- $35.0 million in cash

- $472.9 million in sales, a 6.1 percent sequential and 12.8

percent year-over-year increase

- GAAP diluted EPS of $1.27

- $52.4 million in earnings before interest, taxes, depreciation

& amortization and other non-cash charges ("Adjusted

EBITDA")

- Free Cash Flow of $24.4 million for the quarter, and $54.4

million for the nine months ended September 30, 2024

- Completed five acquisitions through Q3; three water, and two

industrial rotating equipment companies

DXP Enterprises, Inc. ("DXP" or the "Company") (NASDAQ:

DXPE) today announced financial results for the third quarter

ended September 30, 2024. The following are results for the three

months ended September 30, 2024, compared to the three months ended

September 30, 2023, and June 30, 2024, where appropriate. A

reconciliation of the non-GAAP financial measures can be found in

the back of this press release.

Third Quarter 2024 Financial Highlights:

- Sales increased 6.1 percent sequentially to $472.9 million,

compared to $445.6 million for the second quarter of 2024 and

increased 12.8 percent compared to $419.2 million for the third

quarter of 2023.

- Net income for the third quarter was $21.1 million, compared to

$16.2 million for the third quarter of 2023 and $16.7 million for

the second quarter of 2024.

- Earnings per diluted share for the third quarter was $1.27

based upon 16.6 million diluted shares, compared to $0.93 earnings

per diluted share in the third quarter of 2023, based on 17.4

million diluted shares. Adjusted diluted earnings per share was

$1.43 for the third quarter compared to $0.96 in the third quarter

of 2023.

- Adjusted EBITDA for the third quarter was $52.4 million

compared to $44.0 million for the third quarter of 2023 and $48.2

million for the second quarter of 2024. Adjusted EBITDA as a

percentage of sales, or Adjusted EBITDA margin, was 11.1 percent,

10.5 percent, and 10.8 percent, respectively.

- Free Cash Flow (cash flow from operating activities less

capital expenditures) for the third quarter was $24.4 million,

compared to $38.3 million for the third quarter of 2023.

David R. Little, Chairman and Chief Executive Officer commented,

"The Company posted excellent third quarter financial results in a

lessening inflationary and varied spending by end market,

delivering solid sales, adjusted EBITDA, earnings per share and

free cash flow. Third quarter results reflect the continued

execution of our growth strategy and the impact of our acquisition

program. We continue to set new high watermarks as DXPeople. We are

pleased with our sequential sales growth and strong adjusted EBITDA

margins. This resulted in operating leverage that produced earnings

per share of $1.27. DXP’s third quarter 2024 sales were $472.9

million, or a 6.1 percent increase over the second quarter of 2024

and a 12.8 percent growth over the same period in 2023. Adjusted

EBITDA grew $4.2 million, or 8.7 percent over the second quarter of

2024 to $52.4 million. During the third quarter of 2024, sales were

$316.8 million for Service Centers, $89.8 million for Innovative

Pumping Solutions, and $66.3 million for Supply Chain Services.

Overall, we are very pleased with our performance and the progress

DXP continues to make as a growth company."

Kent Yee, Chief Financial Officer and Senior Vice President,

remarked, "DXP achieved yet another high watermark quarter with a

6.1 percent sequential sales increase to $472.9 million in sales

and 11.1 percent Adjusted EBITDA margins. We have closed five

acquisitions through the third quarter, and we have closed two

acquisitions during the fourth quarter of 2024. This quarters

financial results reflect continued execution of our strategic

goals and the impact of our diversification efforts, an overall

reduced energy industry exposure, and a strong balance sheet to

support our key initiatives. Subsequent to the third quarter, we

announced the successful completion of the repricing of our

existing debt plus raising an incremental $105 million. DXP is

saving one hundred basis points on existing debt, while raising

incremental money to further drive anticipated acquisition growth.

Total debt outstanding as of September 30, 2024, was $544.5

million. DXP’s secured leverage ratio or net debt to EBITDA ratio

was 2.54:1.0 with a covenant EBITDA of $200.7 million for the last

twelve months ending September 30, 2024. We expect to finish fiscal

year 2024 strong with momentum going into fiscal year 2025."

Conference Call Information

DXP Enterprises, Inc. management will host a conference call,

November 5, 2024, at 10:30 a.m. Central Time, to discuss the

Company’s financial results. The conference call may be accessed by

going to https://ir.dxpe.com.

Interested investors and other parties can listen to a webcast

of the live conference call by logging onto the Investor Relations

section of the Company's website at https://ir.dxpe.com. The online

replay will be available on the same website immediately following

the call. A slide presentation highlighting the Company’s results

and key performance indicators will also be available on the

Investor Relations section of the Company’s website.

To learn more about DXP Enterprises, Inc., please visit the

Company's website at https://www.dxpe.com

About DXP Enterprises, Inc.

DXP Enterprises, Inc. is a leading products and service

distributor that adds value and total cost savings solutions to

industrial customers throughout North America and Dubai. DXP

provides innovative pumping solutions, supply chain services and

maintenance, repair, operating and production ("MROP") services

that emphasize and utilize DXP’s vast product knowledge and

technical expertise in rotating equipment, bearings, power

transmission, metal working, industrial supplies and safety

products and services. DXP's breadth of MROP products and service

solutions allows DXP to be flexible and customer-driven, creating

competitive advantages for our customers. DXP’s business segments

include Service Centers, Innovative Pumping Solutions and Supply

Chain Services. For more information, go to www.dxpe.com.

Non-GAAP Financial Measures

DXP supplements reporting of net income with certain non-GAAP

measurements, including EBITDA, Adjusted EBITDA, EBITDA Margin,

Adjusted EBITDA Margin, and Free Cash Flow. This supplemental

information should not be considered in isolation or as a

substitute for the unaudited GAAP measurements. Additional

information regarding EBITDA, Adjusted EBITDA, EBITDA Margin,

Adjusted EBITDA Margin, Free Cash Flow and net debt referred to in

this press release are included below under "Unaudited

Reconciliation of Non-GAAP Financial Information".

The Company believes EBITDA provides additional information

about: (i) operating performance, because it assists in comparing

the operating performance of the business, as it removes the impact

of non-cash depreciation and amortization expense as well as items

not directly resulting from core operations such as interest

expense and income taxes and (ii) the performance and the

effectiveness of operational strategies. Additionally, EBITDA

performance is a component of a measure of the Company’s financial

covenants under its credit facilities. Furthermore, some investors

use EBITDA as a supplemental measure to evaluate the overall

operating performance of companies in the industry. Management

believes that some investors’ understanding of performance is

enhanced by including this non-GAAP financial measure as a

reasonable basis for comparing ongoing results of operations. By

providing this non-GAAP financial measure, together with a

reconciliation to its most directly comparable GAAP financial

measure, the Company believes it is enhancing investors’

understanding of the business and results of operations, as well as

assisting investors in evaluating how well the Company is executing

strategic initiatives. Free Cash Flow reconciles to the most

directly comparable GAAP financial measure of cash flows from

operations as provided below. We believe Free Cash Flow is an

important liquidity metric because it measures, during a given

period, the amount of cash generated that is available to fund

acquisitions, make investments, repay debt obligations, repurchase

shares of the Company's common stock, and for certain other

activities.

Information Related to Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a

“safe-harbor” for forward-looking statements. Certain information

included in this press release (as well as information included in

oral statements or other written statements made by or to be made

by the Company) contains statements that are forward-looking. These

forward-looking statements include, without limitation, those about

the Company’s expectations regarding the Company's expectations

regarding the filing of the Form 10-Q; the description of the

anticipated changes in the Company's consolidated balance sheet and

the results of operations and the Company's assessment of the

impact of such anticipated changes; the Company’s business, the

Company’s future profitability, cash flow, liquidity, and growth.

Such forward-looking information involves important risks and

uncertainties that could significantly affect anticipated results

in the future; and accordingly, such results may differ from those

expressed in any forward-looking statement made by or on behalf of

the Company. These risks and uncertainties include, but are not

limited to: the effectiveness of management’s strategies and

decisions; our ability to implement our internal growth and

acquisition growth strategies; general economic and business

conditions specific to our primary customers; changes in government

regulations; our ability to effectively integrate businesses we may

acquire; new or modified statutory or regulatory requirements;

availability of materials and labor; inability to obtain or delay

in obtaining government or third-party approvals and permits;

non-performance by third parties of their contractual obligations;

unforeseen hazards such as weather conditions, acts of war or

terrorist acts and the governmental or military response thereto;

cyber-attacks adversely affecting our operations; other geological,

operating and economic considerations and declining prices and

market conditions, including supply or demand for maintenance,

repair and operating products, equipment and service; inability of

the Company or its independent auditors to complete the work

necessary in order to file the Form 10-Q in the expected time

frame; unanticipated changes to the Company's operating results in

the Form 10-Q as filed or in relation to prior periods, including

as compared to the anticipated changes stated here; unanticipated

impact of such changes and its materiality; ability to obtain

needed capital, dependence on existing management, leverage and

debt service, domestic or global economic conditions, ability to

manage changes and the continued health or availability of

management personnel and changes in customer preferences and

attitudes. In some cases, you can identify forward-looking

statements by terminology such as, but not limited to, “may,”

“will,” “should,” “intend,” “expect,” “plan,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “goal,” or

“continue” or the negative of such terms or other comparable

terminology. More information on these risks and other potential

factors that could affect the Company’s business and financial

results is included in the Company’s filings with the Securities

and Exchange Commission, including in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of the Company’s most recently

filed periodic reports on Form 10-K and Form 10-Q and subsequent

filings. The Company assumes no obligation to update any

forward-looking statements or information, which speak as of their

respective dates.

DXP ENTERPRISES, INC. AND

SUBSIDIARIES

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

($ thousands, except share

amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Sales

$

472,935

$

419,249

$

1,331,126

$

1,271,556

Cost of sales

326,825

293,687

923,341

889,101

Gross profit

146,110

125,562

407,785

382,455

Selling, general and administrative

expenses

106,502

89,706

301,694

273,720

Income from operations

39,608

35,856

106,091

108,735

Interest expense

15,716

12,684

46,644

36,068

Other expense (income), net

160

1,234

(2,844

)

522

Income before income taxes

23,732

21,938

62,291

72,145

Provision for income taxes

2,631

5,766

13,165

19,339

Net income

21,101

16,172

49,126

52,806

Preferred stock dividend

23

22

68

67

Net income attributable to common

shareholders

$

21,078

$

16,150

$

49,058

$

52,739

Net income

$

21,101

$

16,172

$

49,126

$

52,806

Foreign currency translation

adjustments

380

(844

)

(141

)

(87

)

Comprehensive income

$

21,481

$

15,328

$

48,985

$

52,719

Earnings per share:

Basic

$

1.34

$

0.98

$

3.08

$

3.08

Diluted

$

1.27

$

0.93

$

2.93

$

2.94

Weighted average common shares

outstanding:

Basic

15,750

16,516

15,915

17,104

Diluted

16,590

17,356

16,755

17,944

DXP ENTERPRISES, INC. AND

SUBSIDIARIES

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

($ thousands, except share

amounts)

September 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash

$

35,000

$

173,120

Restricted cash

91

91

Accounts receivable, net of allowance of

$5,316 and $5,584, respectively

337,722

311,171

Inventories

109,787

103,805

Costs and estimated profits in excess of

billings

49,707

42,323

Prepaid expenses and other current

assets

26,637

18,044

Total current assets

558,944

648,554

Property and equipment, net

73,050

61,618

Goodwill

448,103

343,991

Other intangible assets, net

89,356

63,895

Operating lease right of use assets,

net

48,498

48,729

Other long-term assets

10,263

10,649

Total assets

$

1,228,214

$

1,177,436

LIABILITIES AND EQUITY

Current liabilities:

Current maturities of debt

$

5,500

$

5,500

Trade accounts payable

106,802

96,469

Accrued wages and benefits

41,230

36,238

Customer advances

12,656

12,160

Billings in excess of costs and estimated

profits

11,911

9,506

Short-term operating lease liabilities

14,928

15,438

Other current liabilities

52,618

48,854

Total current liabilities

245,645

224,165

Long-term debt, net of unamortized debt

issuance costs and discounts

519,250

520,697

Long-term operating lease liabilities

34,922

34,336

Other long-term liabilities

26,029

17,359

Total long-term liabilities

580,201

572,392

Total liabilities

825,846

796,557

Commitments and Contingencies

Shareholders' equity:

Series A preferred stock, $1.00 par value;

1,000,000 shares authorized

1

1

Series B preferred stock, $1.00 par value;

1,000,000 shares authorized

15

15

Common stock, $0.01 par value, 100,000,000

shares authorized; 15,694,883 and 16,177,237 outstanding,

respectively

345

345

Additional paid-in capital

218,062

216,482

Retained earnings

368,329

319,271

Accumulated other comprehensive loss

(31,381

)

(31,240

)

Treasury stock, at cost 4,707,773 and

4,141,989 shares, respectively

(153,003

)

(123,995

)

Total DXP Enterprises, Inc.

equity

402,368

380,879

Total liabilities and equity

$

1,228,214

$

1,177,436

Business segment financial highlights:

- Service Centers’ revenue for the

third quarter was $316.8 million, an increase of 7.6 percent

year-over-year, with a 14.6 percent operating income margin.

- Innovative Pumping Solutions’

revenue for the third quarter was $89.8 million, an increase of

52.3 percent year-over-year, with a 20.3 percent operating income

margin.

- Supply Chain Services’ revenue for

the third quarter was $66.3 million, an increase of 0.7 percent

year-over-year, with a 8.4 percent operating income margin.

SEGMENT DATA

($ thousands, unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

Sales

2024

2023

2024

2023

Service Centers

$

316,831

$

294,459

$

911,783

$

914,078

Innovative Pumping Solutions

89,825

58,962

225,417

158,440

Supply Chain Services

66,279

65,828

193,926

199,038

Total Sales

$

472,935

$

419,249

$

1,331,126

$

1,271,556

Three Months Ended September

30,

Nine Months Ended September

30,

Operating Income

2024

2023

2024

2023

Service Centers

$

46,154

$

41,912

$

130,329

$

134,549

Innovative Pumping Solutions

18,207

10,599

38,543

26,555

Supply Chain Services

5,568

5,589

16,653

16,519

Total Segments Operating Income

$

69,929

$

58,100

$

185,525

$

177,623

RECONCILIATION OF OPERATING

INCOME FOR REPORTABLE SEGMENTS

($ thousands, unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Income from operations for reportable

segments

$

69,929

$

58,100

$

185,525

$

177,623

Adjustment for:

Amortization of intangibles

5,245

5,866

14,333

15,206

Corporate expenses

25,076

16,378

65,101

53,682

Income from operations

$

39,608

$

35,856

$

106,091

$

108,735

Interest expense

15,716

12,684

46,644

36,068

Other expense (income), net

160

1,234

(2,844

)

522

Income before income taxes

$

23,732

$

21,938

$

62,291

$

72,145

RECONCILIATION OF NON-GAAP

FINANCIAL INFORMATION

($ thousands, unaudited)

The following table sets forth the

reconciliation of EBITDA, EBITDA Margin, Adjusted EBITDA and

Adjusted EBITDA Margin to the most comparable U.S. GAAP financial

measure (in thousands):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Income before income taxes

$

23,732

$

21,938

$

62,291

$

72,145

Plus: Interest expense

15,716

12,684

46,644

36,068

Plus: Depreciation and amortization

8,720

7,983

24,385

21,468

EBITDA

$

48,168

$

42,605

$

133,320

$

129,681

Plus: other non-recurring items(1)

2,950

551

4,292

551

Plus: stock compensation expense

1,322

864

3,398

2,211

Adjusted EBITDA

$

52,440

$

44,020

$

141,010

$

132,443

Operating Income Margin

8.4

%

8.6

%

8.0

%

8.6

%

EBITDA Margin

10.2

%

10.2

%

10.0

%

10.2

%

Adjusted EBITDA Margin

11.1

%

10.5

%

10.6

%

10.4

%

(1) Other non-recurring items includes

unique acquisition integration costs and other non-cash,

non-recurring costs not related to continuing business

operations.

The following table sets forth the

reconciliation of Organic Sales and Organic Sales per Business Day

to the most comparable U.S. GAAP financial measure (in

thousands):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Sales by Business Segment

Service Centers

$

316,831

$

294,459

$

911,783

$

914,078

Innovative Pumping Solutions

89,825

58,962

225,417

158,440

Supply Chain Services

66,279

65,828

193,926

199,038

Total DXP Sales

$

472,935

$

419,249

$

1,331,126

$

1,271,556

Acquisition Sales

28,535

3,868

63,713

30,266

Organic Sales

$

444,400

$

415,381

$

1,267,413

$

1,241,290

Business Days

64

63

191

191

Sales per Business Day

$

7,390

$

6,655

$

6,969

$

6,657

Organic Sales per Business Day

$

6,944

$

6,593

$

6,636

$

6,499

RECONCILIATION OF NON-GAAP

FINANCIAL INFORMATION CONTINUED

($ thousands, unaudited)

The following table sets forth the

reconciliation of Free Cash Flow to the most comparable GAAP

financial measure (in thousands):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net cash from operating activities

$

28,344

$

39,758

$

70,068

$

63,775

Less: purchases of property and

equipment

(3,954

)

(1,486

)

(15,673

)

(7,103

)

Free Cash Flow

$

24,390

$

38,272

$

54,395

$

56,672

The following table is a reconciliation of

adjusted net income attributable to DXP Enterprises, Inc., a

non-GAAP financial measure, to net income, calculated and reported

in accordance with U.S. GAAP (in thousands).

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net Income

$

21,101

$

16,172

$

49,126

$

52,806

One-time non-cash items

2,950

551

4,292

551

Adjustment for taxes

(327

)

(145

)

(907

)

(145

)

Adjusted Net Income

$

23,724

$

16,578

$

52,511

$

53,212

Weighted average common shares and

common equivalent shares outstanding

Diluted

16,590

17,356

16,755

17,944

Diluted Earnings per Share

$

1.27

$

0.93

$

2.93

$

2.94

Adjusted Diluted Earnings per Share

$

1.43

$

0.96

$

3.13

$

2.97

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104403504/en/

Kent Yee Senior Vice President, CFO 713-996-4700

www.dxpe.com

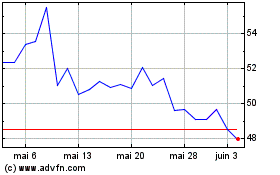

DXP Enterprises (NASDAQ:DXPE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

DXP Enterprises (NASDAQ:DXPE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024