false

0001434524

0001434524

2024-11-20

2024-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 20, 2024

CLEARSIGN TECHNOLOGIES CORPORATION

(Exact name of registrant as specified in charter)

| Delaware |

|

001-35521 |

|

26-2056298 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

8023 E. 63rd Place, Suite 101

Tulsa,

Oklahoma 74133

(Address of Principal Executive Offices)

(Zip Code)

(918) 236-6461

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2 below).

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13(e)-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which

registered |

| Common Stock |

|

CLIR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth

company ¨ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

To

the extent required, the information set forth below in Item 7.01 of this Current Report on Form 8-K is incorporated herein by reference

in its entirety.

| Item 7.01 | Regulation FD Disclosure. |

On

November 20, 2024, ClearSign Technologies Corporation (the “Company”) issued a press release announcing the results of operations

for the quarter ended September 30, 2024 (the “Financial Results”). The press release is furnished as Exhibit 99.1 to

this Current Report on Form 8-K and is incorporated by reference in its entirety into this Item 7.01.

Also

on November 20, 2024, the Company held a conference call discussing the Financial Results and other business related information. A transcript

of this conference call is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated by reference in

its entirety into this Item 7.01.

The

information furnished with this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act,

except as expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

* Filed herewith.

** Furnished herewith.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated: November 21, 2024

| |

CLEARSIGN TECHNOLOGIES CORPORATION |

| |

|

|

| |

By: |

/s/ Colin James Deller |

| |

Name: |

Colin James Deller |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

ClearSign Technologies Corporation Provides

Third Quarter 2024 Update

Company Achieves Record Quarterly Revenue of

$1.85MM

TULSA,

Okla., November 20, 2024 -- ClearSign Technologies Corporation (Nasdaq: CLIR) (“ClearSign” or the “Company”),

an emerging leader in industrial combustion and sensing technologies that support decarbonization, improve operational

and energy efficiency, enable the use of hydrogen as a fuel and enhance safety while dramatically reducing emissions, today provides an

update on operations for the quarter ended September 30, 2024.

“We are happy to report a record revenue quarter of almost two

million dollars,” said Jim Deller, Ph.D., Chief Executive Officer of ClearSign. “We are very encouraged by our growing pipeline

of projects to be shipped, installed and in engineering phases. Our sales channels are expanding through a network of partners, OEM’s

and engineering firms, and we believe this is an integral part of expanding our sales operation. From our installed base to third-party

testing like the California GET program, our operational performance continues to provide additional compelling data for our products

and supports our reputation as a solution provider,” concluded Dr. Deller.

Recent strategic and operational highlights during, and subsequent

to, the end of the third quarter 2024 include:

Reported

Record Quarterly Revenue: For the third quarter of 2024, the Company recognized approximately $1.85 million in revenues compared

to $85 thousand for the comparable period in 2023. The year-over-year increase in revenues was driven predominantly by the shipment of

an order for 20 process burners to a California refinery customer.

Announced

Flare Order for Energy Company in California: The order from a prior flare customer is for the initial engineering for a flare

retrofit to be installed at a production facility. The final product is expected to be fabricated and shipped in the second quarter of

2025 and to be installed at the customer’s site in the San Joaquin Valley of California.

Announced

Public Release of California Statewide Gas Emerging Technologies (GET) Report on Boiler Burners: The study, sponsored by Southern

California Gas Company ("SoCalGas"), was to test and quantify the emissions improvements and efficiency gains for the ClearSign

Core™-Rogue ultra-low NOx boiler burner compared to a conventional (or baseline) ultra-low-NOx burner operating in the same boiler.

Specifically, the report concluded that the ClearSign ultra-low NOx burner demonstrates material savings for fuel and electricity

while producing ultra-low NOx levels and was capable of NOx levels lower than the baseline burner.

Announced

Burner Orders for Power Generation Customers in Oklahoma and Missouri: ClearSign has received two burner orders approximately

a month apart from Exotherm Corporation of Houston, Texas (“Exotherm”). The first burner order was for installation

in a heater in Oklahoma for use by a power generation company. The second burner order is from a different power generation

company for installation and use in Missouri.

Announced

Order for Multi Heater Project for Texas Petrochemical Facility: The Company received the initial engineering order from engineering

and heater manufacturer Birwelco USA Inc. (a BIH Group company) as the first phase of a project to retrofit four process heaters

with a total of 26 ClearSign Core™ burners to be installed in the Gulf Coast facility of a Fortune 500 global chemical company.

Cash and cash equivalents were approximately $14.5 million as of September 30,

2024.

There were 50,234,407 shares of the Company’s common stock issued

and outstanding as of September 30, 2024.

The Company will be hosting a call at 5:00 PM ET today.

Investors interested in participating on the live call can dial 1-800-836-8184 within the U.S. or 1-646-357-8785 from abroad.

Investors can also access the call online through a listen-only webcast at https://app.webinar.net/4grpJ5DdkyV or on

the investor relations section of the Company's website at http://ir.clearsign.com/overview.

The webcast will be archived on the Company's investor relations website

for at least 90 days and a telephonic playback of the conference call will be available by calling 1-888-660-6345 within the U.S. or 1-646-517-4150

from abroad. Conference ID #65937. The telephonic playback will be available for 7 days after the conference call.

About ClearSign Technologies Corporation

ClearSign Technologies Corporation designs and develops products and

technologies for the purpose of decarbonization and improving key performance characteristics of industrial and commercial systems, including operational

performance, energy efficiency, emission reduction, safety, the use of hydrogen as a fuel and overall cost-effectiveness. Our patented

technologies, embedded in established OEM products as ClearSign Core™ and ClearSign Eye™ and other sensing configurations,

enhance the performance of combustion systems and fuel safety systems in a broad range of markets, including the energy (upstream oil

production and down-stream refining), commercial/industrial boiler, chemical, petrochemical, transport and power industries. For more

information, please visit www.clearsign.com.

Cautionary note on forward-looking statements

All

statements in this press release that are not based on historical fact are “forward-looking statements.” You can find many

(but not all) of these statements by looking for words such as “approximates,” “believes,” “hopes,”

“expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,”

“would,” “should,” “could,” “may,” “will” or other similar expressions. While

management has based any forward-looking statements included in this press release on its current expectations on the Company’s

strategy, plans, intentions, performance, or future occurrences or results, the information on which such expectations were based may

change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks,

uncertainties and other factors, many of which are outside of the Company’s control, that could cause actual results to materially

differ from such statements. Such risks, uncertainties and other factors include, but are not limited to, the Company’s

ability to successfully deliver, install, and meet the performance obligations of the Company’s burners in the California

and Texas market, and any other markets the Company may sell products in; the performance of the Company’s products, including

its ultra-low NOx burner and the related fuel and electricity savings; the Company’s ability to timely fabricate and ship its burners;

the Company’s ability to further expand the sale of ultra-low NOx process and boiler burners; the Company’s ability to successfully

perform engineering orders; the Company’s ability to successfully develop the 100% hydrogen burner with the Phase 2 grant funding;

general business and economic conditions; the performance of management and the Company’s employees; the Company’s ability

to obtain financing, when needed; the Company’s ability to compete with competitors; whether the Company’s technology will

be accepted and adopted and other factors identified in the Company’s Annual Report on Form 10-K filed with the U.S. Securities

and Exchange Commission and available at www.sec.gov and other factors that are detailed in the Company’s periodic

and current reports available for review at www.sec.gov. Furthermore, the Company operates in a competitive environment where

new and unanticipated risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction

of actual results. The Company disclaims any intention to, and, except as may be required by law, undertakes no obligation to, update

or revise forward-looking statements to reflect events or circumstances that subsequently occur or of which the Company hereafter become

aware.

For further information:

Investor Relations:

Matthew Selinger

Firm IR Group for ClearSign

+1 415-572-8152

mselinger@firmirgroup.com

ClearSign Technologies Corporation and Subsidiary

Condensed Consolidated Balance Sheets

(Unaudited)

| (in thousands,

except share and per share data) | |

September 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 14,486 | | |

$ | 5,684 | |

| Accounts receivable | |

| 749 | | |

| 287 | |

| Contract assets | |

| 149 | | |

| 188 | |

| Prepaid expenses and other assets | |

| 610 | | |

| 350 | |

| Total current assets | |

| 15,994 | | |

| 6,509 | |

| | |

| | | |

| | |

| Fixed assets, net | |

| 245 | | |

| 275 | |

| Patents and other intangible

assets, net | |

| 855 | | |

| 836 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 17,094 | | |

$ | 7,620 | |

| | |

| | | |

| | |

| LIABILITIES

AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued

liabilities | |

$ | 1,486 | | |

$ | 366 | |

| Current portion of lease liabilities | |

| 82 | | |

| 71 | |

| Accrued compensation and related

taxes | |

| 401 | | |

| 703 | |

| Contract liabilities | |

| 174 | | |

| 1,116 | |

| Total current liabilities | |

| 2,143 | | |

| 2,256 | |

| Long Term Liabilities: | |

| | | |

| | |

| Long term lease liabilities | |

| 128 | | |

| 172 | |

| Total liabilities | |

| 2,271 | | |

| 2,428 | |

| | |

| | | |

| | |

| Commitments and contingencies

(Note 9) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Preferred stock, $0.0001 par

value, zero shares issued and outstanding | |

| — | | |

| — | |

| Common stock, $0.0001 par value,

50,234,407 and 38,687,061 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 5 | | |

| 4 | |

| Additional paid-in capital | |

| 112,686 | | |

| 98,922 | |

| Accumulated other comprehensive

loss | |

| (16 | ) | |

| (17 | ) |

| Accumulated deficit | |

| (97,852 | ) | |

| (93,717 | ) |

| Total stockholders' equity | |

| 14,823 | | |

| 5,192 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders'

Equity | |

$ | 17,094 | | |

$ | 7,620 | |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

ClearSign Technologies Corporation and Subsidiary

Condensed Consolidated Statements of Operations

and Comprehensive Loss

(Unaudited)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| (in thousands, except share and per share data) | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 1,859 | | |

$ | 85 | | |

$ | 3,006 | | |

$ | 1,129 | |

| Cost of goods sold | |

| 1,308 | | |

| 61 | | |

| 1,976 | | |

| 870 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 551 | | |

| 24 | | |

| 1,030 | | |

| 259 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 329 | | |

| 93 | | |

| 1,012 | | |

| 440 | |

| General and administrative | |

| 1,655 | | |

| 1,428 | | |

| 4,840 | | |

| 4,649 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 1,984 | | |

| 1,521 | | |

| 5,852 | | |

| 5,089 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (1,433 | ) | |

| (1,497 | ) | |

| (4,822 | ) | |

| (4,830 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 146 | | |

| 85 | | |

| 284 | | |

| 237 | |

| Government assistance | |

| 131 | | |

| 38 | | |

| 395 | | |

| 145 | |

| Gain from sale of assets | |

| — | | |

| — | | |

| — | | |

| 5 | |

| Other income, net | |

| 1 | | |

| 42 | | |

| 8 | | |

| 204 | |

| Total other income, net | |

| 278 | | |

| 165 | | |

| 687 | | |

| 591 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,155 | ) | |

$ | (1,332 | ) | |

$ | (4,135 | ) | |

$ | (4,239 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and fully diluted | |

$ | (0.02 | ) | |

$ | (0.03 | ) | |

$ | (0.09 | ) | |

$ | (0.11 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding - basic and fully diluted | |

| 54,714,910 | | |

| 38,562,127 | | |

| 46,986,914 | | |

| 38,459,313 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,155 | ) | |

$ | (1,332 | ) | |

$ | (4,135 | ) | |

$ | (4,239 | ) |

| Foreign-exchange translation adjustments, net of taxes | |

| 5 | | |

| (1 | ) | |

| 1 | | |

| (13 | ) |

| Comprehensive loss | |

$ | (1,150 | ) | |

$ | (1,333 | ) | |

$ | (4,134 | ) | |

$ | (4,252 | ) |

Exhibit 99.2

[CLIR] ClearSign Technologies

Q3 2024 Earnings Conference Call

November 20, 2024, 5:00 PM ET.

| Officers and Speakers | |

| |

Matthew Selinger, Firm IR Group | |

| |

Brent Hinds, Chief Financial Officer | |

| |

Jim Deller, Chief Executive Officer | |

Presentation

Operator: Good afternoon, and welcome to the ClearSign Technologies

Third Quarter 2024 Conference Call. (Operator Instructions). After today's presentation, there will be an opportunity to ask questions.

(Operator Instructions). Please note that this event is being recorded.

I would now like to turn the conference over to Matthew Selinger of

Firm IR Group. Please go ahead.

Matthew Selinger: Good afternoon, and thank you, operator. Welcome,

everyone, to the ClearSign Technologies Corporation Third Quarter 2024 Results Conference Call. During this conference call, the company

will make forward-looking statements. Any statement that is not a statement of historical fact is a forward-looking statement. This includes

remarks about the company's projections, expectations, plans, beliefs and prospects. These statements are based on judgments and analysis

as of the date of this conference call, and are subject to numerous important risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking statements.

The risks and uncertainties associated with the forward-looking statements

made in this conference call include, but are not limited to, whether field testing and sales of ClearSign's products will be successfully

completed, whether ClearSign will be successful in expanding the market for its products, and other risks that are described in ClearSign's

filings with the SEC, including those risks discussed under the Risk Factors section of the Annual Report on Form 10-K for the period

ended December 31, 2023, and a quarterly report on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024

and September 30, 2024.

So except as required by law, ClearSign assumes no responsibility to

update these forward-looking statements to reflect future events or actual outcomes, and does not intend to do so.

On the call with me today are Jim Deller, ClearSign's Chief Executive

Officer, and Brent Hinds, ClearSign's Chief Financial Officer. So at this point in the call, I would like to turn the call over to

CFO Brent Hinds. So Brent, please go ahead,

Brent Hinds: Thank you, Matthew, and thank you to everyone for joining

us here today. Before I begin, I'd like to note that our financial results for the quarter period ended September 30, 2024 was

included on our Form 10-Q filed with the SEC on November 14.

And with that, I'd like to give an overview of the financials

for the third quarter of 2024. For the third quarter of 2024, the company recognized approximately $1.9 million in revenues, compared

to $85,000 for the same comparable period in 2023. The year-over-year increase in revenues was driven predominantly by the shipment of

multiple process burners to a California refinery customer.

I would like to note that this quarter's revenue is the largest quarterly

revenue figure ever reported by the company. Our year-to-date revenues for the 9 months ended September 30, 2024 was approximately

$3 million, which is a $1.9 million increase over the prior comparable period in 2023. This is also the largest year-to-date revenue figure

reported by the company since inception.

Our year-to-date gross profit margin also increased year-over-year

by 11% from 22% in 2023 to 33% in 2024, adding approximately 340,000 in profit, compared to the prior period. This profit was offset by

$394,000 as a result of a one-time accrual estimate related to the decision to suspend our China operations. Jim will give more color

about our China decision and suspension in a few moments.

Our year-to-date net loss for the 9 months ended September 30,

2024, decreased by $104,000, which is an improvement of 2.5% over the comparable period in 2023. I need you to keep in mind this net loss

improvement includes the $394,000 from our one-time China approval estimate.

Now I'd like to shift our focus from the income statement to the balance

sheet, more specifically, cash. Our ending cash balance for September 30, 2024 was approximately $14.5 million. Our net cash used

in operations for the quarter ended September 30, 2024 was approximately $1.4 million, compared to approximately $1.3 million for

the same period in 2023.

With that, I'd like to turn the call over to our CEO, Jim Deller.

Jim?

Jim Deller: Thank you, Brent for the financial overview. As always, I'd

like to thank everyone for joining us on the call today and your interest in ClearSign. The call today, we've decided to change the format

from previous calls. We've received positive responses from previous presentations narrated in a question-and-answer format, and we believe

that this will provide a more engaging call.

We've also invited questions to be sent in by email, so we're trying

something new, and we'll be interested in any feedback. So Matthew Selinger will lead a question-and-answer session where we'll go through

our different product lines and business updates, so the overall subjects and updates covered will be much like our previous calls. We

will review our product line, starting with our process burners and then move on to boiler burners.

And after that, I want to give some attention to our flare product

line since there has been a recently-announced order and additional activity there. I'll wrap up by discussing the outlook for the rest

of the year and into 2025.

So with that I'll step back, and hand it over to Matt.

Matthew Selinger: Great, Jim. So Jim, ClearSign just reported a record

revenue quarter. Can you give a little more color, kind of high-level color, on that by chance?

Jim Deller: Yes, certainly. So this was definitely a record quarter

for us by a long margin. I think it's also significant to look back over the trailing 12 months because our business is lumpy. If you

look back over the 12 months, it's also a record period for us and you'll see that our revenue flows are significantly increasing. What's

also important, and as Brent stated, there was an 11% increase in our gross margins accompanying that revenue. That is good.

From my perspective, I believe there is room for improvement with

further volume and efficiency gains, but overall, the increase in revenue and margin, I truly believe that the business is definitely

going in the right direction.

Matthew Selinger: And so that revenue, as Brent mentioned, was mainly

attributed to one order. Would you mind kind of diving in and giving us a little more detail of that order?

Jim Deller: Yes, and this speaks to the lumpiness of our revenue flows.

We have some very large significant orders, but the nature of that is they don't hit consistently every quarter. So this quarter was primarily

driven by the 20 burner order that shipped out to Los Angeles. Those burners were shipped from Zeeco out to the Los Angeles refinery in

California. We were expecting them to be started up early next year. We have learned that that will be delayed. The client's clarified

that's got nothing to do with ClearSign, but the start with those burners will now be around the middle of 2025.

But Matt, if I can just to comment on the order, these burners are

going into two heaters. These are two large heaters in a very prominent refinery in the LA refining hub. One heater is fitted with eight

burners, and one is fitted with four burners. And the reason I'm bringing that up, but I know this'll be the middle of next year now --

but when these are up and running, I really believe that these are going to be a significant reference for us. These will be the

biggest heaters we have in operation at that time. And I believe that having that reference and this performance in that LA hub is going

to be a significant catalyst for increasing the future sales.

Matthew Selinger: Great. Well, let's continue with the process burner

line. Can you give us some more color about the pipeline and outlook? I think when we left off last call, there was another large order

that actually fell into this quarter. But maybe start off from there and kind of talk about that other order?

Jim Deller: Yes, and I think this is relevant because it also gives

some insight into future revenue expectations as well. So at the time of the last call, we just announced, in fact, the largest order

we received to date was for 26 burners going into a Fortune 500 global petrochemical company down on the U.S. Gulf Coast. That order was

received, by the way, from an engineering and heater manufacturer called Birwelco USA. And if you get a minute, I really encourage

you to look that company up, so you understand the type of company we are dealing with.

The order on the Gulf Coast has some special operating requirements,

but we've got the technology to do that. And also the recent 100% hydrogen flexible fuel burner that we have started to sell, in combination

with the new CFD model we've invested in, have really been some big drivers between that led to us receiving that order. That order is

going well and, thinking of revenue, certainly when these shipless burners, it gives some idea what to expect.

But beyond that, we also have two other orders in progress for Kern

Energy. Of course, Kern is a repeat customer for us. Those orders are incidentally also using this flexible fuel new hydrogen burner.

And we're in further discussions with Kern about some other orders that we expect they're going to need next year.

Matthew Selinger: And then so earlier this year too, Jim, there was

the BACT designation, and maybe kind of address that again, what is BACT? And are you seeing that helping to drive business our direction?

Jim Deller: So I think, yes, so switching from looking at what's in-house

and the revenue flow to what's driving our sales, we're seeing a lot of interest in the process burner product line across the board.

There are some drivers. Matt, as you mentioned, the BACT review that was done by the South Coast Air Quality Management District and announced

early in the year were significant. For those of you who don't know, BACT is Best Available Control Technology.

It is a review of new technologies that's run by all the airports in

California, but administered by the South Coast Air Quality Management District. They've reviewed two of our installations for a period

of over a year, with quarterly meetings and feedback. And the result is that the performance that was documented from those installations

have reset their definition of Best Available Control Technology for single burner process heaters and for multiple burner process heaters

that is recognized throughout the industry. We believe that is a very good validated reference for us.

Matt, if I can, also in the same period, while we're talking of sales

and enhancements, we conducted a burner demonstration with Zeeco back in August that went very well. That allowed us to show our

burners running in a multi-burner heater, giving lead engineers and consultants and representatives of many of the top refining and petrochemical

companies the chance to look not only at our standard burner technology, but we also again were able to present our new hydrogen burner

technology to them.

Matthew Selinger: Great. And that was done at the Zeeco facilities,

correct?

Jim Deller: Yes.

Matthew Selinger: Yes, so speaking of Zeeco, how is that relationship

going?

Jim Deller: It's really been going very well. Zeeco has been a very

solid partner for us back since 2019 when we formed the relationship. Now as we've increased our business, they obviously -- they build

all of our process burners. They're aware of the burners we shipped about, the 20 burners that went to California shipped from Zeeco.

They're aware of the 26-burner order that we've recently received and others, and aware of the quotes that are going out because we have

to schedule resources with them. They're also aware of the hydrogen burner development we've done.

We really believe without visibility into our growing business, we've

increased our status with Zeeco. And last week, we were able to meet with them and discuss a joint branding of a ClearSign Zeeco process

burner line. So the intention is that Zeeco will actually start now to promote ClearSign's process burner technology under their own name

and to market it and to brand it and promote it with their own global sales team.

So we met with them, we set a date for us to present our technology

to their North American sales team, and also discuss things like branding, website promotion, etc. So this is a huge development

for us, one I'm very excited about.

Matthew Selinger: Well, that is great news, and I think it's a development

that many of us have been waiting for. So from here let's shift, if we could, Jim, to the horizontal process applications as this also

seems like an area of business that's gaining quite a bit of traction. Would you mind giving us a little color on what you're seeing in

the horizontal process applications?

Jim Deller: Yes, certainly. This is a fairly new product line for us.

It's one that, I'll be honest, has spread further than we anticipated when we started it, so just focus on the horizontally fired

process heaters. These are small heaters often going into the midstream industry, that's typically gas processing. But also we're finding

there are a very wide variety of different industries that are going into.

We recently received an order -- or in fact, two orders, repeat orders,

from Exotherm going into the power generation industry -- as an example, those orders going into Oklahoma and Missouri, so expanding our

national footprint. We've also recently sold, in fact, our largest burner to date, to another midstream heater manufacturer, Devco. And

the first of these midstream heaters furnace was sold to another company here in Tulsa called Tulsa Heaters Midstream.

But why these are all important is not just the order flow rate, although

that in itself is important, but the repeat inquiries and the uptick of interest, and just the flow of future opportunities from them

is really exciting.

Matthew Selinger: So that actually brings up another question, Jim,

kind of regarding sales channels or channel partners. It seems to be a growing part of the ClearSign story. How do you see this continuing

to roll out and kind of present business opportunities for ClearSign?

Jim Deller: Yes, and Matt, if you don't mind, let me take a step back.

So when I joined the company in 2019 and back at that point, we laid out a strategic plan to develop ClearSign as a business, right? Just

for everyone, the parts of that, one was focused on the technology, right? We had to take the technology at the time and develop that

into commercial products that met the customers' needs, and that would be delivered to them in a manner that the customers were needing.

So that led to the partnership with Zeeco because to process burners,

you have to be able to deliver burners with the credentials of a company like Zeeco, and access to a test furnace and from manufacturing

facilities that they are willing to work with and have approved. On the boiler burner side, right, we partner with California Boiler.

They are the customer-facing service team that actually set up Rogue to carry our product line.

But as another part of that plan, we're aware that the company is funded

by investor money. We needed to keep the company asset-light, yet to really leverage the potential of ClearSign technology, we had to

have a means to expand our sales force and get national and ultimately, international reach. And the way we plan to do that, was by working

through partners. So partners obviously, like Zeeco and California Boiler, where we can leverage their sales team.

And I'll refer back to the recent comments about Zeeco and why I'm

so excited there. In the midstream heaters, we're selling to heater manufacturers. Now those heater manufacturers are out chasing their

own work, chasing their own clients with their own industry.

They are using ClearSign burners with our capabilities installed in

their products to make them competitive. What that essentially means for us, is that the sales teams and the marketing of these new partners,

that the midstream heater manufacture in this case become an extension of the ClearSign sales team. The ultimate goal that leveraging

these companies and expanding the sales region asks us to punch above our weight and have a much greater sales outreach than we could

just operating as ClearSign alone. So we're very much developing this business, and plan to develop this business through partnerships.

Matthew Selinger: Jim, thank you for the color there. You did mention

the boiler burner. So can we shift to the boiler burner product line now? There were some recent developments and announcements regarding

some very kind of important third-party testing. Now would you mind just giving a little bit more explanation on that?

Jim Deller: Certainly. So back -- (inaudible) early this year, the

results were published from a study conducted by the California GET program. So a quick background, the California GET program is funded

by the gas utility companies in California, is administered by the South Coast Air Quality Management District. They had engaged a global

consulting company called ICF to conduct third-party testing to quantify the performance of this new burner technology, ClearSign technology,

compared to the other Ultra Low NOx burners available in the market. That report was published, it's available through our website. We

also put a press release out with a link.

But to summarize the data, the third-party study found that a boiler

fitted with ClearSign burner ran and consumed 4% less energy than the burner fitted with -- or a boiler fitted with the industry-standard

burner. So to put that in meaningful terms for a mid-sized 500-horsepower boiler in California with California energy prices, that will

provide a savings about $80,000 per year to our customers. Our burners sell at a premium, but that $80,000 will more than cover that premium

in a single year. So that in itself provides a very powerful selling proposition for ClearSign.

In addition to that, that fuel savings will equate to about 500 tons

per year of CO2 savings for the customer. And the study also found -- or what we knew -- was that the ClearSign burner is capable of operating

down at sub-2.5 parts per million NOx levels. The standard industry or [outflows] burner, I was only able to run down to 6 parts

per million.

Matthew Selinger: So that is (indiscernible) data. So with that, can

you give us an update on kind of the project pipeline in boiler burners?

Jim Deller: Yes, we have a few, we have orders in progress. There's

some burners due to be shipped. There was the first of a series of four boilers going out to a customer in California. That burner is

built and close to being ready to ship. We, of course, have a number of burners now [up and] operational. A couple of pieces of fairly

big news that's new right now -- we have a very large burner installed in San Joaquin Valley area. This has been installed and out there

for a long time waiting for their construction.

We have finally got to the point that that burner, I believe,

is, like I said, about done. It's in, it's up and running. As of today, we have actually engaged a third-party source-testing company.

These are the companies that do the formal measurements. We've had them take our preliminary measurements for us, because down at the

NOx levels are running at the other analyzers are not all consistent, so we wanted to get their full spec equipment. They've measured

the performance and found that the NOx is under the guarantee level.

The final formal source testing and report is being conducted, that's

not completed yet, so we don't have the final result. But obviously at this point, we're optimistic that this is going to be a successful

installation for us, accepted by the customer, and when it is, I cannot emphasize how important I believe this will be for an installation.

The very large boilers operating and requiring less than 2.5 parts per million NOx was the target market. That was the primary objective

when we initially engaged with California Boiler, and mutually decided to develop the product line, and to market it and to put the effort

that, we have to get into the California market. So this, I believe, is going to be a very big benchmark for the ClearSign and my

brand that as the road burner in California.

Matthew Selinger: And when you say "large," could you just

quantify how large?

Jim Deller: Yes, in numeric terms, 1,200 horsepower, right. In terms

of just physically looking at the boiler, this boiler is going to be in the region about 40 feet long. It's probably as big as you could

put on the back of a semi-truck and transport across the country. So this is a very large boiler and classified. It's getting close to

as big as fire tube boilers get before they switch over to the larger water tube, and power generation boilers. This is one of the biggest;

it's not the biggest fire tube boiler, but it is right up there at the top end.

Matthew Selinger: So a notable demonstration of our technology?

Jim Deller: Oh, a huge demonstration. This is how you -- this is almost

the perfect big boiler opportunity that people will look to and say, yes, that is a bona fide proof of the ClearSign technology.

Matthew Selinger: Great. So we also announced a sale of a boiler last

week and didn't know -- for an asphalt company -- and didn't know if you wanted to just get a little color on that sale?

Jim Deller: Yes, and it's actually important, not so much for the --

this is a standard burner for us. The burner the client bought was just under 500 horsepower. Of course, our 500-horsepower or the burner

model is the one that we'll use, but it's important to talk about this, right? So going back, I discussed the strategy and the vision

we laid out in 2019 and how that manifests in the boiler burner business, right. The process burners are necessarily bespoke. There's

unique details for every heater and no two of those are exactly the same. That's just the way the industry is.

The boiler industry is different. These burners are standard burners

and the goal is to have a standard range of burners with standard pricing that can allow our sales channels -- in this case road combustion

California Boilers -- to go out on their own and sell this product but without needing input from us. Of course, we help the sales and

marketing, strategic sales, etc. But the goal is to let them go hands-free and just sell as many of these things as they can.

When they get an order then, to turn around and just place the order

with ClearSign, and we have ready-made drawings and prints. We place the orders with our fabricator, and they fabricate the burners. This

order -- well, the reason for doing that is that gives us a highly scalable model with very little need of ClearSign resources. And it

empowers the sales team to go out and pursue business on their own without needing to get back for quotes or details or engineering input

from ClearSign.

This order is the first of that system. It had, I don't believe,

any input from ClearSign in the sales stage. We just received a purchase order. The drawings were done. We turned around and placed all

of that fabricator to deliver this burner. So it is that vision that we laid out in 2019 actually coming through to fruition for the first

time in this order.

Matthew Selinger: Sure, thanks for the detail. It sounds like things

are kind of starting to hum along. To round out the boiler burner line, just last month, there was a filing regarding the China operations,

and Brent alluded to this in his financial overview. I don't know if you could just kind of touch base on this?

Jim Deller: I can, I've actually got some notes here. So I need

-- because this is formal, just to pass the details on to everyone. So as you said, we filed a Form 8-K that was filed October 1,

announcing that we're suspending our operations in China, and putting our registered business there into a formal state of dormancy by

the end of the year. So what that means is we still have the business in China, but that business is basically parked and not operational.

You might think we're going into hibernation for a period until we choose to revive it.

This decision was a result of the increasingly-delayed progress to

gain commercial traction in China. And as Brent said earlier, there will be some significant one-time costs. Those are mainly related

to employee termination payments. But going forwards, our cost to maintain our business in that dormancy status will be minimal, but it

also gives the ability to maintain that business registration in China. There are additional details, those are available. If you look

at the Form 8-K, there is more detail there for anyone wanting to see more.

Matthew Selinger: Great, thanks for the update there. Then just weeks

ago, there was an announcement regarding a flare. So this is the product line that we haven't heard about for some time. Again, can you

give some color here, and talk about what you're seeing regarding this product line?

Jim Deller: Yes, actually very pleased to. This is an exciting areas

for us. So as you may know, we do have some flares out sold, believe it was 2020. I may be slightly off, but out and installed in the

LA area through California Boiler, those are up and running. And even prior to my joining ClearSign, there were some flare technology

sales. The recent order was for customizing our flare, right, the burner element that goes into a flare. This is for customizing our burner

element to fit into an existing flare, to bring it into compliance with the needs of actually a customer that has already experience of

ClearSign flare technology.

That work is going well, and we expect it to roll on to an equipment

supply order in the reasonably near future. I don't have an exact date for that yet. But when you bring this up, I actually want

to talk about the flare industry and actually the reason that it's exciting today. On a previous call, I mentioned that we went to

visit the government in the State of California, and especially their environmental regulatory personnel, as they have new emissions requirements

there. We are seeing the need for different flaring technology in regions like California, in industries actually different from the standard,

in industries like the upstream oil industry is different industries from that.

As these new regulations are rolled out, and as these new energy projects

are seeking permits, what that means for us is that we have a unique combustion technology. We also have a very strong engineering capability

within ClearSign, and it puts us in a very strong position to actually be a solution provider for some of these new projects. And this

manifests in there may be flares, there may be quite (indiscernible) upsize in projects, but it allows us to get into an expansion of

not just selling strictly the burner equipment, but actually selling more of a system-wide project.

When we look at the long-term -- our plans, my plans, for ClearSign,

they go beyond just the burners and the technology we have today. And a big part of that is getting into a solution provider and a systems

provider. And one of the reasons that we're particularly excited about this, is it starts to dip our toe into the role of a solutions

provider, and putting together a bigger package that has the potential to greatly expand the sales and the revenue of ClearSign.

Matthew Selinger: That's exciting. It sounds like the ClearSign brand

is getting out there, as well as a reputation as a solution provider. One thing you mentioned, the State of California, but I think you

had similar conversations, am I correct, Jim, in states like Colorado?

Jim Deller: Yes.

Matthew Selinger: Fantastic. So Jim, that covers my questions regarding

the business. So I don't know if at this point you'd like to take a moment for a final summary, and maybe some thoughts on the business

going forward?

Jim Deller: Thank you, Matt. And I just reflect back, that was a new

way of presenting the update from the company. So we'll be very pleased to hear from anyone on if you liked it or if you didn't. But I

would like to wrap up and share some thoughts and just to give a perspective on where we are. So firstly, I want to reflect back

on the financial numbers in the 10-Q that was filed last week, and that Brent summarized earlier this afternoon, and also look back over

the last 12 months.

I want to emphasize that I think this is a very significant development

for ClearSign. Yes, the revenue is lumpy and it will continue to be lumpy for some time. But it's also significantly more meaningful than

at any time in ClearSign's history. During the call, I've referred back a few times to a strategic path we laid out in 2019, as a

framework for how the ClearSign business is developing. I do that because I think the framework is meaningful as it helps to understand

how the specific items and developments that we talk about, that may appear normal at face value, provides an interwoven building block

of a highly-integrated asset-light company, and how we're growing that to have national reach and recognition, and how we are growing

and the importance of growing that with our partners.

So we're building a network of companies [especially] comprising our

sales network -- I can't mention all of them, but the ones that we can include by name, I'll just run through some key ones here.

Of course Zeeco -- Zeeco are key for what we do, they've been a fantastic partner. And again, I want to emphasize the recent developments,

the conversations we've had about jointly marketing a co-branded Zeeco ClearSign process burner. We will keep you updated as that rolls

out. It will be a process. I cannot emphasize how big of a step forward this is for ClearSign.

What I didn't mention in the call, just putting Zeeco in perspective,

they have in the region of 2,500 employees. They've got 30 offices worldwide, they are a true global company. And the ability to promote

our technology and to actually have Zeeco promote our technology as a Zeeco burner with ClearSign technology, I think, has massive

potential for ClearSign.

Secondly, California Boiler and Rogue Combustion, they are the customer-facing

and sales partner we have. They are based in California. They have offices and affiliates in other regions of the country especially strong

in the West Coast. Working with them recently have this big success, or we believe the big success we're waiting to formalize of that

very large boiler startup, the 2.5 ppm guarantee in California.

We talked about the Birwelco and the large 26-burner order going down

to the Texas Gulf Coast. Please look up the Birwelco on their website. They are a prominent engineering company. They work with a who's-who

of the refining and petrochemical companies throughout the world, but especially in the U.S. And then in the midstream heat original equipment

manufacturers I mentioned, we're now seeing a repeat flow of inquiries from Tulsa Heaters Midstream, Devco and Exotherm who gave us the

repeat orders just these last few months.

So stepping back, we are growing, and please note we've grown our installation

base in California with both existing and repeat customers. And we've got larger installations coming especially with the 20 burners going

out to the California refinery. We're now making headway into Texas with the larger engineering firms, and I mentioned Birwelco and heater

manufacturers and Fortune 500 customers.

There's a lot of attention on our new flexible fuel with hydrogen burner.

We have several projects in the execution phase utilizing this new technology. We have a pipeline of projects to be shipped, installed

and in the engineering phases, the largest we've ever had. And we have recently had a notable developments in our boiler burner product

line, just the burner in California, in the progress of our sub-2.5 ppm large boiler burner range, and also the California GET report

giving us third-party validation of a compelling financial case for the purchase of our boiler burners. And again, that report is available

through our website. It's also available through links from the press release we put out.

When reflecting on what we've achieved, I want us all to acknowledge

that this takes more than just people showing up for work. From our finance team, our technical and order execution teams, to Ashley,

who's constantly creating and improving our marketing and sales materials, which by the way, includes our website and LinkedIn posts.

I want to extend my sincere gratitude for the buy-in and dedication of all our ClearSign employees.

And in the same thought, I want to thank Zeeco from the leadership

to the staff we interact with on a daily basis, and California Boiler, especially for their commitment to taking care of our mutual customers

and getting the job done.

So with that, I'd like to open up the call for questions. Please,

operator?

Questions and Answers

Operator: We will now begin the question-and-answer session. (Operator

Instructions).

Matthew Selinger: Great. And Constantine, this is Matthew Selinger.

We also received quite a number of questions via email ahead of time, so I'm going to go ahead and start by reading off some questions

here.

Operator: Please go ahead.

Matthew Selinger: Directionally, where do you see margins heading?

Jim Deller: As mentioned in the call, we saw a very significant improvement

in the numbers that Brent reported. I do believe there is room for efficiency gains, certainly with the volume we're inspecting in the

future as well. So there was an increase, there may be a room for that increase again, just looking at the mix of projects we're targeting

in the future. But we do expect -- I think the key thing to emphasize is that we do expect the margins to improve even further than the

improvement that Brent reported in the financials here today.

Matthew Selinger: Fantastic. I've got another one for you here, Jim.

During the most recent conference calls, we've not heard much about Narion and the ClearSign eye sensor technology. Visiting their website,

it seems like a lot's going on. Would you really give some insight onto the relationship and what's going on there?

Jim Deller: Yes, certainly, thank you. And whoever asked that question,

thank you. That's part of our business. We've been very focused on the burner business in the [cores]. So for those of you who don't know,

Narion is a company. It's affiliated with ClearSign, but it is an independent company that was set up in Seattle, by an engineer that

used to work for Boeing. ClearSign has not only burner technology, we have a sensing technology. And Narion was set up with an agreement

with us to develop applications using the ClearSign sensing technology, and especially in fields that are not core to the expertise we

have at ClearSign, but to look at things like obviously with the engineer coming from Boeing in aerospace, transport and a lot of other

applications.

I'll expand this a little. So we do have the standard burner sensors

to actually a burner product line. Narion is helping us also finalize that technology. We believe that we're going to have industrial

installations on a demonstration basis of the pilot sensors in the -- as a reasonably near future. Through Narion, they've also adapted

and engaged industrial partners for a flare pilot sensing technology or a development of our sensor into flare applications. We also expect

through that work, that we'll be able to get some field at least demonstration units, and hopefully, commercial traction in the reasonably

near future.

But getting into the core business of Narion, they've got a number

-- if you look at the website, they have a number of really interesting projects. I think the most prominent one at this point is one

feature of the ClearSign sensor is it is an extremely fast sensor, and they have engagements to adapt that for what I described (indiscernible)

a performance monitoring for a new and growing form of jet engines. There's a lot of interest there.

That is a longer-range prospect. I believe the opportunity and the

potential market is huge. But in terms of timeframe, we'd appreciate that projects like that getting into technology like that do take

longer to come to fruition. So that's going to be further out than the 12 to 24 months that we're looking at for something to show from

the Burnham and Flare Flame Sensors, but I'd encourage you to look at that Narion website and just see what they're doing.

We set the contract up for the work with Narion just to leverage our

sensor technology, realizing there are some very big opportunities. Narion is self-funding. So it's a win-win for them and a win-win for

us.

Matthew Selinger: Okay. It's another question, Jim. I've noticed some

new hires posted on LinkedIn. Could you give some color on these hires? Secondly, do you foresee additional or -- and are there any positions

you're actively looking to fill?

Jim Deller: Yes, we have. We recently hired two new engineers. One,

Dominic, is reporting to our Chief Technology Officer, and the second, Samuel, is reporting to the group headed up by Jeff Lewallen, who

oversees our burner business. So on the bottom line, the reason we brought these people in is our business is growing. We are getting

incredibly busy and we need some more resources in the office to handle our growing business. And what's really important and the reason

we did this now is that both Matt Martin and Jeff Lewallen very well-known and respected engineers in our field are incredibly effective

as customer-facing and business development people.

And quite frankly as a business, we need to get them out in front of

the customers. And as we get busy and they get consumed with more production and product development work personally, it slows them down

from doing that. So we went out, we hired two great engineers, they will give us some bench depth. They will handle the ongoing work,

and really free Jeff and Matt up to focus on technology development and being now in their customer-facing role of developing our business.

So you asked about looking forward. Right now, we do not have any open

positions. But that said, as our business grows, I do expect that we will have open positions coming up to execute the orders we

work and to keep our business growing. But also those positions will be part of the order execution. So if you're looking at the overhead

of the company, I do not expect that to actually increase the overhead, as that will be part of the cost absorbed by the projects.

And they'll be brought in to handle our work and as our work grows.

Matthew Selinger: Great. Jim, here's one from the analysts that cover

us. And they unfortunately were unable to attend the call, but Jim, how would you describe your current pipeline compared to a year ago?

Jim Deller: Oh, it's grown substantially. The orders we're getting

and the people we're talking to are much more mature. The orders are bigger. And we've seen that the other 26 orders going -- burners

going down into Texas, working with companies like Birwelco. If you just look at -- I know you can't see, but the frequency of the buyers

we're getting in, we're now getting in multiple inquiries a week, rather than an inquiry every few weeks.

And just handling that and looking at -- that's one of the key metrics

that I look at internally is just looking at the number of quotes we're putting out and the frequency. And that is just constantly picking

up at a very pleasing rate. So it's looking very promising.

Matthew Selinger: Great. So there's been a few questions very similar

to this one, and I'll kind of summarize it here. With the new administration coming into place next year, will it focus on reducing NOx

emissions remain important? I know you can't see the future. And there's a second -- and B, and could more focus on production in the

United States be beneficial for ClearSign?

Jim Deller: Yes, I truly wish I had that, calibrate the crystal

ball. Look, I've been in this industry now for about 30 years, so I've seen multiple administrations come and go. And typically,

the start of any administration, there's great expectations one way or the other. And the balance is that the influence they have is significantly

less than what we expect at the start of administration. Just the time scale of the projects and what we work with is measured in years,

so the administration will come and go before they've had a significant effect.

Regarding the NOx emissions, they are primarily controlled by the local

states. They are based on the need to adjust ground level ozone down to standard levels that were set out many years ago. So we do not

expect any significant change there. From what we're hearing, there's focus on decarbonization, that is a periphery to us. We are mainly

focused on NOx emissions and operating efficiency.

But also bear in mind that most of our customers are global companies,

a lot are based in Europe. They all post their own environmental mandates and their objectives there on their websites, and they are driving

towards that. So I think they are self-motivated to achieve their environmental goals. So again, changes in the administration don't dictate

the companies, the jobs they set for themselves, especially not when those companies have an international holding.

I think on the other side, just looking forward to talking to our clients,

one area of encouragement maybe I don't think related to the political climate, we are seeing an increased interest in LNG -- that's liquefied

natural gas -- export and production. And we believe that there is likely an uptick in that business next year, which will -- for us,

that's very relevant to the horizontal process burner business and those other clients that I referenced earlier on today.

Matthew Selinger: Great. Here's another question that came in, Jim,

and I think you've addressed this actually a couple of times in your comments. But somebody is asking, could you please provide some color

on the essence of the relationship with Zeeco? So maybe just kind of surmise what you said earlier?

Jim Deller: Yes, and this is probably the biggest step forward for

ClearSign for a long time. This is a -- right, so Zeeco have -- the relationship we're having with them has basically taken the next step

forward. In the recent developments, we are taking steps now to jointly market ClearSign products. That gives Zeeco's sales team a product

to promote that has the capabilities of ClearSign technology, has a dual-branded process burner. And the Zeeco sales team is worldwide.

They're obviously truly a leading global company and having them promote

ClearSign is a huge step forward for us, is one we envisioned back in 2019. And to get to this point and having this development in our

collaboration is certainly a very big deal for ClearSign. And obviously, from Zeeco's side, they have seen what we're doing, and are doing

this because they believe it's a very big deal and a big opportunity for Zeeco also.

Matthew Selinger: Great.

Operator: We don't have any questions over the phones at this moment.

This concludes our question-and-answer session. I would like to turn the conference back over to Jim Deller for any closing remarks. Sir,

please go ahead.

Jim Deller: Well, thank you. I'd like to thank everyone for your interest

and taking the time to participate today. We look forward to updating you regarding our developments and speaking with you on our next

call. In the meantime, please keep checking in for developments on our website, that's www.clearsign.com. And for more behind-the-scenes

updates, I really encourage you please to follow us on LinkedIn.

And with that, I'll say thank you very much, and we will talk

to you next quarter.

Operator: This concludes today's conference. Thank you for attending

today's presentation. You may now disconnect.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

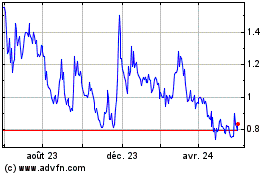

ClearSign Technologies (NASDAQ:CLIR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

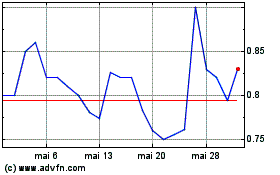

ClearSign Technologies (NASDAQ:CLIR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025