UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM ABS-15G

ASSET-BACKED SECURITIZER

REPORT PURSUANT TO SECTION 15G OF

THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box to indicate the filing

obligation to which this form is intended to satisfy:

¨ Rule

15Ga-1 under the Exchange Act (17 CFR 240.15Ga-1) for the reporting period ________________ to ________________

Date of Report (Date of earliest event reported) __________________________

Commission File Number of securitizer: _______________________________

Central Index Key Number of securitizer: ___________________________________

Indicate by check mark whether the securitizer has no activity to report

for the initial period pursuant to Rule 15Ga-1(c)(1) ☐

Indicate by check mark whether the securitizer has no activity to report

for the quarterly period pursuant to Rule 15Ga-1(c)(2)(i) ☐

Indicate by check mark whether the securitizer has no activity to report

for the annual period pursuant to Rule 15Ga-1(c)(2)(ii) ☐

☒ Rule

15Ga-2 under the Exchange Act (17 CFR 240.15Ga-2)

Central Index Key Number of depositor: 0001518859

CPS Auto Receivables Trust 2023-D

(Exact name of issuing entity as specified in its

charter)

Central Index Key Number of issuing entity (if applicable): Not applicable

Central Index Key Number of underwriter (if applicable): Not applicable

Danny Bharwani, 949-753-6811

Name and telephone number, including area code,

of the person

to contact in connection with this filing

PART II: FINDINGS AND CONCLUSIONS OF THIRD-PARTY

DUE DILIGENCE REPORTS

Item 2.01 Findings and Conclusions of a Third Party Due Diligence

Report Obtained by the Issuer

Attached as Exhibit 99.1

to this Form ABS-15G is an Independent Accountants’ Report on Applying Agreed-Upon Procedures, with respect to certain agreed-upon

procedures performed by KPMG LLP, a third-party due diligence provider.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the reporting entity has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

CPS RECEIVABLES FIVE LLC

(Depositor)

By: /s/ Danny Bharwani

Name: Danny Bharwani

Title: Vice President

Date: October 10, 2023

Exhibit 99.1

|

|

| |

KPMG LLP |

| |

Suite 700 |

| |

20 Pacifica |

| |

Irvine, CA 92618-3391 |

Independent

Accountants’ Agreed-Upon Procedures Report

Consumer Portfolio Services, Inc. (the “Company”)

Citigroup Global Markets Inc.

Capital One Securities, Inc.

(together, the “Specified Parties”)

Re: CPS Auto Receivables Trust 2023-D – Data File Procedures

We have performed the procedures described below on the specified attributes

in an electronic data file entitled “bb.Pool_2023-D_083123_Indictative.xlsx,” provided by the Company on September 11, 2023,

containing information on 11,877 automobile retail installment sale contracts (“Receivables”) as of August 31, 2023 (the “Data

File”), which we were informed are intended to be included as collateral in the offering by CPS Auto Receivables Trust 2023-D. The

Company is responsible for the specified attributes identified by the Company in the Data File.

The Specified Parties have agreed to and acknowledged that the procedures

performed are appropriate to meet their intended purpose of assisting specified parties in evaluating the accuracy of the specified attributes

in the Data File. This report may not be suitable for any other purpose. No other parties have agreed to or acknowledged the appropriateness

of these procedures for the intended purpose or any other purpose.

The procedures performed may not address all the items of interest

to a specified party of this report and may not meet the needs of all specified parties of this report and, as such, specified parties

are responsible for determining whether the procedures performed are appropriate for their purposes. We make no representation regarding

the appropriateness of the procedures either for the intended purpose or for any other purpose.

Unless otherwise stated, the following definitions have been adopted

in presenting our procedures and findings:

| · | The term “compared” means compared to the information shown and found it to be in agreement, unless otherwise stated.

Such compared information was deemed to be in agreement if differences were within the reporting threshold. |

| | |

| · | The term “reporting threshold” means that dollar amounts and percentages were within $1.00 and 0.1%, respectively. |

| | |

| · | The term “Instructions” means the instructions provided by the Company pertaining to a procedure, attribute, or methodology,

as described in the procedures table below. |

| · | The term "Vehicle Mapping" means email correspondence provided by the Company on September 21, 2023, containing the

Vehicle Models and Vehicle Makes corresponding to different abbreviations of vehicle model and vehicle make appearing on the Installment

Sale Contracts. |

| | |

| · | The term “Title Document” means a scanned image of one of the title documents listed in Exhibit A, which the Company informed

us are acceptable forms of Title Document. |

| | |

| · | The term “Acceptable Company Names” means the acceptable company names listed in Exhibit A, which the Company informed

us are acceptable names for the Company that can appear in the Title Documents as the Lien Holder, Owner, Security Interest Holder, or

Secured Party. |

| | |

| · | The term “Insurance Document” means a scanned image of one of the insurance documents listed in Exhibit A, which the Company

informed us are acceptable forms of Insurance Document. |

| | |

| · | The term “Receivable File” means any file containing the following documents for each Sample Receivable (defined below):

Installment Sale Contract (not applicable for direct loans), Addendum to the Installment Sale Contract, Retail Installment Sale Contract

Simple Interest Finance Charge letter, Federal Truth in Lending Disclosure Statement (within the Installment Sale Contract or a stand-alone

document for direct loans), Credit Report, Title Document, Insurance Document, Credit Application (not applicable for direct loans), and/or

origination details screen in the Company’s servicing system. We accessed the Receivable Files in the Company’s servicing

system via virtual desktop. We make no representation regarding the validity, enforceability, or authenticity of the information in the

Receivable File. |

| | |

| · | The term “Provided Information” means the Instructions, Vehicle Mapping, Acceptable Company Names, and Receivable File. |

The procedures we were instructed by the Company

to perform and the associated findings are as follows:

| A. | We randomly selected a sample of 150 Receivables from the Data File (the “Sample Receivables”). A listing of the Sample

Receivables is attached hereto as Exhibit B. For purposes of this procedure, the Company did not inform us of the basis they used to determine

the number of Receivables we were instructed to randomly select from the Data File. |

| | | |

| B. | For each Sample Receivable, we compared the specified attributes in the Data File listed below to or using

the corresponding information included in the Receivable File, utilizing the Instructions, as applicable. The Specified Parties indicated

that the absence of any of the information in the Receivable File or the inability to agree the specified attributes from the Data File

to the Receivable File, utilizing the Instructions, as applicable, constituted an exception. The Receivable File documents are listed

in the order of priority. |

| Attribute |

Receivable File / Instructions |

| |

|

| Obligor’s First Name and Last Name |

Installment Sale Contract, Federal Truth in Lending Disclosure Statement,

Credit Report

Differences related to spacing in the spelling of the Obligor’s

Name were not considered exceptions. |

| |

|

| Contract Date |

Installment Sale Contract, Federal Truth in Lending Disclosure Statement |

| |

|

| Original Term |

Installment Sale Contract, Federal Truth in Lending Disclosure Statement |

| Original Amount Financed |

Installment Sale Contract, Federal Truth in Lending Disclosure Statement |

| |

|

| Scheduled Monthly Payment Amount |

Installment Sale Contract, Federal Truth in Lending Disclosure Statement, Retail Installment Sale Contract Simple Interest Finance Charge letter |

| |

|

| Annual Percentage Rate (“APR”) |

Installment Sale Contract, Federal Truth in Lending Disclosure Statement, Retail Installment Sale Contract Simple Interest Finance Charge letter |

| |

|

| Vehicle Type (New or Used) |

Installment Sale Contract, Federal Truth in Lending Disclosure Statement, Gap Addendum. Consider an entry of “C” in the Data File to be a Used vehicle. |

| |

|

| Vehicle Make |

Installment Sale Contract, Federal Truth in Lending Disclosure Statement, Vehicle Mapping |

| |

|

| Vehicle Model |

Installment Sale Contract, Federal Truth in Lending Disclosure Statement, Vehicle Mapping, Insurance Document |

| C. | For each Sample Receivable, we observed the presence of the following in the Receivable File: |

| 1. | Title Document. We were instructed by the Company to observe that one of the Acceptable Company Names appeared on the Title Document

as the Lien Holder, Owner, Security Interest Holder, or Secured Party. |

| | | |

| 2. | Proof of Insurance. The Company informed us that an Insurance Document was acceptable proof of insurance. |

| | | |

| | | We did not observe the presence of Proof of Insurance for

Sample Receivables #40, #41, #44, #46, #106, #110, #126, and #132. We observed that the origination details screen in the Company's servicing

system for these Sample Receivables indicated they were “Stip Tier 1” (“ST01”) loans, “Stip Tier 2”

(“ST02”) loans, or “Stip Tier 3” (“ST03”) loans, which the Company informed us were not required to

provide Proof of Insurance pursuant to its underwriting policy. These were not considered exceptions. |

| | | |

| 3. | Signed Credit Application (not applicable to direct loans). We make no representation regarding the authenticity of the obligor’s

signature(s). |

We were engaged by the Company to perform this agreed-upon procedures

engagement and conducted our engagement in accordance with attestation standards established by the American Institute of Certified Public

Accountants, which involves us performing the specific procedures agreed to and acknowledged above and reporting on findings based on

performing those procedures. We were not engaged to and did not conduct an examination or review, the objective of which would be the

expression of an opinion or conclusion, respectively, on the specified attributes in the Data File. Accordingly, we do not express such

an opinion or conclusion. Had we performed additional procedures, other matters might have come to our attention that would have been

reported.

We are required to be independent of the Company and to meet our other

ethical responsibilities, in accordance with the relevant ethical requirements related to our agreed-upon procedures engagement.

The procedures performed were applied based on the information included

in the Data File and Provided Information, without verification or evaluation of such information by us; therefore, we express no opinion

or any other form of assurance regarding (i) the reasonableness of the information provided to us by the Company, (ii) the physical

existence of the Receivables, (iii) the reliability or accuracy of the Provided Information which was used in our procedures, or (iv) matters

of legal interpretation.

The procedures performed were not intended to address, nor did they

address: (i) the conformity of the origination of the Receivables to stated underwriting or credit extension guidelines, standards,

criteria or other requirements, (ii) the value of collateral securing any such Receivables being securitized, (iii) the compliance

of the originator of the Receivables with federal, state, and local laws and regulations, or (iv) any other factor or characteristic

of the Receivables that would be material to the likelihood that the issuer of the asset-backed security will pay interest and principal

in accordance with applicable terms and conditions. The procedures performed were not intended to satisfy any criteria for due diligence

published by the nationally recognized statistical rating organizations (“NRSROs”).

The terms of our engagement are such that we have no responsibility

to update this report because of events and circumstances that may subsequently occur.

This report is intended solely for the information and use of the Specified

Parties. It is not intended to be and should not be used by any other person or entity, including investors or the NRSROs, who are not

identified in the report as the Specified Parties but may have access to this report as required by law or regulation.

/s/ KPMG LLP

Irvine, California

October 4, 2023

Exhibit A

Title Documents

| Application for Certificate of Title and Registration of Motor Vehicle or Manufactured Home/Mobile Home |

Electronic Title in the CPS Title Management System |

| Application for Certificate of Title |

Form MV-1 Motor Vehicle Title Application |

| Application for Certificate of Ownership |

Guarantee of Title (provided by the dealer to CPS) |

| Application for Dealer Assignment |

Lien Entry Form |

| Application for Registration |

Multi-Purpose Application |

| Application for Title and/or Registration |

MV-1 |

| Application for Vehicle Transaction |

Notice of Security Interest |

| Application for Noting of Lien, Duplicate Title, or Multipurpose Use |

Registration and Title Application |

| Application to Title/Reg. A Vehicle |

Title & License Plate Application |

| Certificate of Title |

Title and Registration Application |

| Dealer Guarantee of Title Delivery |

Title Application |

| Dealer, Rebuilder or Lessor’s Report of Sale or Lease |

Vehicle Application |

| Direct Lien Receipt from Office of Motor Vehicle Records and Information |

Vehicle Registration/Title Application for Dealer Sales |

| Direct Lien Filing Record |

|

Acceptable Company Names

| CPS |

Consumer Portfolio Service |

| CPS INC |

Consumer Portfolio Services |

| CPS.INC |

Consumer Portfolio Srv, INC |

| CPS Inc. |

Consumer Portfolio Svcs Inc |

| CPS, INC |

Consumer Portfolio Srvcs Inc |

| CPS, Inc. |

Consumer Portfolio Svcs, Inc |

| C.P.S. |

CONSUMER PORFOLIO SERVICEC INC |

| C.P.S. Inc. |

Consumer Portfolio Service Inc |

| CPS Incorporated |

Consumer Portfolio Services In |

| Consumer Portfolio S |

Consumer Portfolio Services, I |

| Consumer Portfolio Inc |

Consumer Portfolio Svcs., Inc. |

| Consumer Portfolio Svs |

Consumer Portfolio Services LLC |

| Consumer Portfolio Serv |

Consumer Portfolio Services Inc |

| Consumer Portfolio Srvs |

Consumer Portfolio Services, Inc |

| Consumer Portfolio Svcs |

Consumer Portfolio Services Inc. |

| Consumer Portfolio Svcs Q85 |

Consumer Portfolio Services, Inc. |

| Consumer Portfolio Servic |

Consumer Portfolio Srvcs Inc. |

| Company’s ELT E-Numbers from different DMV systems |

|

Insurance Documents

|

Agreement for Purchaser to Provide Accidental

Physical Damage Coverage |

Proof of Insurance/Authorization to Release Insurance Information |

| Agreement to Furnish Insurance Policy |

Insurance Card |

| Agreement to Maintain Physical Damage Insurance |

Insurance Certification |

| Agreement to Provide Insurance |

Insurance Coverage Acknowledgment |

| Application for Insurance |

Insurance Declaration Page |

| Auto Insurance Coverage Summary |

Insurance Verification system screenshot |

| Auto Insurance Policy Amended Declarations |

Letter of Coverage |

| Certificate of Insurance |

Memorandum of Insurance |

| Certificate of No-fault Insurance |

Notice of Insurance Requirements showing insurance company name and policy number |

| Confirmation of Accidental Physical Damage Insurance |

Notice of Property Insurance |

| Declaration Personal Auto Policy |

Request for Confirmation of Insurance Coverage |

| Evidence of Liability Insurance |

Temporary Proof of Insurance Card |

| Endorsement Page of Personal Automobile Insurance |

Vehicle Insurance Information |

| Financial Responsibility Identification Card |

Verification of Coverage |

| Insurance Binder |

Verification of Insurance |

Exhibit B

The Sample Receivables

|

Sample Receivable # |

Receivable Number1 |

Sample Receivable # |

Receivable Number1 |

Sample Receivable # |

Receivable Number1 |

| 1 |

2023D001 |

51 |

2023D051 |

101 |

2023D101 |

| 2 |

2023D002 |

52 |

2023D052 |

102 |

2023D102 |

| 3 |

2023D003 |

53 |

2023D053 |

103 |

2023D103 |

| 4 |

2023D004 |

54 |

2023D054 |

104 |

2023D104 |

| 5 |

2023D005 |

55 |

2023D055 |

105 |

2023D105 |

| 6 |

2023D006 |

56 |

2023D056 |

106 |

2023D106 |

| 7 |

2023D007 |

57 |

2023D057 |

107 |

2023D107 |

| 8 |

2023D008 |

58 |

2023D058 |

108 |

2023D108 |

| 9 |

2023D009 |

59 |

2023D059 |

109 |

2023D109 |

| 10 |

2023D010 |

60 |

2023D060 |

110 |

2023D110 |

| 11 |

2023D011 |

61 |

2023D061 |

111 |

2023D111 |

| 12 |

2023D012 |

62 |

2023D062 |

112 |

2023D112 |

| 13 |

2023D013 |

63 |

2023D063 |

113 |

2023D113 |

| 14 |

2023D014 |

64 |

2023D064 |

114 |

2023D114 |

| 15 |

2023D015 |

65 |

2023D065 |

115 |

2023D115 |

| 16 |

2023D016 |

66 |

2023D066 |

116 |

2023D116 |

| 17 |

2023D017 |

67 |

2023D067 |

117 |

2023D117 |

| 18 |

2023D018 |

68 |

2023D068 |

118 |

2023D118 |

| 19 |

2023D019 |

69 |

2023D069 |

119 |

2023D119 |

| 20 |

2023D020 |

70 |

2023D070 |

120 |

2023D120 |

| 21 |

2023D021 |

71 |

2023D071 |

121 |

2023D121 |

| 22 |

2023D022 |

72 |

2023D072 |

122 |

2023D122 |

| 23 |

2023D023 |

73 |

2023D073 |

123 |

2023D123 |

| 24 |

2023D024 |

74 |

2023D074 |

124 |

2023D124 |

| 25 |

2023D025 |

75 |

2023D075 |

125 |

2023D125 |

| 26 |

2023D026 |

76 |

2023D076 |

126 |

2023D126 |

| 27 |

2023D027 |

77 |

2023D077 |

127 |

2023D127 |

| 28 |

2023D028 |

78 |

2023D078 |

128 |

2023D128 |

| 29 |

2023D029 |

79 |

2023D079 |

129 |

2023D129 |

| 30 |

2023D030 |

80 |

2023D080 |

130 |

2023D130 |

| 31 |

2023D031 |

81 |

2023D081 |

131 |

2023D131 |

| 32 |

2023D032 |

82 |

2023D082 |

132 |

2023D132 |

| 33 |

2023D033 |

83 |

2023D083 |

133 |

2023D133 |

| 34 |

2023D034 |

84 |

2023D084 |

134 |

2023D134 |

| 35 |

2023D035 |

85 |

2023D085 |

135 |

2023D135 |

| 36 |

2023D036 |

86 |

2023D086 |

136 |

2023D136 |

| 37 |

2023D037 |

87 |

2023D087 |

137 |

2023D137 |

| 38 |

2023D038 |

88 |

2023D088 |

138 |

2023D138 |

| 39 |

2023D039 |

89 |

2023D089 |

139 |

2023D139 |

| 40 |

2023D040 |

90 |

2023D090 |

140 |

2023D140 |

| 41 |

2023D041 |

91 |

2023D091 |

141 |

2023D141 |

| 42 |

2023D042 |

92 |

2023D092 |

142 |

2023D142 |

| 43 |

2023D043 |

93 |

2023D093 |

143 |

2023D143 |

| 44 |

2023D044 |

94 |

2023D094 |

144 |

2023D144 |

| 45 |

2023D045 |

95 |

2023D095 |

145 |

2023D145 |

| 46 |

2023D046 |

96 |

2023D096 |

146 |

2023D146 |

| 47 |

2023D047 |

97 |

2023D097 |

147 |

2023D147 |

| 48 |

2023D048 |

98 |

2023D098 |

148 |

2023D148 |

| 49 |

2023D049 |

99 |

2023D099 |

149 |

2023D149 |

| 50 |

2023D050 |

100 |

2023D100 |

150 |

2023D150 |

1

The Company has assigned a unique eight-digit Account Number to each Receivable in the Data File. The Receivable Numbers referred to in

this Exhibit are not the Company’s Account Numbers.

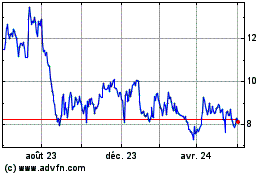

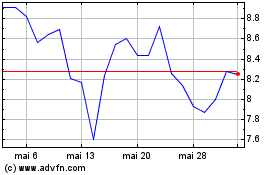

Consumer Portfolio Servi... (NASDAQ:CPSS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Consumer Portfolio Servi... (NASDAQ:CPSS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024