Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

06 Février 2025 - 2:01PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-163

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of February 2025

Alterity

Therapeutics Limited

(Name

of Registrant)

Level 14, 350 Collins Street,

Melbourne, Victoria 3000 Australia

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

This

Form 6-K is being incorporated by reference into our Registration Statement on Form S-8 (Files No. 333-251073, 333-248980

and 333-228671) and our

Registration Statements on Form F-3 (Files No. 333-274816, 333-251647, 333-231417

and 333-250076)

ALTERITY

THERAPEUTICS LIMITED

(a

development stage enterprise)

The

following exhibits are submitted:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Alterity Therapeutics Limited |

| |

|

|

| |

By: |

/s/ Geoffrey P. Kempler |

| |

|

Geoffrey P. Kempler |

| |

|

Chairman |

Date:

February 6, 2025

2

Exhibit 99.1

Form 603

Corporations Act 2001 Section

671B

Notice of initial substantial

holder

| To Company Name/Scheme | |

Alterity Therapeutics ltd |

| ACN/ARSN/ABN | |

37 080 699 065 |

1. Details of substantial holder (1)

| Name | |

JPMorgan Chase & Co. and its affiliates |

| ACN/ARSN (if applicable) | |

NA |

The holder became a substantial holder on 03/February/2025

2. Details of voting power

The total

number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an

associate (2) had a relevant interest (3) in on the date the substantial holder became a substantial holder are as follows:

| Class of securities (4) |

Number of securities |

Person’s votes (5) |

Voting power (6) |

| Ordinary |

272,198,215 |

272,198,215 |

5.11% |

3. Details of relevant interests

The nature of the relevant interest the substantial holder

or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows:

| Holder of relevant interest |

Nature of relevant interest (7) |

Class and number of securities |

| J.P. MORGAN SECURITIES LLC |

Rehypothecation of client securities under a Prime Brokerage Agreement |

66,138,000

(Ordinary) |

| J.P. MORGAN SECURITIES LLC |

Holder of securities subject to an obligation to return under a securities lending agreement |

15,480,000

(Ordinary) |

| J.P. MORGAN SECURITIES AUSTRALIA LIMITED |

Purchase and sales of securities in its capacity as Principal/Proprietary |

190,580,215

(Ordinary) |

4. Details of present registered holders

The persons registered as holders of the securities referred

to in paragraph 3 above are as follows:

| Holder of relevant interest |

Registered holder of securities |

Person entitled to be registered as holder (8) |

Class and number of

securities |

| J.P. MORGAN SECURITIES LLC |

Citi Australia |

Various Clients and Custodians |

66,138,000

(Ordinary) |

| J.P. MORGAN SECURITIES LLC |

Citi Australia |

Citi Australia |

15,480,000

(Ordinary) |

| J.P. MORGAN SECURITIES AUSTRALIA LIMITED |

Ecapital Nominees Pty Ltd |

J.P. MORGAN SECURITIES AUSTRALIA LIMITED |

190,580,215

(Ordinary) |

5. Consideration

The consideration paid for each relevant interest referred

to in paragraph 3 above, and acquired in the four months prior to the day that the substantial holder became a substantial holder is as

follows:

| Holder of relevant interest |

Date of acquisition |

Consideration (9) |

Class and number of securities |

| See Appendix |

|

Cash |

Non-cash |

|

| |

|

|

|

|

| |

|

|

|

|

6. Associates

The reasons the persons named in paragraph 3 above are associates

of the substantial holder are as follows:

| Name and ACN/ARSN (if applicable) |

Nature of association |

| J.P. MORGAN SECURITIES AUSTRALIA LIMITED |

Subsidiary of JPMorgan Chase & Co. |

| J.P. MORGAN SECURITIES LLC |

Subsidiary of JPMorgan Chase & Co. |

7. Addresses

The addresses of persons named in this form are as follows:

| Name |

Address |

| JPMorgan Chase & Co. |

383 Madison Avenue, New York, New York, NY, 10179, United States |

| J.P. MORGAN SECURITIES AUSTRALIA LIMITED |

LEVEL 18, 83-85 CASTLEREAGH STREET, SYDNEY, NSW 2000, Australia |

| J.P. MORGAN SECURITIES LLC |

383 Madison Ave., New York, New York, NY, 10179, United States |

| Signature |

|

|

| |

|

|

| Print name |

S. Seshagiri Rao |

Capacity |

Compliance Officer |

| Sign here |

/s/ S.

Seshagiri Rao |

Date |

05/February/2025 |

DIRECTIONS

| (1) | If there are a number of substantial holders with similar or

related relevant interests (eg. a corporation and its related corporations, or the manager and trustee of an equity trust), the names

could be included in an annexure to the form. If the relevant interests of a group of persons are essentially similar, they may be referred

to throughout the form as a specifically named group if the membership of each group, with the names and addresses of members is clearly

set out in paragraph 7 of the form. |

| (2) | See the definition of “associate” in section 9 of

the Corporations Act 2001. |

| (3) | See the definition of “relevant interest” in sections

608 and 671B(7) of the Corporations Act 2001. |

| (4) | The voting shares of a company constitute one class unless divided

into separate classes. |

| (5) | The total number of votes attached to all the voting shares

in the company or voting interests in the scheme (if any) that the person or an associate has a relevant interest in. |

| (6) | The person’s votes divided by the total votes in the body corporate

or scheme multiplied by 100. |

| (a) | any relevant agreement or other circumstances by which the relevant

interest was acquired. If subsection 671B(4) applies, a copy of any document setting out the terms of any relevant agreement, and a statement

by the person giving full and accurate details of any contract, scheme or arrangement, must accompany this form, together with a written

statement certifying this contract, scheme or arrangement; and |

| (b) | any qualification of the power of a person to exercise, control

the exercise of, or influence the exercise of, the voting powers or disposal of the securities to which the relevant interest relates

(indicating clearly the particular securities to which the qualification applies). |

See the definition of “relevant agreement” in section 9 of

the Corporations Act 2001.

| (8) | If the substantial holder is unable to determine the identity

of the person ( eg. if the relevant interest arises because of an option) write “unknown”. |

| (9) | Details of the consideration must include any and all benefits,

money and other, that any person from whom a relevant interest was acquired has, or may, become entitled to receive in relation to that

acquisition. Details must be included even if the benefit is conditional on the happening or not of a contingency. Details must be included

of any benefit paid on behalf of the substantial holder or its associate in relation to the acquisitions, even if they are not paid directly

to the person from whom the relevant interest was acquired. |

Appendix: Prescribed information pursuant to securities

lending transaction disclosed under the substantial shareholding notice filed with ASX.

| Date: |

05-Feb-2025 |

| Company’s name: |

ALTERITY THERAPEUTICS LTD |

| ISIN: |

AU0000043945 |

| Date of change of relevant interests: |

03-Feb-2025 |

| Schedule |

|

| Type of agreement |

Institutional Account Agreement |

| Parties

to agreement |

JP Morgan Securities LLC for itself and as agent and trustee for the other J.P. Morgan Entities and APEX CLEARING CORPORATION, NATIONAL FINANCIAL SERVICES LLC and TRADESTATION SECURITIES INC (herein referred to as “JPMS”).

“J.P. Morgan Entities” means, as the context may require or permit, any and all of JPMSL, JPMorgan Chase Bank, N.A., J.P. Morgan Securities LLC., J.P. Morgan Markets Limited, J.P. Morgan Securities Australia Limited, J.P. Morgan Securities (Asia Pacific) Limited, J.P. Morgan Securities Japan Co., Ltd and J.P. Morgan Prime Nominees Limited and any additional entity notified to the Company from time to time. |

| Transfer

date |

Settlement Date

30-Jan-2025

03-Feb-2025 |

| Holder of voting rights |

JPMS is the holder of the voting rights from the time at which it exercises its right to borrow. Notwithstanding this, please note that the Company has the right to recall equivalent securities if it wishes to exercise its voting rights in respect of the securities. |

| Are there any restriction on voting rights |

Yes |

| If

yes, detail |

JPMS will not be able to exercise voting rights in circumstances where the Company has recalled equivalent securities from JPMS before the voting rights have been exercised. In these circumstances, JPMS must return the securities to the Company and the Company holds the voting rights. |

| Scheduled return date (if any) |

N/A. There is no term to the loan of securities. |

| Does the borrower have the right to return early? |

Yes. |

| If yes, detail |

JPMS has the right to return all and any securities or equivalent securities early at any time. |

| Does the lender have the right to recall early? |

Yes. |

| If yes, detail |

The Company has the right to recall all or any equivalent securities on demand. |

| Will the securities be returned on settlement? |

Yes. Settlement of the loan will occur when JPMS returns equivalent securities to the Company. There is no term to the loan of securities. |

| If yes, detail any exceptions |

|

| Statement |

If requested by the company to whom the prescribed form must be given, or if requested by ASIC, a copy of the agreement will be given to that company or ASIC. |

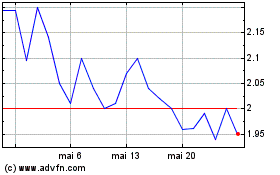

Alterity Therapeutics (NASDAQ:ATHE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Alterity Therapeutics (NASDAQ:ATHE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025