Current Report Filing (8-k)

06 Juin 2022 - 12:01PM

Edgar (US Regulatory)

0000014177

false

0000014177

2022-06-01

2022-06-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

Current

Report Pursuant to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): June 1, 2022

Bridgford

Foods Corporation

(Exact

name of Registrant as specified in its charter)

| Texas |

|

000-02396 |

|

95-1778176 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

| 1707

S. Good Latimer Expressway, Dallas, TX |

|

75226 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(714)

526-5533

(Registrant’s

telephone number, including area code)

Not

applicable

(Former

name, former address and former fiscal year, if applicable)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on which Registered |

| Common

Stock |

|

BRID |

|

Nasdaq

Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM

1.02 — TERMINATION OF A MATERIAL DEFINITIVE AGREEMENT

On

June 1, 2022, in connection with the closing of the Sale Transaction (as defined below), Bridgford Food Processing Corporation, a California

corporation (“BFPC”) and a wholly-owned subsidiary of Bridgford Foods Corporation (NasdaqGM: BRID, the “Registrant”),

repaid in full all indebtedness, liabilities and other obligations under, and terminated the bridge loan commitment note with Wells Fargo

Bank N.A. (“WFB”) entered into on August 30, 2021. Additionally, BFPC repaid all outstanding balances under the revolving

line of credit with WFB which line continues in effect per its terms to March 1, 2023. BFPC did not incur any prepayment fees or penalties

as a result of the foregoing transactions.

ITEM

2.01 — COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On

June 1, 2022, BFPC and CRG Acquisition, LLC (“CRG”), completed the real estate transaction (the “Sale Transaction”)

set forth in the Purchase and Sale Agreement dated March 16, 2020 (as amended to date, the “CRG Purchase Agreement”). BFPC’s

entry into and the terms of the CRG Purchase Agreement were previously reported in a Current Report on Form 8-K filed with the Securities

and Exchange Commission (the “SEC”) on March 19, 2020.

Pursuant

to the terms of the CRG Purchase Agreement, CRG acquired a parcel of land from BFPC including an approximate 156,000 square foot four-story

industrial food processing building located at 170 N. Green Street in Chicago, Illinois. The purchase price for the Sale Transaction

was $60.0 million, less approximately $2.1 million previously received by BFPC as non-refundable earnest money, and subject to certain

closing adjustments as set forth in the CRG Purchase Agreement. In connection with the closing of the Sale Transaction, BFPC paid an

aggregate of $1.2 million in broker commissions, including approximately $300,000 to KR6, Inc., an entity controlled by Keith

Ross (a member of the Registrant’s Board of Directors). BFPC used approximately $18.7 million of the Sale Transaction proceeds

to repay and terminate its bridge loan with WFB and intends to use approximately $18.0 million of such proceeds to repay its outstanding

balance under our revolving credit facility with WFB, each as described in Item 1.02 above. BFPC currently anticipates that a

significant portion of the balance of the sales proceeds will be used to pay federal and state taxes on the transaction, after deduction

of net operating loss carryforwards in the amount of approximately $10.3 million. Any remaining funds will be used at the direction of

the Registrant’s Board of Directors, including, without limitation, for general working capital purposes.

The

foregoing summary of the terms of the CRG Purchase Agreement is not complete and is qualified in its entirety by reference to the full

text of the CRG Purchase Agreement, which was filed as Exhibit 10.1 to the Current Report on Form 8-K filed with the SEC on March 19.

2020 and is incorporated herein by reference.

Forward-Looking

Statements: Any statements contained in this Current Report on Form 8-K that refer to events that may occur in the future or other

non-historical matters are forward-looking statements. These statements generally are characterized by the use of terms such as “plan”,

“may”, “will”, “should”, “anticipate”, “estimate”, “predict”,

“believe” and “expect”. These forward-looking statements relate to, among other things, the proposed use of proceeds

from the Sale Transaction, are based on BFPC’s and the Registrant’s expectations as of the date of this Report and are subject

to risks and uncertainties that could cause actual results to differ materially from current expectations. Actual results could differ

materially from those projected in the forward-looking statements as a result of industry and economic conditions as well as other risks

identified in documents that the Registrant files with the SEC.. Given these uncertainties, the Registrant cautions investors and potential

investors not to place undue reliance on such statements. Neither BFPC nor the Registrant undertakes any obligation to publicly release

the results of any revisions to these forward-looking statements that may be made to reflect future events or circumstances or to reflect

the occurrence of unanticipated events.

Item

9.01 - Financial Statements and Exhibits

(d)

Exhibits.

| |

Exhibit

Number |

|

Description |

| |

|

|

|

| |

104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

BRIDGFORD

FOODS CORPORATION |

| |

|

|

| Date:

June 3, 2022 |

By: |

/s/

Raymond F. Lancy |

| |

Name: |

Raymond

F. Lancy |

| |

Title: |

Principal

Financial Officer |

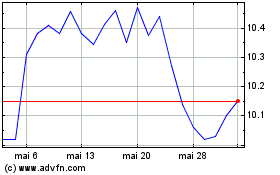

Bridgford Foods (NASDAQ:BRID)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Bridgford Foods (NASDAQ:BRID)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025