UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

| Check

the appropriate box: |

|

Preliminary Proxy Statement |

|

CONFIDENTIAL,

FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to ss.240.14a-12 |

INSTEEL INDUSTRIES INC.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

| Payment

of Filing Fee (Check the appropriate box): |

|

No

fee required. |

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

(5) |

Total fee paid: |

|

Fee

paid previously with preliminary materials. |

|

Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date

of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

(3) |

Filing Party: |

| |

(4) |

Date Filed: |

Dear

Shareholder

|

H.O. Woltz III

Chairman of the Board

January 4, 2022 |

“Thank

you for your

continued support

and interest in Insteel

Industries Inc.” |

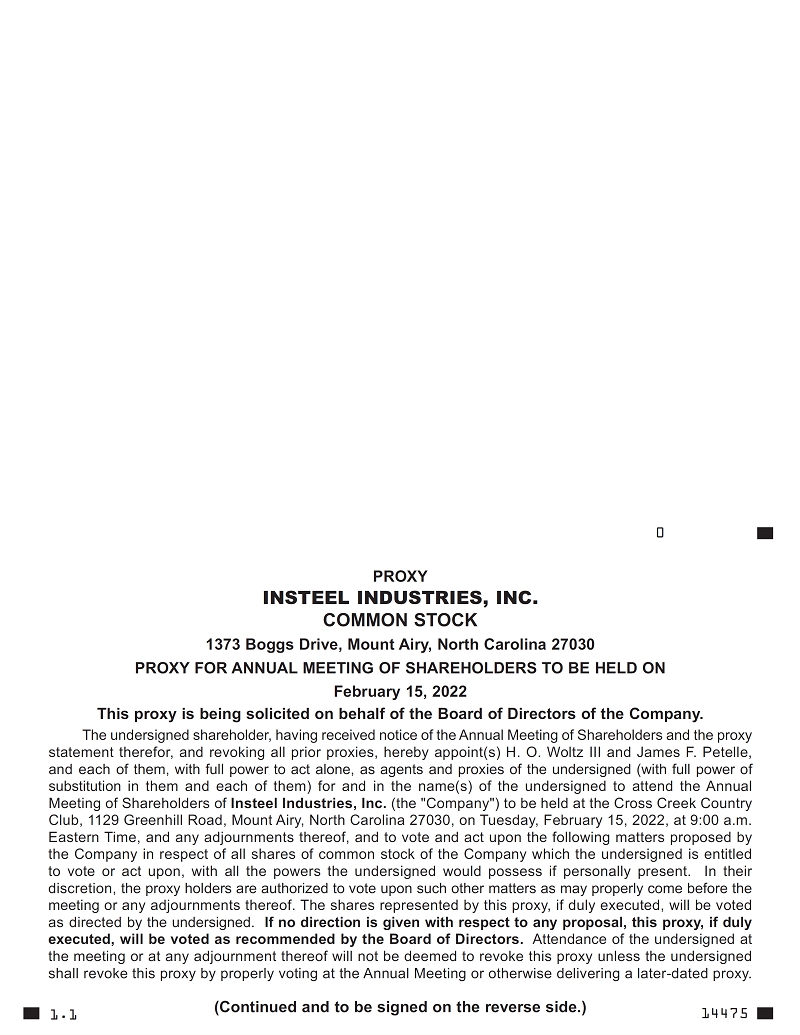

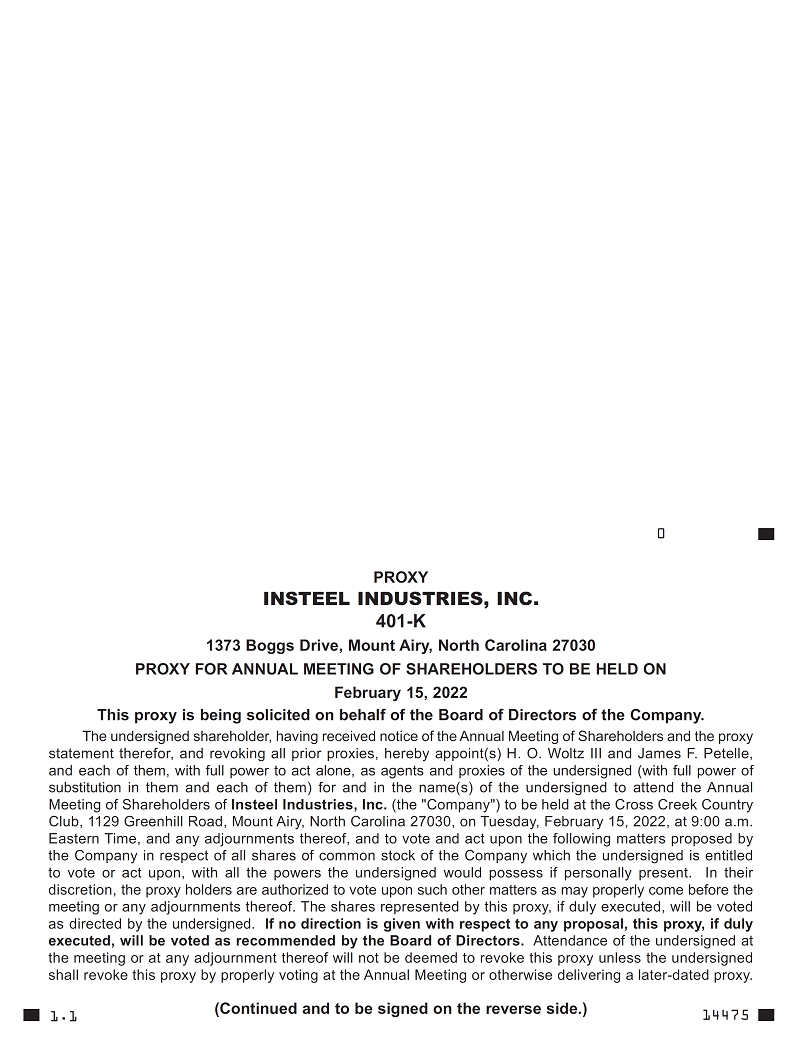

You are cordially invited to attend the

2022 Annual Meeting of Shareholders of Insteel Industries Inc. to be held February 15, 2022 at 9:00 a.m. Eastern Time. The meeting

will take place at the Cross Creek Country Club, 1129 Greenhill Road, Mount Airy, North Carolina.

The attached proxy statement and formal

notice of the meeting describe the matters expected to be acted upon at the meeting. We urge you to review these materials carefully

and to use this opportunity to take part in the Company’s affairs by voting on the matters described in the proxy statement.

At the meeting, we will also discuss our operations, fiscal year 2021 financial results and our plans for the future. Our directors

and management team will be available to answer any questions you may have. We hope that you will be able to attend.

Your vote is important to us. Whether you

plan to attend the meeting or not, please complete the enclosed proxy card and return it as promptly as possible. If you attend

the meeting, you may elect to have your shares voted as instructed on the proxy card or you may withdraw your proxy at the meeting

and vote your shares in person. If you hold shares in “street name” and would like to vote at the meeting, you should

follow the instructions provided in the proxy statement.

Thank you for your continued support and

interest in Insteel Industries Inc.

Sincerely,

Notice

of

Annual Meeting

of Shareholders |

1373 Boggs Drive

Mount Airy, North Carolina

27030

(336) 786-2141 |

FEBRUARY 15, 2022

9:00 a.m., Eastern Time

Cross Creek Country Club

1129 Greenhill Road

Mount Airy, North Carolina 27030

Dear Shareholder:

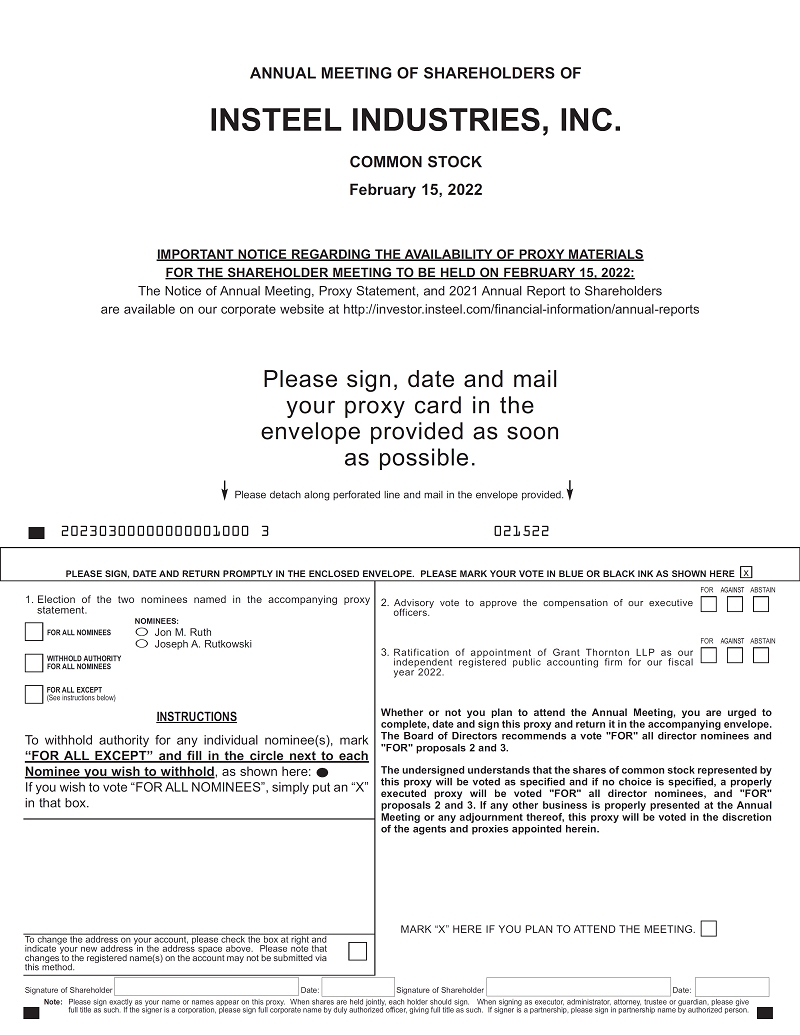

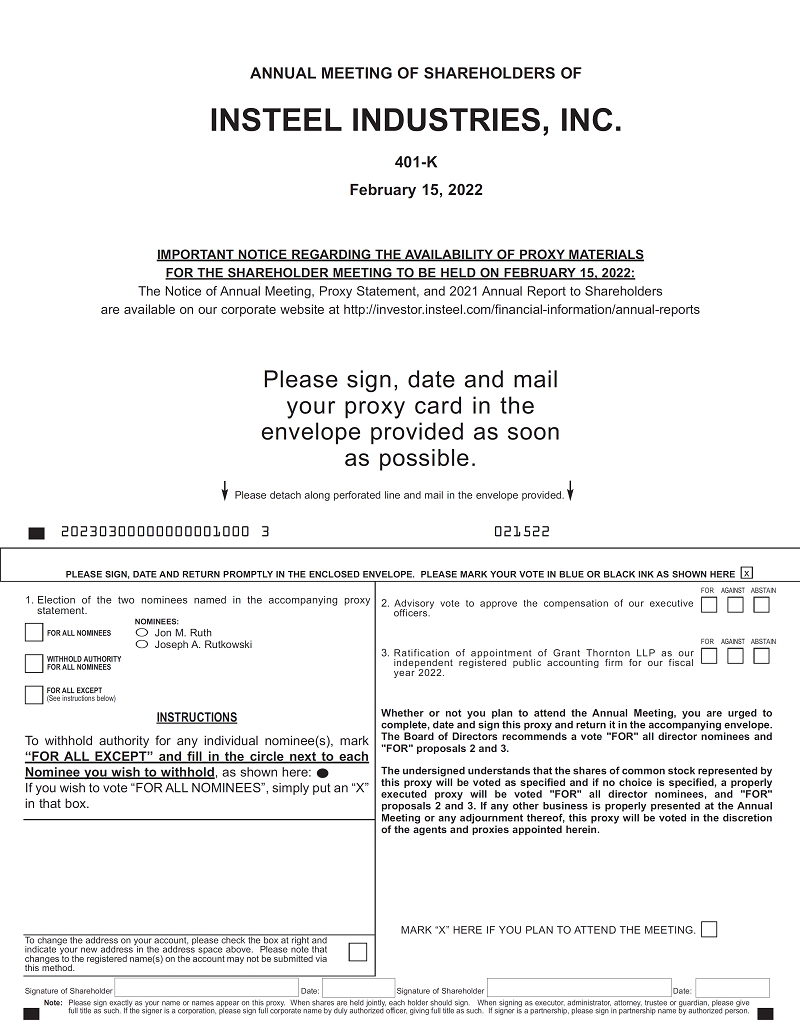

At our Annual Meeting, we will ask you to:

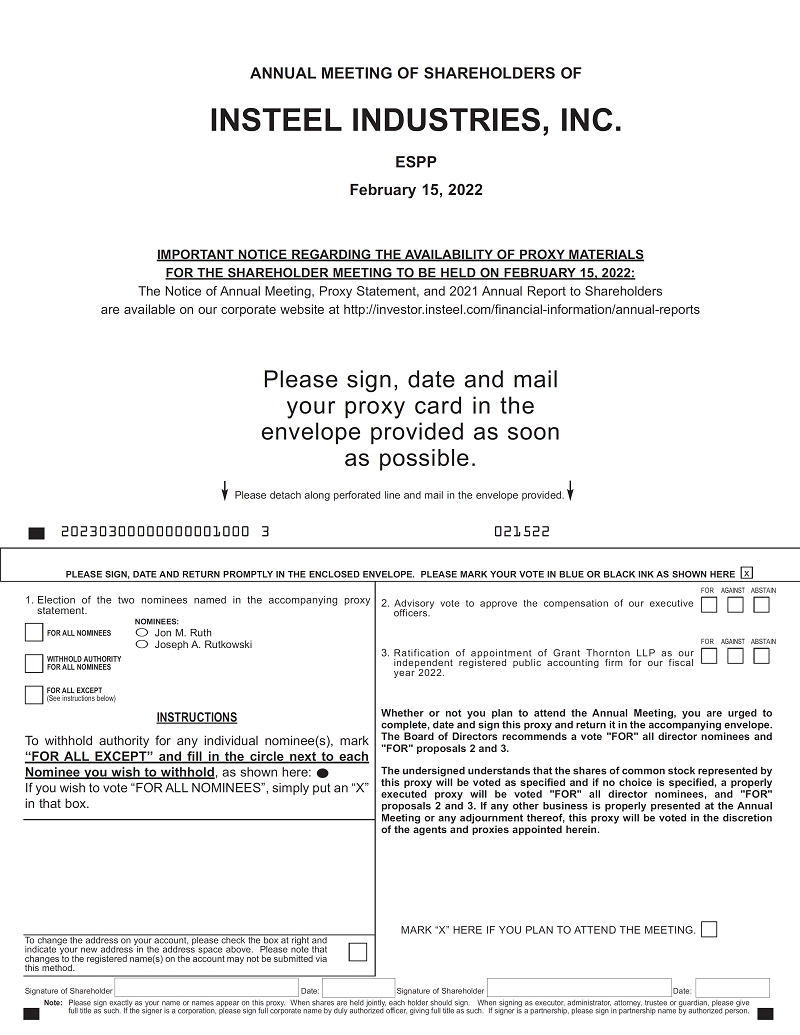

| 1. |

Elect two nominees named in this proxy

statement to the Board of Directors for terms expiring in 2025; |

| 2. |

Approve, on an advisory basis, the compensation of

our executive officers; |

| 3. |

Ratify the appointment of Grant Thornton LLP as our

independent registered public accounting firm for our fiscal year 2022; and |

| 4. |

Transact such other business, if any, as may properly

be brought before the meeting or any adjournment thereof. |

Only shareholders of record at the close

of business on December 15, 2021 are entitled to vote at the Annual Meeting and any adjournment or postponement thereof.

Whether or not you plan to attend the meeting

and vote your common stock in person, please mark, sign, date and promptly return the enclosed proxy card or voting instruction

form in the postage-paid envelope according to the instructions printed on the card. Any proxy may be revoked at any time prior

to its exercise by delivery of a later-dated proxy or by properly voting in person at the Annual Meeting.

Enclosed is a copy of our Annual Report for the year ended October

2, 2021, which includes a copy of our Annual Report on Form 10-K filed with the Securities and Exchange Commission.

By Order of the Board of Directors

James F. Petelle

Vice President and Secretary

January 4, 2022

Mount Airy, North Carolina

of Contents

| |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

5 |

| |

|

|

Proxy Summary

This summary highlights certain information

that is described in more detail elsewhere in this proxy statement. This summary does not contain all the information you should

consider before voting on the issues at our annual meeting, so we ask that you read the entire proxy statement carefully. Page

references are provided to help you quickly find further information.

2022 Annual Meeting of Shareholders

| Date and Time: |

February 15, 2022 |

| |

9:00 a.m. Eastern Time |

| |

|

| Place: |

Cross Creek Country Club |

| |

1129 Greenhill Road |

| |

Mount Airy, NC 27030 |

Eligibility to Vote

You can vote at our annual meeting if you

were a shareholder of record of our common stock at the close of business on December 15, 2021.

Governance Highlights

We are committed to high standards of corporate

governance, and our Board is committed to acting in the long-term best interests of our shareholders. Our Nominating and Governance

Committee continually reviews our policies and practices in light of recent trends in corporate governance, but with its primary

focus on the long-term interest of shareholders. Below is a summary of our corporate governance highlights with respect to our

Board of Directors.

| • |

Six out of our seven directors are independent. |

| • |

Our Lead Independent Director leads executive sessions

of the independent directors, which are held in conjunction with each regularly scheduled board meeting. |

| • |

We require that a nominee for director submit a resignation

to the Board if he or she fails to receive a majority of the shares voted in an uncontested election. |

| • |

We maintain fully independent Audit, Compensation

and Nominating and Governance Committees. |

| • |

We have share ownership guidelines for directors and

executive officers. |

| • |

Our directors and executive officers are prohibited

from hedging our stock and are required to obtain prior approval of any pledge of our stock. |

| • |

We conduct annual Board, committee and CEO evaluations. |

| • |

Our Board participates in annual director education

programs. |

| • |

We require prior approval of certain related party

transactions and Audit Committee review of any such transactions. |

| Information about our corporate governance

policies and practices can be found at pp. 9-13. |

VOTING MATTERS

| Proposal |

Vote Required |

Board Recommendation |

| Proposal 1: Election of two nominees to the Board of Directors |

Plurality of Votes Cast* |

FOR all nominees |

| Proposal 2: Advisory Vote on the compensation of our executive officers |

Majority of the Votes Cast |

FOR |

| Proposal 3: Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for fiscal year 2022. |

Majority of the Votes Cast |

FOR |

| * |

Although a director will be elected

by a plurality of the votes cast, if the director receives less than a majority of the shares voted in an uncontested election

(such as this one), the director is required to submit his or her resignation to the Board. See “Board Governance Guidelines”

on p. 11. |

| www.insteel.com |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

6 |

| |

|

Election of Directors

We typically elect approximately one-third

of our directors each year to serve three-year terms. Our Board of Directors currently consists of seven directors. We are seeking

shareholder approval for two director nominees: Jon M. Ruth and Joseph A. Rutkowski, each of whom have been nominated for three-year

terms.

| Information about our director nominees,

continuing directors and executive officers can be found at pp. 16-19. |

Advisory Vote on the Compensation of

our Executive Officers

Our executive compensation program emphasizes

performance-based compensation, so the amount of compensation paid to our executive officers varies significantly based on our

financial performance. We seek primarily to build long-term shareholder value, and therefore we base the payment of annual cash

bonuses on our return on capital, a metric that has been shown to be closely associated with long-term growth in shareholder value.

Compensation practices include:

|

Stock ownership guidelines; |

|

Double triggers in our change in control severance agreements; |

|

Clawback policy; |

|

No significant perquisites; |

|

Prohibition of hedging of our shares; |

|

Long-term incentives that are entirely equity-based; and |

|

Prohibition of stock option repricing. |

| Information about our executive compensation

program can be found in the “Compensation Discussion and Analysis” at pp. 20-28 and in the compensation tables at

pp. 29-36. |

Ratify the Appointment of Grant Thornton

LLP as our Independent Public Accounting Firm for Fiscal 2022

| Information concerning our independent public

accounting firm, including the fees we paid them in our fiscal years 2020 and 2021, and the Report of the Audit Committee, can

be found at pp. 40-41. |

| |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

7 |

| |

|

|

Proxy Statement

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on February 15, 2022:

The Notice of Annual Meeting of Shareholders, Proxy Statement and 2021 Annual Report to the Shareholders are available on our corporate website at https://investor.insteel.com/financial-information/ annual-reports. |

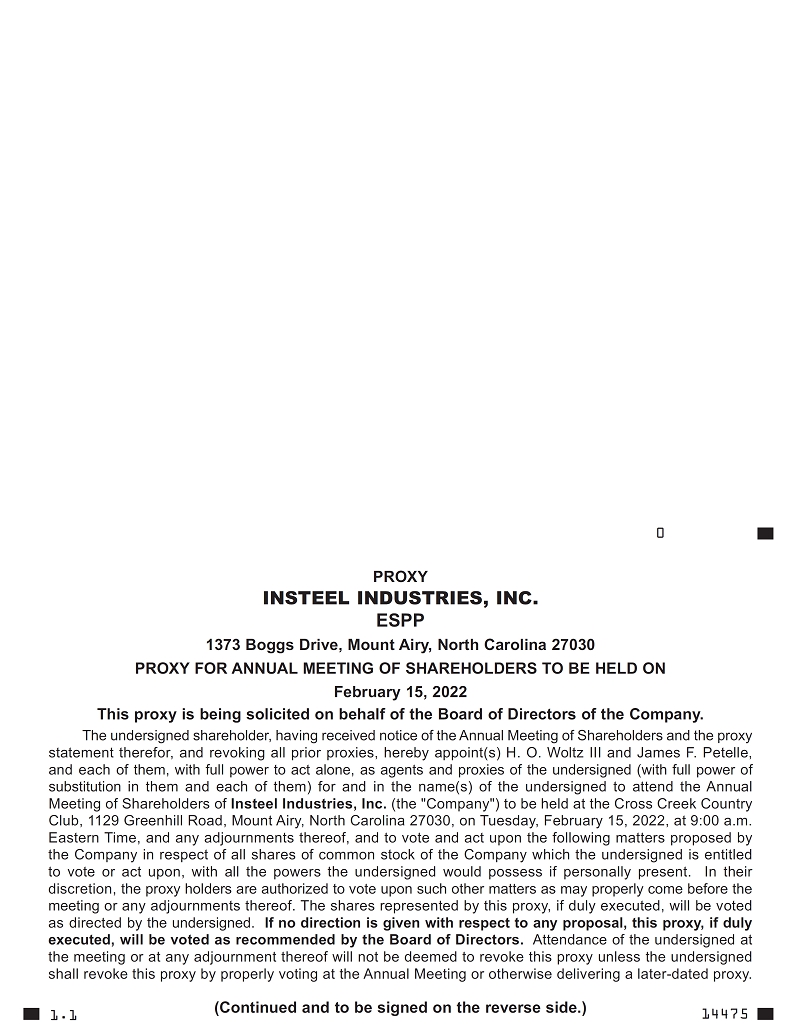

This proxy statement is furnished in connection

with the solicitation of proxies by our Board of Directors for use at the Annual Meeting of Shareholders (the “Annual Meeting”)

to be held on February 15, 2022 at 9:00 a.m., Eastern Time, and at any adjournments or postponements of the Annual Meeting. The

meeting will take place at the Cross Creek Country Club, 1129 Greenhill Road, Mount Airy, North Carolina. This proxy statement,

accompanying proxy card and the 2021 Annual Report, which includes a copy of our Annual Report on Form 10-K filed with the Securities

and Exchange Commission (the “SEC”), are first being mailed or made available to our shareholders on or about January

4, 2022.

This proxy statement summarizes certain

information you should consider before you vote at the Annual Meeting. However, you do not need to attend the Annual Meeting to

vote your shares. If you do not expect to attend or prefer to vote by proxy, you may follow the voting instructions on the enclosed

proxy card. In this proxy statement, Insteel Industries Inc. is generally referred to as “we,” “our,”

“us,” “Insteel Industries,” “Insteel” or “the Company.”

The enclosed proxy card

indicates the number of shares of Insteel common stock that you own as of the record date of December 15, 2021. In this proxy

statement, outstanding Insteel common stock (no par value) is sometimes referred to as the “Shares.”

References to Website

Website addresses and hyperlinks are included

for reference only. The information contained on or available through websites referred to and/or linked to in this proxy statement

(other than the Company’s website to the extent specifically referred to herein as required by SEC rules) is not part of

this proxy solicitation and is not incorporated by reference into this proxy statement or any other proxy materials.

| www.insteel.com |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

8 |

| |

|

Corporate Governance Guidelines and Board Matters

The Board of Directors

Our bylaws provide that our Board of Directors

will have not less than five nor more than 10 directors, with the precise number to be established by resolution of the Board

from time to time. We currently have seven directors. Our Nominating and Governance Committee annually considers whether the size

of the Board is optimal, given its work-load, the Committees on which directors serve and the Company’s size and complexity.

The Board of Directors oversees our business

affairs and monitors the performance of management. In accordance with basic principles of corporate governance, the Board does

not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chairman, our

lead independent director, key executive officers and our principal external advisers (legal counsel, auditors, investment bankers

and other consultants), by reading reports and other materials that are sent to them and by participating in Board and committee

meetings.

At its meeting on August 25, 2009, the Board

of Directors adopted Board Governance Guidelines, which were amended most recently on May 18, 2021. The Board Governance Guidelines

are available on our website at https://investor.insteel.com/corporate-governance/governance-documents.

The Board of Directors, at its meeting on

November 16, 2021, determined that the following members of the Board, which constitute a majority thereof, each satisfy the definition

of “independent director,” as that term is defined under the New York Stock Exchange (“NYSE”) listing

standards: Abney S. Boxley, Anne H. Lloyd, W. Allen Rogers II, Jon M. Ruth, Joseph A. Rutkowski and G. Kennedy Thompson. Our Chairman

and Chief Executive Officer, H.O. Woltz III, is currently our only non-independent director. In addition to considering the objective

independence criteria established by NYSE, the Board also made a subjective determination as to each of these directors that no

transactions, relationships or arrangements exist that, in the opinion of the Board, would interfere with the exercise of the

director’s independent judgment in carrying out his responsibilities as one of our directors. In making these determinations,

the Board reviewed information provided by the directors and us with regard to each director’s business and personal activities

as they may relate to us and our management.

Directors are expected to attend all meetings

of the Board of Directors and all meetings of Board committees on which they serve. The independent directors meet in executive

session with no members of management present before or after each regularly scheduled meeting (see “Executive Sessions”

below). The Board of Directors met four times in fiscal 2021. Each director attended at least 75% of the meetings of the Board

and committees on which he or she served during fiscal 2021.

Director Attendance at Annual Meetings

The Board has determined that it is in our

best interest for all members of the Board of Directors to attend the Annual Meeting of Shareholders. All members of our Board

of Directors attended our 2021 annual meeting.

Committees of the Board

The Audit Committee

The Board has an Audit Committee, which

assists the Board in fulfilling its responsibilities to shareholders concerning our accounting, financial reporting and internal

controls, and facilitates open communication between the Board, outside auditors and management. The Audit Committee discusses

the financial information prepared by management, our internal controls and our audit process with management and with outside

auditors. The Audit Committee is charged with the responsibility of selecting our independent registered public accounting firm.

The independent registered public accounting firm meets with the Audit Committee (both with and without the presence of management)

to review and discuss various matters pertaining to the audit process, including our financial statements, the scope and terms

of its work, the results of its

| |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

9 |

| |

|

|

year-end audit and quarterly reviews, and

its recommendations concerning the financial practices, controls, procedures and policies we employ. The Board has adopted a written

charter for the Audit Committee as well as a Pre-Approval Policy regarding all audits, audit-related, tax and other non-audit

related services to be performed by the independent registered public accounting firm.

The Audit Committee is a separately-designated

standing Audit Committee established in accordance with section 3(a) (58)(A) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), that consists of directors Lloyd, Rogers and Thompson. Mr. Thompson served as chair of the Audit

Committee during fiscal 2021. The Board, at its meeting in November 2021, determined that each of the members of the Audit Committee

meets the definition of “independent director” and certain audit committee-specific independence requirements under

NYSE rules and SEC requirements. At the same meeting, the Board also determined that each of Mr. Rogers, Mr. Thompson and

Ms. Lloyd qualify as an “Audit Committee Financial Expert” as defined under SEC rules. The Board of Directors has

also determined that each of the Audit Committee members is financially literate as such qualification is interpreted in the Board’s

judgment. The functions of the Audit Committee are further described herein under “Report of the Audit Committee.”

The Audit Committee met six times during fiscal 2021, and members of the Audit Committee consulted with management of the Company,

the internal auditor and the independent registered public accounting firm at various times throughout the year. The charter for

the Audit Committee, as most recently revised on February 16, 2021, is available on our website at https://investor.insteel.com/corporate-governance/

governance-documents.

The Executive Compensation Committee

The Executive Compensation Committee is

responsible for (i) determining appropriate compensation levels for our executive officers, including any employment, severance

or change in control arrangements; (ii) evaluating officer and director compensation plans, policies and programs; (iii) reviewing

benefit plans for officers and employees; and (iv) producing an annual report on executive compensation for inclusion in the proxy

statement.

The Executive Compensation Committee Report

is included in this proxy statement. The Executive Compensation Committee also reviews, approves and administers our incentive

compensation plans and equity-based compensation plans and has sole authority for making awards under such plans, including their

timing, valuation and amount. In addition, the Executive Compensation Committee reviews and recommends the structure and level

of outside director compensation to the full Board. The Executive Compensation Committee has the discretion to delegate any of

its authority to a subcommittee, but did not do so during fiscal 2021. The Executive Compensation Committee is chaired by Mr.

Ruth and includes directors Boxley, Lloyd, Rutkowski and Thompson. The Executive Compensation Committee met three times during

fiscal 2021. At its meeting in November 2021, the Board of Directors determined that each of the members of the Executive Compensation

Committee meets the definition of “independent director” and certain compensation committee-specific independence

requirements under NYSE rules and SEC requirements. The charter of the Executive Compensation Committee, as most recently revised

on February 16, 2021, is available on our website at https://investor.insteel.com/corporate-governance/governance-documents.

The Executive Compensation Committee consults

with members of our executive management team on a regular basis regarding our executive compensation program. Our executive compensation

program, including the role members of our executive management team and outside compensation consultants play in assisting with

establishing compensation, is discussed in more detail below under “Executive Compensation - Compensation Discussion and

Analysis.” Our Executive Compensation Committee has retained Pearl Meyer & Partners, LLC to serve as its outside

consultant during fiscal 2021.

The Nominating and Governance Committee

The Nominating and Governance Committee

is responsible for establishing Board membership criteria, identifying individuals qualified to become Board members consistent

with such criteria and recommending nominations of individuals for director when openings exist, recommending the appointment

of Board committee members and chairs, and reviewing corporate governance issues. Specifically, this Committee periodically reviews

our classified board structure, our director election qualifications and procedures, and makes recommendations as appropriate

to our Board.

The Committee also reviews and recommends

changes as necessary to the Board Governance Guidelines and our Code of Business Conduct and facilitates an annual Board self-assessment

process.

The Nominating and Governance Committee,

which consists of Messrs. Rogers, Boxley, Ruth and Rutkowski, met four times during fiscal 2021. The Nominating and Governance

Committee was chaired by Mr. Rutkowski during fiscal 2021. The Board of Directors, at its meeting in November 2021, determined

that each of the members of the Nominating and Governance Committee meets the definition of “independent director”

as that term is defined under NYSE rules. The charter of the Nominating and Governance Committee, as most recently revised on

February 16, 2021, is available on our website at https://investor.insteel.com/corporate-governance/governance-documents.

| www.insteel.com |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

10 |

| |

|

Executive Sessions

Pursuant to the listing standards of NYSE,

the independent directors are required to meet regularly in executive sessions. Generally, those sessions are chaired by the lead

independent director. During fiscal 2021, the lead independent director was W. Allen Rogers II. During the Board’s

executive sessions, the lead independent director has the power to lead the meeting, set the agenda and determine the information

to be provided. During fiscal 2021, the Board held four executive sessions.

The lead independent director can be contacted

by writing to Lead Independent Director, Insteel Industries Inc., c/o Secretary, 1373 Boggs Drive, Mount Airy, North Carolina

27030. We screen mail addressed to the lead independent director for security purposes and to ensure that it relates to discrete

business matters that are relevant to the Company. Mail that satisfies these screening criteria will be forwarded to the lead

independent director.

Board Governance Guidelines

In conjunction with the Board’s establishment

of the Nominating and Governance Committee in 2009, the Board adopted Board Governance Guidelines to set forth the framework pursuant

to which the Board governs the Company. Among other things, the Board Governance Guidelines describe the expectations regarding

attendance at the Annual Meeting and at Board meetings, require regular meetings of independent directors in executive session,

describe the functions of the Board’s standing committees, including an annual self-assessment process facilitated by the

Nominating and Governance Committee, and set forth the procedure pursuant to which shareholders may communicate with directors.

Our Board Governance Guidelines provide that a director who fails to receive a majority of the shares voted in an uncontested

election shall tender his or her resignation to the board, within 10 days of the certification of election results. The Nominating

and Governance Committee will consider the tendered resignation and recommend to the Board the action to be taken with respect

to the resignation. The Board will act on the tendered resignation, taking into account such recommendation, and publicly disclose

its decision regarding the tendered resignation within 90 days from the date of the certification of the election results.

Board Leadership Structure

Our CEO also serves as Chairman of our Board

of Directors, and we have a lead independent director. The Board has determined that this structure is appropriate because it

believes that at this time it is optimal to have one person speak for and lead the Company and the Board, and that the CEO should

be that person. We believe that our lead independent director position, the number and strength of our independent directors and

our overall governance practices minimize any potential conflicts that otherwise could result from combining the positions of

Chairman and CEO.

The lead independent director presides at

meetings of our independent directors, which are held prior to or following all of our regularly scheduled Board meetings. As

noted above, the lead independent director may call for other meetings of the independent directors or of the full Board if he

deems it necessary. The lead independent director also consults with the Chairman regarding meeting agendas, and serves as the

principal liaison between the independent directors and the Chairman.

Risk Oversight

Our Board has overall responsibility for

risk oversight. The Board as a whole exercises its oversight responsibilities with respect to strategic, operational and competitive

risks, as well as risks related to crisis management and executive succession issues. The Board has delegated oversight of certain

other types of risks to its committees. The Audit Committee oversees our policies and processes related to our financial statements

and financial reporting, risks relating to our capital, credit and liquidity status, and risks related to related person transactions.

The Executive Compensation Committee oversees risks related to our compensation programs and structure, including our ability

to motivate and retain talented executives and other employees. The Nominating and Governance Committee oversees risks related

to our governance structure and succession planning for Board membership. Beginning in fiscal 2010, we instituted a formal process

in which the major business risks facing the company are identified and assessed, and appropriate strategies are identified to

respond to such risks. This risk assessment process is conducted and reviewed with the Board on an ongoing basis.

The Board believes that its ability to oversee

risk is enhanced by having one person serve as the Chairman of the Board and CEO. With his in-depth knowledge and understanding

of the Company’s operations, Mr. Woltz as Chairman and CEO is better able to bring key strategic and business issues and

risks to the Board’s attention than would a non-executive Chairman of the Board.

| |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

11 |

| |

|

|

Code of Business Conduct

Consistent with the Board’s commitment

to sound corporate governance, the Board adopted a Code of Business Conduct (the “Code of Conduct”) in 2003, which

applies to all of our employees, officers and directors. The Code of Conduct was amended on February 16, 2021. The Code of Conduct

incorporates an effective reporting and enforcement mechanism. The Board has adopted this Code of Conduct as its own standard.

We adopted the Code of Conduct to help employees, officers and directors understand our standard of ethical business practices

and to promote awareness of ethical issues that may be encountered in carrying out their responsibilities. We include the Code

of Conduct in an employment manual, which is supplied to all of our employees and officers and in a Board of Directors Manual

for directors, each of whom are expected to read and acknowledge in writing that they understand the policies set forth in the

Code.

Stock Ownership Guidelines

We have stock ownership guidelines that

apply to our directors and executive officers. Under the guidelines, the CEO is expected to own Company stock valued at three

times his annual salary, while our other executive officers are expected to own stock valued at one-and-one-half times their annual

salary. A newly-appointed executive officer would have five years to comply from the date upon which he or she becomes covered

under the guidelines. Directors are required to own three times their annual cash retainers, and have three years from the date

they joined the Board in which to comply. All directors and executive officers who have the respective minimum service times in

their positions are in compliance with our guidelines.

Policy Regarding Hedging or Pledging

of Insteel Stock

We also have a policy prohibiting Insteel

directors and officers who are subject to Section 16 reporting requirements (“Section 16 Officers”) from entering

into financial transactions designed to hedge or offset any decrease in the market value of our stock. In addition, the policy

requires that directors and Section 16 Officers pre-disclose to the Board any intention to enter into a transaction involving

the pledge or other use of our stock as collateral to secure personal loans. As of the record date, December 15, 2021, no current

directors or Section 16 Officers have pledged any shares of Insteel Common Stock.

Availability of Bylaws, Board Governance

Guidelines, Code of Conduct and Committee Charters

Our Bylaws, Board Governance Guidelines,

Code of Business Conduct, Audit Committee Charter, Audit Committee Pre-Approval Policy, Executive Compensation Committee Charter

and Nominating and Governance Committee Charter are available on our website at https://investor.insteel.com/corporate-governance/governance-documents, and in print to any shareholder upon written request to our Secretary.

Corporate Responsibility

We are committed to operating our business

responsibly and creating long-term value for our shareholders. We fulfill our commitment to creating long-term value by striving

to operate our business in a sustainable way, since long-term success requires that we maintain a healthy and satisfied workforce,

protect the environment of the communities in which we operate and conserve natural resources.

Our Board and Board committees review with

management our programs related to maintenance of safe operations of our workforce, management succession, compensation and benefits,

compliance with legal and regulatory requirements, compliance with our Code of Conduct and other topics relevant to the responsible

and sustainable operation of the Company. Safe operations with zero harm to employees, the environment and Company assets is a

key goal and is the first item covered at our meetings of senior management and the first item covered in

| www.insteel.com |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

12 |

| |

|

each business operations report that management

provides at board meetings. While we are proud that we maintain an OSHA recordable injury average significantly lower than the

average for our industry, we continually strive to attain our goal of zero harm.

We have continued to operate our factories

and our business during the global COVID-19 pandemic. While we instituted numerous safety protocols and made substantial changes

in many aspects of our business, we had no significant furloughs or reductions in force due to the pandemic, and in fact increased

our total employment from 881 at the beginning of fiscal 2021 to 913 at the end of fiscal 2021. On July 13, 2021, we announced

that, in recognition of the work of our employees during the pandemic, a special award of $1,000 would be paid to substantially

all of our employees on December 3, 2021.

For additional information on our approach

to environmental and human capital issues, please see our website at www.insteel.com and our Annual Report on Form 10-K for fiscal

2021.

Shareholder Recommendations and Nominations

The Nominating and Governance Committee

Charter provides that the Committee will review the qualifications of any director candidates that have been properly recommended

to the Committee by shareholders. Shareholders should submit any such recommendations in writing c/o Insteel Industries Inc.,

1373 Boggs Drive, Mount Airy, North Carolina 27030, Attention: Secretary. In addition, in accordance with our bylaws, any shareholder

entitled to vote for the election of directors at the applicable meeting of shareholders may nominate persons for election to

the Board if such shareholder complies with the notice procedures set forth in the bylaws and summarized in “Shareholder

Proposals for the 2023 Annual Meeting” below.

Process for Identifying and Evaluating

Director Candidates

Pursuant to its charter and our Board Governance

Guidelines, the Nominating and Governance Committee is responsible for developing and recommending to the Board criteria for identifying

and evaluating candidates to serve as directors. The Committee believes that Insteel benefits by fostering a mix of experienced

directors with a deep understanding of our industry, including its highly cyclical nature, and who will represent the long-term

interests of our shareholders. The criteria considered by the committee in evaluating potential candidates for director include:

| • |

Independence; |

| • |

Leadership experience; |

| • |

Business and financial experience; |

| • |

Familiarity with our industry, customers and suppliers; |

| • |

Integrity; |

| • |

Diverse talents, backgrounds and perspectives; |

| • |

Judgment; |

| • |

Other company board or management relationships; |

| • |

Existing time commitments; and |

| • |

NYSE and other regulatory requirements for the Board and its committees. |

The Board seeks to ensure that its membership

consists of directors who have diverse backgrounds, experience and view-points that are relevant in the context of our highly

cyclical and competitive business but does not have a written diversity policy.

The Board shares the concern of many institutional

shareholders concerning Board diversity as that term relates to race, ethnicity, gender and other factors. While one director

is considered diverse today, the Company has a long history of board diversity that predates the recent high profile of this issue.

One diverse board member served for 24 years prior to her retirement and the other passed away unexpectedly after 19 years of

Board service. Each of these diverse individuals was selected for Board service based on leadership skills, integrity and proven

performance managing in highly cyclical industries. There is currently not an opening on our Board, and the Board does not believe

it is in the best interests of shareholders to expand the size of the Board. As we plan for director succession, we are committed

to a process of identifying diverse candidates who are qualified to serve on our Board.

Communications with the Board of Directors

The Board has approved a process for communicating

with the Board. Shareholders and interested parties can send communications to the Board and, if applicable, to any of its committees

or to specified individual directors in writing c/o Insteel Industries Inc., 1373 Boggs Drive, Mount Airy, North Carolina 27030,

Attention: Secretary.

We screen mail addressed to the Board, its

Committees or any specified individual director for security purposes and to ensure that the mail relates to discrete business

matters that are relevant to our Company. Mail that satisfies these screening criteria is required to be forwarded to the appropriate

director or directors.

| |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

13 |

| |

|

|

Security Ownership of Certain Beneficial Owners

On the record date, December 15, 2021, to

our knowledge, no one other than the shareholders listed below beneficially owned more than 5% of the outstanding shares of our

common stock.

| Name

and Address of Beneficial Owner |

|

Number of Shares |

|

Percentage of Shares |

BlackRock, Inc. and affiliates(1)

55 East 52nd Street

New York, NY 10055 |

|

3,009,149 |

|

15.5% |

Franklin Mutual Advisers, LLC and affiliates(2)

101 John F. Kennedy Parkway

Short Hills, NJ 07078-2789 |

|

1,543,224 |

|

8.0% |

T. Rowe Price Associates, Inc.(3)

100 E. Pratt Street

Baltimore, MD 21202 |

|

1,341,037 |

|

6.9% |

The Vanguard Group(4)

100 Vanguard Blvd.

Malvern, PA 19355 |

|

1,220,212 |

|

6.3% |

Dimensional Fund Advisors LP(5)

Building One

6300 Bee Cave Road |

|

1,162,496 |

|

6.0% |

| (1) |

Based upon information set forth in

a Schedule 13G filed with the SEC by BlackRock, Inc. on January 25, 2021 reporting sole power to vote or direct the vote of

2,981,259 shares and sole power to dispose or direct the disposition of 3,009,149 shares. In its Schedule 13G/A, BlackRock,

Inc. reported that the interest of iShares Core S&P Small-Cap ETF in the specified shares is more than 5% of the outstanding

shares of our common stock. |

| (2) |

Based upon information set forth in a Schedule

13G/A filed with the SEC by Franklin Mutual Advisers, LLC on February 4, 2021 reporting sole power to vote or direct the vote

of 1,415,277 shares and sole power to dispose or direct the disposition of 1,543,224 shares. Franklin Mutual Advisers, LLC

disclaimed beneficial ownership of such shares. |

| (3) |

Based upon information set forth in a Schedule

13G/A filed with the SEC by T. Rowe Price Associates, Inc. on February 16, 2021 reporting sole power to vote or direct the

vote of 401,452 shares and sole power to dispose or direct the disposition of 1,341,037 shares. |

| (4) |

Based upon information set forth in a Schedule

13G/A filed with the SEC by The Vanguard Group on February 10, 2021 reporting shared power to vote or direct the vote of 19,958

shares, sole power to dispose or direct the disposition of 1,185,540 shares and shared power to dispose or direct the disposition

of 34,672 shares. |

| (5) |

Based upon information set forth in a Schedule

13G/A filed with the SEC by Dimensional Fund Advisors LP on February 12, 2021 reporting that it or its subsidiaries may possess

sole power to vote or direct the vote of 1,103,002 shares and sole power to dispose or direct the disposition of 1,162,496

shares. Dimensional Fund Advisors LP and its subsidiaries disclaimed beneficial ownership of such shares. |

| www.insteel.com |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

14 |

| |

|

Security Ownership of Directors and Executive Officers

The following table shows the number of

shares of our common stock, beneficially owned on December 15, 2021, the record date, by each of our directors, each of our executive

officers, and by all such directors and executive officers as a group. The table also shows the number of restricted stock units

(“RSUs”) held by each individual and the number of shares of our common stock that each individual had the right to

acquire by exercise of stock options within 60 days after the record date. Beneficial ownership is determined in accordance with

the rules of the SEC. Except as indicated in the footnotes to this table and under applicable community property laws, each shareholder

named in the table has sole voting and dispositive power with respect to the shares set forth opposite the shareholder’s

name. The address of all listed shareholders is c/o Insteel Industries Inc., 1373 Boggs Drive, Mount Airy, North Carolina 27030.

| |

|

Number

of |

|

|

|

Options |

|

|

|

|

| |

|

Shares

of |

|

|

|

Exercisable |

|

|

|

|

| Name

of Beneficial Owner |

|

Common

Stock |

|

RSUs(1) |

|

Within 60 days |

|

Total |

|

% |

| Abney S. Boxley, III |

|

10,498 |

|

2,039 |

|

|

|

10,498 |

|

|

| Anne H. Lloyd |

|

2,716 |

|

2,039 |

|

|

|

2,716 |

|

* |

| W. Allen Rogers II |

|

85,232 |

|

2,039 |

|

|

|

85,232 |

|

* |

| Jon M. Ruth |

|

13,631 |

|

2,039 |

|

|

|

13,631 |

|

* |

| Joseph A. Rutkowski |

|

13,619 |

|

2,039 |

|

|

|

13,619 |

|

* |

| G. Kennedy Thompson |

|

23,182 |

|

2,039 |

|

|

|

23,182 |

|

* |

| H. O. Woltz III(2) |

|

668,874 |

|

38,196 |

|

70,899 |

|

739,773 |

|

3.8 |

| Mark A. Carano |

|

0 |

|

6,764 |

|

2,354 |

|

2,354 |

|

* |

| James F. Petelle |

|

17,746 |

|

9,550 |

|

13,389 |

|

31,135 |

|

* |

| Richard T. Wagner |

|

35,133 |

|

17,506 |

|

54,432 |

|

89,565 |

|

* |

| James R. York |

|

468 |

|

7,003 |

|

11,728 |

|

12,196 |

|

* |

| All

Directors and Executive Officers as a Group (11 Persons) |

|

871,099 |

|

|

|

152,802 |

|

1,023,901 |

|

5.2 |

| (1) |

The economic terms of RSUs are substantially

similar to shares of restricted stock. However, because shares of restricted stock carry voting rights while RSUs do not,

pursuant to SEC rules shares of restricted stock would be included in the “Total” column, while RSUs are not so

included. We show them here because we believe it provides additional information to our shareholders regarding the equity

interests our executive officers and directors hold in the Company. |

| (2) |

Includes 170,610 shares held in various trusts

for which Mr. Woltz serves as co-trustee. Mr. Woltz shares voting and investment power for these shares. He disclaims beneficial

ownership of such shares except to the extent of his pecuniary interest in them. |

| (*) |

Less than 1%. |

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires

our directors, officers and greater than 10% owners to report their beneficial ownership of our common stock and any changes in

that ownership to the SEC, on forms prescribed by the SEC. Specific dates for such reporting have been established by the SEC

and we are required to report in our proxy statement any failure to file such report by the established dates during the last

fiscal year. Based upon our review of the copies of such forms furnished to us for the year ended October 2, 2021, and information

provided to us by our directors, officers and ten percent shareholders, we believe that all forms required to be filed pursuant

to Section 16(a) were filed on a timely basis, except that a single transaction on one Form 4 for Mr. Wagner was filed late due

to administrative error.

| |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

15 |

| |

|

|

Item Number One

Election of Directors

Introduction

Our bylaws, as last amended December 19,

2016, provide that the number of directors, as determined from time to time by the Board, shall be not less than five nor more

than 10, with the precise number to be determined from time to time by resolution of the Board. The Board has most recently set

the number of directors at seven. The bylaws further provide that directors shall be divided into three classes serving staggered

three-year terms, with each class to be as nearly equal in number as possible.

Accordingly, if elected by our shareholders

at this Annual Meeting, Messrs. Ruth and Rutkowski will serve three-year terms expiring at the 2025 Annual Meeting of Shareholders

or until their successors are elected and qualified. Each of the nominees presently serve as our directors. It is not contemplated

that any of the nominees will be unable or unwilling for good cause to serve, but if that should occur, it is the intention of

the agents named in the proxy to vote for election of such other person or persons to serve as a director as the Board may recommend.

If any director resigns, dies or is otherwise unable to serve out his term, or the Board increases the number of directors, the

Board may fill the vacancy until the expiration of such director’s term.

Vote Required

The nominees for director will be elected

by plurality of the votes cast at the meeting at which a quorum representing a majority of all outstanding Shares is present and

voting, either by proxy or in person. This means that the two nominees receiving the highest number of “FOR” votes

will be elected as directors. However, pursuant to the charter of our Nominating and Governance Committee and our Board Governance

Guidelines, a nominee who receives less than a majority of the votes cast in an uncontested election would be required to submit

his or her resignation to the Board. See “Board Governance Guidelines” on p. 11.

Board Recommendation

|

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF THE FOLLOWING TWO

NOMINEES TO SERVE AS DIRECTORS FOR THE TERMS DESCRIBED HEREIN. |

Information Regarding Nominees, Continuing

Directors and Executive Officers

We have set forth below certain information regarding our

nominees for director, our continuing directors and our executive officers. The age shown for each such person is his or her

age on December 15, 2021, our record date.

| |

|

|

|

Executive |

Nominating and |

|

| |

|

Director |

Audit |

Compensation |

Governance |

|

| |

Age |

Since |

Committee |

Committee |

Committee |

Independent |

| Abney S. Boxley III |

63 |

2018 |

|

|

|

Y |

| Anne H. Lloyd |

60 |

2019 |

|

|

|

Y |

| W. Allen Rogers II |

75 |

1986 |

|

|

|

Y |

| Jon M. Ruth |

66 |

2016 |

|

|

|

Y |

| Joseph A. Rutkowski |

66 |

2015 |

|

|

|

Y |

| G. Kennedy Thompson |

71 |

2017 |

|

|

|

Y |

| H. O. Woltz III |

65 |

1986 |

|

|

|

N |

|

Chair |

| www.insteel.com |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

16 |

| |

|

Nominees for Directors with terms expiring at the 2025 Annual

Meeting

JON M. RUTH

Age 66

Director since: 2016

INDEPENDENT

Mr. Ruth retired from Cargill Incorporated,

a global provider of food, agricultural, industrial and financial products and services in August of 2015, following 35 years

of service to Cargill. Mr. Ruth served in various senior executive positions with Cargill, most recently as vice president leading

its SAP enterprise resource planning implementation across its businesses in Europe and North America from 2005 to 2015,

as a director of North Star BlueScope Steel, a joint venture between Cargill and BlueScope Steel from 2004 to 2015, and as President

of North Star Steel from 2003 to 2005. Our Board determined that he should continue to serve as director because of his extensive

experience as a senior executive of a large multi-national company with specific experience in the steel industry.

Committee Memberships:

| • |

Executive Compensation Committee (Chair) |

| • |

Nominating and Governance Committee |

JOSEPH A. RUTKOWSKI

Age 66

Director since: 2015

INDEPENDENT

Mr. Rutkowski has been a Principal at Winyah

Advisors LLC, a management consulting firm, since 2010. Previously, Mr. Rutkowski spent 21 years at Nucor Corporation (Nucor),

the largest steel producer in the United States. Mr. Rutkowski began his career with Nucor in 1989, most recently serving as Executive

Vice President of Business Development, International and North America, for Nucor from November 1998 until his retirement on

February 28, 2010. He served as Vice President of Nucor from 1993 to 1998 and previously as General Manager of a number of Nucor

steel mills. Our Board determined that he should continue to serve as a director because of his extensive background as a senior

executive in the steel industry and because he also contributes his experience as a current director of Cenergy Holdings S.A.,

a Belgian company, and as a former director of Cleveland Cliffs, Inc., a U.S. public company.

Committee Memberships:

| • |

Executive Compensation Committee |

| • |

Nominating and Governance Committee (Chair) |

Current Directorship:

Continuing Directors with terms expiring

at the 2023 Annual Meeting

ABNEY S. BOXLEY,

III

Age 63

Director since: 2018

INDEPENDENT

Mr. Boxley was an employee of Boxley Materials

Company beginning in 1980, and president and CEO of that company from 1988 until its acquisition by Summit Materials Inc. in 2016.

Mr. Boxley currently serves as Summit Materials’ Executive Vice President. In addition to our Board, Mr. Boxley serves on

the boards of two other public companies: Pinnacle Financial Partners, Inc. and RGC Resources, Inc., as well as on a number of

non-profit boards. Our board determined that Mr. Boxley should continue to serve as a director because of his in-depth knowledge

of the construction aggregates business, a business that is related to ours, and because he brings to our board his experience

as a CEO of a substantial business enterprise and his experience as a director of two other public companies.

Committee Memberships:

| • |

Executive Compensation Committee |

| • |

Nominating and Governance Committee |

Current Directorships:

| • |

Pinnacle Financial Partners, Inc. |

| • |

RGC Resources, Inc. |

ANNE H. LLOYD

Age 60

Director since: 2019

INDEPENDENT

Ms. Lloyd served as Executive Vice President

and Chief Financial Officer of Martin Marietta Materials, Inc., a publicly traded global supplier of building materials, from

2005 until her retirement in 2017. She joined Martin Marietta in 1998 as Vice President and Controller and was named Chief Accounting

Officer in 1999. Ms. Lloyd currently serves as a director of Highwood Properties, Inc., a publicly traded company and as a director

of James Hardie Industries p.l.c., an Irish publicly traded company. We believe that Ms. Lloyd should continue to serve as a director

because of her financial expertise, her deep knowledge of the construction aggregates business, a business that is related to

ours, and because of her extensive public-company experience, including as a director of two other public companies.

Committee Memberships:

| • |

Audit Committee |

| • |

Executive Compensation Committee |

Current Directorships:

| • |

Highwood Properties, Inc. |

| • |

James Hardie Industries p.l.c. |

| |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

17 |

| |

|

|

W. ALLEN ROGERS

II

Age 75

Director since: 1986

INDEPENDENT

Mr. Rogers is a Principal of Ewing Capital

Partners, LLC, an investment banking firm founded in 2003 and a partner in Peter Browning Partners, LLC, a provider of advisory

services to public-company boards. From 2002 to 2003, he was a Senior Vice President of Intrepid Capital Corporation, an investment

banking and asset management firm. From 1998 until 2002, Mr. Rogers was President of Rogers & Company, Inc., a private

investment banking boutique. From 1995 through 1997, Mr. Rogers served as a Managing Director of KPMG BayMark Capital LLC,

and the investment banking practice of KPMG. Mr. Rogers served as Senior Vice President – Investment Banking of Interstate/Johnson

Lane Corporation from 1986 to 1995 and as a member of that firm’s Board of Directors from 1990 to 1995. He is a director

of Ewing Capital Partners, LLC, a private company. Mr. Rogers serves as our Lead Independent Director. Our Board determined that

Mr. Rogers should continue to serve as a director due to his expertise in public capital markets, investment banking and finance,

some of which is attributable to his participation as an investment banker in our initial public offering, as well as his expertise

in public-company governance.

Committee Memberships:

| • |

Audit Committee |

| • |

Nominating and Governance Committee |

Current Directorship:

| • |

Ewing Capital Partners, LLC |

Continuing Directors with terms expiring

at the 2024 Annual Meeting

H. O. WOLTZ III

Age 65

Director since: 1986

Mr. Woltz is our Chairman, President and

Chief Executive Officer, having been employed by us and our subsidiaries in various capacities since 1978. He was named President

and Chief Operating Officer in 1989, CEO in 1991 and Chairman of the Board in February 2009. He served as our Vice President from

1988 to 1989 and as President of Rappahannock Wire Company, formerly a subsidiary of our Company, from 1981 to 1989. He also serves

as President of Insteel Wire Products Company, a current subsidiary of our Company. Mr. Woltz served as President of Florida Wire

and Cable, Inc., also formerly a subsidiary of our Company, until its merger with Insteel Wire Products Company in 2002. He has

been employed by us for 43 years and has been our President for 32 years. Our Board determined that he should continue to serve

as a director because he has an intimate knowledge of our products, manufacturing processes, customers and markets, and draws

on that knowledge to provide the Board with detailed analysis and insight regarding the Company’s performance as well as

extensive knowledge of our industry.

G KENNEDY (“KEN”)

THOMPSON

Age 71

Director since: 2017

INDEPENDENT

Mr. Thompson retired in April 2019 from

Aquiline Capital Partners LLC, a private equity firm investing in the global financial services sector where he had been a partner

since 2009. Prior to joining Aquiline, Mr. Thompson was Chairman, President and Chief Executive Officer of Wachovia Corporation,

a publicly traded regional bank from 1999 to 2008. Previously, Mr. Thompson was the chairman of The Clearing House, The Financial

Services Roundtable and the Financial Services Forum. He is a former president of the International Monetary Conference and was

also president of the Federal Advisory Council of the Federal Reserve Board. Mr. Thompson currently serves as a director of two

other publicly traded companies: Lending Tree, Inc. and Pinnacle Financial Partners, Inc. We determined Mr. Thompson should continue

to serve as a director because of his financial expertise, public company leadership experience and executive management experience.

Committee Memberships:

| • |

Executive Compensation Committee |

| • |

Audit Committee (Chair) |

Current Directorships:

| • |

Lending Tree, Inc. |

| • |

Pinnacle Financial Partners, Inc. |

| www.insteel.com |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

18 |

| |

|

Executive Officers Who Are Not Continuing Directors or Nominees

In addition to Mr. Woltz, the executive

officers listed below were appointed by the Board of Directors to the offices indicated for a term that will expire at the next

annual meeting of the Board of Directors or until their successors are elected and qualify. The next meeting at which officers

will be appointed is scheduled for February 15, 2022, at which each of our executive officers is expected to be reappointed.

Mark A. Carano, 52, has served as

Senior Vice President, Chief Financial Officer and Treasurer since October 2020, and as Vice President, Chief Financial Officer

and Treasurer since joining us in May 2020. Before joining us, Mr. Carano had been employed by Big River Steel, a privately-held

manufacturer of steel products, having served as Chief Financial Officer since April 2019. Prior to Big River Steel, he served

in various senior management finance roles with Babcock & Wilcox Enterprises from June 2013 to October 2018. Mr. Carano

also has 14 years of combined investment banking experience with Bank of America, Merrill Lynch, Deutsche Bank and First Union

Securities.

James F. Petelle, 71, has served

as Vice-President-Administration, Secretary and Chief Legal Officer since October 2020. He joined us in October 2006 and

he was elected Vice President and Assistant Secretary in November 2006 and Vice President - Administration and Secretary

in January 2007. He was previously employed by Andrew Corporation, a publicly-held manufacturer of telecommunications infrastructure

equipment, having served as Secretary from 1990 to May 2006, and Vice President - Law from 2000 to October 2006.

Richard T. Wagner, 62, has served

as Senior Vice President and Chief Operating Officer since October 2020. He joined us in 1992 and has served as Vice President

and General Manager of the Concrete Reinforcing Products Business Unit of our subsidiary, Insteel Wire Products Company, since

1998. He was appointed Vice President of the parent company, Insteel Industries Inc., in February 2007. From 1977 until 1992,

Mr. Wagner served in various positions with Florida Wire and Cable, Inc., a manufacturer of PC strand and galvanized strand products,

which was later acquired by us in 2000.

James R. York, 63, has served as

Senior Vice President, Sourcing and Logistics since October 2020 and as Vice President, Sourcing and Logistics since joining us

in 2018. Prior to Insteel, he served in various senior management roles with Leggett & Platt, a publicly-held manufacturer

of diversified engineered products, from 2002 to 2018, including Group President-Rod and Wire Products, Unit President-Wire Products

and Unit President-Specialty Products. Mr. York served in a range of leadership positions at Bekaert Corporation, A U.S. subsidiary

of N.V. Bekaert A.S. of Belgium, from 1983 to 2002.

| |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

19 |

| |

|

|

Executive Compensation

Compensation Discussion and Analysis

Introduction

This section of our proxy statement provides

you with a description of our executive compensation policies and programs, the decisions made by our Executive Compensation Committee

(the “Committee”) regarding fiscal 2021 compensation for our executive officers and the factors that were considered

in making those decisions. In fiscal 2021, our executive officers consisted of the following individuals:

| H.

O. WOLTZ III |

President and Chief Executive Officer |

| MARK A. CARANO |

Senior Vice President, Chief Financial Officer and Treasurer |

| JAMES F. PETELLE |

Vice President – Administration, Secretary and Chief Legal Officer |

| RICHARD T. WAGNER |

Senior Vice President and Chief Operating Officer |

| JAMES

R. YORK(1) |

Senior Vice President – Sourcing and Logistics |

| (1) |

Mr. York

was appointed an executive officer of the Company on February 16, 2021. |

Results of 2021 Say-On-Pay Vote

At our annual meeting on February 16, 2021,

96% of the shareholders who cast votes voted in favor of our Say-on-Pay proposal. The Committee considered the results of this

vote and believes that the consistent high level of support from our Shareholders for our executive compensation program over

the past several years is a result of the Committee’s commitment to compensating our executive officers in a way that provides

a close linkage between pay and performance.

Compensation Program

Changes for Fiscal 2021

Prior to the compensation changes shown

below, which were effective at the end of the first quarter of fiscal 2021, we most recently adjusted executive officer compensation

in the fourth quarter of fiscal 2018. The Committee does not typically adjust base salaries of our executive officers each

fiscal year, but did make the following adjustments to base salaries during fiscal 2021:

| Executive

Officer |

Previous

Base

Salary Approved

July 15, 2018 |

Current

Base

Salary Approved

December 15, 2020 |

| H. O. Woltz III |

$635,000 |

$675,000 |

| James F. Petelle |

$225,000 |

$250,000 |

| Richard T. Wagner |

$330,000 |

$350,000 |

| James R. York |

$230,000 |

$250,000 |

In addition, in connection with his appointment

as an executive officer of the Company, Mr. York’s targeted annual incentive award under our Return on Capital Incentive

Compensation Plan (“ROCICP”) was increased from 40% of base salary to 60% of base salary. Subsequent to the end of

fiscal 2021, the targeted amount of Mr. York’s annual equity awards was increased from $110,000 to $150,000.

The Committee did not adjust the base salary

of Mr. Carano in fiscal 2021, as his employment with us began May 18, 2020.

| www.insteel.com |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

20 |

| |

|

Business and Financial Performance

During Fiscal 2021

We are the nation’s largest manufacturer

of steel wire reinforcing products for concrete construction applications. As such, our revenues normally are driven by the level

of nonresidential construction activity. We achieved record revenues and earnings during fiscal 2021, due to high levels of demand

for our products and favorable spreads between the cost of steel wire rod, our primary raw material, and average selling prices.

We achieved these record results in the face of continued headwinds from sporadic shortfalls of raw material supplies and staffing

challenges, which adversely impacted our operational efficiency. Highlights of our fiscal 2021 performance are as follows:

| • |

Our revenues increased 25% to $590.6M, while our shipments were essentially flat. |

| • |

Net earnings increased 250% to $66.6M or $3.41 per diluted share. |

| • |

Return on capital, as calculated under our Return on Capital Incentive Compensation Plan (“ROCICP”), was 36.9%. |

| • |

We invested $17.5M in our facilities during fiscal 2021 in support of our ongoing efforts to reduce production costs, enhance our manufacturing capabilities and strengthen our market leadership position. |

| • |

We ended fiscal 2021 debt-free with $89.9M of cash, providing us with ample liquidity to meet our funding requirements and pursue growth opportunities. |

| • |

Following the end of fiscal 2021, our Board again decided to return excess cash to shareholders in the form of a special dividend of $2.00 per share, paid on December 17, 2021. |

How Our Performance

Affected Executive Officers’ Compensation

We design our executive officer compensation

programs to maintain a close alignment between our financial performance and total executive compensation based on the Company’s

return on capital. We believe return on capital is more closely correlated with the creation of shareholder value than any other

performance measurement. For Fiscal 2021, we made short-term incentive payments at the plan maximum of 200% of the targeted amounts,

based on our return on capital.

The alignment between pay and performance

in our programs is reflected in the correlation between the incentive payments under our ROCICP and our financial results. Because

our markets are highly cyclical, we anticipate that the short-term incentive compensation of our executive officers will experience

similar volatility, and we do not apply subjective factors to adjust compensation during periods where our failure to meet our

return on capital targets may be due to factors outside the control of our executive officers. The following chart shows the substantial

variability of our short-term incentive payments to our executive officers over the previous 10 years:

| FY |

Short-Term

Incentive

Payments As Percent

of Target |

Return

on Capital

(As Calculated

Under Our ROCICP) |

| 2012 |

0.0% |

1.4% |

| 2013 |

85.6% |

7.7% |

| 2014 |

140.0% |

10.4% |

| 2015 |

153.1% |

11.1% |

| 2016 |

200.0% |

23.1% |

| 2017 |

163.0% |

12.5% |

| 2018 |

200.0% |

16.6% |

| 2019 |

0.0% |

1.8% |

| 2020 |

85.4% |

9.7% |

| 2021 |

200.0% |

36.9% |

| |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

21 |

| |

|

|

Our Key Compensation Practices

Our Board and the Committee maintain governance

standards applicable to our executive compensation and also maintain active oversight of our program, through the following key

practices:

|

A Committee comprised

solely of independent directors. |

|

An independent compensation consultant that reports to and is directed

by the Committee, and that provides no other services to the Company. |

|

A clawback policy in the event of

a financial restatement. |

|

Change in control payments that are contingent upon a qualifying transaction

and a qualifying termination of employment (commonly referred to as a “Double Trigger”). |

|

Share ownership guidelines. |

|

No tax gross-ups of any kind including for any excise taxes in conjunction

with payments that are contingent upon a change in control. |

|

No significant perquisites. |

|

Award caps that apply to both our

ROCICP and to our long-term incentives. |

|

Mitigation of risk, in that responsible management of our assets is

an integral component of the calculation of annual incentives payable under our ROCICP. |

The remainder of this section of our proxy

statement more fully describes our compensation program.

The Committee believes that the success

of the Company requires experienced leadership that fully understands the realities of Insteel’s challenging business environment

and has demonstrated superior business judgment as well as the ability to effectively manage and operate the business. The Committee’s

goal in developing its executive compensation system has been:

| • |

to attract, motivate and retain executives who will be successful in this environment;

|

| • |

to align executives’ interests with those of our shareholders; and |

| • |

to provide appropriate rewards based on the financial performance of our business. |

The Company is committed to “pay for

performance” at all levels of the organization, and accordingly a substantial proportion of each executive officer’s

total compensation is variable, meaning that it is determined based upon the Company’s financial performance. The Committee

does not have a fixed formula to determine the percentage of pay that should be variable, but reviews the mix between base salary

and variable compensation on an annual basis to ensure that its goal of paying for performance will be achieved.

The Committee also believes it is

critically important to retain executive officers who have demonstrated their value to the Company. Accordingly, several

elements of our compensation system are intended to provide strong incentives for executive officers to remain employed by

us. For example, we provide a non-qualified supplemental retirement benefit to executive officers that requires a minimum of

10 years of service before any benefit vests and 30 years of service to earn the full benefit provided (50% of base salary

per year for 15 years following retirement).

The Committee developed its executive compensation

system with the assistance of an independent consultant, Pearl Meyer & Partners, LLC (“Pearl Meyer”). The consultant

reports directly to the Committee and provides a scope of services that is defined by the Committee.

Consistent with the Committee’s policy,

Pearl Meyer performed no other services for us during fiscal 2021. The Committee is responsible for establishing the CEO’s

compensation, and it reviews and evaluates recommendations from the CEO regarding the compensation of other executive officers.

The Committee regularly meets in executive session without members of management present, and solicits input from its consultant

as necessary during its deliberations. In connection with its engagement of Pearl Meyer, the Committee conducted a conflict of

interest assessment by using the factors applicable to compensation consultants under SEC and NYSE rules. After reviewing these

and other factors, the Committee determined that Pearl Meyer was independent and that its engagement did not present any conflicts

of interest.

| www.insteel.com |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

22 |

| |

|

Following are the features of the compensation

system that support the attainment of the Committee’s fundamental objectives:

| • |

Attract, motivate and retain key executives

by providing total compensation opportunities competitive with those provided to executives employed by companies of a similar

size and/or operating in similar industries. |

| |

In formulating our approach to total compensation each year, the Committee requires its consultant to compile peer group data and benchmark our compensation system against systems of other companies in similar industries, as well as comparably-sized companies in other industries. The objective of our benchmarking process is to provide total compensation opportunities to our executive officers that are near the median of our peer group. Although comparisons to compensation levels in other companies are considered helpful in assessing the overall competitiveness of our compensation practices, the Committee does not believe it needs to adhere precisely to the mathematical median, and it places a relatively greater emphasis on overall compensation opportunities rather than on setting each element of compensation at or near the median for that element. |

| • |

Align executives’

interests with those of our shareholders by closely linking performance-based compensation to corporate performance. |

| |

• |

Annual Incentive. Our primary objective is to create shareholder value. To motivate

our executive officers and align their interests with those of our shareholders, we provide annual incentives, which are designed

to reward them for the attainment of short-term goals, and long-term incentives, which are designed to reward them for increases

in our shareholder value over time. The annual incentive for our executive officers is based entirely on the Company’s

return on capital, which is a measure that incorporates both the generation of earnings and the management of the Company’s

balance sheet and is closely correlated with long-term shareholder returns. |

| |

• |

Long-Term Incentives. Our long-term incentives are entirely equity-based, comprised

of 50% RSUs and 50% stock options. Use of these equity-based incentives ensures that their value is directly linked to changes

in the price of our common stock. Following much consideration, we believe that time-based vesting of equity awards is most

appropriate for us in view of the highly volatile nature of our markets and financial performance, and our policy of making

no subjective adjustments to the annual incentive when we do not achieve our return on capital targets. Our long-term incentive

program does not include a cash component. |

| • |

Encourage long-term

commitment to the Company. |

| |

We believe that the value provided by employees increases over time as they become increasingly knowledgeable about our industry, customers and competitors, as well as our business processes, people and culture. We believe that providing incentives for executive officers to remain with the Company will enhance its long-term value. Accordingly, we include programs such as our Supplemental Retirement Plan (“SRP”) and Change-in-Control Severance Agreements as components of our executive compensation system to provide such incentives. The full benefit under our SRP is not earned until an executive officer is employed by us for 30 years, and the minimum benefit under these agreements requires 10 years of service. We believe that our long-term incentives are also a key element of our effort to ensure retention of our key executives. |

| • |

Administrative

simplicity and direct line of sight to performance. |

| |

Each component of the Company’s compensation program is formulaic and focused on creating short-term and long-term shareholder value. The absence of subjective and behavioral criteria in the plan simplifies administration and promotes clear line of sight for participants between performance and their compensation. |

| |

|

INSTEEL INDUSTRIES

INC. | 2022 Proxy Statement |

|

23 |

| |

|

|

| III. |