Sinclair, Inc. (Nasdaq: SBGI), the "Company" or "Sinclair,"

today reported financial results for the three and nine months

ended September 30, 2024.

Highlights:

- Solid third quarter results, with core advertising revenues

growing by 1% year-over-year during a quarter with record political

revenues

- Political revenues of $138 million, a 31% increase over 2020

levels, which was impacted by $5 million of lost revenue due to

late ad cancellations during the quarter

- Approximately $406 in 2024 political revenues, which reflects

$26 million of lost revenue due to a late geographic shift of

existing commitments to non-Sinclair markets

- Distribution revenues in the third quarter up 5% year-over-year

as 78% of our Big 4 network MVPD linear subscriber base are now

subject to new retransmission consent agreements this year

- Third Quarter adjusted EBITDA in-line with guidance range

- Full-year adjusted EBITDA guidance range reflects a

year-over-year increase of 54% to 56%

CEO Comment:

"Sinclair delivered solid third quarter results, as core

advertising revenues grew by 1% year-over-year, in spite of

record-breaking political revenues," commented Chris Ripley,

Sinclair's President and Chief Executive Officer. "This is

unprecedented for Sinclair in recent history and perhaps the

industry to be able to grow core advertising revenues in the third

quarter of a political year. Total advertising revenue was up 42%

year-over-year and distribution revenues grew by 5%. We have now

reached agreement to renew retransmission consent agreements

covering 78% of our Big 4 network MVPD linear subscriber base this

year and we are confident in our ability to grow net retransmission

revenues in line with our prior mid-single-digit CAGR estimate from

2023-2025. Our industry-leading core advertising revenue trends,

and with most of our retrans and network affiliation agreement

renewals now behind us, we believe we are well-positioned to finish

2024 on a strong note."

Recent Company

Developments:

Content and Distribution:

- In August and September, the Company expanded its podcast

division, launching a new slate of sports programming featuring top

athletes, coaches, and experts including “The Triple Option,”

hosted by Urban Meyer, Mark Ingram II, and Rob Stone and

“Throwbacks” with Matt Leinart and Jerry Ferrara. The podcasts have

both consistently ranked among Apple's top-10 sports podcasts.

- In October, the Company announced the launch of a

soccer-focused podcast, "Unfiltered Soccer with Landon and Tim,"

featuring former U.S. soccer stars Landon Donovan and Tim

Howard.

- In the third quarter, the Company entered into a multi-year

renewal with Altice USA for continued carriage of Sinclair's

broadcast stations, Tennis Channel, and the YES Network on Altice's

Optimum and Suddenlink owned systems.

- In the third quarter, the Company entered into a multi-year

renewal with DIRECTV for continued carriage of Sinclair’s broadcast

stations, Tennis Channel, Marquee Sports Network, and the YES

Network across DIRECTV, DIRECTV Stream and U-verse.

- In October, the Company launched the Rip City Television

Network, a network of Sinclair affiliates throughout the Pacific

Northwest to serve as the new television home of Trail Blazers

starting with the 2024-25 season.

- Year-to-date, Sinclair's newsrooms have won a total of 196

journalism awards, including 24 RTDNA Regional Edward R. Murrow

Awards for Outstanding Journalism and 24 regional Emmy awards.

Community:

- In October, the Company ran Sinclair Cares: Hurricane Relief, a

fundraising partnership with the Salvation Army and The United Way

to assist with humanitarian relief efforts on the ground in Western

North Carolina, South Carolina, Georgia, Florida, Virginia and

Tennessee in the aftermath of Hurricanes Helene and Milton.

Including Sinclair's corporate donation of $50,000, the campaign

raised nearly $1.3 million in donations designated for delivering

emergency aid, including food, water, shelter and cleanup

kits.

Investment Portfolio:

- During the third quarter, Sinclair Ventures, LLC (Ventures)

made investments of approximately $7 million in minority

investments and received distributions of approximately $5

million.

Financial Results:

Three Months Ended September 30, 2024 Consolidated Financial

Results:

- Total revenues increased 20% to $917 million versus $767

million in the prior year period. Media revenues increased 20% to

$908 million versus $758 million in the prior year period.

- Total advertising revenues of $433 million increased 42% versus

$304 million in the prior year period. Core advertising revenues,

which exclude political revenues, were $295 million versus $293

million in the prior year period.

- Distribution revenues of $434 million increased versus $414

million in the prior year period.

- Operating income of $179 million increased versus $37 million

in the prior year period.

- Net income attributable to the Company was $94 million versus

net loss of $46 million in the prior year period.

- Adjusted EBITDA increased 72% to $249 million from $145 million

in the prior year period.

- Diluted earnings per common share was $1.43 as compared to

diluted loss per common share of $0.74 in the prior year

period.

Nine Months Ended September 30, 2024 Consolidated Financial

Results:

- Total revenues increased 10% to $2,544 million versus $2,308

million in the prior year period. Media revenues increased 10% to

$2,519 million versus $2,285 million in the prior year period.

- Total advertising revenues of $1,097 million increased 19%

versus $922 million in the prior year period. Core advertising

revenues, which excludes political revenues, of $895 million were

down 1% versus $902 million in the prior year period.

- Distribution revenues of $1,305 million increased versus $1,258

million in the prior year period.

- Operating income of $285 million increased versus $55 million

in the prior year period.

- Net income attributable to the Company was $134 million versus

$50 million in the prior year period.

- Adjusted EBITDA increased 45% to $546 million from $377 million

in the prior year period.

- Diluted earnings per common share was $2.05 as compared to

diluted earnings per common share of $0.75 in the prior year

period.

Segment financial information is included in the following

tables for the periods presented. The Local Media segment consists

primarily of broadcast television stations, which the Company owns,

operates or to which the Company provides services, and includes

multicast networks and original content. The Local Media segment

assets are owned and operated by Sinclair Broadcast Group, LLC

(SBG). The Tennis segment consists primarily of Tennis Channel, a

cable network which includes coverage of most of tennis' top

tournaments and original professional sport and tennis lifestyle

shows; the Tennis Channel International subscription and streaming

service; Tennis Channel Plus streaming service; T2 FAST, a 24-hours

a day free ad-supported streaming television channel; and

Tennis.com. Other includes non-broadcast digital solutions,

technical services, and other non-media investments. For periods

presented subsequent to June 1, 2023 (the date of the

reorganization), the assets of the Tennis segment and Other are

owned and operated by Ventures.

Three months ended September 30,

2024

Local Media

Tennis

Other

Corporate and

Eliminations

Consolidated

($ in millions)

Distribution revenue

$

383

$

51

$

—

$

—

$

434

Core advertising revenue

283

8

9

(5

)

295

Political advertising revenue

138

—

—

—

138

Other media revenue

41

1

—

(1

)

41

Media revenues

$

845

$

60

$

9

$

(6

)

$

908

Non-media revenue

—

—

10

(1

)

9

Total revenues

$

845

$

60

$

19

$

(7

)

$

917

Media programming and production

expenses

$

384

$

30

$

—

$

—

$

414

Media selling, general and administrative

expenses

188

13

6

(6

)

201

Non-media expenses

2

—

12

—

14

Amortization of program costs

18

—

—

—

18

Corporate general and administrative

expenses

24

1

1

15

41

Stock-based compensation

8

—

—

3

11

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

7

—

2

—

9

Interest expense (net)(a)

74

—

(5

)

—

69

Capital expenditures

17

—

—

—

17

Distributions to the noncontrolling

interests

3

—

—

—

3

Cash distributions from equity

investments

—

—

2

—

2

Net cash taxes paid

1

Net income

96

Operating income (loss)

182

11

1

(15

)

179

Adjusted EBITDA(b)

244

16

2

(13

)

249

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes

deferred financing costs, original issue discount amortization, and

other non-cash interest expense, and is net of interest income.

(b)

Adjusted EBITDA is defined as

earnings before interest, tax, depreciation and amortization, and

non-recurring and unusual transaction, implementation, legal,

regulatory and other costs, as well as certain non-cash items such

as stock-based compensation expense and other gains and losses less

amortization of program costs. Refer to the reconciliation at the

end of this press release and the Company’s website.

Three months ended September 30, 2023

Local Media

Tennis

Other

Corporate and

Eliminations

Consolidated

($ in millions)

Distribution revenue

$

365

$

49

$

—

$

—

$

414

Core advertising revenue

281

9

6

(3

)

293

Political advertising revenue

11

—

—

—

11

Other media revenue

40

1

—

(1

)

40

Media revenues

$

697

$

59

$

6

$

(4

)

$

758

Non-media revenue

—

—

11

(2

)

9

Total revenues

$

697

$

59

$

17

$

(6

)

$

767

Media programming and production

expenses

$

371

$

29

$

—

$

—

$

400

Media selling, general and administrative

expenses

164

11

5

(4

)

176

Non-media expenses

3

—

13

(1

)

15

Corporate general and administrative

expenses

31

1

1

12

45

Stock-based compensation

6

—

—

1

7

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

22

—

2

1

25

Interest expense (net)(a)

71

—

(4

)

—

67

Capital expenditures

30

—

—

—

30

Distributions to the noncontrolling

interests

1

—

—

—

1

Cash distributions from equity

investments

—

—

3

—

3

Net cash taxes paid

—

Net loss

(45

)

Operating income (loss)

53

13

(7

)

(22

)

37

Adjusted EBITDA(b)

138

18

—

(11

)

145

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes

deferred financing costs, original issue discount amortization, and

other non-cash interest expense, and is net of interest income.

(b)

Adjusted EBITDA is defined as

earnings before interest, tax, depreciation and amortization, and

non-recurring and unusual transaction, implementation, legal,

regulatory and other costs, as well as certain non-cash items such

as stock-based compensation expense and other gains and losses less

amortization of program costs. Refer to the reconciliation at the

end of this press release and the Company’s website.

Consolidated Balance Sheet and Cash

Flow Highlights of the Company:

- Total Company debt as of September 30, 2024 was $4,131

million.

- Cash and cash equivalents for the Company as of September 30,

2024 was $536 million, of which $202 million is SBG cash and $334

million is Ventures cash.

- As of September 30, 2024, 42.6 million Class A common shares

and 23.8 million Class B common shares were outstanding, for a

total of 66.4 million common shares.

- In September, the Company paid a quarterly cash dividend of

$0.25 per share.

- Capital expenditures for the third quarter of 2024 were $17

million.

Notes:

Certain reclassifications have been made to prior years'

financial information to conform to the presentation in the current

year.

Outlook:

The Company currently expects to achieve the following results

for the three months ending December 31, 2024 and the twelve months

ending December 31, 2024.

For the three months ending December

31, 2024 ($ in millions)

Local Media

Tennis

Other

Corporate and

Eliminations

Consolidated

Core advertising revenue

$307 to 315

$5

$9

$(6

)

$315 to 323

Political advertising revenue

204

—

—

—

204

Advertising revenue

$511 to 519

$5

$9

$(6

)

$519 to 527

Distribution revenue

386 to 388

49

—

—

436 to 438

Other media revenue

38

1

—

(1

)

38

Media revenues

$936 to 945

$55 to 56

$9

$(8

)

$992 to 1,002

Non-media revenue

—

—

12

—

12

Total revenues

$936 to 945

$55 to 56

$21

$(8

)

$1,004 to 1,014

Media programming & production

expenses and media selling, general and administrative expenses

$589 to 590

$43

$6

$(8

)

$631

Non-media expenses

2

—

13

—

15

Amortization of program costs

19

—

—

—

19

Corporate general and administrative

24

—

1

13

39

Stock-based compensation

6

—

—

—

6

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

7

—

1

—

8

Interest expense (net)(a)

67

—

(4

)

—

63

Capital expenditures

27

1

4

—

32

Distributions to the noncontrolling

interests

3

—

4

—

7

Cash distributions from equity

investments

—

—

36

—

36

Net cash tax payments

1

Operating Income

$244 to 253

$6 to 7

$(1

)

$(13

)

$236 to 247

Adjusted EBITDA(b)

$314 to 324

$12

$2

$(14

)

$314 to 325

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes

deferred financing costs, original issue discount amortization, and

other non-cash interest expense, and is net of interest income.

(b)

Adjusted EBITDA is defined as

earnings before interest, tax, depreciation and amortization, and

non-recurring and unusual transaction, implementation, legal,

regulatory and other costs, as well as certain non-cash items such

as stock-based compensation expense and other gains and losses less

amortization of program costs.

For the twelve months ending December 31, 2024 ($ in

millions)

Local Media

Tennis

Other

Corporate and

Eliminations

Consolidated

Core advertising revenue

$1,159 to 1,166

$38

$33

$(19

)

$1,210 to 1,219

Political advertising revenue

406

—

—

—

406

Advertising revenue

$1,565 to 1,572

$38

$33

$(19

)

$1,616 to 1,625

Distribution revenue

1,538 to 1,540

203

—

—

1,740 to 1,742

Other media revenue

155

4

—

(6

)

153

Media revenues

$3,258 to 3,267

$245

$33

$(25

)

$3,510 to 3,521

Non-media revenue

—

—

42

(5

)

37

Total revenues

$3,258 to 3,267

$245

$75

$(30

)

$3,548 to 3,558

Media programming & production

expenses and media selling, general and administrative expenses

$2,287 to 2,288

$184

$23

$(25

)

$2,469 to 2,470

Non-media expenses

8

—

49

(3

)

54

Amortization of program costs

74

—

—

—

74

Corporate general and administrative

118

2

3

65

188

Stock-based compensation

48

1

1

5

55

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

32

—

3

6

41

Interest expense (net)(a)

281

—

(15

)

—

265

Capital expenditures

87

2

4

—

93

Distributions to the noncontrolling

interests

11

—

4

—

15

Cash distributions from equity

investments

26

—

199

—

224

Net cash tax payments

3

Operating Income

$549 to 559

$38 to 39

$(2

)

$(63

)

$522 to 533

Adjusted EBITDA(b)

$851 to 861

$60 to 61

$4

$(55

)

$860 to 871

Note: Certain amounts may not

summarize to totals due to rounding differences.

(a)

Interest expense (net) excludes

deferred financing costs, original issue discount amortization, and

other non-cash interest expense, and is net of interest income.

(b)

Adjusted EBITDA is defined as

earnings before interest, tax, depreciation and amortization, and

non-recurring and unusual transaction, implementation, legal,

regulatory and other costs, as well as certain non-cash items such

as stock-based compensation expense and other gains and losses less

amortization of program costs.

Sinclair Conference Call:

The senior management of Sinclair will hold a conference call to

discuss the Company's third quarter 2024 results on Wednesday,

November 6, 2024, at 4:30 p.m. ET. The call will be webcast live

and can be accessed at www.sbgi.net

under "Investor Relations/Events and Presentations." After the

call, an audio replay will remain available at www.sbgi.net. The press and the public will be

welcome on the call in a listen-only mode. The dial-in number is

(888) 506-0062, with entry code 791357.

About Sinclair:

Sinclair, Inc. is a diversified media company and a leading

provider of local news and sports. The Company owns, operates

and/or provides services to 185 television stations in 86 markets

affiliated with all the major broadcast networks; and owns Tennis

Channel and multicast networks Comet, CHARGE!, TBD., and The Nest.

Sinclair’s content is delivered via multiple platforms, including

over-the-air, multi-channel video program distributors, and the

nation’s largest streaming aggregator of local news content,

NewsON. The Company regularly uses its website as a key source of

Company information which can be accessed at www.sbgi.net.

Sinclair, Inc. and Subsidiaries

Preliminary Unaudited Consolidated

Statements of Operations

(In millions, except share and per

share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

REVENUES:

Media revenues

$

908

$

758

$

2,519

$

2,285

Non-media revenues

9

9

25

23

Total revenues

917

767

2,544

2,308

OPERATING EXPENSES:

Media programming and production

expenses

414

400

1,247

1,211

Media selling, general and administrative

expenses

201

176

591

557

Amortization of program costs

18

18

55

59

Non-media expenses

14

15

39

36

Depreciation of property and equipment

26

24

76

80

Corporate general and administrative

expenses

41

45

149

165

Amortization of definite-lived intangible

assets

37

42

113

124

Loss on deconsolidation of subsidiary

—

10

—

10

(Gain) loss on asset dispositions and

other, net of impairment

(13

)

—

(11

)

11

Total operating expenses

738

730

2,259

2,253

Operating income

179

37

285

55

OTHER INCOME (EXPENSE):

Interest expense including amortization of

debt discount and deferred financing costs

(78

)

(77

)

(230

)

(227

)

Gain on extinguishment of debt

—

4

1

15

Income from equity method investments

—

—

92

30

Other income (expense), net

24

(21

)

22

(48

)

Total other expense, net

(54

)

(94

)

(115

)

(230

)

Income (loss) before income taxes

125

(57

)

170

(175

)

INCOME TAX (PROVISION) BENEFIT

(29

)

12

(30

)

236

NET INCOME (LOSS)

96

(45

)

140

61

Net loss attributable to the redeemable

noncontrolling interests

—

—

—

4

Net income attributable to the

noncontrolling interests

(2

)

(1

)

(6

)

(15

)

NET INCOME (LOSS) ATTRIBUTABLE TO

SINCLAIR

$

94

$

(46

)

$

134

$

50

EARNINGS PER COMMON SHARE ATTRIBUTABLE TO

SINCLAIR:

Basic earnings per share

$

1.43

$

(0.74

)

$

2.06

$

0.75

Diluted earnings per share

$

1.43

$

(0.74

)

$

2.05

$

0.75

Basic weighted average common shares

outstanding (in thousands)

66,355

63,325

65,570

65,670

Diluted weighted average common and common

equivalent shares outstanding (in thousands)

66,526

63,325

65,709

65,727

Adjusted EBITDA is a non-GAAP operating performance measure that

management and the Company’s Board of Directors uses to evaluate

the Company’s operating performance and for executive compensation

purposes. The Company believes that Adjusted EBITDA provides useful

information to investors by allowing them to view the Company’s

business through the eyes of management and is a measure that is

frequently used by industry analysts, investors and lenders as a

measure of relative operating performance.

Adjusted EBITDA is provided on a forward-looking basis under the

section entitled “Outlook” above. The Company has not included a

reconciliation of projected Adjusted EBITDA to net income, which is

the most directly comparable GAAP measure, for the periods

presented in reliance on the unreasonable efforts exception

provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company’s

projected Adjusted EBITDA excludes certain items that are

inherently uncertain and difficult to predict including, but not

limited to, income taxes. Due to the variability, complexity and

limited visibility of the adjusting items that would be excluded

from projected Adjusted EBITDA in future periods, management does

not rely upon them for internal use or measurement of operating

performance, and therefore cannot create a quantitative projected

Adjusted EBITDA to net income reconciliation for the periods

presented without unreasonable efforts. A quantitative

reconciliation of projected Adjusted EBITDA to net income for the

periods presented would imply a degree of precision and certainty

as to these future items that does not exist and could be confusing

to investors. From a qualitative perspective, it is anticipated

that the differences between projected Adjusted EBITDA to net

income for the periods presented will consist of items similar to

those described in the reconciliation of historical results below.

The timing and amount of any of these excluded items could

significantly impact the Company’s net income for a particular

period. When planning, forecasting and analyzing future periods,

the Company does so primarily on a non-GAAP basis without preparing

a GAAP analysis.

In addition to the reconciliation of Adjusted EBITDA to its most

directly comparable GAAP measure, net income, below, the Company

also discloses a reconciliation of the Adjusted EBITDA of its

segments to its more directly comparable GAAP measure, segment

operating income.

Non-GAAP measures are not formulated in accordance with GAAP,

are not meant to replace GAAP financial measures and may differ

from other companies’ uses or formulations. Further discussions and

reconciliations of the Company's non-GAAP financial measures to

their most directly comparable GAAP financial measures can be found

on its website www.sbgi.net.

Sinclair, Inc. and Subsidiaries

Reconciliation of Non-GAAP Measurements

- Unaudited

All periods reclassified to conform

with current year GAAP presentation and Adjusted EBITDA

definitional change due to routine SEC comment process

(in millions)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Reconciliation of Consolidated

Sinclair, Inc. Net Income to Consolidated Adjusted EBITDA

Net income (loss)

$

96

$

(45

)

$

140

$

61

Add: Income tax provision (benefit)

29

(12

)

30

(236

)

Add: Other (income) expense

(3

)

6

(29

)

3

Add: Income from equity method

investments

—

—

(92

)

(30

)

Add: (Income) loss from other investments

and impairments

(15

)

25

30

78

Add: Gain on extinguishment of

debt/insurance proceeds

—

(4

)

(3

)

(15

)

Add: Interest expense

78

77

230

227

Less: Interest income

(6

)

(10

)

(21

)

(33

)

Less: Loss on deconsolidation of

subsidiary

—

10

—

10

Less: (Gain) loss on asset dispositions

and other, net of impairment

(13

)

—

(11

)

11

Add: Amortization of intangible assets

& other assets

37

42

113

124

Add: Depreciation of property &

equipment

26

24

76

80

Add: Stock-based compensation

11

7

49

42

Add: Non-recurring and unusual

transaction, implementation, legal, regulatory and other costs

9

25

34

55

Adjusted EBITDA

$

249

$

145

$

546

$

377

Three months ended September 30,

2024

Local Media

Tennis

Other

($ in millions)

Total revenues

$

845

$

60

$

19

Media programming and production

expenses

384

30

—

Media selling, general and administrative

expenses

188

13

6

Depreciation and intangible amortization

expenses

58

5

1

Amortization of program costs

18

—

—

Corporate general and administrative

expenses

24

1

1

Non-media expenses

2

—

12

Gain on asset dispositions and other, net

of impairment

(11

)

—

(2

)

Segment operating income

$

182

$

11

$

1

Reconciliation of Segment GAAP

Operating Income to Segment Adjusted EBITDA:

Segment operating income

$

182

$

11

$

1

Depreciation and intangible amortization

expenses

58

5

1

Gain on asset dispositions and other, net

of impairment

(11

)

—

(2

)

Stock-based compensation

8

—

—

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

7

—

2

Segment Adjusted EBITDA

$

244

$

16

$

2

Three months ended September 30,

2023

Local Media

Tennis

Other

($ in millions)

Total revenues

$

697

$

59

$

17

Media programming and production

expenses

371

29

—

Media selling, general and administrative

expenses

164

11

5

Depreciation and intangible amortization

expenses

59

5

3

Amortization of program costs

18

—

—

Corporate general and administrative

expenses

31

1

1

Non-media expenses

3

—

13

(Gain) loss on asset dispositions and

other, net of impairment

(2

)

—

2

Segment operating income (loss)

$

53

$

13

$

(7

)

Reconciliation of Segment GAAP

Operating Income to Segment Adjusted EBITDA:

Segment operating income (loss)

$

53

$

13

$

(7

)

Depreciation and intangible amortization

expenses

59

5

3

(Gain) loss on asset dispositions and

other, net of impairment

(2

)

—

2

Stock-based compensation

6

—

—

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

22

—

2

Segment Adjusted EBITDA

$

138

$

18

$

—

Forward-Looking

Statements:

The matters discussed in this news release, particularly those

in the section labeled “Outlook,” include forward-looking

statements regarding, among other things, future operating results.

When used in this news release, the words “outlook,” “intends to,”

“believes,” “anticipates,” “expects,” “achieves,” “estimates,” and

similar expressions are intended to identify forward-looking

statements. Such statements are subject to a number of risks and

uncertainties. Actual results in the future could differ materially

and adversely from those described in the forward-looking

statements as a result of various important factors, including and

in addition to the assumptions set forth therein, but not limited

to, the rate of decline in the number of subscribers to services

provided by traditional and virtual multi-channel video programming

distributors (“Distributors”); the Company’s ability to generate

cash to service, or to refinance on attractive terms if at all, its

substantial indebtedness; the successful execution of outsourcing

agreements; the successful execution of retransmission consent

agreements; the successful execution of network and Distributor

affiliation agreements; the Company’s ability to identify and

consummate acquisitions and investments, to manage increased

financial leverage resulting from acquisitions and investments, and

to achieve anticipated returns on those investments once

consummated; the Company’s ability to compete for viewers and

advertisers; pricing and demand fluctuations in local and national

advertising; the appeal of the Company’s programming and volatility

in programming costs; material legal, financial and reputational

risks and operational disruptions resulting from a breach of the

Company’s information systems; the impact of FCC and other

regulatory proceedings against the Company; compliance with laws

and uncertainties associated with potential changes in the

regulatory environment affecting the Company’s business and growth

strategy; the impact of pending and future litigation claims

against the Company; the Company’s limited experience in operating

or investing in non-broadcast related businesses; and any risk

factors set forth in the Company’s recent reports on Form 10-Q

and/or Form 10-K, as filed with the Securities and Exchange

Commission. There can be no assurances that the assumptions and

other factors referred to in this release will occur. The Company

undertakes no obligation to publicly release the result of any

revisions to these forward-looking statements except as required by

law.

Category: Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106722904/en/

Investor Contacts: Christopher C. King, VP, Investor Relations

Billie-Jo McIntire, AVP, Investor Relations (410) 568-1500

Media Contact: jbellucci-c@sbgtv.com

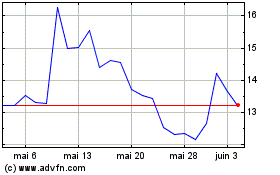

Sinclair (NASDAQ:SBGI)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Sinclair (NASDAQ:SBGI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024