CHARTING OUR FUTURE Se pte m be r 10 , 2024 INVESTOR DAY

Forward Looking Statements & Non-GAAP Financial Measures 2 Statements and information in this presentation that are not historical are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are made pursuant to the “safe harbor” provisions of such Act. Forward-looking statements include, but are not limited to, statements regarding our outlook, guidance, expectations, beliefs, hopes, intentions and strategies. These statements are subject to a number of risks, uncertainties, assumptions and other factors. A ll forward- looking statements are based on information available to us at the time the statements are made. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. You should not place undue reliance on our forward-looking statements. Actual events or results may differ materially from those expressed or implied in the forward-looking statements. The risks, uncertainties, assumptions and other factors that could cause actual events or results to differ from the events or results predicted or implied by our forward-looking statements include the factors disclosed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2023, and in our subsequent Quarterly Reports on Form 10-Q. These reports are available on our investor relations website at lkqcorp.com and on the SEC website at sec.gov. This presentation contains non-GAAP financial measures. Included with this presentation is a reconciliation of each non-GAAP financial measure with the most directly comparable financial measure calculated in accordance with GAAP.

Investor Day Agenda 3 (all times are CST) 8:00AM - 9:00AM Registration 9:00AM Welcome Joseph P. Boutross – VP, Investor Relations, LKQ Corporation 9:00AM - 9:45AM Charting Our Future Justin Jude-President & Chief Executive Officer, LKQ Corporation 9:45AM - 10:15AM North America John Meyne – SVP, Wholesale North America 10:15AM - 10:30AM Break 10:30AM - 11:00 AM Europe Andy Hamilton – SVP of LKQ Corporation and President and Managing Director of LKQ Europe 11:00AM - 11:30AM Financial Overview Rick Galloway SVP & Chief Financial Officer, LKQ Corporation 11:30AM - 12:00PM Q&A Panel

Justin Jude P r e s i d e n t a n d C h i e f E x e c u t i v e O f f i c e r, L KQ C o r p o ra t i o n

Introduction Justin Jude President and Chief Executive Officer • Appointed CEO in July 2024 and elected to the Board at our May 2024 annual meeting • LKQ maintains separate CEO and Chair roles to support strong independent Board oversight • Prior to that, in January 2024, was appointed COO of LKQ • As President of Wholesale – North America Segment (2016-2023), significantly expanded margins, improved cash flow and enhanced leading market position • Joined LKQ in 2004 5

Our Mission To be the leading global value-added and sustainable distributor of vehicle parts and accessories by offering our customers the most comprehensive, available and cost-effective selection of parts and service solutions while building strong partnerships with our employees and the communities in which we operate. 6

LKQ Revenue - from 2003 to 2024 LKQ’s Evolution 7 LKQ Has Grown to Become a Leading Provider of Vehicle Parts Globally • Aftermarket, Paint & Recycled Collision Products • Recycled & Reman Major Mechanical Products Player in Each of Our Segments • Hard Parts • Aftermarket Collision & Paint • Recycled Collision (Sweden) • SEMA Accessories • RV and Marine accessories • Recycled End-of-Life Vehicles • Scrap & Precious Metals Wholesale North America (WNA) Europe Self Service Specialty 1) Other includes scrap and core revenue $0.3 Bn Other WNA Recycled $14+ Bn Self Service Specialty WNA Recycled WNA Aftermarket Europe 2003 2024

Key Themes for Today 8 New CEO’s Leadership Style 01 Strategic Priorities 02 North America - Grow Market Share and Deepen the Moat 03 04 05 Flexible Approach to Capital Allocation Europe - Leverage our Scale to Drive Efficiencies and Widen the Moat

My Approach to Leadership 9 • Development • Diversity & Inclusion • Cohesiveness • Accountability • Assess Markets • Evaluate Portfolio (Grow, Optimize, Fix, Divest) • Execute Right to Win • Above Market Growth • Free Cash Generation • Consistency • No Suprises • Employees • Customers • Board • Investors / Analysts Build the Team Deliver Results Set Strategy Manage Relationships Frameworks for Success Built on Foundation of Integrity and Trust

Driving Sustainable Value to Shareholders 10 Effectively managing climate-related risks and capitalizing on opportunities to drive long-term value across our global business Profitably delivering sustainable outcomes Delivering economic and sustainable value go hand-in-hand People-led performance Empowering our diverse workforce to excel in delivering value safely Strong governance and ethical practices Reinforcing our values through robust corporate citizenship and ethical practices

Key Strategic Priorities 11 Operational Excellence Simplify Business Portfolio and Operations Expand lean operating model globally Grow organically Maximize TSR Invest in organic growth Execute high synergy tuck-in acquisitions Return cash to shareholders, while maintaining investment grade Enhance Margins D ri ve C as h F lo w Develop Talent and Embed these Priorities into our Global Culture

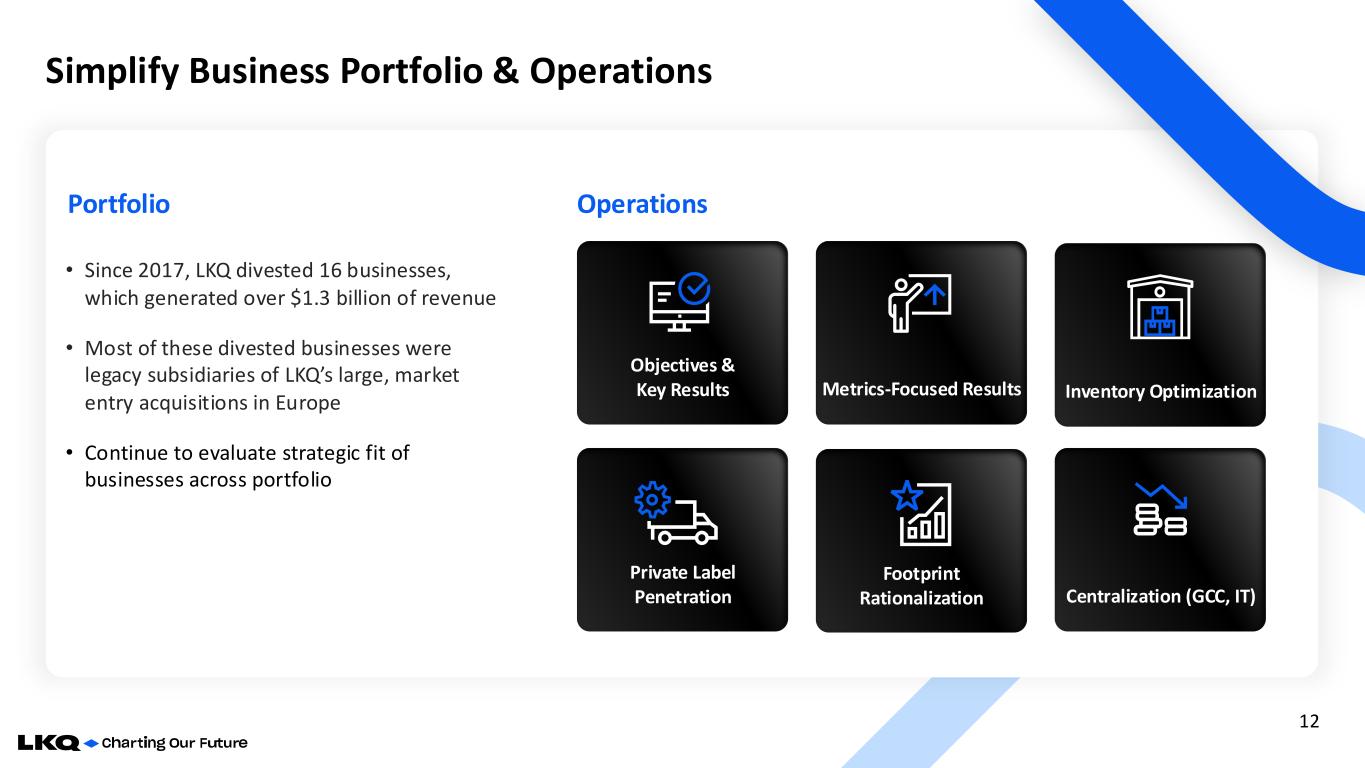

Simplify Business Portfolio & Operations 12 Inventory Optimization Private Label Penetration Footprint Rationalization Metrics-Focused Results Objectives & Key Results Centralization (GCC, IT) OperationsPortfolio • Since 2017, LKQ divested 16 businesses, which generated over $1.3 billion of revenue • Most of these divested businesses were legacy subsidiaries of LKQ’s large, market entry acquisitions in Europe • Continue to evaluate strategic fit of businesses across portfolio

Robust Balance Sheet Provides Capital Allocation Flexibility 13 Dividends Share Repurchases Capital Expenditures Tuck-In M&A Investment For Growth Operating Cash Flow Debt Repayment Return Capital to Stakeholders

M&A Philosophy & Playbook 14 • Expand the moat in our market leading segments • Highly synergistic tuck-ins • Cultural alignment • Aligned with long-term financial targets Strategic No Large Acquisitions & Higher Hurdle Rates for Tuck-ins • Transactions analyzed based on highest return on capital under current market conditions • Accretive within 12-18 months • Analyze returns on ROIC over a 3- year period Financial • Productivity & shared services benefits • Implement swift cost reductions & optimize incremental revenue synergies • Leverage scale for supply chain & footprint optimization Operational

We Compete in Resilient & Growing Markets 15 2023 Long Term Core Markets Expected Growth Over Next Decade APU Headwinds Tailwinds Parc Growth Parts Inflation Parts per Claim ADAS (Frequency) TLV Rate 1.0% - 2.0% North America Collision Total LKQ Growth Rate: Low to Mid Single Digits Europe Hard Parts 0.5% - 1.5% North America Hard Parts 2.5% - 3.5% North America Major Mechanical 2.0% - 3.0% Share Gains Specialty and Self Service

Gaining Share in Our Core Markets 16 Expand Salvage & Reman in Europe Grow Hard Parts Business in North America EV Battery Reman & Battery Recycling Eco System Expand Collision in Europe

Simplify Business Portfolio & Operations Above Market Growth Focused Strategy to Deliver Total Shareholder Return 17 Drive Lean Operating Model Globally Drive Operational Excellence Invest in Organic Growth Execute High Synergy Tuck-ins Capital Allocation Strategy Return Cash to Shareholders

Areas of Expertise Collision • Aftermarket • Recycled & Refurbished • Automotive Paint Mechanical • Recycled & Remanufactured • Hard Parts Services • Vehicle diagnostics & calibration Wholesale North America & Europe 18 Wholesale North America LKQ Europe Operating from a Position of Strength in Our Core Markets Collision Salvage Reman Hard Parts Other / Services ~$6 Bn $6+ Bn Collision Salvage Reman Hard Parts

Wholesale North America & Europe Better Together 19 01 Geographic and product diversification 02 Leveraging regional strengths and best practices globally 03 Greater access to global financing opportunities 04 Wholesale distribution businesses in resilient and non-cyclical markets 05 Jointly and collaboratively developing global EV-related capabilities 06 Global Competency Center Combining the Strength of Core Non-Discretionary Businesses

Leveraging the Scale & Driving Efficiencies Across Our Global Enterprise 20 Finance Business Operations Pricing & Analytics Supply ChainIT • AR / AP • Tax • Treasury Support • Business Controller • Risk and Compliance • Networking • End User Support • Security Ops • Development & Testing • Salvage Procurement • Product Master Data • Web Design • HR Shared Services • Process Excellence • Global Sourcing • Supply Chain Planning • Inventory Management • Inbound Logistics • Indirect Procurement Support • Business Intelligence • Supply Chain Analytics • Pricing • Marketing Analytics

John Meyne S e n i o r V i c e P r e s i d e n t , P r e s i d e n t Wh o l e s a l e N o r t h A m e r i c a

Introduction John Meyne Senior Vice President of LKQ Corporation and President of Wholesale - North America • John R. Meyne became Senior Vice President of LKQ Corporation and President of Wholesale – North America in January 2024 • From 2022 through 2023, served as the East Division Vice President of Wholesale – North America • From 2011 through 2021, served as Regional Vice President for the Southeast Region of the Company’s Wholesale – North America segment • Joined the LKQ team in 2009. During my tenure, I’ve held various operational leadership roles • In 2006, started an aftermarket collision parts company, which was acquired by LKQ in 2009 • Started industry career with Keystone Automotive Industries in 1987 22

Industry Leading Wholesale North America Executive Team 23 75% of WNA Executive Team came into position through internal promotion 21.4 years average tenure (over 171 years of experience) 25% of leaders at the level below the Executive Team are female

Focused on Three Key Pillars 24 Operational Objectives & Our Culture Safety Leadership Operational Excellence • Care for Employees and Our Community • Essential for Productivity • Reinforces a Winning Culture • Build Leaders • Succession Planning • Improves Bench Strength • Gain Efficiencies • Reduce Variability • Control Costs

Leading Positions in Core Markets 25 Remanufacturing Salvage Aftermarket Collision Paint, Body and Equipment (“PBE”) Hard Parts in Canada: Bumper-to-Bumper (“BtB”) Leading Positions New Expanded!

Uni-Select Integration Update 26 $65m Annualized Synergies by Year 3 Footprint 117 branch locations reduced through Finish Master Integration efforts in the United States From 8/1/23 to 6/30/24 Corporate Elimination of duplicate public-company costs Administrative Redundancy Reduction Procurement Leveraging LKQ Europe to enhance margins Private Label sourcing opportunities Go To Market Re-alignment of sales organization Use of Common Tools / Techniques New channel to market for core businesses and cross-selling opportunities

Resilient Core Markets 27 APU Headwinds Tailwinds Parc Growth Parts Inflation Parts per Claim ADAS (Frequency) TLV Rate 1.0% - 2.0% Tailwinds Headwinds Parts per Claim Parc Growth Parts Inflation APU Weather Macro Economic Environment ADAS (Frequency) TLV Rate Change in Total Loss Economics Long Term North America Collision Current North America Collision: Short Term Headwinds Legend Short Term Impacts Structural Impacts

Historical Collision Market Metrics Long Term Headwinds 1. TLV Rate % of Total Claims, % CAGR 2. ADAS Impact on Repairable Claims Volume (Frequency) % Average YoY Impact 16.2% 19.9% 22.0% 2024 Q22019A2015A +5.3% +2.0% 100 96 91 2024 Q22019A2015A -1.0% -1.0% Source: LKQ Internal analysis, BCG, and Experian. 2024 Q2 is the most recent estimate Long Term Tailwinds 1. APU Utilization % of Retail Spend, % CAGR 2. Parts per Claim Parts in Units, % CAGR 3. Total VIO Growth Units in M, % CAGR 4. Avg. Parts Price Inflation Retail $ in Units, % CAGR 36.3% 37.8% 38.1% 2024 Q22019A2015A +1.0% +0.2% 9.5 10.7 13.0 2024 Q22019A2015A +3.0% +4.0% 2015A 2024 Q2 286.0 2019A 257.2 276.8 +1.9% +0.7% $118 $121 $140 2024 Q22019A2015A +0.5% +3.0% 28

Repairable Claim Count & WNA Organic P&S Growth 29 4.6% 2.5% 1.5% 0.1% -1.4% -26.0% 11.4% 0.9% -0.3% -8.2% 5.5% 2.9% 3.4% 5.3% 0.9% -13.3% 6.7% 11.4% 8.6% -4.3% 2016 2017 2018 20192015 2021 2022 2023 2024 Q12020 YoY % Change in Repairable Claims WNA Organic P&S Revenue Growth on a Per Day Basis Y-o-Y change in Repairable Claims Count and WNA Organic P&S Revenue Growth, in % Source: LKQ Internal analysis and LKQ reported data; 2024 Q1 is the most recent estimate *2014-2020 includes Self Service Over this period, we outperformed the Repairable Claims Count growth by an average of 420 bps per year

Why We Win 30 Unmatched Footprint and Distribution Network Value Proposition LKQ Network Effect on Fill Rates 75% 25% LKQ Competition … parts revenue originates and sells in the same yard territory … parts revenue is generated outside the yard, but within the region … of parts revenue is generated in another region 24% 62% 14% 2014 F-150 2018 Nissan Altima 2020 Dodge Caravan Hood Headlamp Transmission New OEM $1,266 $484 $4,660 Reman na na $2,864 Salvage $590 $207 $1,590 AFM $938 $347 na Partnering with national multi-shop operators (MSO) Source: LKQ Internal analysis *For illustrative purposes

Grow Our Core Collision Business 31 04 National Footprint and Inventory 03 Share of Wallet Gains 01 New Product Launches PBE, Private label, LKQ refinish brand 02 Digital Sales Tools

Salvage Business Growth Strategy 32 Salvage • Capacity expansion and enhanced operating model (Mega Yards, Crystal River) to improve part availability, fill rates, and margin • Improving proprietary Machine Learning (ML) algorithms for salvage vehicle procurement • Part inventorying systematization and optimization (Auto DISM) • Enhancing our catalog – VIN and Interchange part identification • Cross selling products, e.g. engine kits

Remanufacturing Growth 33 New channels (BtB)TriStar New ICE Product Additions Capacity Expansion New BEV Product Additions

Increase Customer Base in PBE 34 LKQ Collision Customers Paint & Parts Customers Parts Only Customers

Grow Canadian Hard Parts Business 35 02 3-Step to 2-step conversion 01 Enhancing our relationship with BtB members 04 Product portfolio expansion 03 Bolt-on M&A and greenfield expansion 05 Investments into developing an industry leading hard parts platform 06 Broadening Private Label portfolio via collaboration with Europe 07 Leveraging European intellectual capital to drive revenue and enhance our B2C e- commerce business 08 Cross-selling opportunities across entire LKQ product portfolio

Outperform The Market 36 Next 3 Years Revenue Growth, in % 1.0% 1.5% 0.5% Total WNA Growth High Range Low Range Tuck-in M&A 0.0% Organic Expansions / Share Gains / New Products 2.0% 1.0% 0.5% 3.5% Market

Strategic Objectives Wholesale North America Enhanced Margins Simplification & Operational Excellence 2025 – 2027 Targets Annual Organic Revenue Growth 1.5% to 3.0% Average Annual Organic1 Segment EBITDA Margin Improvement2 10 bps to 20 bps Profitable Growth Drive FCF through continued optimization of trade working capitalTalent Development 37 1) Assumes no impact from potential future tuck-in acquisitions 2) TTM Q2 2024

Andy Hamilton P r e s i d e n t a n d M an a g i n g D i r e c to r, L KQ E u r o p e

Introduction 39 Andy Hamilton President and Managing Director LKQ Europe • 2024: President and Managing Director of LKQ Europe • 2019-2023: CEO, LKQ UK and Ireland, successfully led the transformation of the business from single digit EBITDA margin to double digit EBITDA, the leading margin in Europe • 2016-2019: Chief Commercial Officer, LKQ Europe, managing several key transformation projects • 2011: Joined the Euro Car Parts business, managing the rapid expansion of the UK business following the LKQ acquisition • Prior to LKQ, held a number of management roles at leading UK automotive and leisure retailer, Halfords.

Industry Leading European Executive Team 40 62% of Executive Team came into position through internal promotion 8.2 years average tenure (over 107 years of experience) 30% of leaders at the level below the Executive Team are female

#1 Market Position in Top 7 Markets Segment Overview - Market Leader in Europe 41 18 countries we operate in $6.3 BN Revenue 2023 26,500 Colleagues 900 Locations Source: Competitor filings and LKQ management estimate. Minority interests in countries with patterns. UK & ROI Benelux-France Italy DACH Central and Eastern Europe Scandinavia United Kingdom GermanyCzech RepublicBelgium Italy NetherlandsIreland

Who We Are, Why We Win 42 Size & Scale Market leader with unmatched footprint. 900 locations serve 100,000+ workshops multiple times per day Range & Availability Leading partnerships with Tier 1 suppliers supplemented by LKQ private label products World Class Logistics Concepts & Innovation Tailored services, training & workshop concepts to ensure customers are prepared for the future Only aftermarket company with pan-European logistics network

Category Management Remanufacturing Key Opportunities Total Market Growth 2024-2027 1.0-1.5% CAGR1 90% 9% 78% 1. Includes VIO growth and estimated market inflation Workshop Concept & Customer Loyalty Key Market Dynamics VIO Evolution in Our European Markets, in M Vehicles Source: IHS forecast. Markets included: Austria, Belgium, Czech Republic, France, Germany, Hungary, Ireland, Italy, Netherlands, Romania, Slovakia, Switzerland, Ukraine, United Kingdom 43 91% 87% 83% 9% 79% 2024 91% 2025 88% 2026 86% 2027 250 251 252 253 6%5%4%4% 9%6%5% 3% 93 VIO growth 2024-2027 CAGR +0.4% ICE(P)HEVBEV Headwinds Tailwinds • New car registrations below 2019 levels • Softer 5-13yrs car segment • Lower EV mechanical maintenance • Aging of the car parc • Geographical footprint • New vehicle technologies • Salvage • EV business opportunities

Solid Foundation For Future Growth 44 Aligned Key Suppliers Developed Functional Excellence Progressed System Harmonization Rolled Out Customer Propositions Managed Economic Headwinds Payment & rebate terms Stock level rationalization Centralized 10 functions Workflow processes simplified Built and stabilized ERP platform Harmonized and aligned multiple policies & processes Workshop Concepts & LKQ Academy - BEV and ICE Key Account Management Digitalization roadmap Inflation Pricing Supply Chain

Target Operating Model 45 Customer Growth Workshop Concepts Breadth & Depth Of Product Channel and Geographical Development Product Leadership SKU Consolidation Private Label Expansion Supplier Rationalization Operational Improvements Branch & Network Design Asset Rationalization Central Procurement Organization (CPO) GCC (Global Competency Center) Transition Processes and Systems Aligned Key Suppliers Developed Functional Excellence Progressed System Harmonization Rolled Out Customer Propositions Managed Economic Headwinds Payment & rebate terms Stock level rationalization Centralized 10 functions Workflow processes simplified Built and stabilized ERP platform Harmonized and aligned multiple policies & processes Workshop Concepts & LKQ Academy - BEV and ICE Inflation Pricing Supply Chain Key Account Management Digitalization roadmap

Category Management Project Timeline 46 Too many brands & product duplication creates complexity 742,000 SKUs in scope for current project Only 10% Of those are sold in all Regions 2024 2025 2026 2027 • Over 25 product groups have been assessed including Braking, Clutches and Exhausts covering 425k SKUs analysed to date • Agreed European brands will increase brand commonality from 20% to over 60% with an estimated SKU reduction of 30% by 2027. Phase 1 Product & brand portfolio assessment and analysis Phase 2 - Preparation of new category proposition by region Phase 3 - Launch of the new assortment & support campaigns Ke y Fo cu s 900,000 Number of active SKUs stocked in Europe

Category Management Benefits 47 Brand clutter prevents us serving our customers efficiently Two identical branches. Each has 2,000 stock positions available for braking products Branch A Branch B Enhanced Margins. Lower Inventory. Extended Payment Terms Branch A has 5 braking brands, Branch B only 3 Dividing the stock positions between the brands means Branch A’s offer is shallow Branch B has a better ability to serve their local market than Branch A Brand E Brand D Brand C Brand B Brand A Brand E Brand C Brand A Quality Price Quality Price 502 Brand A 375 Brand B 445 Brand C 265 Brand D 413 Brand E 620 Brand A 562 Brand C 418 Brand E Coverage of applications in local market Covered Not covered

Employee Engagement 48 Talent Expansion & Development Succession Planning Reward & Recognition Diversity & Inclusion Colleague Growth Culture & Values Overview Top words used by our employees to describe our culture 85% Overall response rate 8% vs 2022 68 Engagement rate 1 vs 2022 COLLABORATIVE OPEN INNOVATIONFOCUSED RESPECT FRIENDLY INCLUSIVE DRIVEN

Strategic Objectives LKQ Europe Annual Organic Revenue Growth 2.5% - 3.0% Average Annual Organic1 Segment EBITDA Margin Improvement2 20 bps to 40 bps Drive FCF through continued optimization of trade working capital Enhanced Margins Simplification & Operational Excellence Profitable Growth Talent Development 49 1) Assumes no impact from potential future tuck-in acquisitions 2) TTM Q2 2024 2025 – 2027 Targets

Rick Galloway S e n i o r V i c e P r e s i d e n t a n d C h i e f F i n a n c i a l O f f i c e r, L KQ C o r p o r at i o n

Introduction Rick Galloway Senior Vice President & Chief Financial Officer • Senior Vice President and Chief Financial Officer since September 2022 • Served as Chief Financial Officer of Wholesale - North America and Self- Service segments from July 2019 to September 2022 • Prior to joining LKQ, held various positions at Alcoa and Arconic Corporations from 2010 to 2019 • Served as Chief Financial Officer of Arconic’s Engineered Products and Solutions division, a business that consisted of 97 manufacturing facilities across the globe • Started career in public accounting with Grant Thornton as an auditor with clients in various fields, including manufacturing, oil and gas, non- profit, and government 51

LKQ Financial Snapshot 52 Financial Measures TTM Q2 2024 in $M Revenue $14,483 Segment EBITDA1 $1,732 FCF1 $751 Total Debt $4,334 Total Liquidity2 $1,428 Market Capitalization3 $10,988 Credit Rating4 BBB- / BBB- / Baa3 1) Segment EBITDA and FCF are non-GAAP measures. See the Appendix for reconciliations of non-GAAP measures 2) Total liquidity includes cash and cash equivalents and availability under credit facilities 3) Based on 6/28/24 closing price of $41.59 and 6/30/24 outstanding shares 4) Sources: S&P/Fitch/ Moody’s 5) Reflects TTM Q2 2024 Third Party Revenue5 40% 44% 12% 4% North America Self Service Specialty Europe Segment EBITDA1 56% 34% 8% 2% North America Self Service Specialty Europe

53

New Playbook Linked to Driving Financial Results 54 To be the leading global value-added and sustainable distributor of vehicle parts and accessories by offering our customers the most comprehensive, available and cost-effective selection of parts and service solutions while building strong partnerships with our employees and the communities in which we operate. To deliver value for all LKQ Stakeholders through Operational Excellence and optimal Capital Allocation Execution is key and winning consists of setting specific, measurable, actionable, relevant and time-based objectives. • OKRs • KPIs • Time & Units • Daily Management Meetings > 500 bps in Margin Expansion1 D ri vi n g Fi n a n ci a l R e su lt s • Gemba Walks • TWC Management • Disciplined Balance Sheet The Foundation Has Been Built Action Plan Objectives Strategies Mission Wholesale North America Playbook Next Phase - Europe 1) Segments EBITDA margin; 2019 – 2023 WNA without Uni-Select impact

55

Targeted Financial Results 56 Expanding Vendor Financing Managing TWC to Drive Incremental Cash Driving Incremental Profitability

Driving Growth with Efficiency – Segment EBITDA 57 12.0% 10bps – 20bps Annual Average Sales Leverage Gross Margin Operational Efficiencies Revenue Mix Q2 2024 TTM Segment EBITDA % 2027 Segment EBITDA % Profitable Revenue Growth SKU Rationalization Private Label Growth Procurement Benefits COGS Inflation Limited Price Increases Network Optimization Global Competency Center Synergies Global Lean Operating Model Higher Growth in Lower Margin Businesses Improved Cataloging Customer Loyalty Workshop Concepts Simplified Business Portfolio and Operations

Strong Balance Sheet Provides Significant Operating Flexibility 58 Debt Profile Debt / EBITDA1 2.3x Weighted Average Maturity 4.0 yrs Debt Overview (as of June 2024) S&P BBB- / Stable Moody’s Baa3 / Stable Fitch BBB- / Positive $1.7B (41%) RCF and TLs $2.5B (59%) Bonds Lean TWC Management 512 734 803 600 500 800 268 2025 2026 2027 2028 2029 2030 2031 2032 2033 2028 Euro Bond 2031 Euro bond 2028 US Bond 2033 US Bond USD Term Loan CAD Term Loan RCF $4.3B Total Debt (June-24)2 $1.7B (41%) No Penalty $2.5B (59%) With Penalty Prepayable Debt Inventory • Footprint rationalization • SKU consolidation • Network optimization Accounts Receivable • Integration with customers through automation • Focus on partnership with on-time delivery and percent current Accounts Payable • Supplier rationalization • Increase utilization of vendor financing program 1) Debt / EBITDA as defined in our Credit Agreement dated January 2023 2) Includes ~$0.1B “Other debt” Credit Ratings

Extending Payables to Unlock Incremental Value 59 240 264 285 341 354 375 63 70 68 70 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 WNA Q1 2023 240 264 348 411 422 445 Europe Europe • Payment terms negotiations have been opened with approx. 70% of annual direct spend • DPO improved by over 15% in Q2 2024 YoY • New payment terms improved the TWC by more than €70m in 2023 WNA • Opportunities to expand existing program using LKQ’s investment grade credit rating • Current program is 60% utilized Size of Europe and WNA Vendor Financing Program, In $M 1) Europe only

Strong Operating Cash Flows Allocated to Highest Return Opportunities 60 2021 to June 2024 - Capital Allocation 11% 18% 23% 48% Acquisitions & Other, net of Debt Dividends CapEx Share Repurchases $4.4 Billion Operating Cash Flows Deployed Priorities for Next 3 Years Operating Cash Flow Maintain consistent conversion; scale with business Capital Expenditures Similar level expected with focus on high ROIC projects Dividends Committed to a minimum of 50% of FCF in the short term Share Repurchases Acquisitions Focused on highly accretive tuck- ins with no large platforms expected + / ‒ + / ‒ + / ‒ + / ‒ Cash flow allocated to highest return opportunities across share repurchase, debt paydown, organic investments, and tuck-in acquisitions; further shareholder return via regular quarterly dividend

Robust Balance Sheet Provides Capital Allocation Flexibility 61 Dividends Share Repurchases Capital Expenditures Tuck-In M&A Investment For Growth Projected 2025 – 2027 Operating Cash Flow1 Debt Repayment Return Capital to Stakeholders$3.4B - $4.6B 25% 35% 60% 10% 30% 40% 1) These projections are based on current plan and are subject to change

LKQ’s Investment Thesis 62 • Market leadership in all four reporting segments: • North America • Europe • Specialty • Self Service • Unparalleled customer & geographic diversity • Industry leading service Strong Market Position • Ability to grow revenue organically faster than market growth • Simplify business portfolio and operations • Expand lean operating model globally Organic Growth & Operational Excellence • Convert EBITDA to FCF by maintaining rigorous working capital discipline • Fund high-ROIC projects that contribute to organic growth and margin expansion • Excess free cash flow allocated to enhance long-term shareholder value • Firmly committed to maintaining investment grade credit rating Focus on Cash Flow and Capital Allocation Stable business through economic cycles Organic revenue growth faster than market & EBITDA growth faster than revenue Allocating capital to grow EPS faster than EBITDA Driving consistent and strong growth in Adjusted EPS over the long term

Our Strategic Plan LKQ Corporation Enhanced Margins Cash Flow Generation Simplification & Operational Excellence 2025 – 2027 Targets Annual Organic Revenue Growth Above Market 1.0% to 2.0% Average Annual Organic1 Segment EBITDA Margin Improvement2 10 bps to 20 bps Profitable Growth Next 3-year Cumulative Total Free Cash Flow $2.4 – $3.2 Billion 1) Assumes no impact from potential future tuck-in acquisitions 2) TTM Q2 2024 63

Appendix 64

Financial Policy Summary 65 • Target organic growth greater than market comps • Simplify business portfolio and operations • Expand lean operating model globally • Convert high levels of EBITDA to Free Cash Flow with a focus on trade working capital efficiencies • Maintain or improve investment grade rating through continuation of strong credit metrics and judicious capital deployment • Maintain total leverage of lower than 2.0x EBITDA1 • Strong FCF generation will enable significant annual capital deployment to drive TSR • Organic Investments: Fund high- ROIC projects that contribute to organic growth and margin expansion • Dividends & Share Repurchases: Return value to shareholders through regular quarterly dividends and programmatic share repurchases • Acquisitions: Focused on tuck-in acquisitions with significant synergies or critical capabilities and not large M&A • Maintain liquidity to enable LKQ to invest through a market cycle • We had $1,428 million of total liquidity as of 6/30/24 with $276 million in cash and $1,152 million availability on our revolver • No significant debt maturities until 2026 Focus on Free Cash Flow Generation Maintain Optimal Leverage Deploy Capital into Highest Return Opportunities Maintain Appropriate Liquidity 1) Debt / EBITDA as defined in our Credit Agreement dated January 2023

Appendix 1 Reconciliation of TTM Q2 2024 Net Cash Provided by Operating Activities to Free Cash Flow and Net Income to Segment EBITDA (in millions) Q3 2023 Q4 2023 Q1 2024 Q2 2024 TTM Q2 2024 Net cash provided by operating activities $441 $212 $253 $213 $1,119 Less: purchases of property, plant and equipment 97 125 66 80 368 Free cash flow $344 $87 $187 $133 $751 Net income $208 $178 $158 $186 $730 Less: net income attributable to continuing noncontrolling interest — 1 — 1 2 Net income attributable to LKQ stockholders $208 $177 $158 $185 $728 Less: net income (loss) from discontinued operations 1 (7) — — (6) Net income from continuing operations attributable to LKQ stockholders $207 $184 $158 $185 $734 Adjustments: Depreciation and amortization 84 100 100 100 384 Interest expense, net of interest income 53 58 61 62 234 Provision for income taxes 60 43 71 82 256 Equity in earnings (losses) of unconsolidated subsidiaries (4) (6) 2 (2) (10) Gains on foreign exchange contracts - acquisition related (1) (3) — — — (3) Equity investment fair value adjustments — 1 — 2 3 Restructuring and transaction related expenses 27 12 30 49 118 Restructuring expenses - cost of goods sold 2 2 8 6 18 Gains (losses) on previously held equity interests (4) 1 — — (3) Impairment of net assets held for sale — 1 — — 1 Segment EBITDA $422 $396 $430 $484 $1,732 (1) Related to the Uni-Select acquisition.