonary

function risk.

- Substantially less Type II pneumocyte enlargement compared to

MLi-2, an experimental LRRK2 kinase inhibitor.

- Surfactant protein accumulation in mouse lung observed after

treatment with the LRRK2 kinase inhibitor MLi-2, but not after

treatment with the PROTAC LRRK2 degrader.

- No evidence of collagen deposition in lung to date with PROTAC

LRRK2 degraders in non-human primates.

- Received health authority approval to initiate the multiple

ascending dose portion of the ongoing Phase 1 clinical trial in

healthy volunteers with the PROTAC LRRK2 degrader ARV-102.

ARV-393: Oral PROTAC BCL6 degrader

- Presented preclinical data for ARV-393 at the European

Hematology Association 2024 Annual Congress that showed ARV-393:

- Potently and rapidly degraded the BCL6 protein and inhibited

cell growth in diffuse large B-cell lymphoma (DLBCL) and Burkitt

cell lines.

- Showed tumor growth inhibition, including tumor regression, in

various DLBCL cell line-derived xenograft (CDX) models and in

multiple patient-derived xenograft (PDX) models of non-Hodgkin

lymphoma (NHL), including germinal center B-cell-like (GCB),

activated B-cell (ABC), GCB/ABC, BCL not otherwise specified

(BCL/NOS) subtypes of DLBCL, and Burkitt lymphoma.

- Initiated the first-in-human Phase 1 clinical trial in patients

with B-cell lymphomas with PROTAC BCL6 degrader ARV-393.

Corporate

- Announced the appointment of Andrew Saik, MBA, to the role of

Chief Financial Officer.

- Announced the promotion of Ian Taylor, Ph.D., to President of

Research and Development.

- Announced the promotion of Angela Cacace, Ph.D., to Chief

Scientific Officer.

- Announced the promotion of Randy Teel, Ph.D., to Chief Business

Officer.

Anticipated Upcoming Milestones and

Expectations

Vepdegestrant (ARV-471)As part of Arvinas’

global collaboration with Pfizer, the companies plan to:

- Complete enrollment (4Q24) and announce topline data

(4Q24/1Q25) for the VERITAC-2 Phase 3 monotherapy clinical

trial.

- Evaluate data from the study lead-in of the VERITAC-3 Phase 3

trial to support dose selection for vepdegestrant plus palbociclib

in planned Phase 3 combination trials in patients with ER+/HER2-

locally advanced or metastatic breast cancer (2H24).

- Present initial safety and pharmacokinetic data from the

abemaciclib arm of the ongoing TACTIVE-U trial (2H24).

- Continue enrollment of the ongoing Phase 1b/2 combination

umbrella trial evaluating combinations of vepdegestrant with

abemaciclib, ribociclib, or samuraciclib (TACTIVE-U;

ClinicalTrials.gov Identifiers: NCT05548127, NCT05573555, and

NCT06125522).

- Continue enrollment and evaluate preliminary data from the

ongoing clinical trial with vepdegestrant plus Pfizer’s novel CDK4

inhibitor atirmociclib (TACTIVE-K; ClinicalTrials.gov Identifier:

NCT06206837) to inform the study design for the planned Phase 3

first line combination trial with either atirmociclib or

palbociclib, with planned initiation in 2025.

Pipeline

- Continue enrollment in the single ascending dose portion of the

Phase 1 clinical trial in healthy volunteers with the PROTAC LRRK2

degrader ARV-102 and begin enrolling the multiple ascending dose

portion by the end of 2024.

- Continue enrollment in the first-in-human Phase 1 clinical

trial in patients with B-cell lymphomas with PROTAC BCL6 degrader

ARV-393.

Financial Guidance Based on its current

operating plan, Arvinas believes its cash, cash equivalents,

restricted cash and marketable securities as of June 30, 2024, is

sufficient to fund planned operating expenses and capital

expenditure requirements into 2027.

Second Quarter Financial ResultsCash,

Cash Equivalents, Restricted Cash and Marketable Securities

Position: As of June 30, 2024, cash, cash equivalents,

restricted cash and marketable securities were $1,234.2 million as

compared with $1,266.5 million as of December 31, 2023. The

decrease in cash, cash equivalents, restricted cash and marketable

securities of $32.3 million for the six months ended June 30, 2024

was primarily related to cash used in operations of $36.0 million

(net of $150.0 million received from the Novartis agreements),

unrealized losses on marketable securities of $0.7 million and the

purchase of lab equipment and leasehold improvements of $0.8

million, partially offset by proceeds from the exercise of stock

options of $5.3 million.

Research and Development Expenses: Research and

development expenses were $93.7 million for the quarter ended June

30, 2024, as compared with $103.4 million for the quarter ended

June 30, 2023. The decrease in research and development expenses of

$9.7 million for the quarter was primarily due to decreases in

expenses related to our ER program (which includes the cost sharing

of vepdegestrant under the Vepdegestrant (ARV-471) Collaboration

Agreement with Pfizer) of $6.6 million and our platform and

exploratory programs of $5.7 million, partially offset by an

increase in our AR program (which includes ARV-766 and

bavdegalutamide (ARV-110)) of $2.6 million.

General and Administrative Expenses: General

and administrative expenses were $31.3 million for the quarter

ended June 30, 2024, as compared with $25.7 million for the quarter

ended June 30, 2023. The increase in general and administrative

expenses of $5.6 million for the quarter was primarily due to an

increase in personnel and infrastructure related costs of $4.0

million and professional fees of $1.6 million.

Revenues: Revenues were $76.5 million for the

quarter ended June 30, 2024, as compared with $54.5 million for the

quarter ended June 30, 2023. Revenue for the quarter is related to

the license agreement and the asset purchase agreement with

Novartis, the Vepdegestrant (ARV-471) Collaboration Agreement with

Pfizer, the collaboration and license agreement with Bayer, the

collaboration and license agreement with Pfizer, and revenue

related to our Oerth Bio joint venture. The increase in revenue of

$22.0 million was primarily due to revenue from the Novartis

agreements, which were entered into during the quarter, of $45.4

million, offset by a decrease in revenue from the Vepdegestrant

(ARV-471) Collaboration Agreement with Pfizer of $22.2 million and

a decrease of $1.3 million of previously constrained deferred

revenue related to our Oerth Bio joint venture.

About VepdegestrantVepdegestrant is an

investigational, orally bioavailable PROTAC protein degrader

designed to specifically target and degrade the estrogen receptor

(ER) for the treatment of patients with ER positive (ER+)/human

epidermal growth factor receptor 2 (HER2) negative (ER+/HER2-)

breast cancer. Vepdegestrant is being developed as a potential

monotherapy and as part of combination therapy across multiple

treatment settings for ER+/HER2- metastatic breast cancer.

In July 2021, Arvinas announced a global collaboration with

Pfizer for the co-development and co-commercialization of

vepdegestrant; Arvinas and Pfizer will share worldwide development

costs, commercialization expenses, and profits.

The U.S. Food and Drug Administration (FDA) has granted

vepdegestrant Fast Track designation as a monotherapy in the

treatment of adults with ER+/HER2- locally advanced or metastatic

breast cancer previously treated with endocrine-based therapy.

About ArvinasArvinas (Nasdaq: ARVN) is a

clinical-stage biotechnology company dedicated to improving the

lives of patients suffering from debilitating and life-threatening

diseases. Through its PROTAC® (PROteolysis Targeting Chimera)

protein degrader platform, the Company is pioneering the

development of protein degradation therapies designed to harness

the body’s natural protein disposal system to selectively and

efficiently degrade and remove disease-causing proteins. Arvinas is

currently progressing multiple investigational drugs through

clinical development programs, including vepdegestrant, targeting

the estrogen receptor for patients with locally advanced or

metastatic ER+/HER2- breast cancer; ARV-102, targeting LRRK2 for

neurodegenerative disorders; and ARV-393, targeting BCL6 for

relapsed/refractory non-Hodgkin Lymphoma. Arvinas is headquartered

in New Haven, Connecticut. For more information about Arvinas,

visit www.arvinas.com and connect on LinkedIn and X.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995 that involve

substantial risks and uncertainties, including statements regarding

the expected timing in connection with the completion of enrollment

and readout of topline data from the VERITAC-2 clinical trial,

submission of Arvinas’ first new drug application filing and

transition to a commercial-stage company, assuming regulatory

approval, the availability and timing of data from other clinical

trials, the receipt of milestone and royalty payments in connection

with the transaction with Novartis and the future development,

potential marketing approval and commercialization of ARV-766,

the potential of Arvinas’ PROTAC protein degrader platform and its

potential to deliver new treatments, Arvinas’ and Pfizer’s plans to

determine the recommended palbociclib dose to be combined with

vepdegestrant in the planned Phase 3 combination trials in patients

with ER+/HER2- locally advanced or metastatic breast cancer, and

statements regarding Arvinas’ cash, cash equivalents, restricted

cash and marketable securities. All statements, other than

statements of historical fact, contained in this press release,

including statements regarding Arvinas’ strategy, future

operations, future financial position, future revenues, projected

costs, prospects, plans and objectives of management, are

forward-looking statements. The words “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “may,” “might,” “plan,” “predict,”

“project,” “target,” “potential,” “will,” “would,” “could,”

“should,” “continue,” and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words.

Arvinas may not actually achieve the plans, intentions or

expectations disclosed in these forward-looking statements, and you

should not place undue reliance on such forward-looking statements.

Actual results or events could differ materially from the plans,

intentions and expectations disclosed in the forward-looking

statements Arvinas makes as a result of various risks and

uncertainties, including but not limited to: Arvinas’ and Pfizer’s

performance of the respective obligations with respect to Arvinas’

collaboration with Pfizer; whether Arvinas and Pfizer will be able

to successfully conduct and complete clinical development for

vepdegestrant; whether Arvinas will be able to successfully conduct

and complete development for its other product candidates and

including whether Arvinas initiates and completes clinical trials

for its product candidates and receive results from its clinical

trials on its expected timelines or at all; whether Arvinas and

Pfizer, as appropriate, will be able to obtain marketing approval

for and commercialize vepdegestrant and other product candidates on

current timelines or at all; Arvinas’ and Novartis’ performance of

their respective obligations under the license agreement; whether

Novartis will be able to successfully conduct and complete clinical

development, obtain marketing approval for and commercialize

ARV-766; Arvinas’ ability to protect its intellectual property

portfolio; whether Arvinas’ cash and cash equivalent resources will

be sufficient to fund its foreseeable and unforeseeable operating

expenses and capital expenditure requirements, and other important

factors discussed in the “Risk Factors” section of Arvinas’ Annual

Report on Form 10-K for the year ended December 31, 2023 and

subsequent other reports on file with the U.S. Securities and

Exchange Commission. The forward-looking statements contained in

this press release reflect Arvinas’ current views with respect to

future events, and Arvinas assumes no obligation to update any

forward-looking statements, except as required by applicable law.

These forward-looking statements should not be relied upon as

representing Arvinas’ views as of any date subsequent to the date

of this release.

ContactsInvestors:Jeff Boyle+1

(347) 247-5089Jeff.Boyle@arvinas.com

Media:Kirsten Owens+1 (203)

584-0307Kirsten.Owens@arvinas.com

| Arvinas,

Inc. |

| Condensed

Consolidated Balance Sheets (Unaudited) |

| |

| (dollars and

shares in millions, except per share amounts) |

June 30,2024 |

December 31,2023 |

|

Assets |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

$ |

154.8 |

|

$ |

311.7 |

|

|

Restricted cash |

|

5.5 |

|

|

5.5 |

|

|

Marketable securities |

|

1,073.9 |

|

|

949.3 |

|

|

Other receivables |

|

10.0 |

|

|

7.2 |

|

|

Prepaid expenses and other current assets |

|

12.5 |

|

|

6.5 |

|

|

Total current assets |

|

1,256.7 |

|

|

1,280.2 |

|

| Property,

equipment and leasehold improvements, net |

|

9.8 |

|

|

11.5 |

|

| Operating

lease right of use assets |

|

1.5 |

|

|

2.5 |

|

|

Collaboration contract asset and other assets |

|

11.6 |

|

|

10.4 |

|

|

Total assets |

$ |

1,279.6 |

|

$ |

1,304.6 |

|

|

Liabilities and stockholders' equity |

|

|

|

Current liabilities: |

|

|

|

Accounts payable and accrued liabilities |

$ |

78.1 |

|

$ |

92.2 |

|

|

Deferred revenue |

|

267.9 |

|

|

163.0 |

|

|

Current portion of operating lease liabilities |

|

1.2 |

|

|

1.9 |

|

|

Total current liabilities |

|

347.2 |

|

|

257.1 |

|

| Deferred

revenue |

|

331.3 |

|

|

386.2 |

|

| Long term

debt |

|

0.7 |

|

|

0.8 |

|

| Operating

lease liabilities |

|

0.2 |

|

|

0.5 |

|

|

Total liabilities |

|

679.4 |

|

|

644.6 |

|

|

Stockholders’ equity: |

|

|

|

Preferred stock, $0.001 par value, zero shares issued and

outstanding as of June 30, 2024 and December 31, 2023,

respectively |

|

— |

|

|

— |

|

|

Common stock, $0.001 par value; 68.6 and 68.0 shares issued and

outstanding as of June 30, 2024 and December 31, 2023,

respectively |

|

0.1 |

|

|

0.1 |

|

|

Accumulated deficit |

|

(1,437.3 |

) |

|

(1,332.7 |

) |

|

Additional paid-in capital |

|

2,041.2 |

|

|

1,995.7 |

|

|

Accumulated other comprehensive loss |

|

(3.8 |

) |

|

(3.1 |

) |

|

Total stockholders’ equity |

|

600.2 |

|

|

660.0 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,279.6 |

|

$ |

1,304.6 |

|

| |

|

|

| Arvinas,

Inc. |

| Condensed

Consolidated Statements of Operations (Unaudited) |

| |

|

|

|

|

| |

Three Months EndedJune 30, |

Six Months EndedJune 30, |

|

(dollars and shares in millions, except per share amounts) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

$ |

76.5 |

|

$ |

54.5 |

|

$ |

101.8 |

|

$ |

87.0 |

|

|

Operating expenses: |

|

|

|

|

|

Research and development |

|

93.7 |

|

|

103.4 |

|

|

178.0 |

|

|

198.6 |

|

|

General and administrative |

|

31.3 |

|

|

25.7 |

|

|

55.6 |

|

|

50.7 |

|

|

Total operating expenses |

|

125.0 |

|

|

129.1 |

|

|

233.6 |

|

|

249.3 |

|

| Loss

from operations |

|

(48.5 |

) |

|

(74.6 |

) |

|

(131.8 |

) |

|

(162.3 |

) |

| Interest and

other income |

|

13.5 |

|

|

9.0 |

|

|

27.5 |

|

|

15.5 |

|

| Net

loss before income taxes and loss from equity method

investment |

|

(35.0 |

) |

|

(65.6 |

) |

|

(104.2 |

) |

|

(146.8 |

) |

|

Income tax (expense) benefit |

|

(0.2 |

) |

|

0.3 |

|

|

(0.3 |

) |

|

0.7 |

|

|

Loss from equity method investment |

|

— |

|

|

(1.3 |

) |

|

— |

|

|

(2.4 |

) |

| Net

loss |

$ |

(35.2 |

) |

$ |

(66.6 |

) |

$ |

(104.6 |

) |

$ |

(148.5 |

) |

| Net

loss per common share, basic and diluted |

$ |

(0.49 |

) |

$ |

(1.25 |

) |

$ |

(1.46 |

) |

$ |

(2.78 |

) |

|

Weighted average common shares outstanding, basic and

diluted |

|

71.9 |

|

|

53.4 |

|

|

71.7 |

|

|

53.4 |

|

| |

|

|

|

|

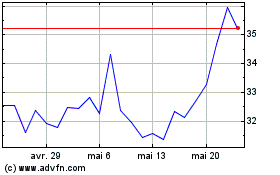

Arvinas (NASDAQ:ARVN)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Arvinas (NASDAQ:ARVN)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024