ReShape Lifesciences Inc. (Nasdaq:

RSLS), the premier physician-led weight loss and metabolic

health-solutions company, today reported financial results for the

third quarter ended September 30, 2024 and provided a corporate

strategic update.

Third Quarter 2024 and Subsequent

Highlights

- November: Revenue increased for the

third consecutive quarter and over the prior year despite continued

pressures from nationwide marketing and adoption of GLP-1

pharmaceutical weight-loss alternatives.

- November: Received approval from

Health Canada for the next-generation Lap-Band® 2.0 FLEX through an

updated Medical Device License.

- November: Awarded an approximately

$241,000 supplementary grant from the National Institutes of Health

(NIH), with the University of Southern California’s Center for

Autonomic Nerve Recording and Stimulation Systems (CARSS), for the

development of the next-generation electrodes for ReShape’s

Diabetes Bloc-Stim Neuromodulation™ (DBSN™) device.

- October: Entered into a securities

purchase agreement (SPA) with an institutional investor. Pursuant

to the SPA, ReShape agreed to issue the investor a senior secured

convertible note in the aggregate original principal amount of

$833,333.34, and also issue to the investor 7,983 shares of ReShape

common stock.

- September: Effected a 1-for-58

reverse stock split of the company’s common stock, which was

effective for trading purposes upon the commencement of trading on

September 23, 2024.

- July 2024: Entered into a

definitive merger agreement with Vyome Therapeutics, Inc., a

private clinical-stage company targeting immuno-inflammatory and

rare diseases, under which ReShape and Vyome will combine in an

all-stock transaction. Under the terms of the merger agreement,

which has been unanimously approved by the boards of directors of

both companies, existing ReShape stockholders will own

approximately 11.1% of the combined company immediately following

the closing of the merger, subject to adjustment based on ReShape’s

actual net cash at closing compared to a target, net cash amount of

$5 million.Simultaneously with the execution of the merger

agreement, ReShape entered into an asset purchase agreement with

Biorad Medisys, Pvt. Ltd., which is party to a previously disclosed

exclusive license agreement with ReShape for ReShape’s Obalon®

Gastric Balloon System. Pursuant to the asset purchase agreement,

ReShape will sell substantially all of its assets to Biorad (or an

affiliate thereof), including ReShape’s Lap-Band® System, Obalon®

Gastric Balloon System and the Diabetes Bloc-Stim Neuromodulation™

(DBSN™) System (but excluding cash), and Biorad will assume

substantially all of ReShape’s liabilities, for a purchase price of

$5.16 million in cash, subject to adjustment based on ReShape’s

actual accounts receivable and accounts payable at the closing

compared to such amounts as of March 31, 2024. The cash purchase

price under the asset purchase agreement will count toward

ReShape’s net cash for purposes of determining the post-merger

ownership allocation between ReShape and Vyome stockholders under

the merger agreement.

“During the third quarter, our revenues

continued to rebound, increasing 16.6% over the second quarter,

representing the third sequential quarter of growth, and we

continued to execute on our 2024 cost reduction plan, leading to

approximately 41% lower operating expenses for the first nine

months of the year, compared to last year. This, in turn, has

increased our gross profit margin to over 60%,” stated Paul F.

Hickey, President and Chief Executive Officer of ReShape

Lifesciences®. “Notably, just this week, we received Health Canada

approval for the next generation Lap-Band® 2.0 FLEX, as well as a

$241,000 supplementary grant from the NIH for our DBSN™ device,

representing two important milestones for our weight loss and

metabolic health products.

“As previously reported, in July, we coordinated

a merger agreement with Vyome Therapeutics and a concurrent asset

purchase agreement with Biorad, successfully maximizing value for

our stockholders. This resulted from the exclusive engagement of

Maxim Group LLC last December to initiate a high-priority search

for synergistic merger and acquisition opportunities. After

thoroughly evaluating various strategic options and discussing a

variety of potential mergers and acquisitions, our board

unanimously recommended merging with Vyome and concurrently selling

assets to Biorad. We believe this merger will unlock significant

value for our shareholders in the newly combined entity.

Furthermore, we are grateful to our Series C preferred stockholders

for lowering their liquidation preference, allowing our common

stockholders to benefit from the merger's potential. It is worth

noting that, in October, we regained compliance with Nasdaq after

effecting a 1-for-58 reverse stock split in September, which was a

critical component for the merger with Vyome. I remain very excited

about the shareholder value and growth potential resulting from

these transactions.”

Third Quarter and Nine Months Ended

September 30, 2024, Financial and Operating Results

Revenue totaled $2.3 million

for the three months ended September 30, 2024, which represents an

increase of 6.4%, compared to the same period in 2023, and an

increase of 16.6% as compared to the second quarter of 2024. This

stabilization in revenue resulted from highly focused DTC marketing

efforts amidst the continued pressure due to GLP-1 pharmaceutical

weight-loss alternatives.

Revenue totaled $6.2 million for the nine months

ended September 30, 2024, which represents a contraction of 7.4%,

or $0.5 million compared to the same period in 2023. This primarily

resulted from a decrease in sales volume, primarily due to GLP-1

pharmaceutical weight-loss alternatives.

Gross Profit for the three

months ended September 30, 2024, was $1.4 million, which was

slightly above $1.3 million for the same period in 2023. Gross

profit as a percentage of total revenue for the three months ended

September 30, 2024, was 62.8% compared to 59.8% for the same period

in 2023. Gross profit for both the nine months ended September 30,

2024 and 2023, was $3.7 million, respectively. Gross profit as a

percentage of total revenue for the nine months ended September 30,

2024, was 60.3% compared to 55.3% for the same period in 2023. The

increase in gross profit percentage is due to the reduction in

overhead related costs, primarily payroll, as the Company had a

reduction of employees late in 2023.

Sales and Marketing Expenses

for the three months ended September 30, 2024, decreased by $1.1

million, or 59.9%, to $0.7 million, compared to $1.8 million for

the same period in 2023. Sales and marketing expenses for the nine

months ended September 30, 2024, decreased by $3.7 million, or

60.8%, to $2.4 million, compared to $6.2 million for the same

period in 2023. The decrease is primarily due to a decrease in

advertising and marketing expenses, including consulting and

professional marketing services, as the Company has reevaluated its

marketing approach and has moved to a targeted digital marketing

campaign, resulting in a reduction of costs. Additionally, there

was a decrease in payroll-related expenditures, including

commissions, stock compensation expense and travel, due to changes

in sales personnel and a reduction in sales, and a reduction of in

other expenses.

General and Administrative

Expenses for the three months ended September 30, 2024,

increased by $24 thousand, or 1.2%, to approximately $2.1 million,

compared to $2.1 million for the same period in 2023. The increase

is primarily due to a $0.4 million increase professional services

primarily related to the merger and asset purchase transaction that

was entered into during July 2024, offset by a $0.2 million

reduction in employee related expenses, a $0.1 million in bad debt

expense and $0.1 million in other expenses.

General and administrative expenses for the nine

months ended September 30, 2024, decreased by $2.7 million, or

30.4%, to $6.1 million, compared to $8.7 million for the same

period in 2023. The decrease is primarily due to a reduction in

professional services, such as audit and legal fees of $1.1

million, primarily due to the Company incurring one-time

adjustments for professional services related to the February 2023

public offering, and a reduction in payroll-related expenditures,

including stock-based compensation expense, of $1.0 million due to

decline in staffing levels, and a reduction in rent expense of $0.1

million, as the Company moved its headquarters at the end of the

second quarter of 2023 to a smaller facility to reduce costs.

Additionally, there was a reduction in bad debt expense of $0.4

million, and a reduction in other miscellaneous expenses of $0.1

million.

Research and Development

Expenses for the three months ended September 30, 2024,

decreased by $0.1 million, or 26.4% to $0.4 million, compared to

$0.5 million for the same period in the prior year. Research and

development expenses for the nine months ended September 30, 2024,

decreased by $0.3 million, or 18.7% to $1.3 million, compared to

approximately $1.6 million for the same period in the prior year.

The primary reason for the decrease is a reduction in payroll and

consulting services.

Cash and Cash Equivalents As of

September 30, 2024, the Company had net working capital of

approximately $1.3 million, primarily due to cash and cash

equivalents and restricted cash of $0.8 million.

A full discussion of the Company’s financials is available in

our Third Quarter 2024 Form 10-Q Report, filed with the Securities

and Exchange Commission.

Conference Call Information

Management will host a conference call to

discuss ReShape’s financial and operational results on

Thursday, November 14 at 4:30 pm ET. Krishna K. Gupta, Chairman of

Vyome Therapeutics, will also join the call to discuss Vyome’s

strategy. To participate in the conference call please register

with the following Registration Link, and dial-in details will be

provided. Participants using this feature are requested to dial

into the conference call fifteen minutes ahead of time to avoid

delays.

An archived replay will also be available on the

“Events and Presentations” section of ReShape’s website at:

https://ir.reshapelifesciences.com/events-and-presentations.

About ReShape Lifesciences®

ReShape Lifesciences® is America’s premier weight loss and

metabolic health-solutions company, offering an integrated

portfolio of proven products and services that manage and treat

obesity and metabolic disease. The FDA-approved Lap-Band® System

provides minimally invasive, long-term treatment of obesity and is

an alternative to more invasive surgical stapling procedures such

as the gastric bypass or sleeve gastrectomy. The investigational

Diabetes Bloc-Stim Neuromodulation™ (DBSN™) system utilizes a

proprietary vagus nerve block and stimulation technology platform

for the treatment of type 2 diabetes and metabolic disorders. The

Obalon® balloon technology is a non-surgical, swallowable,

gas-filled intra-gastric balloon that is designed to provide

long-lasting weight loss. For more information, please visit

www.reshapelifesciences.com.

Non-GAAP DisclosuresIn addition

to the financial information prepared in conformity with GAAP, we

provide certain historical non-GAAP financial information.

Management believes that these non-GAAP financial measures assist

investors in making comparisons of period-to-period operating

results.

Management believes that the presentation of

this non-GAAP financial information provides investors with greater

transparency and facilitates comparison of operating results across

a broad spectrum of companies with varying capital structures,

compensation strategies, and amortization methods, which provides a

more complete understanding of our financial performance,

competitive position, and prospects for the future. However, the

non-GAAP financial measures presented in this release have certain

limitations in that they do not reflect all of the costs associated

with the operations of our business as determined in accordance

with GAAP. Therefore, investors should consider non-GAAP financial

measures in addition to, and not as a substitute for, or as

superior to, measures of financial performance prepared in

accordance with GAAP. Further, the non-GAAP financial measures

presented by the company may be different from similarly named

non-GAAP financial measures used by other companies.

Adjusted EBITDAManagement uses

Adjusted EBITDA in its evaluation of the company’s core results of

operations and trends between fiscal periods and believes that

these measures are important components of its internal performance

measurement process. Adjusted EBITDA is defined as net loss before

interest, taxes, depreciation and amortization, stock-based

compensation, and other one-time costs. Management uses Adjusted

EBITDA in its evaluation of the company’s core results of

operations and trends between fiscal periods and believes that

these measures are important components of its internal performance

measurement process. Therefore, investors should consider non-GAAP

financial measures in addition to, and not as a substitute for, or

as superior to, measures of financial performance prepared in

accordance with GAAP. Further, the non-GAAP financial measures

presented by the company may be different from similarly named

non-GAAP financial measures used by other companies.

Additional InformationIn

connection with the proposed Merger and Asset Sale, ReShape plans

to file with the Securities and Exchange Commission (the “SEC”) and

mail or otherwise provide to its stockholders a joint proxy

statement/prospectus and other relevant documents in connection

with the proposed Merger and Asset Sale. Before making a voting

decision, ReShape’s stockholders are urged to read the joint proxy

statement/prospectus and any other documents filed by ReShape with

the SEC in connection with the proposed Merger and Asset Sale or

incorporated by reference therein carefully and in their entirety

when they become available because they will contain important

information about ReShape, Vyome and the proposed transactions.

Investors and stockholders may obtain a free copy of these

materials (when they are available) and other documents filed by

ReShape with the SEC at the SEC’s website at www.sec.gov, at

ReShape’s website at www.reshapelifesciences.com, or by sending a

written request to ReShape at 18 Technology Drive, Suite 110,

Irvine, California 92618, Attention: Corporate Secretary.

Participants in the

SolicitationThis document does not constitute a

solicitation of proxy, an offer to purchase or a solicitation of an

offer to sell any securities of ReShape and its directors,

executive officers and certain other members of management and

employees may be deemed to be participants in soliciting proxies

from its stockholders in connection with the proposed Merger and

Asset Sale. Information regarding the persons who may, under the

rules of the SEC, be considered to be participants in the

solicitation of ReShape’s stockholders in connection with the

proposed Merger and Asset Sale will be set forth in joint proxy

statement/prospectus if and when it is filed with the SEC by

ReShape and Vyome. Security holders may obtain information

regarding the names, affiliations and interests of ReShape’s

directors and officers in ReShape’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, which was filed with the

SEC on April 1, 2024. To the extent the holdings of ReShape

securities by ReShape’s directors and executive officers have

changed since the amounts set forth in ReShape’s proxy statement

for its most recent annual meeting of stockholders, such changes

have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. Additional information regarding

these individuals and any direct or indirect interests they may

have in the proposed Merger and Asset Sale will be set forth in the

joint proxy statement/prospectus when and if it is filed with the

SEC in connection with the proposed Merger and Asset Sale, at

ReShape’s website at www.reshapelifesciences.com.

Forward-Looking

StatementsCertain statements contained in this filing may

be considered forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements regarding the Merger and Asset Sale and the ability to

consummate the Merger and Asset Sale. These forward-looking

statements generally include statements that are predictive in

nature and depend upon or refer to future events or conditions, and

include words such as “believes,” “plans,” “anticipates,”

“projects,” “estimates,” “expects,” “intends,” “strategy,”

“future,” “opportunity,” “may,” “will,” “should,” “could,”

“potential,” or similar expressions. Statements that are not

historical facts are forward-looking statements. Forward-looking

statements are based on current beliefs and assumptions that are

subject to risks and uncertainties. Forward-looking statements

speak only as of the date they are made, and ReShape undertakes no

obligation to update any of them publicly in light of new

information or future events. Actual results could differ

materially from those contained in any forward-looking statement as

a result of various factors, including, without limitation: (1)

ReShape may be unable to obtain stockholder approval as required

for the proposed Merger and Asset Sale; (2) conditions to the

closing of the Merger or Asset Sale may not be satisfied; (3) the

Merger and Asset Sale may involve unexpected costs, liabilities or

delays; (4) ReShape’s business may suffer as a result of

uncertainty surrounding the Merger and Asset Sale; (5) the outcome

of any legal proceedings related to the Merger or Asset Sale; (6)

ReShape may be adversely affected by other economic, business,

and/or competitive factors; (7) the occurrence of any event, change

or other circumstances that could give rise to the termination of

the Merger Agreement or Asset Purchase Agreement; (8) the effect of

the announcement of the Merger and Asset Purchase Agreement on the

ability of ReShape to retain key personnel and maintain

relationships with customers, suppliers and others with whom

ReShape does business, or on ReShape’s operating results and

business generally; and (9) other risks to consummation of the

Merger and Asset Sale, including the risk that the Merger and Asset

Sale will not be consummated within the expected time period or at

all. Additional factors that may affect the future results of

ReShape are set forth in its filings with the SEC, including

ReShape’s most recently filed Annual Report on Form 10-K,

subsequent Quarterly Reports on Form 10-Q, Current Reports on Form

8-K and other filings with the SEC, which are available on the

SEC’s website at www.sec.gov, specifically under the heading “Risk

Factors.” The risks and uncertainties described above and in

ReShape’s most recent Annual Report on Form 10-K are not exclusive

and further information concerning ReShape and its business,

including factors that potentially could materially affect its

business, financial condition or operating results, may emerge from

time to time. Readers are urged to consider these factors carefully

in evaluating these forward-looking statements, and not to place

undue reliance on any forward-looking statements. Readers should

also carefully review the risk factors described in other documents

that ReShape files from time to time with the SEC. The

forward-looking statements in these materials speak only as of the

date of these materials. Except as required by law, ReShape assumes

no obligation to update or revise these forward-looking statements

for any reason, even if new information becomes available in the

future.

CONTACTS:

ReShape Lifesciences

Contact: Paul

F. HickeyPresident and Chief Executive

Officer949-276-7223ir@ReShapeLifesci.com

Investor Relations Contact:Rx

Communications GroupMichael

Miller(917)-633-6086mmiller@rxir.com

| |

| |

|

RESHAPE LIFESCIENCES INC.Consolidated

Balance Sheets (dollars in thousands; unaudited) |

| |

|

|

|

|

|

| |

September 30, |

|

December 31, |

| |

2024 |

|

2023 |

|

ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

743 |

|

|

$ |

4,459 |

|

|

Restricted cash |

|

100 |

|

|

|

100 |

|

|

Accounts and other receivables |

|

1,344 |

|

|

|

1,659 |

|

|

Inventory |

|

2,934 |

|

|

|

3,741 |

|

|

Prepaid expenses and other current assets |

|

217 |

|

|

|

337 |

|

|

Total current assets |

|

5,338 |

|

|

|

10,296 |

|

| Property and equipment,

net |

|

43 |

|

|

|

60 |

|

| Operating lease right-of-use

assets |

|

177 |

|

|

|

250 |

|

| Deferred tax asset, net |

|

28 |

|

|

|

28 |

|

| Other assets |

|

29 |

|

|

|

29 |

|

|

Total assets |

$ |

5,615 |

|

|

$ |

10,663 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

2,105 |

|

|

$ |

1,689 |

|

|

Accrued and other liabilities |

|

1,643 |

|

|

|

1,814 |

|

|

Warranty liability, current |

|

163 |

|

|

|

163 |

|

|

Operating lease liabilities, current |

|

114 |

|

|

|

111 |

|

|

Total current liabilities |

|

4,025 |

|

|

|

3,777 |

|

| Operating lease liabilities,

noncurrent |

|

77 |

|

|

|

151 |

|

| Common stock warrant

liability |

|

26 |

|

|

|

72 |

|

|

Total liabilities |

|

4,128 |

|

|

|

4,000 |

|

| Commitments and contingencies

(Note 10) |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, 10,000,000 shares authorized: |

|

|

|

|

|

|

Series C convertible preferred stock |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

642,518 |

|

|

|

642,325 |

|

|

Accumulated deficit |

|

(640,943 |

) |

|

|

(635,574 |

) |

|

Accumulated other comprehensive loss |

|

(88 |

) |

|

|

(88 |

) |

|

Total stockholders’ equity |

|

1,487 |

|

|

|

6,663 |

|

|

Total liabilities and stockholders’ equity |

$ |

5,615 |

|

|

$ |

10,663 |

|

| |

|

RESHAPE LIFESCIENCES INC. Consolidated

Statements of Operations (dollars in thousands;

unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

2,292 |

|

|

$ |

2,155 |

|

|

$ |

6,201 |

|

|

$ |

6,696 |

|

| Cost of revenue |

|

853 |

|

|

|

867 |

|

|

|

2,463 |

|

|

|

2,990 |

|

| Gross profit |

|

1,439 |

|

|

|

1,288 |

|

|

|

3,738 |

|

|

|

3,706 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

719 |

|

|

|

1,791 |

|

|

|

2,408 |

|

|

|

6,150 |

|

|

General and administrative |

|

2,082 |

|

|

|

2,058 |

|

|

|

6,074 |

|

|

|

8,724 |

|

|

Research and development |

|

399 |

|

|

|

542 |

|

|

|

1,282 |

|

|

|

1,576 |

|

|

Impairment of long-lived assets |

|

— |

|

|

|

777 |

|

|

|

— |

|

|

|

777 |

|

|

Gain on disposal of assets, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(33 |

) |

| Total operating expenses |

|

3,200 |

|

|

|

5,168 |

|

|

|

9,764 |

|

|

|

17,194 |

|

| Operating loss |

|

(1,761 |

) |

|

|

(3,880 |

) |

|

|

(6,026 |

) |

|

|

(13,488 |

) |

| Other expense

(income), net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

— |

|

|

|

(5 |

) |

|

|

(13 |

) |

|

|

(9 |

) |

|

Loss (gain) on changes in fair value of liability warrants |

|

(27 |

) |

|

|

(412 |

) |

|

|

(46 |

) |

|

|

(3,850 |

) |

|

Gain on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

(429 |

) |

|

|

— |

|

|

Loss (gain) on foreign currency exchange, net |

|

(50 |

) |

|

|

68 |

|

|

|

(10 |

) |

|

|

47 |

|

|

Other |

|

(109 |

) |

|

|

— |

|

|

|

(193 |

) |

|

|

(8 |

) |

| Loss before income tax

provision |

|

(1,575 |

) |

|

|

(3,531 |

) |

|

|

(5,335 |

) |

|

|

(9,668 |

) |

| Income tax expense |

|

6 |

|

|

|

3 |

|

|

|

34 |

|

|

|

21 |

|

| Net loss |

$ |

(1,581 |

) |

|

$ |

(3,534 |

) |

|

$ |

(5,369 |

) |

|

$ |

(9,689 |

) |

| Net loss per share -

basic and diluted: |

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share - basic and

diluted |

$ |

(3.11 |

) |

|

$ |

(59.36 |

) |

|

$ |

(11.94 |

) |

|

$ |

(199.98 |

) |

| Shares used to compute basic

and diluted net loss per share |

|

508,851 |

|

|

|

59,538 |

|

|

|

449,614 |

|

|

|

48,451 |

|

The following table contains a reconciliation of

GAAP net loss to non-GAAP net loss Adjusted EBITDA attributable to

common stockholders for the three months ended September 30, 2024

and 2023 (in thousands):

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

GAAP net loss |

$ |

(1,581 |

) |

|

$ |

(3,534 |

) |

|

$ |

(5,369 |

) |

|

$ |

(9,689 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest (income) expense, net |

|

— |

|

|

|

(5 |

) |

|

|

(13 |

) |

|

|

(9 |

) |

|

Income tax expense (benefit) |

|

6 |

|

|

|

3 |

|

|

|

34 |

|

|

|

21 |

|

|

Depreciation and amortization |

|

6 |

|

|

|

50 |

|

|

|

17 |

|

|

|

147 |

|

|

Stock-based compensation expense |

|

32 |

|

|

|

216 |

|

|

|

169 |

|

|

|

656 |

|

|

Gain on disposal of assets, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(33 |

) |

|

Impairment of long-lived assets |

|

— |

|

|

|

777 |

|

|

|

— |

|

|

|

777 |

|

|

Loss (Gain) on changes in fair value of liability warrants |

|

(27 |

) |

|

|

(412 |

) |

|

|

(46 |

) |

|

|

(3,850 |

) |

|

Gain on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

(429 |

) |

|

|

— |

|

| Adjusted EBITDA |

$ |

(1,564 |

) |

|

$ |

(2,905 |

) |

|

$ |

(5,637 |

) |

|

$ |

(11,980 |

) |

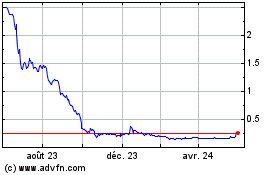

ReShape Lifesciences (NASDAQ:RSLS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

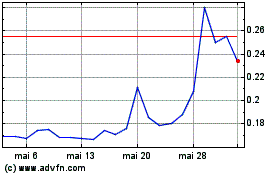

ReShape Lifesciences (NASDAQ:RSLS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024