false

--09-30

0000038264

0000038264

2024-09-30

2024-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): September

30, 2024

Forward

Industries, Inc.

(Exact name of registrant as specified in its charter)

| New York |

|

001-34780 |

|

13-1950672 |

| (State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

700 Veterans Memorial

Hwy. Suite 100

Hauppauge, New York

11788

(Address of Principal Executive Office) (Zip Code)

(631)

547-3055

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

FORD |

The NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material

Definitive Agreement.

On September 30, 2024, Forward Industries, Inc.

(the “Company”) and Forward Industries (Asia-Pacific) Corporation (“FC”), a company owned by the Company’s

Chief Executive Officer and Chairman of the Board, entered into an Accounts Payables Conversion Agreement (the “Conversion Agreement”).

The Conversion Agreement is identical to the prior conversion agreement entered into by the Company and FC, as previously disclosed in

the Company’s Current Reports on Form 8-K filed with the Securities and Exchange Commission on July 3, 2024, and July 8, 2024, except

with respect to the amount converted. In accordance with the terms of the Conversion Agreement, FC converted $500,000 of the money the

Company owes to FC into shares of the Company’s Series A-1 Convertible Preferred Stock (“Series A-1”). Pursuant to the

Conversion Agreement, the $500,000 was converted into 500 shares of Series A-1. The Conversion Agreement was effective on September 30,

2024.

The foregoing description of the Conversion Agreement

does not purport to be complete and is qualified in its entirety by the complete text of the Conversion Agreement, a copy of which is

filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

To the extent required by Item 3.02, the information

contained in Item 1.01 and Item 5.03 is incorporated herein by reference. The transaction was exempt from registration pursuant to Section

4(a)(2) of the Securities Act of 1933 and Rule 506(b) of Regulation D promulgated thereunder.

Item 5.03. Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

Effective September 30, 2024, the Company filed

a Certificate of Amendment of the Certificate of Incorporation (the “Amendment”) increasing the number of authorized shares

of Series A-1 from 1,700 shares to 2,700 shares.

The foregoing description of the Amendment does

not purport to be complete and is qualified in its entirety by the complete text of the Amendment, a copy of which is filed as Exhibit

4.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FORWARD INDUSTRIES, INC. |

|

| |

|

|

|

| Date: October 4, 2024 |

By: |

/s/ Kathleen Weisberg |

|

| |

|

Name: Kathleen Weisberg |

|

| |

|

Title: Chief Financial Officer |

|

Exhibit 4.1

CERTIFICATE OF AMENDMENT OF THE CERTIFICATE OF

INCORPORATION OF FORWARD INDUSTRIES, INC.

UNDER SECTION 805 OF THE BUSINESS CORPORATION LAW

The undersigned, being the Chief

Financial Officer of Forward Industries, Inc. (the “Corporation”), a corporation organized and existing under Business

Corporation Law of the State of New York (the “NYBCL”), hereby certifies as follows, pursuant to Sections 502 and 805

of the NYBCL:

(1)The

name of the Corporation is Forward Industries, Inc. The name under which the Corporation was formed was Progress Heat Sealing Co., Inc.

(2)The

Certificate of Incorporation of the Corporation (the “COI”) was originally filed on March 6, 1961.

(3)This

Certificate of Amendment (“COD”) to the COI was authorized by the vote of the Board of Directors of the Corporation

(“Board”) pursuant to Section 502 of the NYBCL.

(4)The

Corporation is authorized to issue a total of 1,700 shares of Preferred Stock designated as Series A-1 Convertible Preferred Stock, with

a par value of $0.01 per share (“Series A-1”). Immediately prior to the filing of this COD (the “Effective

Time”), there are 1,700 shares of Series A-1 authorized, and 1,700 shares of Series A-1 issued and outstanding.

(5) The

amendment of the Corporation’s COI effected by this COD is to increase the number of authorized shares of Series A-1 by 1,000 shares,

from 1,700 to 2,700, as authorized by Section 502(c) of the NYBCL. Except as otherwise set forth in the preceding sentence, the designations,

rights, preferences, and limitations of the Series A-1 are unchanged, including its par value.

(6)Immediately

after the Effective Time, there will be 2,700 shares of Series A-1 authorized with 1,700 shares issued and outstanding.

(7) Article

FIFTH is hereby amended and restated in its entirety as follows:

The Corporation’s Board

has designated 2,700 shares of Preferred Stock as Series A-1 Convertible Preferred Stock, which shall have the following designations,

rights, preferences and limitations:

Series A-1 Convertible Preferred Stock

1.

Designation. The Corporation designates a series of preferred stock, consisting of 2,700 shares, with a stated value

of $1,000 per share (the “Stated Value”) (as adjusted for any stock splits, stock dividends, recapitalizations, or

similar transaction with respect to such stock), as Series A-1 Convertible Preferred Stock (the “Series A-1”) which

shall have the designations, rights, preferences and limitations described in this Article FIFTH. The Series A-1 will rank, with respect

to the distribution of assets upon the Corporation’s liquidation, dissolution or winding up, (1) senior to all classes or series

of the Corporation’s Common Stock (the “Common Stock”) and to all other equity securities issued by the Corporation

other than equity securities referred to in clauses (2) and (3) of this Section 1 (“Junior Stock”); (2)

on a parity with all equity securities issued by the Corporation with terms specifically providing that those equity securities rank on

a parity with the Series A-1 Convertible Preferred Stock with respect to the distribution of assets upon the Corporation’s liquidation,

dissolution or winding up (“Parity Stock”); (3) junior to all equity securities issued by the Corporation with terms

specifically providing that those equity securities rank senior to the Series A-1 with respect to the distribution of assets upon the

Corporation’s liquidation, dissolution or winding up (“Senior Stock”); and (4) junior to all of the Corporation’s

existing and future indebtedness.

2.

Redemption. The shares of Series A-1 are not redeemable.

3.

Voting Rights. The holders of shares of Series A-1 shall not have any voting rights, except as set forth herein.

4.

Liquidation. Upon the liquidation, dissolution or winding up of the business of the Corporation, whether voluntary

or involuntary, before any distribution or payment shall be made to the holders of any Common Stock or any other class or series of Junior

Stock, each holder of Series A-1 shall be entitled to receive out of assets of the Corporation legally available therefor: (i) an amount

per share equal to the Stated Value of cash and/or other property received by the Corporation pursuant to such liquidation, dissolution

or winding up, and (ii) the same amount that a holder of the Corporation’s Common Stock would receive on an as-converted basis (without

regard to the Conversion Restrictions or any other conversion limitations hereunder). Any distribution in connection with the liquidation,

dissolution or winding up of the Corporation, or any bankruptcy or insolvency proceeding, shall be made in cash to the extent possible.

5.

Remedies, Characterizations. Other Obligations, Breaches and Injunctive Relief. The remedies provided for hereunder,

shall be cumulative and in addition to all other remedies available under this COD, at law or in equity (including a decree of specific

performance and/or other injunctive relief), no remedy contained herein shall be deemed a waiver of compliance with the provisions giving

rise to such remedy, and nothing herein shall limit a holder’s right to pursue actual damages for any failure by the Corporation

to comply with the terms of this COD.

6.

Conversion.

(a)

Subject to the Conversion Restrictions, the Series A-1 shall be convertible at the option of the holder into that number

of shares of Common Stock as is determined by (i) multiplying the number of shares of Series A-1 to be converted by the Stated Value thereof,

(ii) adding to the result all accrued and accumulated and unpaid dividends on such shares of Series A-1 to be converted, and then (ii)

dividing the result by the Conversion Price in effect immediately prior to such conversion.[1]

The “Conversion Price” applicable to the Series A-1 shall initially be equal to $7.50. Such initial Conversion Price,

and the rate at which shares of Series A-1 may be converted into shares of Common Stock, shall be subject to adjustment as provided in

Section 7.

(b)

Notwithstanding the foregoing or anything else in this COD to the contrary, unless and until the Stockholder Approval (to

the extent required under the listing rules of NASDAQ) is obtained, (i) the holders shall not have the right to acquire shares of Common

Stock, and the Corporation shall not be required to issue shares of Common Stock, in excess of the Share Cap and (ii) no Holder shall

have the right to acquire shares of Common Stock, and the Corporation shall not be required to issue shares of Common Stock to such holder,

in excess of such holder’s Individual Holder Share Cap (collectively, the “Conversion Restrictions”), and in

each case, the Corporation shall obtain Stockholder Approval of such issuances.

7.

Stock Dividends, Stock Splits and Combinations. If the Corporation, at any time while any Series A-1 shares are outstanding:

(i) pays a stock dividend or otherwise makes a distribution or distributions payable in shares of Common Stock on shares of Common Stock

or any Common Stock Equivalents, (ii) subdivides outstanding shares of Common Stock into a larger number of shares, (iii) combines (including

by way of a reverse stock split) outstanding shares of Common Stock into a smaller number of shares, or (iv) issues, in the event of a

reclassification of shares of the Common Stock, any shares of capital stock of the Corporation, then the Conversion Price shall be adjusted

proportionately. Any adjustment made pursuant to this Section 7 shall become effective immediately after the record date for the

determination of shareholders entitled to receive such dividend or distribution and shall become effective immediately after the effective

date in the case of a subdivision, combination or re-classification.

8.

Acquired Series A-1. Any shares of Series A-1 that are converted or otherwise acquired by the Corporation or any

of its subsidiaries shall be automatically and immediately cancelled and retired and shall not be reissued, sold or transferred. Neither

the Corporation nor any of its subsidiaries may exercise any voting or other rights granted to the Holders of Series A-1 following conversion

or acquisition.

9.

Noncircumvention. The Corporation hereby covenants and agrees that the Corporation will not, by amendment of its

COI including by the filing of any COD (however such document is named), bylaws or through any reorganization, transfer of assets, consolidation,

merger, scheme of arrangement, dissolution, issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance

or performance of any of the terms of this COD, and will at all times in good faith carry out all the provisions of this COD and take

all action as may be required to protect the rights of the Holders.

__________________________

1

Product of $1,000 Stated Value Multiplied 1,700 shares divided by $7.50 = 226,667 shares of common stock

10.

Vote to Change the Terms of or Issue Preferred Shares. In addition to any other rights provided by law, without first

obtaining the written consent of at least a majority of the outstanding Series A-1, the Corporation shall not: (a) amend or repeal any

provision of, or add any provision to, its COI or bylaws, or file any Certificate of Amendment (however such document is named) to create

a Senior Stock, Parity Stock or any class or any series of preferred stock, if such action would adversely alter or change in any respect

the preferences, rights, privileges or powers, or restrictions provided for the benefit, of the Series A-1; or (b) increase or decrease

(other than by conversion) the authorized number of Series A-1.

11.

Amendment. Except for the Conversion Restrictions of this COD, or as otherwise required by law, this COD may be amended

by the written consent or affirmative vote of at least a majority of the outstanding Series A-1.

12.

Waiver. Except for the Conversion Restrictions set forth in Section 7 of this COD and as otherwise set forth

in Section 11 of this COD, any of the rights, powers, preferences, privileges, restrictions, qualifications, limitations and other

terms of the Series A-1 set forth herein may be waived on behalf of all Holders of Series A-1 by the written consent or affirmative vote

of at least a majority of the outstanding Series A-1.

13.

Specific Shall Not Limit General. No specific provision contained in this COD shall limit or modify any more general

provision contained herein.

14.

Definitions. As used herein with respect to Series A-1:

“Common Stock”

has the meaning set forth in Section 1.

“Common Stock Equivalents”

means any securities of the Company or its subsidiaries which would entitle the holder thereof to acquire at any time Common Stock, including,

without limitation, any debt, preferred stock, right, option, warrant or other instrument that is at any time convertible into or exercisable

or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Conversion Price”

has the meaning set forth in Section 6(a).

“Conversion Restrictions”

has the meaning set forth in Section 6(b).

“Corporation”

means Forward Industries, Inc.

“Individual Holder Share

Cap” means, with respect to any individual Holder, the maximum number of shares of Common Stock that could be issued by the

Company to such Holder without triggering a change of control under NASDAQ Stock Market Rule 5635 (or its successor).

“Junior

Stock” has the meaning set forth in Section1.

“NASDAQ”

means the Nasdaq Stock Market, LLC.

“Parity Stock”

has the meaning set forth in Section 1.

“Senior

Stock” has the meaning set forth in Section 1.

“Series

A” means Series A-1 Preferred Stock.

“Share

Cap” means a number of shares of Common Stock equal to the product of (i) 0.199 and (ii) 1,101,070 (subject to adjustment in

the event of a stock split, stock dividend, combination or other proportionate adjustment).

“Stated

Value” has the meaning set forth in Section 1.

“Stockholder

Approval” means, to the extent required by the listing rules of NASDAQ Stock Market, the approval by the stockholders of the

Company to remove the Share Cap and/or the Individual Holder Share Cap, as applicable, in accordance with NASDAQ Stock Market Rule 5635

(or its successor)

IN WITNESS WHEREOF, the Corporation

has caused this Certificate of Amendment to be duly executed by its Chief Financial Officer as of September 30, 2024.

| |

FORWARD

INDUSTRIES, INC. |

| |

|

| |

|

| |

|

| |

By: |

/s/ Kathleen Weisberg |

| |

|

Name: Kathleen Weisberg

Title: Chief Financial

Officer |

Exhibit 10.1

ACCOUNT PAYABLES

CONVERSION AGREEMENT

This

Account Payables Conversion Agreement (the “Agreement”) is entered into effective as of September 30, 2024 (the “Effective

Date”) by and between FORWARD INDUSTRIES (ASIA-PACIFIC) CORPORATION, a British Virgin Islands registered corporation (the “Provider”)

and FORWARD INDUSTRIES, INC., a New York corporation (the “Company”), with reference to the following facts:

WHEREAS,

under that certain Buying Agency and Supply Agreement between the Company and the Provider (the “Supply Agreement”),

the Provider has performed services at the request of the Company and as of the date of this Agreement is due monies under the Supply

Agreement (the “Payables”), of which the Company and the Provider desire to convert $500,000 of the Payables into shares

of Series A-1 Preferred Stock (the “PS”).

NOW,

THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Provider and the Company

agree as follows:

1.

Conversion to PS. Effective as of the Effective Date, $500,000 of the Payables shall be converted into shares of the Company’s

PS at a price per share of $1,000 for an aggregate number of shares of 500. Upon execution of this Agreement, at the request of the Provider,

the Company shall issue a stock certificate evidencing the shares of PS to the Provider, and the Provider shall acknowledge the payment

of $500,000 of Payables through the issuance of the PS. A form of Certificate of Amendment to the Certificate of Incorporation is attached

as Exhibit A to this Agreement.

2.

The Provider Representations. The Company is issuing the PS to the Provider in reliance upon the following representations

made by the Provider:

(a)

The Provider acknowledges and agrees that the shares of PS are characterized as “restricted securities” under the Securities

Act of 1933 (the “Securities Act”) and that, under the Securities Act and applicable regulations thereunder, such securities

may not be resold, pledged or otherwise transferred without registration under the Securities Act or an exemption therefrom. The Provider

acknowledges and agrees that (i) the shares of PS are being offered in a transaction not involving any public offering in the United

States within the meaning of the Securities Act, and the shares of PS have not yet been registered under the Securities Act, and (ii) such

shares of PS may be offered, resold, pledged or otherwise transferred only in a transaction registered under the Securities Act, or meeting

the requirements of Rule 144, or in accordance with another exemption from the registration requirements of the Securities Act (and based

upon an opinion of counsel if the Company so requests) and in accordance with any applicable securities laws of any State of the United

States or any other applicable jurisdiction.

(b)

The Provider acknowledges and agrees that (i) the registrar or transfer agent for the shares of PS will not be required to

accept for registration of transfer any shares except upon presentation of evidence satisfactory to the Company that the restrictions

on transfer under the Securities Act have been complied with and (ii) any shares of PS in the form of definitive physical certificates

will bear a restrictive legend.

(c)

The Provider acknowledges and agrees that: (a) the shares of PS have not been registered under the Securities Act, or under

any state securities laws, and are being offered and sold in reliance upon federal and state exemptions for transactions not involving

any public offering; (b) the Provider is acquiring the shares of PS solely for its own account for investment purposes, and not with

a view to the distribution thereof in a transaction that would violate the Securities Act or the securities laws of any State of the United

States or any other applicable jurisdiction; (c) the Provider is a sophisticated purchaser with such knowledge and experience in

business and financial matters that it is capable of evaluating the merits and risks of purchasing the shares of PS; (d) the Provider

has had the opportunity to obtain from the Company such information as desired in order to evaluate the merits and the risks inherent

in holding the shares of PS; the Provider is able to bear the economic risk and lack of liquidity inherent in holding the shares

of PS; (f) the Provider is an “accredited investor” within the meaning of Rule 501(a) under the Securities Act; and (g) and

the Provider either has a pre-existing personal or business relationship with the Company or its officers, directors or controlling persons,

or by reason of the Provider’s business or financial experience, or the business or financial experience of their professional advisors

who are unaffiliated with and who are not compensated by the Company, directly or indirectly, have the capacity to protect their own interests

in connection with the purchase of the PS.

(d)

The Provider’s investment in the Company pursuant to this PS is consistent, in both nature and amount, with the Provider’s

overall investment program and financial condition.

(e)

The Provider is located in the United Kingdom.

(f)

The sole owner of the Provider is the Chairman of the Board of Directors and the Chief Executive Officer of the Company.

3.

Miscellaneous.

(a)

This Agreement shall be construed and enforced in accordance with the laws of the State of New York.

(b)

This Agreement constitutes the entire agreement between the parties and supersedes all prior oral or written negotiations and agreements

between the parties with respect to the subject matter hereof. No modification, variation or amendment of this Agreement (including any

exhibit hereto) shall be effective unless made in writing and signed by both parties.

(c)

Each party to this Agreement hereby represents and warrants to the other party that it has had an opportunity to seek the advice

of its own independent legal counsel with respect to the provisions of this Agreement and that its decision to execute this Agreement

is not based on any reliance upon the advice of any other party or its legal counsel. Each party represents and warrants to the other

party that in executing this Agreement such party has completely read this Agreement and that such party understands the terms of this

Agreement and its significance. This Agreement shall be construed neutrally, without regard to the party responsible for its preparation.

(d)

Each party to this Agreement hereby represents and warrants to the other party that (i) the execution, performance and delivery

of this Agreement has been authorized by all necessary action by such party; (ii) the representative executing this Agreement on

behalf of such party has been granted all necessary power and authority to act on behalf of such party with respect to the execution,

performance and delivery of this Agreement; and (iii) the representative executing this Agreement on behalf of such party is of legal

age and capacity to enter into agreements which are fully binding and enforceable against such party.

(e)

This Agreement may be executed in any number of counterparts and may be delivered by e-mail facsimile transmission, all of which

taken together shall constitute a single instrument.

Signature

Page Follows

This

Agreement is entered into and effective as of the date first written above.

| COMPANY: |

|

PROVIDER: |

| |

|

|

|

|

| FORWARD INDUSTRIES, INC. |

|

FORWARD INDUSTRIES

(ASIA-PACIFIC) CORPORATION

|

| |

|

|

|

|

| |

|

|

|

|

| By: |

/s/ Kathleen Weisberg |

|

By: |

/s/ Terence Wise |

| |

Kathleen Weisberg, |

|

|

Terence Wise,

Principal |

| |

Chief Financial

Officer |

|

|

|

| |

|

|

|

|

Exhibit A

Certificate of Amendment to the Certificate

of Incorporation

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

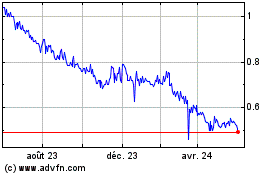

Forward Industries (NASDAQ:FORD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

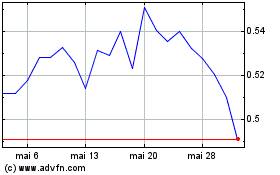

Forward Industries (NASDAQ:FORD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024