SeqLL Provides First Quarter 2023 Financial Results

09 Mai 2023 - 2:30PM

SeqLL Inc. (“SeqLL” or the “Company”) (NASDAQ: SQL; SQLLW), a

technology company providing life sciences instrumentation and

research services aimed at the development of novel scientific

assets and intellectual property, today announced its operating and

financial results for the first quarter ended March 31, 2023.

First Quarter 2023 Results and Financial

Highlights

- Our revenues during the three months ended March 31, 2023, were

$0 as compared to revenues of $47,482 during the three-month period

ended March 31, 2022, representing a decrease of $47,482, or 100%.

During the three-month period ended March 31, 2023, the Company had

no revenues from product sales, grants or research services as

compared to revenue in the same period of 2022 of $47,482 from

grants, and no revenues from product sales or research services.

The decrease in revenue was due to the fact that the Company does

not currently have any active grants under which it is providing

services.

- Gross profit for the three months ended March 31, 2023 was $0,

as compared to gross profit of $47,482 for the three-month periods

ended March 31, 2022, which represented a 100% decrease due to the

fact that the Company did not have any revenue-generating

transactions in the three-month period ended March 31, 2023.

- Research and development expenses increased by $442,050, or

132%, from $334,670 for the three-month period ended March 31,

2022, compared to $776,720 for the three-month period ended March

31, 2023. The increase in expenses was a result of our progressive

return to research and development activities to pre-COVID-19

levels. The Company expects these expenditures to continue

increasing throughout 2023 and beyond as the Company increases

research and development efforts.

- General and administrative expenses increased by $396,235, or

68%, from $584,872 for the three-month period ended March 31, 2022

compared to $981,107 for the three-month period ended March 31,

2023. During the three-month period ended March 31, 2023, the

Company performed a detailed evaluation of its inventory and

determined that $165,852 of its inventory was obsolete, and as

such, expensed the value of the obsolete inventory. No such expense

was recognized in the three-month period ended March 31, 2022. The

Company, also, as part of its implementation of ASC 326, Financial

Instruments – Credit Losses, recorded approximately $78,000 of bad

debt expense. Additionally, the increase was attributable to

increased operating expenses related to the transition to reporting

as a public company, including the addition of accounting, legal,

insurance and audit related expenses. General and administrative

expenditures will continue to increase to support ongoing financial

reporting and compliance activities.

- The Company recognized $56,267 related to investment income

from marketable debt securities of $48,072 and $8,195 for funds in

money market accounts, respectively, during the three-month period

ended March 31, 2023. The Company did not hold such investments

during the three-month period ended March 31, 2022.

- The Company recognized $51,816 in net realized and unrealized

losses on the marketable equity securities during the three-month

period ended March 31, 2022. The Company did not hold such

investments during the three-month period ended March 31,

2023.

- The Company recognized interest expense of $16,806 in the

three-month periods ended March 31, 2023 and 2022, representing no

change. Interest expense was identical for both periods as there

were no changes to the terms of the non-convertible promissory

note.

- Overall, the net loss increased by $780,412, or 83%, to

$1,718,366 as compared to $937,954 for the three-month period ended

March 31, 2022, primarily due to increased operating expenses

during the three-month period ended March 31, 2023.

About True Single Molecule Sequencing (tSMS)

TechnologySeqLL’s collaborators are thoroughly committed

to using only our tSMS platform in their scientific research due to

its unique RNA and DNA sequencing and related services. Our true

single molecule sequencing platform is NGS technology offers

maximum flexibility and avoids many of the challenges common for

standard NGS approaches. It enables direct sequencing of millions

of individual molecules not requiring PCR amplification at any

stage of the process and a simple, economical sample prep

protocols. Therefore, it captures a precise sample composition,

without bias and loss of diversity and rare species. Our tSMS

platform is ideally suited for RNA biomarker discovery and

diagnostic assay developments, including challenging applications

for the standard NGS platform, such as low quantity, difficult or

degraded samples of cell-free DNA, FFPE-isolated nucleic acids,

ancient DNA and forensic samples.

About SeqLL, Inc.SeqLL Inc. (“SeqLL”) is a

technology company providing life sciences instrumentation and

research services in collaborative partnerships aimed at the

development of novel scientific assets and intellectual property

across multiple “omics” fields. The Company leverages its expertise

with its True Single Molecule Sequencing (“tSMS®”) platform to

empower scientists and researchers with improved genetic tools to

better understand the molecular mechanisms of disease that is

essential to the continued development of new breakthroughs in

genomic medicine, and that hopefully address the critical concerns

involved with today’s precision medicine. In sum, our experienced

team works with our collaborators to develop innovative solutions

tailored to the needs of each specific project.

Forward Looking StatementsThis press release

contains certain forward-looking statements, including those

related to the applicability and viability of the

Company’s technology to quantifying RNA molecules from

blood and other statements that are predictive in nature.

Forward-looking statements are based on the Company's current

expectations and assumptions. The Private Securities Litigation

Reform Act of 1995 provides a safe-harbor for forward-looking

statements. These statements may be identified by the use of

forward-looking expressions, including, but not limited to,

"expect," "anticipate," "intend," "plan," "believe," "estimate,"

"potential," "predict," "project," "should," "would" and similar

expressions and the negatives of those terms. Prospective investors

are cautioned not to place undue reliance on such forward-looking

statements, which speak only as of the date of this presentation.

The Company undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future events or otherwise. Important factors that could cause

actual results to differ materially from those in the

forward-looking statements are set forth in the Company's filings

with the Securities and Exchange Commission, including its

registration statement on Form S-1, as amended, under the caption

"Risk Factors."

Contacts:

John W. Kennedy Tel: (914) 727-7764 Email:

jwkennedy@seqll.com

|

SeqLL Inc.Condensed Consolidated Balance

Sheets |

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

5,043,851 |

|

|

$ |

2,180,525 |

|

|

Marketable securities |

|

1,531,574 |

|

|

|

4,036,014 |

|

|

Accounts receivable, net of allowance for doubtful accounts of

$24,507 and $6,016 as of March 31, 2023 and December 31, 2022,

respectively |

|

2,723 |

|

|

|

21,214 |

|

|

Other receivables |

|

- |

|

|

|

60,000 |

|

|

Inventory |

|

- |

|

|

|

165,852 |

|

|

Prepaid expenses |

|

120,900 |

|

|

|

171,859 |

|

|

Total current assets |

|

6,699,048 |

|

|

|

6,635,464 |

|

|

Other assets |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

561,750 |

|

|

|

530,108 |

|

|

Operating lease right-of-use asset |

|

1,097,392 |

|

|

|

1,129,715 |

|

|

Other assets |

|

111,098 |

|

|

|

118,954 |

|

|

Total assets |

$ |

8,469,288 |

|

|

$ |

8,414,241 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

886,122 |

|

|

$ |

622,436 |

|

|

Accrued expenses |

|

448,491 |

|

|

|

495,462 |

|

|

Current portion of operating lease liability |

|

137,478 |

|

|

|

110,114 |

|

|

Total current liabilities |

|

1,472,091 |

|

|

|

1,228,012 |

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

Operating lease liability, less current portion |

|

1,396,345 |

|

|

|

1,444,343 |

|

|

Non-convertible promissory notes - long-term |

|

1,375,000 |

|

|

|

1,375,000 |

|

|

Total non-current liabilities |

|

2,771,345 |

|

|

|

2,819,343 |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

4,243,436 |

|

|

|

4,047,355 |

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

Preferred stock, $0.00001 par value; 20,000,000 shares authorized;

0 shares issued and outstanding |

|

- |

|

|

|

- |

|

|

Common stock, $0.00001 par value; 80,000,000 shares authorized;

13,886,379 and 11,886,379 shares issued and outstanding as of March

31, 2023 and December 31, 2022, respectively |

|

139 |

|

|

|

119 |

|

|

Additional paid-in capital |

|

24,434,824 |

|

|

|

22,853,000 |

|

|

Accumulated deficit |

|

(20,227,050 |

) |

|

|

(18,508,684 |

) |

|

Accumulated other comprehensive income |

|

17,939 |

|

|

|

22,451 |

|

|

Total stockholders’ equity |

|

4,225,852 |

|

|

|

4,366,886 |

|

|

Total liabilities and stockholders’ equity |

$ |

8,469,288 |

|

|

$ |

8,414,241 |

|

|

SeqLL Inc.Condensed Consolidated

Statements of Operations and Comprehensive

Loss(Unaudited) |

|

| |

|

| |

Three months endedMarch 31, |

|

| |

2023 |

|

|

2022 |

|

| Revenue |

|

|

|

|

|

|

Sales |

$ |

- |

|

|

$ |

- |

|

|

Grant revenue |

|

- |

|

|

|

47,482 |

|

|

Total revenue |

|

- |

|

|

|

47,482 |

|

| |

|

|

|

|

|

|

|

| Cost of sales |

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

| Gross

profit |

|

- |

|

|

|

47,482 |

|

| |

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

Research and development |

|

776,720 |

|

|

|

334,670 |

|

|

General and administrative |

|

981,107 |

|

|

|

584,872 |

|

|

Total operating expenses |

|

1,757,827 |

|

|

|

919,542 |

|

| |

|

|

|

|

|

|

|

| Operating

loss |

|

(1,757,827 |

) |

|

|

(872,060 |

) |

| |

|

|

|

|

|

|

|

| Other (income) and

expenses |

|

|

|

|

|

|

|

|

Investment income |

|

(56,267 |

) |

|

|

- |

|

|

Unrealized gain on equity marketable securities |

|

- |

|

|

|

(54,508 |

) |

|

Realized loss on equity marketable securities |

|

- |

|

|

|

106,324 |

|

|

Other income |

|

- |

|

|

|

(2,728 |

) |

|

Interest expense |

|

16,806 |

|

|

|

16,806 |

|

| |

|

|

|

|

|

|

|

|

Net loss |

|

(1,718,366 |

) |

|

|

(937,954 |

) |

| Other comprehensive

income |

|

|

|

|

|

|

|

|

Unrealized gain on marketable debt securities |

|

17,569 |

|

|

|

- |

|

|

Less: reclassification adjustment for net gains included in net

loss |

|

(22,081 |

) |

|

|

- |

|

|

Net change |

|

(4,512 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

Total comprehensive loss |

$ |

(1,722,878 |

) |

|

$ |

(937,954 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share -

basic and diluted |

$ |

(0.13 |

) |

|

$ |

(0.08 |

) |

| |

|

|

|

|

|

|

|

| Weighted average

common shares - basic and diluted |

|

12,886,379 |

|

|

|

11,886,379 |

|

|

SeqLL Inc.Condensed Consolidated

Statements of Cash Flows(Unaudited) |

| |

| |

Three months endedMarch 31, |

|

| |

2023 |

|

|

2022 |

|

| Cash Flows from

Operating Activities |

|

|

|

|

|

|

Net loss |

$ |

(1,718,366 |

) |

|

$ |

(937,954 |

) |

|

Adjustment to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

Depreciation |

|

30,246 |

|

|

|

16,712 |

|

|

Write-off of obsolete inventory |

|

165,852 |

|

|

|

- |

|

|

Unrealized (gain)/loss on marketable equity securities |

|

- |

|

|

|

(54,508 |

) |

|

Realized (gain)/loss on marketable debt and equity securities |

|

(48,072 |

) |

|

|

106,324 |

|

|

Provision for bad debts |

|

78,491 |

|

|

|

- |

|

|

Stock-based compensation |

|

82,594 |

|

|

|

55,914 |

|

|

Non-cash lease expense |

|

11,689 |

|

|

|

27,509 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

- |

|

|

|

1,200 |

|

|

Other receivables |

|

- |

|

|

|

(12,517 |

) |

|

Prepaid expenses |

|

50,959 |

|

|

|

62,938 |

|

|

Inventory |

|

- |

|

|

|

(4,378 |

) |

|

Other assets |

|

7,856 |

|

|

|

(60,762 |

) |

|

Accounts payable |

|

263,686 |

|

|

|

(246,915 |

) |

|

Accrued expenses |

|

(46,971 |

) |

|

|

16,013 |

|

|

Net cash used in operating activities |

|

(1,122,036 |

) |

|

|

(1,030,424 |

) |

| |

|

|

|

|

|

|

|

| Cash Flows from

Investing Activities |

|

|

|

|

|

|

|

|

Purchases of lab equipment |

|

(61,888 |

) |

|

|

(6,935 |

) |

|

Purchases of marketable equity securities |

|

- |

|

|

|

(590 |

) |

|

Sales of marketable equity securities |

|

- |

|

|

|

5,882,138 |

|

|

Maturity of marketable debt securities |

|

2,548,000 |

|

|

|

- |

|

|

Net cash provided by investing activities |

|

2,486,112 |

|

|

|

5,874,613 |

|

| |

|

|

|

|

|

|

|

| Cash Flows from

Financing Activities |

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock, net |

|

1,499,250 |

|

|

|

- |

|

|

Net cash provided by financing activities |

|

1,499,250 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

| Net increase in cash and cash

equivalents |

|

2,863,326 |

|

|

|

4,844,189 |

|

| |

|

|

|

|

|

|

|

| Cash and cash

equivalents, beginning of period |

|

2,180,525 |

|

|

|

4,015,128 |

|

| |

|

|

|

|

|

|

|

| Cash and cash

equivalents, end of period |

$ |

5,043,851 |

|

|

$ |

8,859,317 |

|

| |

|

|

|

|

|

|

|

| Supplemental

disclosure of cash flow information and non-cash financing

transactions |

|

|

|

|

|

|

|

|

Right-of-use asset acquired through operating lease |

$ |

- |

|

|

$ |

1,481,646 |

|

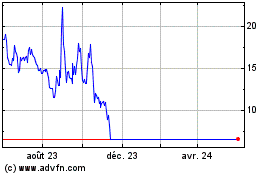

SeqLL (NASDAQ:SQL)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

SeqLL (NASDAQ:SQL)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025