false 0001577916 0001577916 2024-05-07 2024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 7, 2024

Premier, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-36092 |

|

35-2477140 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

13034 Ballantyne Corporate Place

Charlotte, NC 28277

(Address of principal executive offices) (Zip Code)

(704) 357-0022

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Class A Common Stock, $0.01 Par Value |

|

PINC |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. |

Results of Operations and Financial Condition |

On May 7, 2024, Premier, Inc. (the “Company”) issued a press release reporting the financial results of the Company for the three and nine months ended March 31, 2024. A copy of the press release is attached to this report as Exhibit 99.1 and is incorporated herein by reference.

As discussed in the press release, the Company held a conference call and webcast on May 7, 2024. Supplemental slides referenced during the conference call and webcast were available on the Company’s website for viewing by participants. A transcript of the conference call and webcast together with the supplemental slides are attached as Exhibit 99.2 and Exhibit 99.3, respectively, to this report and are incorporated herein by reference.

| Item 7.01. |

Regulation FD Disclosure |

As noted in Item 2.02 of this report, the Company held a conference call and webcast on May 7, 2024, to discuss the Company’s financial results for the three and nine months ended March 31, 2024, as reported in the Company’s May 7, 2024 press release. A copy of the press release, which contains additional information regarding how to access the conference call and webcast and how to listen to a recorded playback, is attached as Exhibit 99.1 to this report. A transcript of the conference call and webcast together with supplemental slides referenced during the conference call and webcast are attached as Exhibit 99.2 and Exhibit 99.3, respectively, to this report and are incorporated herein by reference.

* * * *

The information discussed under Item 2.02 and Item 7.01 above, including Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing by the Company under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01. |

Financial Statements and Exhibits |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Premier, Inc. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Michael J. Alkire |

|

|

|

|

|

|

Name: Michael J. Alkire |

|

|

|

|

|

|

Title: President and Chief Executive Officer |

|

|

|

|

| Date: May 8, 2024 |

|

|

|

|

|

|

Exhibit 99.1

Premier, Inc. Reports Fiscal-Year 2024 Third-Quarter Results

| |

• |

|

Reaffirming fiscal 2024 financial guidance ranges |

| |

• |

|

Executed $400 million accelerated share repurchase transaction |

CHARLOTTE, N.C., May 7, 2024 - Premier, Inc. (NASDAQ: PINC), a leading technology-driven healthcare improvement company, today reported financial results

for the fiscal-year 2024 third quarter ended March 31, 2024.

Third-quarter results:

| |

• |

|

Total net revenue of $342.6 million; growth of 6% over the prior-year period |

| |

• |

|

GAAP net loss of $49.2 million, or $(0.36) per fully diluted share, which includes a $140.1 million

goodwill, intangible and other long-lived assets impairment related to the company’s Contigo Health business |

| |

• |

|

Adjusted earnings per share* of $0.55; flat compared to the prior-year period |

“Our third quarter results, which exceeded our expectations for profitability, reflect ongoing adoption of our products and services by members and other

customers,” said Michael J. Alkire, Premier’s President and CEO. “Consolidated net revenue increased from the prior-year period driven by growth in both our Supply Chain Services and Performance Services segments. We are reaffirming

our fiscal 2024 guidance and also continue to return capital to stockholders as we implemented our $400 million accelerated share repurchase transaction during the quarter, which we expect to be fully settled by the first quarter of fiscal

2025.”

Consolidated Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

|

Nine Months Ended March 31, |

|

| (in thousands, except per share data) |

|

2024 |

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

| Net revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supply Chain Services: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net administrative fees |

|

$ |

156,819 |

|

|

$ |

148,441 |

|

|

|

6% |

|

|

$ |

455,409 |

|

|

$ |

452,870 |

|

|

|

1% |

|

| Software licenses, other services and support |

|

|

14,257 |

|

|

|

11,032 |

|

|

|

29% |

|

|

|

37,954 |

|

|

|

35,963 |

|

|

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Services and software licenses |

|

|

171,076 |

|

|

|

159,473 |

|

|

|

7% |

|

|

|

493,363 |

|

|

|

488,833 |

|

|

|

1% |

|

| Products |

|

|

56,590 |

|

|

|

57,212 |

|

|

|

(1% |

) |

|

|

162,956 |

|

|

|

183,066 |

|

|

|

(11% |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Supply Chain Services |

|

|

227,666 |

|

|

|

216,685 |

|

|

|

5% |

|

|

|

656,319 |

|

|

|

671,899 |

|

|

|

(2% |

) |

| Performance Services |

|

|

115,003 |

|

|

|

105,556 |

|

|

|

9% |

|

|

|

339,972 |

|

|

|

323,860 |

|

|

|

5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total segment net revenue |

|

|

342,669 |

|

|

|

322,241 |

|

|

|

6% |

|

|

|

996,291 |

|

|

|

995,759 |

|

|

|

— % |

|

| Eliminations |

|

|

(73 |

) |

|

|

(9 |

) |

|

|

711% |

|

|

|

(198 |

) |

|

|

(28 |

) |

|

|

607% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenue |

|

$ |

342,596 |

|

|

$ |

322,232 |

|

|

|

6% |

|

|

$ |

996,093 |

|

|

$ |

995,731 |

|

|

|

— % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(49,162 |

) |

|

$ |

48,649 |

|

|

|

(201% |

) |

|

$ |

46,114 |

|

|

$ |

155,982 |

|

|

|

(70% |

) |

| Net (loss) income attributable to stockholders |

|

$ |

(40,195 |

) |

|

$ |

46,801 |

|

|

|

(186% |

) |

|

$ |

58,868 |

|

|

$ |

153,563 |

|

|

|

(62% |

) |

| Diluted (loss) earnings per share attributable to stockholders |

|

$ |

(0.36 |

) |

|

$ |

0.39 |

|

|

|

(192% |

) |

|

$ |

0.50 |

|

|

$ |

1.28 |

|

|

|

(61% |

) |

1

Consolidated Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

|

Nine Months Ended March 31, |

|

| (in thousands, except per share data) |

|

2024 |

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

| NON-GAAP FINANCIAL MEASURES*: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supply Chain Services |

|

$ |

114,021 |

|

|

$ |

117,474 |

|

|

|

(3% |

) |

|

$ |

343,486 |

|

|

$ |

356,978 |

|

|

|

(4% |

) |

| Performance Services |

|

|

27,039 |

|

|

|

24,954 |

|

|

|

8% |

|

|

|

79,768 |

|

|

|

87,290 |

|

|

|

(9% |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total segment adjusted EBITDA |

|

|

141,060 |

|

|

|

142,428 |

|

|

|

(1% |

) |

|

|

423,254 |

|

|

|

444,268 |

|

|

|

(5% |

) |

| Corporate |

|

|

(33,778 |

) |

|

|

(29,772 |

) |

|

|

(13% |

) |

|

|

(96,105 |

) |

|

|

(91,613 |

) |

|

|

(5% |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

107,282 |

|

|

$ |

112,656 |

|

|

|

(5% |

) |

|

$ |

327,149 |

|

|

$ |

352,655 |

|

|

|

(7% |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income |

|

$ |

61,191 |

|

|

$ |

66,357 |

|

|

|

(8% |

) |

|

$ |

192,279 |

|

|

$ |

207,391 |

|

|

|

(7% |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted earnings per share (EPS) |

|

$ |

0.55 |

|

|

$ |

0.55 |

|

|

|

— % |

|

|

$ |

1.64 |

|

|

$ |

1.73 |

|

|

|

(5% |

) |

| * |

These are non-GAAP financial measures. Refer to “Premier’s

Use and Definition of Non-GAAP Measures” below and the supplemental financial information at the end of this release for information on the company’s use of

non-GAAP measures and a reconciliation of reported GAAP results to non-GAAP results. |

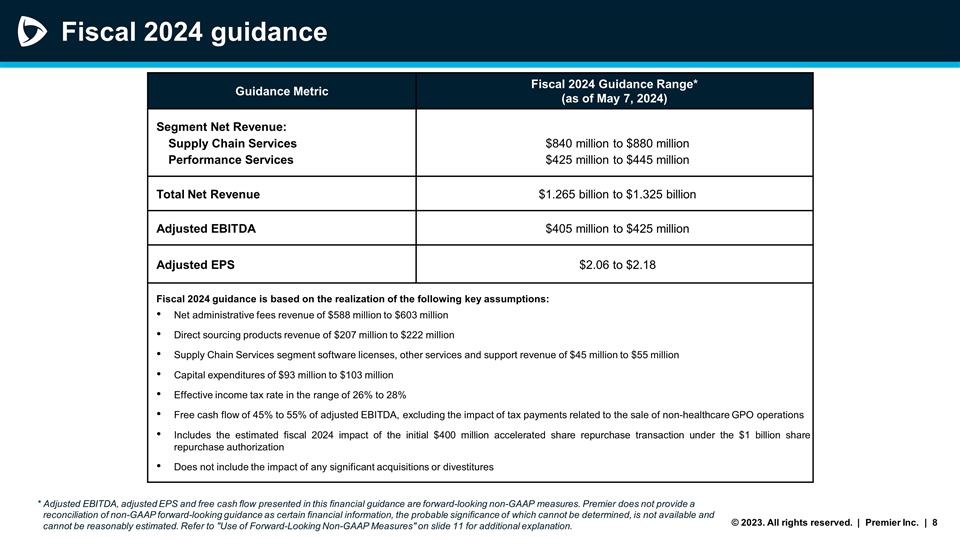

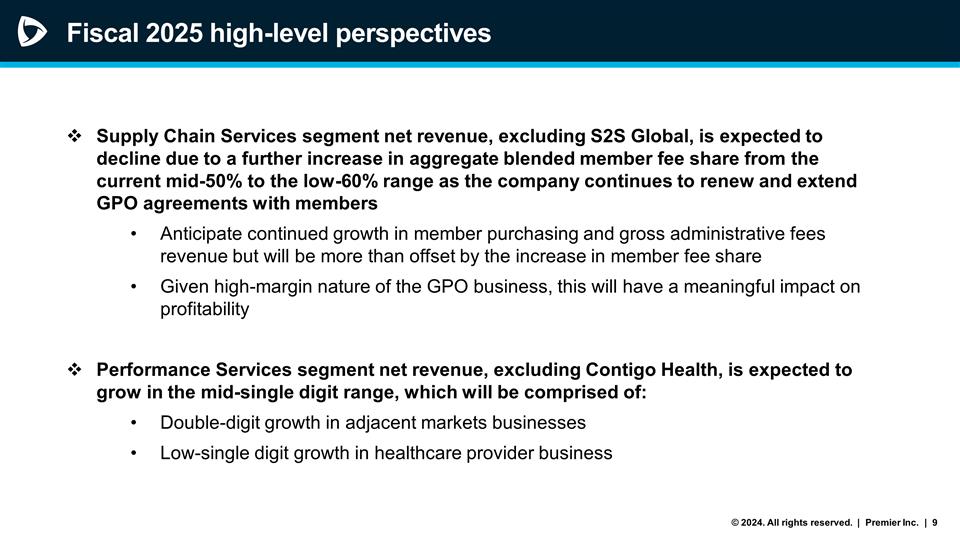

Fiscal 2024 Guidance

Certain statements in this

release, including without limitation, those in this section, are forward-looking statements. For additional information regarding the use and limitations of such statements, refer to “Cautionary Note Regarding Forward-Looking Statements”

below.

Based on its financial results for the nine months ended March 31, 2024, current visibility into the macro environment, and expectations

for the remainder of this fiscal year, the company is reaffirming the following fiscal 2024 guidance ranges:

|

|

|

| Guidance Metric |

|

Fiscal 2024 Guidance Range**

(as of May 7, 2024) |

| Segment Net Revenue: |

|

|

| Supply Chain Services |

|

$840 million to $880 million |

| Performance Services |

|

$425 million to $445 million |

| Total Net Revenue |

|

$1.265 billion to $1.325 billion |

| Adjusted EBITDA |

|

$405 million to $425 million |

| Adjusted EPS |

|

$2.06 to $2.18 |

Fiscal 2024 guidance is based on the realization of the following key assumptions:

| |

• |

|

Net administrative fees revenue of $588 million to $603 million |

| |

• |

|

Direct sourcing products revenue of $207 million to $222 million |

| |

• |

|

Supply Chain Services segment software licenses, other services and support revenue of $45 million to

$55 million |

| |

• |

|

Capital expenditures of $93 million to $103 million |

| |

• |

|

Effective income tax rate in the range of 26-28% |

| |

• |

|

Free cash flow of 45% to 55% of adjusted EBITDA, excluding the impact of tax payments related to the sale of non-healthcare GPO operations |

| |

• |

|

Includes the estimated fiscal 2024 impact of the initial $400 million accelerated share repurchase

transaction under the $1 billion share repurchase authorization |

| |

• |

|

Does not include the impact of any significant acquisitions or divestitures |

| |

** |

Adjusted EBITDA, adjusted EPS and free cash flow presented in this financial guidance are forward-looking non-GAAP measures. Refer to “Premier’s Use and Definition of Non-GAAP Measures” below for information on the company’s use of non-GAAP measures. Premier, Inc. does not provide forward-looking guidance on a GAAP basis as certain financial information, the probable significance of which cannot be determined, is not available and cannot be

reasonably estimated. Refer to “Premier’s Use of Forward-Looking Non-GAAP Measures” below for additional explanation. |

2

Results of Operations for the Three Months Ended March 31, 2024

(As compared with the three months ended March 31, 2023)

GAAP net revenue of $342.6 million increased 6% from $322.2 million in the prior-year period. Refer to “Supply Chain Services” and

“Performance Services” sections below for further discussion on the factors that impacted each segment during the quarter.

GAAP net loss of

$49.2 million decreased 201% from net income of $48.6 million in the prior-year period primarily as a result of the $140.1 million impairment charge to goodwill, intangibles and other long-lived assets related to the company’s

Contigo Health business in the current-year period, lower equity earnings and an increase in employee-related expenses driven by increased headcount, primarily to support growth in our supply chain

co-management business, and higher forecasted performance-related compensation expense as compared to the prior-year period which was lower as fiscal 2023 performance was below targeted expectations. These

decreases were partially offset by higher net revenue, a decrease in interest expense in the current-year period and a gain from the sale of one of the company’s minority investments.

GAAP diluted EPS of $(0.36) decreased 192% from $0.39 in the prior-year period due to the aforementioned drivers affecting GAAP net income offset by a

decrease in the diluted weighted average shares outstanding as a result of the $400 million accelerated share repurchase transaction (“ASR”).

Adjusted EBITDA of $107.3 million decreased 5% from $112.7 million in the prior-year period. Refer to “Supply Chain Services” and

“Performance Services” sections below for further discussion on the factors that impacted each segment during the quarter.

Adjusted net income

of $61.2 million decreased 8% from $66.4 million in the prior-year period primarily as a result of the same factors that impacted adjusted EBITDA as well as an increase in our effective income tax rate as a result of the

$140.1 million impairment of assets partially offset by a decrease in interest expense in the current-year period. Adjusted EPS of $0.55 was flat compared to $0.55 in the prior-year period primarily due to a decrease in the diluted weighted

average shares outstanding as a result of the ASR partially offset by the aforementioned drivers affecting adjusted net income.

Segment Results

(For the fiscal third quarter of 2024 as compared with the fiscal third quarter of 2023)

Supply Chain Services

Supply Chain Services

segment net revenue of $227.7 million increased 5% from $216.7 million in the prior-year period, primarily reflecting higher net administrative fees revenue and software license, other services and support revenue.

Net administrative fees revenue of $156.8 million increased 6% from $148.4 million in the prior-year period driven by continued growth in member

purchasing in both the acute and Continuum of Care group purchasing organization (“GPO”) programs and one-time contractual payments received from certain GPO members due to early termination in

breach of their contracts partially offset by an expected increase in the aggregate blended member fee share.

Products revenue of $56.6 million was

relatively flat compared to $57.2 million in the prior-year period as further expansion and growth of the business was offset by lower pricing for certain products compared to the prior-year period.

Segment adjusted EBITDA of $114.0 million decreased 3% from $117.5 million in the prior-year period primarily due to an increase in expenses in

support of the GPO program and supply chain co-management business and lower profit margin in the company’s direct sourcing business driven by higher logistics costs compared to the prior-year period,

partially offset by the aforementioned increase in net revenue.

Performance Services

Performance Services segment net revenue of $115.0 million increased 9% from $105.6 million in the prior-year period, primarily due to an increase in

revenue from enterprise license agreements in the current-year period compared with the prior-year period partially offset by a decrease in the applied sciences business compared to the prior-year period.

Segment adjusted EBITDA of $27.0 million increased 8% from $25.0 million in the prior-year period mainly due to the aforementioned increase in net

revenue, partially offset by an increase in expenses primarily related to higher performance-related compensation in the current-year period as well as investments to support continued growth in the company’s adjacent markets businesses.

3

Result of Operations for the Nine Months Ended March 31, 2024

(As compared with the nine months ended March 31, 2023)

GAAP net revenue of $996.1 million was flat compared with the prior-year period primarily due to increases in Performance Services segment net revenue and

net administrative fees revenue offset by a decrease in products revenue.

GAAP net income of $46.1 million decreased 70% from net income of

$156.0 million in the prior-year period primarily as a result of the $140.1 million impairment charge to goodwill, intangibles and other long-lived assets related to the company’s Contigo Health business in the current-year period,

lower equity earnings, an increase in certain operating expenses, including costs associated with the sale of the company’s non-healthcare GPO member contracts and higher performance-related compensation

expense in the current-year period, partially offset by an increase in interest income and a decrease in income tax expense in the current-year period.

GAAP diluted EPS of $0.50 decreased 61% from $1.28 in the prior-year period primarily due to the aforementioned drivers affecting GAAP net income partially

offset by a decrease in the diluted weighted average shares outstanding as a result of the ASR.

Adjusted EBITDA of $327.1 million decreased 7% from

$352.7 million in the prior-year period primarily due to decreases in each segment’s adjusted EBITDA.

Adjusted net income of

$192.3 million decreased 7% from $207.4 million in the prior-year period primarily as a result of the decrease in adjusted EBITDA as well as an increase in our effective income tax rate as a result of the $140.1 million impairment of

assets partially offset by an increase in interest income in the current-year period. Adjusted EPS of $1.64 decreased 5% from $1.73 in the prior-year period primarily due to the aforementioned drivers affecting adjusted net income partially offset

by a decrease in the diluted weighted average shares outstanding as a result of the ASR.

Supply Chain Services segment net revenue of $656.3 million

decreased 2% from $671.9 million for the same period a year ago. Segment adjusted EBITDA of $343.5 million decreased 4% from $357.0 million for the same period a year ago.

Performance Services segment net revenue of $340.0 million increased 5% from $323.9 million for the same period a year ago. Segment adjusted EBITDA

of $79.8 million decreased 9% from $87.3 million for the same period a year ago.

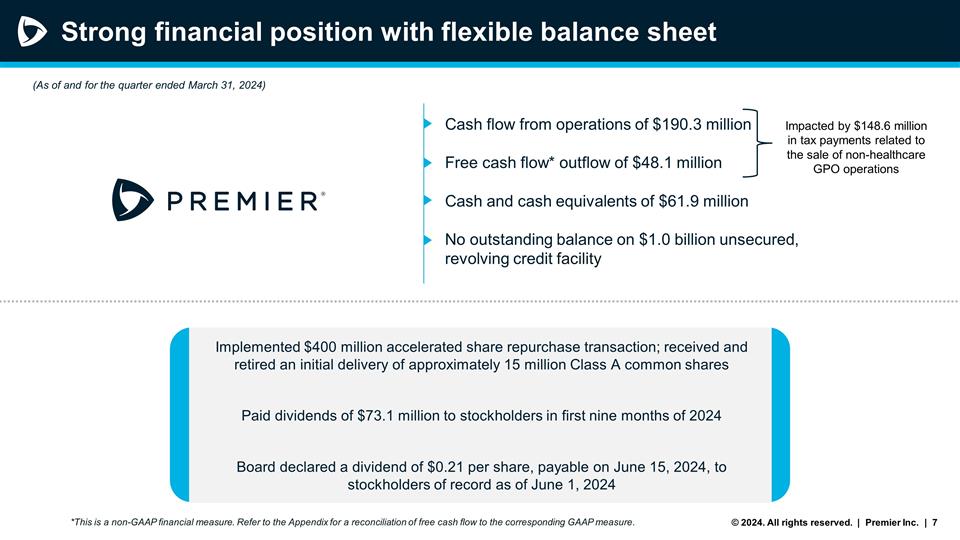

Cash Flows and Liquidity

Net cash provided by operating activities (“operating cash flow”) for the nine months ended March 31, 2024 of $190.3 million decreased from

$331.2 million in the prior-year period primarily due to $148.6 million in tax payments in the current-year period related to the sale of non-healthcare GPO operations and an increase in expenses to

support continued growth in certain areas of the Supply Chain Services and Performance Services segments. These decreases were partially offset by lower fiscal 2023 performance-related compensation payments during the fiscal first quarter compared

to the fiscal 2022 payments in the prior-year period and increased cash inflows from continued growth in the Performance Services business.

Net cash used

in investing activities and net cash used in financing activities for the nine months ended March 31, 2024, were $54.9 million and $163.3 million, respectively. As of March 31, 2024, cash and cash equivalents were

$61.9 million compared with $89.8 million as of June 30, 2023, and the company’s five-year, $1.0 billion revolving credit facility had no outstanding balance.

Free cash flow for the nine months ended March 31, 2024 was $48.1 million compared with $199.5 million in the prior-year period. The decrease

was primarily due to the same factors that impacted operating cash flow, including the aforementioned $148.6 million in tax payments, and an increase in purchases of property and equipment. Refer to “Premier’s Use and Definition of Non-GAAP Measures” below and the supplemental financial information at the end of this release for information on the company’s use of non-GAAP measures and a

reconciliation of reported GAAP results to non-GAAP results.

During the first nine months of fiscal 2024, the

company paid aggregate dividends of $73.1 million to holders of its Class A common stock.

4

Conference Call and Webcast

Premier will host a conference call to provide additional detail around the company’s performance and outlook today at 8:00 a.m. ET. The call will be

webcast live from the company’s website and, along with the accompanying presentation, will be available at the following link: Premier Events. The webcast should be accessed 10 minutes prior to the conference call start time. A replay

of the webcast will be available for one year following the conclusion of the live broadcast and will be accessible on the company’s website at https://investors.premierinc.com.

For those parties who do not have internet access, the conference call may be accessed by calling one of the below telephone numbers and asking to join the

Premier, Inc. call:

|

|

|

|

|

|

|

|

|

Domestic participant dial-in number (toll-free): |

|

(833) 953-2438 |

|

|

|

|

International participant dial-in number: |

|

(412) 317-5767 |

|

|

About Premier, Inc.

Premier, Inc. (NASDAQ: PINC) is a leading healthcare improvement company, uniting an alliance of more than 4,350 U.S. hospitals and health systems and

approximately 300,000 other providers and organizations to transform healthcare. With integrated data and analytics, collaboratives, supply chain solutions, and consulting and other services, Premier enables better care and outcomes at a lower cost.

Premier plays a critical role in the rapidly evolving healthcare industry, collaborating with members to co-develop long-term innovations that reinvent and improve the way care is delivered to patients

nationwide. Headquartered in Charlotte, N.C., Premier is passionate about transforming American healthcare. Please visit Premier’s news and investor sites on www.premierinc.com, as well as X, Facebook, LinkedIn,

YouTube, Instagram and Premier’s blog for more information about the company.

Premier’s Use and Definition of Non-GAAP Measures

Premier uses EBITDA, adjusted EBITDA, segment adjusted EBITDA, adjusted net income, adjusted

earnings per share, and free cash flow. These are non-GAAP financial measures that are not in accordance with, or an alternative to, GAAP, and may be different from

non-GAAP financial measures used by other companies. We include these non-GAAP financial measures to facilitate a comparison of the company’s operating performance

on a consistent basis from period to period and to provide measures that, when viewed in combination with its results prepared in accordance with GAAP, we believe allow for a more complete understanding of factors and trends affecting the

company’s business than GAAP measures alone. Management believes EBITDA, adjusted EBITDA and segment adjusted EBITDA assist the company’s board of directors, management and investors in comparing the company’s operating performance on

a consistent basis from period to period by removing the impact of the company’s asset base (primarily depreciation and amortization) and items outside the control of management (taxes), as well as other

non-cash (impairment of intangible assets and purchase accounting adjustments) and non-recurring items, from operating results. Adjusted EBITDA and segment adjusted

EBITDA are supplemental financial measures used by the company and by external users of the company’s financial statements.

Management considers

adjusted EBITDA an indicator of the operational strength and performance of the company’s business. Adjusted EBITDA allows management to assess performance without regard to financing methods and capital structure and without the impact of

other matters that management does not consider indicative of the operating performance of the business. Segment adjusted EBITDA is the primary earnings measure used by management to evaluate the performance of the company’s business segments.

Management believes free cash flow is an important measure because it represents the cash that the company generates after payment of tax distributions

to limited partners, payments to certain former limited partners that elected to execute a Unit Exchange and Tax Receivable Agreement (“Unit Exchange Agreement”) in connection with our August 2020 restructuring and purchases of property

and equipment to maintain existing products and services and ongoing business operations, as well as development of new and upgraded products and services to support future growth. Free cash flow is important because it enables the company to seek

enhancement of stockholder value through acquisitions, partnerships, joint ventures, investments in related or complimentary businesses and/or debt reduction.

Non-recurring items are items to be income or expenses and other items that have not been earned or incurred

within the prior two years and are not expected to recur within the next two years. Such items include stock-based compensation, acquisition- and disposition-related expenses, strategic initiative- and financial restructuring-related expenses,

remeasurement of TRA liabilities, loss on disposal of long-live assets, gain or loss on FFF put and call rights, income and expense that has been classified as discontinued operations and other expense.

5

Non-operating items include gains or losses on the disposal

of assets and interest and investment income or expense.

EBITDA is defined as net income before income or loss from discontinued operations, net

of tax, interest and investment income or expense, net, income tax expense, depreciation and amortization and amortization of purchased intangible assets.

Adjusted EBITDA is defined as EBITDA before merger and acquisition-related expenses and non-recurring, non-cash or non-operating items.

Segment adjusted EBITDA is defined as

the segment’s net revenue less cost of revenue and operating expenses directly attributable to the segment excluding depreciation and amortization, amortization of purchased intangible assets, merger and acquisition-related expenses and non-recurring or non-cash items. Operating expenses directly attributable to the segment include expenses associated with sales and marketing, general and administrative, and

product development activities specific to the operation of each segment. General and administrative corporate expenses that are not specific to a particular segment are not included in the calculation of Segment Adjusted EBITDA. Segment Adjusted

EBITDA also excludes any income and expense that has been classified as discontinued operations.

Adjusted net income is defined as net income

attributable to Premier (i) excluding income or loss from discontinued operations, net, (ii) excluding income tax expense, (iii) excluding the effect of non-recurring or non-cash items, including certain strategic initiative- and financial restructuring-related expenses, (iv) reflecting an adjustment for income tax expense on Non-GAAP net

income before income taxes at our estimated annual effective income tax rate, adjusted for unusual or infrequent items and (v) excluding the equity in net income of unconsolidated affiliates.

Adjusted earnings per share is Adjusted Net Income divided by diluted weighted average shares.

Free cash flow is defined as net cash provided by operating activities from continuing operations less distributions and Tax Receivable Agreement

payments to limited partners, early termination payments to certain former limited partners that elected to execute a Unit Exchange Agreement in connection with our August 2020 restructuring and purchases of property and equipment. Free Cash Flow

does not represent discretionary cash available for spending as it excludes certain contractual obligations such as debt repayments.

To properly and

prudently evaluate our business, readers are urged to review the reconciliation of these non-GAAP financial measures, as well as the other financial tables, included at the end of this release. Readers should

not rely on any single financial measure to evaluate the company’s business. In addition, the non-GAAP financial measures used in this release are susceptible to varying calculations and may differ from,

and may therefore not be comparable to, similarly titled measures used by other companies.

The Company has revised the definitions for Adjusted EBITDA,

Segment Adjusted EBITDA and Adjusted Net Income from the definitions reported in the 2023 Annual Report. Adjusted EBITDA and segment Adjusted EBITDA definitions were revised to exclude the impact of equity earnings in unconsolidated affiliates. The

Adjusted Net Income definition was revised (1) remove the exclusion of the impact of adjustment of redeemable limited partners’ capital to redemption amount, (2) remove the impact of the exchange of all Class B common units for

shares of Class A common stock for periods prior to our August 2020 Restructuring and the resulting elimination of non-controlling interest in Premier LP, and (3) add the exclusion of equity earnings

in unconsolidated affiliates. For comparability purposes, prior year non-GAAP financial measures are presented based on the current definitions in the above section.

Further information on Premier’s use of non-GAAP financial measures is available in the “Our Use of Non-GAAP Financial Measures” section of Premier’s Form 10-Q for the quarter ended December 31, 2023, expected to be filed with the SEC shortly after this

release, and which will also be made available on Premier’s website at investors.premierinc.com.

Premier’s Use of Forward-Looking Non-GAAP Measures

The company does not meaningfully reconcile guidance for

non-GAAP adjusted EBITDA and non-GAAP adjusted earnings per share to net income attributable to stockholders or earnings per share attributable to stockholders because

the company cannot provide guidance for the more significant reconciling items between net income attributable to stockholders and adjusted EBITDA and between earnings per share attributable to stockholders and

non-GAAP adjusted earnings per share without unreasonable effort. This is due to the fact that future period non-GAAP guidance includes adjustments for items not

indicative of our core operations, which may include, without limitation, items included in the supplemental financial information for reconciliation of reported GAAP results to non-GAAP results. Such items

include, but are not limited to,

6

strategic and acquisition related expenses for professional fees; mark to market adjustments for put options and contingent liabilities; gains and losses on stock-based performance shares;

adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); items related to corporate and facility restructurings; and certain other items the company believes to be non-indicative of its ongoing operations. Such adjustments may be affected by changes in ongoing assumptions, judgements, as well as nonrecurring, unusual or unanticipated charges, expenses or gains/losses or other

items that may not directly correlate to the underlying performance of our business operations. The exact amount of these adjustments is not currently determinable but may be significant.

Cautionary Note Regarding Forward-Looking Statements

Statements made in this release that are not statements of historical or current facts, including, but not limited to those related to our ability to advance

our long-term strategies and develop innovations for, transform and improve healthcare, our ability to find partners for our S2S Global and Contigo Health businesses and the potential benefits thereof, our ability to fund and conduct share

repurchases pursuant to the share repurchase authorization and the potential benefits thereof (including the accelerated share repurchase transaction, which could be affected by volatility or disruptions in the capital markets or other factors), the

payment of dividends at current levels or at all, guidance on expected future financial performance and assumptions underlying that guidance, and our expected effective income tax rate, are “forward-looking statements” within the meaning

of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Premier to be materially

different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward-looking statements. In addition to statements

that explicitly describe such risks and uncertainties, readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,”

“intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its

business and are necessarily subject to risks and uncertainties, many of which are outside Premier’s control. More information on risks and uncertainties that could affect Premier’s business, achievements, performance, financial condition,

and financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” sections of Premier’s periodic and current filings with the SEC, including the information in those sections of Premier’s Form 10-K for the year ended June 30, 2023 and

subsequent Quarterly Reports on Form 10-Q, including the Form 10-Q for the quarter ended March 31, 2024, expected to be filed with the SEC shortly after the date of

this release, all of which are made available on Premier’s website at investors.premierinc.com. Forward-looking statements speak only as of the date they are made, and Premier undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information or future events that occur after that date, or otherwise.

|

|

|

| Investor contact: |

|

Media contact: |

|

|

| Ben Krasinski |

|

Amanda Forster |

| Senior Director, Investor Relations |

|

Vice President, Public Relations |

| 704.816.5644 |

|

202.879.8004 |

| ben_krasinski@premierinc.com |

|

amanda_forster@premierinc.com |

7

Condensed Consolidated Statements of Income

(Unaudited)

(In

thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

|

Nine Months Ended

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net administrative fees |

|

$ |

156,819 |

|

|

$ |

148,441 |

|

|

$ |

455,409 |

|

|

$ |

452,870 |

|

| Software licenses, other services and support |

|

|

129,187 |

|

|

|

116,579 |

|

|

|

377,728 |

|

|

|

359,795 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Services and software licenses |

|

|

286,006 |

|

|

|

265,020 |

|

|

|

833,137 |

|

|

|

812,665 |

|

| Products |

|

|

56,590 |

|

|

|

57,212 |

|

|

|

162,956 |

|

|

|

183,066 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenue |

|

|

342,596 |

|

|

|

322,232 |

|

|

|

996,093 |

|

|

|

995,731 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Services and software licenses |

|

|

70,336 |

|

|

|

54,149 |

|

|

|

200,458 |

|

|

|

163,428 |

|

| Products |

|

|

51,927 |

|

|

|

49,013 |

|

|

|

143,437 |

|

|

|

168,507 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

122,263 |

|

|

|

103,162 |

|

|

|

343,895 |

|

|

|

331,935 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

220,333 |

|

|

|

219,070 |

|

|

|

652,198 |

|

|

|

663,796 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

286,121 |

|

|

|

143,587 |

|

|

|

566,331 |

|

|

|

416,165 |

|

| Research and development |

|

|

661 |

|

|

|

1,001 |

|

|

|

2,452 |

|

|

|

2,976 |

|

| Amortization of purchased intangible assets |

|

|

12,280 |

|

|

|

11,916 |

|

|

|

37,480 |

|

|

|

35,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

299,062 |

|

|

|

156,504 |

|

|

|

606,263 |

|

|

|

454,556 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating (loss) income |

|

|

(78,729 |

) |

|

|

62,566 |

|

|

|

45,935 |

|

|

|

209,240 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity in net income (loss) of unconsolidated affiliates |

|

|

753 |

|

|

|

4,630 |

|

|

|

(1,639 |

) |

|

|

14,547 |

|

| Interest (expense) income, net |

|

|

(1,763 |

) |

|

|

(4,269 |

) |

|

|

870 |

|

|

|

(11,759 |

) |

| Other income, net |

|

|

14,913 |

|

|

|

2,954 |

|

|

|

18,500 |

|

|

|

3,720 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

13,903 |

|

|

|

3,315 |

|

|

|

17,731 |

|

|

|

6,508 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income before income taxes |

|

|

(64,826 |

) |

|

|

65,881 |

|

|

|

63,666 |

|

|

|

215,748 |

|

| Income tax (benefit) expense |

|

|

(15,664 |

) |

|

|

17,232 |

|

|

|

17,552 |

|

|

|

59,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

|

(49,162 |

) |

|

|

48,649 |

|

|

|

46,114 |

|

|

|

155,982 |

|

| Net loss (income) attributable to non-controlling

interest |

|

|

8,967 |

|

|

|

(1,848 |

) |

|

|

12,754 |

|

|

|

(2,419 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable to stockholders |

|

$ |

(40,195 |

) |

|

$ |

46,801 |

|

|

$ |

58,868 |

|

|

$ |

153,563 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Calculation of GAAP (Loss) Earnings per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Numerator for basic and diluted (loss) earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable to stockholders |

|

$ |

(40,195 |

) |

|

$ |

46,801 |

|

|

$ |

58,868 |

|

|

$ |

153,563 |

|

| Denominator for (loss) earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic weighted average shares outstanding |

|

|

111,156 |

|

|

|

118,872 |

|

|

|

116,754 |

|

|

|

118,668 |

|

| Effect of dilutive securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock options |

|

|

— |

|

|

|

76 |

|

|

|

— |

|

|

|

103 |

|

| Restricted stock units |

|

|

— |

|

|

|

528 |

|

|

|

484 |

|

|

|

519 |

|

| Performance share awards |

|

|

— |

|

|

|

340 |

|

|

|

85 |

|

|

|

542 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted average shares |

|

|

111,156 |

|

|

|

119,816 |

|

|

|

117,323 |

|

|

|

119,832 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings per share attributable to stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.36 |

) |

|

$ |

0.39 |

|

|

$ |

0.50 |

|

|

$ |

1.29 |

|

| Diluted |

|

$ |

(0.36 |

) |

|

$ |

0.39 |

|

|

$ |

0.50 |

|

|

$ |

1.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8

Condensed Consolidated Balance Sheets

(Unaudited)

(In

thousands, except share data)

|

|

|

|

|

|

|

|

|

| |

|

March 31, 2024 |

|

|

June 30, 2023 |

|

| Assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

61,856 |

|

|

$ |

89,793 |

|

| Accounts receivable (net of $2,027 and $2,878 allowance for credit losses, respectively) |

|

|

121,159 |

|

|

|

115,295 |

|

| Contract assets (net of $1,217 and $885 allowance for credit losses, respectively) |

|

|

334,256 |

|

|

|

299,219 |

|

| Inventory |

|

|

77,795 |

|

|

|

76,932 |

|

| Prepaid expenses and other current assets |

|

|

79,633 |

|

|

|

60,387 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

674,699 |

|

|

|

641,626 |

|

| Property and equipment (net of $721,427 and $662,554 accumulated depreciation,

respectively) |

|

|

206,363 |

|

|

|

212,308 |

|

| Intangible assets (net of $286,161 and $265,684 accumulated amortization, respectively) |

|

|

279,053 |

|

|

|

430,030 |

|

| Goodwill |

|

|

995,852 |

|

|

|

1,012,355 |

|

| Deferred income tax assets |

|

|

805,741 |

|

|

|

653,629 |

|

| Deferred compensation plan assets |

|

|

52,754 |

|

|

|

50,346 |

|

| Investments in unconsolidated affiliates |

|

|

228,511 |

|

|

|

231,826 |

|

| Operating lease

right-of-use assets |

|

|

21,700 |

|

|

|

29,252 |

|

| Other assets |

|

|

99,057 |

|

|

|

110,115 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

3,363,730 |

|

|

$ |

3,371,487 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and stockholders’ equity |

|

|

|

|

|

| Accounts payable |

|

$ |

67,341 |

|

|

$ |

54,375 |

|

| Accrued expenses |

|

|

69,492 |

|

|

|

47,113 |

|

| Revenue share obligations |

|

|

291,762 |

|

|

|

262,288 |

|

| Accrued compensation and benefits |

|

|

77,780 |

|

|

|

60,591 |

|

| Deferred revenue |

|

|

20,502 |

|

|

|

24,311 |

|

| Current portion of notes payable to former limited partners |

|

|

101,059 |

|

|

|

99,665 |

|

| Line of credit and current portion of long-term debt |

|

|

1,008 |

|

|

|

216,546 |

|

| Current portion of liability related to the sale of future revenues |

|

|

36,615 |

|

|

|

— |

|

| Other current liabilities |

|

|

60,120 |

|

|

|

50,574 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

725,679 |

|

|

|

815,463 |

|

| Long-term debt, less current portion |

|

|

— |

|

|

|

734 |

|

| Liability related to the sale of future revenues, less current portion |

|

|

569,042 |

|

|

|

— |

|

| Notes payable to former limited partners, less current portion |

|

|

25,555 |

|

|

|

101,523 |

|

| Deferred compensation plan obligations |

|

|

52,754 |

|

|

|

50,346 |

|

| Operating lease liabilities, less current portion |

|

|

13,074 |

|

|

|

21,864 |

|

| Other liabilities |

|

|

54,328 |

|

|

|

47,202 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

1,440,432 |

|

|

|

1,037,132 |

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Class A common stock, $0.01 par value, 500,000,000 shares authorized; 111,249,656 shares

issued and 104,820,281 shares outstanding at March 31, 2024 and 125,587,858 shares issued and 119,158,483 shares outstanding at June 30, 2023 |

|

|

1,112 |

|

|

|

1,256 |

|

| Treasury stock, at cost; 6,429,375 shares at both March 31, 2024 and June 30,

2023 |

|

|

(250,129 |

) |

|

|

(250,129 |

) |

| Additional paid-in capital |

|

|

2,104,916 |

|

|

|

2,178,134 |

|

| Retained earnings |

|

|

67,400 |

|

|

|

405,102 |

|

| Accumulated other comprehensive loss |

|

|

(1 |

) |

|

|

(8 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

1,923,298 |

|

|

|

2,334,355 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

3,363,730 |

|

|

$ |

3,371,487 |

|

|

|

|

|

|

|

|

|

|

9

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In

thousands)

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Operating activities |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

46,114 |

|

|

$ |

155,982 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

98,572 |

|

|

|

100,568 |

|

| Equity in net loss (income) of unconsolidated affiliates |

|

|

1,639 |

|

|

|

(14,547 |

) |

| Deferred income taxes |

|

|

(152,112 |

) |

|

|

2,083 |

|

| Stock-based compensation |

|

|

23,215 |

|

|

|

16,375 |

|

| Impairment of assets |

|

|

140,053 |

|

|

|

— |

|

| Other, net |

|

|

(7,653 |

) |

|

|

3,066 |

|

| Changes in operating assets and liabilities, net of the effects of acquisitions: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(5,864 |

) |

|

|

483 |

|

| Contract assets |

|

|

(37,693 |

) |

|

|

(31,975 |

) |

| Inventory |

|

|

(863 |

) |

|

|

25,221 |

|

| Prepaid expenses and other assets |

|

|

(668 |

) |

|

|

21,685 |

|

| Accounts payable |

|

|

15,673 |

|

|

|

8,641 |

|

| Revenue share obligations |

|

|

29,474 |

|

|

|

12,717 |

|

| Accrued expenses, deferred revenue and other liabilities |

|

|

40,383 |

|

|

|

30,879 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

$ |

190,270 |

|

|

$ |

331,178 |

|

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

$ |

(67,626 |

) |

|

$ |

(58,464 |

) |

| Sale of investment in unconsolidated affiliates |

|

|

12,753 |

|

|

|

— |

|

| Acquisition of businesses and equity method investments, net of cash acquired |

|

|

— |

|

|

|

(187,750 |

) |

| Other |

|

|

(30 |

) |

|

|

(3,570 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

$ |

(54,903 |

) |

|

$ |

(249,784 |

) |

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

| Payments on notes payable |

|

$ |

(75,846 |

) |

|

$ |

(76,024 |

) |

| Proceeds from credit facility |

|

|

— |

|

|

|

350,000 |

|

| Payments on credit facility |

|

|

(215,000 |

) |

|

|

(265,000 |

) |

| Proceeds from sale of future revenues |

|

|

629,820 |

|

|

|

— |

|

| Payments on liability related to the sale of future revenues |

|

|

(24,163 |

) |

|

|

— |

|

| Cash dividends paid |

|

|

(73,074 |

) |

|

|

(75,227 |

) |

| Repurchase of Class A common stock |

|

|

(400,000 |

) |

|

|

— |

|

| Other, net |

|

|

(5,048 |

) |

|

|

(9,785 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

$ |

(163,311 |

) |

|

$ |

(76,036 |

) |

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash flows |

|

|

7 |

|

|

|

(8 |

) |

| Net (decrease) increase in cash and cash equivalents |

|

|

(27,937 |

) |

|

|

5,350 |

|

| Cash and cash equivalents at beginning of year |

|

|

89,793 |

|

|

|

86,143 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

61,856 |

|

|

$ |

91,493 |

|

|

|

|

|

|

|

|

|

|

10

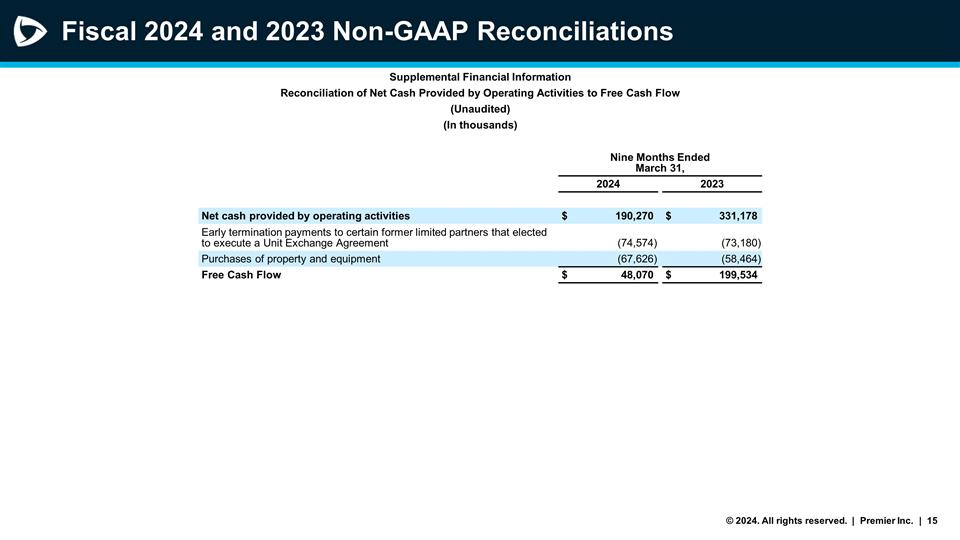

Supplemental Financial Information

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow

(Unaudited)

(In

thousands)

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Net cash provided by operating activities |

|

$ |

190,270 |

|

|

$ |

331,178 |

|

| Early termination payments to certain former limited partners that elected to execute a Unit

Exchange Agreement (a) |

|

|

(74,574 |

) |

|

|

(73,180 |

) |

| Purchases of property and equipment |

|

|

(67,626 |

) |

|

|

(58,464 |

) |

|

|

|

|

|

|

|

|

|

| Free Cash Flow |

|

$ |

48,070 |

|

|

$ |

199,534 |

|

|

|

|

|

|

|

|

|

|

| (a) |

Early termination payments to certain former limited partners that elected to execute a Unit Exchange Agreement

in connection with Premier’s August 2020 restructuring are presented in the Condensed Consolidated Statements of Cash Flows under “Payments made on notes payable.” During the nine months ended March 31, 2024, the company paid

$77.0 million to members including imputed interest of $2.4 million which is included in net cash provided by operating activities. During the nine months ended March 31, 2023, the company paid $77.0 million to members, including

imputed interest of $3.8 million which is included in net cash provided by operating activities. |

11

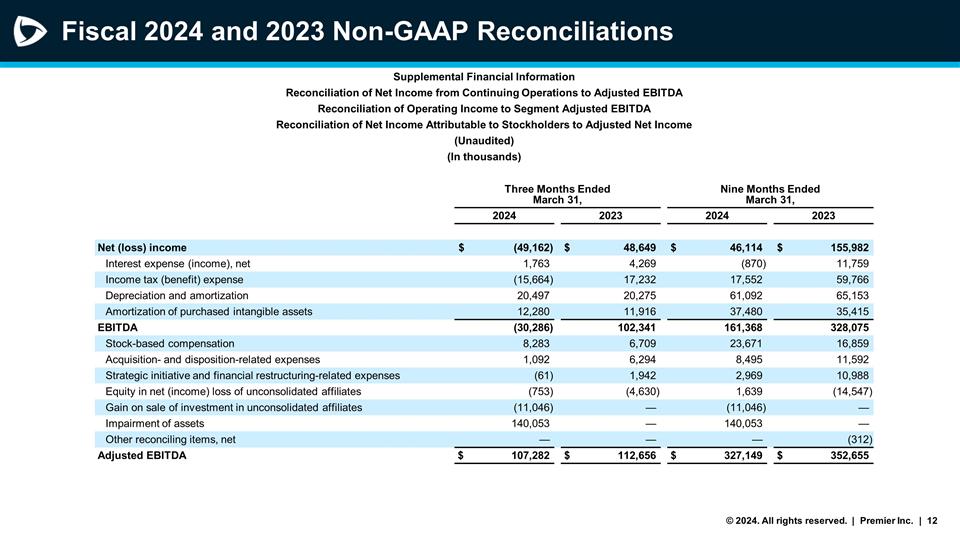

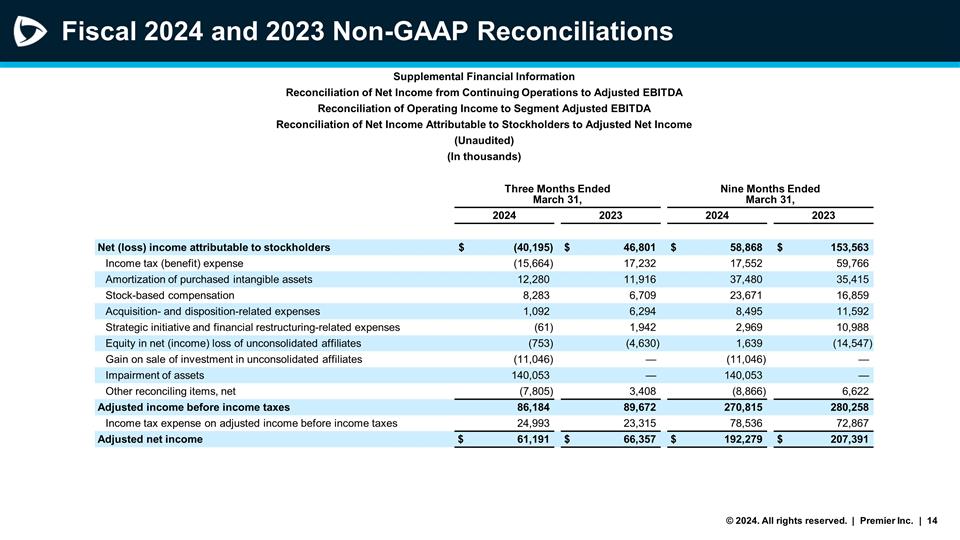

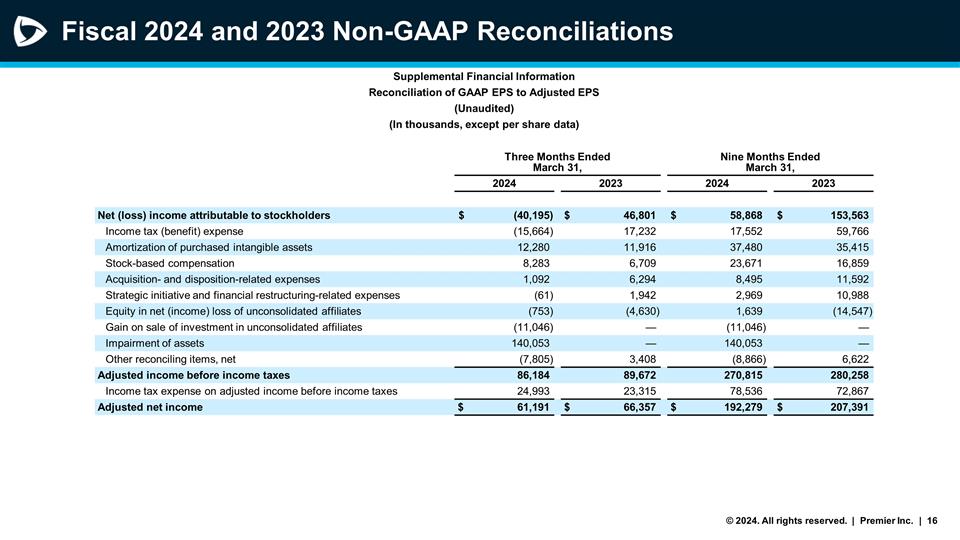

Supplemental Financial Information

Reconciliation of Net Income from Continuing Operations to Adjusted EBITDA

Reconciliation of Operating Income to Segment Adjusted EBITDA

Reconciliation of Net Income Attributable to Stockholders to Adjusted Net Income

(Unaudited)

(In

thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

|

Nine Months Ended

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net (loss) income |

|

$ |

(49,162 |

) |

|

$ |

48,649 |

|

|

$ |

46,114 |

|

|

$ |

155,982 |

|

| Interest expense (income), net |

|

|

1,763 |

|

|

|

4,269 |

|

|

|

(870 |

) |

|

|

11,759 |

|

| Income tax (benefit) expense |

|

|

(15,664 |

) |

|

|

17,232 |

|

|

|

17,552 |

|

|

|

59,766 |

|

| Depreciation and amortization |

|

|

20,497 |

|

|

|

20,275 |

|

|

|

61,092 |

|

|

|

65,153 |

|

| Amortization of purchased intangible assets |

|

|

12,280 |

|

|

|

11,916 |

|

|

|

37,480 |

|

|

|

35,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

(30,286 |

) |

|

|

102,341 |

|

|

|

161,368 |

|

|

|

328,075 |

|

| Stock-based compensation |

|

|

8,283 |

|

|

|

6,709 |

|

|

|

23,671 |

|

|

|

16,859 |

|

| Acquisition- and disposition-related expenses |

|

|

1,092 |

|

|

|

6,294 |

|

|

|

8,495 |

|

|

|

11,592 |

|

| Strategic initiative and financial restructuring-related expenses |

|

|

(61 |

) |

|

|

1,942 |

|

|

|

2,969 |

|

|

|

10,988 |

|

| Equity in net (income) loss of unconsolidated affiliates |

|

|

(753 |

) |

|

|

(4,630 |

) |

|

|

1,639 |

|

|

|

(14,547 |

) |

| Gain on sale of investment in unconsolidated affiliates |

|

|

(11,046 |

) |

|

|

— |

|

|

|

(11,046 |

) |

|

|

— |

|

| Impairment of assets |

|

|

140,053 |

|

|

|

— |

|

|

|

140,053 |

|

|

|

— |

|

| Other reconciling items, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(312 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

107,282 |

|

|

$ |

112,656 |

|

|

$ |

327,149 |

|

|

$ |

352,655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

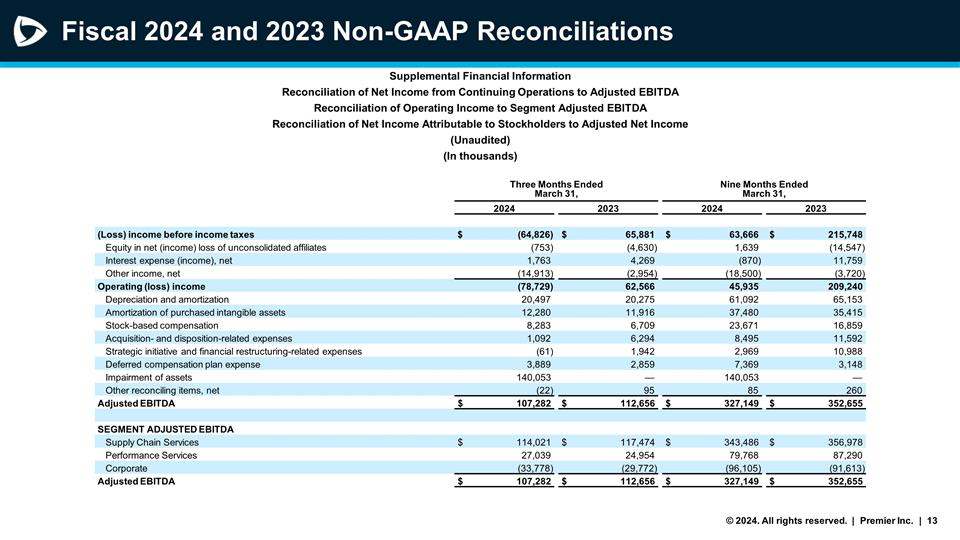

| (Loss) income before income taxes |

|

$ |

(64,826 |

) |

|

$ |

65,881 |

|

|

$ |

63,666 |

|

|

$ |

215,748 |

|

| Equity in net (income) loss of unconsolidated affiliates |

|

|

(753 |

) |

|

|

(4,630 |

) |

|

|

1,639 |

|

|

|

(14,547 |

) |

| Interest expense (income), net |

|

|

1,763 |

|

|

|

4,269 |

|

|

|

(870 |

) |

|

|

11,759 |

|

| Other income, net |

|

|

(14,913 |

) |

|

|

(2,954 |

) |

|

|

(18,500 |

) |

|

|

(3,720 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating (loss) income |

|

|

(78,729 |

) |

|

|

62,566 |

|

|

|

45,935 |

|

|

|

209,240 |

|

| Depreciation and amortization |

|

|

20,497 |

|

|

|

20,275 |

|

|

|

61,092 |

|

|

|

65,153 |

|

| Amortization of purchased intangible assets |

|

|

12,280 |

|

|

|

11,916 |

|

|

|

37,480 |

|

|

|

35,415 |

|

| Stock-based compensation |

|

|

8,283 |

|

|

|

6,709 |

|

|

|

23,671 |

|

|

|

16,859 |

|

| Acquisition- and disposition-related expenses |

|

|

1,092 |

|

|

|

6,294 |

|

|

|

8,495 |

|

|

|

11,592 |

|

| Strategic initiative and financial restructuring-related expenses |

|

|

(61 |

) |

|

|

1,942 |

|

|

|

2,969 |

|

|

|

10,988 |

|

| Deferred compensation plan expense |

|

|

3,889 |

|

|

|

2,859 |

|

|

|

7,369 |

|

|

|

3,148 |

|

| Impairment of assets |

|

|

140,053 |

|

|

|

— |

|

|

|

140,053 |

|

|

|

— |

|

| Other reconciling items, net |

|

|

(22 |

) |

|

|

95 |

|

|

|

85 |

|

|

|

260 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

107,282 |

|

|

$ |

112,656 |

|

|

$ |

327,149 |

|

|

$ |

352,655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SEGMENT ADJUSTED EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supply Chain Services |

|

$ |

114,021 |

|

|

$ |

117,474 |

|

|

$ |

343,486 |

|

|

$ |

356,978 |

|

| Performance Services |

|

|

27,039 |

|

|

|

24,954 |

|

|

|

79,768 |

|

|

|

87,290 |

|

| Corporate |

|

|

(33,778 |

) |

|

|

(29,772 |

) |

|

|

(96,105 |

) |

|

|

(91,613 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

107,282 |

|

|

$ |

112,656 |

|

|

$ |

327,149 |

|

|

$ |

352,655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable to stockholders |

|

$ |

(40,195 |

) |

|

$ |

46,801 |

|

|

$ |

58,868 |

|

|

$ |

153,563 |

|

| Income tax (benefit) expense |

|

|

(15,664 |

) |

|

|

17,232 |

|

|

|

17,552 |

|

|

|

59,766 |

|

| Amortization of purchased intangible assets |

|

|

12,280 |

|

|

|

11,916 |

|

|

|

37,480 |

|

|

|

35,415 |

|

| Stock-based compensation |

|

|

8,283 |

|

|

|

6,709 |

|

|

|

23,671 |

|

|

|

16,859 |

|

| Acquisition- and disposition-related expenses |

|

|

1,092 |

|

|

|

6,294 |

|

|

|

8,495 |

|

|

|

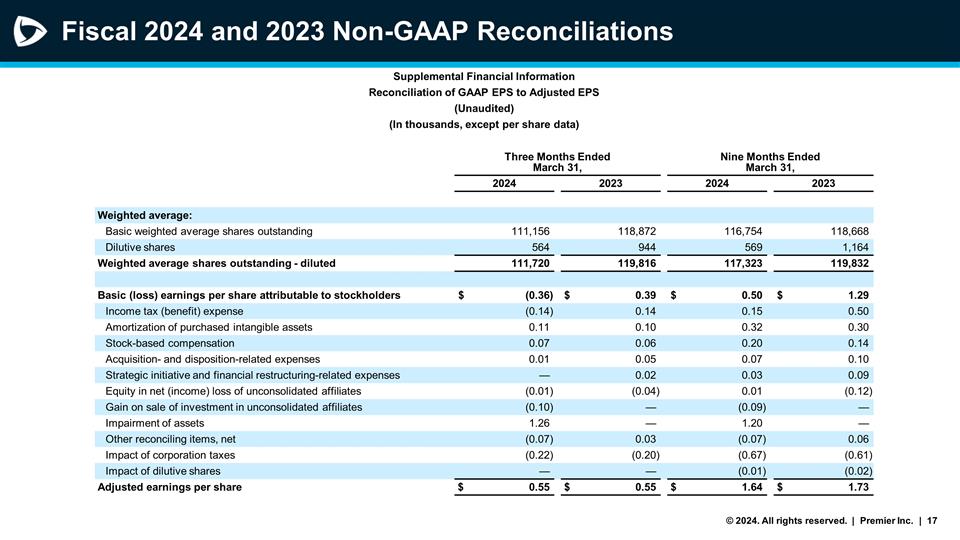

11,592 |