Dyadic International, Inc. ("Dyadic" or the "Company") (NASDAQ:

DYAI), a global biotechnology company focused on building

innovative microbial protein production platforms to address the

growing demand for global protein bioproduction utilizing its

advanced microbial platforms to develop and manufacture

prophylactic, therapeutic, and nutritional biopharmaceutical

products for human and animal health and wellness, announced today

that it entered into a securities purchase agreement on March 8,

2024, pursuant to which, the Company has sold and issued an

aggregate principal amount of $6.0 million of its 8.0% Senior

Secured Convertible Promissory Notes due March 8, 2027 (the

“Convertible Notes”) in a private placement in reliance on the

exemption from registration provided by Section 4(a)(2) of the

Securities Act of 1933, as amended (the “Securities Act”). The

purchasers of the Convertible Notes include immediate family

members and family trusts related to Mark Emalfarb, our President

and Chief Executive Officer and a member of our Board of Directors,

including The Francisco Trust, an existing holder of more than 5%

of the Company’s outstanding common stock, (collectively, the

“Purchasers”).

The Convertible Notes will be senior, secured

obligations of Dyadic and its affiliates, and interest will be

payable quarterly in cash on the principal amount equal to 8% per

annum. The Convertible Notes will mature on March 8, 2027 (the

“Maturity Date”), unless earlier converted, repurchased, or

redeemed in accordance with the terms of the Convertible Notes.

The Convertible Notes will be convertible into

shares of Dyadic’s Class A common stock (the “Common Stock”), at

the option of the holders of the Convertible Notes (the

“Noteholders”) at any time prior to the Maturity Date. The

conversion price is $1.79 per share of the Common Stock, which is

equal to 125% of the trailing 30-day VWAP of the Common Stock

ending on the trading day immediately preceding the date of the

securities purchase agreement.

“I would like to extend our gratitude to

long-term shareholders for their steadfast support. This private

placement funding is pivotal for Dyadic in propelling our near-term

revenue growth and expediting what we believe will be the global

adoption and commercialization of Dyadic technologies, particularly

the C1 and Dapibus™ protein production platforms, across

pharmaceutical and non-pharmaceutical sectors,” said Mr. Emalfarb,

Dyadic’s President and CEO. “Within the next two years, we

anticipate reaching multiple revenue streams and other inflection

points through fully funded collaborations and the Company’s

pipeline products to enhance shareholder value.”

Mr. Emalfarb continued, “We believe the top-line

safety and reactogenicity results for Dyadic’s first in human

clinical trial is transformational because we successfully

demonstrated for the first time that a protein manufactured using

our C1 technology platform is safe for use in humans. Within months

of announcing the successful Phase I milestone, we have received

increased interest across industry collaborators, including two top

ten pharmaceutical companies, resulting in the initiation of more

than twelve fully funded vaccine and antibody targets.

Additionally, the Company remains dedicated to driving near-term

revenue and growth through innovation and commercialization

efforts, expanding the use of the Dapibus™ platform for developing

alternative recombinant proteins, such as alpha-lactalbumin,

recombinant human albumin, and non-animal dairy enzymes for food

production, across various applications.” Mr. Emalfarb concluded,

“I cannot overstate how exciting this time is in Dyadic’s history.

We are uniquely positioned to rapidly capitalize on the present

opportunities and those on the horizon.”

Dyadic intends to use the net proceeds from the

sale of the Convertible Notes for working capital and general

corporate purposes.

In addition, Dyadic entered into a registration

rights agreement with the Purchasers, which grants the Purchasers

with certain customary registration rights with respect to the

shares of Class A common stock issuable upon conversion of the

Convertible Notes. For a full description of the foregoing

transactions and agreements related thereto, see the Form 8-K filed

by the Company with the SEC on or about the date hereof.

The offer and sale of the Convertible Notes and

the shares of Class A common stock issuable upon conversion of the

Convertible Notes, if any, have not been registered under the

Securities Act or the securities laws of any other jurisdiction,

and the Convertible Notes and any such shares may not be offered or

sold absent registration or an applicable exemption from such

registration requirements.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any securities,

including the Convertible Notes or Dyadic common stock, nor shall

there be any sale of securities in any state or jurisdiction in

which such an offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or jurisdiction.

About Dyadic International,

Inc.

Dyadic International, Inc. is a global

biotechnology company focused on building innovative microbial

protein production platforms to address the growing demand for

global protein bioproduction utilizing its advanced microbial

platforms to develop and manufacture prophylactic, therapeutic, and

nutritional biopharmaceutical products for human and animal health

and wellness.

Dyadic’s gene expression and protein production

platforms are based on the highly productive and scalable

fungus Thermothelomyces heterothallica (formerly

Myceliophthora thermophila). Our lead technology, C1-cell

protein production platform, is based on an industrially proven

microorganism (named C1), which is currently used to speed

development, lower production costs, and improve performance of

biologic vaccines and drugs at flexible commercial scales for the

human and animal health markets. Dyadic has also developed the

Dapibus™ filamentous fungal based microbial protein production

platform to enable the rapid development and large-scale

manufacture of low-cost proteins, metabolites, and other biologic

products for use in non-pharmaceutical applications, such as food,

nutrition, and wellness.

With a passion to enable our partners and

collaborators to develop effective preventative and therapeutic

treatments in both developed and emerging countries, Dyadic is

building an active pipeline by advancing its proprietary microbial

platform technologies, including our lead asset DYAI-100 COVID-19

vaccine candidate, as well as other biologic vaccines, antibodies,

and other biological products.

To learn more about Dyadic and our commitment to helping bring

vaccines and other biologic products to market faster, in greater

volumes and at lower cost, please

visit https://www.dyadic.com.

Safe Harbor Regarding Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

including those regarding Dyadic International’s expectations,

intentions, strategies, and beliefs pertaining to future events or

future financial performance, such as the issuance of Convertible

Notes and the use of proceeds thereof. Actual events or results may

differ materially from those in the forward-looking statements

because of various important factors, including those described in

the Company’s most recent filings with the SEC. Dyadic assumes no

obligation to update publicly any such forward-looking statements,

whether because of new information, future events or otherwise. For

a more complete description of the risks that could cause our

actual results to differ from our current expectations, please see

the section entitled “Risk Factors” in Dyadic’s annual reports on

Form 10-K and quarterly reports on Form 10-Q filed with the SEC, as

such factors may be updated from time to time in Dyadic’s periodic

filings with the SEC, which are accessible on the SEC’s website and

at www.dyadic.com.

Contact:Dyadic International, Inc.Ping W.

RawsonChief Financial OfficerPhone: (561)

743-8333Email: ir@dyadic.com

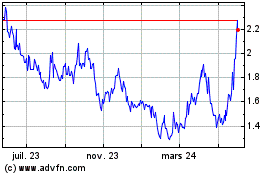

Dyadic (NASDAQ:DYAI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Dyadic (NASDAQ:DYAI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025