Dyadic International, Inc. (“Dyadic”, “we”, “us”, “our”, or the

“Company”) (NASDAQ: DYAI), a biotechnology company focused on the

efficient large-scale manufacture of proteins for use in human and

animal vaccines and therapeutics, as well as non-pharmaceutical

applications including food, nutrition, and wellness, today

announced its financial results for the first quarter of 2024 and

highlighted recent Company progress.

“We continue to execute our business strategy to

focus on near-term pharmaceutical and non-pharmaceutical

applications for our proprietary and patented C1 and Dapibus™

protein production platforms and pipeline products,” said Mr. Mark

Emalfarb, President and CEO of Dyadic. “One of our key highlights

was the successful completion of a Phase 1 clinical trial that met

its primary endpoint of safety and reactogenicity affirming the

safety of proteins produced by Dyadic's C1 platform in humans. We

believe this milestone not only establishes the safety of our

platform but also provides a solid foundation for C1 technology’s

future applications in human and animal vaccines and therapeutics.

With the H5N1 ('Bird Flu') virus outbreaks in poultry and U.S.

dairy cows, along with one recent human case, we are seeing an

increasing interest in our H5N1 'Bird Flu' ferritin nanoparticle

human vaccine candidate, developed with ViroVax. Additional animal

studies indicate that the vaccine candidate has the potential to

generate high neutralizing antibodies for use in cattle. Our Q1

2024 achievements demonstrate our ongoing commitment to enhancing

our microbial platforms for diverse applications, and our

dedication to improving health for humans and animals, while

tackling the challenges of sustainable food production.”

Mr. Emalfarb continued, “As we progress into the

second quarter, our Company continues to focus on enhancing the

Dapibus™ platform, designed specifically for non- pharmaceutical

uses in industries such as food, nutrition, health, and other

bioproducts. To accomplish this goal, we have honed our business

development strategy, focusing on key areas where our technologies

can deliver the greatest impact with shorter commercialization

timelines. Our strategy includes simultaneously targeting multiple

offtakes for a single product in several corresponding business

segments and seeking out new opportunities that are in line with

our strategy.”

Joe Hazelton, Dyadic’s Chief Operating Officer,

elaborated, “In addition to operational advancements, we also

strengthened our financial position with the issuance of $6.0

million in convertible notes, which will be used to accelerate and

exploit our strategic objective of near-term revenue generating

products and commercialization opportunities for pharmaceutical and

non-pharmaceutical applications. We believe that product

opportunities such as recombinant human albumin and

alpha-lactalbumin provide Dyadic with multiple monetization

opportunities as a licensed product or cell line in pharmaceutical,

diagnostic, and food applications. We are confident that our strong

position, both financially and scientifically, will enable us to

implement our business plans with improved capabilities and

resources. We are enthusiastic about our future prospects and

remain committed to providing value to our customers and

stakeholders.”

Recent Company Progress

Corporate Events:

- On March 8, 2024, the Company

issued an aggregate principal amount of $6.0 million of its 8.0%

Senior Secured Convertible Promissory Notes due March 8, 2027 (the

“Convertible Notes”) in a private placement in reliance on the

exemption from registration provided by Section 4(a)(2) of the

Securities Act of 1933, as amended. The purchasers of the

Convertible Notes include immediate family members and family

trusts related to Mark Emalfarb, our President and Chief Executive

Officer and a member of our Board of Directors, including The

Francisco Trust, an existing holder of more than 5% of the

Company’s outstanding common stock.

- On March 28,

2024, the Company announced changes in the leadership roles of the

Board and senior management team: the appointment of Mr. Patrick

Lucy as Chairman of Board of Directors and promotion of Mr. Joe

Hazelton to Chief Operating Officer.

Human Health Sector

DYAI-100 Phase 1

Clinical Trial

DYAI-100, a

C1-SARS-CoV-2 recombinant protein RBD vaccine candidate, is the

first C1-expressed protein tested in humans. The Phase 1

randomized, double-blind, placebo-controlled trial was designed as

a first-in-human trial to assess the clinical safety and antibody

response of DYAI-100, produced using the C1 platform and

administered as a booster vaccine at two single dose levels in

healthy volunteers. Following regulatory clearance from the South

African Health Products Regulatory Authority (SAHPRA), the trial

was initiated in 1Q 2023, with the last patient visit occurring in

3Q 2023. On November 29, 2023, the Company announced the top-line

safety results, indicating that the study has met its primary

endpoint that both the low and high dose levels of the vaccine are

safe and well tolerated among participants. Additionally, the

vaccine has been shown to induce immune responses at both dose

levels, suggesting its potential efficacy in generating protective

immunity against the target virus. The study has been finalized,

and the final Clinical Study Report has been issued, demonstrating

that the DYAI-100 vaccine met its primary endpoint of safety and

reactogenicity.

- In April 2024,

Dyadic and its development partner ViroVax reported pre-clinical

animal testing on a ferritin nanoparticle H5N1 bird flu recombinant

protein human vaccine candidate that demonstrated a strong immune

response in rabbits. The potential vaccine combines Dyadic’s C1

single step ferritin nanoparticle H5N1 antigen production with a

novel adjuvant from ViroVax. Additional animal studies are being

carried out that preliminarily show that this H5N1 bird flu vaccine

has the potential to be used in humans.

- Successfully

expressed H1N1 influenza antigen in the fully funded research

collaboration with the Vaccine and Immunotherapy Center (“VIC”) at

Massachusetts General Hospital to express vaccine antigens for

influenza A and other infectious diseases, as part of a US $5.88

million award from the Department of Defense (“DoD”).

- On March 25,

2024, the Company entered a funded research collaboration with a

top ten pharmaceutical company to develop a vaccine antigen and a

monoclonal antibody produced from the C1 technology.

- In March 2024, a

manuscript of preclinical studies on C1-produced monoclonal

antibody in non-human primates and hamsters was published in the

prestigious peer-reviewed journal Nature Communications. A

non-human primate challenge study completed dosing of a C1-produced

COVID-19 monoclonal antibody (mAb) that had previously demonstrated

broad neutralization and protection against Omicron (BA.1 and BA.2)

and the other earlier variants of concern in hamsters. Preliminary

results obtained from the challenge study with the SARS-CoV-2 Delta

virus on non-human primates demonstrated potential high protection.

This was the first time a C1-produced monoclonal antibody was used

in a non-human primate study validating the safety and efficacy of

a C1 produced antibody for infectious diseases.

- On February 28,

2024, the Company’s Dutch subsidiary, Dyadic Nederland BV, entered

into a strategic partnership agreement and collaboration with

Rabian BV (“Rabian”), a Dutch innovative SME founded by experienced

entrepreneurs and vaccine scientists. Awarded by Eurostars for the

AVATAR project, a part of the European Partnership on Innovative

SMEs (small and medium-sized enterprises), and co-funded by the

European Union through Horizon Europe. Rabian will use the total

funding of approximately Є1.7 million leveraging its expertise in

virology to develop a rabies vaccine using Dyadic’s C1 protein

production platform to tackle the challenges posed by rabies,

particularly in lower- and middle-income countries. Dyadic is

expected to receive an equity stake in Rabian, fully funded

research and development costs, and specified product milestones

and royalties upon commercialization.

- On February 21,

2024, the Company announced it has advanced its collaboration with

the IIBR and its commercial arm Life Science Research Israel

(LSRI), to target emerging disease solutions. This partnership aims

to leverage Dyadic’s expertise in microbial platforms for flexible

scale protein bioproduction and the IIBR’s antibodies and antigens

discovery capabilities to develop and manufacture innovative

solutions for addressing emerging diseases and potential

bio-threats. Through this collaboration, both parties are working

towards the development of effective treatments and vaccines to

combat global health challenges with the intention of future

commercialization (to date, the framework is non-binding and

subject to the execution of a binding agreement to be negotiated by

the parties) through collaborative out-licensing initiatives.

- On February 13,

2024, the Company announced a strategic partnership with Cygnus

Technologies®, part of Maravai LifeSciences®, who have developed

the C1 Host Cell Protein ELISA Kit for the quality release of

products produced using Dyadic’s protein expression platforms. The

C1 Host Cell Protein ELISA Kit is now available for purchase on

Cygnus Technologies website under Fungal HCP ELISA kits tab.

- On February 6,

2024, the Company announced it signed a fully funded evaluation

agreement including a commercial option with an undisclosed leading

global biopharmaceutical company to design and produce recombinant

proteins using Dyadic’s C1 microbial protein production

platform.

Animal Health Sector

- On March 15, 2024, the Company expanded its collaboration with

Phibro Animal Health/Abic Biological Laboratories Ltd to develop

vaccines and treatments for companion and livestock animal

diseases.

- C1 produced adjuvanted recombinant

ferritin nanoparticle H5N1 “Bird Flu” human vaccine candidate

demonstrated a strong immune response in animal studies for

potential use in poultry, cattle and other animals.

- The H5N1 C1 produced bird flu

ferritin nanoparticle vaccine elicits high neutralizing antibodies

against all three virus isolates (including Texas) of the H5 virus

in livestock.

Alternative Proteins Sector

Dyadic is advancing a pipeline of differentiated

product candidates that leverage its microbial protein production

platforms, including Dapibus™ which have demonstrated the ability

and efficiency to enable the rapid development and large-scale

manufacture of proteins at low cost in a wide range of

non-pharmaceutical applications and commercial use.

Cell Culture Media Products

- In March 2024, the Company executed a term sheet with a large

global albumin manufacturer and distributor to develop and license

Dyadic’s recombinant serum albumin. The Company’s animal-free

recombinant serum albumin projects were initiated in late 2022

using Dyadic pharmaceutical cell lines for use in potential

therapeutic, product development, research, and/or diagnostic human

and animal pharmaceutical applications. The Company has completed

the initial analysis of its recombinant albumin products and has

Certificates of Analysis for recombinant human and bovine albumin

that demonstrate comparability to reference standards used in the

testing.

- In March 2024, the Company entered

into a co-promotion agreement with Biftek Co. for the promotion of

growth media supplement for cell culture.

- The Company is undergoing a project

to produce recombinant transferrin for use in cell culture media

for the alternative protein industry.

- The Company is currently sampling

recombinant bovine albumin for application testing as growth media

for the cultured meat industry.

Non-animal Dairy Products

- As previously announced, in September 2023, the Company entered

into a development and exclusive license agreement to commercialize

certain non-animal dairy enzymes used in the production of food

products using Dapibus™ and received an upfront payment of $0.6

million in October 2023. The Company believes it has achieved the

specified target yield level required for a milestone payment upon

verification by its partner, and the development of a second enzyme

is progressing as planned.

- The Company has developed a highly

productive strain and is actively sampling recombinant

alpha-lactalbumin, a whey protein, and is currently negotiating

several development and commercialization agreements.

- The Company is undergoing a

beta-lactoglobulin animal-free recombinant whey protein project,

expected to begin sampling in the late third quarter.

- The Company is undergoing a

recombinant lactoferrin project, expected to begin sampling the

product in the late second or early third quarter.

Bio Industrial Products

- The Company has developed three enzymes, with plans for two

additional enzymes, that have the potential for use in multiple

industries, such as dairy, nutrition, biogas, biofuels and

biorefining. Several initial targets are under evaluation with

interested parties.

Financial Highlights

Cash Position: As of March 31,

2024, cash, cash equivalents, and the carrying value of

investment-grade securities, including accrued interest, were

approximately $12.1 million compared to $7.3 million as of December

31, 2023.

Revenue: Research and

development revenue and license revenue for the three months ended

March 31, 2024, decreased to approximately $335,000 compared to

$934,000 for the same period a year ago. The decrease in research

and development revenue was due to the winding down of several

large research collaborations conducted in 2023. For the three

months ended March 31, 2024, the Company’s revenue was generated

from ten collaborations compared to seven collaborations in the

same period a year ago.

Cost of

Revenue: Cost of research and development revenue

for the three months ended March 31, 2024, decreased to

approximately $144,000 compared to $727,000 for the same period a

year ago. The decrease in cost of research and development revenue

was due to the same reasons as for revenue described above.

R&D

Expenses: Research and development expenses for

the three months ended March 31, 2024, decreased by 35.5% to

approximately $523,000 compared to $811,000 for the same period a

year ago. The decrease reflected the winding down of activities

related to the Company’s Phase 1 clinical trial of DYAI-100

COVID-19 vaccine candidate and a decrease in the amount of ongoing

internal research projects.

G&A

Expenses: General and administrative expenses for

the three months ended March 31, 2024, increased by 20.9% to

approximately $1,789,000 compared to $1,480,000 for the same period

a year ago. The increase reflected increases in business

development and investor relations expenses of approximately

$138,000, audit fees of $99,000, management incentives of $59,000,

and other increases of $59,000, offset by decreases in insurance

expenses of $29,000 and legal expenses of $17,000.

Loss from Operations: Loss from

operations for the three months ended March 31, 2024, slightly

increased to $2,126,000, compared to $2,050,000 for the same period

a year ago.

Net Loss: Net loss for the

three months ended March 31, 2024, was $2,010,000 or $(0.07) per

share compared to $956,000 or $(0.03) per share for the same period

a year ago. The increase in net loss was derived from the sale of

the Company’s equity interest in Alphazyme LLC for $989,000 in

2023.

Conference Call

Information:Date: Tuesday, May 14, 2024Time: 5:00

p.m. Eastern TimeDial-in numbers: Toll Free 877-407-0784

International +1-201-689-8560Conference ID: 13743568Webcast link:

https://viavid.webcasts.com/starthere.jsp?ei=1650831&tp_key=0f89478e24

An archive of the webcast will be available within 24 hours

after completion of the live event and will be accessible on the

Investor Relations section of the Company’s website at

www.dyadic.com. To access the replay of the webcast, please follow

the webcast link above.

About Dyadic International,

Inc.

Dyadic International, Inc. is a biotechnology company focused on

the efficient large-scale manufacture of proteins for use in human

and animal vaccines and therapeutics, as well as non-pharmaceutical

applications including food, nutrition, and wellness.

Dyadic’s gene expression and protein production

platforms are based on the highly productive and scalable fungus

Thermothelomyces heterothallica (formerly Myceliophthora

thermophila). Our lead technology, C1-cell protein production

platform, is based on an industrially proven microorganism (named

C1), which is currently used to speed development, lower production

costs, and improve performance of biologic vaccines and drugs at

flexible commercial scales for the human and animal health markets.

Dyadic has also developed the Dapibus™ filamentous fungal based

microbial protein production platform to enable the rapid

development and large-scale manufacture of low-cost proteins,

metabolites, and other biologic products for use in

non-pharmaceutical applications, such as food, nutrition, and

wellness.

With a passion to enable our partners and

collaborators to develop effective preventative and therapeutic

treatments in both developed and emerging countries, Dyadic is

building an active pipeline by advancing its proprietary microbial

platform technologies, including our lead asset DYAI-100 COVID-19

vaccine candidate, as well as other biologic vaccines, antibodies,

and other biological products.

To learn more about Dyadic and our commitment to

helping bring vaccines and other biologic products to market

faster, in greater volumes and at lower cost, please visit

http://www.dyadic.com.

Safe Harbor

Regarding Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

and Section 21E of the Exchange Act, including those regarding

Dyadic International’s expectations, intentions, strategies, and

beliefs pertaining to future events or future financial

performance, such as the success of our clinical trial and interest

in our protein production platforms, our research projects and

third-party collaborations, as well as the availability of

necessary funding. Forward-looking statements generally can be

identified by use of the words “expect,” “should,” “intend,”

“anticipate,” “will,” “project,” “may,” “might,” “potential,” or

“continue” and other similar terms or variations of them or similar

terminology. Forward-looking statements involve many risks,

uncertainties or other factors beyond Dyadic’s control. These

factors include, but are not limited to, the following: (i) our

history of net losses; (ii) market and regulatory acceptance of our

microbial protein production platforms and other technologies;

(iii) competition, including from alternative technologies; (iv)

the results of nonclinical studies and clinical trials; (v) our

capital needs; (vi) changes in global economic and financial

conditions; (vii) our reliance on information technology; (viii)

our dependence on third parties; (ix) government regulations and

environmental, social and governance issues; and (x) intellectual

property risks. For a more complete description of the risks that

could cause our actual results to differ from our current

expectations, please see the section entitled “Risk Factors” in

Dyadic’s annual reports on Form 10-K and quarterly reports on Form

10-Q filed with the SEC, as such factors may be updated from time

to time in Dyadic’s periodic filings with the SEC, which are

accessible on the SEC’s website and at www.dyadic.com. All

forward-looking statements speak only as of the date made, and

except as required by applicable law, Dyadic assumes no obligation

to publicly update any such forward-looking statements for any

reason after the date of this press release to conform these

statements to actual results or to changes in our expectations.

Contact:Dyadic International, Inc.Ping W.

Rawson, Chief Financial OfficerPhone: 561-743-8333 Email:

ir@dyadic.com

|

DYADIC INTERNATIONAL,

INC. AND

SUBSIDIARIESCONSOLIDATED

STATEMENTS OF

OPERATIONS |

| |

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

Research and development revenue |

$ |

334,617 |

|

|

$ |

933,934 |

|

|

License revenue |

|

— |

|

|

|

44,118 |

|

|

Total revenue |

|

334,617 |

|

|

|

978,052 |

|

|

|

|

|

|

|

|

|

|

|

Costs and

expenses: |

|

|

|

|

|

|

|

|

Costs of research and development revenue |

|

143,955 |

|

|

|

726,918 |

|

|

Research and development |

|

522,723 |

|

|

|

810,566 |

|

|

General and administrative |

|

1,788,594 |

|

|

|

1,480,040 |

|

|

Foreign currency exchange loss |

|

4,903 |

|

|

|

11,022 |

|

|

Total costs and

expenses |

|

2,460,175 |

|

|

|

3,028,546 |

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(2,125,558 |

) |

|

|

(2,050,494 |

) |

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

Interest income |

|

87,443 |

|

|

|

104,731 |

|

|

Gain on sale of Alphazyme |

|

60,977 |

|

|

|

989,319 |

|

|

Interest expense |

|

(21,639 |

) |

|

|

— |

|

|

Interest expense-related party |

|

(10,819 |

) |

|

|

— |

|

|

Total other

income (expense),

net |

|

115,962 |

|

|

|

1,094,050 |

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(2,009,596 |

) |

|

$ |

(956,444 |

) |

|

|

|

|

|

|

|

|

|

| Basic

and diluted net loss per common share |

$ |

(0.07 |

) |

|

$ |

(0.03 |

) |

|

|

|

|

|

|

|

|

|

| Basic

and diluted weighted-average common shares outstanding |

|

28,828,282 |

|

|

|

28,761,469 |

|

|

|

|

|

|

|

|

|

|

See Notes to Consolidated Financial

Statements in Item 1 of Dyadic’s Quarterly Report on Form 10-Q

filed with the Securities and Exchange Commission on May 14,

2024.

|

DYADIC INTERNATIONAL,

INC. AND

SUBSIDIARIESCONSOLIDATED

BALANCE SHEETS |

| |

| |

March 31,

2024 |

|

December 31,

2023 |

| |

(Unaudited) |

|

(Audited) |

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

10,569,814 |

|

|

$ |

6,515,028 |

|

|

Short-term investment securities |

|

1,468,002 |

|

|

|

748,290 |

|

|

Interest receivable |

|

15,227 |

|

|

|

10,083 |

|

|

Accounts receivable |

|

246,138 |

|

|

|

466,159 |

|

|

Prepaid expenses and other current assets |

|

242,131 |

|

|

|

327,775 |

|

| Total current assets |

|

12,541,312 |

|

|

|

8,067,335 |

|

| |

|

|

|

|

| Non-current assets: |

|

|

|

|

|

Operating lease right-of-use asset, net |

|

129,519 |

|

|

|

141,439 |

|

|

Other assets |

|

10,435 |

|

|

|

10,462 |

|

| Total

assets |

$ |

12,681,266 |

|

|

$ |

8,219,236 |

|

| |

|

|

|

|

|

|

|

| Liabilities

and stockholders’

equity |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

661,243 |

|

|

$ |

656,445 |

|

|

Accrued expenses |

|

987,973 |

|

|

|

1,057,164 |

|

|

Deferred research and development obligations |

|

534,018 |

|

|

|

490,113 |

|

|

Operating lease liability, current portion |

|

49,551 |

|

|

|

48,059 |

|

|

Accrued interest |

|

19,556 |

|

|

|

— |

|

|

Accrued interest -related party |

|

9,778 |

|

|

|

— |

|

| Total current liabilities |

|

2,262,119 |

|

|

|

2,251,781 |

|

| |

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

Convertible notes, net of issuance costs |

|

3,884,967 |

|

|

|

— |

|

|

Convertible notes, net of issuance costs -related party |

|

1,942,484 |

|

|

|

— |

|

|

Operating lease liability, net of current portion |

|

75,894 |

|

|

|

88,870 |

|

| Total liabilities |

|

8,165,464 |

|

|

|

2,340,651 |

|

| |

|

|

|

|

|

|

|

| Commitments and contingencies

(Note 5) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock, $.0001 par value: |

|

|

|

|

|

|

|

|

Authorized shares - 5,000,000; none issued and outstanding |

|

— |

|

|

|

— |

|

|

Common stock, $.001 par value: |

|

|

|

|

|

|

|

|

Authorized shares - 100,000,000; issued shares - 41,440,316 and

41,064,563, outstanding shares - 29,186,814 and 28,811,061 as of

March 31, 2024, and December 31, 2023, respectively |

|

41,441 |

|

|

|

41,065 |

|

|

Additional paid-in capital |

|

105,691,193 |

|

|

|

105,044,756 |

|

|

Treasury stock, shares held at cost - 12,253,502 |

|

(18,929,915 |

) |

|

|

(18,929,915 |

) |

|

Accumulated deficit |

|

(82,286,917 |

) |

|

|

(80,277,321 |

) |

| Total stockholders’

equity |

|

4,515,802 |

|

|

|

5,878,585 |

|

| Total

liabilities and

stockholders’ equity |

$ |

12,681,266 |

|

|

$ |

8,219,236 |

|

| |

|

|

|

|

|

|

|

See Notes to Consolidated Financial

Statements in Item 1 of Dyadic’s Quarterly Report on Form 10-Q

filed with the Securities and Exchange Commission on May 14,

2024.

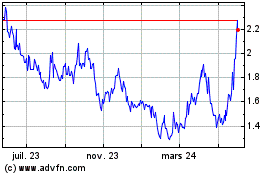

Dyadic (NASDAQ:DYAI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Dyadic (NASDAQ:DYAI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025