false

--12-31

0001755953

0001755953

2023-12-20

2023-12-20

0001755953

KERN:CommonStockParValue0.0001PerShareMember

2023-12-20

2023-12-20

0001755953

KERN:WarrantsToPurchaseCommonStockMember

2023-12-20

2023-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 20, 2023

| AKERNA CORP. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-39096 |

|

83-2242651 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 1550 Larimer Street, #246, Denver, Colorado |

|

80202 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (888) 932-6537

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

KERN |

|

NASDAQ Capital Market |

| Warrants to purchase Common Stock |

|

KERNW |

|

NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On December 20, 2023, Akerna Corp. (the “Company”)

and the signatories (the “Holders”) to its Exchange Agreements, dated January 27, 2023 (the “Exchange Agreements”)

entered into Amendment No. 1 to each such Exchange Agreements (the “Amended Exchange Agreements”), respectively, to amend

the terms of the Exchange Agreements related to the Initial Closing (as defined therein) and the issuance of shares of the Company’s

Series C Non-Convertible Preferred Stock (the “Series C Preferred Stock”) at the Initial Closing.

Specifically, the Amended Exchange Agreements,

amends each Exchange Agreement, respectively, as follows: (i) the ‘Initial Closing Date” under the Exchange Agreement to conduct

the Initial Exchange is December 14, 2023, (ii) the “Exchange Note Amount” was amended to be in no event greater than the

lesser of (x) the aggregate amount then outstanding under the senior secured convertible notes of the Company issued on October 5, 2023

held by the Holder (the “Existing Note”) and (y) such portion of the Maximum Note Amount (as defined in the Exchange Agreement)

that is convertible, pursuant to the terms of the Existing Note (after giving effect to the Conversion Price Adjustment, as defined in

the Exchange Agreement) into such number of Series C Preferred Stock equal to 19.9% of the voting rights of the Company outstanding as

of the time immediately following the issuance of the Series C Preferred Stock issued hereunder and any other issuances of Series C Preferred

Stock being issued to other holders of the Notes under similar Exchange Agreements which will close concurrently with the exchange hereunder

upon the consummation of the Initial Exchange, (iii) as calculated under the terms of the Exchange Agreement, as amended, the Exchange

Note Amount was agreed to be $1,711,000 (the “Actual Exchange Note Amount”), the Exchange Share Amount was agreed to be 3,422,000

shares of Common Stock (the “Actual Exchange Share Amount”) and the number of shares of Series C Preferred Stock having a

stated value of $1,000 per share to be issued to each Holder was agreed to be 1,711 shares of Series C Preferred Stock (“Actual

New Preferred Shares”) each such share of Series C Preferred Stock having the voting equivalent of 2,000 shares of Common Stock,

(iv) Certificate of Designations of the Series C Stock attached as Exhibit B to the Exchange Agreement was amended and restated in the

form of Exhibit A attached to the Amended Exchange Agreements to reflect the actual number of Series C Preferred Stock being issued at

the Initial Closing, change the outside date for Holder redemptions and eliminate provisions regarding automatic redemption/exchange upon

a change of control and (v) the Initial Exchange was consummated on December 14, 2023 pursuant to Section 3(a)(9) of the Securities Act

of 1933, as amended (the “1933 Act”) and the terms set forth in the Amended Exchange Agreement.

The foregoing description of the material terms

of the Amended Exchange Agreements does not purport to be complete and is qualified in its

entirety by reference to the full text of the Amended Exchange Agreements, the form of which is filed as Exhibit 10.1 to the

Current Report on Form 8-K and is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

On December 20, 2023, in connection with the Initial

Closing under the Amended Exchange Agreements, as described in Item 1.01 hereof, the Company issued an aggregate total of 3,244 shares

of Series C Preferred Stock upon exchange of $3,422,000 in principal amount of Existing Notes. Additionally, from October 1, 2023 through

December 20, 2023, the Company issued 550,000 shares of common stock to the holders of the Existing Notes upon conversion of $1,100,000

in principal amount of Existing Notes pursuant to the previously disclosed conversion terms of the Existing Notes, resulting in approximately

$3.14 million in aggregate principal amount of Existing Notes remaining following such conversions and the exchange into Series C Preferred

Stock. The shares of Series C Preferred Stock issued upon exchange of the Existing Notes and the shares of common stock issued upon conversion

of the Existing Notes were issued pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended,

provided by Section 3(a)(9) thereof.

Item 3.03 Material Modification of Rights to Security Holders.

The information

included in Item 5.03 of this Current Report on Form 8-K is also incorporated by reference into this Item 3.03 of this Current Report

on Form 8-K.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year

On December 20, 2023, the

Company filed with the Secretary of the State of Delaware an Amended and Restated Certificate of Designations of Preferences, Rights

and Limitations of the Series C Preferred Stock (the “Amended Certificate of Designations”). The Amended and Restated Certificate

of Designations amended and restated the Certificate of Designations of Preferences, Rights and Limitations of the Series C Preferred

Stock as filed with the Secretary of State of the State of Delaware on December 14, 2023 (the “Original Certificate of Designations”)

as described below. Except as set forth below, the preferences, rights and limitations of the Series C Preferred Stock as set forth in

the Original Certificate of Designation have not been amended, revised or otherwise altered from the description set forth in Item 5.03

of the Company’s Current Report on Form 8-K as filed with the Commission on December 20, 2023, which description is incorporated

herein by reference.

The Amended

and Restated Certificate of Designations amends Section 5(b) of Original Certificate of Designations as follows:

Section

5(b) of the Original Certificate of Designations read in its entirety as follows:

“(b) Automatic

Redemption/Exchange Upon a Change of Control. Notwithstanding Section 5(a), in the event of a Fundamental Transaction that constitutes

a Change of Control, no later than ten (10) Trading Days prior to the time consummation of a Change of Control (the “Change of Control

Date”), but not prior to the public announcement of such Change of Control, the Company shall deliver written notice thereof via

electronic mail and overnight courier to each Holder (a “Change of Control Notice”). If the Required Holders vote to approve

such Change of Control (each, a “Permitted Change of Control”), immediately following the time of occurrence of such Permitted

Change of Control, but in no event later than the second (2nd) Trading Day after such Change of Control, the Preferred Shares of each

Holder then outstanding shall be automatically redeemed and/or exchanged, as applicable, (each a “Change of Control Redemption/Exchange”)

by the Company or the acquiring party (or its designee), as applicable, for an aggregate amount of consideration (whether consisting of

cash, assets or shares, as applicable) (the “Change of Control Redemption/Exchange Consideration”) equal to the product of

(x) as determined in reference to any given holder of one (1) share of Common Stock immediately prior to such Permitted Change of Control,

such aggregate amount of cash, assets, shares and/or other property, as applicable as shall be held by such holder after giving effect

to such Permitted Change of Control and the Change of Control Redemption/Exchange (solely with respect to such one (1) share of Common

Stock held by such holder immediately prior to such Permitted Change of Control) and (y) the Common Stock Per Share Equivalent Amount

of the Preferred Shares subject to such Change of Control Redemption/Exchange by such applicable Holder; provided, however, that to the

extent that such Holder’s right to participate in any such Change of Control Redemption/Exchange would result in such Holder and

its other Attribution Parties exceeding the Maximum Rights Percentage, then such Holder shall not participate in such Change of Control

Redemption/Exchange in excess of the Maximum Rights Percentage (and shall not have beneficial ownership of such shares of Common Stock

(or other equivalent security) as a result of such Change of Control Redemption/Exchange (and beneficial ownership) to such extent of

any such excess) and such remaining portion of such Change of Control Redemption/Exchange Consideration shall be held in abeyance for

the benefit of such Holder until such time or times as its right thereto would not result in such Holder and the other Attribution Parties

exceeding the Maximum Percentage, at which time or times, if any, such Holder shall be granted such remaining portion of such Change of

Control Redemption/Exchange Consideration upon the redemption and/or exchange of such remaining Preferred Shares. The Company agrees not

to consummate any Change of Control without complying with this Section 5(b).”

Section

5(b) of the Amended and Restated Certificate of Designations reads in its entirety as follows:

“(b)

Approval of Change of Control. Notwithstanding Section 5(a), in the event of a Fundamental Transaction that constitutes a Change

of Control, no later than five (5) Trading Days prior to the consummation of a Change of Control (the “Change of Control Date”),

but prior to the public announcement of the consummation of the Change of Control, the Company shall deliver written notice of the Change

of Control via electronic mail and overnight courier to each Holder (the “Change of Control Notice”). The Company agrees not

to consummate the Change of Control unless and until the Required Holders, in their sole discretion, approve the Change of Control, as

evidenced by one or more written consents duly executed by the Required Holders after the date hereof.”

The foregoing

description of the preferences, rights and limitations of the Series C Preferred Stock is qualified in its entirety by the Amended and

Restated Certificate of Designation which is filed as Exhibit 3.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are filed as part of this

report:

| * |

Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request. |

Additional Information

and Where to Find It

This Current Report on

Form 8-K may be deemed to be solicitation material with respect to the proposed transactions between Akerna and Gryphon Digital Mining,

Inc. (‘Gryphon”) and between Akerna and MJ Acquisition Corp. In connection with the proposed transactions, Akerna has filed

relevant materials with the United States Securities and Exchange Commission, or the SEC, including a registration statement on Form S-4

that contains a prospectus and a proxy statement. Akerna will mail the proxy statement/prospectus to the Akerna stockholders, and the

securities may not be sold or exchanged until the registration statement becomes effective. Investors and securityholders of Akerna and

Gryphon are urged to read these materials because they will contain important information about Akerna, Gryphon and the proposed transactions.

This Current Report on Form 8-K is not a substitute for the registration statement, definitive proxy statement/prospectus or any other

documents that Akerna may file with the SEC or send to securityholders in connection with the proposed transactions. Investors and securityholders

may obtain free copies of the documents filed with the SEC on Akerna’s website at www.akerna.com, on the SEC’s website at

www.sec.gov or by directing a request to Akerna’s Investor Relations at (516) 419-9915.

This Current Report on

Form 8-K is not a proxy statement or a solicitation of a proxy, consent or authorization with respect to any securities or in respect

of the proposed transactions, and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of

an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the

Solicitation

Each of Akerna, Gryphon,

MJ Acquisition Corp. and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies

from the stockholders of Akerna in connection with the proposed transactions. Information about the executive officers and directors of

Akerna are set forth in Akerna’s Definitive Proxy Statement on Schedule 14A relating to the 2022 Annual Meeting of Stockholders,

filed with the SEC on April 19, 2022. Other information regarding the interests of such individuals, who may be deemed to be participants

in the solicitation of proxies for the stockholders of Akerna, is set forth in the proxy statement/prospectus included in Akerna’s

registration statement on Form S-4 as filed with the SEC on May 12, 2023, as last amended on December 8, 2023. You may obtain free copies

of these documents as described above.

Cautionary Statements

Regarding Forward-Looking Statements

This Current Report on

Form 8-K contains forward-looking statements based upon the current expectations of Gryphon and Akerna. Actual results and the timing

of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties,

which include, without limitation: (i) the risk that the conditions to the closing of the proposed transactions are not satisfied, including

the failure to timely obtain stockholder approval for the transactions, if at all; (ii) uncertainties as to the timing of the consummation

of the proposed transactions and the ability of each of Akerna, Gryphon and MJ Acquisition Co. to consummate the proposed merger or asset

sale, as applicable; (iii) risks related to Akerna’s ability to manage its operating expenses and its expenses associated with the

proposed transactions pending closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental

or quasi-governmental entity necessary to consummate the proposed transactions; (v) the risk that as a result of adjustments to the exchange

ratio, Akerna stockholders and Gryphon stockholders could own more or less of the combined company than is currently anticipated; (vi)

risks related to the market price of Akerna’s common stock relative to the exchange ratio; (vii) unexpected costs, charges or expenses

resulting from either or both of the proposed transactions; (viii) potential adverse reactions or changes to business relationships resulting

from the announcement or completion of the proposed transactions; (ix) risks related to the inability of the combined company to obtain

sufficient additional capital to continue to advance its business plan; (x) risks associated with the possible failure to realize certain

anticipated benefits of the proposed transactions, including with respect to future financial and operating results and (xi) risks related

to the Panel not granting additional time for Akerna to regain compliance with the listing rules and Akerna being suspended and delisted

from The Nasdaq Capital Market. Actual results and the timing of events could differ materially from those anticipated in such forward-looking

statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in periodic

filings with the SEC, including the factors described in the section titled “Risk Factors” in Akerna’s Annual Report

on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, each filed

with the SEC, and in other filings that Akerna makes and will make with the SEC in connection with the proposed transactions, including

the proxy statement/prospectus described under “Additional Information and Where to Find It.” You should not place undue reliance

on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated in the forward-looking statements.

Except as required by law, Akerna and Gryphon expressly disclaim any obligation or undertaking to update or revise any forward-looking

statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances

on which any such statements are based.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Dated: December 22, 2023 |

AKERNA CORP. |

| |

|

| |

By: |

/s/ Jessica Billingsley |

| |

|

Name: |

Jessica Billingsley |

| |

|

Title: |

Chief Executive Officer |

5

Exhibit 3.1

Exhibit 10.1

AKERNA CORP.

AMENDMENT NO. 1 TO EXCHANGE AGREEMENT

This Amendment No. 1 (the

“Amendment”) to that certain Exchange Agreement, dated January 27, 2023, by and between Akerna Corp., a Delaware corporation

with offices located at 1550 Larimer Street, #246, Denver, Colorado 80202 (the “Company”), and investor signatory thereto

(the “Holder”) (the “Exchange Agreement”), is entered into as of this 20th day of December, 2023,

by and between the Company and the Holder, with reference to the following facts (capitalized terms used but not otherwise defined herein

shall have the meanings as set forth in the Exchange Agreement (as amended hereby) (the “Amended Exchange Agreement”):

A. Prior to the date hereof,

pursuant to that certain Securities Purchase Agreement, dated as of October 5, 2021, by and between the Company and the investors party

thereto (as amended, the “Securities Purchase Agreement”), the Company issued to such investors certain senior secured

convertible notes (the “Notes”).

B. As of the date hereof,

the Holder holds ________ in aggregate principal amount of Notes (the “Existing Note”).

C. Previously, the Company,

Gryphon Digital Mining, Inc. (“Gryphon”) and Akerna Merger Co., a Delaware corporation (“Merger Sub”),

entered into an Agreement and Plan of Merger, dated January 27, 2023 (the “Merger Agreement”), pursuant to which

Merger Sub will merge with and into Gryphon (the “Merger”), with Gryphon surviving the Merger as a wholly owned subsidiary

of the Company.

D. In connection with the

entry by the Company and Gryphon into the Merger Agreement, the Company and the Holder entered into an Exchange Agreement dated January

27, 2023 (the “Exchange Agreement”) and authorized a new series of Preferred Stock of the Company designated as Series

C Preferred Stock the terms of which are set forth in the certificate of designation for such series of Preferred Stock (the “New

Certificate of Designation”) in the form attached as Exhibit B to the Exchange Agreement (together with any shares

of Series C Preferred Stock issued in replacement thereof in accordance with the terms thereof, the “Series C Preferred Stock”).

F. Under the terms of the

Exchange Agreement, subject to the satisfaction of the conditions set forth therein, the Holder agreed to exchange (the “Initial

Exchange”) up to such maximum aggregate Conversion Amount (as defined in the Existing Note) of the Existing Note as set forth

on the signature page of the Holder attached to the Exchange Agreement (the “Maximum Note Amount”), but in no event

greater than the lesser of (x) the aggregate amount then outstanding under the Existing Note and (y) such portion of the Maximum Note

Amount that is convertible, pursuant to the terms of the Existing Note (after giving effect to the Conversion Price Adjustment, as defined

in the Exchange Agreement), into 19.9% of the common stock of the Company (“Common Stock”) outstanding as of the date

of consummation of the Initial Exchange (such lesser amount, the “Exchange Note Amount,” and the aggregate number of

shares of Common Stock then issuable upon conversion of the Exchange Note Amount immediately prior to giving effect to the Exchange, the

“Exchange Share Amount”) into such aggregate number of shares of Series C Preferred Stock (the “New Preferred

Shares”) with an aggregate voting power and economic value equal to the Exchange Share Amount.

G. The parties desire to amend

the Exchange Agreement as follows (collectively, the “Amendments”): (i) the ‘Initial Closing Date” under

the Exchange Agreement to conduct the Initial Exchange shall be the date hereof, (ii) the “Exchange Note Amount” shall be

amended to be in no event greater than the lesser of (x) the aggregate amount then outstanding under the Existing Note and (y) such portion

of the Maximum Note Amount that is convertible, pursuant to the terms of the Existing Note (after giving effect to the Conversion Price

Adjustment, as defined in the Exchange Agreement) into such number of Series C Preferred Stock equal to 19.9% of the voting rights of

the Company outstanding as of the time immediately following the issuance of the Series C Preferred Stock issued hereunder and any other

issuances of Series C Preferred Stock being issued to other holders of the Notes under similar Exchange Agreements which will close concurrently

with the exchange hereunder upon the consummation of the Initial Exchange, (iii) as calculated under the terms of the Exchange Agreement,

as amended hereby, the Exchange Note Amount is $1,711,000 (the “Actual Exchange Note Amount”), the Exchange Share Amount

is 3,422,000 shares of Common Stock (the “Actual Exchange Share Amount”) and the number of shares of Series C Preferred

Stock having a stated value of $1,000 per share to be issued to the Holder will be 1,711 shares of Series C Preferred Stock (“Actual

New Preferred Shares”) each such share of Series C Preferred Stock having the voting equivalent of 2,000 shares of Common Stock,

(iii) Exhibit B to the Exchange Agreement shall be amended and restated in the form of Exhibit A attached hereto to reflect the actual number of Series C Preferred Stock being issued, change the outside date of Holder redemptions and eliminate provisions

regarding automatic redemption/exchange upon a change of control and (iv)

Initial Exchange shall be consummated on the date hereof pursuant to Section 3(a)(9) of the Securities Act of 1933, as amended (the “1933

Act”) and the terms set forth in the Amended Exchange Agreement.

NOW, THEREFORE,

in consideration of the foregoing premises and the mutual covenants hereinafter contained, the sufficiency of which is acknowledged

by the parties, the parties hereto agree as follows:

1. Amendments;

Initial Closing. Effective upon the execution and delivery of this Agreement, the Amendments

shall be effective and the Initial Closing shall occur in accordance with the terms and conditions of the Amended Exchange Agreement.

2. Acknowledgment.

The Company hereby confirms and agrees that (i) except with respect to the Amendments set forth in Sections 1 above that are effective

upon the execution and delivery of this Agreement, the Exchange Agreement shall continue to be, in full force and effect and is hereby

ratified and confirmed in all respects, except that on and after the date hereof: (a) all references in the Securities Purchase Agreement

or Exchange Agreement to “this Agreement,” “hereto,” “hereof,” “hereunder” or words of

like import referring to such agreements shall mean the Securities Purchase Agreement as amended by the Exchange Agreement and as further

amended by this Amendment, and (b) all references in the other Transaction Documents to the “Securities Purchase Agreement,”

“thereto,” “thereof,” “thereunder” or words of like import referring to the Securities Purchase Agreement

shall mean the Securities Purchase Agreement as amended by the Exchange Agreement and as further amended by this Amendment; (ii) the execution,

delivery and effectiveness of this Amendment shall not operate as an amendment, modification or waiver of any right, power or remedy of

the Holder except to the extent expressly set forth and the Holder does not hereby waive any of the conditions set forth in the Exchange

Agreement for the Initial Closing to occur.

3. The

Company’s Representations and Warranties. The Company hereby represents and warrants to the Holder

that the following representations are true and complete as of the date hereof.

A. Organization

and Standing. The Company is a corporation duly organized and validly existing under the laws of the State of Delaware and is in good

standing as a corporation under the laws of Delaware.

B. Authorization.

The Company’s execution, delivery, and performance of this Amendment has been duly authorized by all requisite corporate action,

and this Amendment constitutes the Company’s legal, valid, and binding obligation, enforceable in accordance with its terms, subject

to applicable bankruptcy, insolvency, reorganization or similar laws relating to or affecting the enforcement of creditors’ rights.

The Company’s execution, delivery, and performance of this Amendment, and the Company’s compliance with the provisions of

this Amendment, do not conflict with, or result in a breach or violation of the terms, conditions, or provisions of, or constitute a default

(or an event with which the giving of notice or passage of time, or both could result in a default) under, or result in the creation or

imposition of any lien pursuant to the terms of, the Company’s Certificate of Incorporation, as currently in effect, or the Company’s

Bylaws.

C. Company

Bring Down. Except as set forth on Schedule 3(C) attached hereto, the Company hereby makes the representations and warranties to the

Holder as set forth in Section 7 of the Exchange Agreement (as amended hereby) as if such representations and warranties were made as

of the date hereof as set forth in their entirety in this Amendment, mutatis mutandis. Such representations and warranties to the

transactions thereunder and the securities issued pursuant thereto are hereby deemed for purposes of this Amendment to be references to

the transactions hereunder and the issuance of the securities pursuant hereto, references therein to “Initial Closing Date”

being deemed references to the date hereof, and references to “the date hereof” being deemed references to the date of this

Amendment.

D. Initial

Closing Conditions. The Company hereby represents to the Holder that all of the conditions for the Initial Closing under the Exchange

Agreement have been fulfilled as of the date hereof.

E. Principal

Amount of Notes following Initial Closing. The Company hereby represents and agrees that following the Initial Closing hereunder the

aggregate principal amount of Notes held by the Holder will be _______________.

4. Holder’s

Representations and Warranties. The Holder represents and warrants to the Company with respect to the

transactions contemplated by this Amendment as follows:

A. Right,

Title, and Interest. The Holder is the lawful owner of the Existing Note, has good and marketable title to the Existing Note, and

has all right, title, and interest in and to the Existing Note. The Existing Note is free and clear of all liens, encumbrances, equities,

security interests, and any other claims whatsoever. No third-party has any right to prevent the Holder from converting the Existing Note

as contemplated by this Amendment, and no third-party has any right to receive notice of the conversion of the Existing Note as contemplated

by this Amendment. The Holder is not aware of any basis for any disputes or challenges regarding the Holder’s ownership of the Existing

Note and no such disputes or challenges are pending or alleged.

B. Authorization.

The Holder has full power and authority to enter into this Amendment. All action on the part of the Holder necessary for the authorization,

execution, delivery and performance of this Amendment, and the performance of all of the Holder’s obligations under this Amendment,

has been taken or will be taken prior to the effectiveness of the Agreement. This Agreement, when executed and delivered by the Holder,

will constitute valid and legally binding obligations of the Holder, enforceable in accordance with their terms.

5. Miscellaneous.

A. Disclosure

of Transaction. The Company shall, on or before 8:30 a.m., New York City time, on or prior to the first Business Day after the date

of this Amendment, file a Current Report on Form 8-K describing the terms of the transactions contemplated hereby in the form required

by the 1934 Act and attaching this Amendment and the Certificate of Designation for the Series C Preferred Stock as exhibits to such filing

(excluding schedules, the “8-K Filing”). From and after the filing of the 8-K Filing, the Company shall have disclosed

all material, non-public information (if any) provided up to such time to the Holder by the Company or any of its Subsidiaries or any

of their respective officers, directors, employees or agents. In addition, upon the filing of the 8-K Filing, the Company acknowledges

and agrees that any and all confidentiality or similar obligations under any agreement with respect to the transactions contemplated by

this Amendment or as otherwise disclosed in the 8-K Filing, whether written or oral, between the Company, any of its Subsidiaries or any

of their respective officers, directors, affiliates, employees or agents, on the one hand, and any of the Holder or any of their affiliates,

on the other hand, shall terminate. Neither the Company, its Subsidiaries nor the Holder shall issue any press releases or any other public

statements with respect to the transactions contemplated hereby; provided, however, the Company shall be entitled, without

the prior approval of the Holder, to issue a press release or make such other public disclosure with respect to such transactions (i)

in substantial conformity with the 8-K Filing and contemporaneously therewith or (ii) as is required by applicable law and regulations

(provided that in the case of clause (i) the Holder shall be consulted by the Company in connection with any such press release or other

public disclosure prior to its release). For the avoidance of doubt, the foregoing sentence shall not apply to any press release or other

public statement solely with respect to the Merger Agreement and the transactions contemplated thereby and without any reference to the

Holder or this Amendment. Without the prior written consent of the Holder (which may be granted or withheld in the Holder’s sole

discretion), except as required by applicable law, the Company shall not (and shall cause each of its Subsidiaries and affiliates to not)

disclose the name of the Holder in any filing, announcement, release or otherwise. Notwithstanding anything contained in this Amendment

to the contrary and without implication that the contrary would otherwise be true, the Company expressly acknowledges and agrees that

the Holder shall not have (unless expressly agreed to by the Holder after the date hereof in a written definitive and binding agreement

executed by the Company and the Holder (it being understood and agreed that no Other Holder may bind the Holder with respect thereto)),

any duty of confidentiality with respect to, or a duty not to trade on the basis of, any material, non-public information regarding the

Company or any of its Subsidiaries

B. Fees.

The Company shall reimburse Kelley Drye & Warren, LLP (counsel to the lead Holder) in an aggregate non-accountable amount of $5,000

(the “Legal Fee Amount”) for costs and expenses incurred by it in connection with drafting and negotiation of this

Amendment; provided, that the Company shall promptly reimburse Kelley Drye & Warren LLP on demand for any additional reasonable and

documented fees and expenses not so reimbursed through such withholding at each Closing. Each party to this Amendment shall bear its own

expenses in connection with the structuring, documentation, negotiation and closing of the transactions contemplated hereby, except as

provided in the previous sentence, and except that the Company shall be responsible for the payment of any placement agent’s fees,

financial advisory fees, transfer agent fees, Depository Trust Company (“DTC”) fees relating to or arising out of the

transactions contemplated hereby.

C. Independent

Nature of Holder’s Obligations and Rights. The obligations of the Holder under this Amendment are several and not joint with

the obligations of any other holder of securities of the Company (each, an “Other Holder”), and the Holder shall not

be responsible in any way for the performance of the obligations of any Other Holder under any other agreement by and between the Company

and any Other Holder (each, an “Other Agreement”). Nothing contained herein or in any Other Agreement, and no action

taken by the Holder pursuant hereto, shall be deemed to constitute the Holder and Other Holders as a partnership, an association, a joint

venture or any other kind of entity, or create a presumption that the Holder and Other Holders are in any way acting in concert or as

a group with respect to such obligations or the transactions contemplated by this Amendment or any Other Agreement and the Company acknowledges

that, to the best of its knowledge, the Holder and the Other Holders are not acting in concert or as a group with respect to such obligations

or the transactions contemplated by this Amendment or any Other Agreement. The Company, and the Holder confirm that the Holder has independently

participated in the negotiation of the transactions contemplated hereby with the advice of its own counsel and advisors. The Holder shall

be entitled to independently protect and enforce its rights, including, without limitation, the rights arising out of this Amendment,

and it shall not be necessary for any Other Holder to be joined as an additional party in any proceeding for such purpose.

D. Notices.

Any notices, consents, waivers or other communications required or permitted to be given under the terms of this Amendment must be in

writing and will be deemed to have been delivered: (i) upon receipt, when delivered personally; (ii) upon delivery, when sent by electronic

mail; or (iii) one Trading Day after deposit with an overnight courier service, in each case properly addressed to the party to receive

the same. The addresses and e-mail addresses for such communications shall be as set forth on the signature pages attached hereto or to

such other address and/or e-mail address and/or to the attention of such other Person as the recipient party has specified by written

notice given to each other party five (5) days prior to the effectiveness of such change. Written confirmation of receipt (A) given by

the recipient of such notice, consent, waiver or other communication, (B) mechanically or electronically generated by the sender’s

e-mail containing the time, date and copy of the message or (C) provided by an overnight courier service shall be rebuttable evidence

of personal service, receipt by electronic mail or receipt from an overnight courier service in accordance with clause (i), (ii) or (iii)

above, respectively.

E. Successors

and Assigns. Except as otherwise provided herein, the terms and conditions of this Amendment shall inure to the benefit of and be

binding upon the parties hereto and the respective successors and assigns of the parties. Nothing in this Amendment, express or implied,

is intended to confer upon any party, other than the parties hereto or their respective successors and assigns, any rights, remedies,

obligations or liabilities under or by reason of this Amendment, except as expressly provided in this Amendment.

F. Governing

Law. All questions concerning the construction, validity, enforcement and interpretation of this Amendment shall be governed by the

internal laws of the State of New York, without giving effect to any choice of law or conflict of law provision or rule (whether of the

State of New York or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of

New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state or federal courts sitting in The City of New

York, Borough of Manhattan, for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated

hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that

it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding is brought in an inconvenient

forum or that the venue of such suit, action or proceeding is improper. Each party hereby irrevocably waives personal service of process

and consents to process being served in any such suit, action or proceeding by mailing a copy thereof to such party at the address for

such notices to it under this Amendment and agrees that such service shall constitute good and sufficient service of process and notice

thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law. EACH

PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER

OR IN CONNECTION WITH OR ARISING OUT OF THIS AGREEMENT OR ANY TRANSACTION CONTEMPLATED HEREBY..

G. Severability.

If one or more provisions of this Amendment are held to be unenforceable under applicable law, such provision shall be excluded from this

Amendment and the balance of the Agreement shall be interpreted as if such provision were so excluded and shall be enforceable in accordance

with its terms so long as this Amendment as so modified continues to express, without material change, the original intentions of the

parties as to the subject matter hereof and the prohibited nature, invalidity or unenforceability of the provision(s) in question does

not substantially impair the respective expectations or reciprocal obligations of the parties or the practical realization of the benefits

that would otherwise be conferred upon the parties. The parties will endeavor in good faith negotiations to replace the prohibited, invalid

or unenforceable provision(s) with a valid provision(s), the effect of which comes as close as possible to that of the prohibited, invalid

or unenforceable provision(s).

H. Counterparts.

This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall

constitute one and the same instrument.

I. No

Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective permitted successors

and assigns, and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

(Signature

pageS follow)

IN WITNESS WHEREOF, the Company and the Holder have each executed

this Amendment as of the date set forth on the first page of this Amendment.

| |

AKERNA CORP. |

| |

|

|

| |

By: |

|

| |

Name: |

Jessica Billingsley |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

Mailing Address and E-Mail Address for Notices: |

| |

1550 Larimer Street, #246 |

| |

Denver, Colorado 80202 |

| |

jlb@akerna.com |

[SIGNATURE PAGE TO AMENDMENT NO. 1 TO EXCHANGE AGREEMENT]

IN WITNESS WHEREOF,

the Holder and the Company have executed this Amendment as of the date set forth on the first page of this Amendment.

| |

HOLDER: |

| |

|

|

| |

HIGH TRAIL INVESTMENTS ON LLC |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

Mailing Address and E-Mail Address for Notices: |

| |

|

| |

|

| |

|

[SIGNATURE PAGE TO AMENDMENT NO. 1 TO EXCHANGE

AGREEMENT]

IN WITNESS WHEREOF,

the Holder and the Company have executed this Amendment as of the date set forth on the first page of this Amendment.

| |

HOLDER: |

| |

|

|

| |

ALTO OPPORTUNITY MASTER FUND, SPC - SEGREGATED MASTER PORTFOLIO B |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

Mailing Address and E-Mail Address for Notices: |

| |

|

| |

|

| |

|

[SIGNATURE PAGE TO AMENDMENT NO. 1 TO EXCHANGE

AGREEMEN

EXHIBIT A

SERIES C CERTIFICATE OF DESIGNATION

9

v3.23.4

Cover

|

Dec. 20, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 20, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-39096

|

| Entity Registrant Name |

AKERNA CORP.

|

| Entity Central Index Key |

0001755953

|

| Entity Tax Identification Number |

83-2242651

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1550 Larimer Street

|

| Entity Address, Address Line Two |

#246

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80202

|

| City Area Code |

888

|

| Local Phone Number |

932-6537

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

KERN

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase Common Stock |

|

| Title of 12(b) Security |

Warrants to purchase Common Stock

|

| Trading Symbol |

KERNW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=KERN_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=KERN_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

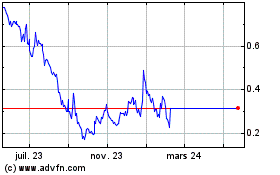

Akerna (NASDAQ:KERN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Akerna (NASDAQ:KERN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024