UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

12b-25

NOTIFICATION

OF LATE FILING

(Check

one):

☒

Form 10-K ☐ Form 20-F ☐ Form 11-K ☐ Form 10-Q ☐ Form 10-D ☐ Form N-CEN ☐ Form N-CSR

For

Period Ended: December 31, 2022

| |

☐ |

Transition

Report on Form 10-K |

| |

☐ |

Transition

Report on Form 20-F |

| |

☐ |

Transition

Report on Form 11-K |

| |

☐ |

Transition

Report on Form 10-Q |

For

the Transition Period Ended:

Nothing

in this form shall be construed to imply that the Commission has verified any information contained

herein.

|

If

the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART

I — REGISTRANT INFORMATION

Nova

LifeStyle, Inc.

Full

Name of Registrant

N/A

Former

Name if Applicable

6565

E. Washington Blvd

Address

of Principal Executive Office (Street and Number)

Commerce,

CA 90040

City,

State and Zip Code

PART

II — RULES 12b-25(b) AND (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b),

the following should be completed. (Check box if appropriate)

| |

(a) |

The

reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense |

| |

|

|

| ☒ |

(b) |

The

subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion

thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report

or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the

fifth calendar day following the prescribed due date; and |

| |

|

|

| |

(c) |

The

accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART

III — NARRATIVE

State

below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not

be filed within the prescribed time period.

Nova

Lifestyle, Inc. (the “Company”) is unable to file its Annual Report on Form 10-K for the fiscal year ended December

31, 2022 within the prescribed time period without unreasonable effort or expense because additional time is required to complete the

preparation of the Company’s financial statements in time for filing. The Company anticipates filing its Form 10-K on or before

the fifteenth calendar day following the prescribed due date.

PART

IV — OTHER INFORMATION

| (1) |

Name

and telephone number of person to contact in regard to this notification |

| |

Thanh

H. Lam |

|

323 |

|

888-9999 |

| |

(Name) |

|

(Area

Code) |

|

(Telephone

Number) |

| (2) |

Have

all other periodic reports required under Section 13 or 15(d) of the Securities Exchange

Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months

or for such shorter period that the registrant was required to file such report(s) been filed

? If answer is no, identify report(s).

|

| |

☒

Yes ☐ No |

| |

|

| (3) |

Is

it anticipated that any significant change in results of operations from the corresponding

period for the last fiscal year will be reflected by the earnings statements to be included

in the subject report or portion thereof?

☒

Yes ☐ No

If

so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons

why a reasonable estimate of the results cannot be made. |

Nova

LifeStyle Inc.

(Name

of Registrant as Specified in Charter)

has

caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| Date:

April 3, 2023 |

By: |

/s/

Thanh H. Lam |

| |

|

Thanh

H. Lam |

| |

Title: |

Chief

Executive Officer |

Part

IV. (3) Anticipated Significant Changes in Results of Operations

We

anticipate reporting the following significant changes in the results of operations from the 2022 fiscal year.

Cost

of Sales

Cost

of sales from continuing operations consists primarily of costs of finished goods purchased from third-party manufacturers. Total cost

of sales from continuing operations increased by 192% to $20.53 million for the year ended December 31, 2022, compared to $7.03 million

for 2021. Cost of sales as a percentage of sales increased to 161% for the year ended December 31, 2022, compared to 56% for 2021. The

increase in cost of sales in dollar term and cost of sales as a percentage of sales, was mainly due to our write down of $12.90 million

of the slow-moving inventory, primarily the jade mats in Malaysia, to the lower of cost and net

realizable value for 2022, compared to no inventory write down for 2021. The substantial difference of the inventory write downs

between the years ended December 31, 2022 and 2021, was caused by the ownership transfer of the jade mats in Malaysia from Nova HK to

Nova Malaysia on February 15, 2022, as Nova HK entered a de-registration process in February 2022 and its operations were reported as

discontinued operations for all periods presented, and thus the write down of $15.96 million of the jade mats in Malaysia was reported

from the Company’s discontinued operations for 2021.

Moreover,

if total cost of sales from continuing operations excluded our inventory write down of $12.90 million for the year ended December 31,

2022, total cost of sales from continuing operations would increase by 8% to $7.62 million for the year ended December 31, 2022, compared

to $7.03 million for 2021, and cost of sales as a percentage of sales would increase to 60% for the year ended December 31, 2022, compared

to 56% for 2021. The increase in cost of sales in dollar term and cost of sales as a percentage of sales, was a result of the increase

in our direct container sales which came with low profit margin.

Gross

(Loss) Profit

Gross

loss from continuing operations was $7.78 million for the year ended December 31, 2022, compared to gross profit of $5.52 million for

2021, representing a decrease in gross profit of $13.30 million. Our gross loss margin was 61% for the year ended December 31, 2022,

compared to a gross profit margin of 44% for 2021. The decrease in gross profit and gross profit margin, was mainly a result of our inventory

write down of $12.90 million for 2022, primarily for the jade mats in Malaysia, compared to no inventory write down for 2021. For 2021,

the write down of $15.96 million of the jade mats was reported from the Company’s discontinued operations, since the ownership

of the jade mats remained with Nova HK until February 2022, which operations were reported as discontinued operations for all periods

presented.

Moreover,

if total cost of sales from continuing operations excluded our inventory write down of $12.90 million for the year ended December 31,

2022, gross profit would be $5.12 million for the year ended December 31, 2022, compared to gross profit of $5.52 million for 2021, and

our gross profit margin would be 40% for the year ended December 31, 2022, compared to a gross profit margin of 44% for 2021. The decrease

in gross profit and gross profit margin, was primarily due to the increasing direct container sales with low profit margin.

Other

Expenses, Net

Other

expenses, net, from continuing operations were $851,166 for the year ended December 31, 2022, compared to $200,675 for 2021, representing

an increase in other expenses of $650,491. The increase in other expenses was due primarily to an increase in foreign exchange loss of

$737,507 to $639,432 for the year ended December 31, 2022 from foreign exchange gain of $98,075 for 2021. The increase in foreign exchange

loss was mainly a result of the depreciation of Malaysian Ringgit against U.S. dollars on the Company’s assets in Malaysia. However,

the increase in other expenses was partially offset by a decrease in interest expenses of $97,928 to $25,216 for the year ended December

31, 2022, compared to $123,144 for 2021.

Loss

from Continuing Operations

As

a result of the foregoing, our loss from continuing operations was $17.08 million for the year ended December 31, 2022, compared to $4.23

million for 2021.

Loss

from Discontinued Operations

On

February 15, 2022, we transferred our entire assets and business in Nova HK to Nova Malaysia, one of our subsidiaries. Operations of

Nova HK were reported as discontinued operations in the accompanying consolidated financial statements for all periods presented. We

had loss from discontinued operations of $0.03 million and $15.74 million for the years ended December 31, 2022 and 2021, respectively.

Net

Loss

As

a result of the foregoing, our net loss was $17.10 million for the year ended December 31, 2022, compared to $19.96 million for 2021.

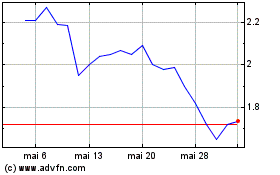

Nova Lifestyle (NASDAQ:NVFY)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Nova Lifestyle (NASDAQ:NVFY)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025