As

filed with the Securities and Exchange Commission on February 7, 2025.

Registration No. 333-284032

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Amendment No. 2

TO

FORM S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

GT

BIOPHARMA, INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Delaware |

|

2834 |

|

94-1620407 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

315

Montgomery Street, 10th Floor

San

Francisco, CA 94104

(415)

919-4040

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Michael

Breen

Interim

Chief Executive Officer

315

Montgomery Street, 10th Floor

San

Francisco, CA 94104

(415)

919-4040

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies

to:

Roger

W. Bivans

Baker

& McKenzie LLP

1900

N. Pearl Street, Suite 1500

Dallas,

TX 75201, USA

(214)

978 3000 |

|

Charles

Phillips

Ellenoff

Grossman & Schole LLP

1345

Avenue of Americas

New

York, NY

(212)

370 1300 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

Accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant files a further amendment which specifically states that this registration statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on

such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell

these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION DATED February 7, 2025

PRELIMINARY

PROSPECTUS

Up

to 3,361,344 Shares of Common Stock

Up

to 3,361,344 Pre-Funded Warrants to Purchase

up to 3,361,344 Shares of Common Stock

Up

to 3,361,344 Common Warrants to Purchase

up to 3,361,344 Shares of Common Stock

Up

to 201,680 Placement Agent Warrants to Purchase

up to 201,680 Shares of Common Stock

Up

to 6,924,368 Shares of Common Stock underlying up to 3,361,344 Pre-Funded Warrants,

up

to 3,361,344 Common Warrants and up to

201,680 Placement Agent Warrants

This is a reasonable best

efforts public offering of up to 3,361,344 shares (the “shares”) of our common stock, par value $0.001 per share

(“common stock”) together with up to 3,361,344 common warrants to purchase up to 3,361,344 shares of

common stock at an assumed combined public offering price of $2.38 per share and common warrant (the last reported sale price

per share of our common stock on the Nasdaq Capital Market, on January 23, 2025). Each share of common stock is being offered

together with one common warrant to purchase one share of common stock. The shares of common stock and common warrants will be

separately issued. Each common warrant will be immediately exercisable upon issuance with an exercise price of

$ per share (100% of the combined public offering price of each share of

common stock and accompanying common warrant in this offering) and will expire five years after the issuance date. This

prospectus also covers the shares of common stock issuable from time to time upon the exercise of the common warrants. See

“Description of Securities we are Offering – Common Warrants.”

We

are also offering pre-funded warrants to those purchasers, whose purchase of shares of common stock in this offering would result in

the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of

the purchaser, 9.99%) of our outstanding common stock following the consummation of this offering in lieu of the shares of our common

stock that would result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%). Each pre-funded warrant will be

exercisable for one share of common stock at an exercise price of $0.0001 per share. Each pre-funded warrant is being offered together

with the same common warrant to purchase one share of common stock described above that is being offered with each share of common stock.

The purchase price of each pre-funded warrant will equal the combined public offering price per share of common stock and common warrants

being sold in this offering, less the $0.0001 per share exercise price of each such pre-funded warrant. Each pre-funded warrant will

be exercisable upon issuance and will expire when exercised in full. The pre-funded warrants and common warrants will be separately issued.

For each pre-funded warrant that we sell, the number of shares of common stock that we are selling will be decreased on a one-for-one

basis. This prospectus also covers the shares of common stock issuable from time to time upon the exercise of the pre-funded warrants.

See “Description of Securities we are Offering – Pre-Funded Warrants.”

We

have engaged Roth Capital Partners, LLC, or the placement agent, to act as our exclusive placement agent in connection with this offering.

The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus.

The placement agent is not purchasing or selling any of the securities we are offering and the placement agent is not required to arrange

the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay to the placement agent the placement

agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. There is no arrangement

for funds to be received in escrow, trust or similar arrangement. There is no minimum number of shares of securities or minimum aggregate

amount of proceeds that is a condition for this offering to close. We may sell fewer than all of the securities offered hereby, which

may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund if we do not

sell all of the securities offered hereby. Because there is no escrow account and no minimum number of securities or amount of proceeds,

investors could be in a position where they have invested in us, but we have not raised sufficient proceeds in this offering to adequately

fund the intended uses of the proceeds as described in this prospectus. We will bear all costs associated with the offering. See “Plan

of Distribution” on page 36 of this prospectus for more information regarding these arrangements. This offering will terminate

no later than February 28, 2025, unless we decide to terminate the offering (which we may do at any time in our discretion) prior

to that date. The securities will be offered at a fixed price and are expected to be issued in a single closing. Investors purchasing

securities offered hereby will have the option to execute a securities purchase agreement with us. We expect that the closing of the

offering will occur one trading day after we price the securities offered hereby. When we price the securities, we will simultaneously

enter into securities purchase agreements relating to the offering with those investors who so choose. The offering will settle delivery

versus payment (“DVP”)/receipt versus payment (“RVP”). That is, on the closing date, we will issue the shares

of common stock directly to the account(s) at the placement agent identified by each purchaser; upon receipt of such shares, the placement

agent shall promptly electronically deliver such shares to the applicable purchaser, and payment therefor shall be made by the placement

agent (or its clearing firm) by wire transfer to us.

Our

common stock is listed on the Nasdaq Capital Market under the symbol “GTBP.” On January 23, 2025, the last reported

sale price of our common stock on the Nasdaq Capital Market was $2.38 per share. All share, common warrant and pre-funded warrant

numbers are based on an assumed combined public offering price of $2.38 per share or pre-funded warrant, as applicable, and common

warrants. The actual combined public offering price per share and common warrants and the actual combined public offering price per common

warrants and pre-funded warrants will be determined between us and investors based on market conditions at the time of pricing, and may

be at a discount to the current market price of our common stock. Therefore, the assumed public offering price used throughout this prospectus

may not be indicative of the final public offering price.

You

should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information

By Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing

in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 9

of this prospectus and in the documents incorporated by reference into this prospectus for a discussion of risks that should be considered

in connection with an investment in our securities.

| | |

| Per

Share and Common Warrant | | |

| Per Pre-Funded Warrant and

Common

Warrant | | |

| Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Placement Agent fees(1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds to us, before expenses(2) | |

$ | | | |

$ | | | |

$ | | |

|

(1) Includes a cash fee up to 6% of the gross proceeds raised in this offering; provided, however,

the cash fee shall equal 3% of the gross proceeds raised in this offering for securities purchased by certain excluded investors, to

be paid to the placement agent. We have also agreed to reimburse the placement agent for certain of its offering-related expenses in

an aggregate amount up to $100,000. In addition, we have agreed to issue the placement agent or its designees warrants to purchase

up to 201,680 shares of common stock (equal to 6% of the aggregate number of shares of common stock and pre-funded warrants

sold in this offering, subject to a partial adjustment in the event certain investors participate) at an exercise price of $

per share, which represents 125% of the public offering price per share of common stock and common warrants. We refer to these warrants

in this prospectus as the “placement agent warrants.” See “Plan of Distribution” for a complete description

of the compensation to be received by the placement agent. |

| |

|

| |

(2) Because there is no minimum number of securities or amount of proceeds required as a condition

to closing in this offering, the actual public offering amount, placement agent fees, and proceeds to us, if any, are not presently

determinable and may be substantially less than the total maximum offering amounts set forth above. We estimate the total expenses

of this offering payable by us, excluding the placement agent fee, will be approximately $390,531. |

The

delivery of the shares of common stock any pre-funded warrants and common warrants to purchasers is expected to be made no later

than , 2025, subject to the satisfaction of customary closing conditions.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Roth

Capital Partners

The

date of this prospectus is , 2025.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus

as well as additional information described under “Incorporation of Certain Information by Reference,” before deciding

to invest in our securities.

We

have not, and the placement agent has not, authorized anyone to provide any information or to make any representations other than those

contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We

take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This

prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful

to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless

of its time of delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may have

changed since that date.

The

information incorporated by reference or provided in this prospectus contains statistical data and estimates, including those relating

to market size and competitive position of the markets in which we participate, that we obtained from our own internal estimates and

research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications,

studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal

company research is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions

have been verified by any independent source.

For

investors outside the United States: We have not, and the placement agent has not, done anything that would permit this offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons

outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the offering of the securities and the distribution of this prospectus outside the United States.

This

prospectus and the information incorporated by reference into this prospectus contain references to our trademarks and to trademarks

belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus and the information incorporated

by reference into this prospectus, including logos, artwork, and other visual displays, may appear without the ® or TM symbols, but

such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights

or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’

trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some

of the statements in this prospectus are “forward-looking statements” within the meaning of the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements regarding our current

beliefs, goals and expectations about matters such as our expected financial performance and condition, operating results, our business

strategy and our financing plans. The forward-looking statements in this prospectus are not based on historical facts, but rather reflect

the current expectations of our management concerning future results and events. The forward-looking statements generally can be identified

by the use of terms such as “believe,” “expect,” “anticipate,” “intend,” “plan,”

“foresee,” “may,” “guidance,” “estimate,” “potential,” “outlook,”

“target,” “forecast,” “likely” or other similar words or phrases. Similarly, statements that describe

our objectives, plans or goals are, or may be, forward-looking statements.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements

to be different from any future results, performance and achievements expressed or implied by these statements. We cannot guarantee that

our forward-looking statements will turn out to be correct or that our beliefs and goals will not change. Our actual results could be

very different from and worse than our expectations for various reasons. The risk factors and cautionary language discussed in this prospectus

provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described

by us in such forward-looking statements, including among other things:

| |

● |

our

ability to develop and advance our current product candidates and programs into, and successfully complete, clinical trials; |

| |

|

|

| |

● |

our financial condition raises substantial doubt as

to our ability to continue as a going concern; |

| |

|

|

| |

● |

our

financial performance and our ability to effectively manage our anticipated growth; |

| |

|

|

| |

● |

the

period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses and

capital expenditure requirements; |

| |

|

|

| |

● |

the

impact of laws and regulations; |

| |

|

|

| |

● |

general

economic conditions; |

| |

|

|

| |

● |

the

effects of the coronavirus and other communicable diseases on the continued or resumed disruption of supply chains, the global economy,

on the global financial markets and on our business; |

| |

|

|

| |

● |

the

timing, scope and likelihood of regulatory filings and approvals; |

| |

|

|

| |

● |

our

continued reliance on third parties to conduct additional clinical trials of our product candidates; |

| |

|

|

| |

● |

our

manufacturing, commercialization, and marketing capabilities and strategy; |

| |

|

|

| |

● |

our

intellectual property position, including the scope of protection we are able to establish and maintain for intellectual property

rights covering product candidates we may develop, including the validity of intellectual property rights held by third parties,

and our ability not to infringe, misappropriate or otherwise violate any third-party intellectual property rights; |

| |

|

|

| |

● |

the

rate and degree of market acceptance and clinical utility of our product candidates we may develop; |

| |

● |

our

ability to hire additional qualified personnel and attract and retain key employees; and |

| |

|

|

| |

● |

the

result of any future financing efforts; and |

| |

|

|

| |

● |

our

failure to maintain compliance with the Nasdaq Capital Market’s (“Nasdaq”) continued listing requirements could

result in the delisting of our common stock. |

These

risks, among others, could cause actual results to differ materially from those implied by the forward-looking statements contained in

this prospectus. You should review carefully all information, including the discussion under “Risk Factors” in this

prospectus and in the documents incorporated by reference herein. Any forward-looking statements in this prospectus are made only as

of the date hereof and, except as may be required by law, we do not have any obligation to publicly update any forward-looking statements

contained in this prospectus to reflect subsequent events or circumstances.

You

should read this prospectus with the understanding that our actual future results may be materially different from what we expect. We

do not assume any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise,

except as required by applicable law.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you

should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including the “Risk

Factors” section in this prospectus and under similar captions in the documents incorporated by reference into this prospectus.

In this prospectus, unless otherwise stated or the context otherwise requires, references to the terms “GTBP,” “the

Company,” “we,” “us” and “our” refer to GT Biopharma, Inc., together with its subsidiaries,

unless the context otherwise requires. This prospectus and the information incorporated herein by reference include trademarks, service

marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference

into this prospectus and the information incorporated herein by reference are the property of their respective owners.

Overview

We

are a clinical stage biopharmaceutical company focused on the development and commercialization of novel immuno-oncology products based

on our proprietary Tri-specific Killer Engager (TriKE®), and Tetra-specific Killer Engager (Dual Targeting TriKE®)

fusion protein immune cell engager technology platforms. Our TriKE® and Dual Targeting TriKE® platforms generate proprietary

therapeutics designed to harness and enhance the cancer killing abilities of a patient’s own natural killer cells, or NK cells.

Once bound to an NK cell, our moieties are designed to activate the NK cell to direct it to one or more specifically targeted proteins

expressed on a specific type of cancer cell or virus infected cell, resulting in the targeted cell’s death. TriKE®s

can be designed to target any number of tumor antigens, including B7-H3, HER2, CD33 and PDL1, on hematologic malignancies or solid

tumors and do not require patient-specific customization. We believe our TriKE® and Dual Targeting TriKE® platforms that activate

endogenous NK cells are potentially safer than T-cell immunotherapy because there is less cytokine release syndrome (CRS) and fewer neurological

complications. Our preclinical data suggests that this is explained by the TriKE® dependent CD16 directed IL-15 proliferation of

NK cells but little effect endogenous T cells.

We

are using our TriKE® platform with the intent to bring to market immuno-oncology products that can treat a range of hematologic

malignancies, solid tumors, and potentially autoimmune disorders. The platform is scalable, and we are implementing processes to produce

investigational new drug (IND) ready moieties in a timely manner after a specific TriKE® conceptual design. Specific drug

candidates can then be advanced into the clinic on our own or through potential collaborations with partnering companies. We believe

our TriKE®s may have the ability, if approved for marketing, to be used as both monotherapy and in combination with other standard-of-care

therapies.

Our

initial work was conducted in collaboration with the Masonic Cancer Center at the University of Minnesota under a program led by Dr.

Jeffrey Miller, Professor of Medicine, and the Deputy Director at the Center. Dr. Miller is a recognized key opinion leader in the field

of NK cell and IL-15 biology and their therapeutic potential. We have exclusive rights to the TriKE® platform and are

generating additional intellectual property for specific moieties.

Product

Pipeline

Our

current product candidate pipeline is summarized in the table below

GTB-3550

GTB-3550

was our first TriKE® product candidate and its clinical development was suspended so that we could focus resources on second-generation

TriKEs®. GTB-3550 is a tri-specific killer engager (TriKE) comprised of two single-chain variable fragments

(“scFv”) composed of the variable regions of the heavy and light chains of anti-CD16

and anti-CD33 antibodies and a modified form of IL-15. We studied this anti-CD16-IL-15-anti-CD33 TriKE® in CD33 positive leukemias,

a marker expressed on tumor cells in acute myelogenous leukemia, or AML, and myelodysplastic syndrome, or MDS. The anti-CD33 antibody

fragment in GTB-3550 was derived from the M195 humanized anti-CD33 scFv We believe the approval of the antibody-drug conjugate gemtuzumab

validates the targeting of CD33.

We

previously announced the interim clinical trial results for GTB-3550, which showed significantly reduced CD 33+ bone marrow blast levels

by 33.3%, 61.7%, 63.6%, 50% in Patient 5 (25 µg/kg/day), Patient 7 (50 µg/kg/day), Patient 9 (100 µg/kg/day), and Patient

11 (150 µg/kg/day), respectively. After the end of infusion, GTB-3550 and IL-15 concentrations declined rapidly with overall geometric

mean terminal phase elimination half-life (T1/2) of 2.2 and 2.52 hours, respectively. There was minimal CRS resulting from hyperactivation

of patient’s T-cell population at doses 5–150 µg/kg/day.

Despite

the positive interim clinical trial results, GTB-3550

was replaced by a more potent next-generation camelid nanobody TriKE®, GTB-3650, that similarly targets CD33 on relapsed/refractory

AML and high-risk MDS. A key difference between GTB-3550 and GTB-3650 is the incorporation of camelid antibody technology instead of

a scFv; our preclinical experience showed markedly enhanced potency of TriKEs® comprised of camelid components. This is illustrated

below by better tumor control of AML bearing animals with GTB-3650 (purple dots) compared to GTB-3550 (blue dots). This provided the

rationale for pausing further development of GTB-3550 and moving over to solely develop the second-generation, camelid-based TriKE®

platform.

Second

Generation TriKE®s Utilize Camelid Nanobody Technology

Our

goal is to be a leader in immuno-oncology therapies targeting a broad range of indications including hematological malignancies and solid

tumors. A key element of our strategy includes introducing a next-generation camelid nanobody platform. Camelid antibodies (often referred

as nanobodies) are smaller than human immunoglobulin, consisting of two heavy chains instead of two heavy and two light chains. These

nanobodies have the potential to have greater affinity to target antigens, potentially resulting in greater potency. We are utilizing

this camelid antibody structure for all of our new TriKE® product candidates.

To

develop second generation TriKE®s, we designed a new humanized CD16 engager derived from a single-domain antibody. While scFvs consist

of a heavy and a light variable chain joined by a linker, single-domain antibodies consist of a single variable heavy chain capable of

engaging without the need of a light chain counterpart (see figure below).

These

single-domain antibodies are thought to have certain attractive features for antibody engineering, including physical stability, ability

to bind deep grooves, and increased production yields, amongst others. Pre-clinical studies demonstrated increased NK cell activation

against CD33+ targets including enhanced NK cell degranulation (% CD107a+) and IFNγ with the single-domain CD16 TriKE®

(cam 16-wt15-33; GTB-3650) compared to the original TriKE® (scFv16-m 15-33; GTB-3550) (see figure below). This data was published

by Dr. Felices M et al (2020) in Cancer Immunol Res.

CD33+

HL60 Targets in Killing Assays

The

purple line represents the GTB-3650 and the blue line represents GTB-3550.

GTB-3650

GTB-3650

is a TriKE® which targets CD33 on the surface of myeloid leukemias and an agonistic camelid engager to the potent activating receptor

on NK cells, CD16. Use of this engager enhances the activity of wild type IL-15 included in GTB-3650. The TriKE® approach provides

a novel way to specifically target these tumors by leveraging NK cells, which have been shown to mediate relapse protection in this setting,

in an anti-CD33-targeted fashion. We are advancing GTB-3650 to clinical studies based on pre-clinical data showing a marked increase

in potency compared to GTB-3550, which we anticipate could lead to an enhanced efficacy signal in AML and MDS. We advanced GTB-3650 through

requisite preclinical studies and filed an Investigational New Drug (IND) application with the U.S. Food and Drug Administration (FDA)

in December 2023. In late June 2024, the FDA cleared our IND Application for GTB-3650. We started study enrollment targeting patients

with relapsed/refractory AML and high grade MDS on January 21, 2025. This initial study is testing GTB-3650 as monotherapy

testing administration 2 weeks on and two weeks off (to prevent NK cell exhaustion) for at least 2 cycles of therapy, as agreed

on with the FDA.

GTB-5550

GTB-5550

is a B7-H3 targeted TriKE® which targets B7-H3 on the surface of advanced solid tumors (figure above). GTB-5550 is our first

dual camelid TriKE®. B7-H3 is expressed on a broad spectrum of solid tumor malignancies, allowing our team to target these

malignancies through GTB-5550. Pre-clinical work has shown that this molecule has NK-cell targeted activity against a variety of

solid tumors, including head and neck cancer squamous cell carcinoma (figure below), prostate cancer, breast cancer, ovarian cancer,

glioblastoma, and lung cancer (amongst others). We are advancing GTB-5550 through preclinical studies and initiated a GMP

manufacturing campaign in anticipation of filing an IND in the first half of 2025. A pre-IND packet was submitted to the FDA in

October 2023 with a written response from the FDA in December 2023. The main question from the FDA was regarding pre-clinical

toxicology and a pivot to subcutaneous dosing. The initial trial expected in 2025 is designed as a basket trial for patients with

B7-H3+ solid tumors using Monday through Friday dosing (2 weeks on and 2 weeks off to prevent immune exhaustion), and is dependent

on manufacturing of clinical materials.

GTB-7550

GTB-7550

TriKE® is a product candidate in development for the treatment of lupus and other autoimmune disorders. GTB-7550 TriKE® is a

tri-specific molecule composed of a camelid nanobody that binds the CD16 receptor on NK cells, a scFv engager against CD19 on malignant

and normal B cells, and a human IL-15 sequence between them.

Published data shows that

GTB-7550 effectively targets CD19+ malignant cell lines and primary chronic lymphocytic leukemia (CLL). Preliminary data shows that GTB-7550

can target and eliminate normal B cells, which we are continuing to test in mice. We are currently exploring and assessing potential

manufacturers of GTB-7550.

Litigation

Update

As

disclosed in our third quarter report on Form 10-Q for the period ended September 30, 2024, on November 14, 2023, former interim Chief

Executive Officer, Dr. Gregory Berk filed a lawsuit in the U.S. District Court for the District of Massachusetts alleging that the Company

discriminated and retaliated against Dr. Berk for engaging in protected whistleblowing activity in violation of the Sarbanes Oxley Act

(“SOX”). Although the Company vigorously defended this matter and believes it to be without merit, the lawsuit was dismissed

with prejudice on December 4, 2024 as a result of the parties’ settlement.

As disclosed in our third

quarter report on Form 10-Q for the period ended September 30, 2024, on May 24, 2023, TWF Global, LLC (“TWF”) filed a Complaint

in the California Superior Court for the County of Los Angeles naming the Company as defendant. The Complaint alleges that TWF is the

holder of two Convertible Promissory Notes (“Notes”) and that the Company did not deliver shares of common stock due on conversion

in February 2021. TWF was seeking per diem liquidated damages based on the terms of alleged Notes. On July 14, 2023, the Company filed

a motion to dismiss for improper forum because the terms of the Notes, as alleged, require disputes to be filed in New York state and

federal courts. TWF voluntarily dismissed its Complaint before the California Superior Court of Los Angeles without prejudice. The Company

subsequently filed a Summons and Complaint for Interpleader against TWF and Z-One LLC before the Supreme Court of the State of New York

County of New York, asking the Supreme Court to determine if the Company’s shares of common stock are properly registered to TWF

or Z-One LLC, as both of these entities have made conflicting demands for registration of the shares of common stock. On February 5,

2024, the Company filed a motion for entry of default against TWF, seeking an order directing the Company to register the shares of common

stock in the name of Z-One and that the Company be released from all associated liability and claims. The Court denied the motion without

prejudice to reconsider the motion without further briefing upon the filing of a supplemental party affidavit. On May 9, 2024, Z-One

filed a motion for summary judgement seeking dismissal of the action, representing that Z-One and TWF have settled their dispute over

the entitlement to the Company’s shares of common stock and there is no remaining dispute before the Court. On May 21, 2024, the

Company filed a supplemental affidavit in support of its motion for entry of default. On November 14, 2024, the Court held a hearing

on the parties’ motions, at which the Court found that the motion for entry of default was mooted by the settlement agreement between

Z-One and TWF. The Court ordered that the case be dismissed.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and

have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies. Accordingly, we may provide

less public disclosure than larger public companies, including the inclusion of only two years of audited consolidated financial statements

and only two years of management’s discussion and analysis of financial condition and results of operations disclosure and the

inclusion of reduced disclosure about our executive compensation arrangements. As a smaller reporting company, we are also exempt from

compliance with the auditor attestation requirements pursuant to the Sarbanes-Oxley Act. As a result, the information that we provide

to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We will continue to be a “smaller reporting company” until we have $250 million or more in public float (based on our common

stock) measured as of the last business day of our most recently completed second fiscal quarter or, in the event we have no public float

or a public float (based on our common stock) that is less than $700 million, annual revenues of $100 million or more during the most

recently completed fiscal year.

Corporate

Information

Our

common stock currently trades on the Nasdaq under the symbol “GTBP.” Our principal executive offices are located at

315 Montgomery Street, 10th Floor, San Francisco, CA 94104, and our telephone number is (415) 919-4040. We maintain a website

at www.gtbiopharma.com. Information contained on or accessible through our website is not, and should not be considered, part

of, or incorporated by reference into, this prospectus.

| THE

OFFERING |

| |

| Common

Stock to be Offered |

|

Up

to 3,361,344 shares of common stock. |

| Common

Warrants to be Offered |

|

Common

warrants to purchase up to 3,361,344 shares of our common stock. Each common warrant

has an exercise price of $ per share of common

stock. Common warrants will become exercisable immediately after issuance and will expire

five years from the date of issuance.

The

shares of common stock and pre-funded warrants, and the accompanying common warrant, as the

case may be, can only be purchased together in this offering but will be issued separately

and will be immediately separable upon issuance. This prospectus also relates to the offering

of the shares of common stock issuable upon exercise of the common warrants.

|

| Pre-funded

Warrants to be Offered |

|

We

are also offering to certain purchasers whose purchase of shares of common stock in this

offering would otherwise result in the purchaser, together with its affiliates and certain

related parties, beneficially owning more than 4.99% (or, at the election of the purchaser,

9.99%) of our outstanding common stock immediately following the consummation of this offering,

the opportunity to purchase, if such purchasers so choose, pre-funded warrants to purchase

shares of common stock, in lieu of shares of common stock that would otherwise result in

any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the

purchaser, 9.99%) of our outstanding common stock. Each pre-funded warrant will be exercisable

for one share of our common stock. The purchase price of each pre-funded warrant and accompanying

common warrants will equal the price at which the share of common stock and accompanying

common warrants are being sold to the public in this offering, minus $0.0001, and the exercise

price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants will

be exercisable immediately and may be exercised at any time until all of the pre-funded warrants

are exercised in full. This offering also relates to the shares of common stock issuable

upon exercise of any pre-funded warrants sold in this offering. For each pre-funded warrant

we sell, the number of shares of common stock we are offering will be decreased on a one-for-one

basis. Because we will also issue one common warrant to purchase one share of common stock

for each share of our common stock and for each pre-funded warrant to purchase one share

of our common stock sold in this offering, the number of common warrants sold in this offering

will not change as a result of a change in the mix of the shares of our common stock and

pre-funded warrants sold.

|

| Common

Stock to be Outstanding Before this Offering |

|

2,234,328

shares. |

| |

|

|

| Common

Stock to be Outstanding Immediately After this Offering |

|

5,595,672

shares, (assuming full exercise of the pre-funded

warrants and assuming no exercise of the common warrants). |

| |

|

|

| Use

of Proceeds |

|

We

estimate that the net proceeds from this offering will be approximately $7.1 million, excluding the proceeds, if any, from

the cash exercise of the common warrants in this offering. We currently intend to use the net proceeds from this offering for working

capital and general corporate purposes, including the further development of our product candidates that are currently undergoing

clinical trials, our product candidates that we expect to submit an investigational new drug application for in the near term, and

our product candidates that are pre-clinical. See “Use of Proceeds” for additional information. |

| |

|

|

| Risk

Factors |

|

An

investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 9 of

this prospectus and the other information included and incorporated by reference in |

| |

|

this

prospectus for a discussion of the risk factors you should carefully consider before deciding to invest in our securities. |

| |

|

|

| Nasdaq

Symbol |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “GTBP.” There is no established public trading market

for the common warrants or pre-funded warrants, and we do not expect a market to develop. In addition, we do not intend to apply

to list the common warrants or pre-funded warrants on any national securities exchange or other nationally recognized trading system.

Without an active trading market, the liquidity of the common warrants and pre-funded warrants will be limited. |

Unless

otherwise stated in this prospectus, the number of shares of our common stock to be outstanding as of the date of this prospectus

and after this offering is based on 2,234,328 shares outstanding as of September 30, 2024, and excludes (a) placement agent warrants

to purchase up to 201,680 shares of our common stock issuable upon the exercise of warrants to be issued to the placement

agent in connection with this offering having an exercise price of $ per share, (b)

the shares of common stock issuable upon exercise of the common warrants and pre-funded warrants being offered by us in this

offering, (c) previously issued and outstanding warrants to purchase up to 1,133,762 shares of our common stock, and (d) outstanding

stock options to purchase up to 101,264 shares of our common stock. See “Note 7 – Common Stock Warrants and

Options” to our Third Quarter Report filed on Form 10-Q that is incorporated by reference into this prospectus.

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below in addition

to the other information contained in this prospectus and any prospectus supplement before deciding whether to invest in shares of our

common stock. The risks summarized below and others are discussed more fully in the section titled “Risk Factors” in our

Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated herein by reference. If any of the following risks

or the risks incorporated by reference occur, our business, financial condition or operating results could be harmed. In that case, the

trading price of our common stock could decline and you may lose part or all of your investment. In the opinion of management, the risks

discussed below and incorporated by reference represent the material risks known to us. Additional risks and uncertainties not currently

known to us or that we currently deem immaterial may also impair our business, financial condition and operating results and adversely

affect the market price of our common stock..

Risks

Related to Our Business

Risks

related to our business risks include, but are not limited to, the following:

| |

● |

Our

financial condition raises substantial doubt as to our ability to continue as a going concern. |

| |

|

|

| |

● |

Our

business is at an early stage of development and we may not develop therapeutic products that can be commercialized. |

| |

|

|

| |

● |

We

have a history of operating losses and we expect to continue to incur losses for the foreseeable future. We may never generate revenue

or achieve profitability. |

| |

|

|

| |

● |

We

will need additional capital to conduct our operations and develop our products, and our ability to obtain the necessary funding

is uncertain. |

| |

|

|

| |

● |

Our

current and future indebtedness may impose significant operating and financial restrictions on us and affect our ability to access

liquidity. |

| |

|

|

| |

● |

The

cost of our research and development programs may be significantly higher than expected, and there is no assurance that they will

successful in a timely manner, or at all. |

| |

|

|

| |

● |

If

our efforts to protect the proprietary nature of the intellectual property related to our technologies are not adequate, we may not

be able to compete effectively in our market and our business would be harmed. |

| |

|

|

| |

● |

Claims

that we infringe the intellectual property rights of others may prevent or delay our drug discovery and development efforts. |

| |

|

|

| |

● |

We

may desire, or be forced, to seek additional licenses to use intellectual property owned by third parties, and such licenses may

not be available on commercially reasonable terms, or at all. |

| |

|

|

| |

● |

If

we are unsuccessful in obtaining or maintaining patent protection for intellectual property in development or licensed from third

parties, our business and competitive position would be harmed. |

| |

|

|

| |

● |

If

we fail to meet our obligations under our license agreements, we may lose our rights to key technologies on which our business depends. |

| |

|

|

| |

● |

Our

reliance on the activities of our non-employee consultants, research institutions and scientific contractors, whose activities are

not wholly within our control, may lead to delays in development of our proposed products. |

| |

|

|

| |

● |

Clinical

drug development is costly, time-consuming and uncertain, and we may suffer setbacks in our clinical development program that could

harm our business. |

| |

|

|

| |

● |

If

we experience delays or difficulties in the enrollment of patients in clinical trials, those clinical trials could take longer than

expected to complete and our receipt of necessary regulatory approvals could be delayed or prevented. |

| |

|

|

| |

● |

Obtaining

regulatory approval, even after clinical trials that are believed to be successful, is an uncertain process. |

| |

|

|

| |

● |

We

will continue to be subject to extensive FDA regulation following any product approvals, and if we fail to comply with these regulations,

we may suffer a significant setback in our business. |

| |

|

|

| |

● |

Many

of our business practices are subject to scrutiny and potential investigation by regulatory and government enforcement authorities,

as well as to lawsuits brought by private citizens under federal and state laws. We could become subject to investigations, and our

failure to comply with applicable law or an adverse decision in lawsuits may result in adverse consequences to us. If we fail to

comply with U.S. healthcare laws, we could face substantial penalties and financial exposure, and our business, operations and financial

condition could be adversely affected. |

| |

|

|

| |

● |

Our

product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval,

limit the commercial profile of an approved label, or result in significant negative consequences following marketing approval, if

any. |

| |

|

|

| |

● |

We

may expend our limited resources to pursue a particular product candidate or indication that does not produce any commercially viable

products and may fail to capitalize on product candidates or indications that may be more profitable or for which there is a greater

likelihood of success. |

| |

|

|

| |

● |

Our

products may be expensive to manufacture, and they may not be profitable if we are unable to control the costs to manufacture them. |

| |

|

|

| |

● |

We

currently lack manufacturing capabilities to produce our therapeutic product candidates at commercial-scale quantities and do not

have an alternate manufacturing supply, which would negatively impact our ability to meet any demand for the product. |

| |

|

|

| |

● |

Our

business is based on novel technologies that are inherently expensive and risky and may not be understood by or accepted in the marketplace,

which could adversely affect our future value. |

| |

|

|

| |

● |

We

could be subject to product liability lawsuits based on the use of our product candidates in clinical testing or, if obtained, following

marketing approval and commercialization. If product liability lawsuits are brought against us, we may incur substantial liabilities

and may be required to cease clinical testing or limit commercialization of our product candidates. |

| |

|

|

| |

● |

We

rely on third parties to supply candidates for clinical testing and to conduct preclinical and clinical trials of our product candidates.

If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may not be able to obtain

regulatory approval for or commercialize our product candidates. As a result, our business could be substantially harmed. |

| |

|

|

| |

● |

Our

failure to maintain compliance with the Nasdaq Capital Market’s (“Nasdaq”) continued listing requirements could

result in the delisting of our common stock. |

These

risks are described more fully in our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated herein by

reference.

Risks

Related to our Business

Our

financial condition raises substantial doubt as to our ability to continue as a going concern.

As

of September 30, 2024, we had approximately $6.5 million in cash and cash equivalents and restricted cash, and working capital of $2.1

million, and we have incurred and expect to continue to incur significant costs in pursuit of our drug candidates. For

the nine months ended September 30, 2024, we recorded a net loss of approximately $9.4 million and used cash in operations of approximately

$10.4 million. Our unaudited consolidated condensed financial statements for the nine month period ended September 30, 2024 have

been prepared assuming that we will continue to operate as a going concern, which contemplates the realization of assets and the satisfaction

of liabilities in the normal course of business. To date, we have not generated substantial product revenues from our activities and

have incurred substantial operating losses. We expect that we will continue to generate substantial operating losses for the foreseeable

future until we complete development and approval of our product candidates. We will continue to fund our operations primarily through

utilization of our current financial resources and additional raises of capital.

These

conditions raise substantial doubt about our ability to continue as a going concern. For further information, please see Note 1 to our

third quarter unaudited condensed consolidated financial statements for the nine-months ended September 30, 2024. The Company has evaluated

the significance of the uncertainty regarding the Company’s financial condition in relation to its ability to meet its obligations,

which has raised substantial doubt about the Company’s ability to continue as a going concern. While it is very difficult to estimate

the Company’s future liquidity requirements, the Company believes if it is unable to obtain additional financing, existing cash

resources will not be sufficient to enable it to fund the anticipated level of operations through one year from the date the accompanying

unaudited condensed consolidated financial statements are issued. There can be no assurances that the Company will be able to secure

additional financing on acceptable terms. In the event the Company does not secure additional financing, the Company will be forced to

delay, reduce, or eliminate some or all of its discretionary spending, which could adversely affect the Company’s business prospects,

ability to meet long-term liquidity needs and the ability to continue operations.

Risks

Related to this Offering and Our Common Stock

There

has been a limited public market for our common stock, and we do not know whether one will develop to provide you adequate liquidity.

Furthermore, the trading price for our common stock, should an active trading market develop, may be volatile and could be subject to

wide fluctuations in per-share price.

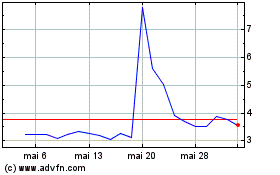

Our

common stock is now listed on the Nasdaq Capital Market under the trading symbol “GTBP”; historically, however, there has

been a limited public market for our common stock. We cannot assure you that an active trading market for our common stock will develop

or be sustained. The liquidity of any market for the shares of our common stock will depend on a number of factors, including:

| |

● |

the

number of stockholders;

|

| |

|

|

| |

● |

our

operating performance and financial condition;

|

| |

|

|

| |

● |

the

market for similar securities;

|

| |

|

|

| |

● |

the

extent of coverage of us by securities or industry analysts; and

|

| |

|

|

| |

● |

the

interest of securities dealers in making a market in the shares of our common stock. |

Even

if an active trading market develops, the market price for our common stock may be highly volatile and could be subject to wide fluctuations.

In addition, the price of shares of our common stock could decline significantly if our future operating results fail to meet or exceed

the expectations of market analysts and investors and actual or anticipated variations in our quarterly operating results could negatively

affect our share price.

The

volatility of the price of our common stock may also be impacted by the risks discussed under this “Risk Factors” section,

in addition to other factors, including:

| |

● |

developments

in the financial markets and worldwide or regional economies;

|

| |

|

|

| |

● |

announcements

of innovations or new products or services by us or our competitors;

|

| |

|

|

| |

● |

announcements

by the government relating to regulations that govern our industry;

|

| |

|

|

| |

● |

significant

sales of our common stock or other securities in the open market;

|

| |

|

|

| |

● |

variations

in interest rates;

|

| |

|

|

| |

● |

changes

in the market valuations of other comparable companies; and

|

| |

|

|

| |

● |

changes

in accounting principles. |

Our

outstanding warrants and options may affect the market price of our common stock

As

of the date of this prospectus, we had 2,234,328 shares of common stock outstanding

and issued and had outstanding warrants for the purchase of up to 1,120,429 additional shares of common stock at a weighted average

exercise price of $18.85 per share, all of which are exercisable as of the date of this prospectus (subject to certain beneficial ownership

limitations). In addition, we had outstanding options for the purchase of up to 124,600 additional shares of common stock at a

weighted average exercise price of $32.69 per share, 105,154 of which are exercisable as of the date of this prospectus. The amount of

common stock reserved for issuance may have an adverse impact on our ability to raise capital and may affect the price and liquidity

of our common stock in the public market. In addition, the issuance of these shares of common stock will have a dilutive effect on current

stockholders’ ownership.

Because

our common stock may be deemed a low-priced “penny” stock, an investment in our common stock should be considered high-risk

and subject to marketability restrictions.

Historically,

the trading price of our common stock has been $5.00 per share or lower, and deemed a penny stock, as defined in Rule 3a51-1 under the

Exchange Act, and subject to the penny stock rules of the Exchange Act specified in rules 15g-1 through 15g-100. Those rules require

broker–dealers, before effecting transactions in any penny stock, to:

| ● |

deliver

to the customer, and obtain a written receipt for, a disclosure document; |

| |

|

| ● |

disclose

certain price information about the stock; |

| |

|

| ● |

disclose

the amount of compensation received by the broker-dealer or any associated person of the broker-dealer; |

| |

|

| ● |

send

monthly statements to customers with market and price information about the penny stock; and |

| |

|

| ● |

in

some circumstances, approve the purchaser’s account under certain standards and deliver written statements to the customer

with information specified in rules. |

Consequently,

the penny stock rules may restrict the ability or willingness of broker-dealers to sell the common stock and may affect the ability of

holders to sell their common stock in the secondary market and the price at which such holders can sell any such securities. These additional

procedures could also limit our ability to raise additional capital in the future.

Financial

Industry Regulatory Authority (“FINRA”) sales practice requirements may also limit a stockholder’s ability to buy and

sell our common stock, which could depress the price of our common stock.

In

addition to the “penny stock” rules described above, FINRA has adopted rules that require a broker-dealer to have reasonable

grounds for believing that the investment is suitable for that customer before recommending an investment to a customer. Prior to recommending

speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information

about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these

rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some

customers. Thus, the FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock,

which may limit your ability to buy and sell our shares of common stock, have an adverse effect on the market for our shares of common

stock, and thereby depress our price per share of common stock.

If

securities or industry analysts do not publish research or reports about our business, or if they issue an adverse or misleading opinion

regarding our stock, our stock price and trading volume could decline.

The

trading market for our common stock may be influenced by the research and reports that industry or securities analysts publish about

us or our business. We currently have research coverage by only one securities analyst, and we may never obtain research coverage by

additional analysts. If no or few securities or industry analysts commence coverage of us, the trading price for our common stock may

be negatively affected. In the event that we receive additional securities or industry analyst coverage, if any of the analysts who cover

us issue an adverse or misleading opinion regarding us, our business model, our intellectual property or our stock performance, or if

our operating results fail to meet the expectations of analysts, our stock price would likely decline. If one or more of these analysts

cease coverage of us or fail to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could

cause our stock price or trading volume to decline.

Anti-takeover

provisions may limit the ability of another party to acquire us, which could cause our stock price to decline.

Delaware

law and our restated certificate of incorporation (“certificate of incorporation”), our restated bylaws (“bylaws”)

and other governing documents contain provisions that could discourage, delay or prevent a third party from acquiring us, even if doing

so may be beneficial to our stockholders, which could cause our stock price to decline. In addition, these provisions could limit the

price investors would be willing to pay in the future for shares of our common stock.

We

do not currently or for the foreseeable future intend to pay dividends on our common stock.

We

have never declared or paid any cash dividends on our common stock. We currently anticipate that we will retain future earnings for the

development, operation and expansion of our business and do not anticipate declaring or paying any cash dividends for the foreseeable

future. As a result, any return on your investment in our common stock will be limited to the appreciation in the price of our common

stock, if any.

Purchasers

of our common stock in this offering will experience immediate and substantial dilution in the book value of their investment.

The

offering price per share in this offering is substantially higher than the net tangible book value per share of our ordinary shares before

giving effect to this offering. Accordingly, purchasers of our securities in this offering will incur immediate dilution of approximately

$0.73 per share, representing the difference between the public offering price per share and our as-adjusted net tangible

book value per share as of September 30, 2024. Furthermore, if outstanding options or warrants are exercised, purchasers could experience

further dilution. For more information, including how these amounts were calculated, see “Dilution.”

Our

management will have broad discretion as to the use of the proceeds from this offering, and may not use the proceeds effectively.

Our

management will have broad discretion as to the application of the net proceeds from this offering. Currently, we intend to use the net

proceeds from this offering for working capital and general corporate purposes, including the further development of our product candidates

that are currently undergoing clinical trials, our product candidates that we expect to submit an investigational new drug application

for in the near term, and our product candidates that are pre-clinical. See “Use of Proceeds.” Purchasers will not have

the opportunity, as part of their investment decision, to assess whether these proceeds are being used appropriately. Our management

may use the net proceeds for corporate purposes that may not improve our financial condition or market value, which could cause the price

of our securities to decline.

We

will need additional capital to conduct our operations and develop our products, and our ability to obtain the necessary funding is uncertain.

We

have used a significant amount of cash since inception to finance the continued development and testing of our product candidates, and

we expect to need substantial additional capital resources to develop our product candidates going forward and launch and commercialize

any product candidates for which we receive regulatory approval.

We

may not be successful in generating and/or maintaining operating cash flow, and the timing of our capital expenditures and other expenditures

may not result in cash sufficient to sustain our operations through the commercialization of our product candidates. If financing is

not sufficient and additional financing is not available or available only on terms that are detrimental to our long-term survival, it

could have a material adverse effect on our ability to continue to function. The timing and degree of any future capital requirements

will depend on many factors, including:

| ● |

accuracy

of the assumptions underlying our estimates for capital needs in 2025 and beyond;

|

| |

|

| ● |

scientific

and clinical progress in our research and development programs;

|

| |

|

| ● |

the

magnitude and scope of our research and development programs and our ability to establish,

enforce and maintain strategic arrangements for research, development, clinical testing,

manufacturing and marketing;

|

| |

|

| ● |

our

progress with pre-clinical development and clinical trials;

|

| |

|

| ● |

the

time and costs involved in obtaining regulatory approvals;

|

| |

|

| ● |

the

costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent

claims; and

|

| |

|

| ● |

the

number and type of product candidates that we pursue. |

Additional

financing through strategic collaborations, public or private equity or debt financings or other financing sources may not be available

on acceptable terms, or at all. Additional equity financing could result in significant dilution to our stockholders, and any debt financings

will likely involve covenants restricting our business activities. Further, if we obtain additional funds through arrangements with collaborative

partners, these arrangements may require us to relinquish rights to some of our technologies, product candidates or products that we

would otherwise seek to develop and commercialize on our own.

If

sufficient capital is not available, we may be required to delay, reduce the scope of or eliminate one or more of our research or product

development initiatives, any of which could have a material adverse effect on our financial condition or business prospects.

There

is no public market for the common warrants or pre-funded warrants being offered by us in this offering.

There

is no established public trading market for the common warrants or the pre-funded warrants, and we do not expect a market to develop.

In addition, we do not intend to apply to list the common warrants or pre-funded warrants on any national securities exchange or other

nationally recognized trading system. Without an active market, the liquidity of the common warrants and pre-funded warrants will be

limited.

Holders of warrants purchased in this

offering will have no rights as common stockholders until such holders exercise their warrants and acquire our common stock.

Until holders of warrants

acquire shares of our common stock upon exercise thereof, holders of warrants will have no rights with respect to the shares of our common

stock underlying such warrants. Upon exercise of the warrants, the holders will be entitled to exercise the rights of a common stockholder

only as to matters for which the record date occurs after the exercise date.

This

is a reasonable best efforts offering, no minimum amount of securities is required to be sold, and we may not raise the amount of capital

we believe is required for our business plans, including our near-term business plans.

The

placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement

agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar

amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering.

Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement

agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth above.

We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and

investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to support our

continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we believe is required

for our operations in the short-term and may need to raise additional funds, which may not be available or available on terms acceptable

to us.

Purchasers who purchase our securities

in this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit

of a securities purchase agreement.

In

addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers

that enter into a securities purchase agreement will also be able to bring claims of breach of contract against us. The ability to

pursue a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them

under the securities purchase agreement including, but not limited to: (i) timely delivery of shares; (ii) agreement to not issue

any shares or securities convertible into shares for a period of sixty days from closing of the offering, subject to certain

exceptions; and (iii) indemnification for breach of contract.

Our

common stock may be at risk for delisting from the Nasdaq Capital Market in the future if we do not maintain compliance with Nasdaq’s

continued listing requirements. Delisting could adversely affect the liquidity of our common stock and the market price of our common

stock could decrease.

Our

common stock is currently listed on Nasdaq. Nasdaq has minimum requirements that a company must meet in order to remain listed on Nasdaq,

including corporate governance standards and a requirement that we maintain a stockholders’ equity above $2,500,000 as set forth

in Nasdaq Listing Rule 5550(b)(1).

On

November 21, 2024, the Company received a letter from Nasdaq notifying the Company that its amount of stockholders’ equity has

fallen below the $2,500,000 required minimum for continued listing set forth in Nasdaq Listing Rule 5550(b)(1).

Nasdaq’s

Letter has no immediate effect on the listing of the Company’s common stock, and its common stock will continue to trade on The

Nasdaq Capital Market under the symbol “GTBP” at this time. Pursuant to Nasdaq Listing Rules, the Company provided

Nasdaq with a plan to achieve and sustain compliance on December 31, 2024. If Nasdaq accepts the Company’s plan to regain

compliance, Nasdaq may grant an extension of up to 180 calendar days from the date of the Letter to evidence compliance. If Nasdaq does

not accept the Company’s plan to regain compliance, the Company will have the opportunity to appeal the decision to a Nasdaq Hearings

Panel. The Company intends to submit to Nasdaq, within the requisite time period, a plan to regain compliance with Listing Rule 5550(b)(1).

There can be no assurance that Nasdaq will accept the Company’s plan, that the Company will be able to regain compliance with Listing

Rule 5550(b)(1) or that the Company will be able meet the continued listing requirements during any compliance period that may be granted

by Nasdaq.

In

the future, if we fail to maintain such minimum requirements and a final determination is made by Nasdaq that our common stock must be

delisted, the liquidity of our common stock would be adversely affected and the market price of our common stock could decrease. In addition,

if delisted, we would no longer be subject to Nasdaq rules, including rules requiring us to have a certain number of independent directors

and to meet other corporate governance standards. Our failure to be listed on Nasdaq or another established securities market would have

a material adverse effect on the value of your investment in us.

USE

OF PROCEEDS

We estimate that the net proceeds

from the offering will be approximately $7.1 million, based on the assumed public offering price of $2.38 per share and

common warrant, which is the last reported sales price of our common stock on Nasdaq on January 23, 2024 after deducting the placement

agent fees and estimated offering expenses payable by us, assuming no sale of any fixed combinations of warrants and pre-funded warrants

offered hereunder. We may only receive additional proceeds from the exercise of the common warrants issuable in connection with this

offering and, if such common warrants are exercised in full for cash, the estimated net proceeds will increase to $15.1 million.

However, because this is a reasonable best-efforts offering and there is no minimum offering amount required as a condition to the closing

of this offering, the actual offering amount, the placement agent’s fees and net proceeds to us are not presently determinable