UBS Announces Assumption of Three Outstanding Credit Suisse ETNs; Rebranding as “ETRACS”

31 Mai 2024 - 10:30PM

Business Wire

UBS Group AG announced on May 31, 2024, that it has completed

the merger of UBS AG and Credit Suisse AG (the “Parent Bank

Merger” or “PBM”). At the effective time of the PBM,

Credit Suisse AG was deregistered in the Commercial Register of the

Canton of Zurich and has ceased to exist as a separate entity. With

the PBM, UBS AG has succeeded to all the rights and obligations of

Credit Suisse AG, including under the three outstanding series of

Exchange Traded Notes previously issued by Credit Suisse AG listed

below (collectively, the “ETNs”). In connection with the PBM

and the assumption of Credit Suisse AG’s obligations under such

ETNs, UBS AG rebranded each of the ETNs, which were formerly issued

under the “X-Links®” brand, as “ETRACS.” Following the PBM, each of

the ETNs will remain traded on NASDAQ under the same ticker symbol,

will have the same CUSIP identifiers, and the terms and conditions

applicable to each of the ETNs will remain the same.

ETN Ticker

Previous ETN Name

New ETN Name

ETN CUSIP

GLDI

X-Links® Gold Shares Covered Call ETNs due

February 2, 2033

ETRACS Gold Shares Covered Call ETNs due

February 2, 2033

22542D233

SLVO

X-Links® Silver Shares Covered Call ETNs

due April 21, 2033

ETRACS Silver Shares Covered Call ETNs due

April 21, 2033

22542D225

USOI

X-Links® Crude Oil Shares Covered Call

ETNs due April 24, 2037

ETRACS Crude Oil Shares Covered Call ETNs

due April 24, 2037

22539U602

About ETRACS

ETRACS ETNs are senior unsecured notes issued by UBS AG, are

traded on NYSE Arca and NASDAQ, and can be bought and sold through

a broker or financial advisor. An investment in ETRACS ETNs is

subject to a number of risks, including the risk of loss of some or

all of the investor’s principal, and is subject to the

creditworthiness of UBS AG. Investors are not guaranteed any coupon

or distribution amount under the ETNs. We urge you to

read the more detailed explanation of risks described under “Risk

Factors” in the applicable prospectus supplement for the

ETNs.

UBS AG has filed a registration statement (including a

prospectus and supplements thereto) with the Securities and

Exchange Commission (the “SEC”) for the offerings of securities to

which this communication relates. Before you invest, you should

read the prospectus, along with the applicable prospectus

supplement to understand fully the terms of the securities and

other considerations that are important in making a decision about

investing in the ETRACS. The applicable offering document for each

ETRACS may be obtained by clicking on the name of each ETRACS

identified above. You may also get these documents without cost by

visiting EDGAR on the SEC website at www.sec.gov. The securities

related to the offerings are not deposit liabilities and are not

insured or guaranteed by the Federal Deposit Insurance Corporation

or any other governmental agency of the United States, Switzerland

or any other jurisdiction.

About UBS

UBS is a leading and truly global wealth manager and the leading

universal bank in Switzerland. It also provides diversified asset

management solutions and focused investment banking capabilities.

With the acquisition of Credit Suisse, UBS manages 5.7 trillion

dollars of invested assets as per fourth quarter 2023. UBS helps

clients achieve their financial goals through personalized advice,

solutions and products. Headquartered in Zurich, Switzerland, the

firm is operating in more than 50 markets around the globe. UBS

Group shares are listed on the SIX Swiss Exchange and the New York

Stock Exchange (NYSE).

This material is issued by UBS AG and/or any of its subsidiaries

and/or any of its affiliates (“UBS”). Products and services

mentioned in this material may not be available for residents of

certain jurisdictions. Past performance is not necessarily

indicative of future results. Please consult the restrictions

relating to the product or service in question for further

information. Activities with respect to US securities may be

conducted through UBS Securities LLC or Credit Suisse Securities

(USA) LLC, each a US broker/dealer. Members of SIPC

(http://www.sipc.org/).

ETRACS ETNs are sold only in conjunction with the relevant

offering materials. UBS has filed a registration statement

(including a prospectus, as supplemented by the applicable

prospectus supplement for the offering of the ETRACS ETNs) with the

SEC for the offerings to which this communication relates. Before

you invest, you should read these documents and any other documents

that UBS has filed with the SEC for more complete information about

UBS and the offerings to which this communication relates. You may

get these documents for free by visiting EDGAR on the SEC website

at www.sec.gov. Alternatively, you can request the applicable

prospectus and prospectus supplement by calling toll-free

(+1-877-387 2275). In the US, securities underwriting, trading and

brokerage activities and M&A advisor activities are provided by

UBS Securities LLC, a registered broker/dealer that is a wholly

owned subsidiary of UBS AG, a member of the New York Stock Exchange

and other principal exchanges, and a member of SIPC. UBS Financial

Services Inc. and Credit Suisse Securities (USA) LLC are registered

brokers/dealers and affiliates of UBS Securities LLC.

UBS specifically prohibits the redistribution or reproduction of

this communication in whole or in part without the prior written

permission of UBS and UBS accepts no liability whatsoever for the

actions of third parties in this respect.

About the Indices

The return on the GLDI ETNs is based on the performance of the

Credit Suisse NASDAQ Gold FLOWS™ (Formula-Linked OverWrite

Strategy) 103 Index (the “GLDI Index”). The GLDI Index is reported

on Bloomberg under ticker symbol “QGLDI <Index>” and measures

the return of a “covered call” strategy on the shares of the SPDR®

Gold Trust (Bloomberg ticker symbol “GLD UP <Equity>”, and

such shares, the “GLD Shares”) by reflecting changes in the price

of the GLD Shares and the notional option premiums received from

the notional sale of monthly call options on the GLD Shares less

notional costs incurred in connection with the implementation of

the covered call strategy.

The return on the SLVO ETNs is based on the performance of the

Credit Suisse NASDAQ Silver FLOWS™ (Formula-Linked OverWrite

Strategy) 106 Index (the “SLVO Index”). The SLVO Index is reported

on Bloomberg under ticker symbol “QSLVO <Index>” and measures

the return of a “covered call” strategy on the shares of the

iShares® Silver Trust (Bloomberg ticker symbol “SLV UP

<Equity>”, and such shares, the “SLV Shares”) by reflecting

changes in the price of the SLV Shares and the notional option

premiums received from the notional sale of monthly call options on

the SLV Shares less notional costs incurred in connection with the

implementation of the covered call strategy.

The return on the USOI ETNs is based on the performance of the

price return version of the Credit Suisse Nasdaq WTI Crude Oil

FLOWS™ 106 Index (the “USOI Index”). The USOI Index is reported on

Bloomberg under ticker symbol “QUSOI <Index>” and measures

the return of a “covered call” strategy on the shares of the United

States Oil Fund® (Bloomberg ticker symbol “USO UP <Equity>”,

and such shares, the “Reference Oil Shares”) by reflecting changes

in the price of the Reference Oil Shares and the notional option

premiums received from the notional sale of monthly call options on

the Reference Oil Shares less notional costs incurred in connection

with the implementation of the covered call strategy.

“Credit Suisse Nasdaq WTI Crude Oil FLOWS™ Index”, and “FLOWS™”

are trademarks or service marks or registered trademarks or

registered service marks of UBS. UNITED STATES OIL FUND® is a

registered trademark of United States Commodity Funds LLC (“USCF).

USCF is not affiliated with UBS or the ETNs.

© UBS 2024. The key symbol, UBS and ETRACS are among the

registered and unregistered trademarks of UBS. Other marks may be

trademarks of their respective owners. All rights reserved.

1 Individual investors should instruct their

broker/advisor/custodian to call us or should call together with

their broker/advisor/custodian.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240531656640/en/

Media contact Alison Keunen +1-212-713-2296

alison.keunen@ubs.com Institutional Investor contact1

+1-877-387 2275

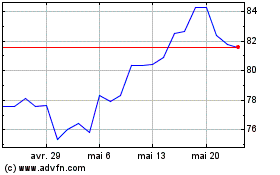

UBS AG ETRACS Silver Sha... (NASDAQ:SLVO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

UBS AG ETRACS Silver Sha... (NASDAQ:SLVO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024