Fiesta Stockholders to Receive Significant,

Immediate and Certain Value of $8.50 per Share in Cash

Fiesta’s Pollo Tropical Restaurants to Join

Garnett Station’s Authentic Restaurant Brands Platform

Fiesta Restaurant Group, Inc. ("Fiesta" or the "Company")

(NASDAQ: FRGI), parent company of the Pollo Tropical® restaurant

brand, and Authentic Restaurant Brands (“ARB”), a portfolio company

of Garnett Station Partners, LLC (“Garnett Station” or “GSP”), a

New York-based principal investment firm, today announced that they

have entered into a definitive agreement under which a wholly owned

subsidiary of ARB will acquire the Company in an all cash

transaction.

ARB is a holding company with a portfolio of powerhouse, iconic

regional food and beverage brands, with extraordinary customer

brand loyalty and rich, authentic stories. Current brands include

Primanti Bros Restaurant & Bar, P.J. Whelihan’s Pub &

Restaurant and Mambo Seafood. ARB is led by industry veterans

including Chairman Alex Macedo and CEO Felipe Athayde. Upon closing

the transaction, Fiesta will operate as a privately held company

and Pollo Tropical will remain based in Miami, FL. Fiesta’s

leadership team will continue to operate Pollo Tropical as an

independent brand within the ARB platform.

Under the terms of the definitive merger agreement, which has

been unanimously approved by Fiesta’s Board of Directors, Fiesta

common stockholders will receive cash consideration of $8.50 per

share.

“Our Board formed a Special Committee comprising independent

directors that worked with outside advisors and conducted a

comprehensive review of a wide range of strategic alternatives to

maximize shareholder value,” said Stacey Rauch, Fiesta’s Chair of

the Board of Directors. “The Special Committee and, ultimately, the

full Fiesta Board of Directors, determined that this transaction

delivers significant, immediate and certain value to Fiesta

stockholders while providing Pollo Tropical the scale, resources

and flexibility for continued success as part of a private

company.”

Dirk Montgomery, Fiesta Restaurant Group President and Chief

Executive Officer, said, “The transaction validates the actions we

have taken to position Pollo Tropical in our markets, enhance the

guest experience and improve performance across our footprint. With

this transaction, Fiesta will be better positioned financially and

operationally to advance our mission of providing great food and

hospitality to our guests. Garnett Station has a proven track

record of successfully identifying and partnering with iconic,

regionally focused brands to help accelerate their growth. We look

forward to working closely with Alex, Felipe and the rest of the

Garnett Station and ARB teams and to benefiting from their

extensive restaurant, digital and analytical expertise as we focus

on supporting the success of our brand, franchisees and

people.”

“We have been fans of Fiesta and their Pollo Tropical

restaurants for some time,” said Alex Macedo, Chairman of Authentic

Restaurant Brands. “Pollo Tropical restaurants are a mainstay on

the dining scene throughout Florida, and we are confident that ARB

is a perfect partner to harness the power of the brand for the

future.”

“Fiesta and Pollo Tropical restaurants are a natural fit into

ARB’s existing portfolio,” said Matt Perelman, Managing Partner and

Co-Founder of Garnett Station Partners. “Pollo Tropical restaurants

have a storied heritage and a deep-rooted connection with their

local communities that perfectly align with ARB’s ethos and value

proposition. ARB looks forward to working with Dirk and Fiesta’s

leadership.”

Transaction Details

The transaction is expected to be completed in the fourth

quarter of 2023 and is subject to approval by Fiesta's

stockholders, expiration or termination of the applicable waiting

period under the Hart-Scott-Rodino Antitrust Improvements Act of

1976, as well as other customary closing conditions. The definitive

merger agreement also includes a 30-day “go shop” period that will

allow the Company to affirmatively solicit alternative proposals

from interested parties.

The transaction is not subject to a financing contingency and

affiliates of Jefferies Financial Group Inc. and AREX Capital

Management, LP and its affiliated investors, who together own or

control approximately 30% of the Company’s outstanding shares, have

each entered into a voting agreement pursuant to which they have

agreed, among other things, to vote their respective shares of

common stock of Fiesta in favor of the transaction.

In a separate press release, Fiesta announced its results for

the second quarter of 2023. The Company’s earnings press release

can be found on the Company’s investor relations website at

www.frgi.com/investor-relations. In connection with the

transaction, Fiesta will not host an earnings conference call.

Advisors

Jefferies LLC is acting as lead financial advisor and Gibson,

Dunn & Crutcher LLP is serving as legal counsel to Fiesta in

connection with the proposed transaction. Houlihan Lokey Capital,

Inc. is acting as financial advisor to the Special Committee of the

Fiesta Board of Directors. Guggenheim Securities is serving as lead

financial advisor and Kirkland & Ellis LLP is acting as legal

counsel to ARB and Garnett Station. William Blair & Company,

LLC also is serving as a financial advisor to the Board of

Directors of ARB.

About Fiesta Restaurant Group, Inc.

Fiesta Restaurant Group, Inc., owns, operates and franchises for

the Pollo Tropical restaurant brand. The brand specializes in the

operation of fast casual/quick service restaurants that offer

distinct and unique flavors with broad appeal at a compelling

value. The brands feature fresh-made cooking, drive-thru service,

and catering. For more information about Fiesta Restaurant Group,

Inc., visit www.frgi.com.

About Authentic Restaurant Brands

Authentic Restaurant Brands is a holding company of powerhouse,

regional food and beverage brands with extraordinary customer brand

loyalty and rich, authentic stories. Established in 2021, ARB is a

Garnett Station portfolio company currently comprised of three

market-leading, iconic brands each with over 25-year operating

histories including Primanti Bros Restaurant & Bar based in

Pennsylvania, West Virginia, Ohio, and Maryland, P.J. Whelihan's

Pub & Restaurant based in the Greater Delaware Valley including

Philadelphia and South Jersey and Mambo Seafood based in Houston,

Texas.

ARB is strongly committed to growing each of our brands by

leveraging their respective foundations, while sharing best

practices across our portfolio under our common ownership. For more

information, please visit www.authenticrb.com.

About Garnett Station Partners

Garnett Station Partners is a principal investment firm founded

in 2013 by Matt Perelman and Alex Sloane that manages over $2

billion of assets. Garnett Station partners with experienced and

entrepreneurial management teams and strategic investors to build

value for its portfolio of growth platforms. The firm draws on its

global relationships, operational experience and rigorous diligence

process to source, underwrite and manage investments. Core sectors

include consumer and business services, health & wellness,

automotive, and food & beverage. Garnett Station's culture is

based on the principles of entrepreneurship, collaboration,

analytical rigor and accountability. For more information, please

visit www.garnettstation.com.

Forward Looking Statements

Certain statements contained in this news release and in our

public disclosures, whether written, oral or otherwise made,

relating to future events or future performance, including any

discussion, express or implied, regarding anticipated Pollo

Tropical growth, plans, objectives and the impact of our

initiatives, and our investments in strategic initiatives for Pollo

Tropical, such as improved customer experience initiatives,

investments in our digital and related platforms and new unit

expansion, contain forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These

statements are often identified by the words "may," "might,"

"believes," "thinks," "anticipates," "plans," "positioned,"

"target," "continue," "expects," "look to," "intends" and other

similar expressions, whether in the negative or the affirmative,

that are not statements of historical fact. These forward-looking

statements are not guarantees of future performance and involve

certain risks, uncertainties, and assumptions that are difficult to

predict, and you should not place undue reliance on our

forward-looking statements. Our actual results and timing of

certain events could differ materially from those anticipated in

these forward-looking statements as a result of certain factors,

including, but not limited to, those discussed from time to time in

our reports filed with the Securities and Exchange Commission,

including our Annual Report on Form 10-K and our quarterly reports

on Form 10-Q. Additional factors that may cause actual results to

differ materially from any forward-looking statements regarding the

proposed transaction include, but are not limited to: occurrence of

any event, change or other circumstances that could give rise to

the termination of the merger agreement or the failure to satisfy

the closing conditions, the possibility that the consummation of

the proposed transaction is delayed or does not occur, including

the failure of Fiesta's stockholders to approve the proposed

transaction, uncertainty as to whether the parties will be able to

complete the proposed transaction on the terms set forth in the

merger agreement, uncertainty regarding the timing of the receipt

of required regulatory approvals for the proposed transaction and

the possibility that the parties may be required to accept

conditions that could reduce or eliminate the anticipated benefits

of the proposed transaction as a condition to obtaining regulatory

approvals or that the required regulatory approvals might not be

obtained at all, the outcome of any legal proceedings that have

been or may be instituted against the parties or others following

announcement of the transactions contemplated by the merger

agreement, challenges, disruptions and costs of integrating and

achieving anticipated synergies, or that such synergies will take

longer to realize than expected, risks that the proposed

transaction and other transactions contemplated by the merger

agreement disrupt current plans and operations that may harm

Fiesta's businesses, the amount of any costs, fees, expenses,

impairments and charges related to the proposed transaction, and

uncertainty as to the effects of the announcement or pendency of

the proposed transaction on the market price of Fiesta's common

stock and/or on its financial performance. All forward-looking

statements and the internal projections and beliefs upon which we

base our expectations included in this release are made only as of

the date of this release and may change. While we may elect to

update forward-looking statements at some point in the future, we

expressly disclaim any obligation to update any forward-looking

statements, whether as a result of new information, future events,

or otherwise.

Additional Information and Where to Find It

Fiesta intends to file with the Securities and Exchange

Commission (the “SEC”) a preliminary proxy statement and furnish or

file other materials with the SEC in connection with the proposed

transaction. Once the SEC completes its review of the preliminary

proxy statement, a definitive proxy statement will be filed with

the SEC and mailed to the stockholders of Fiesta. This

communication is not intended to be, and is not, a substitute for

the proxy statement or any other document that Fiesta may file with

the SEC in connection with the proposed transaction. BEFORE MAKING

ANY VOTING DECISION, FIESTA'S STOCKHOLDERS ARE URGED TO READ THE

PROXY STATEMENT AND THOSE OTHER MATERIALS CAREFULLY AND IN THEIR

ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED

TRANSACTION.

The proxy statement and other relevant materials (when they

become available), and any other documents filed by Fiesta with the

SEC, may be obtained free of charge at the SEC’s website at

www.sec.gov. In addition, security holders will be able to obtain

free copies of the proxy statement from Fiesta by going to Fiesta's

Investor Relations page on its corporate website at

www.frgi.com.

Participants in the Solicitation

This communication does not constitute a solicitation of proxy,

an offer to purchase or a solicitation of an offer to sell any

securities. Fiesta and its directors and executive officers may be

deemed to be participants in the solicitation of proxies from the

stockholders of Fiesta in connection with the proposed transaction.

Information regarding the interests of these directors and

executive officers in the transaction will be included in the proxy

statement described above. Additional information regarding the

directors and executive officers of Fiesta is included in Fiesta

proxy statement for its 2023 Annual Meeting, which was filed with

the SEC on March 30, 2023, and is supplemented by other public

filings made, and to be made, with the SEC by Fiesta. To the extent

the holdings of Fiesta securities by Fiesta’s directors and

executive officers have changed since the amounts set forth in the

proxy statement for its 2023 Annual Meeting, such changes have been

or will be reflected on Statements of Change in Ownership on Form 4

filed with the SEC. These documents are available free of charge at

the SEC’s website at www.sec.gov and at the Investor Relations page

on Fiesta's corporate website at www.frgi.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230806471539/en/

Fiesta Restaurant Group

Raphael Gross 203-682-8253 investors@frgi.com

Joele Frank, Wilkinson Brimmer Katcher Matthew Sherman / Aaron

Palash / Nick Jannuzzi 212-355-4449

Authentic Restaurant Brands and Garnett

Station Partners

Gagnier Communications Dan Gagnier / Lindsay Barber

GSP@gagnierfc.com

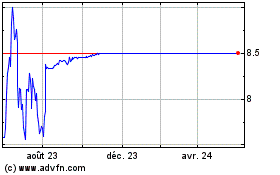

Fiesta Restaurant (NASDAQ:FRGI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

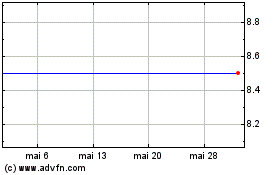

Fiesta Restaurant (NASDAQ:FRGI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025