UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934 (Amendment No. 1)*

| MERCURITY

FINTECH HOLDING INC. |

| (Name

of Issuer) |

| Ordinary

Shares, par value $0.004 |

| (Title

of Class of Securities) |

Xin

Rong Gan

Room

2-204, Building 7,

Jindaotian

Jinzhou Garden, Luohu District,

Shenzhen,

Guangdong Province, China

Phone:

+86 17486297789 |

| (Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| |

| May

23, 2024 |

| (Date

of Event which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See 240.13d-7(b)

for other parties to whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE

13D

| 1 |

NAMES OF REPORTING PERSON

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Xin Rong Gan |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

PF |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(D) OR 2(E)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

China |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

4,600,000 (1) |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

4,600,000 (1) |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

4,600,000 (1) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11)

7.6%(2) |

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

IN |

(1)

Including reporting person’s holding of 4,600,000 Ordinary Shares.

(2)

Based on the sum of 60,819,897 ordinary shares of the Issuer issued and outstanding as of July 31, 2024.

| Item

1. |

Security

and Issuer |

This

statement on Schedule 13D/A (this “Statement”) relates to the ordinary shares, par value $0.004 per share (“Ordinary

Shares”), of Mercurity Fintech Holding Inc., a Cayman Islands company (the “Issuer”), whose principal executive offices

are located at 1330 Avenue of Americas, Fl 33, New York, 10019, United States.

The

Issuer’s Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “MFH.”

| Item

2. |

Identity

and Background |

| (a) |

This

statement of beneficial ownership on Schedule 13D is being filed by Xin Rong Gan (the “Reporting Person”). |

| |

|

| (b) |

Address:

Room 2-204, Building 7, Jindaotian Jinzhou Garden, Luohu District, Shenzhen, Guangdong Province, China. |

| |

|

| (c) |

Occupations:

Self-employed. |

| |

|

| (d) |

During

the last five years, the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors). |

| |

|

| (e) |

During

the last five years, the Reporting Person has not been a party to a civil proceeding of a judicial or administrative body of competent

jurisdiction and is not as a result of such proceeding subject to a judgment, decree or final order enjoining future violations of,

or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such

laws. |

| |

|

| (f) |

China. |

| Item

3. |

Source

and Amount of Funds or Other Considerations |

On

March 23, 2023, Xin Rong Gan entered into a share ownership transfer agreement (the “Share Ownership Transfer Agreement”)

and a warrant transfer agreement (the “Warrant Transfer Agreement”) with Hanqi Li, pursuant to which Xin Rong Gan acquired

from Hanqi Li 4,600,000 ordinary shares and warrants to purchase 13,800,000 ordinary shares of the Issuer for US$3,450,000 derived from

personal funds.

The

description of the Share Ownership Transfer Agreement and Warrant Transfer Agreement as aforementioned is qualified in its entirety by

reference to the complete text of the Share Ownership Transfer Agreement and the Warrant Transfer Agreement, which have been filed as

Exhibit 99.1 and Exhibit 99.2, and which are incorporated herein by reference in its entirety.

| Item

4. |

Purpose

of Transaction |

The

information set forth in Items 3 and 5 is hereby incorporated by reference in its entirety in this Item 4.

On

May 23, 2024, Xin Rong Gan surrendered 13,800,000 warrants to the Issuer pursuant to a warrant surrender agreement, for no consideration.

The

description of the Warrant Surrender Agreement as aforementioned is qualified in its entirety by reference to the complete text of the

original Warrant Surrender agreement, which have been filed as exhibit 99.9, and which are incorporated herein by reference in its entirety.

The

Reporting Person acquired the Shares for investment purposes and intends to review and evaluate its investment in the Company on a continuous

basis. Depending upon various factors, including but not limited to the business, prospects and financial condition of the Reporting

Person and the Issuer and other developments concerning Reporting Person and the Issuer, market conditions and other factors that the

Reporting Person may deem relevant to its investment decision, and subject to compliance with applicable laws, rules and regulations,

the Reporting Person may in the future take actions with respect to its investment in the Company as it deems appropriate with respect

to any or all matters required to be disclosed in this Schedule 13D, including without limitation changing its intentions or increasing

or decreasing its investment in the Company or engaging in any hedging or other derivative transactions with respect to the Ordinary

Shares.

| Item

5. |

Interest

in Securities of the Issuer |

| (a) |

The

Reporting Person beneficially owned a total of 4,600,000 ordinary shares(constituting 7.6% of the total issued and outstanding ordinary

shares based on the sum of 60,819,897 ordinary shares of the Issuer issued and outstanding as of July 31, 2024. |

| |

|

| (b) |

The

Reporting Person has 4,600,000 ordinary shares to which he has sole power to vote and dispose. |

| |

|

| (c) |

Except

as disclosed in this Statement, the Reporting Person did not effect any transaction with respect to the Ordinary Shares during the

past 60 days. |

| |

|

| (d) |

Except

as disclosed in this Statement, to the best knowledge of the Reporting Person, no person other than the Reporting Person is known

to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Ordinary

Shares beneficially owned by the Reporting Person. |

| |

|

| (e) |

Not

applicable. |

| Item

6. |

Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Item

3 and Item 4 are incorporated herein by reference in their entirety.

To

the best knowledge of the Reporting Person, except as provided herein, there are no other contracts, arrangements, understandings or

relationships (legal or otherwise) between the Reporting Person and any other person with respect to any securities of the Issuer, joint

ventures, loan or option arrangements, puts or calls, guarantees of profits, divisions of profits or loss, or the giving or withholding

of proxies, or a pledge or contingency, the occurrence of which would give another person voting power over the securities of the Issuer.

| Item

7. |

Material

to Be Filed as Exhibits |

Exhibit

No. |

|

Description |

| 99.1* |

|

Share Ownership Transfer Agreement, dated as of March 23, 2023, by and between Hanqi Li and Xin Rong Gan |

| 99.2* |

|

Warrant Transfer Agreement, dated as of March 23, 2023, by and between Hanqi Li and Xin Rong Gan |

| 99.3 |

|

Share Ownership Transfer Agreement, dated as of March 23, 2023, by and between Hanqi Li and Xin Rong Gan |

| 99.4 |

|

Warrant Transfer Agreement, dated as of March 23, 2023, by and between Hanqi Li and Xin Rong Gan |

| 99.5 |

|

Share Ownership Transfer Agreement, dated as of April 11, 2023, by and between Hanqi Li and Hailei Zhang |

| 99.6 |

|

Warrant Transfer Agreement, dated as of April 11, 2023, by and between Hanqi Li and Hailei Zhang |

| 99.7 |

|

Share Ownership Transfer Agreement, dated as of May 1, 2023, by and between Hanqi Li and Hong Mei Zhou |

| 99.8 |

|

Warrant Transfer Agreement, dated as of May 1, 2023, by and between Hanqi Li and Hong Mei Zhou |

| 99.9 |

|

Warrant Surrender Agreement dated as of May 23, 2024 |

*

Previously filed

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Dated:

August 15, 2024 |

/s/

Xin Rong Gan |

| |

Name: |

Xin

Rong Gan |

| |

Title: |

Individual |

The

original statement shall be signed by each person on whose behalf the statement is filed or his authorized representative. If the statement

is signed on behalf of a person by his authorized representative (other than an executive officer or general partner of this filing person),

evidence of the representative’s authority to sign on behalf of such person shall be filed with the statement, provided, however,

that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name and

any title of each person who signs the statement shall be typed or printed beneath his signature.

Attention:

Intentional misstatements or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001).

Exhibit 99.9

NOTICES TO MERCURITY FINTECH HOLDING INC.

Dear Mercurity Fintech Holding Inc.,

I, [Xin Rong Gan], the holder of Warrant No. [ ], dated March [23],

2023 (the “Warrant”), hereby formally notify Mercurity Fintech Holding Inc. of my decision to voluntarily surrender the rights

granted under the aforementioned Warrant. The Warrant entitles me to purchase

[ 13,800,000 ] ordinary shares which is 3 times of purchase ordinary

shares of Mercurity Fintech Holding Inc.

Please acknowledge receipt of this notice and confirm in writing

that the Warrant rights are surrendered and that no further actions or obligations are required from me as the warrant holder.

Thank you for your prompt attention to this matter.

| Sincerely, |

|

| |

|

| /s/

Xin Rong Gan |

|

| Xin

Rong Gan |

|

| Date:

5/23/2024 |

|

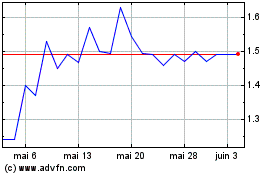

Mercurity Fintech (NASDAQ:MFH)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Mercurity Fintech (NASDAQ:MFH)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024