Microsoft Closes $69 Billion Acquisition of Activision Blizzard

16 Octobre 2023 - 2:58PM

Finscreener.org

Microsoft (NASDAQ:

MSFT) has successfully

completed its $69 billion purchase of video game publisher

Activision Blizzard (NASDAQ:

ATVI), marking the tech

giantU+02019s biggest acquisition in its nearly five decades of

existence. The dealU+02019s closure, as revealed in a regulatory

filing on Friday, followed approvals from regulatory authorities in

the U.S., U.K., and Europe, who addressed and alleviated

competitive concerns.

Earlier in the day, the U.K.’s

Competition and Markets Authority endorsed the acquisition, paving

the path for its finalization. Initially announced in January 2022,

this acquisition furnishes Microsoft with an extensive collection

of popular video game titles. Notable franchises like Call of Duty,

Crash Bandicoot, Diablo, Overwatch, StarCraft, Tony Hawk Pro

Skater, and Warcraft are now under Microsoft’s umbrella.

In its most recent fiscal year,

Activision Blizzard boasted $7.5 billion in revenue, a sum that,

while significant, pales in comparison to MicrosoftU+02019s

colossal $212 billion in sales.

According to a recent blog post,

Microsoft Gaming CEO Phil Spencer announced the initiation of

efforts to integrate popular Activision, Blizzard, and King titles

into Game Pass and other platforms. Details on availability are

expected in the upcoming months. Bobby Kotick, the current CEO of

Activision Blizzard, is slated to retain his position until the

year’s end.

Microsoft continues to diversify its revenue

stream

The acquisition aligns with

Microsoft CEO Satya Nadella’s strategy to broaden the company’s portfolio beyond its

foundational products like operating systems and office tools.

Nadella, who assumed leadership in 2014, views the partnership and

competition with Activision, known for its blockbuster games, as a

step towards this diversification.

Originally anticipated to

conclude by June 2023, the acquisition encountered delays due to

regulatory concerns. In July, both corporations agreed to push the

completion deadline to October 18 after the Federal Trade

Commission (FTC) in the U.S., the European Commission, and the

U.K.’s Competition and Markets Authority voiced their

reservations.

To address European regulatory

concerns, Microsoft committed to providing free licenses for

European Economic Area consumers to stream Activision Blizzard

titles. Furthermore, agreements were inked with console competitors

Nintendo and Sony (NYSE:

SNE), ensuring decade-long access to popular games

like Call of Duty. Cloud gaming providers, including

Boosteroid, Nvidia (NASDAQ:

NVDA), Nware, and Ubitus,

received similar assurances.

Are regulators concerned with the acquisition of

Activision Blizzard?

In the U.S., the FTC sought a

preliminary injunction to halt the acquisition pending

comprehensive approval but was overruled by a judge after extensive

hearings. The appellate court upheld this decision, enabling the

continuation of the acquisition process.

Navigating the U.K. regulatory

landscape proved intricate. Microsoft disclosed in August a

contingency plan granting game publisher Ubisoft a 15-year access

to cloud streaming rights for Activision’s titles, contingent upon

the deal’s finalization.

The FTC said Friday it still has

concerns. “We remain focused on the federal appeal process despite

Microsoft and Activision closing their deal in advance of a

scheduled December appeals court hearing,” FTC spokesperson

Victoria Graham said.

Graham added, “Microsoft and

Activision’s new agreement with Ubisoft presents a whole new facet

to the merger that will affect American consumers, which the FTC

will assess as part of its ongoing administrative proceeding. The

FTC continues to believe this deal is a threat to

competition.”

Activision ended the

second quarter

with $587 million in net income on

$2.2 billion in revenue, which was up 34% year over

year.

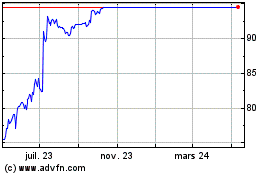

Activision Blizzard (NASDAQ:ATVI)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Activision Blizzard (NASDAQ:ATVI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024