false

0001690080

0001690080

2024-03-07

2024-03-07

0001690080

ATNF:CommonStockParValue0.0001PerShareMember

2024-03-07

2024-03-07

0001690080

ATNF:WarrantsToPurchaseSharesOfCommonStockMember

2024-03-07

2024-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): March 7, 2024

180 LIFE SCIENCES CORP.

(Exact Name of Registrant

as Specified in Charter)

| Delaware |

|

001-38105 |

|

90-1890354 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

3000 El Camino Real, Bldg. 4, Suite 200

Palo Alto, CA |

|

94306 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (650) 507-0669

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ATNF |

|

The NASDAQ Stock Market LLC |

| Warrants to purchase shares of Common Stock |

|

ATNFW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) Resignation of Director

On

March 7, 2023, Sir Marc Feldmann, Ph.D. provided notice to the Board of Directors of 180 Life Sciences Corp. (the “Company”,

“we” and “us”) of his resignation as a member of the Board of Directors, effective on the same date

(March 7, 2024). Sir Feldmann’s resignation was not the result of any disagreement with the Company relating to the Company’s

operations, policies or practices, or otherwise.

Prior

to his resignation, Sir Feldmann served as Co-Executive Chairman of the Company, but did not serve on any committees of the Board of Directors.

Sir Feldmann will continue to serve as an employee of one of the Company’s subsidiaries.

(d) Appointment of New Directors

Effective March 7, 2024, the

Board of Directors of the Company appointed Omar Jimenez and Ryan L. Smith (collectively, the “Appointees” and the

“Appointments”) as members of the Board of Directors (“Board”), which Appointments were effective

as of the same date. Mr. Jimenez and Mr. Smith were each appointed as a Class II director, and will serve until the Company’s 2024

Annual Meeting of Stockholders, until their successors have been duly elected and qualified, or until their earlier death, resignation

or removal.

At the same time, the Board,

pursuant to the power provided to the Board by the Company’s Second Amended and Restated Certificate of Incorporation, as amended,

set the number of members of the Board at five (5) members.

The Board of Directors determined

that each of Messrs. Jimenez and Smith were “independent” pursuant to the rules of the Nasdaq Capital Market and pursuant

to Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended, and that Mr. Jimenez will be considered the Company’s

“audit committee financial expert” pursuant to Section (a)(5) of Item 407 of Regulation S-K.

Messrs. Jimenez and Smith

are not party to any material plan, contract or arrangement (whether or not written) with the Company, except for the Offer Letters (discussed

and described below), and there are no arrangements or understandings between Messrs. Jimenez and Smith and any other person pursuant

to which Messrs. Jimenez or Smith were selected to serve as a director of the Company, nor are Messrs. Jimenez or Smith a participant

in any related party transaction required to be reported pursuant to Item 404(a) of Regulation S-K.

The Company plans to enter

into a standard form of Indemnity Agreement (the “Indemnification Agreement”) with Messrs. Jimenez and Smith in connection

with their appointments to the Board. The Indemnification Agreement provides, among other things, that the Company will indemnify Messrs.

Jimenez and Smith under the circumstances and to the extent provided for therein, for certain expenses they may be required to pay in

connection with certain claims to which they may be made a party by reason of their position as directors of the Company, and otherwise

to the fullest extent permitted under Delaware law and the Company’s governing documents. The foregoing is only a brief description

of the Indemnification Agreement, does not purport to be complete and is qualified in its entirety by the Company’s standard form

of indemnification agreement, previously filed as Exhibit 10.8 to the Company’s Registration Statement on Form

S-1 (No. 333-217475), as amended, on April 26, 2017. The Indemnification Agreement will be identical in all material respects to the indemnification

agreements entered into with other Company directors.

There are no family relationships

between any director or executive officer of the Company, including Messrs. Jimenez and Smith.

Also on March 7, 2024, the

Board determined to combine the Strategy and Alternatives Committee and the Risk, Safety and Regulatory Committee into a Strategy and

Alternatives, Risk, Safety and Regulatory Committee, which has materially the same responsibilities that the two committees had prior

to such combination.

Upon his appointment to the

Board, Mr. Jimenez was appointed as a member of the Board’s (a) Compensation Committee; (c) Nominating and Corporate Governance

Committee; and (c) Strategy and Alternatives, Risk, Safety and Regulatory Committee, and as Chairperson of the Company’s Audit Committee.

Upon his appointment to the

Board, Mr. Smith was appointed as a member of the Board’s (a) Audit Committee; and (b) Strategy and Alternatives, Risk, Safety and

Regulatory Committee, and as Chairperson of the Compensation Committee and Nominating and Corporate Governance Committee.

As a result, the Committees

of the Board of Directors are currently as follows:

| Director Name | |

Audit

Committee | |

Compensation

Committee | |

Nominating,

Corporate Governance

Committee | |

Strategy and

Alternatives,

Risk, Safety

and Regulatory

Committee |

| Lawrence Steinman, M.D. (1) | |

| |

| |

| |

|

| James N. Woody, M.D., Ph.D. | |

| |

| |

| |

|

| Blair Jordan (2) | |

M | |

M | |

M | |

C |

| Omar Jimenez | |

C | |

M | |

M | |

M |

| Ryan Smith | |

M | |

C | |

C | |

M |

| (1) |

Executive Chairman of the Board of Directors. |

| (2) |

Lead Independent Director. |

| C |

- Chairperson of the Committee. |

| M |

- Member of the Committee. |

In connection with Messrs.

Jimenez and Smith’s appointments to the Board and on March 4, 2024 and March 5, 2024, respectively, to be effective upon each of

their appointments to the Board, the Company entered into an offer letter with each of Messrs. Jimenez and Smith (collectively, the “Offer

Letters”). The Offer Letters provide for each of Messrs. Jimenez and Smith to be paid $40,000 per year as an annual retainer

fee for serving on the Board; Mr. Jimenez to be paid $10,000 per year for serving as the Chairman of the Audit Committee; and Mr. Smith

to be paid $10,000 per year for serving as the Chairman of the Compensation Committee and Nominating and Corporate Governance Committee.

The Company agreed to pay each of Messrs. Jimenez and Smith in connection with their appointment to the Board, quarterly in arrears, and

pro-rated for partial quarters. Messrs. Jimenez and Smith have the option of receiving half of their compensation in cash and half of

their compensation in stock, or alternatively receiving all of their compensation in cash, with half of such cash compensation accrued

until such time as the Company raises an aggregate of $1 million from any source (for greater certainty, such sources being cumulative

and not discrete), including but not limited to debt and/or equity raises, quasi- equity raises, receipt of insurance proceeds, litigation

proceeds, and corporate transactions.

The foregoing summary of the

material terms of the Offer Letters is not complete and is qualified in its entirety by reference to the Offer Letters, copies of which

are filed herewith as Exhibits 10.1 and 10.2, and incorporated by reference in this Item 5.02.

Biographical information for

Messrs. Jimenez and Smith is provided below:

Omar Jimenez, age 62

Mr. Jimenez has served as

Chief Financial Officer (Principal Financial/Accounting Officer) and Chief Compliance Officer of Golden Matrix Group, Inc. (GMGI:NASDAQ),

an established business-to-business and business-to-consumer gaming technology company operating across multiple international markets,

since April 2021. Since February 2020, Mr. Jimenez has also served as Chief Financial Officer and Chief Operating Officer of Alfadan,

Inc. a pre-startup that will provide a series of marine specific engines ranging from 450 horsepower (HP) to 1,050 HP when the research

and development on such engines is completed. From September 2016 to January 2020 and from January 2016 to January 2020, Mr. Jimenez served

as Treasurer and Secretary and Chief Financial Officer and Chief Operating Officer, respectively, of NextPlay Technologies, Inc. (f/k/a

Monaker Group, Inc.) (NXTP:NASDAQ), a travel services company. Mr. Jimenez also served as a member of the Board of Directors of NextPlay

Technologies, Inc. (then known as Monaker Group, Inc.) from January 2017 to August 2019. Mr. Jimenez has held a variety of senior financial

management positions during his career. From May 2009 to January 2016, he served as the founder of MARMEL International, Inc., a company

that provides accounting and consulting services. In addition, from June 2004 to May 2009 he served as President and Chief Financial Officer

at American Leisure Holdings, Inc. (AMLH:OTC & ALG:AIM), focusing on leisure and business travel, hospitality & hotels, call centers

and real estate development. Mr. Jimenez also served from April 2002 to June 2004 as Director of Operations for US Installation Group,

Inc., a selling and installation group for The Home Depot, and CFO and VP of Onyx Group, Inc., a conglomerate with 700 employees and annual

revenues exceeding $400 million. Mr. Jimenez is a Certified Public Accountant (CPA), Chartered Global Management Accountant (CGMA), Chartered

Property Casualty Underwriter (CPCU), a Member of the AICPA and FICPA. Mr. Jimenez holds a B.B.A in Accounting and a B.B.A in Finance

from the University of Miami and an M.B.A from Florida International University.

We have concluded that Mr.

Jimenez is well qualified to serve on our Board of Directors based upon his significant business and accounting experience, including

his public company background and his knowledge in compliance matters.

Ryan L. Smith, Age 41

Since December 2019, Mr. Smith

has served as Chief Executive Officer of U.S. Energy Corp. (USEG:NASDAQ)(“U.S. Energy”), an oil and gas company focused

on consolidating high-quality producing assets in the United States. Mr. Smith served as Chief Financial Officer of U.S. Energy from May

2017 to June 2023, and has served as a member of the Board of Directors of U.S. Energy since January 2021. Mr. Smith consulted for U.S.

Energy from January 2017 to May 2017. Prior to holding that position, Mr. Smith served as Emerald Oil Inc.’s Chief Financial Officer

from September 2014 to January 2017 and Vice President of Capital Markets and Strategy from July 2013 to September 2014. Emerald Oil Inc.

filed for Chapter 11 bankruptcy protection in March 2016 and emerged from bankruptcy in November 2016. Prior to joining Emerald, Mr. Smith

was a Vice President in Canaccord Genuity’s Investment Banking Group focused solely on the energy sector. Mr. Smith joined Canaccord

Genuity in 2008 and was responsible for the execution of public and private financing engagements along with mergers and acquisitions

advisory services. Prior to joining Canaccord Genuity, Mr. Smith was an Analyst in the Wells Fargo Energy Group, working solely with upstream

and midstream oil and gas companies. Mr. Smith holds a Bachelor of Business Administration degree in Finance from Texas A&M University.

We have concluded that Mr.

Smith is well qualified to serve on our Board of Directors based upon his significant business experience, including his public company

background, and experience in public company fund raising.

* * * * *

As a result of the resignation

from the Board of Directors of Sir Feldmann (who was not independent), and the appointment of Messrs. Jimenez and Smith to the Board of

Directors, as of March 7, 2024, the Company now has a Board of Directors consisting of a majority of independent members (as determined

by the rules of Nasdaq), and an Audit Committee; Compensation Committee; and Nominating and Corporate Governance Committee, each consisting

of three independent members.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

180 LIFE SCIENCES CORP. |

| |

|

|

| Date: March 11, 2024 |

By: |

/s/ James N. Woody, M.D., Ph.D. |

| |

|

James N. Woody, M.D., Ph.D. |

| |

|

Chief Executive Officer |

Exhibit

10.1

March

4, 2024

Dear

Omar:

On

behalf of 180 Life Sciences Corp., a Delaware corporation (the “Company”), I am pleased to extend to you an

offer to join the Company’s Board of Directors (the “Board”), effective upon approval of your appointment

by the Board of Directors. This offer is contingent upon (i) your completion of the enclosed Officers, Directors, Managers and Principal

Stockholders Questionnaire and Supplemental Questionnaire for Director Nominees, (ii) receipt of a background check satisfactory to the

Company, (iii) your confirmation of the enclosed Policy on Insider Trading and Policy on Control and Disclosure of Confidential Information,

and (iv) formal approval of your appointment by the Board.

The

Company’s current schedule includes approximately four regular meetings of the Board, which are currently held via Zoom, plus additional

special meetings as called by the Board from time to time which usually take place via Zoom. In addition to your attendance at Board

meetings, we expect to take advantage of your expertise by reaching out to you for advice and counsel between meetings. To the extent

that you are appointed as a member of the Audit Committee, you will need to meet at least quarterly with the other members of the committee.

It is anticipated that you will serve as the Chairman of the Audit Committee.

As

a member of the Board, you will owe fiduciary duties to the Company and its stockholders, such as the duty of care, duty of loyalty and

the duty of disclosure, which include protecting Company proprietary information from unauthorized use or disclosure.

The

following summarizes the compensation that will be provided to you effective upon your appointment to the Board, and subject to approval

by the Board:

| ● | Cash

Fees: Initially, your cash compensation will consist of $40,000 per year as an annual

retainer fee for serving on the Board, and $10,000 per year for serving as the Chairman of

the Audit Committee. It is contemplated that you will serve on one or more of the Compensation

Committee, Strategic and Alternatives Committee and/or Nominating and Corporate Governance

Committee, in addition to the Audit Committee. All such appointments are subject to the Board’s

discretion. The Company will make fee payments one quarter in arrears, and will be pro-rated

for partial quarters. The Company does not pay incremental fees for attendance of Board meetings

or telephone/Zoom conferences but will reimburse you for reasonable travel expenses for attending

in-person Board meetings and other Board-related expenses, subject to compliance with the

Company’s reimbursement policies. You have the option of receiving half of your compensation

in cash and half of your compensation in stock, or alternatively receiving all of your compensation

in cash, with half of such cash compensation accrued until such time as the Company raises

an aggregate of $1 million from any source (for greater certainty, such sources being cumulative

and not discrete), including but not limited to debt and/or equity raises, quasi- equity

raises, receipt of insurance proceeds, litigation proceeds, and corporate transactions. |

The

compensation set forth above is subject to change from time to time in the future as determined by the Board. In addition, the Company’s

option plan outlines change in control provisions, termination rights, and other matters related to the option grants.

Enclosed

are the following documents for your completion:

| ● | Officers,

Directors, Managers and Principal Stockholders Questionnaire and Supplemental Questionnaire

for Director Nominees; and |

| | | |

| ● | Policy

on Insider Trading and Policy on Control and Disclosure of Confidential Information |

This

offer is submitted to you with the understanding that you will tender your resignation as a member of the Board in the event that you

are not in compliance with the Company’s then applicable policies, codes or charters (including those set forth above). Should

you accept this offer, you are representing to us that you (i) do not know of any conflict which would restrict your ability to serve

on the Board and (ii) will not provide the Company with any documents, records, or other confidential information in violation of the

rights of other parties.

Consistent

with the Company’s governing documents, while the Board has authority to appoint you as a member of the Board, your continued service

on the Board will be subject to stockholder approval at the next annual meeting of stockholders relating to the applicable Class of Directors

to which you are appointed. Nothing in this offer should be construed to interfere with or otherwise restrict in any way the rights of

the Company and the Company’s stockholders to remove any individual from the Board at any time in accordance with the provisions

of applicable law.

You

will also be entitled to indemnification for your services as a Board member in accordance with the Company’s standard form of

indemnification agreement, a copy of which will be provided to you upon your appointment, and the governing documents of the Company.

You

are free to end your relationship as a member of the Board at any time and for any reason. In addition, your right to serve as a member

of the Board is subject to the provisions of the Company’s charter documents.

The

terms in this letter agreement supersede any other agreements or promises made to you by anyone, whether oral or written, and comprise

the final, complete and exclusive agreement between you and the Company regarding your service on the Board. Nothing in this letter should

be construed as an offer of employment.

While

you serve on the Board, you will be expected to notify the Company’s legal department of any conflicts of interests that may arise

with respect to the Company.

I

hope that you will accept our offer to join the Company’s Board of Directors and look forward to a productive future relationship.

If you agree with the above, please indicate your agreement with these terms and accept this offer by signing and dating this letter

below.

Sincerely,

/s/

James N. Woody

James

N. Woody, M.D., Ph.D.

Acknowledged

and Agreed:

| /s/ Omar

Jimenez |

|

| Omar

Jimenez |

|

Exhibit

10.2

March

5, 2024

Dear

Ryan:

On

behalf of 180 Life Sciences Corp., a Delaware corporation (the “Company”), I am pleased to extend to you

an offer to join the Company’s Board of Directors (the “Board”), effective upon approval of your

appointment by the Board of Directors. This offer is contingent upon (i) your completion of the enclosed Officers, Directors,

Managers and Principal Stockholders Questionnaire and Supplemental Questionnaire for Director Nominees, (ii) receipt of a background

check satisfactory to the Company, (iii) your confirmation of the enclosed Policy on Insider Trading and Policy on Control and

Disclosure of Confidential Information, and (iv) formal approval of your appointment by the Board.

The

Company’s current schedule includes approximately four regular meetings of the Board, which are currently held via Zoom, plus additional

special meetings as called by the Board from time to time which usually take place via Zoom. In addition to your attendance at Board

meetings, we expect to take advantage of your expertise by reaching out to you for advice and counsel between meetings. To the extent

that you are appointed as a member of the Audit Committee, you will need to meet at least quarterly with the other members of the committee.

As

a member of the Board, you will owe fiduciary duties to the Company and its stockholders, such as the duty of care, duty of loyalty and

the duty of disclosure, which include protecting Company proprietary information from unauthorized use or disclosure.

The

following summarizes the compensation that will be provided to you effective upon your appointment to the Board, and subject to approval

by the Board:

| ● | Cash Fees:

Initially, your cash compensation will consist of $40,000 per year as an annual retainer fee for serving on the Board and $10,000 per

year for serving as the Chairman of the Nominating and Corporate Governance Committee, and the Compensation Committee. It is contemplated

that you will serve on one or more of the Audit Committee, and Strategic and Alternatives Committee. All such appointments are subject

to the Board’s discretion. The Company will make fee payments one quarter in arrears, and will be pro-rated for partial quarters.

The Company does not pay incremental fees for attendance of Board meetings or telephone/Zoom conferences but will reimburse you for reasonable

travel expenses for attending in-person Board meetings and other Board-related expenses, subject to compliance with the Company’s

reimbursement policies. You have the option of receiving half of your compensation in cash and half of your compensation in stock, or

alternatively receiving all of your compensation in cash, with half of such cash compensation accrued until such time as the Company

raises an aggregate of $1 million from any source (for greater certainty, such sources being cumulative and not discrete), including

but not limited to debt and/or equity raises, quasi- equity raises, receipt of insurance proceeds, litigation proceeds, and corporate

transactions. |

The

compensation set forth above is subject to change from time to time in the future as determined by the Board. In addition, the Company’s

option plan outlines change in control provisions, termination rights, and other matters related to the option grants.

Enclosed

are the following documents for your completion:

| ● | Officers,

Directors, Managers and Principal Stockholders Questionnaire and Supplemental Questionnaire

for Director Nominees; and |

| ● | Policy

on Insider Trading and Policy on Control and Disclosure of Confidential Information |

This

offer is submitted to you with the understanding that you will tender your resignation as a member of the Board in the event that you

are not in compliance with the Company’s then applicable policies, codes or charters (including those set forth above). Should

you accept this offer, you are representing to us that you (i) do not know of any conflict which would restrict your ability to serve

on the Board and (ii) will not provide the Company with any documents, records, or other confidential information in violation of the

rights of other parties.

Consistent

with the Company’s governing documents, while the Board has authority to appoint you as a member of the Board, your continued service

on the Board will be subject to stockholder approval at the next annual meeting of stockholders relating to the applicable Class of Directors

to which you are appointed. Nothing in this offer should be construed to interfere with or otherwise restrict in any way the rights of

the Company and the Company’s stockholders to remove any individual from the Board at any time in accordance with the provisions

of applicable law.

You

will also be entitled to indemnification for your services as a Board member in accordance with the Company’s standard form of

indemnification agreement, a copy of which will be provided to you upon your appointment, and the governing documents of the Company.

You

are free to end your relationship as a member of the Board at any time and for any reason. In addition, your right to serve as a member

of the Board is subject to the provisions of the Company’s charter documents.

The

terms in this letter agreement supersede any other agreements or promises made to you by anyone, whether oral or written, and comprise

the final, complete and exclusive agreement between you and the Company regarding your service on the Board. Nothing in this letter should

be construed as an offer of employment.

While

you serve on the Board, you will be expected to notify the Company’s legal department of any conflicts of interests that may arise

with respect to the Company.

I

hope that you will accept our offer to join the Company’s Board of Directors and look forward to a productive future relationship.

If you agree with the above, please indicate your agreement with these terms and accept this offer by signing and dating this letter

below.

Sincerely,

/s/

James N. Woody

James

N. Woody, M.D., Ph.D.

Acknowledged and Agreed:

| /s/ Ryan Smith |

|

| Ryan Smith |

|

v3.24.0.1

Cover

|

Mar. 07, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 07, 2024

|

| Entity File Number |

001-38105

|

| Entity Registrant Name |

180 LIFE SCIENCES CORP.

|

| Entity Central Index Key |

0001690080

|

| Entity Tax Identification Number |

90-1890354

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3000 El Camino Real

|

| Entity Address, Address Line Two |

Bldg. 4

|

| Entity Address, Address Line Three |

Suite 200

|

| Entity Address, City or Town |

Palo Alto

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94306

|

| City Area Code |

650

|

| Local Phone Number |

507-0669

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ATNF

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase shares of Common Stock |

|

| Title of 12(b) Security |

Warrants to purchase shares of Common Stock

|

| Trading Symbol |

ATNFW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATNF_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATNF_WarrantsToPurchaseSharesOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

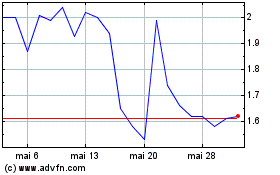

180 Life Sciences (NASDAQ:ATNF)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

180 Life Sciences (NASDAQ:ATNF)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025