false

0001500375

0001500375

2024-10-11

2024-10-11

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

| |

|

Washington, D.C. 20549

|

| |

|

FORM 8-K

|

| |

|

CURRENT REPORT

|

|

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| |

| |

|

Date of Report (Date of earliest event reported) October 11, 2024

|

| |

| |

|

Home Federal Bancorp, Inc. of Louisiana

|

|

(Exact name of registrant as specified in its charter)

|

| |

| |

|

Louisiana

|

001-35019 |

02-0815311

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number) |

(IRS Employer

Identification No.)

|

| |

| |

|

624 Market Street, Shreveport, Louisiana

|

71101

|

|

(Address of principal executive offices)

|

(Zip Code)

|

| |

| |

|

Registrant's telephone number, including area code

|

(318) 222-1145

|

| |

| |

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

| |

| |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

| |

|

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

| Securities registered pursuant to Section 12(b) of the Act: |

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock (par value $.01 per share)

|

HFBL

|

Nasdaq Stock Market, LLC

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(a)

|

Not applicable.

|

|

(b)

|

Not applicable.

|

|

(c)

|

Not applicable.

|

|

(d)

|

Not applicable.

|

(e) On October 11, 2024, the Compensation Committee of the Board of Directors approved the amendment and restatement of the Home Federal Bank (the “Bank”) Loan Officer Incentive Plan, which covers the Bank’s commercial sales manager (the “CSM”), K. Matthew Sawrie, and other commercial loan officers. The terms of the Loan Officer Incentive Plan are reviewed annually and were amended and restated on October 11, 2024 to include for Mr. Sawrie provisions governing non-solicitation of customers and employees for a period of two years in the event he voluntarily terminates his employment or the Bank terminates his employment for Cause, as defined.

The Loan Officer Incentive Plan is an annual incentive compensation plan intended to reward participating commercial loan officers with variable cash awards that are contingent upon the net interest income produced from the loan officer’s identified loan portfolio, and in the case of the CSM, all loans originated by commercial loan officers, and net income from new loans originated during the performance period plus commercial deposit fee income, multiplied by a portfolio rating based on the performance measures.

The CSM receives a cash incentive award equal to 1.0% of the net interest income from loans originated by all the commercial loan officers prior to the beginning of the fiscal year, which will not exceed 50% of the CSM’s base salary at the time of the award, and a cash incentive award equal to 5.0% of the net income from all of the loans originated by the commercial loan officers during the performance period plus year to date commercial deposit fee income, in each case multiplied by a portfolio rating based on the five performance measures.

The foregoing description is qualified in its entirety by reference to the Loan Officer Incentive Plan, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference thereto.

(f) Not applicable.

Item 9.01 Financial Statements and Exhibits

|

(a)

|

Not applicable.

|

|

(b)

|

Not applicable.

|

|

(c)

|

Not applicable.

|

|

(d)

|

Not applicable.

|

The following exhibits are included herewith.

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

| 104 |

|

Cover page interactive data file (embedded within the XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HOME FEDERAL BANCORP, INC. OF LOUISIANA

|

| |

|

|

| |

|

|

| |

|

|

|

Date:

|

October 17, 2024

|

By:

|

/s/ James R. Barlow

|

| |

|

|

James R. Barlow

|

| |

|

|

Chairman of the Board, President and Chief Executive Officer

|

HOME FEDERAL BANK

Loan Officer Incentive Plan (LOIP)

Participant: K. Matthew Sawrie

Approved and adopted on October 11, 2024.

HOME FEDERAL BANK

Loan Officer Incentive Plan (LOIP) Description

I. Plan Purpose -- The LOIP is an annual, cash-based variable incentive compensation plan. It is specifically designed to encourage selected Commercial Loan Officers (CLO) to produce results that enable the Bank to reach targeted levels of financial performance for the fiscal year. The LOIP provides participants with an opportunity to earn variable rewards that are contingent on (i) the net interest income (interest income less interest expense) produced from the CLO’s identified loan portfolios; and (ii) the net income (interest income plus 1st year fee income, less interest expense) from the CLO’s new loans originated during the performance period (loan growth).

The President and CEO will use the LOIP as a part of his overall management strategy to provide direction and encouragement to participants. The LOIP will help control the escalation in fixed compensation costs and provide participants with an opportunity to enhance their overall level of compensation. This should better enable the Bank to attract, motivate and retain the kinds of Loan Officers needed to ensure financial success. It should also create incremental shareholder value through the generation of enhanced earnings.

The LOIP is administered by the Compensation Committee of the Board of Directors. Under normal circumstances the plan remains in effect for the current performance period, the fiscal year. However, the Compensation Committee may discontinue or modify the plan, in its sole discretion, at any time during the performance period, provided that the amount of any award for such partial fiscal year shall be calculated based upon the performance and other factors described herein through the end of the month immediately preceding the date of such discontinuation or modification, with such pro-rated award to be paid if the participating CLO or Commercial Sales Manager (CSM) is still employed and in good standing at the time of such discontinuation or modification.

II. Performance Period – This is a 12-month plan that is linked with portfolio performance and production targets established for the fiscal year. However, management may pay estimated awards, as deemed appropriate by the Compensation Committee, at intervals more frequent than annually. Each year the LOIP is reviewed and modified to ensure it is consistent with the financial measures in the annual business plan. Any financial measures that are related to lending performance in the LOIP are reviewed each year and adjusted to coincide with changes in participants, their compensation, and the LOIP formula.

III. Plan Participants – The LOIP is intended for certain eligible Commercial Loan Officers. The President and CEO will review the CLO’s at the beginning of each fiscal year and select those eligible to participate in the LOIP. Recommended participants and their participation levels are presented to the Compensation Committee for approval. The list of participating CLO’s will be maintained in the records of the Compensation Committee. Participants who join the Bank during the targeted year may have special arrangements during the time they are developing their portfolios.

IV. Participation Levels – The LOIP will have three participation levels, two based on size of each CLO’s book of business (BOB) and one for the CSM. BOB is defined as loans plus deposits assigned to a CLO. A minimum BOB equal to $10 million is needed for eligibility to participate in LOIP. Level I participants are those CLO’s with BOB equal to or greater than $10 million but less than $50 million. Level II participants are those CLO’s with BOB equal to or greater than $50 million. The CSM, having responsibility for the overall Commercial division, will participate based on the combined portfolios of the CLO’s participating in the LOIP.

Level I Participants will receive 2.00% of the net interest income (interest income less interest expense) from loans identified as having been originated by the particular CLO prior to the beginning of the fiscal year. Participants also receive 15.00% of the net income (interest income plus 1st year fee income and YTD commercial deposit fee income, less interest expense) from the CLO’s loans originated during the performance period (loan growth).

Level II Participants will receive 3.00% of the net interest income (interest income less interest expense) from loans identified as having been originated by the particular CLO prior to the beginning of the fiscal year. Participants also receive 10.00% of the net income (interest income plus 1st year fee income and YTD commercial deposit fee income, less interest expense) from the CLO’s loans originated during the performance period (loan growth).

The CSM will receive 1.00% of the net interest income (interest income less interest expense) from loans identified as having been originated by all CLO’s including the CSM participating in the LOIP prior to the beginning of the fiscal year, which shall not exceed 50% of the CSM’s base salary at the time of award. The CSM will also receive 5.00% of the net income (interest income plus 1st year fee income and YTD commercial deposit fee income, less interest expense) from loans originated by all CLO’s including the CSM participating in the LOIP during the performance period (loan growth).

Support staff participation will be determined by the CSM with each team member eligible for up to a 10% bonus based on most recent performance appraisal and division performance. Support staff bonuses will be deducted from the CLO & CSM incentive payments on a pro-rata basis of the total amounts earned for the period. A pay matrix is attached in Appendix C.

The President and CEO will review the participation levels and percentages at the beginning of each fiscal year and recommend any needed modifications to the Compensation Committee for all plan participants.

V. Plan Formula – Fiscal year performance is calculated for each participating CLO to ensure an accurate determination of portfolio performance. A portfolio rating is calculated based on the BOB performance as shown on attached Appendix A. Sample calculations for a Level I and II participant with a portfolio rating of 100% are provided on attached Appendix B.

Cumulative interest income from loans existing at the beginning of the performance period is calculated. Interest expense, equal to loan volume times the most recently available average cost of funds for the Bank, is deducted from interest income to determine loan officer contribution. Loan officer contribution is multiplied by the portfolio rating to calculate the income base. The income base is multiplied by the appropriate factor based on participation level to determine the incentive award from existing loans.

Cumulative interest income from growth in loans during the performance period is calculated. Interest expense, equal to the growth in loans times the most recently available average cost of funds for the Bank, is deducted from interest income to determine net interest income. 1st year fee income from loan originations plus YTD commercial deposit fee income is also added to determine loan officer contribution. Loan officer contribution is multiplied by the portfolio rating to calculate the income base. The income base is multiplied by the appropriate factor based on participation level to determine the incentive award from growth in Loans. A decline in a participant’s loan portfolio will result in a negative impact to cumulative interest income for the performance period. This will, in effect, lower the incentive payment allocated for existing loans.

The incentive awards from existing loans and loan growth are added to determine the total award payment for the performance period.

VI. Book of Business Performance – BOB performance is used to calculate the portfolio rating to help ensure that asset quality, BOB growth, and other performance targets are met. BOB quality guidelines are established by the President and CEO with input from the Senior Credit Officer. There will be five performance measures: 1) Classified Loans - loans that are downgraded to “Special Mention” or lower during the performance period, regardless if loan is subsequently upgraded prior to the end of performance period. 2) Past Due Loans – loans that are past due 30 or more days at quarter end during performance period regardless if loan subsequently becomes current. 3) Net Losses – losses sustained due to charged off loans, deposit accounts, & fraud measured as a percentage of total loans assigned to CLO. 4) Deposit Growth – growth in deposit account balances as of the end of performance period measured as a percentage of target $ growth. 5) Loan Growth – growth in loan portfolio as of the end of the performance period measured as a percentage of target $ growth. Target $ growth will be assigned to each CLO based on growth expectations for the Bank. A sample calculation is provided on attached Appendix A.

For the CSM to attain BOB rating of 110%, all CLO direct reports must attain a minimum BOB rating of 100%.

VII. Plan Communications -- Following approval of the LOIP by the Compensation Committee, the President and CEO will ensure that all participants are notified of their participation, target awards, the plan formula, how incentive awards are calculated and what they may do to positively influence the size of their awards. During the performance period the President and CEO will ensure that all participants are provided with periodic updates on the status of the LOIP. This enables participants to project the formula awards for which they are potentially eligible.

VIII. Award Determination – Awards are calculated and deemed “earned” on a fiscal year annual basis. However, management may pay estimated awards, as deemed appropriate by the Compensation Committee, at intervals more frequent than annually. These estimated awards are considered prepayments of the annual award and subject to claw-back if the amount of the prepayment exceeds the amount of the award actually earned for the fiscal year or if the participant is no longer in good standing during the fiscal year.

IX. Award Payments -- As soon as practicable following the end of each fiscal year, the Compensation Committee shall determine the amount of the award earned by each participant in the LOIP during such fiscal year, with the amount of the earned award (minus any prepayments under Section VIII above) to be paid in the Bank’s first regular payroll cycle that commences after the approval of the awards by the Compensation Committee. In order to receive an award for the fiscal year, the participant must be in good standing throughout the fiscal year (written or verbal warning during the performance period will result in the participant forfeiting any right to an award under the LOIP). The payments can be made by separate check or included in regular pay, but will be specifically designated as incentive awards and taxed accordingly.

X. Effect of Termination of Employment or Leave of Absence -- If a participant’s employment is voluntarily or involuntarily terminated during the fiscal year at a time when the participant is in good standing (written or verbal warning during the performance period will result in the participant forfeiting any right to an award under the LOIP), then the participant’s award for such partial fiscal year shall be calculated based upon the performance and other factors described herein through the end of the month immediately preceding the date of such termination of employment (except that the first three performance measures under Section VI shall be based on the entire fiscal year), with such pro-rated award (minus any prepayments under Section VIII above) to be paid when the actual earned awards are paid following completion of the fiscal year as described in Section IX above.

If a participant is on medical leave or other leave of absence during the fiscal year, then the participant’s award for the fiscal year shall be calculated based upon the performance and other factors described herein for only the full months of the fiscal year that the participant is not on a leave of absence (except that the first three performance measures under Section VI shall be based on the entire fiscal year), with such pro-rated award (minus any prepayments under Section VIII above) to be paid when the actual earned awards are paid following completion of the fiscal year as described in Section IX above.

XI. LOIP Review -- As soon as practicable following the end of each fiscal year, the President and CEO, with input from the CFO, will review the LOIP and determine whether modifications should be proposed for the new plan year commencing on July 1. Any modifications are subject to review and approval by the Compensation Committee. The President and CEO will ensure that all participants are informed about any changes in the plan as soon as practical following approval and adoption of the new plan.

XII. President and CEO and Compensation Committee Discretion – The guidelines for the LOIP build structure into the incentive compensation determination process. Along with the guidelines, a certain amount of common sense and discretion are frequently needed. The President and CEO has the discretion to recommend certain awards to the Compensation Committee, should they be warranted. Similarly, members of the Compensation Committee may recommend certain discretionary awards. This is in keeping with good compensation management practices.

XIII. Non-Solicitation – If CSM’s employment is voluntarily terminated or the Bank terminates the CSM’s employment for Cause, as defined below, the CSM agrees that during the two-year period next following the date of termination, the CSM shall not directly or indirectly (i) solicit or induce, or cause others to solicit or induce, any executive officer or employee of the Bank to leave the employment of the Bank, or (ii) solicit (whether by mail, telephone, personal meeting or any other means, excluding general solicitations of the public that are not based in whole or in part on any list of customers of the Bank) any customer of the Bank to transact business with any firm, business, person, partnership, corporation or other entity which competes with the Bank or any affiliate or related entity, directly or indirectly, in any aspect of the business of the Bank, or to reduce or refrain from doing any business with the Bank, or (iii) interfere with or damage (or attempt to interfere with or damage) any relationship between the Bank and any such customers. The foregoing non-solicitation provisions shall be null and void in the event that James R. Barlow is not serving in any capacity as Chairman, President or CEO of the Bank at the time of CSM’s termination and shall lapse if the Bank ceases to be engaged in a similar business. If the CSM is in violation of any provision in this section, the Bank shall not be obligated to make any payment otherwise due under this Agreement to the CSM and shall be entitled to recoup from the CSM any payment made to the CSM with respect to the Bank’s fiscal year immediately preceding the date of termination of CSM’s employment.

Termination of the CSM’s employment for “Cause” shall mean the good faith determination of the Board of Directors of the Bank, in the exercise of its reasonable judgment, that the CSM (1) is grossly negligent in the performance of his duties hereunder or is not meeting stated goals delivered in writing to the CSM; (2) has violated any material written policy or directive of the Bank; (3) has committed a fraudulent act or practice that materially affects the Bank; (4) has been convicted of, pled guilty or no contest to, or admitted in court to a felony act of any kind or an act of fraud, misappropriation or embezzlement; (5) has engaged in misconduct that is materially injurious to the Bank or has committed a willfully dishonest act intended to result in substantial personal enrichment of himself or others to the detriment of the Bank; (6) has willfully violated, in any material respect, any law, rule or regulation (other than traffic violations or similar offenses not material in nature); or (7) has been prohibited from engaging in the business of banking by any applicable governmental regulatory agency.

XIV. Understanding and Acceptance – By signing the Loan Officer Incentive Plan, participant hereby understands and agrees to all terms and conditions contained in the LOIP.

Target Loan Growth: -0-* Target Deposit Growth: -0-

*Maintain balances as of 06/30/2024

Acknowledgement:

Manager:/s/ James R. Barlow Participant:/s/ K. Matthew Sawrie

James R. Barlow K. Matthew Sawrie

Date: 10/15/24

Appendix A

Appendix B

Appendix B Cont.

Appendix C

v3.24.3

Document And Entity Information

|

Oct. 11, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Home Federal Bancorp, Inc. of Louisiana

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 11, 2024

|

| Entity, Incorporation, State or Country Code |

LA

|

| Entity, File Number |

001-35019

|

| Entity, Tax Identification Number |

02-0815311

|

| Entity, Address, Address Line One |

624 Market Street

|

| Entity, Address, City or Town |

Shreveport

|

| Entity, Address, State or Province |

LA

|

| Entity, Address, Postal Zip Code |

71101

|

| City Area Code |

318

|

| Local Phone Number |

222-1145

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001500375

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

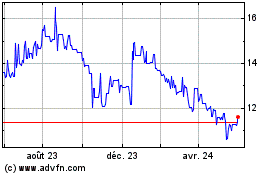

Home Federal Bancorp Inc... (NASDAQ:HFBL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

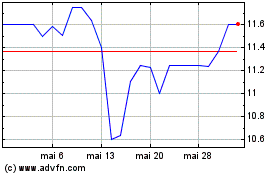

Home Federal Bancorp Inc... (NASDAQ:HFBL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025