Altisource Announces it has Entered Into a Transaction Support Agreement with Lenders Holding Approximately 99% of the Company's Term Loans to Effectuate Exchange, Amendment and Maturity Extension Transactions

17 Décembre 2024 - 3:47AM

Altisource Portfolio Solutions S.A. (“Altisource” or the “Company”)

(NASDAQ: ASPS), a leading provider and marketplace for the real

estate and mortgage industries, today announced that it entered

into a binding transaction support agreement (the “Agreement”) with

lenders holding approximately 99% of the Company’s term loans (the

“Existing Term Loans”) that set forth the principal terms of, among

other things, a proposed exchange, amendment and maturity extension

transaction of the Company’s Existing Term Loans. The Company also

executed a commitment letter and term sheet for a $12.5 million

super senior credit facility to fund transaction costs and for

general corporate purposes. The Company is engaged in outreach with

the remaining lenders seeking to obtain their consent to the

Agreement.

The key anticipated benefits of the transactions

contemplated by the Agreement would be as follows:

- Reduces the

Company’s current outstanding debt obligations by an aggregate of

$58 million, or 25%, to $172.5 million (at transaction closing),

comprised of (i) an up to $110 million interest-bearing first lien

loan (the “New Debt”), (ii) an up to $50 million

non-interest-bearing exit fee associated with the New Debt to be

paid at maturity or any voluntary or mandatory prepayment of the

New Debt (the “Exit Fee” and collectively with the New Debt, “New

Facility”) and (iii) a $12.5 million super senior credit facility

(the “Super Senior Facility”); any prepayments of the New Facility

are applied on a pro rata basis to the New Debt and the Exit

Fee

- Reduces the

Company’s annual cash and paid-in-kind (“PIK”) interest on

outstanding debt obligations by approximately $18 million1; cash

interest reduced by approximately $9 million and PIK interest

reduced by approximately $9 million1; the interest rate on the New

Debt and the Super Senior Facility is SOFR + 6.50% (approximately

10.9% today2); the interest rate on the Existing Term Loans is SOFR

+ 8.75%

- Extends the

maturity date under the New Facility by five years to April 30,

2030 (compared to the April 30, 2025 maturity date under the

Existing Term Loans, with a possible extension by 12 months,

subject to certain conditions)

- Provides lenders

under the New Facility with approximately 57.9 million common

shares of Altisource, representing 63.5% of the pro forma

outstanding shares of Altisource immediately following the

transaction

- Grants

pre-transaction Altisource shareholders, penny warrant holders, and

restricted stock unit holders, as of a defined record date

preceding the closing of the transactions, (the “Stakeholders”)

warrants to purchase approximately 115 million common shares of

Altisource at an exercise price of $1.20 per share (the

“Stakeholder Warrants”), potentially reducing dilution from the

common shares to be granted to the lenders under the Agreement;

Stakeholders are expected to receive warrants to purchase

approximately 3.25 shares of Altisource common stock for each share

of or right to common stock held

“I am pleased that we executed the Transaction

Support Agreement to exchange, amend and extend our senior secured

term loan facility. We have improved Altisource’s Net Cash Used in

Operating Activities by more than $55 million since 20213. The

transactions contemplated by the Agreement would significantly

strengthen Altisource’s balance sheet which, combined with the

Company’s improving financial performance, is aimed to

stabilize the Company and position it for sustainable long-term

growth and value creation,” said Chairman and Chief Executive

Officer William B. Shepro.

The transactions described in this press release

and contemplated by the Agreement and the Super Senior Facility

remain subject to certain terms and conditions, negotiation of,

agreement upon and execution of definitive agreements, and Company

Board of Directors and shareholder approvals, as necessary.

The Company has also posted a presentation to

the Investor Relations section of its website providing additional

information. The descriptions herein of the Agreement and the Super

Senior Facility are not complete, and the description of

the Agreement is qualified in its entirety by reference to the

Agreement, a copy of which is attached as an exhibit to

Altisource's Form 8-K which will be filed with the Securities and

Exchange Commission December 17, 2024.

Paul Hastings LLP served as counsel to

Altisource and Cantor, Fitzgerald & Co served as investment

banker to Altisource on the transactions. Davis Polk &

Wardwell LLP served as counsel to an ad hoc group of lenders.

|

|

|

|

|

1. |

Reduction in annual cash interest is based on SOFR of 4.36% as of

December 12, 2024 and the anticipated outstanding balance on the

Existing Term Loans as of December 31, 2024. Reduction in annual

PIK interest is based on anticipated PIK interest expense in 2025

under the Existing Term Loans, which includes quarterly compounding

of PIK interest. Actual cash interest reduction versus existing

loan terms will vary based on actual SOFR rate |

|

2. |

Based on SOFR of 4.36% as of December 12, 2024 |

|

3. |

Based on annualized year-to-date September 2024 Net Cash Used in

Operating Activities compared to 2021 Net Cash Used in Operating

Activities |

| |

|

Webcast

Altisource will host a conference call at 8:30

a.m. EST on December 17, 2024 to discuss the potential transactions

contemplated by the Agreement. A link to the live audio webcast

will be available on Altisource’s website in the Investor Relations

section. Those who want to listen to the call should go to the

website at least fifteen minutes prior to the call to register,

download and install any necessary audio software. A replay of the

conference call will be available via the website approximately two

hours after the conclusion of the call and will remain available

for approximately 30 days.

Disclaimer

This press release does not constitute an offer

to sell or buy, nor the solicitation of an offer to sell or buy,

any securities nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law.

In particular, this communication is not an offer of securities for

sale into the United States or any other jurisdiction. No offer of

securities shall be made absent registration under the Securities

Act of 1933, as amended, or pursuant to an exemption from, or in a

transaction not subject to, such registration requirements.

Forward-Looking Statements

This press release contains forward-looking

statements that involve a number of risks and uncertainties. These

forward-looking statements include all statements that are not

historical fact, including statements that relate to, among other

things, future events or our future performance or financial

condition, including without limitation, statements relating to the

Company’s entry into definitive documentation and consummating the

transactions contemplated by the Agreement, as well as the number

of shares for which the Shareholder Warrants may be exercisable.

These statements may be identified by words such as “anticipate,”

“intend,” “expect,” “may,” “could,” “should,” “would,” “plan,”

“estimate,” “seek,” “believe,” “potential” or “continue” or the

negative of these terms and comparable terminology. Such statements

are based on expectations as to the future and are not statements

of historical fact. Furthermore, forward-looking statements are not

guarantees of future performance and involve a number of

assumptions, risks and uncertainties that could cause actual

results to differ materially. Important factors that could cause

actual results to differ materially from those suggested by the

forward-looking statements include, but are not limited to, the

risks discussed in Item 1A of Part I “Risk Factors” in our Form

10-K filing with the Securities and Exchange Commission, as the

same may be updated from time to time in our Form 10-Q filings. We

caution you not to place undue reliance on these forward-looking

statements which reflect our view only as of the date of this

report. We are under no obligation (and expressly disclaim any

obligation) to update or alter any forward-looking statements

contained herein to reflect any change in our expectations with

regard thereto or change in events, conditions or circumstances on

which any such statement is based. The risks and uncertainties to

which forward-looking statements are subject include, but are not

limited to, risks related to the COVID-19 pandemic, customer

concentration, the timing of the anticipated increase in default

related referrals following the expiration of foreclosure and

eviction moratoriums and forbearance programs, the timing of the

expiration of such moratoriums and programs, and any other delays

occasioned by government, investor or servicer actions, the use and

success of our products and services, our ability to retain

existing customers and attract new customers and the potential for

expansion or changes in our customer relationships, technology

disruptions, our compliance with applicable data requirements, our

use of third party vendors and contractors, our ability to

effectively manage potential conflicts of interest, macro-economic

and industry specific conditions, our ability to effectively manage

our regulatory and contractual obligations, the adequacy of our

financial resources, including our sources of liquidity and ability

to repay borrowings and comply with our debt agreements, including

the financial and other covenants contained therein, as well as

Altisource’s ability to retain key executives or employees,

behavior of customers, suppliers and/or competitors, technological

developments, governmental regulations, taxes and policies, and the

risks and uncertainties related to completion of the transactions

described in this press release and contemplated by the Agreement

on the anticipated terms or at all, including the negotiation of

and entry into the definitive agreements and the satisfaction of

the closing conditions of such definitive agreements, including the

obtaining of the required shareholder approvals. The financial

projections and scenarios contained in this press release are

expressly qualified as forward-looking statements and, as with

other forward-looking statements, should not be unduly relied upon.

We undertake no obligation to update these statements, scenarios

and projections as a result of a change in circumstances, new

information or future events, except as required by law.

About Altisource

Altisource Portfolio Solutions S.A. is an

integrated service provider and marketplace for the real estate and

mortgage industries. Combining operational excellence with a suite

of innovative services and technologies, Altisource helps solve the

demands of the ever-changing markets we serve. Additional

information is available at www.Altisource.com.

|

FOR FURTHER INFORMATION CONTACT: |

| |

|

Michelle D. Esterman |

|

Chief Financial Officer |

|

T: (770) 612-7007 |

|

E: Michelle.Esterman@altisource.com |

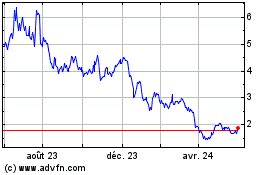

Altisource Portfolio Sol... (NASDAQ:ASPS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

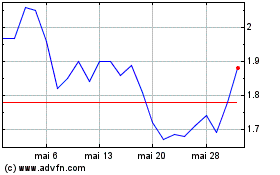

Altisource Portfolio Sol... (NASDAQ:ASPS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024