Maravai LifeSciences Holdings, Inc. (Maravai) (NASDAQ:

MRVI), a global provider of life science reagents and

services to researchers and biotech innovators, today reported

financial results for the third quarter ended September 30,

2024, together with other business updates.

Financial Highlights:

- Quarterly revenue

of $65.2 million, Net loss of $(176.0) million (including a

goodwill impairment of $154.2 million), and Adjusted EBITDA of

$12.7 million; and

- Updated revenue

guidance for the full year 2024 to be in the range of $255.0

million to $265.0 million.

Innovation and Awards:

- TriLink

BioTechnologies (TriLink) enhanced our product offering with the

introduction of custom sets of mRNA constructs, supporting our

customers’ screening phase and allowing them to more quickly

evaluate and prioritize their target;

- TriLink and

Alphazyme collaborated to launch CleanScribe™ RNA Polymerase,

providing researchers with a simple way to significantly reduce

dsRNA in their IVT without compromising other important mRNA

quality attributes;

- Commenced our first

mRNA contract for a customer’s Phase II clinical trial in our

Flanders 2 GMP manufacturing facility, demonstrating our ability to

bring TriLink’s best-in-class mRNA manufacturing processes to our

Phase II and Phase III mRNA service customers;

- Strengthened

TriLink’s patent estate with the issuance of an additional U.S.

patent for our CleanCap® IVT capping technology;

- Cygnus Technologies

(Cygnus) and TriLink collaborated to launch AccuRes™ Host Cell DNA

Quantification Kits. The all-in-one kit combines Cygnus’

proprietary extraction procedure with a probe-based master mix

containing TriLink’s patented CleanAmp® dNTPs and a Hot Start Taq

DNA Polymerase; and

- Chanfeng Zhao, Vice

President, R&D Chemistry for TriLink was honored on the 2024

PharmaVoice 100 list in the category of Clinical Trial Pros.

Pending Acquisition:

- Entered into

definitive agreement to acquire the DNA and RNA business of

Officinae Bio, a privately held technology company with a

proprietary digital platform designed with artificial intelligence

and machine learning capabilities to support the biological design

of therapeutics. The acquisition is subject to customary closing

conditions, and is expected to close in early 2025. Once completed,

the acquisition is expected to expand our ability to assist

customers in developing innovative nucleic acid-based

therapies.

"We achieved significant milestones this

quarter, launching innovative new products across the portfolio. Of

note, we commenced our first mRNA contract for a customer at our

Flanders2 GMP manufacturing facility, further strengthened our

CleanCap® IVT capping technology patent estate with the issuance of

an additional U.S. patent, and introduced a new plate-based mRNA

screening offering," said Trey Martin, CEO, Maravai LifeSciences.

“Today we announced our planned acquisition of the DNA and RNA

business of Officinae Bio, a provider of precision DNA and RNA

design services through an AI-driven digital platform. We believe

Officinae will add complementary capabilities to offer uniquely

effective and timely design solutions for our customers. The mRNA,

Gene Editing and cell and gene therapy markets continue to evolve

rapidly, and we remain committed to being our customers’ preferred

partner by delivering innovative solutions to address critical

barriers, increase process efficiency and improve potency and

efficacy.”

Revenue for the

Third Quarter

2024

| |

Three Months Ended September 30, |

| (Dollars in 000’s) |

2024 |

|

2023 |

|

Year-over-Year % Change |

|

Nucleic Acid Production |

$ |

49,947 |

|

$ |

51,228 |

|

(2.5 |

)% |

| Biologics Safety Testing |

|

15,253 |

|

|

15,637 |

|

(2.5 |

)% |

|

Total Revenue |

$ |

65,200 |

|

$ |

66,865 |

|

(2.5 |

)% |

Revenue for the Nine

Months Ended September 30, 2024

| |

Nine Months Ended September 30, |

| (Dollars in 000’s) |

2024 |

|

2023 |

|

Year-over-Year % Change |

|

Nucleic Acid Production |

$ |

154,446 |

|

$ |

165,944 |

|

(6.9 |

)% |

| Biologics Safety Testing |

|

48,333 |

|

|

48,860 |

|

(1.1 |

)% |

|

Total Revenue |

$ |

202,779 |

|

$ |

214,804 |

|

(5.6 |

)% |

Third Quarter

2024 Financial Results

Revenue for the third quarter was $65.2 million,

representing a 2.5% decrease over the same period in the prior year

and was driven by the following:

- Nucleic Acid

Production revenue was $49.9 million for the third quarter,

representing a 2.5% decrease year-over-year. The revenue decrease

was primarily driven by lower demand for research and discovery

products.

- Biologics Safety

Testing revenue was $15.3 million for the third quarter,

representing a 2.5% decrease year-over-year, primarily due to lower

demand in the bioprocessing market.

Net loss and Adjusted EBITDA (non-GAAP) were

$(176.0) million and $12.7 million, respectively, for the third

quarter of 2024, compared to net loss and Adjusted EBITDA

(non-GAAP) of $(15.1) million and $11.9 million, respectively, for

the third quarter of 2023.

Nine Months Ended September 30,

2024 Financial Results

Revenue for the nine months ended

September 30, 2024 was $202.8 million, representing a 5.6%

decrease over the same period in the prior year and was driven by

the following:

- Nucleic Acid

Production revenue was $154.4 million for the nine months ended

September 30, 2024, representing a 6.9% decrease

year-over-year. The revenue decrease was primarily driven by lower

demand for research and discovery products.

- Biologics Safety

Testing revenue was $48.3 million for the nine months ended

September 30, 2024, representing a 1.1% decrease

year-over-year.

Net loss and Adjusted EBITDA (non-GAAP) were

$(213.1) million and $37.5 million, respectively, for the nine

months ended September 30, 2024, compared to net loss and

Adjusted EBITDA (non-GAAP) of $(28.4) million and $44.8 million,

respectively, for the same period in the prior year.

Financial Guidance for

2024

Maravai’s financial guidance for the full year

2024 is based on expectations for its existing business and does

not include the financial impact of potential new acquisitions,

including the planned acquisition of the DNA and RNA business of

Officinae Bio, or items that have not yet been identified or

quantified. This guidance is subject to a number of risks,

uncertainties and other factors, including those identified in

“Forward-looking Statements” below.

Revenue expectations for 2024 are now expected

to be in the range of $255.0 million to $265.0 million.

Adjusted EBITDA (non-GAAP) margins are now

expected to be in the range of 16% to 18%.

As it relates to forward-looking Adjusted EBITDA

margin, Maravai cannot provide guidance for the most directly

comparable GAAP measure or a reconciliation of this non-GAAP

financial measure because it is unable to provide a meaningful or

accurate calculation or estimation of certain significant

reconciling items without unreasonable effort.

|

MARAVAI LIFESCIENCES HOLDINGS, INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(in thousands, except per share amounts) |

|

(Unaudited) |

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

65,200 |

|

|

$ |

66,865 |

|

|

$ |

202,779 |

|

|

$ |

214,804 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Cost of revenue |

|

36,826 |

|

|

|

36,686 |

|

|

|

113,432 |

|

|

|

113,635 |

|

|

Selling, general and administrative |

|

39,087 |

|

|

|

38,864 |

|

|

|

120,528 |

|

|

|

112,912 |

|

|

Research and development |

|

4,344 |

|

|

|

4,347 |

|

|

|

14,660 |

|

|

|

12,686 |

|

|

Change in estimated fair value of contingent consideration |

|

(178 |

) |

|

|

2,385 |

|

|

|

(1,373 |

) |

|

|

69 |

|

|

Goodwill impairment |

|

154,239 |

|

|

|

— |

|

|

|

154,239 |

|

|

|

— |

|

|

Restructuring |

|

(4 |

) |

|

|

— |

|

|

|

(1,220 |

) |

|

|

— |

|

| Total operating expenses |

|

234,314 |

|

|

|

82,282 |

|

|

|

400,266 |

|

|

|

239,302 |

|

| Loss from operations |

|

(169,114 |

) |

|

|

(15,417 |

) |

|

|

(197,487 |

) |

|

|

(24,498 |

) |

| Other income

(expense): |

|

|

|

|

|

|

|

|

Interest expense |

|

(13,634 |

) |

|

|

(11,637 |

) |

|

|

(36,437 |

) |

|

|

(30,492 |

) |

|

Interest income |

|

7,071 |

|

|

|

7,432 |

|

|

|

21,367 |

|

|

|

20,268 |

|

|

Change in payable to related parties pursuant to the Tax Receivable

Agreement |

|

(39 |

) |

|

|

(1,007 |

) |

|

|

(39 |

) |

|

|

(2,342 |

) |

|

Other income (expense) |

|

72 |

|

|

|

66 |

|

|

|

(2,384 |

) |

|

|

(1,386 |

) |

| Loss before income taxes |

|

(175,644 |

) |

|

|

(20,563 |

) |

|

|

(214,980 |

) |

|

|

(38,450 |

) |

| Income tax expense

(benefit) |

|

311 |

|

|

|

(5,461 |

) |

|

|

(1,853 |

) |

|

|

(10,057 |

) |

| Net loss |

|

(175,955 |

) |

|

|

(15,102 |

) |

|

|

(213,127 |

) |

|

|

(28,393 |

) |

| Net loss attributable to

non-controlling interests |

|

(76,917 |

) |

|

|

(8,640 |

) |

|

|

(94,426 |

) |

|

|

(15,323 |

) |

| Net loss attributable

to Maravai LifeSciences Holdings, Inc. |

$ |

(99,038 |

) |

|

$ |

(6,462 |

) |

|

$ |

(118,701 |

) |

|

$ |

(13,070 |

) |

| |

|

|

|

|

|

|

|

| Net loss per Class A common

share attributable to Maravai LifeSciences Holdings, Inc., basic

and diluted |

$ |

(0.70 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.87 |

) |

|

$ |

(0.10 |

) |

| Weighted average number of

Class A common shares outstanding, basic and diluted |

|

141,555 |

|

|

|

131,930 |

|

|

|

136,595 |

|

|

|

131,845 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARAVAI LIFESCIENCES HOLDINGS, INC. |

|

RECONCILIATION OF NON-GAAP FINANCIAL

INFORMATION |

|

(in thousands, except per share amounts) |

|

(Unaudited) |

| |

| Net Loss to

Adjusted EBITDA |

|

|

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net loss |

$ |

(175,955 |

) |

|

$ |

(15,102 |

) |

|

$ |

(213,127 |

) |

|

$ |

(28,393 |

) |

| Add: |

|

|

|

|

|

|

|

| Amortization |

|

6,891 |

|

|

|

6,870 |

|

|

|

20,629 |

|

|

|

20,487 |

|

| Depreciation |

|

5,044 |

|

|

|

4,071 |

|

|

|

15,386 |

|

|

|

8,966 |

|

| Interest expense |

|

13,634 |

|

|

|

11,637 |

|

|

|

36,437 |

|

|

|

30,492 |

|

| Interest income |

|

(7,071 |

) |

|

|

(7,432 |

) |

|

|

(21,367 |

) |

|

|

(20,268 |

) |

| Income tax expense

(benefit) |

|

311 |

|

|

|

(5,461 |

) |

|

|

(1,853 |

) |

|

|

(10,057 |

) |

|

EBITDA |

|

(157,146 |

) |

|

|

(5,417 |

) |

|

|

(163,895 |

) |

|

|

1,227 |

|

| Acquisition contingent

consideration (1) |

|

(178 |

) |

|

|

2,385 |

|

|

|

(1,373 |

) |

|

|

69 |

|

| Acquisition integration costs

(2) |

|

919 |

|

|

|

3,268 |

|

|

|

4,641 |

|

|

|

9,198 |

|

| Stock-based compensation

(3) |

|

13,050 |

|

|

|

9,987 |

|

|

|

38,870 |

|

|

|

25,246 |

|

| Merger and acquisition related

expenses (4) |

|

833 |

|

|

|

46 |

|

|

|

863 |

|

|

|

3,708 |

|

| Financing costs (5) |

|

114 |

|

|

|

— |

|

|

|

114 |

|

|

|

— |

|

| Acquisition related tax

adjustment (6) |

|

(67 |

) |

|

|

(77 |

) |

|

|

2,374 |

|

|

|

1,370 |

|

| Tax Receivable Agreement

liability adjustment (7) |

|

39 |

|

|

|

1,007 |

|

|

|

39 |

|

|

|

2,342 |

|

| Goodwill impairment (8) |

|

154,239 |

|

|

|

— |

|

|

|

154,239 |

|

|

|

— |

|

| Restructuring costs (9) |

|

(10 |

) |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

| Other (10) |

|

946 |

|

|

|

701 |

|

|

|

1,578 |

|

|

|

1,615 |

|

|

Adjusted EBITDA |

$ |

12,739 |

|

|

$ |

11,900 |

|

|

$ |

37,451 |

|

|

$ |

44,775 |

|

|

|

| Adjusted Net

(Loss) Income and Adjusted Fully Diluted (Loss) Earnings Per

Share |

|

|

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net loss attributable to Maravai LifeSciences Holdings, Inc. |

$ |

(99,038 |

) |

|

$ |

(6,462 |

) |

|

$ |

(118,701 |

) |

|

$ |

(13,070 |

) |

| Net loss impact from pro forma

conversion of Class B shares to Class A common shares |

|

(76,917 |

) |

|

|

(8,640 |

) |

|

|

(94,426 |

) |

|

|

(15,323 |

) |

| Adjustment to the provision

for income tax (11) |

|

18,353 |

|

|

|

2,074 |

|

|

|

22,531 |

|

|

|

3,670 |

|

| Tax-effected net loss |

|

(157,602 |

) |

|

|

(13,028 |

) |

|

|

(190,596 |

) |

|

|

(24,723 |

) |

| Acquisition contingent

consideration (1) |

|

(178 |

) |

|

|

2,385 |

|

|

|

(1,373 |

) |

|

|

69 |

|

| Acquisition integration costs

(2) |

|

919 |

|

|

|

3,268 |

|

|

|

4,641 |

|

|

|

9,198 |

|

| Stock-based compensation

(3) |

|

13,050 |

|

|

|

9,987 |

|

|

|

38,870 |

|

|

|

25,246 |

|

| Merger and acquisition related

expenses (4) |

|

833 |

|

|

|

46 |

|

|

|

863 |

|

|

|

3,708 |

|

| Financing costs (5) |

|

114 |

|

|

|

— |

|

|

|

114 |

|

|

|

— |

|

| Acquisition related tax

adjustment (6) |

|

(67 |

) |

|

|

(77 |

) |

|

|

2,374 |

|

|

|

1,370 |

|

| Tax Receivable Agreement

liability adjustment (7) |

|

39 |

|

|

|

1,007 |

|

|

|

39 |

|

|

|

2,342 |

|

| Goodwill impairment (8) |

|

154,239 |

|

|

|

— |

|

|

|

154,239 |

|

|

|

— |

|

| Restructuring costs (9) |

|

(10 |

) |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

| Other (10) |

|

946 |

|

|

|

701 |

|

|

|

1,578 |

|

|

|

1,615 |

|

| Tax impact of adjustments

(12) |

|

(16,667 |

) |

|

|

(6,765 |

) |

|

|

(21,130 |

) |

|

|

(14,948 |

) |

| Net cash tax benefit retained

from historical exchanges (13) |

|

119 |

|

|

|

(279 |

) |

|

|

687 |

|

|

|

555 |

|

| Adjusted net (loss)

income |

$ |

(4,265 |

) |

|

$ |

(2,755 |

) |

|

$ |

(9,693 |

) |

|

$ |

4,432 |

|

| |

|

|

|

|

|

|

|

| Diluted weighted

average shares of Class A common stock outstanding |

|

255,203 |

|

|

|

251,033 |

|

|

|

253,910 |

|

|

|

251,301 |

|

| |

|

|

|

|

|

|

|

| Adjusted net (loss)

income |

$ |

(4,265 |

) |

|

$ |

(2,755 |

) |

|

$ |

(9,693 |

) |

|

$ |

4,432 |

|

| Adjusted fully diluted

(loss) earnings per share |

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.04 |

) |

|

$ |

0.02 |

|

____________________Explanatory Notes to

Reconciliations

| (1) |

|

Refers to the change in estimated

fair value of contingent consideration related to completed

acquisitions. |

| (2) |

|

Refers to incremental costs incurred to execute and integrate

completed acquisitions, including retention payments related to

integration that were negotiated specifically at the time of the

Company’s acquisition of MyChem, LLC (“MyChem”) and Alphazyme, LLC

(“Alphazyme”), which were completed in January 2022 and January

2023, respectively. These retention payments arise from the

Company’s agreements executed in connection with the acquisitions

of MyChem and Alphazyme and provide incremental financial

incentives, over and above recurring compensation, to ensure the

employees of these companies remain present and participate in

integration of the acquired businesses during the integration and

knowledge transfer periods. The Company agreed to pay certain

employees of Alphazyme retention payments totaling $9.3 million as

of various dates but primarily through December 31, 2025, as long

as these individuals continue to be employed by the Company. The

Company agreed to pay the sellers of MyChem retention payments

totaling $20.0 million as of the second anniversary of the closing

of the acquisition date as long as two senior employees (who were

also the sellers of MyChem) continue to be employed by TriLink. The

Company considers the payment of these retention payments as

probable and is recognizing compensation expense related to these

payments in the post-acquisition period ratably over the service

period. Retention payment expenses were $0.8 million (Alphazyme

$0.8 million) and $4.3 million (MyChem $1.8 million; Alphazyme $2.5

million) for the three and nine months ended September 30,

2024, respectively. Retention payment expenses were $3.1 million

(MyChem $2.4 million; Alphazyme $0.7 million) and $8.6 million

(MyChem $6.8 million; Alphazyme $1.8 million) for the three and

nine months ended September 30, 2023, respectively. Retention

expenses for MyChem concluded in the first quarter of 2024, and

following the payments in the first quarter of 2024, there are no

further retention expenses payable for MyChem. The remaining

retention accrual for Alphazyme is $4.2 million, expected to be

accrued ratably each quarter through December 31, 2025, with

payments expected to be made in the first quarter of 2026. There

are no further cash-based retention payments planned, other than

those disclosed above, for acquisitions completed as of

September 30, 2024. |

| (3) |

|

Refers to non-cash expense

associated with stock-based compensation. |

| (4) |

|

Refers to diligence, legal,

accounting, tax and consulting fees incurred associated with

acquisitions that were pursued but not consummated. |

| (5) |

|

Refers to transaction costs

related to the refinancing of our long-term debt that are not

capitalizable. |

| (6) |

|

Refers to non-cash (income)

expense associated with adjustments to the indemnification asset

recorded in connection with the acquisition of MyChem. |

| (7) |

|

Refers to the adjustment of the

Tax Receivable Agreement liability primarily due to changes in

Maravai’s estimated state apportionment and the corresponding

change of its estimated state tax rate. |

| (8) |

|

Refers to goodwill impairment

recorded for our Nucleic Acid Production segment. |

| (9) |

|

Refers to restructuring costs (benefit) associated with the Cost

Realignment Plan, which was implemented in November 2023. For the

nine months ended September 30, 2024, stock-based compensation

benefit of $1.2 million related to forfeited stock awards in

connection with the restructuring is included in the stock-based

compensation line item. For the three months ended

September 30, 2024, such amount was immaterial. |

| (10) |

|

For the three and nine months ended September 30, 2024, refers

to loss on abandoned projects, severance payments, inventory

step-up charges and certain other adjustments in connection with

the acquisition of Alphazyme, and other non-recurring costs. For

the three and nine months ended September 30, 2023, refers to

severance payments, legal settlement amounts, inventory step-up

charges in connection with the acquisition of Alphazyme, certain

working capital and other adjustments related to the acquisition of

MyChem, and other non-recurring costs. |

| (11) |

|

Represents additional corporate income taxes at an assumed

effective tax rate of approximately 24% applied to additional net

loss attributable to Maravai LifeSciences Holdings, Inc. from the

assumed proforma exchange of all outstanding shares of Class B

common stock for shares of Class A common stock. |

| (12) |

|

Represents income tax impact of non-GAAP adjustments at an assumed

effective tax rate of approximately 24% and the assumed proforma

exchange of all outstanding shares of Class B common stock for

shares of Class A common stock. |

| (13) |

|

Represents income tax benefits due to the amortization of

intangible assets and other tax attributes resulting from the tax

basis step up associated with the purchase or exchange of Maravai

Topco Holdings, LLC units and Class B common stock, net of payment

obligations under the Tax Receivable Agreement. |

Non-GAAP Financial

Information

This press release contains financial measures

that have not been calculated in accordance with accounting

principles generally accepted in the U.S. (GAAP). These non-GAAP

measures include: Adjusted EBITDA and Adjusted fully diluted

Earnings Per Share (EPS).

Maravai defines Adjusted EBITDA as net (loss)

income before interest, taxes, depreciation and amortization and

adjustments to exclude, as applicable: (i) fair value adjustments

to acquisition contingent consideration; (ii) incremental costs

incurred to execute and integrate completed acquisitions, and

associated retention payments; (iii) non-cash expenses related to

share-based compensation; (iv) expenses incurred for acquisitions

that were pursued but not consummated (including legal, accounting

and professional consulting services); (v) transaction costs

incurred for debt refinancings; (vi) non-cash expense associated

with adjustments to the carrying value of the indemnification asset

recorded in connection with completed acquisitions; (vii) loss

(income) recognized during the applicable period due to changes in

the tax receivable agreement liability; (viii) impairment charges;

(ix) restructuring costs; (x) loss on abandoned projects; (xi)

severance payments; (xii) legal settlement amounts; and (xii)

inventory step-up charges in connection with completed

acquisitions. Maravai defines Adjusted Net (Loss) Income as

tax-effected earnings before the adjustments described above, and

the tax effects of those adjustments. Maravai defines Adjusted

Diluted EPS as Adjusted Net (Loss) Income divided by the diluted

weighted average number of shares of Class A common stock

outstanding for the applicable period, which assumes the proforma

exchange of all outstanding units of Maravai Topco Holdings, LLC

(paired with shares of Class B common stock) for shares of Class A

common stock.

These non-GAAP measures are supplemental

measures of operating performance that are not prepared in

accordance with GAAP and that do not represent, and should not be

considered as, an alternative to net (loss) income, as determined

in accordance with GAAP.

Management uses these non-GAAP measures to

understand and evaluate Maravai’s core operating performance and

trends and to develop short-term and long-term operating plans.

Management believes the measures facilitate comparison of Maravai’s

operating performance on a consistent basis between periods and,

when viewed in combination with its results prepared in accordance

with GAAP, help provide a broader picture of factors and trends

affecting Maravai’s results of operations.

These non-GAAP financial measures have

limitations as an analytical tool, and you should not consider them

in isolation, or as a substitute for analysis of Maravai’s results

as reported under GAAP. Because of these limitations, they should

not be considered as a replacement for net (loss) income, as

determined by GAAP, or as a measure of Maravai’s profitability.

Management compensates for these limitations by relying primarily

on Maravai’s GAAP results and using non-GAAP measures only for

supplemental purposes. The non-GAAP financial measures should be

considered supplemental to, and not a substitute for, financial

information prepared in accordance with GAAP.

Conference Call and Webcast

Maravai’s management will host a conference call

today at 2:00 p.m. PT/ 5:00 p.m. ET to discuss its financial

results for the third quarter of fiscal year 2024. Approximately 10

minutes before the call, dial (888) 596-4144 or (646) 968-2525 and

reference Maravai LifeSciences, Conference ID 9502421. The call

will also be available via live or archived webcast on the

"Investors" section of the Maravai web site at

https://investors.maravai.com/.

About Maravai

Maravai is a leading life sciences company

providing critical products to enable the development of drug

therapies, diagnostics and novel vaccines and to support research

on human diseases. Maravai’s companies are leaders in providing

products and services in the fields of nucleic acid synthesis and

biologics safety testing to many of the world's leading

biopharmaceutical, vaccine, diagnostics, and cell and gene therapy

companies.

For more information about Maravai LifeSciences,

visit www.maravai.com.

Forward-looking Statements

This press release contains, and Maravai’s

officers and representatives may from time-to-time make,

“forward-looking statements” within the meaning of the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Investors are cautioned that statements in this press release

which are not strictly historical statements constitute

forward-looking statements, including, without limitation,

statements regarding Maravai’s financial guidance for 2024;

Maravai’s effect on the acceleration of transformational research

in RNA therapeutics and discovery; growth opportunities, including

both organic and inorganic growth; Maravai’s plans to acquire the

DNA and RNA business of Officinae Bio and the expected benefits

thereof; and future innovations, constitute forward-looking

statements and are identified by words like “believe,” “expect,”

“see,” “project,” “may,” “will,” “should,” “seek,” “anticipate,” or

“could” and similar expressions.

Forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based only on management’s current beliefs, expectations

and assumptions regarding the future of Maravai’s business, future

plans and strategies, projections, anticipated events and trends,

the economy and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict and many of which are outside of management’s

control. Maravai’s actual results and financial condition may

differ materially from those indicated in the forward-looking

statements. Therefore, you should not rely on any of these

forward-looking statements. Important factors that could cause

Maravai’s actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the following:

- The level of

Maravai’s customers’ spending on and demand for outsourced nucleic

acid production and biologics safety testing products and

services.

- The impact of

ongoing macroeconomic challenges and changes in economic

conditions, including adverse developments affecting banks and

financial institutions, follow-on effects of those events and

related systemic pressures, on Maravai and Maravai’s customers’

current and future business operations.

- The effects of

Maravai’s recent reduction in force, including on Maravai’s ability

to attract and/or retain qualified key personnel.

- Use of Maravai’s

products by customers in the production of vaccines and therapies,

some of which represent relatively new and still-developing modes

of treatment, and the impact of unforeseen adverse events, negative

clinical outcomes, development of alternative therapies, or

increased regulatory scrutiny of these modes of treatment and their

financial cost on Maravai’s customers’ use of its products and

services.

- Competition with

life science, pharmaceutical and biotechnology companies who are

substantially larger than Maravai and potentially capable of

developing new approaches that could make Maravai’s products,

services and technology obsolete.

- The potential

failure of Maravai’s products and services to not perform as

expected and the reliability of the technology on which Maravai’s

products and services are based.

- The risk that

Maravai’s products do not comply with required quality

standards.

- Market acceptance

of Maravai’s life science reagents.

- Significant

fluctuations and unpredictability in Maravai’s quarterly and annual

operating results, which make Maravai’s future operating results

difficult to predict and could cause Maravai’s operating results to

fall below expectations or any guidance Maravai may provide.

- Maravai’s ability

to implement its strategic plan successfully.

- Natural disasters,

geopolitical instability (including the ongoing military conflicts

in Ukraine and the Gaza Strip) and other catastrophic events.

- Risks related to

Maravai’s acquisitions, including whether Maravai achieves the

anticipated benefits of acquisitions of businesses or

technologies.

- Product liability

lawsuits.

- Maravai’s

dependency on a limited number of customers for a high percentage

of its revenue and Maravai’s ability to maintain its current

relationships with such customers.

- Maravai’s reliance

on a limited number of suppliers or, in some cases, sole suppliers,

for some of Maravai’s raw materials and the risk that Maravai may

not be able to find replacements or immediately transition to

alternative suppliers.

- The risk that

Maravai’s products become subject to more onerous regulation by the

FDA or other regulatory agencies in the future.

- Maravai’s ability

to obtain, maintain and enforce sufficient intellectual property

protection for Maravai’s current or future products.

- The risk that a

future cyber-attack or security breach cannot be prevented.

- Maravai’s ability

to protect the confidentiality of Maravai’s proprietary

information.

- The risk that one

of Maravai’s products may be alleged (or found) to infringe on the

intellectual property rights of third parties.

- Compliance with

Maravai’s obligations under intellectual property license

agreements.

- Maravai’s or

Maravai’s licensors’ failure to maintain the patents or patent

applications in-licensed from a third party.

- Maravai’s ability

to adequately protect Maravai’s intellectual property and

proprietary rights throughout the world.

- Maravai’s existing

level of indebtedness and Maravai’s ability to raise additional

capital on favorable terms.

- Maravai’s ability

to generate sufficient cash flow to service all of Maravai’s

indebtedness.

- Maravai’s potential

failure to meet Maravai’s debt service obligations.

- Restrictions on

Maravai’s current and future operations under the terms applicable

to Maravai’s Credit Agreement.

- Maravai’s

dependence, by virtue of Maravai’s principal asset being its

interest in Maravai Topco Holdings, LLC (“Topco LLC”), on

distributions from Topco LLC to pay Maravai’s taxes and expenses,

including payments under a tax receivable agreement with the former

owners of Topco LLC (the “Tax Receivable Agreement” or “TRA”)

together with various limitations and restrictions that impact

Topco LLC’s ability to make such distributions.

- The risk that

conflicts of interest could arise between Maravai’s shareholders

and Maravai Life Sciences Holdings, LLC (“MLSH 1”), the only other

member of Topco LLC, and impede business decisions that could

benefit Maravai’s shareholders.

- The substantial

future cash payments Maravai may be required to make under the Tax

Receivable Agreement to MLSH 1 and Maravai Life Sciences Holdings

2, LLC (“MLSH 2”), an entity through which certain of Maravai’s

former owners hold their interests in the Company and the negative

effect of such payments.

- The fact that

Maravai’s organizational structure, including the TRA, confers

certain benefits upon MLSH 1 and MLSH 2 that will not benefit

Maravai’s other common shareholders to the same extent as they will

benefit MLSH 1 and MLSH 2.

- Maravai’s ability

to realize all or a portion of the tax benefits that are expected

to result from the tax attributes covered by the Tax Receivable

Agreement.

- The possibility

that Maravai will receive distributions from Topco LLC

significantly in excess of Maravai’s tax liabilities and

obligations to make to make payments under the Tax Receivable

Agreement.

- Unanticipated

changes in effective tax rates or adverse outcomes resulting from

examination of Maravai’s income or other tax returns.

- Risks related to

Maravai’s annual assessment of the effectiveness of Maravai’s

internal control over financial reporting, including the potential

existence of any material weakness or significant deficiency.

- The fact that

investment entities affiliated with GTCR, LLC (“GTCR”) currently

control a majority of the voting power of Maravai’s outstanding

common stock, and it may have interests that conflict with

Maravai’s or yours in the future.

- Risks related to

Maravai’s “controlled company” status within the meaning of the

corporate governance standards of NASDAQ.

- The potential

anti-takeover effects of certain provisions in Maravai’s corporate

organizational documents.

- Potential sales of

a significant portion of Maravai’s outstanding shares of Class A

common stock.

- Potential preferred

stock issuances and the anti-takeover impacts of any such

issuances.

- Such other factors

as discussed throughout the sections entitled “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in Maravai’s most recent Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q, as well as other

documents Maravai files with the Securities and Exchange

Commission.

Any forward-looking statements made in this

release are based only on information currently available to

management and speak only as of the date on which it is made.

Maravai undertakes no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

Contact Information:

Deb Hart

Maravai LifeSciences

+ 1 858-988-5917

ir@maravai.com

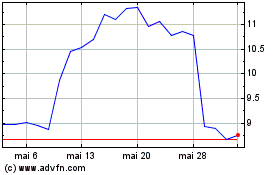

Maravai LifeSciences (NASDAQ:MRVI)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Maravai LifeSciences (NASDAQ:MRVI)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024