BayCom Corp (“BayCom” or the “Company”) (NASDAQ: BCML), the

holding company for United Business Bank (the “Bank” or “UBB”),

announced earnings of $6.6 million, or $0.56 per diluted common

share, for the third quarter of 2023, compared to earnings of $7.2

million, or $0.59 per diluted common share, for the second quarter

of 2023 and $7.0 million, or $0.52 per diluted common share, for

the third quarter of 2022.

Net income for the third quarter of 2023 compared to the second

quarter of 2023 decreased $576,000 or 8.0%, primarily as a result

of a $1.9 million increase in provision for credit losses,

reflecting a $674,000 provision for credit losses for the current

quarter compared to a $1.3 million reversal of the allowance for

credit losses during the second quarter of 2023, partially offset

by a $528,000 increase in net interest income, $568,000 increase in

noninterest income and a $224,000 decrease in provision for income

taxes. Net income for the third quarter of 2023 compared to the

third quarter of 2022 decreased $340,000 or 4.9%, primarily as a

result of $728,000 decrease in noninterest income and $423,000

increase in noninterest expense, partially offset by a $520,000

decrease in provision for credit losses, a $84,000 increase in net

interest income and $207,000 decrease in provision for income

taxes.

Net income for the nine months ended September 30, 2023 compared

to the same period in 2022 increased $4.9 million or 30.6%,

primarily as a result of a $4.1 million increase in net interest

income and a $4.1 million decrease in provision for credit losses,

reflecting a $311,000 reversal of the allowance for credit losses

for the nine months ended September 30, 2023 compared to a $3.8

million provision for credit losses for the same period in 2022,

partially offset by a $891,000 decrease in noninterest income and a

$2.4 million increase in provision for income taxes.

George Guarini, Founder, President, and Chief Executive Officer

of the Company, stated, "Our financial performance for the third

quarter of 2023 remained resilient despite the challenges

confronting the banking industry. Similar to other banks, we

experienced some pressure on our net interest margin, but this

appears to have eased somewhat in the recent quarter. During the

quarter, we proactively bolstered our loan loss reserves, primarily

in response to specific loans. On the whole, our credit quality

remains solid, and we have not identified any systemic credit

issues within our loan portfolio."

Guarini concluded, "Our financial indicators remain stable, with

a net interest margin exceeding 4.0%, a return on assets surpassing

1.0%, and an improving efficiency ratio. Our liquidity and deposit

levels have held steady throughout the quarter. We are committed to

enhancing our tangible book value through earnings and the

repurchase of our shares, which are currently trading well below

our tangible book value. Additionally, we maintain the belief that

merger and acquisition opportunities may arise as other banks

recognize the advantages of consolidation in the current

operational environment."

Third Quarter Performance Highlights:

- Annualized net interest margin was 4.03% for the current

quarter, compared to 4.02% in the preceding quarter and 3.99% in

the same quarter a year ago.

- Annualized return on average assets was 1.03% for the current

quarter, compared to 1.13% in the preceding quarter and 1.07% in

the same quarter a year ago.

- Assets totaled $2.6 billion at both September 30, 2023 and June

30, 2023, compared to $2.5 billion at September 30, 2022.

- Loans, net of deferred fees, totaled $2.0 billion at September

30, 2023, remaining relatively unchanged from June 30, 2023, and

September 30, 2022.

- Nonperforming loans totaled $14.3 million or 0.73% of total

loans at September 30, 2023, compared to $12.8 million or 0.64% of

total loans at June 30, 2023, and $19.7 million or 0.99% of total

loans at September 30, 2022.

- The allowance for credit losses for loans totaled $19.8

million, or 1.01% of total loans outstanding, at September 30,

2023, compared to $19.1 million, or 0.95% of total loans

outstanding, at June 30, 2023, and $18.1 million, or 0.90% of total

loans outstanding, at September 30, 2022. The Company adopted the

Current Expected Credit Losses (“CECL”) standard as of January 1,

2023, which resulted in a one-time adjustment to the allowance for

credit losses for loans by $1.5 million (which included the

reclassification of the net credit discount on acquired purchased

credit impaired loans totaling $845,000) and an allowance for

unfunded credit commitments of $45,000, and an after-tax decrease

to opening retained earnings of $491,000 during the first quarter

of 2023.

- A $674,000 provision for credit losses for loans was recorded

during the current quarter compared to a $1.3 million reversal of

the allowance for credit losses for loans and $1.2 million

provision for credit losses for loans in the prior quarter and the

same quarter a year ago, respectively.

- Deposits totaled $2.2 billion at September 30, 2023 compared to

$2.1 billion at both June 30, 2023 and September 30, 2022. At

September 30, 2023, noninterest bearing deposits totaled $667.3

million, or 30.9% of total deposits, compared to $664.1 million, or

30.9% of total deposits at June 30, 2023, and $813.5 million, or

38.5% of total deposits, at September 30, 2022.

- The Company repurchased 239,649 shares of common stock at an

average cost of $18.86 per share during the third quarter of 2023,

compared to 543,955 shares repurchased at an average cost of $16.71

per share during the second quarter of 2023, and 406,534 shares

repurchased at an average cost of $19.14 per share during the third

quarter of 2022.

- On August 18, 2023, the Company announced the declaration of a

cash dividend on the Company’s common stock of $0.10 per share,

which was paid on October 13, 2023 to stockholders of record as of

September 15, 2023.

- The Bank remained a “well-capitalized” institution for

regulatory capital purposes at September 30, 2023.

Earnings

Net interest income increased $528,000, or 2.2%, to $24.8

million for the third quarter of 2023 from $24.3 million in the

prior quarter, and increased $84,000, or 0.3%, from $24.7 million

in the same quarter a year ago. The increase in net interest income

from the previous quarter and same quarter in 2022 reflects

increases in interest income on loans, federal funds sold and

interest-bearing balances in banks and, to a lesser extent,

investment securities, including dividends on Federal Reserve Bank

(“FRB”) and Federal Home Loan Bank (“FHLB”) stock, partially offset

by higher funding costs related to our deposits and junior

subordinated debt due to higher market rates. Average

interest-earning assets increased $21.7 million, or 0.8%, and

decreased $12.0 million, or 0.46% for the three months ended

September 30, 2023 compared to the second quarter of 2023 and the

third quarter of 2022, respectively. Average yield (annualized) on

interest earning assets for the third quarter of 2023 was 5.34%,

compared to 5.18% for the second quarter of 2023 and 4.38% for the

third quarter of 2022. The average rate paid on interest-bearing

liabilities for third quarter of 2023 was 2.04 %, compared to 1.82%

for the second quarter of 2023, and 0.66% for the third quarter of

2022. The increases in average yield on interest-earning assets and

average rate paid on interest-bearing liabilities during the

current quarter reflect increases in market interest rates due to

recent increases in the target range for federal funds, including a

100 basis-point increase during the first nine months of 2023, to a

range of 5.25% to 5.50%.

Interest income on loans, including fees, increased $562,000, or

2.1%, to $27.2 million for the three months ended September 30,

2023 compared to the three months ended June 30, 2023, primarily

due to a 14 basis point increase in the average loan yield,

partially offset by a $36.0 million decrease in the average balance

of loans. Interest income on loans, including fees, increased $3.2

million, or 13.4%, for the three months ended September 30, 2023

compared to the three months ended September 30, 2022, primarily

due to a 69 basis point increase in the average loan yield,

partially offset by a $24.2 million decrease in the average balance

of loans. The average balance of loans was $2.0 billion for the

third quarter of 2023, second quarter of 2023 and the same quarter

a year ago. The average yield on loans was 5.42% for the third

quarter of 2023, compared to 5.28% for the second quarter of 2023

and 4.73% for the third quarter of 2022. The increase in the

average yield on loans from the third quarter of 2023 and the third

quarter of 2022 was due to the impact of increased rates on

variable rate loans as well as new loans being originated at higher

market interest rates.

Interest income on loans included $372,000, $5,000, and $63,000

in accretion of the net discount on acquired loans for the three

months ended September 30, 2023, June 30, 2023, and September 30,

2022, respectively. The balance of the net discounts on these

acquired loans totaled $419,000, $331,000, and $480,000 at

September 30, 2023, June 30, 2023, and September 30, 2022,

respectively. Interest income included minimal fees earned related

to Paycheck Protection Program (“PPP”) loans in the quarters ended

September 30, 2023 and June 30, 2023, and $161,000 during the

quarter ended September 30, 2022. Interest income also included

fees related to prepayment penalties of $142,000 in the quarter

ended September 30, 2023, compared to $48,000 in the second quarter

of 2023, and $195,000 in the third quarter of 2022.

Interest income on investment securities increased $11,000, or

0.6%, from the prior quarter and totaled $1.7 million for both the

three months ended September 30, 2023 and the three months ended

June 30, 2023, and increased $149,000, or 9.6%, from $1.6 million

for the three months ended September 30, 2022. Average yield on

investment securities increased two basis points to 4.01% for the

three months ended September 30, 2023, compared to 3.99% for the

three months ended June 30, 2023, and increased 74 basis points

from 3.27% for the three months ended September 30, 2022. The

average balance of investment securities totaled $168.6 million for

the three months ended September 30, 2023, compared to $170.1

million and $188.7 million for the three months ended June 30, 2023

and September 30, 2022, respectively. In addition, during the third

quarter of 2023, we received $376,000 in cash dividends on our FRB

and FHLB stock, up 10.6% from $340,000 in the second quarter of

2023 and up 31.9% from $285,000 in the third quarter of 2022.

Interest income on federal funds sold and interest-bearing

balances in banks increased $961,000, or 37.5%, to $3.5 million for

the three months ended September 30, 2023, compared to $2.6 million

for the three months ended June 30, 2023, and increased $2.2

million, or 173.8%, from $1.3 million for the three months ended

September 30, 2022 as a result of an increase in the average yield.

The average yield on federal funds sold and interest-bearing

balances in banks increased 24 basis points to 5.38% for the three

months ended September 30, 2023, compared to 5.14% for the three

months ended June 30, 2023, and increased 320 basis points from

2.18% for the three months ended September 30, 2022. The average

balance of federal funds sold and interest-bearing balance in banks

totaled $259.6 million for the three months ended September 30,

2023, compared to $199.9 million and $234.6 million for the three

months ended June 30, 2023 and September 30, 2022,

respectively.

Interest expense increased $1.0 million, or 14.9%, to $8.0

million for the three months ended September 30, 2023, compared to

$7.0 million for the three months ended June 30, 2023, and

increased $5.6 million, or 232.5%, compared to $2.4 million for the

three months ended September 30, 2022, reflecting higher funding

costs primarily related to increased market rates of interest on

our deposits. Average balance of deposits totaled $2.2 billion for

the third quarter of 2023 compared to $2.1 billion for the second

quarter of 2023, and $2.2 billion for the third quarter of 2022.

The average cost of funds for the third quarter of 2023 was 2.04%,

compared to 1.82% for the second quarter of 2023 and 0.66% for the

third quarter of 2022. The increase in the average cost of funds

during the current quarter compared to the prior quarter of 2023

and the third quarter of 2022 was due to higher interest rates paid

on money market and time deposits due to increased competition and

pricing pressures and a change in deposit mix due to shift of

deposits from noninterest bearing accounts to higher costing money

market and time deposits. The average cost of total deposits for

the three months ended September 30, 2023 was 1.27%, compared to

1.10% for the three months ended June 30, 2023, and 0.25% for the

three months ended September 30, 2022. The average balance of

noninterest bearing deposits decreased $2.7 million, or 0.4%, to

$674.8 million for the three months ended September 30, 2023,

compared to $677.5 million for the three months ended June 30, 2023

and decreased $127.1 million, or 15.8%, compared to $801.9 million

for the three months ended September 30, 2022. Interest expense on

junior subordinated debt increased $14,000, or 6.9% to $217,000 for

the three months ended September 30, 2023 compared to $203,000 for

the three months ended June 30, 2023, and increased $88,000, or

68.2%, compared to $129,000 for the three months ended September

30, 2022, due to higher market rates.

Annualized net interest margin was 4.03% for the third quarter

of 2023, compared to 4.02% for the second quarter of 2023 and 3.99%

for third quarter of 2022. The average yield on interest earning

assets for the third quarter of 2023 increased 16 basis points and

96 basis points over the average yields for the second quarter of

2023 and the third quarter of 2022, respectively, while the average

rate paid on interest-bearing liabilities for third quarter of 2023

increased 22 basis points and 138 basis points over the average

rates paid for the second quarter of 2023 and the third quarter of

2022, respectively. Net interest margin in the third quarter of

2023 was positively impacted by increasing yields on loans and

accretion of the net discount and increasing yields on investment

securities, fed funds sold and interest bearing-balances in banks,

which outpaced on a percentage basis higher funding costs.

The average yield on PPP loans, including the recognition of

deferred PPP loan fees, was 1.00% during the third and second

quarters of 2023, resulting in a minimal negative impact to the net

interest margin, compared to an average yield of 2.28% during the

third quarter of 2022 resulting in a positive impact to the net

interest margin of three basis points. Accretion of the net

discount increased the average yield on loans by eight basis points

during the third quarter of 2023, compared to no effect and a one

basis point increase on the average yield on loans during the prior

quarter of 2023 and the third quarter of 2022, respectively. At

September 30, 2023, there was a total of $4.3 million of PPP loans

outstanding, with a minimal amount of unrecognized deferred fees

and costs.

Based on our review of the allowance for credit losses at

September 30, 2023, the Company recorded a $674,000 provision for

credit losses for the third quarter of 2023, compared to a $1.3

million reversal of the allowance for credit losses in the prior

quarter of 2023 and a $1.2 million provision for credit losses in

the third quarter of 2022. The provision for credit losses for

loans in the third quarter of 2023 was primarily due to $1.2

million increase in reserve for individually evaluated loans, which

included the loan to the Trust discussed below and previously

disclosed, and an increase in qualitative reserves, partially

offset by improvements in forecasted economic conditions,

specifically, national gross domestic product and national

unemployment, indicators utilized to estimate credit losses and, to

a lesser extent, a decrease in outstanding loan balances and

$25,000 in net charge-offs during the third quarter of 2023.

During the quarter ended September 30, 2023, the Company

determined that a certificate of deposit-secured line of credit

loan made to a revocable living trust (the “Trust” or the

“Borrower”) with an outstanding balance of approximately $1.0

million as of September 30, 2023 was impaired as a result of the

sole trustee and beneficiary of the Trust filing for personal

bankruptcy in July 2023. At June 30, 2023, the loan had an

outstanding balance of $5.0 million and was secured by a $4.0

million certificate of deposit held at the Bank. An additional $1.0

million in cash collateral securing the loan had previously been

released by the Bank into a third-party escrow account at the

request of the Borrower to be used as a refundable retainer in

connection with a separate transaction by the Borrower. The loan

matured on July 16, 2023, and the Bank received notification that

the sole trustee and beneficiary of the Trust filed for personal

bankruptcy on July 18, 2023. After receiving this notification, the

Bank used the $4.0 million certificate of deposit held at the Bank

to offset amounts owed on the loan and contacted the third-party

escrow agent for the return of the additional $1.0 million of

collateral. The Bank was advised by the escrow agent that the

previously escrowed funds had been released by the escrow agent,

which was done without the Bank’s consent and contrary to the

written escrow instructions. The Bank has initiated legal action

against the Borrower, the Borrower’s related parties and the escrow

agent to recover the previously escrowed collateral. The results of

the planned legal action and the Bank’s ability to recover the

previously escrowed collateral are currently uncertain. The loan

was fully reserved for at September 30, 2023.

Noninterest income for the third quarter of 2023 increased

$568,000, or 52.3%, to $1.7 million compared to $1.1 million in the

prior quarter of 2023 and decreased $728,000, or 30.6%, compared to

$2.4 million for the third quarter of 2022. The increase in

noninterest income for the current quarter compared to the prior

quarter of 2023 was primarily due to a $643,000 decrease in loss on

equity securities as a result of improvement in fair value

adjustments on these securities, a $91,000 increase in service

charges and other fees and a $36,000 increase in other income and

fees, partially offset by a $162,000 decrease in loan servicing

fees and other fees, and a $40,000 decrease in gain on sale of SBA

loans (guaranteed portion) generally due to a decrease in the

volume of SBA loans sold during the current quarter. The decrease

in noninterest income for the current quarter compared to the same

quarter in 2022 was primarily due to a $1.3 million decrease in

gain on sale of loans due to a decrease in the volume of and

premiums observed on SBA loans (guaranteed portion) sold and a

$57,000 decrease in loan servicing fees and other fees, partially

offset by a $288,000 increase in income from our investment in a

Small Business Investment Company (“SBIC”) fund, a $156,000

increase in service charges and other fees, a $88,000 decrease in

loss on equity securities and a $47,000 increase in other income

and fees.

Noninterest expense for the third quarter of 2023 decreased

$38,000, or 0.2%, to $16.5 million compared to $16.6 million for

the prior quarter of 2023, and increased $423,000, or 2.6%,

compared to $16.1 million for the third quarter of 2022. The

decrease in noninterest expense for the third quarter of 2023

compared to the prior quarter of 2023 was primarily due to a

$461,000 decrease in salaries and employee benefits as a result of

decline in other benefits expense, partially offset by a $159,000

increase in occupancy and equipment expense due to higher

depreciation and property maintenance expense, a $158,000 increase

in data processing and a $106,000 increase in other expense. The

increase in noninterest expense for the third quarter of 2023

compared to the third quarter of 2022 was primarily due to a

$212,000 increase in data processing, a $120,000 increase in

salaries and employee benefits due to wage increases and an

increase in full-time equivalent employees, and a $90,000 increase

in occupancy and equipment.

The provision for income taxes decreased $224,000, or 7.8%, to

$2.6 million for the third quarter of 2023 compared to $2.9 million

for the prior quarter of 2023 and decreased $207,000, or 7.3%, to

$2.8 million compared to the third quarter of 2022. The effective

tax rate for the third quarter of 2023 was 28.5%, compared to 28.4%

for the prior quarter of 2023, and 29.0% for the third quarter of

2022. The effective tax rate was lower for the third quarter of

2023 compared to the third quarter of 2022 due to accrual for

non-deductible compensation expenses.

Loans and Credit Quality

Loans, net of deferred fees, decreased $44.5 million and $26.2

million from the prior quarter-end and September 30, 2022,

respectively, and totaled $2.0 billion at September 30, 2023, June

30, 2023 and September 30, 2022. The decrease in loans at September

30, 2023 compared to June 30, 2023 primarily was due to $15.6

million of new loan originations, which was more than offset by

$58.6 million of loan repayments, including $584,000 in PPP loan

repayments. At September 30, 2023, there was a total of $4.3

million in PPP loans outstanding compared to $4.9 million at June

30, 2023, and $35.4 million at September 30, 2022.

Nonperforming loans, consisting of non-accrual loans and

accruing loans 90 days or more past due, totaled $14.3 million or

0.73% of total loans at September 30, 2023, compared to $12.8

million or 0.64% of total loans at June 30, 2023, and $19.7 million

or 0.99% of total loans at September 30, 2022. The increase in

nonperforming loans from the prior quarter-end was primarily due to

the line of credit loan discussed above made to the Trust that was

placed on nonaccrual during the current quarter. The portion of

nonaccrual loans guaranteed by government agencies totaled $801,000

at both September 30, 2023 and June 30, 2023, compared to $862,000

at September 30, 2022. There were no loans, 90 days or more past

due and still accruing and in the process of collection at both

September 30, 2023 and June 30, 2023, compared to 18 loans totaling

$3.3 million in accruing SBA guaranteed PPP loans which were 90

days or more past due and in the process of forgiveness at

September 30, 2022. Accruing loans past due between 30 and 89 days

at September 30, 2023, were $2.6 million, compared to $1.6 million

at June 30, 2023, and $5.3 million at September 30, 2022. The

increase in accruing loans past due between 30-89 days from the

prior quarter-end was primarily due to timing of borrower

payments.

At September 30, 2023, the Company’s allowance for credit losses

for loans was $19.8 million, or 1.01% of total loans, compared to

$19.1 million, or 0.95% of total loans, at June 30, 2023 and $18.1

million, or 0.90% of total loans, at September 30, 2022. We

recorded net charge-offs of $25,000 for the third quarter of 2023,

compared to net charge-offs of $60,000 in the prior quarter of 2023

and net charge-offs of $944,000 in the third quarter of 2022.

In accordance with acquisition accounting, acquired loans were

recorded at their estimated fair value, which resulted in a net

discount to the loans’ contractual amounts. Credit discounts are

included in the determination of fair value and as a result, no

allowance for credit losses is recorded for acquired loans at the

acquisition date. However, the allowance for credit losses includes

an estimate for credit deterioration of acquired loans that occurs

after the date of acquisition, which is included in the provision

for credit losses in the period that the deterioration occurred.

The discount recorded on the acquired loans is not reflected in the

allowance for credit losses on loans or the related allowance

coverage ratios. As of September 30, 2023, acquired loans net of

their discount totaled $224.4 million with a remaining net discount

on these loans of $419,000, compared to $234.7 million of acquired

loans with a remaining net discount of $331,000 at June 30, 2023,

and $229.4 million of acquired loans with a remaining net discount

of $480,000 at September 30, 2022. The net discount includes a

credit discount based on estimated losses on the acquired loans,

partially offset by a premium, if any, based on market interest

rates on the date of acquisition.

Deposits and Borrowings

Deposits totaled $2.2 billion at September 30, 2023, compared to

$2.1 billion at both June 30, 2023 and September 30, 2022. The

deposit mix shifted, in part, due to interest rate sensitive

clients moving a portion of their non-operating deposit balances

from lower costing deposits, including noninterest bearing

deposits, into higher costing money market and time deposits. At

September 30, 2023, noninterest bearing deposits totaled $667.3

million, or 30.9% of total deposits, compared to $664.1 million, or

30.9% of total deposits at June 30, 2023, and $813.5 million, or

38.5% of total deposits at September 30, 2022.

We consider our deposit base to be seasoned, stable and

well-diversified, and we do not have any significant industry

concentrations among our non-insured deposits. We also offer an

insured cash sweep product (ICS) that allows customers to insure

deposits above FDIC insurance limits. At September 30, 2023, our

average deposit account size (excluding public funds), calculated

by dividing period-end deposits by the population of accounts with

balances, was approximately $59,000.

The Bank has an approved secured borrowing facility with the

FHLB of San Francisco for up to 25% of total assets for a term not

to exceed five years under a blanket lien of certain types of

loans. At September 30, 2023, June 30, 2023 and September 30, 2022,

the Bank had no FHLB advances outstanding. The Bank has Federal

Funds lines with four corresponding banks. Cumulative available

commitments on these lines totaled $65.0 million at September 30,

2023, June 30, 2023 and September 30, 2022. There were no amounts

outstanding under these facilities at September 30, 2023, June 30,

2023 or September 30, 2022.

At September 30, 2023, June 30, 2023 and September 30, 2022, the

Company had outstanding junior subordinated debt, net of fair value

adjustments, related to junior subordinated deferrable interest

debentures assumed in connection with its previous acquisitions

totaling $8.5 million. At both September 30, 2023 and June 30,

2023, the Company also had outstanding subordinated debt, net of

costs to issue, totaling $63.8 million, compared to $63.7 million

at September 30, 2022.

At September 30, 2023, June 30, 2023 and September 30, 2022, the

Company had no other borrowings outstanding.

Shareholders’ Equity

Shareholders’ equity totaled $307.3 million at September 30,

2023, compared to $307.0 million at June 30, 2023, and $314.4

million at September 30, 2022. The increase at September 30, 2023

compared to June 30, 2023, reflects $6.6 million of net income

during the current quarter, partially offset by repurchases of $4.5

million of common stock, $1.2 million of accrued cash dividends

payable and a $840,000 increase in accumulated other comprehensive

loss, net of taxes, during the current quarter. At September 30,

2023, 482,311 shares remained available for future purchases under

the Company’s current stock repurchase plan.

The decrease in shareholders’ equity at September 30, 2023,

compared to September 30, 2022, primarily was due to the repurchase

of $21.7 million of Company common stock, cash dividends paid and

accrued of $3.6 million, and a $5.7 million increase in accumulated

other comprehensive loss, net of taxes, partially offset by $21.0

million of net income earned during the first nine months of 2023

and the fourth quarter of 2022.

About BayCom Corp

The Company, through its wholly owned operating subsidiary,

United Business Bank, offers a full-range of loans, including SBA,

CalCAP, FSA and USDA guaranteed loans, and deposit products and

services to businesses and their affiliates in California,

Washington, New Mexico and Colorado. The Bank is an Equal Housing

Lender and a member of FDIC. The Company’s common stock is listed

on the NASDAQ Global Select Market under the symbol “BCML”. For

more information, go to www.unitedbusinessbank.com.

Forward-Looking Statements

This release, as well as other public or shareholder

communications by the Company, may contain forward-looking

statements, including, but not limited to, (i) statements regarding

the financial condition, results of operations and business of the

Company, (ii) statements about the Company’s plans, objectives,

expectations and intentions and other statements that are not

historical facts and (iii) other statements identified by the words

or phrases “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimate,” “project,” “intends” or

similar expressions that are intended to identify “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are not historical

facts but instead are based on current beliefs and expectations of

the Company’s management and are inherently subject to significant

business, economic and competitive uncertainties and contingencies,

many of which are beyond the Company’s control. In addition, these

forward-looking statements are subject to assumptions with respect

to future business strategies and decisions that are subject to

change.

There are a number of factors that could cause future results to

differ materially from historical performance and these

forward-looking statements. Factors which could cause actual

results to differ materially from the results anticipated or

implied by our forward-looking statements include, but are not

limited to: potential adverse impacts to economic conditions in our

local market areas, other markets where the Company has lending

relationships, or other aspects of the Company’s business

operations or financial markets, including, without limitation, as

a result of employment levels, labor shortages and the effects of

inflation, a potential recession or slowed economic growth; changes

in the interest rate environment, including the recent increases in

the Federal Reserve benchmark rate and duration at which such

increased interest rate levels are maintained, which could

adversely affect our revenues and expenses, the values of our

assets and obligations, and the availability and cost of capital

and liquidity; the impact of continuing high inflation and the

current and future monetary policies of the Federal Reserve in

response thereto; the effects of any federal government shutdown;

the impact of bank failures or adverse developments at other banks

and related negative press about the banking industry in general on

investor and depositor sentiment; review of the Company’s

accounting, accounting policies and internal control over financial

reporting; risks and uncertainties related to the recent

restatement of certain of our historical consolidated financial

statements; the subsequent discovery of additional adjustments to

the Company’s previously issued financial statements; future

acquisitions by the Company of other depository institutions or

lines of business; fluctuations in interest rates; the risks of

lending and investing activities, including changes in the level

and direction of loan delinquencies and write-offs and changes in

estimates of the adequacy of the allowance for credit losses; the

Company's ability to access cost-effective funding; fluctuations in

real estate values and both residential and commercial real estate

market conditions; demand for loans and deposits in the Company's

market area; increased competitive pressures; changes in

management’s business strategies; disruptions, security breaches,

or other adverse events, failures or interruptions in, or attacks

on, our information technology systems or on the third-party

vendors who perform critical processing functions for us; the

effects of climate change, severe weather events, natural

disasters, pandemics, epidemics and other public health crises,

acts of war or terrorism, and other external events on our

business; and other factors described in the Company’s latest

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and

other reports filed with or furnished to the Securities and

Exchange Commission (“SEC”) that are available on our website at

www.unitedbusinessbank.com and on the SEC's website at

www.sec.gov.

The factors listed above could materially affect the Company’s

financial performance and could cause the Company’s actual results

for future periods to differ materially from any opinions or

statements expressed with respect to future periods in any current

statements.

The Company does not undertake - and specifically declines any

obligation - to publicly release the result of any revisions, that

may be made to any forward-looking statements to reflect events or

circumstances after the date of such statements or to reflect the

occurrence of anticipated or unanticipated events whether as a

result of new information, future events or otherwise, except as

may be required by law or NASDAQ rules. When considering

forward-looking statements, you should keep in mind these risks and

uncertainties. You should not place undue reliance on any

forward-looking statement, which speaks only as of the date

made.

BAYCOM CORP

STATEMENTS OF COMPREHENSIVE

INCOME (UNAUDITED)

(Dollars in thousands, except per

share data)

Three months ended

Nine months ended

September 30,

June 30,

September 30,

September 30,

September 30,

2023

2023

2022

2023

2022

(As Restated)

(As Restated)

Interest income

Loans, including fees

$

27,229

$

26,667

$

24,010

$

80,151

$

69,921

Investment securities

1,704

1,693

1,555

5,037

4,483

Fed funds sold and interest-bearing

balances in banks

3,521

2,560

1,286

7,910

2,303

FHLB dividends

232

196

160

616

467

FRB dividends

144

144

126

432

387

Total interest and dividend income

32,830

31,260

27,137

94,146

77,561

Interest expense

Deposits

6,908

5,881

1,387

16,489

4,310

Subordinated debt

896

895

896

2,687

2,687

Junior subordinated debt

217

203

129

623

319

Total interest expense

8,021

6,979

2,412

19,799

7,316

Net interest income

24,809

24,281

24,725

74,347

70,245

Provision for (reversal of) credit

losses

674

(1,260

)

1,194

(311

)

3,824

Net interest income after provision for

(reversal of) credit losses

24,135

25,541

23,531

74,658

66,421

Noninterest income

Gain on sale of loans

28

68

1,278

508

2,714

Loss on equity securities

(274

)

(917

)

(362

)

(2,087

)

(3,971

)

Service charges and other fees

973

882

817

2,740

2,165

Loan servicing fees and other fees

431

593

488

1,434

1,670

Income on investment in SBIC fund

225

225

(63

)

939

155

Bargain purchase gain

—

—

—

—

1,665

Other income and fees

271

235

224

769

796

Total noninterest income

1,654

1,086

2,382

4,303

5,194

Noninterest expense

Salaries and employee benefits

10,284

10,745

10,164

32,065

29,751

Occupancy and equipment

2,133

1,974

2,043

6,134

6,388

Data processing

1,774

1,616

1,562

4,855

5,502

Other expense

2,328

2,222

2,327

6,551

7,986

Total noninterest expense

16,519

16,557

16,096

49,605

49,627

Income before provision for income

taxes

9,270

10,070

9,817

29,356

21,988

Provision for income taxes

2,640

2,864

2,847

8,327

5,882

Net income

$

6,630

$

7,206

$

6,970

$

21,029

$

16,106

Net income per common share:

Basic

$

0.56

$

0.59

$

0.52

$

1.72

$

1.22

Diluted

0.56

0.59

0.52

1.72

1.22

Weighted average shares used to compute

net income per common share:

Basic

11,812,583

12,228,206

13,307,555

12,243,506

13,179,263

Diluted

11,812,583

12,228,206

13,307,555

12,243,506

13,179,263

Comprehensive income

Net income

$

6,630

$

7,206

$

6,970

$

21,029

$

16,106

Other comprehensive loss:

Change in unrealized loss on

available-for-sale securities

(1,178

)

(4,999

)

(6,835

)

(8,001

)

(19,200

)

Deferred tax benefit

338

1,437

1,967

2,302

5,525

Other comprehensive loss, net of tax

(840

)

(3,562

)

(4,868

)

(5,699

)

(13,675

)

Comprehensive income

$

5,790

$

3,644

$

2,102

$

15,330

$

2,431

BAYCOM CORP

STATEMENTS OF CONDITION

(UNAUDITED)

(Dollars in thousands)

September 30,

June 30,

September 30,

2023

2023

2022

(As Restated)

Assets

Cash and due from banks

$

30,444

$

36,637

$

32,206

Federal funds sold and interest-bearing

balances in banks

271,490

213,562

192,475

Cash and cash equivalents

301,934

250,199

224,681

Time deposits in banks

1,743

1,992

2,490

Investment securities available-for-sale

(AFS)

145,845

146,506

152,810

Equity securities

11,639

11,912

14,403

Federal Home Loan Bank ("FHLB") stock, at

par

11,313

11,313

10,679

Federal Reserve Bank ("FRB") stock, at

par

9,621

9,616

9,595

Loans held for sale

1,274

—

3,491

Loans, net of deferred fees

1,968,804

2,013,307

1,994,966

Allowance for credit losses for loans

(19,800)

(19,100

)

(18,050

)

Premises and equipment, net

13,466

13,039

13,697

Other real estate owned ("OREO")

—

—

21

Core deposit intangible

4,221

4,527

5,718

Cash surrender value of bank owned life

insurance policies, net

22,698

22,528

22,043

Right-of-use assets

15,220

15,270

15,875

Goodwill

38,838

38,838

38,838

Interest receivable and other assets

47,570

47,539

43,241

Total Assets

$

2,574,386

$

2,567,486

$

2,534,498

Liabilities and Shareholders’ Equity

Noninterest bearing deposits

$

667,336

$

664,096

$

813,510

Interest bearing deposits

Transaction accounts and savings

790,089

775,117

937,076

Premium money market

270,675

248,730

140,377

Time deposits

431,344

459,123

224,488

Total deposits

2,159,444

2,147,066

2,115,451

Junior subordinated deferrable interest

debentures, net

8,544

8,524

8,464

Subordinated debt, net

63,839

63,796

63,669

Salary continuation plans

4,886

4,955

4,724

Lease liabilities

16,017

15,947

16,411

Interest payable and other liabilities

14,396

20,184

11,376

Total Liabilities

2,267,126

2,260,472

2,220,095

Shareholders’ Equity

Common stock, no par value

183,499

187,866

208,770

Accumulated other comprehensive loss, net

of tax

(17,260

)

(16,420

)

(11,509

)

Retained earnings

141,021

135,568

117,142

Total shareholders’ equity

307,260

307,014

314,403

Total Liabilities and Shareholders’

Equity

$

2,574,386

$

2,567,486

$

2,534,498

BAYCOM CORP

FINANCIAL HIGHLIGHTS

(UNAUDITED)

(Dollars in thousands, except per

share data)

At and for the three months

ended

At and for the nine months

ended

September 30,

June 30,

September 30,

September 30,

September 30,

Selected

Financial Ratios and Other Data:

2023

2023

2022

2023

2022

(As Restated)

(As Restated)

Performance Ratios:

Return on average assets (1)

1.03

%

1.13

%

1.07

%

1.10

%

0.81

%

Return on average equity (1)

8.55

9.22

8.65

8.93

6.76

Yield on earning assets (1)

5.34

5.18

4.38

5.21

4.12

Rate paid on average interest-bearing

liabilities

2.04

1.82

0.66

1.75

0.64

Interest rate spread - average during the

period

3.30

3.36

3.72

3.46

3.48

Net interest margin (1)

4.03

4.02

3.99

4.12

3.73

Loan to deposit ratio

91.17

93.77

94.30

91.17

94.30

Efficiency ratio (2)

62.42

65.27

59.38

63.07

65.78

Charge-offs, net

$

25

$

60

$

944

$

400

$

3,474

Per Share Data:

Shares outstanding at end of period

11,673,830

11,900,022

13,075,447

11,673,830

13,075,447

Average diluted shares outstanding

11,812,583

12,228,206

13,307,555

12,243,506

13,179,263

Diluted earnings per share

$

0.56

$

0.59

$

0.52

$

1.72

$

1.22

Book value per share

26.32

25.80

24.05

26.32

24.05

Tangible book value per share (3)

22.63

22.16

20.64

22.63

20.64

Asset Quality Data:

Nonperforming assets to total assets

(4)

0.56

%

0.50

%

0.78

%

Nonperforming loans to total loans (5)

0.73

%

0.64

%

0.99

%

Allowance for credit losses on loans to

nonperforming loans (5)

138.26

%

148.86

%

91.70

%

Allowance for credit losses on loans to

total loans

1.01

%

0.95

%

0.90

%

Classified assets (graded substandard and

doubtful)

$

29,366

$

21,546

$

23,904

Total accruing loans 30‑89 days past

due

2,592

1,623

5,343

Total loans 90 days past due and still

accruing

—

—

3,315

Capital Ratios (6):

Tier 1 leverage ratio — Bank

13.26

%

13.05

%

12.90

%

Common equity tier 1 — Bank

17.20

%

16.60

%

16.16

%

Tier 1 capital ratio — Bank

17.20

%

16.60

%

16.16

%

Total capital ratio — Bank

18.23

%

17.59

%

17.07

%

Equity to total assets — end of period

11.94

%

11.97

%

12.40

%

Tangible equity to tangible assets — end

of period (3)

10.44

%

10.45

%

10.84

%

Loans:

Real estate

$

1,785,640

$

1,816,355

$

1,746,157

Non-real estate

168,350

183,780

233,178

Nonaccrual loans

14,321

12,831

16,369

Mark to fair value at acquisition

419

331

(480

)

Total Loans

1,968,730

2,013,297

1,995,224

Net deferred fees on loans (7)

74

10

(258

)

Loans, net of deferred fees

$

1,968,804

$

2,013,307

$

1,994,966

Other Data:

Number of full-service offices

35

34

34

Number of full-time equivalent

employees

376

383

375

(1)

Annualized.

(2)

Total noninterest expense as a percentage

of net interest income and total noninterest income.

(3)

Represents a non-GAAP financial measure.

See “Non-GAAP Financial Measures” below.

(4)

Nonperforming assets consist of nonaccrual

loans, accruing loans that are 90 days or more past due, and other

real estate owned.

(5)

Nonperforming loans consist of nonaccrual

loans and accruing loans that are 90 days or more past due.

(6)

Capital ratios are for United Business

Bank only.

(7)

Deferred fees include $2,600, $2,800 and

$227,000 as of September 30, 2023, June 30, 2023, and September 30,

2022, respectively, in fees related to PPP loans

Non-GAAP Financial Measures:

In addition to results presented in accordance with generally

accepted accounting principles utilized in the United States

(“GAAP”), this earnings release contains tangible book value per

share, a non-GAAP financial measure. Tangible book value per share

is calculated by dividing tangible common shareholders’ equity by

the number of common shares outstanding at the end of the period.

Tangible common shareholders’ equity excludes intangible assets

from shareholders’ equity. For this financial measure, the

Company’s intangible assets are goodwill and core deposit

intangibles. The Company believes that this measure is consistent

with the capital treatment by our bank regulatory agencies, which

excludes intangible assets from the calculation of risk-based

capital ratios, and presents this measure to facilitate comparison

of the quality and composition of the Company’s capital over time

in comparison to its peers. Non-GAAP financial measures have

inherent limitations, are not required to be uniformly applied, and

are not audited. Further, these non-GAAP financial measure should

not be considered in isolation or as a substitute for the

comparable financial measures determined in accordance with GAAP

and may not be comparable to similarly titled measures reported by

other companies.

Reconciliation of the GAAP and non-GAAP financial measures is

presented below:

Non-GAAP Measures

(Dollars in thousands, except per

share data)

September 30,

June 30,

September 30,

2023

2023

2022

Tangible Book Value:

Total common shareholders’ equity

(GAAP)

$

307,260

$

307,014

$

314,403

less: Goodwill and other intangibles

43,059

43,365

44,556

Tangible common shareholders’ equity

(Non-GAAP)

$

264,201

$

263,649

$

269,847

Total assets (GAAP)

$

2,574,386

$

2,567,486

$

2,534,498

less: Goodwill and other intangibles

43,059

43,365

44,556

Total tangible assets (Non-GAAP)

$

2,531,327

$

2,524,121

$

2,489,942

Equity to total assets (GAAP)

11.94

%

11.96

%

12.40

%

Tangible equity to tangible assets

(Non-GAAP)

10.44

%

10.45

%

10.84

%

Book value per share (GAAP)

$

26.32

$

25.80

$

24.05

Tangible book value per share

(Non-GAAP)

$

22.63

$

22.16

$

20.64

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231019588863/en/

BayCom Corp Keary Colwell, 925-476-1800

kcolwell@ubb-us.com

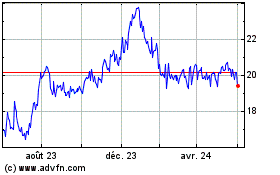

BayCom (NASDAQ:BCML)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

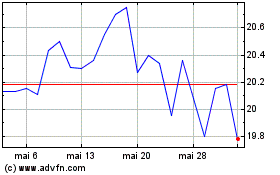

BayCom (NASDAQ:BCML)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024