Current Report Filing (8-k)

25 Mai 2023 - 10:01PM

Edgar (US Regulatory)

false 0001746466 0001746466 2023-05-25 2023-05-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 25, 2023

Equillium, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-38692 |

|

82-1554746 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 2223 Avenida de la Playa |

|

|

| Suite 105 |

|

|

| La Jolla, California |

|

92037 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 858 412-5302

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.0001 per share |

|

EQ |

|

NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement.

On May 25, 2023, Equillium, Inc. (the “Company”), prepaid in full all amounts due and owing under, and terminated, the Loan and Security Agreement dated as of September 30, 2019 (as amended from time to time, the “Loan Agreement”) among Oxford Finance LLC, as collateral agent, the certain lenders, including Oxford Finance LLC and Silicon Valley Bank (the “Lenders”), the Company, and Bioniz Therapeutics, Inc. For a description of the Loan Agreement, refer to Note 10 to the Company’s audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended December 31, 2022. In connection with the repayment and termination of the Loan Agreement, the Company paid a total of approximately $6.8 million, which consisted of (i) the remaining principal amount and interest outstanding of approximately $6.2 million, (ii) a prepayment premium of approximately $62,000, (iii) a final payment fee of approximately $0.5 million, and (iv) the remainder for transaction expenses. There was no material relationship between the Company or its affiliates and the other parties to the Loan Agreement other than in respect of such agreement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUILLIUM, INC. |

|

|

|

|

| Date: May 25, 2023 |

|

|

|

By: |

|

/s/ Bruce D. Steel |

|

|

|

|

|

|

Bruce D. Steel |

|

|

|

|

|

|

President and Chief Executive Officer |

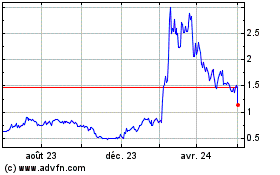

Equillium (NASDAQ:EQ)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Equillium (NASDAQ:EQ)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024