As

filed with the Securities and Exchange Commission on June 3, 2024

Registration

No. 333-272616

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 3

TO

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

MICROVISION,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

91-1600822 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification Number) |

18390

NE 68th Street

Redmond,

WA 98052

(425)

936-6847

(Address,

including zip code, and telephone number, including area code of registrant’s principal executive offices)

Drew

G. Markham

Vice

President, General Counsel, and Secretary

MicroVision,

Inc.

18390

NE 68th Street

Redmond,

Washington 98052

(425)

936-6847

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Please

send copies of all communications to:

Thomas

Fraser

Ropes

& Gray LLP

Prudential

Tower

800

Boylston Street

Boston,

MA 02199

(617)

951-7000

Approximate

date of commencement of proposed sale to the public: From time to time after the effectiveness of the registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☒ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☐ |

Smaller

reporting company |

☐ |

| |

|

|

|

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

EXPLANATORY

NOTE

This

Post-Effective Amendment No. 3 to the Registration Statement on Form S-3 (File No. 333-272616) (“Post-Effective Amendment No. 3”)

of MicroVision, Inc. (the “Company”) is being filed as an exhibit-only filing solely to file: an updated consent of Moss

Adams LLP, as Exhibit 23.1; an updated consent of EY GmbH & Co. KG Wirtschaftsprüfungsgesellschaft, as Exhibit 23.2; an updated

opinion of Ropes & Gray LLP, as Exhibit 5.1; and an updated consent of Ropes & Gray LLP, as Exhibit 23.3. Accordingly, this amendment

consists only of the facing page, this explanatory note, Item 16 of Part II of the Registration Statement, the signature page to the

Registration Statement and the updated Exhibit 5.1, Exhibit 23.1, Exhibit 23.2 and Exhibit 23.3. The prospectus, the prospectus supplement

and the balance of Part II of the Registration Statement are unchanged and have been omitted.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

16. Exhibits

| |

|

Title

of Exhibit |

| |

|

|

| 1.1* |

|

Form

of Underwriting Agreement |

| |

|

|

| 1.2 |

|

At-the-Market Issuance Sales Agreement, dated August 29, 2023, by and between the Company and Craig-Hallum Capital Group LLC (incorporated by reference to Exhibit 1.1 to the Company’s Current Report on Form 8-K, filed with the SEC on August 29, 2023). |

| |

|

|

| 4.1 |

|

Form of Specimen Stock Certificate for Common Stock (incorporated by reference to Exhibit 4.1 to the Company’s Post-Effective Amendment to Form S-3 Registration Statement, Registration No. 333-102244, filed with the SEC on December 24, 2003). |

| |

|

|

| 4.2* |

|

Form

of Specimen Stock Certificate for Preferred Stock |

| |

|

|

| 4.3* |

|

Form

of Warrant Agreement (including Form of Warrant Certificate) |

| |

|

|

| 5.1 |

|

Opinion of Ropes & Gray LLP (relating to the base prospectus). |

| |

|

|

| 5.2 |

|

Opinion of Ropes & Gray LLP (relating to the at-the-market offering prospectus) (incorporated by reference to Exhibit 5.2 to the Company’s Post-Effective Amendment to Form S-3 Registration Statement, Registration No. 333-272616, filed with the SEC on March 1, 2024). |

| |

|

|

| 23.1 |

|

Consent of Moss Adams LLP. |

| |

|

|

| 23.2 |

|

Consent of EY GmbH & Co. KG Wirtschaftsprüfungsgesellschaft. |

| |

|

|

| 23.3 |

|

Consent of Ropes & Gray LLP (included in the opinion filed as Exhibit 5.1). |

| |

|

|

| 24.1 |

|

Powers of Attorney (incorporated by reference to the signature page hereto). |

| |

|

|

| 107 |

|

Filing Fees (incorporated by reference to Exhibit 107 to the Company’s Post-Effective Amendment to Form S-3ASR Registration Statement, Registration No. 333-272616, filed with the SEC on February 29, 2024). |

| * |

To

be filed by amendment or by a Current Report on Form 8-K. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-3 and has duly caused this Post-Effective Amendment No.3 to the Registration Statement

to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Redmond, state of Washington, on the 3rd

day of June, 2024.

| MICROVISION, INC. |

|

| |

|

| By: |

/s/

Drew G. Markham |

|

| Name: |

Drew G. Markham |

|

| Title: |

Vice President, General Counsel & Secretary |

|

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Post-Effective Amendment No. 3 to the Registration Statement has

been signed by the following persons in the capacities indicated below on the 3rd day of June, 2024.

| Signature |

|

Title |

| |

|

|

| /s/

Sumit Sharma |

|

Chief

Executive Officer and Director |

| Sumit

Sharma |

|

(Principal

Executive Officer) |

| |

|

|

| /s/

Anubhav Verma |

|

Chief

Financial Officer |

| Anubhav

Verma |

|

(Principal

Financial Officer and Principal Accounting Officer) |

| |

|

|

| * |

|

Director |

| Simon

Biddiscombe |

|

|

| |

|

|

| * |

|

Director |

| Robert

P. Carlile |

|

|

| |

|

|

| * |

|

Director |

| Judy

Curran |

|

|

| |

|

|

| * |

|

Director |

| Jeffrey

Herbst |

|

|

| |

|

|

| * |

|

Director |

| Mark

Spitzer |

|

|

| |

|

|

| * |

|

Director |

| Brian

Turner |

|

|

| *

By: |

/s/

Drew G. Markham |

|

| |

Drew

G. Markham |

|

| |

Attorney-in-Fact |

|

Exhibit

5.1

|

ROPES

& GRAY LLP

PRUDENTIAL

TOWER

800

BOYLSTON STREET

BOSTON,

MA 02199-3600

WWW.ROPESGRAY.COM |

June

3, 2024

MicroVision,

Inc.

18390

NE 68th Street

Redmond,

WA 98052

Re:

Post-Effective Amendment No. 3 to the Registration Statement on Form S-3

Ladies

and Gentlemen:

We

have acted as counsel to MicroVision, Inc., a Delaware corporation (the “Company”), in connection with the Post-Effective

Amendment No. 3 to the Registration Statement on Form S-3 (Registration No. 333-272616) (as amended, the “Registration Statement”)

filed on the date hereof by the Company with the Securities and Exchange Commission (the “Commission”) under the Securities

Act of 1933, as amended (the “Securities Act”), relating to the registration under the Securities Act and the proposed

issuance and sale from time to time pursuant to Rule 415 under the Securities Act of:

(i)

shares of the Company’s common stock, $0.001 par value per share (the “Common Stock”);

(ii)

warrants representing the right to receive or the obligation to sell, upon exercise, a number of shares of Common Stock (the “Common

Stock Warrants”); and

(iii)

shares of preferred stock of the Company, $0.001 par value per share (the “Preferred Stock”).

The

Common Stock, the Common Stock Warrants and the Preferred Stock are referred to herein collectively as the “Securities.”

In

connection with this opinion letter, we have examined such certificates, documents and records and have made such investigation of fact

and such examination of law as we have deemed appropriate in order to enable us to render the opinions set forth herein. In conducting

such investigation, we have relied, without independent verification, upon certificates of officers of the Company, public officials

and other appropriate persons.

The

opinions expressed below are limited to the Delaware General Corporation Law.

Based

upon and subject to the foregoing and the assumptions, qualifications and limitations set forth below, we are of the opinion that:

1.

When (i) the issuance and sale of any shares of Common Stock have been duly authorized by all necessary corporate action of the Company

and (ii) such shares have been issued and delivered against payment of the purchase price therefor (in an amount in excess of the par

value thereof) in accordance with the applicable purchase, underwriting or other agreement, and as contemplated by the Registration Statement,

such shares of Common Stock will be validly issued, fully paid and nonassessable. The Common Stock covered in the opinion in this paragraph

includes any shares of Common Stock that may be issued upon exercise, conversion or exchange pursuant to the terms of any other Securities.

2.

When (i) the terms of any Common Stock Warrants and their issuance and sale have been duly authorized by all necessary corporate action

of the Company and (ii) such Common Stock Warrants have been duly executed, countersigned and delivered in accordance with the applicable

warrant agreement and against payment of the purchase price therefor in accordance with the applicable purchase, underwriting or other

agreement, and as contemplated by the Registration Statement, such Common Stock Warrants will constitute valid and binding obligations

of the Company enforceable against the Company in accordance with their terms.

3.

When (i) the terms of any Preferred Stock of a particular series and their issuance and sale have been duly authorized by all necessary

corporate action of the Company, (ii) a certificate of designations with respect to such series of Preferred Stock has been duly adopted

by the Company and filed with the Secretary of State of the State of Delaware, and (iii) such shares of Preferred Stock have been issued

and delivered against payment of the purchase price therefor (in an amount in excess of the par value thereof) in accordance with the

applicable purchase, underwriting or other agreement, and as contemplated by the Registration Statement, such shares of Preferred Stock

will be validly issued, fully paid, and nonassessable. The Preferred Stock covered in the opinion in this paragraph includes any shares

of Preferred Stock that may be issued upon exercise, conversion or exchange pursuant to the terms of any other Securities.

In

rendering the opinions set forth above, we have assumed that (i) the Registration Statement will have become effective under the Securities

Act, a prospectus supplement will have been prepared and filed with the Commission describing the Securities offered thereby and such

Securities will have been issued and sold in accordance with the terms of such prospectus supplement; (ii) a definitive purchase, underwriting,

or similar agreement, and any applicable indenture (including any supplemental indenture), warrant, depositary or guarantee agreement,

pursuant to which such Securities may be issued, will have been duly authorized, executed and delivered by the Company and the other

parties thereto, and the specific terms of such Securities will have been duly established in conformity with the applicable agreement

and the certificate of incorporation and bylaws of the Company (if applicable); (iii) at the time of the issuance of any Securities,

the Company will be a validly existing corporation under the law of its jurisdiction of incorporation; (iv) the number of shares of Common

Stock issued pursuant to the Registration Statement, together with the number of shares outstanding or reserved at the time of issuance,

will not exceed the respective number of shares authorized by the Company’s certificate of incorporation in effect at the time

of such issuance; (v) the number of shares of Preferred Stock issued pursuant to the Registration Statement, together with the number

of shares outstanding or reserved at the time of issuance, will not exceed the respective number of shares authorized by the Company’s

certificate of incorporation in effect at the time of such issuance; and (vi) all the foregoing actions to be taken by the Company will

have been taken so as not to violate any applicable law and so as to comply with any requirement or restriction imposed by any court

or governmental or regulatory body having jurisdiction over the Company or any of its property.

Our

opinions set forth above are subject to (a) bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance and similar laws

affecting the rights and remedies of creditors generally and (b) general principles of equity.

We

hereby consent to the filing of this opinion letter as an exhibit to the Registration Statement and to the use of our name therein and

in the related prospectus under the caption “Legal Matters.” In giving such consent, we do not thereby admit that we are

in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission

thereunder.

| |

Very

truly yours, |

| |

|

| |

/s/

Ropes & Gray LLP |

| |

Ropes

& Gray LLP |

Exhibit

23.1

Consent

of Independent Registered Public Accounting Firm

We

consent to the incorporation by reference in this Post-Effective Amendment No. 3 to Registration Statement on Form S-3 (No. 333-272616)

of MicroVision, Inc. (the “Company”) of our reports dated February 29, 2024, relating to the consolidated financial statements

and schedule of the Company and the effectiveness of internal control over financial reporting of the Company, appearing in the Annual

Report on Form 10-K of the Company for the year ended December 31, 2023, filed with the Securities and Exchange Commission. We also consent

to the reference to us under the heading “Experts” in such Registration Statement.

/s/

Moss Adams LLP

Seattle,

Washington

June 3, 2024

Exhibit

23.2

Consent

of Independent Auditors

We

consent to the incorporation by reference in this Post-Effective Amendment No. 3 to the Registration Statement (Form S-3 No. 333-272616)

and related Prospectus of MicroVision, Inc. for the registration of common stock, preferred stock, and warrants, of our report dated

April 18, 2023, with respect to the financial statements of Ibeo Automotive Systems GmbH, included in the Current Report on Form 8-K/A

Amendment No. 1 of MicroVision, Inc. and filed with the Securities and Exchange Commission on April 18, 2023. We also consent to the reference to us under the heading “Experts”

in such Registration Statement.

/s/

EY GmbH & Co. KG Wirtschaftsprüfungsgesellschaft

Berlin,

Germany

June 3, 2024

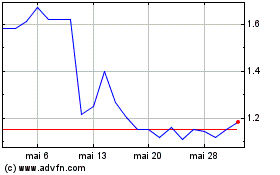

Microvision (NASDAQ:MVIS)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Microvision (NASDAQ:MVIS)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024