| Prospectus

Supplement No. 4 |

|

Filed

pursuant to Rule 424(b)(3) |

| (To

Prospectus dated May 10, 2023) |

|

Registration

Statement No. 333-271396 |

SharpLink

Gaming Ltd.

This

prospectus supplement updates, amends and supplements the prospectus dated May 10, 2023 (the “Prospectus”), which forms a

part of our Registration Statement on Form S-1 (Registration No. 333-271396). Capitalized terms used in this prospectus supplement and

not otherwise defined herein have the meanings specified in the Prospectus.

This

prospectus supplement is being filed to update, amend, and supplement the information included in the Prospectus with the information

contained in our Amendment No. 1 to the Annual Report on Form 10-K/A filed with the SEC on July 14, 2023, which is set forth below.

This

prospectus supplement is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus,

which is to be delivered with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information

in this prospectus supplement updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement

with your Prospectus for future reference.

Our

Ordinary Shares are traded on The Nasdaq Capital Market under the symbol “SBET.” On July 14, 2023, the last reported sale

price of our Ordinary Shares was $2.90 per share.

Investing

in shares of our Ordinary Shares involves risks that are described in the “Risk Factors” section beginning on page 10 of

the Prospectus.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued

under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the

contrary is a criminal offense.

The

date of this prospectus supplement is July 17, 2023

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K/A

(Amendment

No. 1)

(Mark

One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2022

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _______ to ________

Commission

file number: 000-28950

| SHARPLINK

GAMING LTD. |

| (Exact

name of registrant as specified in its charter) |

| Israel

|

|

98-1657258 |

| (State

or other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification No.) |

| |

|

|

333

Washington Avenue North, Suite 104,

Minneapolis,

Minnesota |

|

55401 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 612-293-0619

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Ordinary

Shares |

|

SBET |

|

Nasdaq

Capital Market |

Securities

registered pursuant to Section 12(g) of the Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer,” “emerging growth company”

and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that require a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The

aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which

the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was

$21,461,158.

As

of March 31, 2023, there were 26,880,250 Ordinary Shares, par value $0.02 per share, issued and outstanding.

EXPLANATORY

NOTE

SharpLink

Gaming Ltd. (“SharpLink” or the “Company”) is filing this Amendment No. 1 on Form 10-K/A (the “Amendment”)

to address in its Annual Report on Form 10-K as of December 31, 2022 originally filed with the U.S. Securities and Exchange Commission

(the “SEC”) on April 5, 2023 (the “Original 10-K”). The Amendment is being filed solely to:

| 1. | Emphasize

the Company’s going concern status in the forefront of the MD&A and in Liquidity

and Capital Resources discussion; |

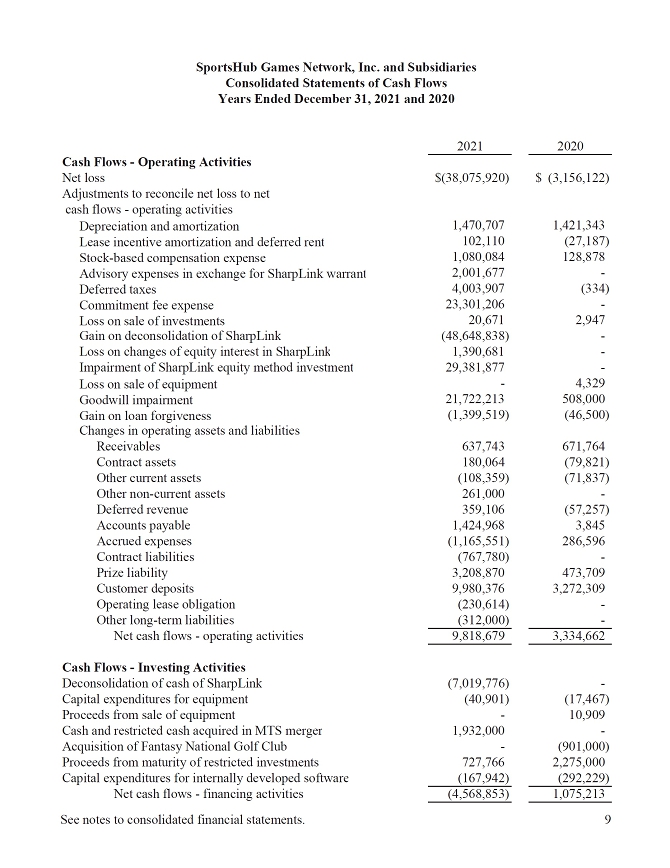

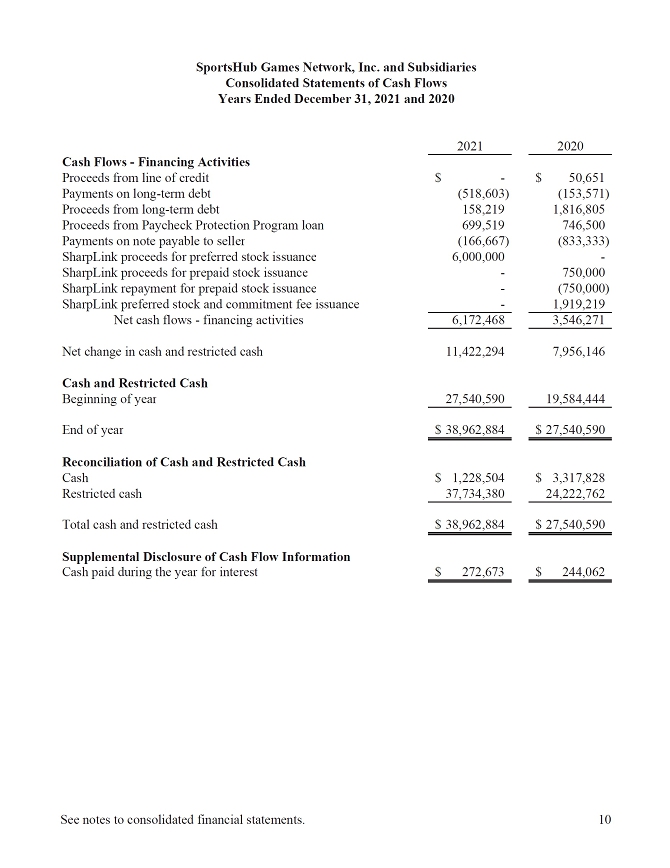

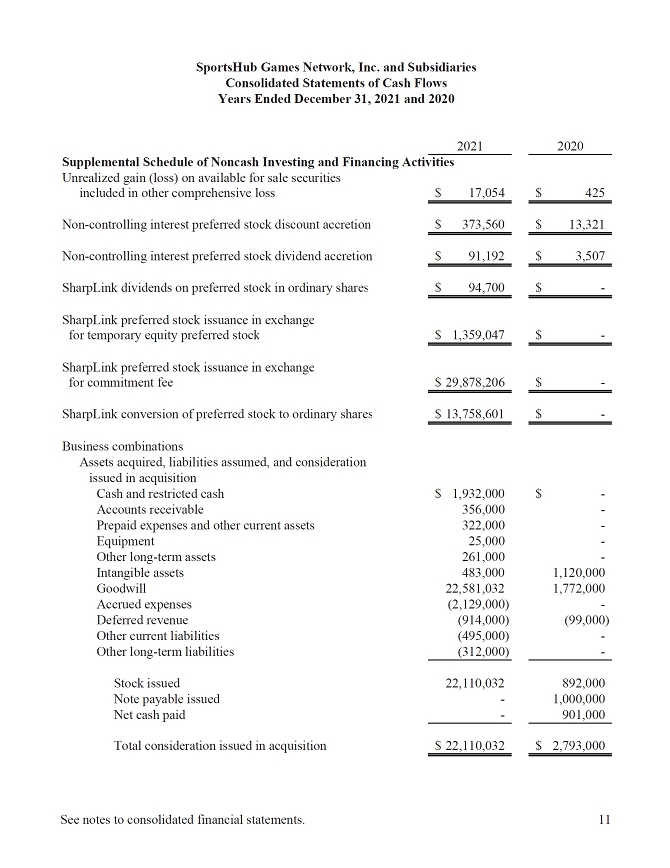

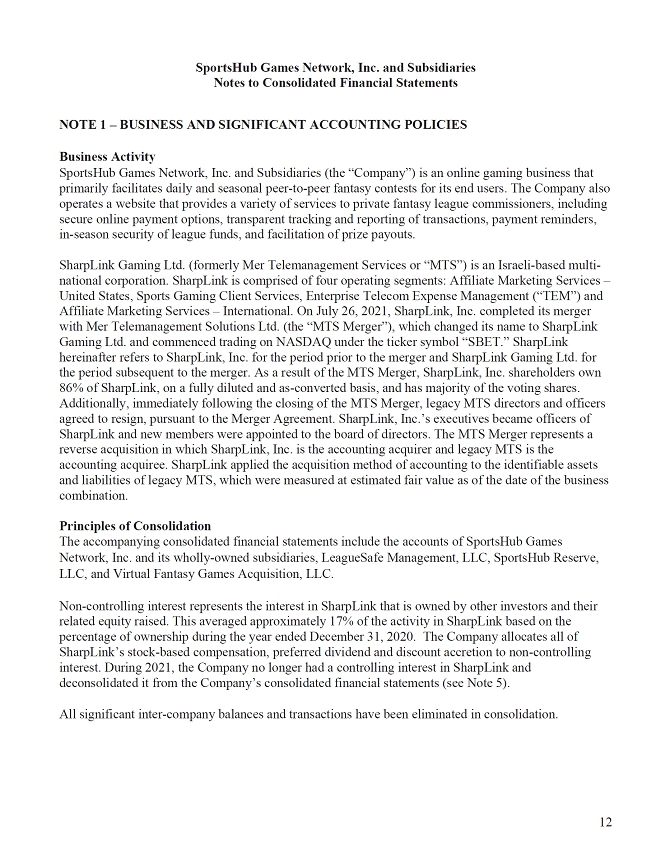

| 2. | Include

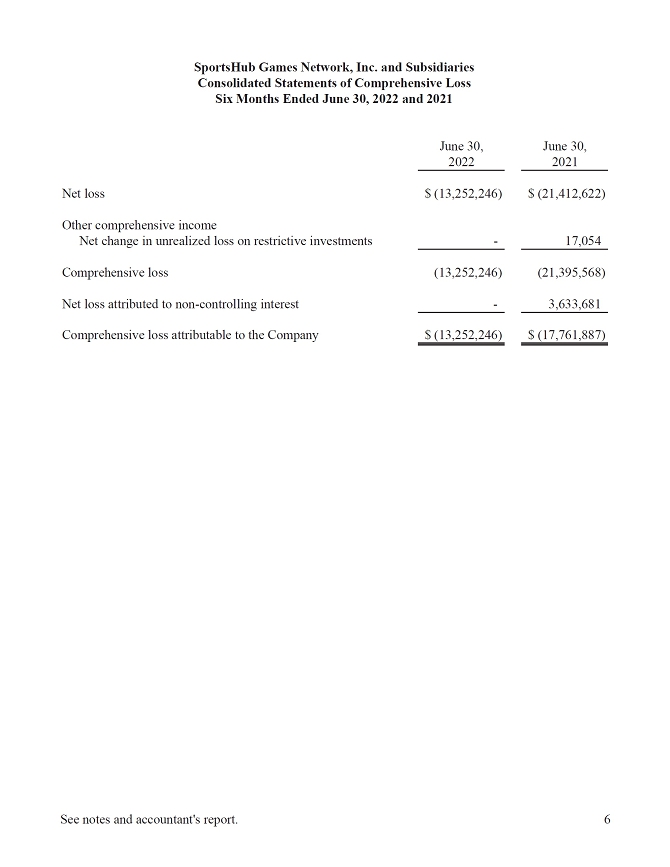

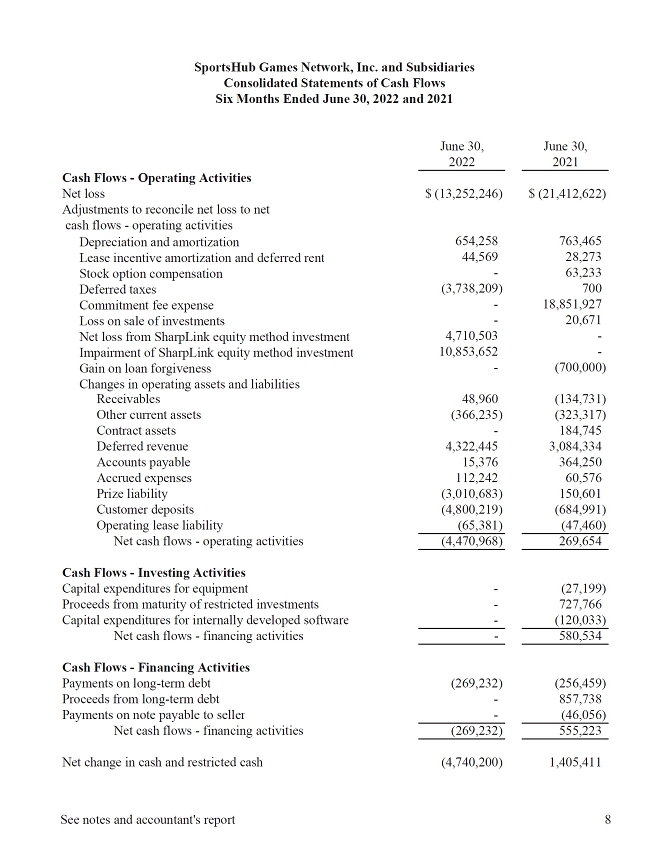

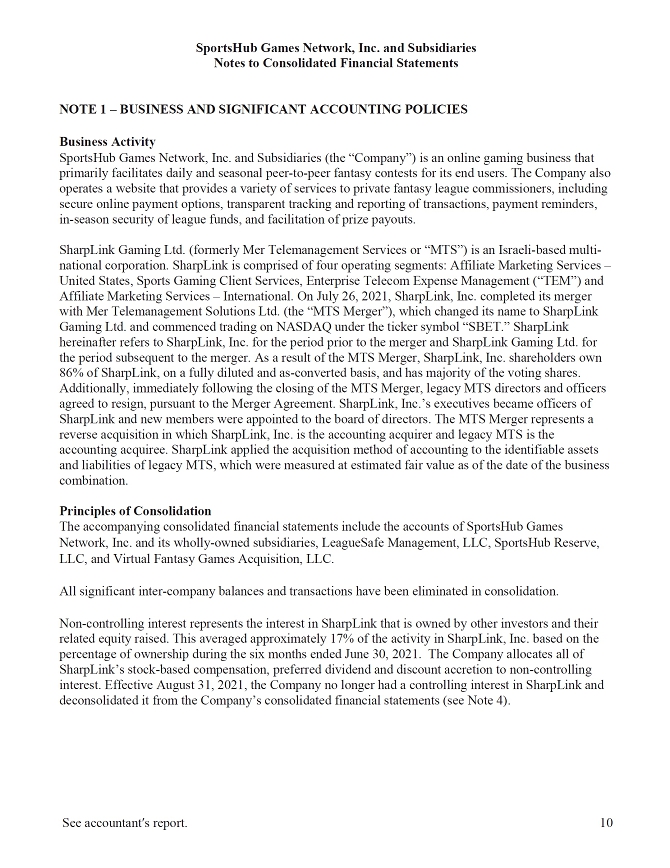

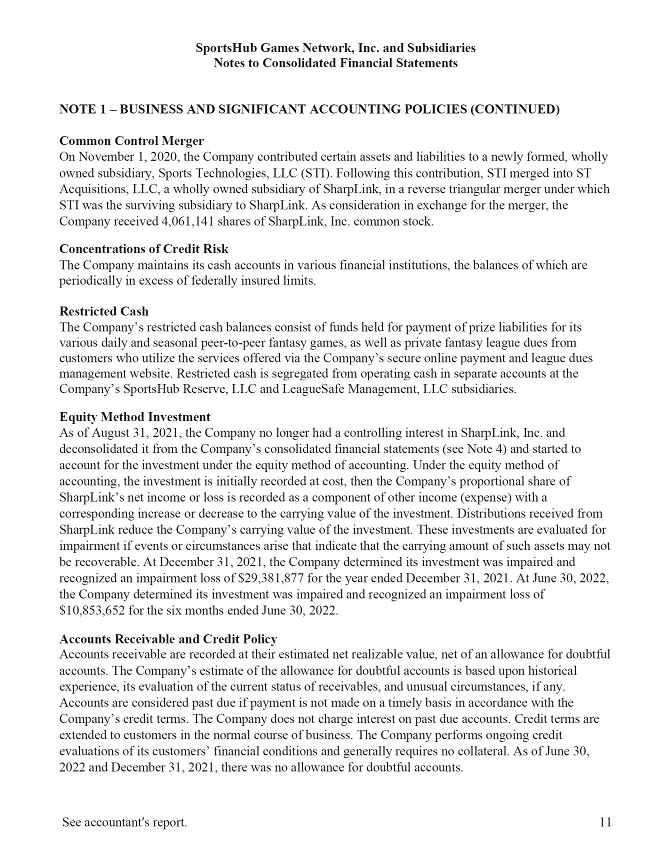

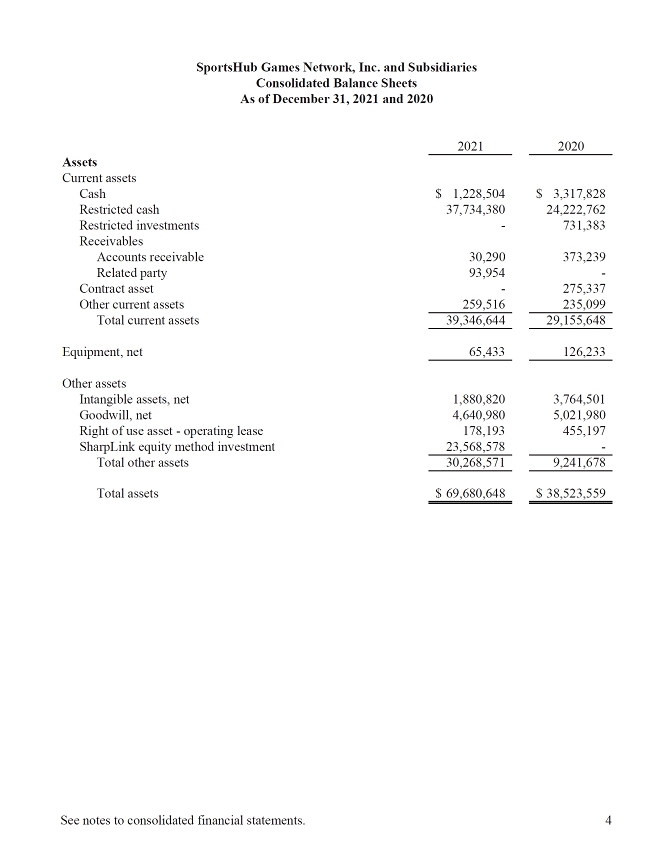

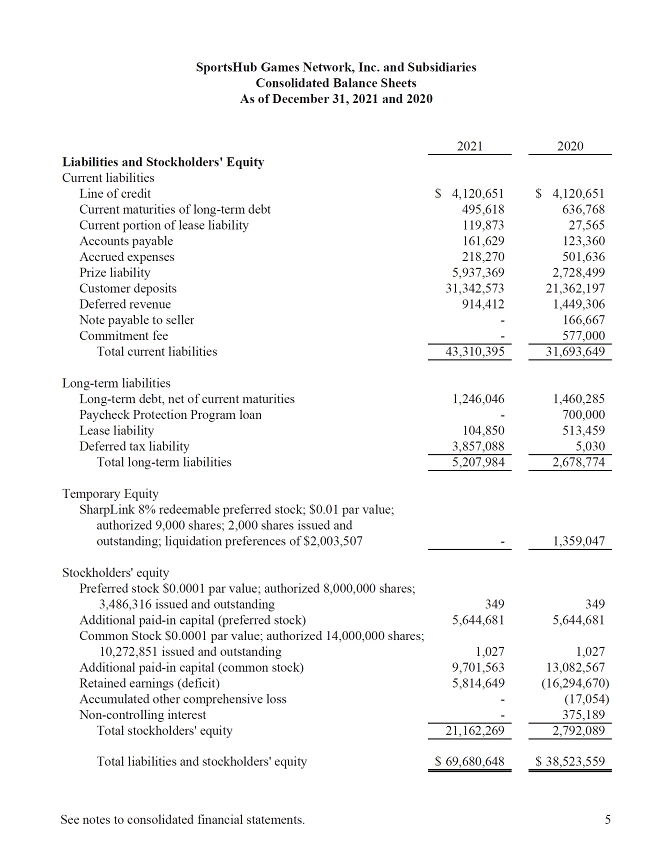

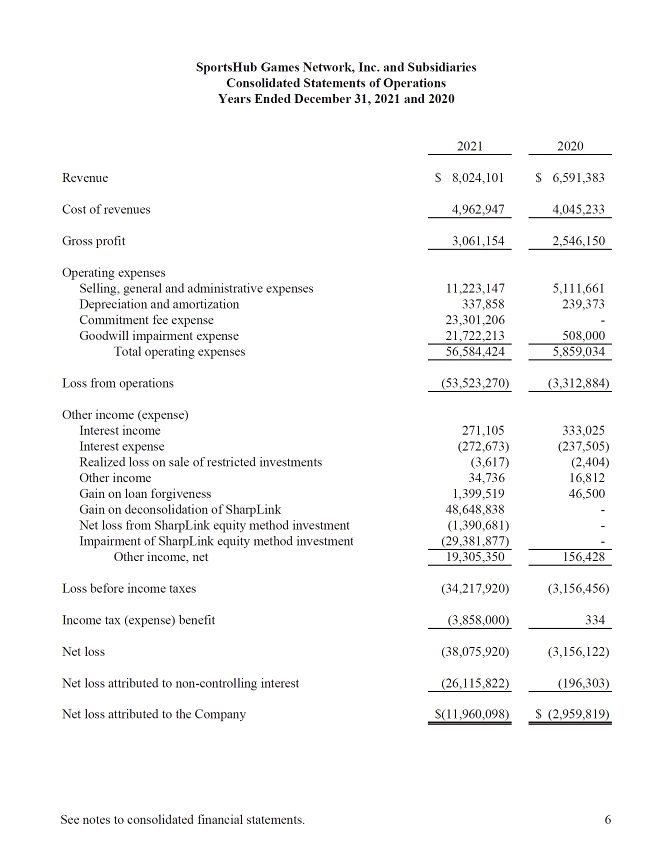

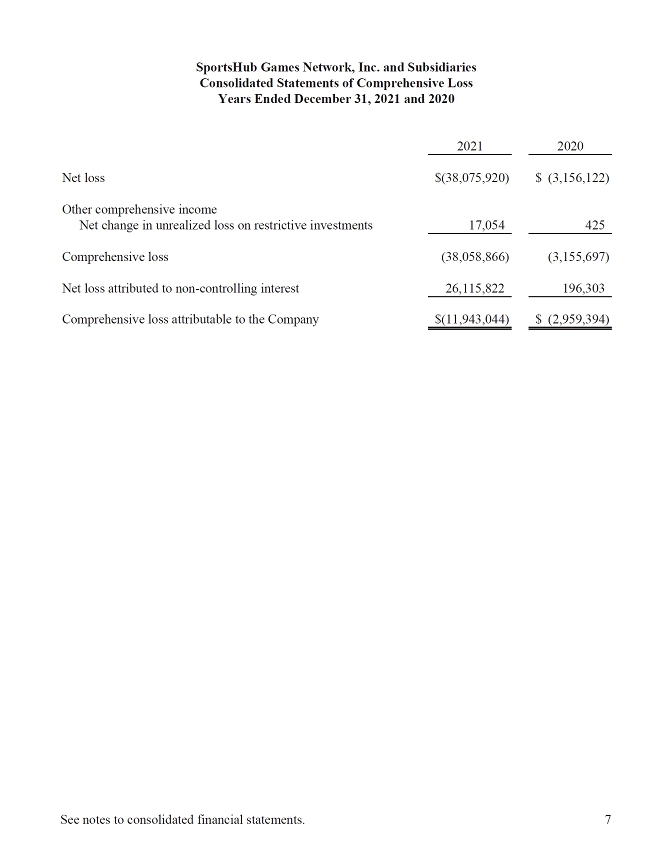

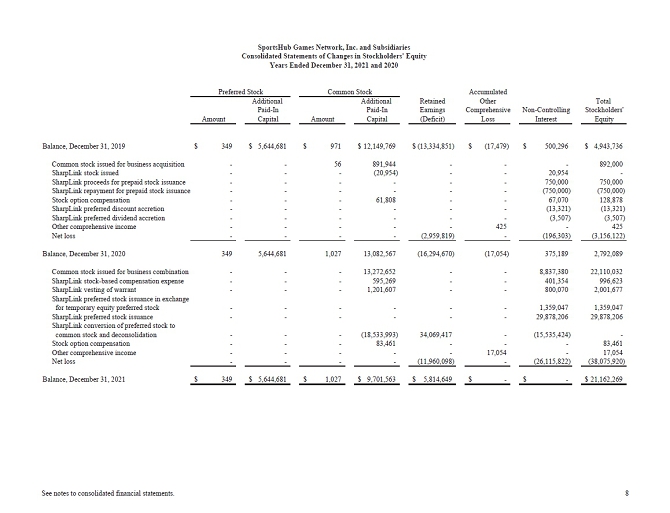

the unaudited financial statements of SportsHub Games Network, Inc. and Subsidiaries for

the six months ended June 30, 2022 and 2021, and audited financial statements of SportsHub

Games Network, Inc. and Subsidiaries for the years ended December 31, 2021 and 2020. |

As

previously disclosed, on September 7, 2022, SharpLink, SHGN Acquisition Corp., a Delaware corporation and wholly owned subsidiary of

SharpLink (“Merger Subsidiary”), SportsHub Games Network Inc. (“SportsHub”) and Christian Peterson, an individual

acting as the SportsHub stockholders’ representative entered into a Merger Agreement in which SharpLink acquired SportsHub. The

Merger Agreement, as amended, contained the terms and conditions of the proposed acquisition by SharpLink of SportsHub.

On

November 8, 2022, the Company furnished a Current Report on Form 6-K (the “6-K”) to the SEC to include, among other exhibits,

Exhibit 99.2 for the Notice of and Proxy Statement for SharpLink Gaming Ltd. Extraordinary General Meeting of Shareholders to be held

on December 14, 2022, to solicit its shareholders’ approval on the Merger Agreement. Exhibit

99.2 encompasses (i) the unaudited financial statements of SportsHub Games Network, Inc. and Subsidiaries for the six months ended June

30, 2022 and 2021, as Annex C, and (ii) the audited financial statements of SportsHub Games Network, Inc. and Subsidiaries for the years

ended December 31, 2021 2020, as Annex D.

On

December 14, 2022, The Company’s shareholders approved the Merger Agreement and the merger transaction was closed on December 22,

2022. To make it more convenient for the investors and shareholders to locate and access to the above-mentioned financial statements

of SportsHub, the Company is including them at the end of SharpLink’s audited financial statements for the years ended December

31, 2022 and 2021 of this Amendment.

Pursuant

to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), this Amendment also contains new

certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, which are attached hereto.

No

other changes have been made to the Original 10-K. This Amendment does not reflect subsequent events occurring after the filing date

of the Original 10-K or modify or update in any way disclosures made in the Original 10-K. This Amendment should be read in conjunction

with the Original 10-K.

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion highlights the principal factors that have affected our financial condition and results of operations as well as

our liquidity and capital resources for the periods described. This discussion should be read in conjunction with our Consolidated Financial

Statements and the related notes included in Item 8 of this Form 10-K. This discussion contains forward-looking statements. Please see

the explanatory note concerning “Forward-Looking Statements” in Part I of this Annual Report on Form 10-K and Item 1A. Risk

Factors for a discussion of the uncertainties, risks and assumptions associated with these forward-looking statements. The operating

results for the periods presented were not materially affected by inflation.

Overview

Founded

in 2019 and headquartered in Minneapolis, Minnesota, SharpLink is a leading business-to-business provider of performance marketing and

advanced technology-enabled fan engagement and conversion solutions for the fast emerging U.S. sports betting and iGaming industries.

Our base of marquis customers and trusted business partners comprise many of the nation’s leading sports media publishers, leagues,

teams, sportsbook operators, casinos and sports technology companies, including Turner Sports, NASCAR, PGA TOUR, National Basketball

Association (“NBA”), National Collegiate Athletic Association (“NCAA”), NBC Sports, BetMGM, Party Poker, World

Poker Tour and Tipico, among numerous others.

We

continue to make deliberate and substantial investments in support of our mission and long-term growth objectives. Our primary growth

strategy is centered on cost effectively monetizing our own and our customers’ respective online audiences of U.S. fantasy sports

and casual sports fans and casino gaming enthusiasts by converting them into loyal online sports and iGaming bettors. We are endeavoring

to achieve this through deployment of our proprietary conversion technologies, branded as our “C4” solutions, which are seamlessly

integrated with fun, highly engaging fan experiences. Purpose built from the ground-up specifically for the U.S. market, SharpLink’s

C4 innovations are designed to help unlock the lifetime value of sports bettors and online casino players. More specifically, C4:

| |

● |

COLLECTS,

analyzes and leverages deep learning of behavioral data relating to individual fans; |

| |

|

|

| |

● |

CONNECTS

and controls fan engagement with real-time, personalized betting offers sourced from U.S. sportsbooks and casinos in states where

online betting has been legalized; |

| |

|

|

| |

● |

CONVERTS

passive fantasy sports and casual sports fans into sports bettors on a fully automated basis; and |

| |

|

|

| |

● |

readily

enables gaming operators and publishers to CAPITALIZE on acquiring and scaling sports betting and iGaming depositors, resulting

in higher revenue generation and greatly enhanced user experiences. |

We

reach fans and cultivate audience growth and activation through our four primary operating segments: 1) Sports Gaming Client Services;

2) SportsHub Games Network/Fantasy Sports; 3) Direct to Player (“D2P”)/Affiliate Marketing Services – International;

and 4) D2P/Affiliate Marketing Services – United States.

The

Company previously owned and operated an enterprise telecom expense management business (“Enterprise TEM”) acquired in July

2021 in connection with SharpLink’s go-public merger with Mer Telemanagement Solutions. Beginning in 2022, we discontinued operations

for this business unit and sought a buyer for the business. On December 31, 2022, we completed the sale of this business to Israel-based

Entrypoint South Ltd.

SharpLink

is guided by an accomplished, entrepreneurial leadership team of industry veterans and pioneers encompassing decades of experience in

delivering innovative sports solutions to partners that have included Turner Sports, Google, Facebook, the National Football League (“NFL”),

NCAA and NBA, among many other iconic organizations, with executive experience at companies which include ESPN, NBC, Sportradar, AOL,

Cantor Gaming, Betfair and others.

As

of March 2023, the Company’s state regulatory initiatives have resulted in SharpLink being licensed and/or authorized to operate

in 24 U.S. states, the District of Columbia and Ontario, Canada, or nearly 100% of the legal online betting market in North America.

By

leveraging our technology and building on our current client and industry relationships, SharpLink believes we are well positioned to

earn a leadership position in the rapidly evolving sports betting and iGaming markets by driving down customer acquisition costs, materially

increasing and enhancing player engagement and delivering users with high lifetime value to our proprietary web properties and to those

of our gaming partners.

Going

Concern

We

will require additional capital to support our growth plans. If we do not raise sufficient capital, there is substantial doubt about

our ability to continue as a going concern. In the pursuit of our long-term growth strategy and the development of our sports betting

conversion, affiliate marketing services and related businesses, we have sustained continued operating losses. During the years ended

December 31, 2022 and 2021, we had a net loss from continuing operations of $15,303,402 and $33,469,830, respectively, and cash used

in operating activities from continuing operations of $6,510,965 and $5,854,995. To help fund our operations, we raised capital from

banks and outside investors in the aggregate amounts of $2,675,343 and $15,678,085 for the years ended December 31, 2022 and 2021, respectively,

in the form of a term loan in 2022 and the sale of Ordinary Shares and conversion of preferred stock and prefunded and regular warrants

during 2021. Based on continued expected cash needs to fund our ongoing technology development initiatives and grow our Affiliate Marketing

Services–United States operations, we may require additional liquidity to continue our operations for the next year. Subsequent

to the end of 2022, in February 2023 we closed on a $4.4 million convertible debenture and signed a two-year $7.0 million revolving loan

agreement with our commercial lender.

Until

we can generate a sufficient amount of revenue to finance our capital needs, which we may never achieve, we expect to finance our cash

needs primarily through public or private equity financings or conventional debt financings. We cannot be certain that additional funding

will be available on acceptable terms or at all. If we are not able to secure additional funding when needed to support our business

growth and to respond to business challenges, track and comply with applicable laws and regulations, develop new technology and services

or enhance our existing offering, improve our operating infrastructure, enhance our information security systems to combat changing cyber

threats and expand personnel to support our business, we may have to delay or reduce the scope of planned strategic growth initiatives.

Moreover, any additional equity financing that we obtain may dilute the ownership held by our existing shareholders. The economic dilution

to our shareholders will be significant if our stock price does not materially increase, or if the effective price of any sale is below

the price paid by a particular shareholder. Any debt financing could involve substantial restrictions on activities and creditors could

seek additional pledges of some or all of our assets. If we fail to obtain additional funding as needed, we may be forced to cease or

scale back operations, and our results, financial conditions and stock price would be adversely affected.

Impact

of COVID-19 On Our Business Operations

The

worldwide outbreak of COVID-19 in early 2020 negatively affected economic conditions regionally as well as globally and caused a reduction

in consumer spending. Efforts to contain the effect of the virus included business closures, travel restrictions, and restrictions on

public gatherings and events. Many businesses eliminated non-essential travel and canceled in-person events to reduce instances of employees

and others being exposed to public gatherings. Governments around the world, including governments in Europe and state and local governments

in the U.S., restricted business activities and strongly encouraged, instituted orders or otherwise restricted individuals from leaving

their home. To date, governmental authorities imposed or recommended various measures, including social distancing, quarantine, limitations

on the size of gatherings, closures of work facilities, schools, public buildings and businesses, and cancellation of events, including

sporting events, concerts, conferences and meetings. The suspension, postponement and cancellation of sporting events affected by COVID-19

had an adverse impact on the progression of SharpLink’s overall business plan and our revenue and the revenue of our clients.

Although

many sports seasons and sporting events recommenced in 2021, the fluidity of this situation, potential for virus variants and potential

setbacks associated therewith precludes any prediction as to the ultimate impact of COVID-19 and any emerging variants of coronavirus,

which remains a material uncertainty and risk with respect to SharpLink’s business, performance, and financial results. The revenue

of our clients, and our own revenue, continue to depend on sports events taking place and consumer participation and spending on entertainment

and leisure activities, and any further setbacks with respect to COVID-19 and its variants could have a material adverse effect on our

business, financial condition, results of operations and prospects.

Recent

Developments

Merger

with SportsHub Games Network Inc. (the “SportsHub Merger”)

SharpLink,

SharpLink, SHGN Acquisition Corp., a Delaware corporation and wholly owned subsidiary of SharpLink (“Merger Subsidiary”),

SportsHub and Christian Peterson, an individual acting as the SportsHub stockholders’ representative entered into the Merger Agreement

on September 7, 2022. The Merger Agreement, as amended on November 2, 2022 by the Merger Agreement Amendment, contained the terms and

conditions of the proposed business combination of SharpLink and SportsHub. Pursuant to the Merger Agreement, as amended, on December

22, 2022, SportsHub merged with and into Merger Subsidiary in accordance with the provisions of Delaware’s General Corporation

Law, as amended, with Merger Subsidiary surviving as a wholly owned subsidiary of SharpLink. In association with the transaction, SharpLink

issued, in aggregate, 4,319,263 ordinary shares to common and preferred stockholders of SportsHub, on a fully diluted basis. An additional

aggregate amount of 405,862 ordinary shares are being held in escrow for SportsHub shareholders who have yet to provide the applicable

documentation required in connection with the SportsHub Merger, as well as shares held in escrow for indemnifiable losses and for the

reimbursement of expenses incurred by the Stockholder Representative in performing his duties pursuant to the Merger Agreement.

NASDAQ

Notice

On

November 4, 2022, we received a deficiency notice from NASDAQ stating that we no longer comply with NASDAQ Marketplace Rule 5550(a)(2)

because the bid price of our Ordinary Shares closed below the required minimum $1.00 per share for the previous 30 consecutive business

days. The notice also indicated that, in accordance with Marketplace Rule 5810(c)(3)(A), we have a period of 180 calendar days, until

May 3, 2023, to regain compliance with Rule 5550(a)(2). If at any time before May 3, 2023 the bid price of our Ordinary Shares closes

at $1.00 per share or more for a minimum of 10 consecutive business days, NASDAQ will notify us that we have regained compliance with

Rule 5550(a)(2). In the event we do not regain compliance with Rule 5550(a)(2) prior to the expiration of the 180-day period, we may

then be eligible for additional time if we meet the continued listing requirements for market value of publicly held shares and all other

initial listing standards for The Nasdaq Capital Market, with the exception of the bid price requirement, and will be required to provide

written notice of our intention to cure the deficiency during the second compliance period equal to an additional 180 calendar days.

If we cannot demonstrate compliance by the end of the second compliance period, Nasdaq will notify us that our Ordinary Shares are subject

to delisting.

On

January 20, 2023, our shareholders authorized a reverse share split in a ratio of up to and including 20:1, which if effected, would

increase the per share price of our Ordinary Shares to regain compliance with the minimum bid price requirements. The ratio and date

of such reverse split, if effected, will be determined by our Board of Directors.

Sale

of Legacy MTS Business

On

December 31, 2022, SharpLink closed on the sale of its legacy MTS business (“Legacy MTS”) to Israel-based Entrypoint South

Ltd., a subsidiary of Entrypoint Systems 2004 Ltd. In consideration of Entrypoint South Ltd. acquiring all rights, title, interests and

benefits to Legacy MTS, including 100% of the shares of MTS Integratrak Inc., one of the Company’s U.S. subsidiaries, it will pay

SharpLink an earn-out payment equal to three times Legacy MTS’ Earnings Before Interest, Taxes and Depreciation for the year ending

December 31, 2023, up to a maximum earn-out payment of $1 million (adjusted to reflect net working capital as of the closing date).

2023

$7 Million Revolving Credit Line

On

February 13, 2023, SharpLink, Inc., a Minnesota corporation and wholly owned subsidiary of the Company, entered into a Revolving Credit

Agreement with Platinum Bank, a Minnesota banking corporation and executed a revolving promissory note of $7,000,000.

Assumption

of Loans as a Result of Merger to SportsHub Games Network, Inc.

In

connection with the SportsHub Merger that closed on December 22, 2022, on February 13, 2023, SharpLink, Inc (the “New Borrower”),

as successor by merger to SportsHub (the “Existing Borrower”), LeagueSafe Management, LLC, a Minnesota limited liability

company (“LeagueSafe”), and Virtual Fantasy Games Acquisition, LLC, a Minnesota limited liability company (“Virtual

Fantasy”) entered into a consent, assumption and second amendment agreement with the Lender, to assume a term loan in the principal

amount of up to $2,000,000 as set forth by the term loan agreement dated June 9, 2020, as amended. LeagueSafe and Virtual Fantasy were

the Existing Borrower’s subsidiaries, and as a result of the merger, became the New Borrower’s subsidiaries.

In

connection with the SportsHub Merger that closed on December 22, 2022, on February 13, 2023, the New Borrower, LeagueSafe and Virtual

Fantasy entered into a consent, assumption and third amendment agreement with the Lender, to assume a revolving line of credit in the

principal amount of up to $5,000,000 as set forth by the revolving credit loan agreement dated March 27, 2020, as amended.

2023

Convertible Debenture and Warrant Financing

On

February 14, 2023, the Company entered into the SPA with Alpha, a current shareholder of the Company, pursuant to which the Company issued

to Alpha, an 8% Interest Rate, 10% Original Issue Discount, Senior Convertible Debenture in the aggregate principal amount of $4,400,000

for a purchase price of $4,000,000 on February 15, 2023. The Debenture will be convertible, at any time, and from time to time, at Alpha’s

option, into Conversion Shares, at an initial conversion price equal to $0.70 per share, subject to adjustment as described in the Debenture.

In addition, the Conversion Price of the Debenture is subject to an initial reset immediately prior to the Company’s filing of

a registration statement covering the resale of the Underlying Shares to the lower of $0.70 and the average of the five Nasdaq Official

Closing Prices immediately preceding such date, provided there shall be no Reset Price below $0.30 per share, the Floor Price, unless

waived in writing by the Company by notice to Alpha. If the Reset Price is below the Floor Price and the Company chooses not to waive

the Floor Price, the Debenture shall be repayable in cash within 10 business days of such reset date. As part of the SPA, the Regular

Warrants exercisable to purchase an aggregate of 2,666,667 ordinary shares have an exercise price of $4.50 per share were reduced from

$4.50 per share to $.06 per share. (See Notes 10 and 18 to the Consolidated Financial Statements.)

On

February 15, 2023, the Company also issued to Alpha the Warrant to purchase 8,800,000 ordinary shares of the Company at an initial exercise

price of $0.875. The Warrant is exercisable in whole or in part, at any time on or after February 15, 2023 and before February 15, 2028.

The Exercise Price of the Warrant is subject to an initial reset immediately prior to the Company’s filing of a proxy statement

that includes the Shareholder Approval Proposal to the lower of $0.875 and the average of the five Nasdaq Official Closing Prices immediately

preceding such date the. The Warrant includes a beneficial ownership blocker of 9.99%. The Warrant provides for adjustments to the Exercise

Price, in connection with stock dividends and splits, subsequent equity sales and rights offerings, pro rata distributions, and certain

fundamental transactions. In the event the Company, at any time while the Warrants are still outstanding, issues or grants any right

to re-price, ordinary shares or any type of securities giving rights to obtain ordinary shares at a price below Exercise Price, Alpha

shall be extended full-ratchet anti-dilution protection on the Warrants (reduction in price, only, no increase in number of Warrant Shares,

and subject to customary Exempt Transaction issuances), and such reset shall not be limited by the Floor Price.

Critical

Accounting Policies and Estimates

Our

management’s discussion and analysis of our financial condition and results of operations are based on our consolidated financial

statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America (“US

GAAP”). The preparation of these consolidated financial statements requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the consolidated financial

statements and the reported amount of revenues and expenses during the reporting period. Our most critical estimates include those related

to purchase accounting, intangibles and long-lived assets, goodwill and impairment, stock-based compensation, discontinued operations

and revenue recognition. On an ongoing basis, we evaluate our estimates and assumptions. We base our estimates on historical experience

and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments

about the carrying value of assets and liabilities that are not readily apparent from other sources. Our actual results may differ from

these estimates under different assumptions or conditions.

We

believe the following critical accounting estimates affect the more significant judgments and estimates used in preparing our consolidated

financial statements. Please see Note 1 to our consolidated financial statements, which are included in Item 8 “Financial Statements

and Supplementary Data” of this Annual Report, for our Summary of Significant Accounting Policies. There have been no material

changes made to the critical accounting estimates during the periods presented in the consolidated financial statements.

Purchase

Accounting

The

purchase price of an acquired business is allocated to the assets acquired and liabilities assumed at their estimated fair values on

the date of acquisition. Any unallocated purchase price amount is recognized as goodwill on the consolidated balance sheet if it exceeds

the estimated fair value or as a bargain purchase gain on the consolidated statement of operations if it is below the estimated fair

value. Determining the fair value of assets acquired and liabilities assumed requires management’s judgment, and the utilization

of independent valuation experts as well as the use of historical information and significant estimates and assumptions with respect

to the timing and amounts of future cash inflows and outflows, discount rates, market prices and asset lives, among other items. The

judgments made in the determination of the estimated fair value assigned to the assets acquired and liabilities assumed, as well as the

estimated useful life of each asset and the duration of each liability, can materially impact the financial statements in periods after

acquisition, especially depreciation and amortization expense. Acquisition-related costs are expensed as incurred and changes in deferred

tax asset valuation allowances and income tax uncertainties after the measurement period are recorded in Provision for Income Taxes.

Intangible

and Long-Lived Assets

Intangible

assets consist of internally developed software, customer relationships, trade names and acquired technology and are carried at cost

less accumulated amortization. The Company amortizes the cost of identifiable intangible assets on a straight-line basis over the expected

period of benefit, which ranges from three to ten years.

Costs

associated with internally developed software are expensed as incurred unless they meet generally accepted accounting criteria for deferral

and subsequent amortization. Software development costs incurred prior to the application development stage are expensed as incurred.

For costs that are capitalized, the subsequent amortization is the straight-line method over the remaining economic life of the product,

which is estimated to be five years.

The

Company begins amortizing the asset and subsequent enhancements once the software is ready for its intended use. The Company reassesses

whether it has met the relevant criteria for deferral and amortization at each reporting date.

The

Company reviews the carrying value of its long-lived assets, including equipment and finite-lived intangible assets, for impairment whenever

events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimate future cash flows expected

to result from its use and eventual disposition. In cases where undiscounted cash flows are less than the carrying value of an asset

group, an impairment loss is recognized equal to an amount by which the asset group’s carrying value exceeds the fair value of

assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the

manner in which the property is used, and the effects of customer loss, obsolescence, demand, competition, and other economic factors.

Goodwill

and Impairment

The

Company evaluates the carrying amount of goodwill annually or more frequently if events or circumstances indicate that the goodwill may

be impaired. Factors that could trigger an impairment review include significant underperformance relative to historical or forecasted

operating results, a significant decrease in the market value of an asset or significant negative industry or economic trends. The Company

completes impairment reviews for its reporting units using a fair-value method based on management’s judgments and assumptions.

When performing its annual impairment assessment, the Company evaluates the recoverability of goodwill assigned to each of its reporting

units by comparing the estimated fair value of the respective reporting unit to the carrying value, including goodwill. The Company estimates

fair value utilizing the income approach and the market approach or a combination of both income and market approaches.

The

income approach requires management to make assumptions and estimates for each reporting unit, including projected future operating results,

economic projections, anticipated future cash flows, working capital levels, income tax rates, and a weighted-average cost of capital

reflecting the specific risk profile of the respective reporting unit. The key assumptions used in the income approach include revenue

growth, operating income margin, discount rate and terminal growth rate. These assumptions are the most sensitive and susceptible to

change as they require significant management judgment. Discount rates are determined by using market and industry data as well as Company-specific

risk factors for each reporting unit. The discount rate utilized for each reporting unit is indicative of the return an investor would

expect to receive for investing in such a business.

The

market approach estimates fair value using performance multiples of comparable publicly-traded companies. In the event the fair value

of a reporting unit is less than the carrying value, including goodwill, an impairment loss is recognized for the difference between

the implied fair value and the carrying value of the reporting unit.

There

is inherent uncertainty included in the assumptions used in goodwill impairment testing. A change to any of the assumptions could lead

to a future impairment that could be material.

Stock-Based

Compensation

The

fair value of each option award is estimated on the date of grant using a Black Scholes option-pricing model. The Company uses historical

option exercise and termination data to estimate the expected term the options are expected to be outstanding. The risk-free rate is

based on the U.S. Treasury yield curve in effect at the time of grant. The expected dividend yield is calculated using historical dividend

amounts and the stock price at the option issue date. The expected volatility is determined using the volatility of peer companies. The

Company’s underlying stock has been publicly traded since the date of the MTS Merger. All option grants during the year ended December

31, 2022 and 2021 were granted under the 2021 plan subsequent to the MTS Merger. All option grants made under the SharpLink, Inc. 2020

plan were prior to the MTS Merger. SharpLink, Inc.’s underlying stock was not publicly traded, but was estimated on the date of

the grants using valuation methods that consider valuations from recent equity financings as well as future planned transactions.

Discontinued

Operations

In

June 2022, the Company’s Board of Directors approved management to enter into negotiations to sell MTS. The Company negotiated

a Share and Asset Purchase Agreement with the transaction completed on December 31, 2022. In accordance with ASC 205-20 Presentation

of Financial Statements: Discontinued Operations, a disposal of a component of an entity or a group of components of an entity is required

to be reported as discontinued operations if the disposal represents a strategic shift that has (or will have) a major impact on an entity’s

operations and financial results when the components of an entity meets the criteria in ASC paragraph 205-20-45-10. In the period in

which the component meets the held for sale or discontinued operations criteria the major assets, other assets, current liabilities and

non-current liabilities shall be reported as a component of total assets and liabilities separate from those balances of the continuing

operations. At the same time, the results of all discontinued operations, less applicable income taxes (benefit), shall be reported as

components of net income (loss) separate from the income (loss) of continuing operations.

Revenue

Recognition

The

Company follows a five-step model to assess each sale to a customer; identify the legally binding contract, identify the performance

obligations, determine the transaction price, allocate the transaction price, and determine whether revenue will be recognized at a point

in time or over time. Revenue is recognized upon transfer of control of promised products or services (i.e., performance obligations)

to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for promised goods

or services. Management judgment is required in determining whether the performance obligations will be recognized at a point in time

or overtime and when the transfer of control of goods and services are made to entitle the Company to receive payment. The exercise of

management judgment has a material impact on when revenue is recognized.

The

Affiliate Marketing Services – United States and the Affiliate Marketing Services – International operating segments generate

revenue by earning commissions from sportsbooks and casino operators when a new depositor is directed to them by our affiliate marketing

websites.

The

Sports Gaming Client Services operating segments’ performance obligations are satisfied over time (software licenses). Software

license revenue is recognized when the customer has access to the license and the right to use and benefit from the license. Other items

relating to charges collected from customers include reimbursable expenses. Charges collected from customers as part of the Company’s

sales transactions are included in revenues and the associated costs are included in cost of revenues. In addition, this segment provides

sports betting data (e.g., betting lines) to sports media publishers in exchange for a fixed fee.

The

Company’s SportsHub operating segment collects fees from customers for daily and season-long online fantasy sports games in advance

and recognizes the related fees over the term of the online fantasy game. It also collects various forms of fee revenue from customers

using its wallet system platform. Its performance obligation is to provide these customers with an online platform to collect entry fees,

provide transparency into league transactions, encourage timely payment of entry fees, safeguard funds during the season and facilitate

end-of-season prize payouts. Fee revenue related to payment transactions is deferred until the end of the specific season (a single performance

obligation recognized at the end of the respective season). Other types of fee revenue are recognized on a transactional basis when users

complete transactions or when a customer’s account becomes inactive under the terms of the user agreement. SportsHub also provides

sports simulation software that customers pay a fee to access over a period of time. SportsHub provides and maintains the software throughout

the duration of the season, which constitutes a single performance obligation and revenue is recognized over the term of the service.

SportsHub also collects subscription fees from users of its Fantasy National Golf Club. Its performance obligation under these contracts

is to provide subscribers with access to SportsHub’s intellectual property. Revenue is initially deferred and recognized ratably

over the subscription period. Any discounts, promotional incentives or waived entry fees are treated as a reduction in revenue.

The

Company’s Enterprise TEM operating segment entered into contracts with customers to license the rights to use its software products

and to provide maintenance, hosting and managed services, support and training to customers. Certain software licenses require customization.

The Company sells its products directly to end-users and indirectly through resellers and operating equipment managers, who are considered

end users.

The

Enterprise TEM operating segment’s performance obligations are satisfied either overtime (managed services and maintenance) or

at a point in time (software licenses). Professional services rendered after implementation are recognized as performed. Software license

revenue is recognized when the customer has access to the license and the right to use and benefit from the license. Many of the Enterprise

TEM operating segment’s agreements include software license bundled with maintenance and supports. The Company allocates the transaction

price for each contract to each performance obligation identified in the contract based on the relative standalone selling price (“SSP”).

The Company determines SSP for the purposes of allocating the transaction price to each performance obligation by considering several

external and internal factors including, but not limited to, transactions where the specific element sold separately, historical actual

pricing practices in accordance with ASC 606, Revenues from Contracts with Customers. The determination of SSP requires the exercise

of judgement. For maintenance and support, the Company determines the SSP based on the price at which the Company sells a renewal contract.

Estimates

The

preparation of the consolidated financial statements in conformity with generally accepted accounting principles requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the consolidated financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Going

Concern

In

the pursuit of SharpLink’s long-term growth strategy and the development of its fan activation and conversion software and related

businesses, the Company has sustained continued operating losses. During the year ending December 31, 2022, the Company had a net loss

from continuing operations as of December 31, 2022 and 2021 of $15,303,402 and $33,469,830, respectively; and $6,490,519 and $5,854,995

of cash used in operating activities as of December 31, 2022 and 2021, respectively. To fund these planned losses from operations, the

Company secured additional financing through a $3,250,000 term loan in January 2022, as described in Note 8 - Debt. To fund future operations,

as described in Note 19, on February 13, 2023, the Company entered into a Revolving Credit Agreement with Platinum Bank and executed

a revolving promissory note of $7,000,000. Moreover, on February 14, 2023, the Company entered into a Securities Purchase Agreement (the

“SPA”) with Alpha Capital Anstalt (“Alpha”), a current shareholder of the Company, pursuant to which the Company

issued to Alpha an 8% Interest Rate, 10% Original Issue Discount, Senior Convertible Debenture (the “Debenture”) in the aggregate

principal amount of $4,400,000 for a purchase price of $4,000,000.

The

Company is continually evaluating strategies to obtain the required additional funding for future operations. These strategies may include,

but are not limited to, obtaining equity financing, issuing, or restructuring debt, entering into other financing arrangements, and restructuring

of operations to grow revenues and decrease expenses. The Company may be unable to access further equity or debt financing when needed.

As such, these factors, among others, raise substantial doubt about the ability of the Company to continue as a going concern for a reasonable

period.

Results

of Operations

The

following table provides certain selected financial information for the periods presented:

| | |

December

31, 2022 | | |

December

31, 2021 | | |

Change | | |

%

Change | |

| Revenues | |

$ | 7,288,029 | | |

$ | 2,635,757 | | |

$ | 4,652,272 | | |

| 176.51 | % |

| Cost of Revenues | |

| 6,154,434 | | |

| 2,935,119 | | |

| 3,219,315 | | |

| 109.68 | % |

| Gross profit | |

| 1,133,595 | | |

| (299,362 | ) | |

| 1,432,957 | | |

| 478.67 | % |

| Gross profit percentage | |

| 15.55 | % | |

| -11.35 | % | |

| | | |

| | |

| Total operating expenses | |

| 16,610,112 | | |

| 33,195,352 | | |

| (16,585,240 | ) | |

| -49.96 | % |

| Operating loss from continuing operations | |

| (15,476,517 | ) | |

| (33,494,714 | ) | |

| (18,018,197 | ) | |

| -53.79 | % |

| Total other income (expenses) | |

| 184,481 | | |

| 29,055 | | |

| 155,426 | | |

| 534.94 | % |

| Net loss before income taxes | |

| (15,292,036 | ) | |

| (33,465,659 | ) | |

| 18,173,623 | | |

| -54.31 | % |

| Provision for income taxes | |

| 11,366 | | |

| 4,171 | | |

| 7,195 | | |

| 172.50 | % |

| Net loss from continuing operations | |

| (15,303,402 | ) | |

| (33,469,830 | ) | |

| 18,166,428 | | |

| -54.28 | % |

| Net income (loss) from

discontinued ops, net of tax | |

| 70,024 | | |

| (22,174,305 | ) | |

| 22,244,329 | | |

| -100.32 | % |

| Net loss | |

$ | (15,233,378 | ) | |

$ | (55,644,135 | ) | |

$ | 40,410,757 | | |

| -72.62 | % |

Year

Ended December 31, 2022 as Compared to Year Ended December 31, 2021

Revenues

For

the year ended December 31, 2022, our revenues climbed 177% to $7,288,029 when compared to revenues of $2,635,757 reported for the year

ended December 31, 2021. The improvement was largely attributed to additional revenue resulting from the Company’s merger and acquisition

activities, namely the acquisition of FourCubed, which closed on December 31, 2021, and the merger with SportsHub, which closed on December

22, 2022.

On

a segmented basis, revenues from SharpLink’s Sports Gaming Client Services division totaled $2,493,685, increased 3% from $2,424,229

on a comparable year-over-year basis. The SportsHub/Fantasy Sports group contributed $951,196 compared to $0 in the prior year due to

the timing of the closing of its acquisition on December 22, 2022. The Affiliate Marketing Services – International segment, representing

revenue contribution from the acquisition of FourCubed at December 31, 2021, was $3,427,698 compared to $0 in the prior year. The Affiliate

Marketing – U.S. increased 96% to $415,450 for the year ended December 31, 2022, which compared to $211,528 for the same period

in 2021. This increase was due to the addition of revenues generated by our new state-specific affiliate marketing sites, which were

launched in November 2022 as part of our strategy to deliver unique fan activation solutions to our sportsbook and casino partners.

Gross

Profit

Gross

profit totaled $1,133,595 for the year ended December 31, 2022, which compared to a negative gross profit of $299,362 in the previous

year – reflecting a 479% improvement. As a result, gross profit margin also improved, rising to 16% from a negative 11% on a comparable

year-over-year basis. The increase was primarily attributable to higher revenues and the mix of higher margin products and services sold

in 2022 as a direct result of our acquisition of FourCubed and merger with SportsHub.

Total

Operating Expenses

For

the year ended December 31, 2022, total operating expenses declined 50% to $16,610,112 compared to total operating expenses of $33,195,352

for the year ended December 31, 2021. The decrease was largely due to the commitment fee expense of $23,301,206 recorded in 2021. The

non-cash commitment fee expense recorded in 2021 represented the change in fair value of the commitment fee associated with our go-public

reverse acquisition of Mer Telemanagement Solutions Ltd., whereby SharpLink, Inc. sold to the holder of the Company’s preferred

shares approximately 2.8 million shares of Series B Preferred Stock for $6.0 million and issued Series A-1 Preferred Stock equal to 3%

of the Company’s issued and outstanding capital; this, in turn, required SharpLink, Inc. to transfer a variable number of shares

outside of its control and classifying it as a liability. The decrease in the commitment fee expense was offset by a non-cash goodwill

impairment of $4,726,000 recorded in 2022, which related to our client Entain plc’s loss of access to customers in Russia.

Operating

Loss from Continuing Operations

Operating

loss totaled $15,476,517 and $33,494,714 for the years ended December 31, 2022 and 2021, respectively, reflecting a 53% reduction in

operating loss on a year-over-year basis. Operating losses declined in 2022 due to a combination of higher revenues and lower operating

expenses recorded during the year for the aforementioned reasons.

Net

Loss from Continuing Operations

For

the reasons detailed above, after factoring total other income and expenses, net of $184,481 and income tax expense of $11,366, the net

loss from continuing operations for the year ended December 31, 2022 totaled $15,303,402. This represented a 54% reduction from a net

loss from continuing operations of $33,469,830 for the prior year after other income and expense, net of $29,055 and income tax expenses

of $4,171.

Net

Income (Loss) from Discontinued Operations

Net

income from discontinued operations of SharpLink’s legacy MTS business totaled $70,024 for the year ended December 31, 2022, which

compared to a net loss from discontinued operations of $22,174,305 for the prior year. The primary reason for the change was that the

legacy MTS business recorded a goodwill impairment charge of $1,224,671 and $21,722,213 for the years ended December 31, 2022 and 2021,

respectively.

Net

Loss

For

all of the aforementioned reasons, net loss declined 73% to $15,233,378, or $0.62 loss per basic and diluted share for continuing and

discontinued operations for the year ended December 31, 2022, compared to a net loss of $55,644,135, or $3.94 loss per basic and diluted

share for continuing and discontinued operations for the year ended December 31, 2021.

Cash

Flows

Year

ended December 31, 2022 as Compared to the Year ended December 31, 2021

As

of December 31, 2022, cash on hand was $39,324,529, a 548% increase when compared to cash on hand of $6,065,461 as of December 31, 2021.

For the years ended December 31, 2022 and 2021, restricted cash totaled $11,132,957 and $0, respectively. The increase in restricted

cash resulted from the merger with SportsHub on December 22, 2022.

For

the year ended December 31, 2022, cash used in operations totaled $5,937,385, as compared to net cash used in operations of $6,070,874

in the prior year. The increase in cash used in operating activities was primarily attributable to an increase in the accounting for

depreciation and amortization, higher stock-based compensation expense, offset by a decline in goodwill and intangible asset impairment

expenses.

For

the year ended December 31, 2022, cash provided by the Company’s investing activities totaled $48,302,068 an increase of 1,095%

when compared to cash used for investing activities of $4,411,720 for the previous year. The increase in cash generated in our investing

activities resulted from cash and restricted cash acquired from the merger with SportsHub in December 2022 offset by payments made relating

to the acquisition of FourCubed in 2021.

For

the year ended December 31, 2022, cash provided by financing activities was $2,675,343, an 83% decrease from net cash provided by financing

activities of $15,678,085 provided from financing activities during the year ended December 31, 2021. The year-over-year decrease was

largely due to placement of Series B preferred stock, ordinary shares, prefunded warrants and regular warrants issued in connection with

equity fundings during the year ended December 31, 2021. During 2022, the Company’s capital raising activities were limited to

raising $3,250,000 through a term loan secured from our commercial lender, Platinum Bank, offset by debt repayments and debt issue costs.

Liquidity

and Capital Resources

We

will require additional capital to support our growth plans and such capital may not be available on reasonable terms or at all. If we

do not raise sufficient capital, there is substantial doubt about our ability to continue as a going concern.

In

the pursuit of our long-term growth strategy and the development of our sports betting conversion software, affiliate marketing

services and related businesses, we have sustained continued operating losses. As of December 31, 2022, we had negative working

capital of $5,000,468. For the year ended December 31, 2022, we incurred a loss from continuing operations of $15,303,402, inclusive

of $4,726,000 for goodwill and intangible asset impairment charges. and cash used in operating activities from continuing operations

of $6,490,519. To help fund our operations, we raised capital from banks and outside investors in the aggregate amounts of

$2,675,343 and $15,678,085 for the years ended December 31, 2022 and 2021, respectively, in the form of a term loan in 2022 and the

sale of Ordinary Shares and conversion of preferred stock and prefunded and regular warrants during 2021. Based on continued

expected cash needs to fund our ongoing technology development initiatives and grow our Affiliate Marketing Services–United

States operations, we may require additional liquidity to continue our operations for the next year. Subsequent to the end of 2022,

in February 2023 we closed on a $4.4 million convertible debenture and signed a two-year $7.0 million revolving loan agreement with

our commercial lender.

We

have continued to realize losses from operations. However, with the revenue generated from our customers and our capital raise efforts,

we believe that we will have sufficient access to cash to meet our anticipated operating costs and capital expenditure requirements through

the end of 2023. Our primary need for liquidity is to fund working capital requirements of our business, capital expenditures, acquisitions,

debt service, and for general corporate purposes. Our primary source of liquidity is funds generated by financing activities and from

private placements. Our ability to fund our operations, to make planned capital expenditures and acquisitions, to service debt payments,

and to repay or refinance indebtedness depends on our future operating performance and cash flows. Our future operating performance and

cash flows are subject to prevailing economic conditions and financial, business and other factors, some of which are beyond our control.

If

the Company is unable to generate significant sales growth in the near term and raise additional capital, there is a risk that the Company

could default on its obligations; and could be required to discontinue or significantly curtail the scope of its operations if no other

means of financing operations are available. The consolidated financial statements do not include any adjustments relating to the recoverability

and classification of recorded asset amounts or the amount and classification of liabilities or any other adjustment that might be necessary

should the Company be unable to continue as a going concern.

Off-Balance

Sheet Arrangements

On

December 31, 2022, we did not have any off-balance sheet arrangements. Additionally, we have no off-balance sheet arrangements that have

or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses,

results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Contractual

Obligations

Material

contractual obligations arising in the normal course of business primarily consist of purchase obligations in the normal course of business,

principal and interest payment obligations to our commercial lender and payments for lease obligations.

Inflation

Our

opinion is that inflation did not have a material effect on our operations for 2022.

Climate

Change

Our

opinion is that neither climate change, nor governmental regulations related to climate change, have had, or are expected to have, any

material effect on our operations.

Recently

Issued Accounting Pronouncements Not Yet Adopted

In

June 2016, the FASB issued ASC 326, Financial Instruments – Credit Losses (Topic 326): Measurements of Credit Losses on Financial

Instruments (“ASC 326”), which replaces the existing incurred loss model with a current expected credit loss (“CECL”)

model that requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. The Company

would be required to use a forward looking CECL model for accounts receivables, guarantees and other financial instruments. The Company

adopted ASC 326 on January 1, 2023. ASC 326 did not have a material impact on its consolidated financial statements.

In

June 2022, the FASB issued ASU 2022-03, Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to

Contractual Sale Restrictions (“ASU 2022-03”), which clarifies the guidance in Accounting Standards Codification Topic

820, Fair Value Measurement (“Topic 820”), when measuring the fair value of an equity security subject to contractual restrictions

that prohibit the sale of an equity security and introduces new disclosure requirements for equity securities subject to contractual

sale restrictions that are measured at fair value in accordance with Topic 820. ASU 2022-03 is effective for fiscal years beginning after

December 15, 2023, including interim periods within those fiscal years, and early adoption is permitted. While the Company is continuing

to assess the timing of adoption and the potential impacts of ASU 2022-03, it does not expect ASU 2022-03 to have a material effect on

the Company’s consolidated financial condition, results of operations or cash flows.

PART

IV

ITEM

15. EXHIBITS, FINANCIAL STATEMENTS, SCHEDULES

| Exhibit

Number |

|

Description |

| |

|

|

| 3.1 |

|

Memorandum of Association (incorporated by reference to Exhibit 4.1 to Form F-3 filed with the SEC on July 27, 2021) (translated from Hebrew; the original language version is on file with the Registrant and is available upon request) |

| |

|

|

| 3.2 |

|

Second Amended and Restated Articles of Association (incorporated by reference to Exhibit 4.2 to Form F-3 filed with the SEC on July 27, 2021) |

| |

|

|

| 4.1 |

|

Specimen of Ordinary Share Certificate (incorporated by reference to Exhibit 2.1 to the Annual Report on Form 20-F for the year ended December 31, 2017) |

| |

|

|

| 4.2 |

|

Form of Prefunded Warrant issued to Alpha Capital Anstalt (incorporated by reference to Exhibit 4.1 to the Report on Form 6-K submitted to the SEC on November 19, 2021) |

| |

|

|

| 4.3 |

|

Form of Regular Warrant issued to Alpha Capital Anstalt (incorporated by reference to Exhibit 4.2 to the Report on Form 6-K submitted to the SEC on November 19, 2021) |

| |

|

|

| 4.4 |

|

Common Stock Purchase Warrant for 8,800,000 shares in favor of Alpha Capital Anstalt, dated February 15, 2023 (incorporated by reference to Exhibit 4.1 to Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 2.4* |

|

Description of the rights of each class of securities registered under Section 12 of the Securities Exchange Act of 1934 |

| |

|

|

| 10.1 |

|

Agreement and Plan of Merger, dated April 15, 2021, among the Registrant, SharpLink, Inc., and New SL Acquisition Corp. (incorporated by reference to Exhibit 99.2 to the Report on Form 6-K submitted to the SEC on April 15, 2021) |

| |

|

|

| 10.2 |

|

Amendment No. 1 to Agreement and Plan of Merger, dated July 23, 2021, Mer Telemanagement Solutions Ltd., New SL Acquisition Corp. and SharpLink, Inc. (incorporated by reference to Exhibit 2.2 to Form F-3 filed with the SEC on July 27, 2021) |

| |

|

|

| 10.3+ |

|

SharpLink, Inc. 2020 Stock Incentive Plan (incorporated by reference to Exhibit 99.2 to the Registration Statement on Form S-8 filed with the SEC on October 12, 2021) |

| |

|

|

| 10.4+ |

|

2021 Equity Incentive Plan, as amended (incorporated by reference to Exhibit 99.1 to the Registration Statement on Form S-8 filed with the SEC on October 12, 2021) |

| |

|

|

| 10.5+ |

|

Employment Agreement by and between SharpLink, Inc. and Rob Phythian, dated July 26, 2021 (incorporated by reference to Exhibit 10.4 to the Registration Statement on Form S-4 filed with the SEC on February 3, 2022) |

| |

|

|

| 10.6+ |

|

Employment Agreement by and between SharpLink, Inc. and Chris Nicholas, dated July 26, 2021(incorporated by reference to Exhibit 10.5 to the Registration Statement on Form S-4 filed with the SEC on February 3, 2022) |

| |

|

|

| 10.7+ |

|

Employment Agreement by and between SharpLink, Inc. and Brian Bennett, dated July 30, 2021 (incorporated by reference to Exhibit 10.6 to the Registration Statement on Form S-4 filed with the SEC on February 3, 2022) |

| |

|

|

| 10.8+ |

|

Directors and Officers Compensation Policy (incorporated by reference to Annex C to Exhibit 99.2 of the Report on Form 6-K submitted to the SEC on July 28, 2022) |

| |

|

|

| 10.9 |

|

Securities Purchase Agreement dated December 23, 2020, between SharpLink, Inc. and Alpha Capital Anstalt, as amended on June 15, 2021 and July 23, 2021 (incorporated by reference to Exhibit 10.1 to the Report on Form 6-K submitted to the SEC on November 19, 2021) |

| |

|

|

| 10.10 |

|

Securities Purchase Agreement dated November 16, 2021 between the Company and Alpha Capital Anstalt (incorporated by reference to Exhibit 10.1 to the Report on Form 6-K submitted to the SEC on November 19, 2021) |

| |

|

|

| 10.11 |

|

Asset Purchase Agreement, dated December 31, 2021, by and among FourCubed Acquisition Company, LLC, 6t4 Company, FourCubed Management, LLC, Chris Carlson, and SharpLink Gaming Ltd. (incorporated by reference to Exhibit 10.1 to the Report on Form 6-K submitted to the SEC on January 12, 2022) |

| |

|

|

| 10.12† |

|

Registration Rights Agreement, dated December 31, 2021, by and among SharpLink Gaming Ltd., 6t4 Company, and Chris Carlson (incorporated herein by reference to Exhibit 10.2 to the Report on Form 6-K submitted to the SEC on January 12, 2022) |

| |

|

|

| 10.13 |

|

Agreement and Plan of Merger, dated September 7, 2022, by and among Sharplink Gaming Ltd., SHGN Acquisition Corp., SportsHub Games Network, Inc. and Christian Peterson, in his capacity as the Stockholder Representative (incorporated by reference to Annex A-1 to Exhibit 99.2 of the Report on Form 6-K submitted to the SEC on November 8, 2022) |

| |

|

|

| 10.14 |

|

First Amendment to Agreement and Plan of Merger, dated November 2, 2022, by and among Sharplink Gaming Ltd., SHGN Acquisition Corp., SportsHub Games Network, Inc. and Christian Peterson, in his capacity as the Stockholder Representative (incorporated by reference to Annex A-1 to Exhibit 99.2 of the Report on Form 6-K submitted to the SEC on November 8, 2022) |

| |

|

|

| 10.15†† |

|

Share and Asset Purchase Agreement, dated as of November 9, 2022, by and between SharpLink Gaming Ltd. and Entrypoint South Ltd. (incorporated herein by reference to Exhibit 2.1 to the Report on Form 6-K submitted to the SEC on January 5, 2023) |

| |

|

|

| 10.16 |

|

Revolving Credit Agreement, dated February 13, 2023, by and between SharpLink, Inc. and Platinum Bank (incorporated herein by reference to Exhibit 10.1 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.17 |

|

Revolving Promissory Note, dated February 13, 2023, executed by SharpLink, Inc. (incorporated herein by reference to Exhibit 10.2 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.18 |

|

Deposit Account Pledge And Control Agreement, dated February 13, 2023, by and between SHGN Acquisition Corp. and Platinum Bank (incorporated herein by reference to Exhibit 10.3 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.19 |

|

Form of Company Guaranty, dated February 13, 2023, issued by SHGN Acquisition Corp., SLG 1 Holdings LLC and SLG 2 Holdings LLC (incorporated herein by reference to Exhibit 10.4 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.20 |

|

Term Loan Agreement, dated June 9, 2020, by and between SportsHub Games Network, Inc. and Platinum Bank (incorporated herein by reference to Exhibit 10.5 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.21 |

|

Amendment Agreement, dated November 4, 2021, by and between SportsHub Games Network, Inc., LeagueSafe Management, LLC, Virtual Fantasy Games Acquisition, LLC, Rob Phythian, Chris Nicholas and Platinum Bank (incorporated herein by reference to Exhibit 10.6 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.22 |

|

Consent, Assumption and Second Amendment Agreement, dated February 13, 2023, by and between SHGN Acquisition Corp., LeagueSafe Management, LLC, Virtual Fantasy Games Acquisition, LLC and Platinum Bank (incorporated herein by reference to Exhibit 10.7 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.23 |

|

Amended and Restated Term Promissory Note, dated February 13, 2023, executed by SHGN Acquisition Corp. (incorporated herein by reference to Exhibit 10.8 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.24 |

|

Security Agreement, dated June 9, 2020, executed by SHGN Acquisition Corp. (incorporated herein by reference to Exhibit 10.9 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.25 |

|

Third Party Security Agreement, dated as of June 9, 2020, executed by Virtual Fantasy Games Acquisition, LLC (incorporated herein by reference to Exhibit 10.10 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.26 |

|

Amended and Restated Deposit Account Pledge Agreement, dated February 13, 2023, executed by SHGN Acquisition Corp. (incorporated herein by reference to Exhibit 10.11 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.27 |

|

Revolving Credit Agreement, dated March 27, 2020, by and between SportsHub Games Network, Inc. and Platinum Bank (incorporated herein by reference to Exhibit 10.12 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.28 |

|

Second Amendment Agreement, dated November 4, 2021, by and between SportsHub Games Network, Inc., LeagueSafe Management, LLC, Virtual Fantasy Games Acquisition, LLC and Platinum Bank (incorporated herein by reference to Exhibit 10.13 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.29 |

|

Consent, Assumption and Third Amendment Agreement, dated February 13, 2023, by and between SHGN Acquisition Corp., LeagueSafe Management, LLC, Virtual Fantasy Games Acquisition, LLC and Platinum Bank (incorporated herein by reference to Exhibit 10.14 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.30 |

|

Amended and Restated Promissory Note executed by SHGN Acquisition Corp., dated February 13, 2023 (incorporated herein by reference to Exhibit 10.15 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.31 |

|

Security Agreement, dated March 27, 2020, executed by SportsHub Games Network, Inc. (incorporated herein by reference to Exhibit 10.16 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.32 |

|

Security Agreement, dated March 27, 2020, by and between LeagueSafe Management, LLC and SportsHub Games Network, Inc. (incorporated herein by reference to Exhibit 10.17 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.33 |

|

Third Party Security Agreement, dated March 27, 2020, executed by Virtual Fantasy Games Acquisition, LLC (incorporated herein by reference to Exhibit 10.18 to the Report on Form 8-K/A filed with the SEC on February 17, 2023) |

| |

|

|

| 10.34 |

|

Securities Purchase Agreement, dated February 14, 2023, by and between SharpLink, Inc. and Alpha Capital Anstalt (incorporated herein by reference to Exhibit 10.19 to the Report on Form 8-K filed with the SEC on February 16, 2023) |

| |

|

|

| 10.35 |

|

8% Senior Convertible Debenture Due February 15, 2026 (incorporated herein by reference to Exhibit 10.20 to the Report on Form 8-K filed with the SEC on February 16, 2023) |

| |

|

|

| 10.36 |

|

Registration Rights Agreement, dated February 14, 2026, by and between SharpLink, Inc. and Alpha Capital Anstalt (incorporated herein by reference to Exhibit 10.21 to the Report on Form 8-K filed with the SEC on February 16, 2023) |

| |

|

|

| 21.1* |

|

List of Subsidiaries |

| |

|

|

| 23.1* |

|

Consent of Cherry Bekaert, LLP |

| |

|

|

| 23.2* |

|

Consent of RSM US LLP |

| |

|

|

| 31.1** |

|

Certification of Chief Executive Officer pursuant to Rule 13a-14(a) under the Securities Exchange Act of 1934, as amended |

| |

|

|

| 31.2** |

|

Certification of Chief Financial Officer pursuant to Rule 13a-14(a) under the Securities Exchange Act of 1934, as amended |

| |

|

|

| 32.1** |

|

Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| |

|

|

| 32.2** |

|

Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| |

|

|

| 101.INS** |

|

XBRL

Instance Document |

| |

|

|

| 101.SCH** |

|

XBRL

Taxonomy Extension Schema Document |

| |

|

|

| 101.CAL** |

|

XBRL

Taxonomy Extension Calculation Linkbase Document |

| |

|

|

| 101.DEF** |

|

XBRL

Taxonomy Extension Definition Linkbase Document |

| |

|

|

| 101.LAB** |

|

XBRL

Taxonomy Extension Labels Linkbase Document |

| |

|

|

| 101.PRE** |

|

XBRL

Taxonomy Extension Presentation Linkbase Document |

| * |

Incorporated by reference to the Annual Report on Form 10-K filed with

the SEC on April 5, 2023. |

| **

|

Filed

herewith |

SIGNATURES

In

accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

SHARPLINK

GAMING LTD. |

| |

|

|

| Dated:

July 14, 2023 |

By: |

/s/

Rob Phythian |

| |

|

Rob

Phythian |

| |

|

Chief

Executive Officer and Director |

| |

|

|

| Dated:

July 14, 2023 |

By: |

/s/

Robert DeLucia |

| |

|

Robert

DeLucia |

| |

|

Chief

Financial Officer |

Pursuant

to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the

registrant and in the capacities and on the dates indicated.

| Signatures |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Rob Phythian |

|

Chief

Executive Officer and Director |

|

July

14, 2023 |

| Rob

Phythian |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Robert DeLucia |

|

Chief

Financial Officer |

|

July

14, 2023 |

| Robert

DeLucia |

|

(Principal

Financial Officer) |

|

|

| |

|

|

|

|

| /s/

Chris Nicholas |

|

Chief

Operator Officer and Director |

|

July

14, 2023 |

| Chris

Nicholas |

|

|

|

|

| |

|

|

|

|

| /s/

Joseph Housman |

|

Chairman

of the Board |

|

July

14, 2023 |

| Joseph

Housman |

|

|

|

|

| |

|

|

|

|

| /s/

Paul Abdo |

|

Director |

|

July

14, 2023 |

| Paul

Abdo |

|

|

|

|

| |

|

|

|

|

| /s/

Thomas Doering |

|

Director |

|

July

14, 2023 |

| Thomas

Doering |

|

|

|

|

| |

|

|

|

|

| /s/

Adrienne Anderson |

|

Outside

Director |

|

July

14, 2023 |

| Adrienne

Anderson |

|

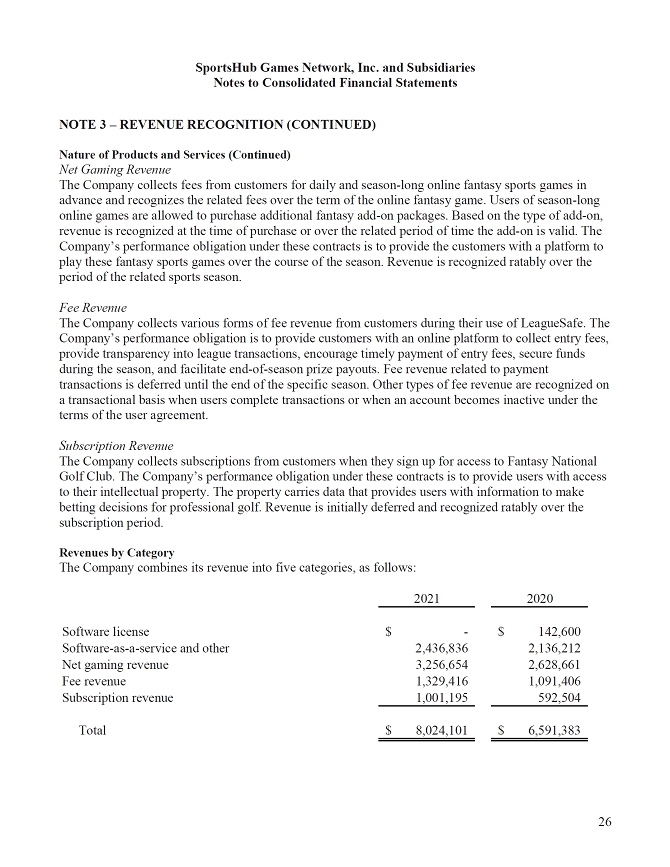

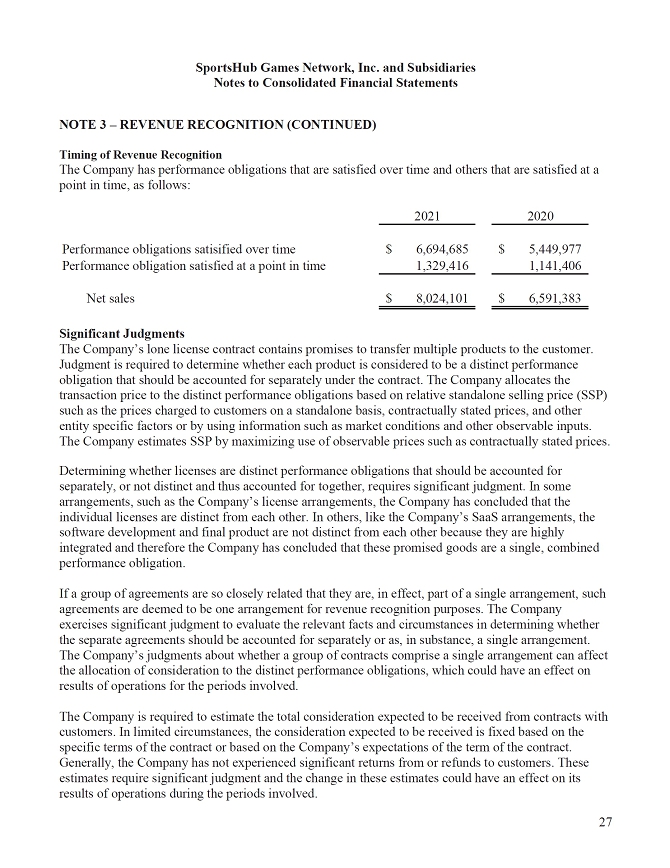

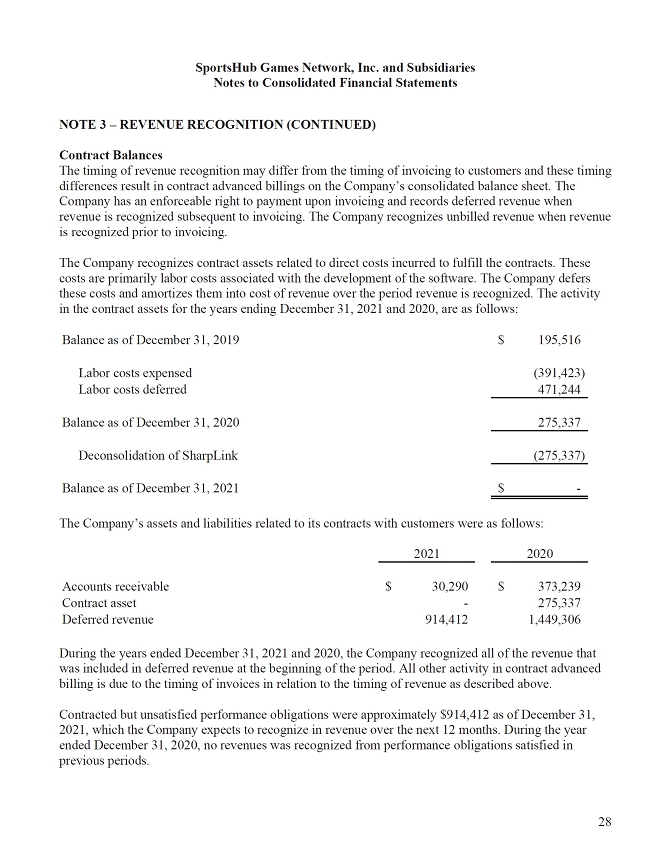

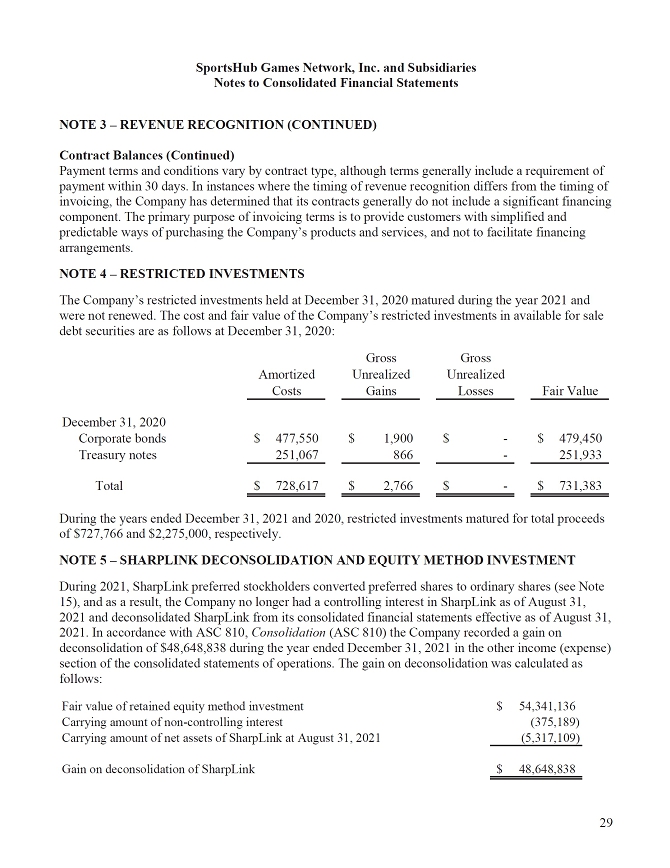

|