Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

14 Novembre 2024 - 10:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

______________________________________________

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box: | | | | | |

| ¨ | Preliminary Proxy Statement |

| |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | Definitive Proxy Statement |

| |

| x | Definitive Additional Materials |

| |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

bluebird bio, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check all boxes that apply): | | | | | | | | | | | | | | |

| x | | No fee required. |

| | |

| ¨ | | Fee paid previously with preliminary materials. |

| | |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

Commencing on November 14, 2024, bluebird bio, Inc. plans to provide the following communication to its stockholders.

November 14, 2024

Fellow Stockholder:

On December 4, bluebird bio will reconvene its Annual Stockholder Meeting for an important vote that will help determine the future direction of the Company. We are asking that you vote FOR Proposal 4 – a reverse stock split of the Company’s common stock.

| | | | | |

| As a reminder, the approval of Proposal 4 would: |

| |

| 1. | Effect a reverse stock split, thus facilitating ongoing compliance with Nasdaq’s minimum bid price requirement, which we believe would increase the attractiveness of bluebird bio to institutional investors.

|

| 2. | Increase the number of shares on a relative basis that the Company is authorized to issue, which would enable future potential financing. |

bluebird continues to make progress on our potential path to cash flow breakeven in the second half of 2025. On November 14, we announced that we had more than doubled patient starts between our second and third quarter updates, and we project strong performance through the remainder of the year, with a minimum of $25 million in net revenue projected in the fourth quarter.

Looking further ahead, more than 25 patients are already scheduled to begin treatment with one of bluebird’s gene therapies in 2025, which we believe provides clear evidence that our commercial launches continue to accelerate. However, we must secure additional cash resources to fund the business and reach our projected cash flow breakeven point in the second half of next year. The approval of Proposal 4 provides us with necessary flexibility as we consider financing options.

As previously announced, ISS and Glass Lewis, independent proxy advisory firms to thousands of institutional investors and pension funds, have both recommended in FAVOR of the reverse stock split in Proposal 4.

While overall stockholder votes received to date trend in favor of Proposal 4 by approximately two to one, approval for the proposed reverse stock split requires a vote of more than 50 percent of the total shares outstanding.

Your Vote is Important!

Proxies previously submitted in respect of Proposal 4 will be voted at the adjourned Annual Meeting unless properly revoked. Stockholders who previously voted against Proposal 4 are encouraged to reconsider and change their vote in favor of the proposal. Stockholders who have previously submitted their proxy or otherwise voted in respect of Proposal 4 and who do not want to change their vote need not take any action.

The proxy statement for the Annual Meeting of Stockholders of bluebird bio filed on September 26, 2024 contains important information and this letter should be read in conjunction with the proxy statement, which, along with other relevant materials, is available at no charge at the U.S. Securities & Exchange Commission’s website

www.sec.gov and at the Company’s website https://investor.bluebirdbio.com/sec-filings.

We appreciate your continued support of bluebird bio.

Andrew Obenshain

President & Chief Executive Officer

| | |

If you have any questions, or need assistance in voting your shares, please call our proxy solicitor.

INNISFREE M&A INCORPORATED TOLL-FREE, at 1-877-750-0854 |

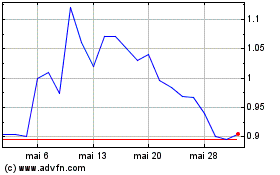

bluebird bio (NASDAQ:BLUE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

bluebird bio (NASDAQ:BLUE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025