Mercurity Fintech Holding Inc. Board Approves Proposals, Including Share Consolidation and ADR Ratio Change

04 Janvier 2023 - 11:00PM

Mercurity Fintech Holding Inc. (the “Company,” “we,” “us,” “our

company,” or “MFH”) (Nasdaq: MFH), a digital fintech group powered

by blockchain technology, today announced that, on December 29,

2022, the Company’s Board of Directors (the “Board”) has approved

to proceed with: 1) the share consolidation and simultaneous change

of the ADR ratio; 2) the transfer of the register of members of the

Company; and 3) the termination of the deposit agreement.

The Share Consolidation and Change of the ADR

ratio

The Board approved the proposal on the share

consolidation to the authorized share capital (the “Share

Consolidation”) at a ratio of four hundred (400)-for-one (1) with

the par value of each ordinary share changed to US$0.004 per

ordinary share. Following the Share Consolidation, the authorized

share capital of the Company will be US$250,000 divided into

62,500,000 ordinary shares with a par value of US$0.004 each (the

"Ordinary Share"). Further, as approved by the Board, the Company

will effect a simultaneous change of the American Depositary

Receipts (“ADRs”) to ordinary share ratio from 1-to-360 to 1-to-1

(the “ADR Ratio Change”).

The exact timing of the Share Consolidation and

ADR Ratio Change, and additional details and instructions for

registered shareholders regarding the Share Consolidation, will be

communicated by the Company in a press release and other

documentation to be issued at a later date.

The Transfer of the Register of Members of

the Company

The Board approved the transfer of the register

of members of the Company from Maples Corporate Services Limited to

VStock Transfer, LLC, which will act as the transfer agent of the

Company’s ordinary shares, upon the suspension of the Company’s

ADRs program and the commencement of trading the Company’s ordinary

shares.

The Termination of the Deposit

Agreement.

The Board approved to terminate the Deposit

Agreement, as amended (the “Deposit Agreement”) effective on

February 28, 2023, by and among the Company, Citibank, N.A., and

the holders and beneficial owners of American Depositary Shares

outstanding under the terms of the Deposit Agreement dated as of

April 13, 2015 and as amended.

“The Share Consolidation, the ADR Ratio Change

and termination of the ADR program are all positive from our

company’s perspective,” said Shi Qiu, the Company’s Chief Executive

Officer. “This will likely save our company a significant

cost, solidify our place in the U.S. capital markets, allow for

more transparent oversight and compliance with the U.S. Securities

and Exchange Commission, NASDAQ, and other U.S. regulators, and

provide a broader range of capital opportunities and potential

partnerships in the future. All of these factors combined to

make this a relatively easy decision for our Board of Directors, as

the benefits from the Share Consolidation, the ADR Ratio Change and

termination of the ADR program would potentially make our company

more attractive to investors and a more solid choice for similar

firms looking to collaborate on projects in the coming

years.”

About Mercurity Fintech Holding Inc.

Mercurity Fintech Holding Inc. is a digital

fintech group powered by blockchain technology. The Company’s

primary business scope includes digital asset trading, asset

digitization, cross-border remittance and other services, providing

compliant, professional, and highly efficient digital financial

services to its customers. The Company recently began to narrow in

on Bitcoin mining, digital currency investment and trading, and

other related fields. This shift has enabled the company to deepen

its involvement in all aspects of the blockchain industry, from

production to circulation.

Forward-Looking Statements

This announcement contains forward-looking

statements within the meaning of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical fact in this announcement are

forward-looking statements. These forward-looking statements

involve known and unknown risks and uncertainties and are based on

current expectations and projections about future events and

financial trends that the Company believes may affect its financial

condition, results of operations, business strategy and financial

needs. Investors can identify these forward-looking statements by

words or phrases such as “may,” “will,” “expect,” “anticipate,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “potential,”

“continue,” “is/are likely to” or other similar expressions. The

Company undertakes no obligation to update forward-looking

statements to reflect subsequent occurring events or circumstances,

or changes in its expectations, except as may be required by law.

Although the Company believes that the expectations expressed in

these forward-looking statements are reasonable, it cannot assure

you that such expectations will turn out to be correct, and the

Company cautions investors that actual results may differ

materially from the anticipated results.

For more information, please contact:

International Elite Capital Inc. Vicky Chueng Tel:

+1(646) 866-7989 Email: mfhfintech@iecapitalusa.com

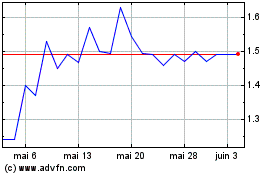

Mercurity Fintech (NASDAQ:MFH)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Mercurity Fintech (NASDAQ:MFH)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025