false

0001191070

BIONOMICS LIMITED/FI

00-0000000

0001191070

2024-12-16

2024-12-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): December 16, 2024

BIONOMICS LIMITED

(Exact name of registrant as specified in its charter)

| Australia |

|

001-41157 |

|

n/a |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

|

200 Greenhill Road

Eastwood, SA

Australia |

|

5063 |

| (Address of principal executive offices) |

|

(Zip Code) |

+61 8 8150 7400

(Registrant’s telephone number, including

area code)

|

N/A

(Former name or former address, if changed since

last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of exchange on which registered |

| American Depositary Shares |

|

BNOX |

|

The Nasdaq Global Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item

8.01 Other Events

As discussed in Current Reports on Form 8-K that were filed with the

Securities and Exchange Commission on October 2, 2024 and November 8, 2024, Bionomics Limited, an Australian corporation (“Bionomics”),

and Neuphoria Therapeutics Inc., a Delaware corporation (“Neuphoria”), have entered into a Scheme Implementation Agreement

to re-domicile from Australia to the U.S. State of Delaware pursuant to a Scheme of Arrangement (“Scheme”) under Australian

law. Upon completion of the Scheme, Bionomics would become a wholly-owned subsidiary of Neuphoria.

As discussed in a Current Report on Form 8-K that was filed with the

Securities and Exchange Commission on December 12, 2024, Bionomics shareholders approved the Scheme.

At 3:00pm Sydney time on December 16, 2024, the Supreme Court of New

South Wales, Australia (“Court”) made orders approving the Scheme. A copy of the Court’s orders with respect to the

Scheme was lodged with the Australian Securities & Investments Commission following the Court hearing, at which time the Scheme became

legally effective.

Bionomics’ ADSs will continue to trade on Nasdaq until the implementation

date (December 23, 2024 (New York time)).

Shares of Neuphoria are expected to begin trading on Nasdaq under the

symbol “NEUP” on December 24, 2024 or as soon as possible thereafter.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

BIONOMICS LIMITED |

| |

|

|

| Date: December 16, 2024 |

By: |

/s/ Spyridon Papapetropoulos |

| |

|

Spyridon Papapetropoulos |

| |

|

President and Chief Executive Officer |

2

Exhibit 99.1

Supreme Court of New South Wales approves Bionomics’ re-domiciliation

Adelaide, Australia and Cambridge, Mass., December 16, 2024 (GLOBE NEWSWIRE) – Bionomics Limited (Nasdaq: BNOX) (“Bionomics”

or the “Company”) is pleased to announce that the Supreme Court of New South Wales, Australia (“Court”)

has today made orders approving the scheme of arrangement in relation to the Company’s proposed re-domiciliation from Australia

to the United States (“Scheme”), under which Neuphoria Therapeutics Inc., a Delaware corporation (“Neuphoria”),

will become the ultimate parent company of Bionomics Limited following the implementation of the Scheme.

A copy of the Court’s orders with respect to the Scheme was lodged

with the Australian Securities & Investments Commission following the Court hearing, at which time the Scheme became legally effective.

Bionomics’ ADSs will continue to trade on Nasdaq until the implementation date (December 23, 2024 (New York time)).

Bionomics shareholders who hold shares on the record date for the Scheme

(5:00pm Sydney time on Tuesday, December 17, 2024) will be entitled to receive the Scheme consideration (in accordance with the terms

of the Scheme as set out in Section 6 of the Scheme Booklet dated November 11, 2024 (“Scheme Booklet”)). The Scheme

consideration will be paid to Scheme Shareholders (as defined in the Scheme Booklet) on the implementation date.

Shares of Neuphoria are expected to begin trading on Nasdaq under the

symbol “NEUP” on December 24, 2024 or as soon as possible thereafter.

| For further information, please contact: |

|

|

| |

|

|

| General |

Investor Relations |

Investor Relations |

| Rajeev Chandra |

Kevin Gardner |

Chris Calabrese |

| Company Secretary |

kgardner@lifesciadvisors.com |

ccalabrese@lifesciadvisors.com |

| CoSec@bionomics.com.au |

|

|

About Bionomics Limited

Bionomics (NASDAQ: BNOX) is a clinical-stage biotechnology company

developing novel, potential first-in-class, allosteric ion channel modulators to treat patients suffering from serious central nervous

system (“CNS”) disorders with high unmet medical need. Bionomics is advancing its lead drug candidate, BNC210, an oral, proprietary,

selective negative allosteric modulator of the α7 nicotinic acetylcholine receptor, for the acute treatment of Social Anxiety Disorder

(SAD) and chronic treatment of Post-Traumatic Stress Disorder (PTSD). Beyond BNC210, Bionomics has a strategic partnership with Merck

& Co., Inc. (known as MSD outside the United States and Canada) with two drugs in early-stage clinical trials for the treatment of

cognitive deficits in Alzheimer’s disease and other central nervous system conditions. Bionomics’ pipeline also includes preclinical

assets that target Kv3.1/3.2 and Nav1.7/1.8 ion channels being developed for CNS conditions of high unmet need.

Forward-Looking Statements

Bionomics cautions that statements included in this press release that

are not a description of historical facts are forward-looking statements. Words such as “may,” “could,” “will,”

“would,” “should,” “expect,” “plan,” “anticipate,” “believe,”

“estimate,” “intend,” “predict,” “seek,” “contemplate,” “potential,”

“continue” or “project” or the negative of these terms or other comparable terminology are intended to identify

forward-looking statements. The forward-looking statements are based on our current beliefs and expectations. The inclusion of forward-looking

statements should not be regarded as a representation by Bionomics that any of its plans will be achieved. Actual results may differ materially

from those set forth in this release due to the risks and uncertainties inherent in the Company’s business and other risks described

in the Company’s filings with the SEC, including the Company’s Annual Report on Form 10-K filed with the SEC, and its other

reports. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof,

and Bionomics undertakes no obligation to revise or update this news release to reflect events or circumstances after the date hereof.

Further information regarding these and other risks, uncertainties and other factors is included in Bionomics’ filings with the

SEC, copies of which are available from the SEC’s website (www.sec.gov) and on Bionomics’ website (www.bionomics.com.au) under

the heading “Investor Center.” All forward-looking statements are qualified in their entirety by this cautionary statement.

This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995. Bionomics

expressly disclaims all liability in respect to actions taken or not taken based on any or all the contents of this press release.

Not an offer of securities

This press release does not constitute an offer to sell, or the solicitation

of an offer to buy, any securities in any jurisdiction. The Neuphoria shares have not been registered under the U.S. Securities Act of

1933 and may not be offered or sold except in a transaction registered under the Securities Act or in a transaction exempt from, or not

subject to, such registration requirements and applicable U.S. state securities laws.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

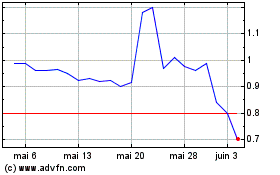

Bionomics (NASDAQ:BNOX)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Bionomics (NASDAQ:BNOX)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025