RadNet Secures Commitments to Amend its Credit Facility, Resulting in 0.25% Reduction in Interest Rates

22 Novembre 2024 - 5:00PM

RadNet, Inc. (NASDAQ: RDNT), a national

leader in providing high-quality, cost-effective, fixed-site

outpatient diagnostic imaging services, today announced that it has

completed pricing and allocations for Amendment No. 1 to Credit and

Guaranty Agreement (the “First Amendment”) which will reduce the

interest rates payable under its Third Amended and Restated First

Lien Credit and Guaranty Agreement (the “Credit Agreement”).

RadNet has $872,812,500 of outstanding term

loans under the Credit Agreement, and is undrawn on its revolving

credit facility. With the successful completion of the First

Amendment, the interest rate on the term loans will be reduced by

0.25% to, at RadNet’s election, either Term SOFR plus 2.25% or the

alternate base rate plus 1.25%. The interest rate on the revolving

credit facility will also be reduced by 0.25%, which is subject to

a pricing grid based upon RadNet’s leverage ratio. All other terms

of the term loans and revolving credit facility, including their

respective maturity dates, will remain unchanged.

In connection with the First Amendment, RadNet

has provided call protection to the lenders for a period of six

months following the First Amendment. RadNet estimates that the

First Amendment will result in approximately $2.2 million of annual

cash interest expense reduction. The closing under the First

Amendment is expected to be next week.

Mark Stolper, Executive Vice President and Chief

Financial Officer of RadNet, commented “I would like to thank our

relationship banks and term loan lenders for their continued

support of our company. With almost $750 million of cash on our

balance sheet, a leverage ratio of Adjusted EBITDA(1) to Net Debt

of under 1.0x and term loans that do not mature until 2031, we are

well-positioned with the liquidity necessary to implement our

business plan in the coming years.”

RadNet’s wholly-owned subsidiary, Radnet

Management, Inc. is the borrower under the First Amendment. The

borrower’s obligations under the First Amendment are guaranteed by

RadNet, and substantially all of the borrower’s current and future

wholly-owned domestic subsidiaries and certain of its affiliates.

With certain exceptions, the obligations are secured by

substantially all of the assets of the borrower, RadNet and such

subsidiaries and affiliates.

Footnotes

(1) The Company defines Adjusted EBITDA as

earnings before interest, taxes, depreciation and amortization,

each from continuing operations and adjusted for losses or gains on

the sale of equipment, other income or loss, debt extinguishments

and non-cash equity compensation. Adjusted EBITDA includes equity

earnings in unconsolidated operations and subtracts allocations of

earnings to non-controlling interests in subsidiaries, and is

adjusted for non-cash or extraordinary and one-time events taken

place during the period.

Adjusted EBITDA is reconciled to its nearest

comparable GAAP financial measure. Adjusted EBITDA is a non-GAAP

financial measure used as analytical indicator by RadNet management

and the healthcare industry to assess business performance, and is

a measure of leverage capacity and ability to service debt.

Adjusted EBITDA should not be considered a measure of financial

performance under GAAP, and the items excluded from Adjusted EBITDA

should not be considered in isolation or as alternatives to net

income, cash flows generated by operating, investing or financing

activities or other financial statement data presented in the

consolidated financial statements as an indicator of financial

performance or liquidity. As Adjusted EBITDA is not a measurement

determined in accordance with GAAP and is therefore susceptible to

varying methods of calculation, this metric, as presented, may not

be comparable to other similarly titled measures of other

companies.

About RadNet, Inc.

RadNet, Inc. is the leading national provider of

freestanding, fixed-site diagnostic imaging services in the United

States based on the number of locations and annual imaging revenue.

RadNet has a network of 399 owned and/or operated outpatient

imaging centers. RadNet’s markets include Arizona, California,

Delaware, Florida, Maryland, New Jersey, New York and Texas. In

addition, RadNet provides radiology information technology and

artificial intelligence solutions marketed under the DeepHealth

brand, teleradiology professional services and other related

products and services to customers in the diagnostic imaging

industry. Together with affiliated radiologists, and inclusive of

full-time and per diem employees and technologists, RadNet has a

total of over 10,000 employees. For more information, visit

http://www.radnet.com.

Contact:RadNet,

Inc.Mark Stolper,

310-445-2800Executive Vice President and Chief

Financial Officer

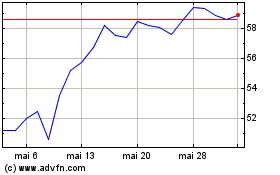

RadNet (NASDAQ:RDNT)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

RadNet (NASDAQ:RDNT)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024