0001534120false00015341202024-03-272024-03-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 1 to

Form 8-K filed March 28, 2024

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 27, 2024

AVALO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | |

| 001-37590 | | 45-0705648 |

| (Commission File Number) | | (IRS Employer Identification No.) |

540 Gaither Road, Suite 400, Rockville, Maryland 20850

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (410) 522-8707

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | AVTX | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On March 28, 2024, Avalo Therapeutics, Inc. (the “Company” or “Avalo”) filed a Current Report on Form 8-K (the “Original 8-K”) disclosing, among other things, that the Company had completed its acquisition of AlmataBio, Inc. (“Almata”), pursuant to the agreement and plan of merger and reorganization (the “Merger Agreement”) between the Company and Almata.

This Amendment to the Original 8-K is being filed for the purpose of satisfying the Company’s undertaking to file the financial statements and pro forma financial information required by Item 9.01 of Form 8-K, and this amendment should be read in conjunction with the Original 8-K. Except as set forth herein, no modifications have been made to information contained in the Original 8-K, and the Company has not updated any information contained therein to reflect events that have occurred since the date of the Original 8-K.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired.

The audited financial statements of Almata as of December 31, 2023 and for the period from April 28, 2023 (date of inception) to December 31, 2023 and the related notes are attached hereto as Exhibit 99.1 and incorporated herein by reference.

(b) Pro Forma Financial Information.

Unaudited pro forma condensed combined financial information, which includes pro forma condensed combined statements of operations for the year ended December 31, 2023 and the three months ended March 31, 2024 and the notes related thereto, are filed as Exhibit 99.2 to this report and incorporated herein by reference.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 23.1 | | |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | The cover pages of this Current Report on Form 8-K, formatted in Inline XBRL. |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | AVALO THERAPEUTICS, INC. |

| | | |

| Date: June 3, 2024 | | By: | /s/ Christopher Sullivan |

| | | Christopher Sullivan |

| | | Chief Financial Officer |

Consent of Independent Auditors

We consent to the incorporation by reference in the following Registration Statements (Form S-1 Nos 333-204905 and 333-213676, Form S-3 Nos 333-214507, 333-218252, 333-227227, 333-229283, 333-233978, 333-238197, 333-254000, and 333-271225, Form S-4 No 333-235666, and Form S-8 Nos 333-211490, 333-211491, 333-226767, 333-241661, 333-256080, 333-256082, 333-256083, 333-268199, and 333-271655) of Avalo Therapeutics, Inc. of our report dated June 3, 2024, with respect to the financial statements of AlmataBio, Inc. for the period from April 28, 2023 (date of inception) to December 31, 2023 included in this Current Report on Form 8-K/A of Avalo Therapeutics Inc. dated June 3, 2024.

/s/ Ernst & Young LLP

Tysons, Virginia

June 3, 2024

ALMATABIO, INC.

INDEX TO FINANCIAL STATEMENTS

Report of Independent Auditors

To the Shareholders and the Board of Directors of AlmataBio, Inc.,

Opinion

We have audited the financial statements of AlmataBio, Inc. (the Company), which comprise the balance sheet as of December 31, 2023, and the related statements of operations and comprehensive loss, changes in redeemable preferred stock and stockholders’ equity and cash flows for the period from April 28, 2023 (date of inception) to December 31, 2023, and the related notes (collectively referred to as the “financial statements”).

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2023, and the results of its operations and its cash flows for the period from April 28, 2023 (date of inception) to December 31, 2023 in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

•Exercise professional judgment and maintain professional skepticism throughout the audit.

•Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

•Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed.

•Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

•Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/ Ernst & Young LLP

Tysons, Virginia

June 3, 2024

ALMATABIO, INC.

Balance Sheet

(In thousands, except share data)

| | | | | | | | |

| | December 31, 2023 |

| | |

| Assets | | |

| Current assets: | | |

| Cash and cash equivalents | | $ | 1,767 | |

| Prepaid expenses and other current assets | | 7 | |

| Total assets | | $ | 1,774 | |

| Liabilities, redeemable preferred stock and stockholders’ equity | | |

| Current liabilities: | | |

| Accrued expenses and other current liabilities | | $ | 105 | |

| Total liabilities | | 105 | |

| Redeemable preferred stock (Par value $0.0001; 6,163,075 shares authorized at December 31, 2023 and 3,627,797 shares issued and outstanding at December 31, 2023) | | 1,550 | |

| Stockholders’ equity: | | |

| Common stock (Par value $0.0001; 22,880,198 shares authorized at December 31, 2023 and 11,555,570 shares issued and outstanding at December 31, 2023) | | 1 | |

| Additional paid-in capital | | 777 | |

| Accumulated deficit | | (659) | |

| Total stockholders’ equity | | 119 | |

| Total liabilities, redeemable preferred stock and stockholders’ equity | | $ | 1,774 | |

See accompanying notes to the financial statements.

ALMATABIO, INC.

Statement of Operations and Comprehensive Loss

(In thousands)

| | | | | | | | |

| | |

| | | For the period from April 28, 2023 (date of inception) to December 31, 2023 |

| Operating expenses: | | |

| Acquired in-process research and development | | $ | 528 | |

| General and administrative | | 131 | |

| Total operating expenses | | 659 | |

| Net loss | | $ | (659) | |

See accompanying notes to the financial statements.

ALMATABIO, INC.

Statement of Changes in Redeemable Preferred Stock and Stockholders’ Equity

(In thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Redeemable preferred stock | | | Common stock | | | | Additional paid-in | | Accumulated | Total stockholders’ |

| | Shares | | Amount | | | Shares | | Amount | | | | | | capital | | deficit | | equity |

| Balance, April 28, 2023 (date of inception) | — | | | $ | — | | | | — | | | $ | — | | | | | | | $ | — | | | $ | — | | | $ | — | |

| Issuance of common stock | — | | | — | | | | 11,555,570 | | | 1 | | | | | | | 1 | | | — | | | 2 | |

| Issuance of redeemable preferred stock | 3,627,797 | | | 1,550 | | | | — | | | — | | | | | | | — | | | — | | | — | |

| Issuance of warrants | — | | | — | | | | — | | | | | | | | | 776 | | | | | 776 | |

| Net loss | — | | | — | | | | — | | | — | | | | | | | — | | | (659) | | | (659) | |

| Balance, December 31, 2023 | 3,627,797 | | | $ | 1,550 | | | | 11,555,570 | | | $ | 1 | | | | | | | $ | 777 | | | $ | (659) | | | $ | 119 | |

| | | | | | | | | | | | | | | | | | |

See accompanying notes to the financial statements.

ALMATABIO, INC.

Statement of Cash Flows

(Amounts in thousands)

| | | | | | | | |

| | | For the period from April 28, 2023 (date of inception) to December 31, 2023 |

| Operating activities | | |

| Net Loss | | $ | (659) | |

| Adjustments to reconcile net loss used in operating activities: | | |

| Prepaid expenses and other assets | | (7) | |

| Accrued expenses and other liabilities | | 105 | |

| Net cash used in operating activities | | (561) | |

| Investing activities | | |

| Net cash used in investing activities | | — | |

| Financing activities | | |

| Proceeds from common stock | | 2 | |

| Proceeds from preferred stock | | 1,570 | |

| Proceeds from warrants | | 785 | |

| Transaction costs from preferred stock issuance | | (19) | |

| Transaction costs from warrants issuance | | (10) | |

| Net cash provided by financing activities | | 2,328 | |

| Cash and cash equivalents at beginning of period | | — | |

| Cash and cash equivalents at end of period | | $ | 1,767 | |

See accompanying notes to the financial statements.

ALMATABIO, INC.

Notes to the Financial Statements

As of December 31, 2023 and for the period from April 28, 2023 (date of inception) to December 31, 2023

1. Business

AlmataBio, Inc. (the “Company” or “AlmataBio” or “we”) is a biotechnology company that was incorporated on April 28, 2023 (date of inception), with primary operations largely limited to identifying and in-licensing its primary developmental drug compound, the anti-IL-1β asset. The anti-IL-1β asset was acquired by AlmataBio on December 6, 2023 from Leap Therapeutics Inc, pursuant to an Asset Purchase Agreement.

On March 27, 2024, Avalo Therapeutics, Inc. (the “Parent”) entered into and closed an agreement and plan of merger and reorganization (the “Merger Agreement”), with Project Athens Merger Sub, Inc. (“Merger Sub”), Second Project Athens Merger Sub, LLC (“Second Merger Sub”) and AlmataBio. Pursuant to the Merger Agreement on March 27, 2024, Merger Sub merged with and into AlmataBio, with AlmataBio continuing as the surviving entity, and immediately thereafter AlmataBio merged with and into Second Merger Sub (collectively, the “Merger”), with Second Merger Sub as the surviving entity and a wholly owned subsidiary of the Parent (the “Transaction”). The Transaction was structured as a stock-for-stock transaction whereby all outstanding equity interests in AlmataBio were exchanged for a combination of Avalo common stock and shares of Avalo non-voting convertible preferred stock. Refer to Note 7 for further information.

Liquidity

The Company has incurred losses and negative cash flows from operations since inception. As of December 31, 2023, the Company had an accumulated deficit of $0.7 million and cash of $1.8 million. The Company has not generated any product revenue to date and does not expect to generate product revenue until it successfully identifies a partner to assist in completing development and obtaining regulatory approval for its product candidate. From inception to date, the Company has financed its operations primarily through the sale and issuance of common and preferred stock. The Company anticipates that it will continue to incur net losses and negative operating cash flows for the foreseeable future. Management believes that the Company’s current cash, combined with the net proceeds from its common and preferred stock financing, are adequate to meet its needs for at least the next twelve months. However, the Company may need to borrow funds or raise additional equity to achieve its longer-term business objectives. Refer to Note 7 for the transaction entered into with the Parent in March 2024.

2. Significant Accounting Policies

Basis of Presentation

The accompanying financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (the “FASB”). The financial statements have been prepared on the basis of continuity of operations, realization of assets, and the satisfaction of liabilities in the ordinary course of business.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, expenses, and related disclosures. Actual results may differ from those estimates or assumptions.

Risks and Uncertainties

The Company is subject to all of the risks inherent in an early-stage company that is searching for partners to in-license their products. These risks include, but are not limited to, the potential need for additional financing, limited management

resources, and potential inability to find a partner for the assets. The Company’s operating results may be materially affected by the foregoing factors.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. The carrying amounts reported in the balance sheets for cash are valued at cost, which approximates their fair value. At December 31, 2023, the Company had no investments that would be classified as cash equivalents and had no restricted cash.

Acquired In-Process Research and Development

Acquired in-process research and development (“IPR&D”) includes payments made or due in connection with license agreements, including upon the achievement of development and regulatory milestones.

The Company evaluates in-licensed agreements for IPR&D projects to determine if they meet the definition of a business and thus should be accounted for as a business combination. If the in-licensed agreement for IPR&D does not meet the definition of a business and the assets have not reached technological feasibility and therefore have no alternative future use, the Company expenses payments made under such license agreements as acquired in-process research and development expenses in its statements of operations. Payments for milestones achieved and payments for a product license prior to regulatory approval of the product are expensed in the period incurred. Payments made in connection with regulatory and sales-based milestones will be capitalized and amortized to cost of product sales over the remaining useful life of the asset. No such payments were made or were due to be made related to milestones during the period ended December 31, 2023.

Comprehensive Loss

Comprehensive loss comprises net loss and other changes in equity that are excluded from net loss. For the period from April 28, 2023 (date of inception) to December 31, 2023, the Company’s net loss was equal to comprehensive loss and, accordingly, no additional disclosure is presented.

3. Asset Purchase Agreement

On December 6, 2023, the Company entered into an Asset Purchase Agreement with Leap Therapeutics, Inc. and its wholly-owned subsidiary, Flame Biosciences LLC which included a world-wide exclusive license from Eli Lilly and Company to obtain the rights to an anti-IL-1β mAb (now known as AVTX-009). The agreement involved the sale of assets related to Leap's proprietary anti-IL-1ß antibodies, FL-101 and FL-103. The transaction was completed with the Company paying $500,000 in cash for the transferred assets. Refer to Note 6 for further detail related to the commitments and contingencies associated with the transaction.

The purchase price of the asset acquisition was $528,414, including transaction costs. This amount was expensed as Acquired IPR&D. The regulatory milestones, as referenced in Note 6, were not considered probable as of December 31, 2023 and therefore no amounts have been recognized.

4. Capital Structure

The Company’s amended and restated certificate of incorporation authorizes it to issue up to 22,880,198 shares of common stock with a par value of $0.0001 per share and up to 6,163,075 shares of preferred stock with a par value of $0.0001 per share. As of December 31, 2023, all shares of preferred stock had been designated as Series Seed Preferred Stock.

Common Stock

As of December 31, 2023, there were 11,555,570 shares issued and outstanding. Within the first months of the Company’s inception, 10,627,785 of shares of common stock were issued to the Company’s founders and an affiliated entity and viewed as equity transactions with no compensatory element. The voting, dividend, and liquidation rights of the holders of the Company’s common stock are subject to and qualified by the rights, powers and preferences of the holders of the Series Seed Preferred Stock set forth below. Each share of common stock entitles the holder to one vote, together with the holders of the

Series Seed Preferred Stock, on all matters submitted to the stockholders for a vote. The holders of common stock are entitled to receive dividends, if any, as declared by the Company’s board of directors. No dividends were declared or paid for the period from April 28, 2023 (date of inception) to December 31, 2023.

Series Seed Preferred Stock

On November 22, 2023, the Company entered into an investment agreement with various purchasers, which provided for the issuance of 3,281,132 Series Seed Preferred Stock at a purchase price of $0.64904 per share (the “Original Issue Price”). The Company also issued these purchasers warrants exercisable into 1,640,564 shares of common stock. On December 14, 2023, the Company issued an additional 346,665 Series Seed Preferred Stock at a purchase price of $0.64904 per share and warrants to purchase 173,332 shares of common stock. In total, the Company sold 3,627,797 Series Seed Preferred Stock and issued warrants to purchase 1,813,896 shares of common stock, for gross proceeds of $2.4 million and incurred $0.03 million of issuance costs.

Each holder of Series Seed Preferred Stock was entitled to cast the number of votes equal to the number of whole shares of common stock into which the shares of Series Seed Preferred Stock held by such holder are convertible as of record date. Holders of Series Seed Preferred Stock shall vote together as a single class with holders of common stock and on an as converted to common stock basis.

The Series Seed Preferred Stock did not have rights to cumulative dividends. If the Company declares a dividend, holders of Series Seed Preferred Stock will participate on an as converted basis with holders of common stock.

The Series Seed Preferred Stock was convertible into common stock at any time, at the option of the holder, and without the payment of additional consideration, at the applicable conversion ratio then in effect. In addition, each share of Series Seed Preferred Stock will be automatically converted into shares of common stock at the then-effective applicable conversion ratio upon either (i) the closing of a firm-commitment underwritten public offering of its common stock, or (ii) the date specified by vote or written consent of the holders of a majority in voting power of the outstanding shares of Series Seed Preferred Stock, voting as a single class. The conversion ratio of the Series Seed Preferred Stock is determined by dividing the Original Issue Price by the Conversion Price. As of December 31, 2023, the Conversion Price was $0.64904 per share for Series Seed Preferred Stock, subject to appropriate adjustment in the event of any share dividend, share split, combination, other similar recapitalization, or diluting issuances with respect to the Series Seed Preferred Stock.

In the event of any liquidation, dissolution, winding-up of the Company or a Deemed Liquidation Event as defined in the amended and restated certificate of incorporation, collectively referred to as Liquidation Events, the holders of Series Seed Preferred Stock shall be entitled to receive, prior and in preference, to any distribution of the assets or funds of the Company to the holders of the common stock, an amount per share equal to the greater of (i) the Original Issue Price and (ii) an amount that would have been payable had all shares of each series of Preferred Stock been converted into common stock immediately prior to such Liquidation Event. After the payment in full of the Series Seed Preferred Stock preference amount, the remaining assets or funds of the Company will be distributed among the holders of shares of common stock.

As of December 31, 2023, no Series Seed Preferred Stock had been converted to common stock. Given the Series Seed Preferred Stock is contingently redeemable outside the control of the Company, the carrying value of $1.6 million is recognized outside of stockholders’ equity on the Company’s balance sheet.

Warrants

The Company issued warrants to the Series Seed Preferred Stock investors which allow them to purchase 1,813,896 shares of common stock at an exercise price of $0.0001 per share. The warrants expire upon the earlier of (i) November 22, 2028, (ii) the closing of a firm-commitment underwritten public offering of its common stock, (iii) occurrence of a Liquidation Event, and (iv) occurrence of an event where ownership of a majority of outstanding voting power changes. The Transaction terminated the Warrants. The Company determined that the warrants satisfy the conditions to be accounted for as equity instruments and recorded $0.8 million to additional paid-in-capital upon issuance of the warrants. As of December 31, 2023, no warrants had been exercised.

5. Income Taxes

The Company accounts for income taxes in accordance with ASC 740, Income Taxes. ASC 740 is an asset and liability approach that requires the recognition of deferred tax assets and liabilities for the expected tax consequences or events that have been recognized in our financial statement or tax returns. ASC 740 also clarifies the accounting for uncertainty in

income taxes recognized in the financial statement. The interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken, or expected to be taken, in a tax return. There were no significant matters determined to be unrecognized tax benefits taken or expected to be taken in a tax return that have been recorded in our financial statement for the period from April 28, 2023 (date of inception) to December 31, 2023. Tax years beginning in 2023 are subject to examination by taxing authorities, although net operating losses from all years are subject to examinations and adjustments for at least three years following the year in which the attributes are used.

ASC 740 provides guidance on the recognition of interest and penalties related to income taxes. There were no interest or penalties related to uncertain tax positions arising in the years ended December 31, 2023. It is the Company's policy to treat interest and penalties, to the extent they arise, as a component of income taxes.

The components of deferred taxes are as follows:

| | | | | | | | |

| (in thousands) | | For the period from April 28, 2023 (date of inception) to December 31, 2023 |

| Deferred tax assets: | | |

| Net operating loss carryovers | | $ | 46 | |

| Capitalized research and development | | 119 | |

| Gross deferred tax assets | | 165 | |

| | |

| Valuation allowance | | (165) | |

| Net deferred taxes | | $ | — | |

As of December 31, 2023, the Company has approximately $0.2 million of gross net operating losses for Federal and State tax purposes that were not subject to expiration. Net operating losses may be subject to an annual limitation in the event of certain cumulative changes in ownership interest of significant shareholders pursuant to Sections 382 and 383 of the Internal Revenue Code of 1986, as amended, as well as similar state provisions. This can limit the amount of net operating losses that the Company can utilize to offset future taxable income. The Company has not analyzed Sections 382 and 383 as of December 31, 2023 and therefore, there is uncertainty as to the ability utilize the net operating losses in future years.

The income tax benefit for the period from April 28, 2023 (date of inception) to December 31, 2023 differed from the amounts computed by applying the U.S. federal income tax rate of 21% as follows:

| | | | | | | | |

| (in thousands) | | For the period from April 28, 2023 (date of inception) to December 31, 2023 |

| Federal Statutory Rate | | 21.00 | % |

| State Taxes | | 4.00 | % |

| Valuation Allowances | | (25.00) | % |

| Effective Tax Rate | | — | % |

The valuation allowance recorded by the Company as of December 31, 2023, resulted from the uncertainties of the future utilization of deferred tax assets mainly resulting from net operating loss carry forwards for federal and state income tax purposes as well as the federal research and experimental capitalized intangibles. The Company will continue to evaluate its valuation allowance position in each jurisdiction on a regular basis. To the extent the Company determines that all or a

portion of its valuation allowance is no longer necessary, the Company will recognize an income tax benefit in the period such determination is made for the reversal of the valuation allowance.

6. Commitments and Contingencies

Litigation

The Company is not a party to any material legal proceedings and is not aware of any pending or threatened claims. From time to time, the Company may be subject to various legal proceedings and claims that arise in the ordinary course of its business activities.

Leap Therapeutics Future Milestone Payments

As discussed in Note 3, on December 6, 2023, the Company obtained the rights to an anti-IL-1β mAb (now known as AVTX-009), including the world-wide exclusive license from Eli Lilly and Company (the “Lilly License Agreement”), through the Asset Purchase Agreement entered into with Leap Therapeutics, Inc. The Company is required to pay up to $70 million based on the achievement of specified development and regulatory milestones. Upon commercialization, the Company is required to pay sales-based milestones aggregating up to $720 million. Additionally, the Company is required to pay royalties during a country-by-country royalty term equal to a mid-single digit to low double digit percentage of the Company or its sublicensees’ annual net sales.

7. Subsequent Events

Cash Dividend

On March 21, 2024, the stockholders and the board of directors of the Company authorized and approved the payment of a cash dividend to the holders of Series Seed Preferred Stock of the Company, in the amount of $1.2 million.

Avalo Transaction

On March 27, 2024, the Company was acquired by Avalo Therapeutics, Inc. (“Avalo”), which was structured as a stock-for-stock transaction whereby all outstanding equity interests in AlmataBio were exchanged in a merger for a combination of Avalo common stock and shares of Avalo non-voting convertible preferred stock, resulting in the issuance of 171,605 shares of Avalo common stock and 2,412 shares of non-voting convertible preferred stock. In addition, a cash payment of $7.5 million was due, and paid, to the former AlmataBio stockholders upon the initial closing of the private placement investment, which closed on March 28, 2024. Avalo is also required to pay development milestones to the former AlmataBio stockholders, including $5 million due upon the first patient dosed in a Phase 2 trial in patients with hidradenitis suppurativa for AVTX-009 and $15 million due upon the first patient dosed in a Phase 3 trial for AVTX-009, both of which are payable in cash or stock of Avalo (or a combination thereof) at the election of the former AlmataBio stockholders, subject to the terms and conditions of the definitive merger agreement.

Subject to Avalo stockholder approval, each share of Avalo non-voting convertible preferred stock (i) issued to former AlmataBio stockholders and ii) pursuant to the private placement investment will automatically convert to 1,000 shares of common stock, subject to certain beneficial ownership limitations. The non-voting convertible preferred stock holds no voting rights.

Unaudited Pro Forma Condensed Combined Financial Information

On March 27, 2024 (the “Closing Date”), Avalo Therapeutics, Inc. (the “Parent” or “Avalo”) entered into a definitive merger agreement (the “Agreement”) with AlmataBio, Inc., (the “Company” or “Acquiree” or “AlmataBio”) and the Company became a wholly owned subsidiary of the Parent (the “Transaction” or “Merger”).

Avalo’s acquisition of AlmataBio was structured as a stock-for-stock transaction whereby all outstanding equity interests in AlmataBio were exchanged in a merger for a combination of Avalo common stock and shares of Avalo Series C Preferred Stock resulting in the issuance of an aggregate of 171,605 shares of Avalo common stock and an aggregate of 2,412 shares of Series C Preferred Stock (convertible into 2,412,000 shares of common stock). In addition, a cash payment of $7.5 million was due to the former AlmataBio stockholders upon the initial closing of the private placement investment (which Avalo paid in April 2024). Avalo is also required to pay development milestones to the former AlmataBio stockholders, including $5 million due upon the first patient dosed in a Phase 2 trial in patients with hidradenitis suppurativa (“HS”) for AVTX-009 and $15 million due upon the first patient dosed in a Phase 3 trial for AVTX-009, both of which are payable in cash, Avalo stock, or a combination thereof at the election of the former AlmataBio stockholders, subject to the terms and conditions of the definitive merger agreement.

In connection with the Transaction, the Parent secured funding through private investment in public equity financing (“PIPE Financing”) for up to $185.0 million in gross proceeds, including an initial gross upfront investment of $115.6 million. The Parent could receive up to an additional $69.4 million of gross proceeds upon the exercise of the warrants issued in the PIPE Financing.

The following unaudited pro forma condensed combined financial information of Avalo is presented to illustrate the estimated effects of 1) the Merger and 2) the PIPE Financing.

The unaudited pro forma condensed combined statement of operations for the year ended December 31, 2023 and quarter ended March 31, 2024 combines the historical consolidated statement of operations and comprehensive loss of Avalo and the historical statement of operations of AlmataBio, giving effect to the Merger and PIPE Financing as if they had occurred on January 1, 2023. A pro forma balance sheet as of March 31, 2024 is not presented because the Merger and PIPE Financing are reflected in the Avalo consolidated balance sheet as of March 31, 2024. See Note 1 — Description of Transactions and Basis of Presentation for additional information.

The unaudited pro forma condensed combined financial information, including the notes thereto, should be read in conjunction with accompanying notes to the unaudited pro forma condensed combined financial statements. In addition, the unaudited pro forma condensed combined financial information is based on, and should be read in conjunction with, the following historical consolidated financial statements and notes:

•the audited consolidated financial statements of Avalo as of December 31, 2023 and for the year then ended and related notes included in the Annual Report on Form 10-K for the year ended December 31, 2023;

•the audited financial statements of AlmataBio as of December 31, 2023 and for the period from April 28, 2023 (date of inception) to December 31, 2023 and related notes which are filed as Exhibit 99.1 to the Current Report on this Form 8-K/A; and

•the unaudited consolidated financial statements of Avalo as of March 31, 2024 and for the quarter then ended and related notes included in the Quarterly Report on Form 10-Q for the quarter ended March 31, 2024.

The following unaudited pro forma condensed combined financial information has been prepared in accordance with Article 11 of Regulation S-X under the Securities Act of 1933, as amended (Securities Act) and presents the consolidated results of operations of Avalo and the historical results of operations of AlmataBio, adjusted to give effect to (i) the acquisition of AlmataBio as further described in Note 1 — Description of the Transaction and Basis of Presentation; and (ii) the pro forma effects of certain assumptions and adjustments described in “Notes to the Unaudited Pro Forma Condensed Combined Financial Information” below. The unaudited pro forma condensed combined financial information is presented for illustrative and informational purposes only and is based upon available information and reflects estimates and certain assumptions made by our management that we believe are reasonable. Actual adjustments may differ materially from the information presented herein. The unaudited pro forma condensed combined financial information does not purport to represent what the results of operations would have been had the Merger and PIPE Financing actually occurred on the dates indicated, nor does it purport to project the results of operations for any future period or as of any future date. Avalo’s actual results of operations may differ significantly from the pro forma amounts reflected herein due to a variety of factors.

The unaudited pro forma condensed combined financial information has been prepared using the acquisition method of accounting under U.S. generally accepted accounting principles, which is referred to herein as GAAP, with Avalo being the accounting acquirer. The unaudited pro forma condensed combined financial information does not give effect to the potential impact of current financial conditions, regulatory matters, operating efficiencies or other savings or expenses that may be associated with the integration of the two companies and does not purport to represent the actual results of operations that Avalo and AlmataBio would have achieved had the companies been combined during the periods presented and is not intended to project the future results of operations that the combined company may achieve after the Merger. The unaudited pro forma combined financial information does not reflect any potential cost savings that may be realized as a result of the Merger and also does not reflect any restructuring or integration-related costs to achieve those potential cost savings.

Unaudited Pro Forma Condensed Combined Statement of Operations and Comprehensive Loss

For the Year Ended December 31, 2023

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| (in thousands) | | Avalo Therapeutics, Inc.

(Historical) | | AlmataBio, Inc.

(Historical) | | Transaction Adjustments | Notes | Pro Forma Combined |

| Revenues: | | | | | | | | |

| Product revenue, net | | $ | 1,408 | | | $ | — | | | $ | — | | | $ | 1,408 | |

| License and other revenue | | 516 | | | — | | | — | | | 516 | |

| Total revenues, net | | 1,924 | | | — | | | — | | | 1,924 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Cost of product sales | | 1,284 | | | — | | | — | | | 1,284 | |

| Research and development | | 13,784 | | | — | | | — | | | 13,784 | |

| Acquired in-process research and development | | — | | | 528 | | | — | | | 528 | |

| Selling, general and administrative | | 10,300 | | | 131 | | | — | | | 10,431 | |

| Goodwill impairment | | 3,907 | | | — | | | — | | | 3,907 | |

| Amortization expense | | — | | | — | | | — | | | — | |

| Total operating expenses | | 29,275 | | | 659 | | | — | | | 29,934 | |

| | (27,351) | | | (659) | | | — | | | (28,010) | |

| Other expense: | | | | | | | | — | |

| Interest expense, net | | (3,417) | | | — | | | — | | | (3,417) | |

| Change in fair value of derivative liability | | (720) | | | — | | | — | | | (720) | |

| Other expense, net | | (42) | | | — | | | — | | | (42) | |

| Total other expense, net | | (4,179) | | | — | | | — | | | (4,179) | |

| Loss before income taxes | | (31,530) | | | (659) | | | — | | | (32,189) | |

| Income tax expense | | 14 | | | — | | | — | | | 14 | |

| Net loss | | $ | (31,544) | | | $ | (659) | | | $ | — | | | $ | (32,203) | |

| | | | | | | | |

| Net loss per share of common stock, basic and diluted | | $ | (114) | | | $ | — | | | $ | — | | | $ | (70) | |

| Weighted average common stock outstanding, basic and diluted | | 277,727 | | | — | | | 171,605 | | A | 449,332 | |

Unaudited Pro Forma Condensed Combined Statement of Operations and Comprehensive Loss

For the Quarter Ended March 31, 2024

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| (in thousands) | | Avalo Therapeutics, Inc.

(Historical) | | AlmataBio, Inc.

(Historical) | | Transaction Adjustments | Notes | Pro Forma Combined |

| Operating expenses: | | | | | | | | |

| Cost of product sales | | (80) | | | — | | | — | | | (80) | |

| Research and development | | 2,116 | | | — | | | — | | | 2,116 | |

| Acquired in-process research and development | | 27,538 | | | — | | | — | | | 27,538 | |

| General and administrative | | 3,193 | | | 864 | | | — | | | 4,057 | |

| Total operating expenses | | 32,767 | | | 864 | | | — | | | 33,631 | |

| | (32,767) | | | (864) | | | — | | | (33,631) | |

| Other expense: | | | | | | | | — | |

| Excess of warrant fair value over private placement proceeds | | (79,276) | | | — | | | — | | | (79,276) | |

| Private placement transaction costs | | (9,220) | | | — | | | — | | | (9,220) | |

| Change in fair value of derivative liability | | (120) | | | — | | | — | | | (120) | |

| Interest income, net | | 100 | | | — | | | — | | | 100 | |

| Total other expense, net | | (88,516) | | | — | | | — | | | (88,516) | |

| Loss before income taxes | | (121,283) | | | (864) | | | — | | | (122,147) | |

| Income tax expense | | 7 | | | — | | | — | | | 7 | |

| Net loss | | $ | (121,290) | | | $ | (864) | | | $ | — | | | $ | (122,154) | |

| | | | | | | | |

| Net loss per share of common stock, basic and diluted | | $ | (141) | | | $ | — | | | $ | — | | | $ | (119) | |

| Weighted average common stock outstanding, basic and diluted | | 859,381 | | | — | | | 164,062 | | A | 1,023,443 | |

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED

FINANCIAL INFORMATION

1. Description of Transactions and Basis of Presentation

Description of the Merger

On March 27, 2024 (the “Closing Date”), Avalo Therapeutics, Inc. (the “Parent” or “Avalo”) entered into a definitive merger agreement (the “Agreement”) with AlmataBio, Inc., (the “Company” or “Acquiree” or “AlmataBio”) and the Company became a wholly owned subsidiary of the Parent (the “Transaction” or “Merger”).

Avalo’s acquisition of AlmataBio was structured as a stock-for-stock transaction whereby all outstanding equity interests in AlmataBio were exchanged in a merger for a combination of Avalo common stock and shares of Avalo non-voting Series C Preferred Stock resulting in the issuance of an aggregate of 171,605 shares of Avalo common stock and an aggregate of 2,412 shares of non-voting Series C Preferred Stock (convertible into 2,412,000 shares of common stock). In addition, a cash payment of $7.5 million was due to the former AlmataBio stockholders upon the initial closing of the private placement investment (which Avalo paid in April 2024). Avalo is also required to pay development milestones to the former AlmataBio stockholders, including $5 million due upon the first patient dosed in a Phase 2 trial in patients with HS for AVTX-009 and $15 million due upon the first patient dosed in a Phase 3 trial for AVTX-009, both of which are payable in cash, Avalo stock, or a combination thereof at the election of the former AlmataBio stockholders, subject to the terms and conditions of the definitive merger agreement.

AlmataBio was formed in April 2023 and its primary operations were largely limited to identifying and in-licensing the anti-IL-1β asset.

PIPE Financing

In connection with the Transaction, the Parent secured funding through private investment in public equity financing (“PIPE Financing”) for up to $185.0 million in gross proceeds, including an initial gross upfront investment of $115.6 million. The Parent could receive up to an additional $69.4 million of gross proceeds upon the exercise of the warrants issued in the PIPE Financing. This funding provides the Parent with sufficient equity to support the development through Phase 2 in HS (topline results from a planned Phase 2 trial in HS are expected in 2026 and the upfront funding is expected to fund the asset through this data readout and into 2027).

Basis of Presentation

The unaudited pro forma condensed combined financial information was prepared with the Merger being accounted for as an asset acquisition by Avalo of AlmataBio. Upon completion of the Merger, Avalo obtained control of AlmataBio’s assets consisting primarily of cash and in-process research and development (“IPR&D”). In accordance with U.S. GAAP, Avalo must first assess whether an integrated set of assets and activities should be accounted for as an acquisition of a business or an asset acquisition. An initial screen test is completed to determine if substantially all of the fair value of the gross assets acquired of AlmataBio is concentrated in a single asset or group of similar assets. If that screen is met, the transaction is accounted for as an asset acquisition. If the screen is not met, further determination is required as to whether or not the Company has acquired inputs and processes that have the ability to create outputs which would meet the definition of a business. Avalo accounted for the acquisition of AlmataBio as an asset acquisition as substantially all of the fair value of the gross assets being acquired of AlmataBio is concentrated within AlmataBio’s IPR&D, specifically AVTX-009.

Under the asset acquisition method of accounting, the assets acquired and liabilities assumed are recognized and measured at fair value and no goodwill is recorded or recognized. Acquired IPR&D that has no future alternative use is expensed at the time of acquisition.

The pro forma adjustments reflecting the consummation of the Merger and PIPE Financing are based on certain currently available information and certain assumptions and methodologies that Avalo believes are reasonable under the circumstances. The pro forma adjustments, which are described in the accompanying notes, may be revised as additional information becomes available and is evaluated. Therefore, it is possible that the actual adjustments will differ from the pro forma adjustments, and it is possible the difference may be material. Avalo believes that its assumptions and methodologies provide a reasonable basis for presenting all of the significant effects of the Merger and PIPE Financing based on information

available to management at this time and that the pro forma adjustments give appropriate effect to those assumptions and are properly applied in the unaudited pro forma condensed combined financial information.

The unaudited pro forma condensed combined financial information does not give effect to any anticipated synergies, operating efficiencies, tax savings, or cost savings that may be associated with the Merger.

The unaudited pro forma condensed combined financial information does not give effect to the potential impact of current financial conditions, regulatory matters, operating efficiencies or other savings or expenses that may be associated with the integration of the two companies and does not purport to represent the actual results of operations that Avalo and AlmataBio would have achieved had the companies been combined during the periods presented and is not intended to project the future results of operations that the combined company may achieve after the Merger.

2. Estimated Consideration and Preliminary Purchase Price Allocation

The fair value of the consideration totaling approximately $27.2 million, inclusive of the estimated Avalo transaction costs incurred after March 31, 2024 in connection with the asset acquisition, is summarized as follows (in thousands):

| | | | | | | | |

| | | |

| (in thousands) | | Amount |

| Stock consideration | | $ | 12,272 | |

| Milestone payment due upon close of private placement investment | | 7,500 | |

| Milestone payment due upon first patient dosed in a Phase 2 trial | | 5,000 | |

| Transaction costs | | 2,402 | |

| Total GAAP Purchase Price at Close | | $ | 27,174 | |

The fair value of the Stock consideration transferred is equal to the aggregate common shares issued of 171,605 and the aggregate preferred shares issued of 2,412 (as-converted to 2,412,000 shares of common stock), multiplied by the Company’s closing stock price of $4.75 on March 27, 2024.

Avalo deemed the milestones included above to be probable and estimable as of the transaction close date and therefore included as part of the GAAP purchase price at close.

Allocation of the consideration transferred to the net assets acquired and based upon the net assets of AlmataBio as of March 31, 2024, was as follows (in thousands):

| | | | | | | | |

| | | |

| (in thousands) | | Amount |

| Acquired IPR&D | | $ | 27,538 | |

| Cash | | 356 | |

| Accrued expenses and other current liabilities | | (720) | |

| Total GAAP Purchase Price | | $ | 27,174 | |

3. Transaction Accounting Adjustments

A.The pro forma combined basic and diluted loss per share have been adjusted to reflect the pro forma net loss for the three months ended March 31, 2024 and the pro forma net loss attributable to common stockholders for the year ended December 31, 2023. In addition, the number of shares used in calculating the pro forma combined basic and diluted loss per share has been adjusted assuming that the estimated total number of shares of common stock of the combined company that were issued in connection with the Merger have been outstanding for the entirety of all periods presented. The pro forma adjustment for the three months ending March 31, 2024 reflects the incremental amount of common shares not already included in Avalo’s historical weighted average common stock outstanding as of March 31, 2024.

The following table sets forth the calculation of the pro forma adjustment to the weighted-average number of common shares outstanding — basic and diluted.

| | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| (in thousands) | | March 31, 2024 | | December 31, 2023 |

| Issuance of common stock to AlmataBio shareholders | | 171,605 | | 171,605 |

| Less: Common stock issued to AlmataBio shareholders included in Avalo’s historical weighted average common stock outstanding | | 7,543 | | — |

| Pro forma adjustment | | 164,062 | | 171,605 |

Cover Page Document

|

Mar. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

Mar. 27, 2024

|

| Entity Registrant Name |

AVALO THERAPEUTICS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37590

|

| Entity Tax Identification Number |

45-0705648

|

| Entity Address, Address Line One |

540 Gaither Road, Suite 400

|

| Entity Address, City or Town |

Rockville

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20850

|

| City Area Code |

410

|

| Local Phone Number |

522-8707

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value

|

| Trading Symbol |

AVTX

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001534120

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

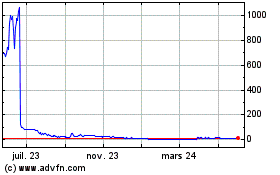

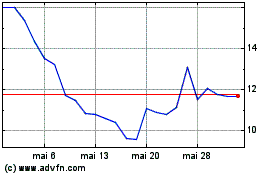

Avalo Therapeutics (NASDAQ:AVTX)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Avalo Therapeutics (NASDAQ:AVTX)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024