Altisource Portfolio Solutions S.A. (“Altisource” or the “Company”)

(NASDAQ: ASPS), a leading provider and marketplace for the real

estate and mortgage industries, today announced certain preliminary

unaudited financial results for July 2023, a status update on the

July 2023 cost reduction plan, updated guidance for adjusted

earnings before interest, tax, depreciation and amortization

(“Adjusted EBITDA”) for the second half of 2023, and an updated

Run-Rate scenario.

“Altisource continues to execute on its strategy

to recover from the impact of the pandemic. We believe our July

2023 Adjusted EBITDA(1) of $0.1 million, updated outlook for the

third quarter of break-even to $1 million of Adjusted EBITDA(1),

and outlook for full year 2023 positive Adjusted EBITDA(1)

demonstrates our progress. We are also on plan to reduce annual

cash operating expenses by $13.5 million compared to the annualized

second quarter cash operating expenses. Based upon our progress in

the third quarter, we estimate that we will generate $1.0 million

per month of expense savings for the month of September 2023,” said

William B. Shepro, Chairman and Chief Executive Officer of

Altisource.

The Company has prepared the preliminary

estimates of financial results for the month of July 2023 in good

faith based upon the most recent information available to

management from the Company’s internal reporting procedures as of

the date of this press release. The estimated amounts set forth

herein are preliminary, unaudited and subject to further

completion, reflect our current good faith estimates, are subject

to additional financial closing procedures and may be revised as a

result of management’s further review of the Company’s results and

any adjustments that may result from the completion of the interim

review of the third quarter 2023 consolidated financial statements.

The Company and its auditors have not completed its normal

quarterly review as of and for the three months ended September 30,

2023, and there can be no assurance that the Company’s final

results for this quarterly period will not differ from these

estimates. Any such changes could be material. During the course of

the preparation of the Company’s consolidated financial statements

and related notes as of and for the three months ended September

30, 2023, the Company may identify items that would require it to

make material adjustments to the preliminary information presented

below.

The Company expects to publicly report its final

consolidated financial statements and related notes as of and for

the quarter ended September 30, 2023 in October 2023. The Company’s

actual results may differ materially from the estimates below.

These estimates should not be viewed as a substitute for full

audited or interim financial statements prepared in accordance with

GAAP. In addition, the preliminary results for the three months

ended September 30, 2023 are not necessarily indicative of future

performance of any other period. See “Forward-Looking

Statements.”

Preliminary Financial Results for the

Month of July 2023

- Total revenue of $12.0 million

- Service revenue $11.1 million

- Net loss attributable to the Company of

$(4.1) million

- Adjusted EBITDA(1) of $0.1 million

July 2023 Cost Reduction Plan

Status

In July 2023, Altisource began to implement a

company-wide cost reduction plan that the Company estimates will

reduce annual cash operating expenses by $13.5 million

compared to annualized second quarter cash operating expenses. The

Company believes that it is on track to achieve the cost reduction

plan and estimates the monthly cash operating costs to be

$1.0 million lower beginning in September 2023 compared to the

average second quarter 2023 monthly cash operating costs.

As of August 31, 2023, the Company has

approximately 1,100 full time employees, excluding contractors.

Second Half 2023 Guidance

- Third quarter Adjusted EBITDA(1)

forecasted to be between $0 and $1.0 million

- Fourth quarter Adjusted EBITDA(1)

forecasted to be positive

- Full year 2023

Adjusted EBITDA(1) forecasted to be positive

Run-Rate Scenario Update

- The Run-Rate scenario is intended

to provide sensitivity with respect to our Servicer and Real Estate

segment assuming the default market returns to a normal,

pre-pandemic foreclosure environment; we may be unable to predict

the manner and timing of the recovery of the default market

| |

| |

|

|

LTM(2) |

|

Run-Rate |

|

($ in millions, except for Service revenue per delinquent loan /

active foreclosure) |

|

2019 |

|

|

Q2 2023 |

|

Scenario |

| |

|

|

|

|

|

| Servicer and Real Estate

Segment: |

|

|

|

|

|

| Default Service revenue -

Ocwen-serviced loans (Non GSE): |

|

|

|

|

|

|

Average number of loans serviced by Ocwen (in 000s) |

|

795 |

|

|

|

485 |

|

|

|

364 |

|

|

Average delinquency rate of loans serviced by Ocwen |

|

17.1 |

% |

|

|

14.9 |

% |

|

|

17.5 |

% |

|

Service revenue per delinquent loan(3) |

$ |

3,058 |

|

|

$ |

1,055 |

|

|

$ |

1,700 |

|

| Default Service revenue from

Ocwen-serviced loans (Non GSE) |

$ |

417.0 |

|

|

$ |

76.2 |

|

|

$ |

108.3 |

|

| |

|

|

|

|

|

| Default Service revenue -

Ocwen-serviced loans (GSE and FHA): |

|

|

|

|

|

|

Average number of loans serviced by Ocwen (in 000s) |

|

629 |

|

|

|

758 |

|

|

|

863 |

|

|

Average delinquency rate of loans serviced by Ocwen |

|

3.0 |

% |

|

|

1.6 |

% |

|

|

3.0 |

% |

|

Service revenue per delinquent loan(3) |

$ |

277 |

|

|

$ |

459 |

|

|

$ |

1,100 |

|

| Default Service revenue from

Ocwen-serviced loans (GSE and FHA) |

$ |

5.3 |

|

|

$ |

5.6 |

|

|

$ |

28.5 |

|

| |

|

|

|

|

|

| Default Service revenue -

Non-Ocwen and Non-Rithm customers: |

|

|

|

|

|

|

Total U.S. mortgage loans (End of period “EOP”, in 000s)(4) |

|

51,144 |

|

|

|

52,866 |

|

|

|

52,866 |

|

|

% of seriously delinquent loans(4) |

|

1.5 |

% |

|

|

1.3 |

% |

|

|

1.8 |

% |

|

Seriously delinquent loans (EOP in 000s)(4) |

|

768 |

|

|

|

695 |

|

|

|

925 |

|

|

% of seriously delinquent loans in active foreclosure(4) |

|

37.5 |

% |

|

|

32.2 |

% |

|

|

37.5 |

% |

|

Active foreclosures (EOP in 000s)(4) |

|

288 |

|

|

|

224 |

|

|

|

347 |

|

|

Altisource Service revenue per active foreclosure |

$ |

149 |

|

|

$ |

89 |

|

|

$ |

149 |

|

| Default Service revenue from

Non-Ocwen and Non-Rithm customers |

$ |

42.9 |

|

|

$ |

20.0 |

|

|

$ |

51.7 |

|

| |

|

|

|

|

|

| Non-default Service

revenue |

$ |

14.0 |

|

|

$ |

8.4 |

|

|

$ |

14.0 |

|

| Total Servicer and Real Estate

Segment Service revenue |

$ |

479.1 |

|

|

$ |

110.2 |

|

|

$ |

202.4 |

|

| |

|

|

|

|

|

| Origination Segment: |

|

|

|

|

|

| Total Origination segment

Service revenue |

$ |

36.8 |

|

|

$ |

29.1 |

|

|

$ |

29.1 |

|

| |

|

|

|

|

|

| Corporate and Other

Segment: |

|

|

|

|

|

| Total Corporate and Other

Service revenue |

$ |

105.9 |

|

|

$ |

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

| Consolidated Service

revenue |

$ |

621.9 |

|

|

$ |

139.3 |

|

|

$ |

231.5 |

|

| |

|

|

|

|

|

|

Adjusted EBITDA(1): |

|

|

|

|

|

|

Servicer and Real Estate |

$ |

160.8 |

|

|

$ |

35.4 |

|

|

$ |

81.0 |

|

|

Origination |

|

2.8 |

|

|

|

(4.5 |

) |

|

|

2.2 |

|

|

Corporate and Other |

|

(92.8 |

) |

|

|

(38.7 |

) |

|

|

(38.7 |

) |

| Consolidated Adjusted

EBITDA(1) |

$ |

70.8 |

|

|

$ |

(7.9 |

) |

|

$ |

44.5 |

|

| |

|

|

|

|

|

| Adjusted EBITDA

Margins(1): |

|

|

|

|

|

|

Servicer and Real Estate |

|

34 |

% |

|

|

32 |

% |

|

|

40 |

% |

|

Origination |

|

8 |

% |

|

(16)% |

|

|

8 |

% |

| Consolidated Adjusted EBITDA

Margin(1) |

|

11 |

% |

|

(6)% |

|

|

19 |

% |

_________________________Note: Numbers may not

sum due to rounding

Run-Rate Scenario

Assumptions

Servicer and Real Estate Segment

Assumptions:

- Default Market:

- The default market will return to a

normal, pre-pandemic foreclosure environment

- Default Service revenue - Ocwen

Financial Corporation (together with its subsidiaries,

"Ocwen")-serviced loans:

- Existing Ocwen-serviced

non-government-sponsored enterprise (“GSE”) loan portfolios (loan

count) decline 10% per year for three years

- Existing Ocwen-serviced GSE and

Federal Housing Administration (“FHA”) loan portfolio acquisitions

(net of run-off) increase by 5% per year for three years reflecting

portfolio acquisitions, net of run-off

- Average delinquency rates for

Ocwen-serviced portfolios in line with Q4’19 levels

- Service revenue per delinquent loan

for Ocwen-serviced non-GSE loans reflects 2019 revenue per

delinquent loan, adjusted down for the estimated field services,

valuation and title referrals associated with Rithm Capital

Corporation (together with one or more of its subsidiaries or one

or more of its subsidiaries individually, "Rithm") (formerly New

Residential Investment Corporation)’s portfolios that it redirected

to its vendor subsidiaries

- Service revenue per delinquent loan

for Ocwen-serviced GSE and FHA loans reflects 2019 revenue per

delinquent loan, adjusted upward to reflect our May 2021 expanded

relationship with Ocwen to include estimated normalized field

services and Hubzu referrals revenue from FHA, Veterans Affairs and

United States Department of Agriculture portfolios

- Default Service revenue - Non-Ocwen

and Non-Rithm customers:

- Total number of U.S. mortgages

remains flat

- Percentage of seriously delinquent

loans generally consistent with 2018 market levels

- Service revenue per active

foreclosure based on 2019 levels

- Non-default Service revenue:

- Non-default

related revenue in the Servicer and Real Estate segment held

constant relative to 2019

Origination Segment Assumptions:

- Origination revenue held constant

relative to LTM(2) Q2’23 based on current interest rate

environment

Corporate and Other Segment Assumptions:

- Note: 2019 Service revenue and

Adjusted EBITDA(1) in Corporate and Other includes businesses that

have been sold or discontinued; no Service revenue for Corporate

and Other is assumed in the Run-Rate scenario

Adjusted EBITDA Margins and Corporate and Other

Costs Assumptions:

- Servicer and Real Estate segment Adjusted EBITDA

margins(1) are improving from revenue growth, product mix and

efficiency initiatives

- Origination segment Adjusted EBITDA margins(1) are equal

to 2019 Origination Adjusted EBITDA margins(1)

- Corporate and Other costs held

constant relative to LTM(2) Q2’23

_________________________(1) Adjusted EBITDA and Adjusted

EBITDA margin are non-GAAP measures that are defined and reconciled

to the corresponding GAAP measure herein(2) Represents last twelve

months ending June 30, 2023(3) Delinquent loans, as used herein,

are 30+ days outstanding(4) Source: Black Knight August 2023

Mortgage Monitor Report

ALTISOURCE PORTFOLIO SOLUTIONS

S.A.NON-GAAP MEASURES(in thousands, except per share

data)(preliminary and unaudited)

Non-GAAP Financial Measures

Adjusted earnings before interest, tax,

depreciation and amortization (“Adjusted EBITDA”), and Adjusted

EBITDA margin, which are presented elsewhere in this press

release, are non-GAAP measures used by management, existing

shareholders, potential shareholders and other users of the

Company’s financial information to measure Altisource’s performance

and does not purport to be alternative to net loss attributable to

Altisource, including current portion, as measures of Altisource’s

performance. We believe these measures are useful to

management, existing shareholders, potential shareholders and other

users of our financial information in evaluating operating

profitability more on the basis of continuing costs as it excludes

amortization expense related to acquisitions that occurred in prior

periods and non-cash share-based compensation, as well as the

effect of more significant non-operational items from earnings. We

believe these measures are also useful in evaluating the

effectiveness of our operations and underlying business trends in a

manner that is consistent with management’s evaluation of business

performance. Furthermore, we believe the exclusion of more

significant non-operational items enables comparability to prior

period performance and trend analysis. Specifically, management

uses Adjusted EBITDA to measure the Company’s overall performance

without regard to its capitalization (debt vs. equity) or its

income taxes and to perform trend analysis of the Company’s

performance over time. Adjusted EBITDA adjusts net loss

attributable to Altisource for the impact of more significant

non-recurring items, amortization expense relating to prior

acquisitions (some of which fluctuates with revenue from certain

customers and some of which is amortized on a straight-line basis)

and non-cash share-based compensation expense which can fluctuate

based on vesting schedules, grant date timing and the value

attributable to awards. Our effective income tax rate can vary

based on the jurisdictional mix of our income. Additionally, as the

Company’s capital expenditures have significantly declined over

time, it provides a measure for management to evaluate the

Company’s performance without regard to prior capital expenditures.

Management also uses Adjusted EBITDA as one of the measures in

determining bonus compensation for certain employees. We believe

Adjusted EBITDA is useful to existing shareholders, potential

shareholders and other users of our financial information for the

same reasons that management finds the measure useful.

It is management’s intent to provide non-GAAP

financial information to enhance the understanding of Altisource’s

GAAP financial information, and it should be considered by the

reader in addition to, but not instead of, the financial statements

prepared in accordance with GAAP. Each non-GAAP financial measure

is presented along with the corresponding GAAP measure so as not to

imply that more emphasis should be placed on the non-GAAP measure.

The non-GAAP financial information presented may be determined or

calculated differently by other companies. The non-GAAP financial

information should not be unduly relied upon.

Adjusted EBITDA is calculated by removing the

income tax provision, interest expense (net of interest income),

depreciation and amortization, intangible asset amortization

expense, share-based compensation expense, (gain) loss on sale of

business, sales tax accrual, loss on BRS portfolio sale, other

assets write-down from business exits and restructuring charges

and/or cost of cost savings initiatives from net loss attributable

to Altisource. Adjusted EBITDA margin represents, in any

period, Adjusted EBITDA divided by service revenue for such

period.

These non-GAAP measures are presented as

supplemental information and reconciled to the appropriate GAAP

measure in this press release.

Preliminary reconciliations of the non-GAAP

measures to the corresponding GAAP measures are as follows:

| |

Twelve months ended |

|

Month ended |

|

Six months ended |

|

Twelve months ended |

|

Run-Rate |

| |

December 31, 2019 |

|

July 31, 2023 |

|

June 30, 2023 |

|

June 30, 2023 |

|

Scenario |

| |

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Altisource |

$ |

(307,969 |

) |

|

$ |

(4,060 |

) |

|

$ |

(31,797 |

) |

|

$ |

(57,530 |

) |

|

$ |

(11,149 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Income tax provision |

|

318,296 |

|

|

|

40 |

|

|

|

2,168 |

|

|

|

5,027 |

|

|

|

5,027 |

|

|

Interest expense (net of interest income) |

|

21,051 |

|

|

|

3,374 |

|

|

|

15,915 |

|

|

|

24,905 |

|

|

|

37,366 |

|

|

Depreciation and amortization |

|

18,509 |

|

|

|

197 |

|

|

|

1,354 |

|

|

|

2,948 |

|

|

|

2,948 |

|

|

Intangible asset amortization expense |

|

19,021 |

|

|

|

451 |

|

|

|

2,560 |

|

|

|

5,121 |

|

|

|

5,121 |

|

|

Share-based compensation expense |

|

11,874 |

|

|

|

437 |

|

|

|

2,687 |

|

|

|

5,158 |

|

|

|

5,158 |

|

|

(Gain) loss on sale of business |

|

(17,814 |

) |

|

|

— |

|

|

|

— |

|

|

|

242 |

|

|

|

— |

|

|

Sales tax accrual |

|

311 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Loss on BRS portfolio sale |

|

1,770 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other assets write-down from business exits |

|

6,102 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Unrealized gain on investment in equity securities |

|

(14,431 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Restructuring charges and/or Cost of cost savings initiatives |

|

14,080 |

|

|

|

844 |

|

|

|

670 |

|

|

|

1,825 |

|

|

|

— |

|

|

Debt amendment costs |

|

— |

|

|

|

50 |

|

|

|

3,343 |

|

|

|

3,343 |

|

|

|

— |

|

|

Unrealized (gain) loss on warrant liability |

|

— |

|

|

|

(1,274 |

) |

|

|

1,080 |

|

|

|

1,081 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

70,800 |

|

|

$ |

59 |

|

|

$ |

(2,020 |

) |

|

$ |

(7,880 |

) |

|

$ |

44,471 |

|

|

Service revenue |

$ |

621,866 |

|

|

$ |

11,096 |

|

|

$ |

70,244 |

|

|

$ |

139,339 |

|

|

$ |

231,532 |

|

|

Adjusted EBITDA margin |

|

11 |

% |

|

|

1 |

% |

|

|

(3) |

% |

|

|

(6) |

% |

|

|

19 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

Twelve months ended |

|

Month ended |

|

Six months ended |

|

Twelve months ended |

|

Run-Rate |

| |

December 31, 2019 |

|

July 31, 2023 |

|

June 30, 2023 |

|

June 30, 2023 |

|

Scenario |

| Servicer and Real Estate: |

|

|

|

|

|

|

|

|

|

|

Income before income taxes and non-controlling interests |

$ |

138,507 |

|

|

$ |

2,735 |

|

|

$ |

16,092 |

|

|

$ |

30,518 |

|

|

$ |

76,288 |

|

|

Interest expense, net of interest income |

|

(3 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Depreciation and amortization expense |

|

5,730 |

|

|

|

72 |

|

|

|

431 |

|

|

|

919 |

|

|

|

919 |

|

|

Intangible asset amortization expense |

|

12,050 |

|

|

|

247 |

|

|

|

1,480 |

|

|

|

2,961 |

|

|

|

2,961 |

|

|

Share-based compensation |

|

1,904 |

|

|

|

97 |

|

|

|

435 |

|

|

|

792 |

|

|

|

792 |

|

|

Restructuring charges and/or Cost of cost savings initiatives |

|

2,597 |

|

|

|

242 |

|

|

|

39 |

|

|

|

180 |

|

|

|

— |

|

|

Adjusted EBITDA |

$ |

160,785 |

|

|

$ |

3,393 |

|

|

$ |

18,477 |

|

|

$ |

35,370 |

|

|

$ |

80,960 |

|

|

Service revenue |

$ |

479,137 |

|

|

$ |

8,698 |

|

|

$ |

54,679 |

|

|

$ |

110,229 |

|

|

$ |

202,422 |

|

|

Adjusted EBITDA margin |

|

34 |

% |

|

|

39 |

% |

|

|

34 |

% |

|

|

32 |

% |

|

|

40 |

% |

| |

|

|

|

|

|

|

|

|

|

| Origination: |

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes and non-controlling

interests |

$ |

1,373 |

|

|

$ |

(753 |

) |

|

$ |

(3,645 |

) |

|

$ |

(7,625 |

) |

|

$ |

— |

|

|

Non-controlling interests |

|

(2,613 |

) |

|

|

(24 |

) |

|

|

(93 |

) |

|

|

(342 |

) |

|

|

(342 |

) |

|

Depreciation and amortization expense |

|

34 |

|

|

|

3 |

|

|

|

19 |

|

|

|

38 |

|

|

|

38 |

|

|

Intangible asset amortization expense |

|

2,705 |

|

|

|

204 |

|

|

|

1,080 |

|

|

|

2,159 |

|

|

|

2,159 |

|

|

Share-based compensation |

|

548 |

|

|

|

42 |

|

|

|

185 |

|

|

|

381 |

|

|

|

381 |

|

|

Restructuring charges and/or Cost of cost savings initiatives |

|

760 |

|

|

|

216 |

|

|

|

412 |

|

|

|

854 |

|

|

|

— |

|

|

Adjusted EBITDA |

$ |

2,807 |

|

|

$ |

(312 |

) |

|

$ |

(2,042 |

) |

|

$ |

(4,535 |

) |

|

$ |

2,236 |

|

|

Service revenue |

$ |

36,821 |

|

|

$ |

2,398 |

|

|

$ |

15,565 |

|

|

$ |

29,110 |

|

|

$ |

29,110 |

|

|

Adjusted EBITDA margin |

|

8 |

% |

|

(13)% |

|

(13)% |

|

(16)% |

|

|

8 |

% |

| |

|

|

|

|

|

|

|

|

|

| Corporate and Other: |

|

|

|

|

|

|

|

|

|

|

Loss before income taxes and non-controlling interests |

$ |

(127,441 |

) |

|

$ |

(5,977 |

) |

|

$ |

(41,983 |

) |

|

$ |

(75,052 |

) |

|

$ |

(82,059 |

) |

|

Non-controlling interests |

|

501 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Interest expense, net of interest income |

|

21,055 |

|

|

|

3,374 |

|

|

|

15,915 |

|

|

|

24,903 |

|

|

|

37,366 |

|

|

Depreciation and amortization expense |

|

12,745 |

|

|

|

122 |

|

|

|

903 |

|

|

|

1,990 |

|

|

|

1,990 |

|

|

Intangible asset amortization expense |

|

4,266 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Share-based compensation |

|

9,423 |

|

|

|

298 |

|

|

|

2,067 |

|

|

|

3,986 |

|

|

|

3,986 |

|

|

Sales tax accrual |

|

311 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Loss on BRS portfolio sale |

|

1,770 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other assets write-down from business exits |

|

6,102 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Unrealized gain on investment in equity securities |

|

(14,432 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Restructuring charges and/or Cost of cost savings initiatives |

|

10,722 |

|

|

|

387 |

|

|

|

219 |

|

|

|

791 |

|

|

|

— |

|

|

(Gain) loss on sale of business |

|

(17,814 |

) |

|

|

— |

|

|

|

— |

|

|

|

242 |

|

|

|

— |

|

|

Debt amendment costs |

|

— |

|

|

|

50 |

|

|

|

3,343 |

|

|

|

3,343 |

|

|

|

— |

|

|

Unrealized (gain) loss on warrant liability |

|

— |

|

|

|

(1,274 |

) |

|

|

1,080 |

|

|

|

1,080 |

|

|

|

— |

|

|

Adjusted EBITDA |

$ |

(92,792 |

) |

|

$ |

(3,020 |

) |

|

$ |

(18,456 |

) |

|

$ |

(38,717 |

) |

|

$ |

(38,717 |

) |

|

Service revenue |

$ |

105,908 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Adjusted EBITDA margin |

(88)% |

|

|

— |

% |

|

|

— |

% |

|

|

— |

% |

|

|

— |

% |

_________________________Note: Amounts may not

add to the total due to rounding.

Forward-Looking Statements

This press release contains forward-looking

statements that involve a number of risks and uncertainties. These

forward-looking statements include all statements that are not

historical fact, including statements that relate to, among other

things, future events or our future performance or financial

condition. These statements may be identified by words such as

“anticipate,” “intend,” “expect,” “may,” “could,” “should,”

“would,” “plan,” “estimate,” “seek,” “believe,” “potential” or

“continue” or the negative of these terms and comparable

terminology. Such statements are based on expectations as to the

future and are not statements of historical fact. Furthermore,

forward-looking statements are not guarantees of future performance

and involve a number of assumptions, risks and uncertainties that

could cause actual results to differ materially. Important factors

that could cause actual results to differ materially from those

suggested by the forward-looking statements include, but are not

limited to, the risks discussed in Item 1A of Part I “Risk Factors”

in our Form 10-K filing with the Securities and Exchange

Commission, as the same may be updated from time to time in our

Form 10-Q filings. We caution you not to place undue reliance on

these forward-looking statements which reflect our view only as of

the date of this report. We are under no obligation (and expressly

disclaim any obligation) to update or alter any forward-looking

statements contained herein to reflect any change in our

expectations with regard thereto or change in events, conditions or

circumstances on which any such statement is based. The risks and

uncertainties to which forward-looking statements are subject

include, but are not limited to, risks related to the COVID-19

pandemic, customer concentration, the timing of the anticipated

increase in default related referrals following the expiration of

foreclosure and eviction moratoriums and forbearance programs, the

timing of the expiration of such moratoriums and programs, and any

other delays occasioned by government, investor or servicer

actions, the use and success of our products and services, our

ability to retain existing customers and attract new customers and

the potential for expansion or changes in our customer

relationships, technology disruptions, our compliance with

applicable data requirements, our use of third party vendors and

contractors, our ability to effectively manage potential conflicts

of interest, macro-economic and industry specific conditions, our

ability to effectively manage our regulatory and contractual

obligations, the adequacy of our financial resources, including our

sources of liquidity and ability to repay borrowings and comply

with our Credit Agreement, including the financial and other

covenants contained therein, as well as Altisource’s ability to

retain key executives or employees, behavior of customers,

suppliers and/or competitors, technological developments,

governmental regulations, taxes and policies. The financial

projections and scenarios contained in this press release are

expressly qualified as forward-looking statements and, as with

other forward-looking statements, should not be unduly relied upon.

We undertake no obligation to update these statements, scenarios

and projections as a result of a change in circumstances, new

information or future events.

Disclaimer

This press release does not constitute an offer

to sell or buy, nor the solicitation of an offer to sell or buy,

any securities.

About Altisource

Altisource Portfolio Solutions S.A. is an

integrated service provider and marketplace for the real estate and

mortgage industries. Combining operational excellence with a suite

of innovative services and technologies, Altisource helps solve the

demands of the ever-changing markets we serve. Additional

information is available at www.Altisource.com.

| FOR FURTHER

INFORMATION CONTACT: |

| |

| Michelle D. Esterman |

| Chief Financial Officer |

| T: (770) 612-7007 |

| E:

Michelle.Esterman@altisource.com |

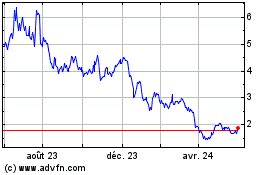

Altisource Portfolio Sol... (NASDAQ:ASPS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

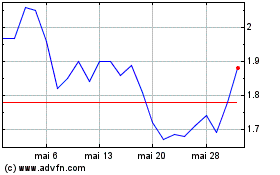

Altisource Portfolio Sol... (NASDAQ:ASPS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024