0001315399FALSE00013153992024-01-242024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 24, 2025

| | | | | | | | | | | | | | |

| | | | |

| PARKE BANCORP, INC. | |

| (Exact name of registrant as specified in its charter) | |

| | | | |

| | | | | | | | | | | | | | |

| New Jersey | | 0-51338 | | 65-1241959 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | |

| | | | | | | | |

601 Delsea Drive, Washington Township, New Jersey | | 08080 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code: (856) 256-2500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, Par Value $0.10 per share | | PKBK | | The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

PARKE BANCORP, INC.

INFORMATION TO BE INCLUDED IN THE REPORT

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition.

On January 24, 2025, Parke Bancorp, Inc. issued a press release to report earnings for the quarter and year ended December 31, 2024. A copy of the press release is furnished with this Current Report as Exhibit 99.1 hereto and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | | | | | | | | | | |

| Exhibit No. | Description | | | | |

| 99.1 | | | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PARKE BANCORP, INC.

| | | | | | | | | | | | | | |

| Date: January 24, 2025 | By | /s/ Jonathan D. Hill | |

| | | Jonathan D. Hill | |

| | | Senior Vice President and Chief Financial Officer | |

| | | (Duly Authorized Representative) | |

| | | | |

Parke Bancorp, Inc.

601 Delsea Drive,

Washington Township, NJ 08080

Contact:

Vito S. Pantilione, President and CEO

Jonathan D. Hill, Senior Vice President and CFO

(856) 256-2500

PARKE BANCORP, INC. ANNOUNCES FOURTH QUARTER 2024 EARNINGS

| | | | | | | | | | | | | | |

| Highlights: | | |

| | | | |

| Net Income: | | $7.4 million for Q4 2024, decreased 1.5% from Q3 2024 |

| Revenue: | | $34.5 million for Q4 2024, increased 4.4% over Q3 2024 |

| Total Assets: | | $2.14 billion, increased 5.9% from December 31, 2023 |

| Total Loans: | | $1.87 billion, increased 4.5% from December 31, 2023 |

| Total Deposits: | | $1.63 billion, increased 5.0% from December 31, 2023 |

| | |

WASHINGTON TOWNSHIP, NJ, January 24, 2025 - Parke Bancorp, Inc. (“Parke Bancorp” or the "Company") (NASDAQ: “PKBK”), the parent company of Parke Bank (the "Bank"), announced its operating results for the quarter and fiscal year ended December 31, 2024.

Highlights for the fourth quarter and year ended December 31, 2024:

•Net income available to common shareholders was $7.4 million, or $0.62 per basic common share and $0.61 per diluted common share, for the three months ended December 31, 2024, a decrease of $0.8 million, or 9.5%, compared to net income available to common shareholders of $8.2 million, or $0.68 per basic common share and $0.67 per diluted common share, for the same quarter in 2023. The decrease is primarily driven by an increase in provision for credit losses, lower non-interest income, and an increase in non-interest expense.

•Net interest income increased 0.7% to $15.6 million for the three months ended December 31, 2024, compared to $15.5 million for the same period in 2023.

•Provision for credit losses was an increase of $0.6 million, to $0.2 million, for the three months ended December 31, 2024, compared to a recovery of $0.4 million for the same period in 2023.

•Non-interest income decreased $0.3 million, or 23.1%, to $1.1 million for the three months ended December 31, 2024, compared to $1.5 million for the same period in 2023.

•Non-interest expense increased $0.6 million, or 9.0%, to $6.9 million for the three months ended December 31, 2024, compared to $6.3 million for the same period in 2023.

•Net income available to common shareholders was $27.5 million, or $2.30 per basic common share and $2.27 per diluted common share, for the fiscal year ended December 31, 2024, a decrease of $0.9 million, or

3.3%, compared to net income available to common shareholders of $28.4 million, or $2.38 per basic common share and $2.35 per diluted common share, for the fiscal year ended December 31, 2023. The decrease was primarily due to a decrease in net interest income, an increase in the provision for credit losses, and a decrease in non-interest income, partially offset by a decrease in non-interest expense.

•Net interest income decreased 8.6% to $58.7 million for the fiscal year ended December 31, 2024, compared to $64.2 million for the fiscal year ended December 31, 2023.

•Provision for credit losses increased $2.8 million to $0.7 million for the fiscal year ended December 31, 2024, compared to a recovery of $2.1 million for the fiscal year ended December 31, 2023.

•Non-interest income decreased $2.4 million, or 35.7%, to $4.3 million for the fiscal year ended December 31, 2024, compared to $6.7 million for the fiscal year ended December 31, 2023.

•Non-interest expense decreased $9.3 million, or 26.3%, to $26.0 million, for the fiscal year ended December 31, 2024, compared to $35.3 million for the fiscal year ended December 31, 2023. The decrease in non-interest expense in 2024 was primarily due to the recognition of a one-time $9.5 million contingent loss in 2023.

The following is a recap of the significant items that impacted the fourth quarter of 2024 and the fiscal year ended December 31, 2024:

Interest income increased $3.0 million for the fourth quarter of 2024 compared to the fourth quarter of 2023, primarily due to an increase in interest and fees on loans of $2.4 million to $30.9 million, due to higher average outstanding loan balances and higher interest rates. Additionally, during the fourth quarter of 2024, interest earned on average deposits held at the Federal Reserve Bank ("FRB") increased to $2.2 million from $1.5 million in the fourth quarter of 2023, due to higher cash balances held at the FRB. For the year ended December 31, 2024, interest income increased $12.4 million from the fiscal year ended December 31, 2023, primarily driven by an increase in interest and fees on loans of $11.8 million, due to higher average outstanding loan balances and higher interest rates, as well as an increase in interest earned on average deposits held at the FRB of $0.6 million.

Interest expense increased $2.9 million for the three months ended December 31, 2024, compared to the same period in 2023, primarily due to higher market interest rates, as well as a change in the deposit mix with a reduction in non-interest bearing demand deposits and an increase in interest-bearing deposits. For the year ended December 31, 2024, interest expense increased $17.9 million compared to the fiscal year ended December 31, 2023, primarily due to higher market interest rates, as well as a change in the deposit mix with a reduction in non-interest bearing demand deposits and an increase in interest-bearing deposits.

The provision for credit losses increased $0.6 million for the three months ended December 31, 2024, compared to the same period in 2023, as a result of an increase in outstanding loan balances, partially offset by a decrease in vintage and qualitative loss rates. For the year ended December 31, 2024, the provision for credit losses increased $2.8 million from the fiscal year ended December 31, 2023 due to an increase in outstanding loan balances, partially offset by a decrease in vintage and qualitative loss rates.

Non-interest income decreased $0.3 million for the three months ended December 31, 2024 compared to the same period in 2023, primarily as a result of a decrease in service fees on deposit accounts of $0.4 million, and a decrease in bank owned life insurance income of $0.1 million, partially offset by an increase in other income of $0.2 million. For the year ended December 31, 2024, non-interest income decreased $2.4 million comapred to the fiscal year ended December 31, 2023, primarily driven by a decrease in service fees on deposit accounts of $2.5 million. The decrease in service fees on deposit accounts during the year ended December 31, 2024, was primarily attributable to a decrease in fees from our cannabis related businesses deposit accounts.

Non-interest expense increased $0.6 million for the three months ended December 31, 2024 compared to the same period in 2023, primarily driven by an increase in professional services of $0.5 million, and

compensation and benefits of $0.4 million, partially offset by a decrease in OREO expense of $0.2 million, and a decrease in other operating expense of $0.2 million. For the fiscal year ended December 31, 2024, non-interest expense decreased $9.3 million, mainly due to the contingent loss in 2023 referred to above, and a decrease in other operating expense of $0.6 million, partially offset by an increase in compensation and benefits of $0.4 million, and an increase in professional services of $0.4 million. The increase in compensation and benefits during the year ended December 31, 2024, was primarily due to a $0.4 million increase in salaries, and a $0.2 million decrease in deferred loan origination costs attributable to a reduction in the number of loans originated, partially offset by a $0.2 million decrease in SERP expense.

Income tax expense decreased $0.7 million for the three months ended December 31, 2024 compared to the same period in 2023. For the year ended December 31, 2024, income tax expense decreased $0.4 million compared to the fiscal year ended December 31, 2023. The effective tax rate for the fourth quarter of 2024 and the year ended December 31, 2024 was 23.9% and 24.2%, respectively, compared to 26.8% and 24.5% for the same periods in 2023.

December 31, 2024 discussion of financial condition

•Total assets increased to $2.14 billion at December 31, 2024, from $2.02 billion at December 31, 2023, an increase of $118.7 million, or 5.9%.

•Cash and cash equivalents totaled $221.5 million at December 31, 2024, as compared to $180.4 million at December 31, 2023.

•The investment securities portfolio decreased to $14.8 million at December 31, 2024, from $16.4 million at December 31, 2023, a decrease of $1.6 million, or 9.9%, primarily due to pay downs of securities.

•Gross loans increased to $1.87 billion at December 31, 2024, from $1.79 billion at December 31, 2023, an increase of $80.8 million or 4.5%. The increase in loans was primarily due to an increase in the multi-family loan portfolio of $71.5 million, and an increase in the CRE owner occupied portfolio balance of $18.2 million, partially offset by a decrease in the construction portfolio balance of $17.9 million.

•Nonperforming loans at December 31, 2024 increased to $11.8 million, representing 0.63% of total loans, an increase of $4.5 million, from $7.3 million of nonperforming loans at December 31, 2023. The increase was primarily driven by a $1.6 million increase in the residential 1 to 4 family investment portfolio, a $1.6 million increase in the residential 1 to 4 family portfolio, and a $2.1 million increase in the CRE non-owner occupied portfolio, partially offset by a $0.7 million decrease in the CRE owner-occupied portfolio. OREO at December 31, 2024 was $1.6 million, which was unchanged from $1.6 million at December 31, 2023. Nonperforming assets (consisting of nonperforming loans and OREO) represented 0.62% and 0.44% of total assets at December 31, 2024 and December 31, 2023, respectively. Loans past due 30 to 89 days were $1.4 million at December 31, 2024, a decrease of $2.5 million from December 31, 2023.

•The allowance for credit losses was $32.6 million at December 31, 2024, as compared to $32.1 million at December 31, 2023. The ratio of the allowance for credit losses to total loans was 1.74% and 1.80% at December 31, 2024 and at December 31, 2023, respectively. The ratio of allowance for credit losses to non-performing loans was 276.5% at December 31, 2024, compared to 442.5%, at December 31, 2023.

•Total deposits were $1.63 billion at December 31, 2024, up from $1.55 billion at December 31, 2023, an increase of $78.2 million or 5.0% compared to December 31, 2023. The increase in deposits was attributed to an increase in brokered time deposits of $61.5 million, an increase in money market deposits of $48.4 million, and an increase in time deposits of $46.6 million, partially offset by a decrease in non-interest bearing demand deposits of $48.2 million, and a decrease in savings deposits of $27.6 million. Brokered money market deposits, included in the above balances, decreased $75.1 million, to zero at December 31, 2024. Deposits from our cannabis related businesses increased $55.2 million to $151.9 million at December 31, 2024, compared to $96.7 million at December 31, 2023.

•Total borrowings increased $20.2 million during the twelve months ended December 31, 2024, to $188.3 million at December 31, 2024 from $168.1 million at December 31, 2023, due primarily to an increase of $20.0 million in Federal Home Loan Bank of New York ("FHLBNY") advances.

.

•Total equity increased to $300.1 million at December 31, 2024, up from $284.3 million at December 31, 2023, an increase of $15.8 million, or 5.5%, primarily due to the retention of earnings, partially offset by the payment of $8.6 million of cash dividends, and the repurchase of Company common stock of $4.3 million.

CEO outlook and commentary

"There was a lot of excitement and some surprises in 2024, which is not unusual for a Presidential election year. Many projections for 2024 did not materialize including the anticipated pace of reducing interest rates. The economy’s surprising strength and a slower than hoped for decline in inflation tempered and delayed the Feds reduction of interest rates. It was initially projected that interest rates would be reduced beginning in the second quarter of 2024, but this did not begin until the fourth quarter. Although the region’s real estate market remained surprisingly resilient the anticipated strengthening of the industry was slow and in some market sectors non-existent. The slow interest rate decline resulted in a higher interest expense for our company in 2024 than initially anticipated, reducing our net interest income. We are seeing the continued slow increase in loan demand and anticipate that this will not change in 2025. New home construction is one market sector that we see improving faster than some other sectors."

"Although we are disappointed with the higher than anticipated interest expense negatively affecting our net interest income, we are pleased that we generated strong earnings in 2024. We continue to maintain tight controls on our expenses with our cost efficiency ratio improving to close to 41%. Asset Quality also remains an important focus as we supported the strength of our credit loss reserve at 1.74%. Our 30 to 89 days past due loans decreased $2.5 million from year end 2023."

"Our net income, tight control of our expenses and our total equity exceeding $300 million puts us in a good position to take advantage of opportunities in the market including new lending markets that we are supporting. We are seeing more optimism in the business and real estate industries which we share. Parke Bank will cautiously proceed in identifying new business opportunities while maintaining our focus on supporting our shareholders confidence in investing in our company."

Forward Looking Statement Disclaimer

This release may contain forward-looking statements. Such forward-looking statements are subject to risks and uncertainties which may cause actual results to differ materially from those currently anticipated due to a number of factors; our ability to maintain strong capital, strong asset quality and strong reserves; our ability to recover or partially offset any losses resulting from loss of stored or missing cash; our ability to generate strong revenues with increased interest income and net interest income;; our ability to continue the financial strength and growth of our Company and Parke Bank; our ability to continue to increase shareholders’ equity, good credit quality; our ability to be well structured to face challenging economic conditions; our ability to ensure that our loan loss provision is well positioned for the future; our ability to continue to reduce our nonperforming loans and delinquencies and the expenses associated with them; our ability to realize a high recovery rate on disposition of troubled assets; our ability to continue to pay a dividend in the future; our ability to enhance shareholder value in the future; our ability to continue growing our Company, our earnings and shareholders’ equity; and our ability to continue to grow our loan portfolio; the possibility of additional corrective actions or limitations on the operations of Parke Bancorp, Inc. and Parke Bank being imposed by banking regulators, therefore, readers should not place undue reliance on any forward-looking statements. Parke Bancorp, Inc. does not undertake, and specifically disclaims, any obligations to publicly release the results of any revisions that may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such circumstance.

(PKBK-ER)

Financial Supplement:

Table 1: Condensed Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | |

| Parke Bancorp, Inc. and Subsidiaries |

| Condensed Consolidated Balance Sheets |

|

| December 31, | | December 31, |

| 2024 | | 2023 |

| (Dollars in thousands) |

| Assets | | | |

| Cash and cash equivalents | $ | 221,527 | | | $ | 180,376 | |

| Investment securities | 14,760 | | | 16,387 | |

| | | |

| Loans, net of unearned income | 1,868,153 | | | 1,787,340 | |

| Less: Allowance for credit losses | (32,573) | | | (32,132) | |

| Net loans | 1,835,580 | | | 1,755,208 | |

| Premises and equipment, net | 5,316 | | | 5,579 | |

| Bank owned life insurance (BOLI) | 29,070 | | | 28,415 | |

| Other assets | 35,983 | | | 37,535 | |

| Total assets | $ | 2,142,236 | | | $ | 2,023,500 | |

| | | |

| Liabilities and Equity | | | |

| | | |

| Non-interest bearing deposits | $ | 184,037 | | | $ | 232,189 | |

| Interest bearing deposits | 1,447,013 | | | 1,320,638 | |

| FHLBNY borrowings | 145,000 | | | 125,000 | |

| | | |

| Subordinated debentures | 43,300 | | | 43,111 | |

| Other liabilities | 22,813 | | | 18,245 | |

| Total liabilities | 1,842,163 | | | 1,739,183 | |

| | | |

| | | |

| | | |

| Total shareholders' equity | 300,073 | | | 284,317 | |

| | | |

| Total liabilities and shareholders' equity | $ | 2,142,236 | | | $ | 2,023,500 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Table 2: Consolidated Income Statements (Unaudited) | | | | | | | |

| | For the three months ended December 31, | | For the twelve months ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (Dollars in thousands, except per share data) |

| Interest income: | | | | | | | |

| Interest and fees on loans | $ | 30,857 | | | $ | 28,459 | | | $ | 117,834 | | | $ | 106,061 | |

| Interest and dividends on investments | 281 | | | 303 | | | 1,042 | | | 1,048 | |

| Interest on deposits with banks | 2,188 | | | 1,537 | | | 6,237 | | | 5,595 | |

| Total interest income | 33,326 | | | 30,299 | | | 125,113 | | | 112,704 | |

| Interest expense: | | | | | | | |

| Interest on deposits | 15,189 | | | 13,214 | | | 57,312 | | | 41,259 | |

| Interest on borrowings | 2,518 | | | 1,570 | | | 9,093 | | | 7,231 | |

| Total interest expense | 17,707 | | | 14,784 | | | 66,405 | | | 48,490 | |

| Net interest income | 15,619 | | | 15,515 | | | 58,708 | | | 64,214 | |

| Provision for (recovery of) credit losses | 182 | | | (451) | | | 728 | | | (2,051) | |

| Net interest income after provision for (recovery of) credit losses | 15,437 | | | 15,966 | | | 57,980 | | | 66,265 | |

| Non-interest income | | | | | | | |

| Service fees on deposit accounts | 328 | | | 724 | | | 1,387 | | | 3,872 | |

| Gain on sale of SBA loans | — | | | — | | | 23 | | | — | |

| Other loan fees | 231 | | | 239 | | | 849 | | | 851 | |

| Bank owned life insurance income | 167 | | | 294 | | | 655 | | | 737 | |

| Net gain on sale and valuation adjustment of OREO | — | | | — | | | — | | | 38 | |

| Other | 412 | | | 223 | | | 1,387 | | | 1,194 | |

| Total non-interest income | 1,138 | | | 1,480 | | | 4,301 | | | 6,692 | |

| Non-interest expense | | | | | | | |

| Compensation and benefits | 3,302 | | | 2,925 | | | 12,768 | | | 12,340 | |

| Professional services | 1,089 | | | 583 | | | 2,730 | | | 2,328 | |

| Occupancy and equipment | 655 | | | 666 | | | 2,598 | | | 2,604 | |

| Data processing | 389 | | | 348 | | | 1,366 | | | 1,385 | |

| FDIC insurance and other assessments | 333 | | | 332 | | | 1,306 | | | 1,292 | |

| OREO expense | 59 | | | 229 | | | 835 | | | 839 | |

| Other operating expense | 1,023 | | | 1,204 | | | 4,381 | | | 14,479 | |

| Total non-interest expense | 6,850 | | | 6,287 | | | 25,984 | | | 35,267 | |

| Income before income tax expense | 9,725 | | | 11,159 | | | 36,297 | | | 37,690 | |

| Income tax expense | 2,327 | | | 2,986 | | | 8,785 | | | 9,228 | |

| | | | | | | |

| | | | | | | |

| Net income attributable to Company | 7,398 | | | 8,173 | | | 27,512 | | | 28,462 | |

| Less: Preferred stock dividend | (5) | | | (6) | | | (20) | | | (26) | |

| Net income available to common shareholders | $ | 7,393 | | | $ | 8,167 | | | $ | 27,492 | | | $ | 28,436 | |

| Earnings per common share | | | | | | | |

| Basic | $ | 0.62 | | | $ | 0.68 | | | $ | 2.30 | | | $ | 2.38 | |

| Diluted | $ | 0.61 | | | $ | 0.67 | | | $ | 2.27 | | | $ | 2.35 | |

| Weighted average common shares outstanding | | | | | | | |

| Basic | 11,937,412 | | | 11,947,530 | | | 11,954,483 | | | 11,945,740 | |

| Diluted | 12,153,318 | | | 12,133,511 | | | 12,139,451 | | | 12,137,052 | |

Table 3: Operating Ratios

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Twelve months ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Return on average assets | 1.41 | % | | 1.64 | % | | 1.38 | % | | 1.45 | % |

| Return on average common equity | 9.82 | % | | 11.50 | % | | 9.36 | % | | 10.21 | % |

| Interest rate spread | 2.01 | % | | 2.17 | % | | 1.94 | % | | 3.08 | % |

| Net interest margin | 3.02 | % | | 3.17 | % | | 3.00 | % | | 3.34 | % |

| Efficiency ratio* | 40.88 | % | | 36.99 | % | | 41.24 | % | | 48.34 | % |

* Efficiency ratio is calculated using non-interest expense divided by the sum of net interest income and non-interest income.

Table 4: Asset Quality Data

| | | | | | | | | | | |

| December 31, | | December 31, |

| 2024 | | 2023 |

| (Amounts in thousands except ratio data) |

| Allowance for credit losses | $ | 32,573 | | | $ | 32,132 | |

| Allowance for credit losses to total loans | 1.74 | % | | 1.80 | % |

| Allowance for credit losses to non-accrual loans | 276.46 | % | | 442.53 | % |

| Non-accrual loans | $ | 11,782 | | | $ | 7,261 | |

| OREO | $ | 1,562 | | | $ | 1,550 | |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

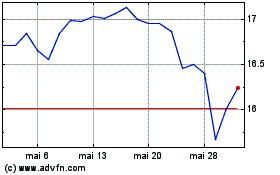

Parke Bancorp (NASDAQ:PKBK)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

Parke Bancorp (NASDAQ:PKBK)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025