SoFi Closes $697.6 Million Securitization of Loan Platform Business Volume

03 Mars 2025 - 3:00PM

Business Wire

Offering Includes Participation from 35 Unique

Investors

SoFi Technologies, Inc. (NASDAQ: SOFI), a member-centric,

one-stop shop for digital financial services that helps members

borrow, save, spend, invest and protect their money, announced

today the issuance of $697.6 million in notes secured by a pool of

personal loans originated by SoFi Bank, N.A. The transaction was a

co-contributor securitization with collateral consisting primarily

of loans previously placed with loan platform business partners.

SoFi’s loan platform business, which originates loans on behalf of

third parties, generated $2.1 billion in personal loan volume in

2024.

This represents the first securitization of new collateral in

SoFi’s Consumer Loan Program (SCLP) since 2021 and the first using

collateral originated in the loan platform business. It provides

co-contributors with meaningful liquidity to support their ongoing

investment in the loan platform business given the strong market

demand for SoFi’s personal loans. SoFi issued notes to 35 investors

in the deal, representing a range of new and existing partners.

“As SoFi’s personal loan products resonate with more and more

people, we see continued strong demand for our loans in the capital

markets,” said Chris Lapointe, Chief Financial Officer of SoFi.

“This offering demonstrates the clear value of our loan platform

business and our diversified funding strategy.”

The transaction (“SCLP 2025-1”) closed on February 28, 2025 and

consisted of four classes of notes rated by Fitch Ratings and

Morningstar DBRS from “AAA” to “BBB+”. Fitch Ratings assigned

ratings to all four classes of notes, and Morningstar DBRS provided

ratings on the Class A, B, and C notes. Goldman Sachs was the

structuring agent and joint lead bookrunner with Bank of America.

The transaction priced at industry-leading costs of funds levels,

with a weighted average spread of 87 basis points and an all-in

yield of 5.10%. The notes were offered pursuant to Rule 144A under

the Securities Act of 1933, as amended.

Since the launch of SCLP in 2015, SoFi has issued more than $12

billion in notes to investors across 25 transactions.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of such jurisdiction.

About SoFi

SoFi (NASDAQ: SOFI) is a member-centric, one-stop shop for

digital financial services on a mission to help people achieve

financial independence to realize their ambitions. The company’s

full suite of financial products and services helps its over 10.1

million SoFi members borrow, save, spend, invest, and protect their

money better by giving them fast access to the tools they need to

get their money right, all in one app. SoFi also equips members

with the resources they need to get ahead – like credentialed

financial planners, exclusive experiences and events, and a

thriving community – on their path to financial independence.

SoFi innovates across three business segments: Lending,

Financial Services – which includes SoFi Checking and Savings, SoFi

Invest, SoFi Credit Card, SoFi Protect, and SoFi Insights – and

Technology Platform, which offers the only end-to-end vertically

integrated financial technology stack. SoFi Bank, N.A., an

affiliate of SoFi, is a nationally chartered bank, regulated by the

OCC and FDIC and SoFi is a bank holding company regulated by the

Federal Reserve. The company is also the naming rights partner of

SoFi Stadium, home of the Los Angeles Chargers and the Los Angeles

Rams. For more information, visit https://www.sofi.com or download

our iOS and Android apps.

Disclosures

Availability of Other Information About SoFi

Investors and others should note that we communicate with our

investors and the public using our website (https://www.sofi.com),

the investor relations website (https://investors.sofi.com), and on

social media (X and LinkedIn), including but not limited to

investor presentations and investor fact sheets, Securities and

Exchange Commission filings, press releases, public conference

calls and webcasts. The information that SoFi posts on these

channels and websites could be deemed to be material information.

As a result, SoFi encourages investors, the media, and others

interested in SoFi to review the information that is posted on

these channels, including the investor relations website, on a

regular basis. This list of channels may be updated from time to

time on SoFi’s investor relations website and may include

additional social media channels. The contents of SoFi’s website or

these channels, or any other website that may be accessed from its

website or these channels, shall not be deemed incorporated by

reference in any filing under the Securities Act of 1933, as

amended.

SOFI-F

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250303216504/en/

PR@sofi.com

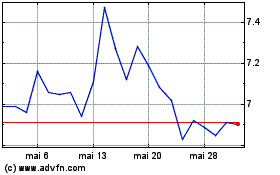

SoFi Technologies (NASDAQ:SOFI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

SoFi Technologies (NASDAQ:SOFI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025