UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of December 2024

(Report No. 4)

Commission file number: 001-41387

SaverOne 2014 Ltd.

(Translation of registrant’s name into English)

Em Hamoshavot Rd. 94

Petah Tikvah, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

CONTENTS

On December

13, 2024, SaverOne 2014 Ltd. (the “Company”) announced that it will hold its Extraordinary General Meeting of Shareholders

(the “Meeting”) on Sunday, January 19, 2025 at 3:00 p.m. (Israel time) at the Company’s offices in Petah Tikva, Israel.

In connection with the meeting, the Company furnishes the following documents:

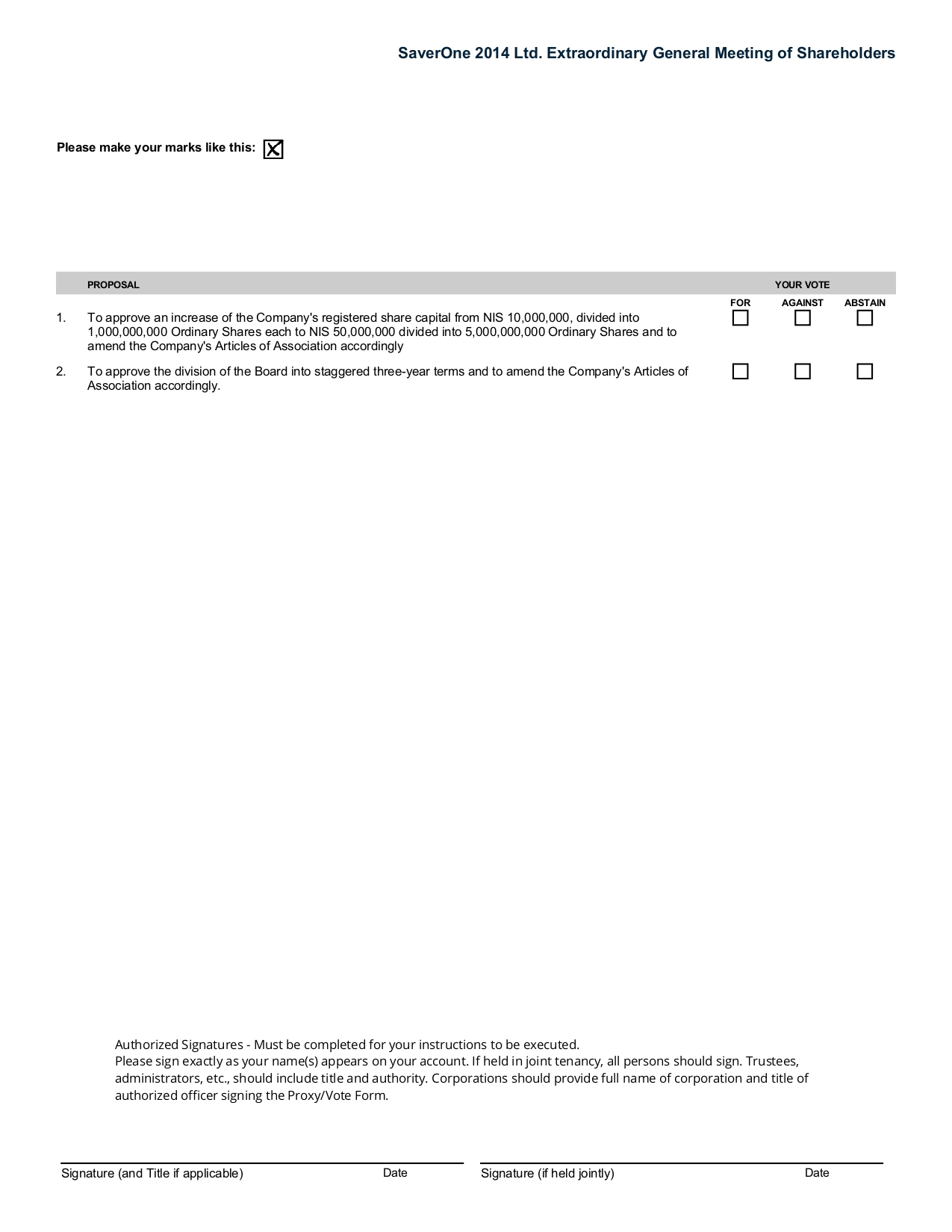

| 1. |

A copy of the Notice and Proxy Statement with respect to the Meeting of Shareholders describing the proposals to be voted upon at the Meeting, the procedure for voting in person or by proxy at the Meeting and various other details related to the Meeting, attached hereto as Exhibit 99.1; |

| 2. |

A form of Proxy Card whereby holders of ordinary shares of the Company may vote at the Meeting without attending in person, attached hereto as Exhibit 99.2; and |

| 3. |

A form of Voting Instruction Card whereby holders of American Depositary Shares (“ADSs”) of the Company may vote at the Meeting without attending in person, attached hereto as Exhibit 99.3. |

Only shareholders and holders of ADSs at the close

of business on December 23, 2024, the record date, are entitled to notice of, and to vote at, the Meeting and any adjournment or postponement

thereof.

This Report on Form 6-K is incorporated by reference into the Company’s

Registration Statements on Form F-3 (File No. 333-274458, 333-263338 and 333-269260) and Form S-8 (File No. 333-274455),

filed with the Securities and Exchange Commission, to be a part thereof from the date on which this report is submitted, to the extent

not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

SaverOne 2014 Ltd. |

| |

|

| Date: December 13, 2024 |

By: |

/s/ Ori Gilboa |

| |

|

Name: |

Ori Gilboa |

| |

|

Title: |

Chief Executive Officer |

3

Exhibit 99.1

NOTICE OF

THE EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 19, 2025

To the shareholders and ADS

holders of SaverOne 2014 Ltd. (the “Company”):

Notice is hereby given that

the Extraordinary General Meeting of Shareholders (the “Meeting”) will be held on Sunday, January 19, 2025, at 3:00 p.m. Israel

time at our offices, Em Hamoshavot Rd. 94, Petah Tikva, Israel.

The agenda of the Meeting

will be as follows:

| |

1. |

To approve an increase of the Company’s registered share capital from NIS 10,000,000 divided into 1,000,000,000 ordinary shares, par value NIS 0.01 each (the “Ordinary Shares”) to NIS 50,000,000, divided into 5,000,000,000 Ordinary Shares, and to amend the Company’s Articles of Association accordingly. |

| |

2. |

To approve the division of the Board of Directors of the Company into staggered three-year terms and to amend the Company’s Articles of Association accordingly. |

Only shareholders and holders

of ADSs at the close of business on December 23, 2024 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting

and any adjournment or postponement thereof. You are cordially invited to attend the Meeting in person.

If you are unable to attend

the Meeting in person, you are requested to complete, date and sign the enclosed proxy and to return it promptly in the pre-addressed

envelope provided. Shareholders who attend the Meeting may revoke their proxies and vote their shares in person.

Beneficial owners who hold

ordinary shares through members of the Tel Aviv Stock Exchange, or the TASE, may either vote their shares in person at the Meeting by

presenting a certificate signed by the TASE Clearing House member through which the shares are held, which complies with the Israel Companies

Regulations (Proof of Ownership for Voting in General Meetings)-2000 as proof of ownership of the shares on the Record Date, or send such

certificate along with a duly executed proxy (in the form filed by us on MAGNA, the distribution site of the Israeli Securities Authority,

at www.magna.isa.gov.il), to us at Em Hamoshavot Rd. 94, Petah Tikva, Israel 49130, Israel Attention: Chief Financial Officer.

| |

By Order of the Board of Directors |

| |

|

| |

/s/ Jacob Tenenbaum |

| |

Chairman of the Board |

| |

December 13, 2024 |

Em Hamoshavot Rd.

94, Petah Tikva,

Israel

PROXY STATEMENT

FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 19, 2025

This Proxy Statement is furnished

to our holders of Ordinary Shares, including holders of our Ordinary shares that are represented by American Depository Shares, or ADSs,

in connection with the Extraordinary General Meeting of Shareholders (the “Meeting”), to be held on Sunday, January 19, 2025,

at 3:00 p.m. Israel time at our offices, Em Hamoshavot Rd. 94, Petah Tikva, Israel, or at any adjournments thereof.

Throughout this Proxy Statement,

we use terms such as “SaverOne”, “we”, “us”, “our” and the “Company” to refer

to SaverOne 2014 Ltd. and terms such as “you” and “your” to refer to our shareholders and ADS holders.

Agenda Items

The agenda of the Meeting

will be as follows:

| |

1. |

To approve an increase of the Company’s registered share capital from NIS 10,000,000 divided into 1,000,000,000 Ordinary Shares each to NIS 50,000,000, divided into 5,000,000,000 Ordinary Shares and to amend the Company’s Articles of Association accordingly, |

| |

2. |

To approve the division of the Board into staggered three-year terms and to amend the Company’s Articles of Association accordingly. |

We currently are unaware of

any other matters that may be raised at the Meeting. Should any other matters be properly raised at the Meeting, the persons designated

as proxies shall vote according to their own judgment on those matters.

Board Recommendation

Our Board of Directors (the

“Board”) unanimously recommends that you vote “FOR” each of the proposals on the agenda.

Who Can Vote

Only shareholders and ADS

holders at the close of business on December 23, 2024, shall be entitled to receive notice of and to vote at the Meeting.

How You Can Vote

You can vote your ordinary

shares by attending the Meeting. If you do not plan to attend the Meeting, the method of voting will differ for shares held as a record

holder, shares held in “street name” (through a Tel Aviv Stock Exchange, or TASE, member) and shares underlying ADSs that

you hold. Holders of ADSs (whether registered in their name or in “street name”) will receive voting instruction cards in

order to instruct their banks, brokers or other nominees on how to vote.

Shareholders of Record

If you are a shareholder of

record, you can submit your vote by completing, signing and submitting an applicable proxy, which has been published at www.magna.isa.gov.il

and www.maya.tase.co.il and which will be accessible at the “Investor Relations” portion of our website, as described below

under “Shareholder Meetings”.

Shareholders Holding in

“Street Name,” Through the TASE

If you hold ordinary shares

in “street name,” that is, through a bank, broker or other nominee that is admitted as a member of the TASE, your shares will

only be voted if you provide instructions to the bank, broker or other nominee as to how to vote, or if you attend the Meeting in person.

If voting by mail, you must

sign and date a proxy and attach to it a certificate signed by the TASE Clearing House member through which the shares are held, which

complies with the Israel Companies Regulations (Proof of Ownership for Voting in General Meetings)-2000 as proof of ownership of the shares,

as applicable, on the Record Date, and return the proxy, along with the proof of ownership certificate, to us, as described in the instructions

available on MAGNA.

If you choose to attend the

Meeting (where ballots will be provided), you must bring the proof of ownership certificate from the TASE’s Clearing House member

through which the shares are held, indicating that you were the beneficial owner of the shares, as applicable, on the Record Date.

Holders of ADSs

Under the terms of the Deposit

Agreement between the Company, The Bank of New York Mellon, as depositary, or BNY Mellon, and the holders of our ADSs, BNY Mellon shall

endeavor (insofar as is practicable) to vote or cause to be voted the number of shares represented by ADSs in accordance with the instructions

provided by the holders of ADSs to BNY Mellon. For ADSs that are held in “street name”, through a bank, broker or other nominee,

the voting process will be based on the underlying beneficial holder of the ADSs directing the bank, broker or other nominee to arrange

for BNY Mellon to vote the ordinary shares represented by the ADSs in accordance with the beneficial holder’s voting instructions.

If no instructions are received by BNY Mellon from any holder of ADSs (whether held directly by a beneficial holder or in “street

name”) with respect to any of the shares represented by the ADSs on or before the date established by BNY Mellon for such purpose,

BNY Mellon shall not vote or attempt to vote the shares represented by such ADSs.

Multiple Record Holders

or Accounts

You may receive more than

one set of voting materials, including multiple copies of this document or voting instruction cards. For example, shareholders who hold

ADSs in more than one brokerage account will receive a separate voting instruction card for each brokerage account in which ADSs are held.

You should complete, sign, date and return each voting instruction card you receive.

Our Board urges you to vote

your shares so that they will be counted at the Meeting or at any postponements or adjournments of the Meeting.

Solicitation

Shareholders and ADS holders

may vote at the Meeting whether or not they attend. If a properly executed proxy is received by us at least 48 hours prior to the Meeting

(and received by BNY Mellon no later than the date indicated on the voting instruction card, in the case of ADS holders), all of the shares

represented by the proxy shall be voted as indicated on the form or, if no preference is noted, shall be voted in favor of the matter

described above, and in such manner as the holder of the proxy may determine with respect to any other business as may come before the

Meeting or any adjournment thereof. Shareholders and ADS holders may revoke their proxy at any time before the deadline for receipt of

powers of attorney by filing with us (in the case of holders of ordinary shares) or with BNY Mellon (in the case of holders of ADSs),

a written notice of revocation or duly executed proxy bearing a later date. Proxies are being distributed to shareholders and ADS holders

on or about December 17, 2024. Certain officers, directors, employees, and agents of ours, none of whom will receive additional compensation

therefor, may solicit proxies by telephone, emails, or other personal contact. We will bear the cost for the solicitation of the proxies,

including postage, printing, and handling, and will reimburse the reasonable expenses of brokerage firms and others for forwarding material

to beneficial owners of shares and ADSs.

To the extent you would like

to submit a position statement with respect to the proposals described in this proxy statement pursuant to the Companies Law, you may

do so by delivery of appropriate notice to our offices (Attention: Chief Financial Officer) located at Em Hamoshavot Rd. 94, Petah Tikva,

49130, Israel, not later than ten days before the Meeting. Response of the board to the position statement may be submitted not later

than five days before the Meeting.

Quorum

At the close of business on

December 13, 2024, we had outstanding 246,533,076 Ordinary Shares. Each Ordinary Share (including Ordinary Shares represented by ADSs)

outstanding as of the close of business on the Record Date is entitled to one vote upon each of the matters to be voted on at the Meeting.

Under our Articles of Association,

the Meeting will be properly convened if at least two shareholders attend the meeting in person or sign and return proxies, provided that

they hold shares representing at least 25% of our voting power. If such quorum is not present within half an hour from the time scheduled

for the Meeting, the Meeting will be postponed to the following week, on the same day, time and place, and the agenda for which the first

meeting was called will be discussed at the postponed meeting. If there is no quorum at the postponed meeting by the end of half an hour

from the date called for the Meeting, the postponed Meeting shall be held with the presence of any number of participants whatsoever.

No further notice will be given or publicized with respect to such adjourned meeting. At the reconvened meeting, if there is no quorum

within half an hour from the time scheduled for the meeting, any number of our shareholders present in person or by proxy shall constitute

a lawful quorum.

Vote Required for Each Proposal

The affirmative vote of the

holders of a majority of the voting power present at the Meeting in person or by proxy and voting thereon is necessary for the approval

of all the Proposals on the Meeting’s agenda.

Under the Companies Law, in

general, you will be deemed to be a controlling shareholder if you have the power to direct our activities, otherwise than by reason of

being a director or other office holder of ours, if you hold 50% or more of the voting rights in our Company or have the right to appoint

the majority of the directors of the Company or its chief executive officer, and you are deemed to have a personal interest if any member

of your immediate family or their spouse has a personal interest in the adoption of the proposal. In addition, you are deemed to have

a personal interest if a company, other than SaverOne, that is affiliated to you has a personal interest in the adoption of the proposal.

Such company is a company in which you or a member of your immediate family serves as a director or chief executive officer, has the right

to appoint a director or the chief executive officer, or owns 5% or more of the outstanding shares. However, you are not deemed to have

a personal interest in the adoption of the proposal if your interest in such proposal arises solely from your ownership of our shares,

or to a matter that is not related to a relationship with a controlling shareholder.

In the proxy card and voting

instruction card attached to the proxy statement you will be asked to indicate whether you have a personal interest with respect to the

proposal. If any shareholder casting a vote in connection hereto does not notify us whether or not they have a personal interest with

respect to the proposal, their vote with respect to the proposal will be disqualified.

If you provide specific instructions

(mark boxes) with regard to certain proposals, your shares will be voted as you instruct. If you sign and return your proxy card or voting

instruction form without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board.

The proxy holders will vote in their discretion on any other matters that properly come before the meeting.

If you are a shareholder of

record and do not return your proxy card, your shares will not be voted. If you hold shares (or ADSs representing shares) beneficially

in street name, your shares will also not be voted at the meeting if you do not return your proxy card or voting instruction card to instruct

your broker or BNY Mellon how to vote. A broker (and BNY Mellon) may only vote in accordance with instructions from a beneficial owner

of shares or ADSs.

Availability of Proxy Materials

Copies of the applicable proxy

card and voting instruction card, the Notice of the Extraordinary General Meeting of Shareholders and this Proxy Statement are available

at the “Investor Relations” portion of our website, www.saver.one. The contents of that website are not a part of this Proxy

Statement.

Reporting Requirements

We are subject to the information

reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, applicable to foreign private issuers.

We fulfill these requirements by filing reports with the Securities and Exchange Commission, or Commission. Our filings with the Commission

may be inspected without charge at the Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information

on the operation of the Public Reference Room can be obtained by calling the Commission at 1-800-SEC-0330. Our filings are also available

to the public on the Commission’s website at http://www.sec.gov.

As a foreign private issuer,

we are exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements. The circulation of this

notice and proxy statement should not be taken as an admission that we are subject to the proxy rules under the Exchange Act.

PROPOSAL 1

Background

Our Articles of Association

(the “Articles”) provides that the Company’s registered share capital is NIS 10,000,000 divided into 1,000,000,000 ordinary

shares, par value NIS 0.01 each. The Board believes that increasing the Company’s registered share capital would afford the Company

greater flexibility in raising additional funds, use its share capital as currency for potential transactions and will incentivize its

employees. Accordingly, on December 12, 2024, the Board adopted the resolution by unanimous written consent, and recommended that the

shareholders approve a proposal, to increase the Company’s registered share capital from NIS 1,000,000 divided into 1,000,000,000

Ordinary Shares each to NIS 50,000,000, divided into 5,000,000,000 Ordinary Shares. If approved by shareholders, we will amend the

Articles accordingly using the form of Amended and Restated Articles, annexed hereto as Exhibit A.

Proposed Resolutions

It is proposed that at the

Meeting the following resolutions be adopted:

“RESOLVED, that the

Company is authorized to increase the Company’s registered share capital from NIS 10,000,000, divided into 1,000,000,000 Ordinary

Shares each to NIS 50,000,000, divided into 5,000,000,000 Ordinary Shares (the “Increase of Share Capital”), and to amend

the Articles as set forth in the form of Amended and Restated Articles, annexed hereto as Exhibit A,

Required Vote

Under the Companies Law and

our Articles, the affirmative vote of the holders of a majority of the Ordinary Shares represented at the Meeting, in person or by proxy,

entitled to vote and voting on the Increase of Share Capital.

For this purpose, you are

asked to indicate on your proxy card or voting instruction card whether you have a personal interest in the re-election of the external

director. Under the Companies Law, in general, you are deemed to have a personal interest if any member of your immediate family or their

spouse has a personal interest in the adoption of the proposal. In addition, you are deemed to have a personal interest if a company,

other than SaverOne, that is affiliated to you has a personal interest in the adoption of the proposal. Such company is a company in which

you or a member of your immediate family serves as a director or chief executive officer, has the right to appoint a director or the chief

executive officer, or owns 5% or more of the outstanding shares. However, you are not deemed to have a personal interest in the adoption

of the proposal if your interest in such proposal arises solely from your ownership of our shares, or to a matter that is not related

to a relationship with a controlling shareholder.

Board Recommendation

Our Board recommends a vote FOR the Increase of

Share Capital.

PROPOSAL 2:

Background

At the Meeting, you will be

asked for an approval to divide our Board into three (3) classes with staggered three-year terms (the “Staggered Board Proposal”),

and to amend the Articles accordingly.

Our Board believes that given

our current position, it is important to ensure that the Board has the tools to promote our interests and our shareholders’ interests

in the long-term. Accordingly, on December 12, 2024, our Board approved, and recommended to our shareholders to approve the Staggered

Board Proposal, to divide the Board into three classes with staggered three-year terms.

Under our Articles, we must

have at least three (3) directors and may have no more than 12 directors, including the legally required number of external directors.

Our Board currently consists of five directors, including two directors who are deemed external directors per the requirements of the

Companies Law. Under our Articles, directors may be selected only in annual general meetings of our shareholders. Every director

so selected shall serve until the following annual general meeting of our shareholders. Notwithstanding anything to the contrary, each

director shall serve until his or her successor is elected and qualified or until such earlier time as such director’s office is

vacated.

If the Staggered Board Proposal

is approved at the Meeting, then at each annual meeting of our shareholders, the election or re-election of directors following the expiration

of the term of office of the directors of that class of directors will be for a term of office that expires on the third annual general

meeting following such election or re-election, such that from the annual meeting of 2025 and after, each year the term of office of only

one class of directors will expire.

If the Staggered Board Proposal is approved at

the Meeting, we will amend our Articles using the form of Amended and Restated Articles, annexed hereto as Exhibit A, to reflect

that our Board, will be divided among the three classes as follows:

Yaron Beeri will be classified as a Class I director

and his term will expire at our annual meeting of shareholders to be held in 2025;

Ori Gilboa will be classified as a Class II director

and his term will expire at our annual meeting of shareholders to be held in 2026; and

Jacob Tenenboim will be classified as a Class III director,

and his term will expire at our annual meeting of shareholders to be held in 2027.

Further, we will reflect in

our Amended and Restated Articles that (i) directors may only be elected at the Company’s annual shareholders’ meeting, (ii)

a director may not be dismissed from office by shareholders or at a shareholders’ meeting prior to the expiration of their term

of office under the staggered board provisions, (iii) any shareholder of the Company who intends to present a proposal at a shareholders’

meeting must satisfy the requirements of the Israeli Companies Law and must meet certain additional requirements, as will be set forth

in the proposed Amended and Restated Articles, and (iv) an affirmative vote of 65% of the voting power represented at a general meeting

and voting thereon, disregarding abstentions from the count of the voting power present and voting, provided that the quorum is not less

than 20% of the Company’s then issued and outstanding share capital, is required to amend Amended and Restated Articles, with respect

to the provisions relating to the staggered board, dismissal and the provisions relating to shareholder proposals.

Proposed Resolution

It is proposed that at the

Meeting the following resolution be adopted:

“RESOLVED, that the

Articles shall be amended, implementing the division of the Board into three (3) classes with staggered three-year terms as set forth in the form

of the proposed Amended and Restated Articles, annexed hereto as Exhibit A.

Required Vote

Under the Companies Law and

our articles of association, the affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person

or by proxy, entitled to vote and voting on the matter, is required for this proposal.

Recommendation

Our Board recommends a vote

FOR the foregoing resolution approving the Staggered Board Proposal and to reflect it in the Amended and Restated Articles.

OTHER BUSINESS

Other than as set forth above,

as of the mailing of this Proxy Statement, management knows of no business to be transacted at the Meeting, but, if any other matters

are properly presented at the Meeting, the persons named in the enclosed form of proxy will vote upon such matters in accordance with

their best judgment.

YOU SHOULD RELY ONLY ON THE

INFORMATION CONTAINED IN THIS PROXY STATEMENT OR THE INFORMATION FURNISHED TO YOU IN CONNECTION WITH THIS PROXY STATEMENT WHEN VOTING

ON THE MATTERS SUBMITTED TO SHAREHOLDER AND ADS HOLDERS VOTE HEREUNDER. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION

THAT IS DIFFERENT FROM WHAT IS CONTAINED IN THIS DOCUMENT. THIS PROXY STATEMENT IS DATED DECEMBER 13, 2024. YOU SHOULD NOT ASSUME THAT

THE INFORMATION CONTAINED IN THIS DOCUMENT IS ACCURATE AS OF ANY DATE OTHER THAN DECEMBER 13, 2024, AND THE MAILING OF THIS DOCUMENT TO

SHAREHOLDERS AND ADS HOLDERS SHOULD NOT CREATE ANY IMPLICATION TO THE CONTRARY.

| |

By Order of the Board of Directors |

| |

|

| |

Jacob Tenenboim |

| |

Chairman of the Board |

| |

December 13, 2024 |

Exhibit A

Form of Amended and Restated Articles

Articles of Association

Saverone2014

Ltd.

| The Clause |

|

Page |

| 1-6. |

Interpretation |

1-2 |

| 7. |

The Company’s Name |

2 |

| 8. |

The Company’s Goals |

2 |

| 9. |

The Company’s Purpose |

2 |

| 10. |

The Registered Share Capital |

2 |

| 11. |

The Shareholders’ Liability |

3 |

| 12. |

Public Company |

3 |

| 13-19. |

Shares |

3 |

| 20-24. |

Share Certificate/ Share Note |

4 |

| 25-30. |

Calls on Shares |

5 |

| 31-41. |

Forfeiture and Lien on Shares |

5-6 |

| 42-50. |

Transfer and Delivery of Shares |

7-8 |

| 51-53. |

Redeemable Securities |

8 |

| 54-56. |

Alterations of Share Capital |

8-9 |

| 57-64. |

General Meetings |

9-11 |

| 65-75. |

Voting Rights |

11-12 |

| 76-84. |

Discussions and Adopting Resolutions at General Meetings |

13-14 |

| 85-93. |

The Board of Directors |

14-15 |

| 94-96. |

The Board of Directors’ Powers and Positions |

16 |

| 97-108. |

The Board of Directors’ Meetings |

16-17 |

| 109-112. |

The Board of Directors’ Committees |

17-18 |

| 113-115. |

The Chief Executive Officer |

18 |

| 116-117. |

Officers |

18-19 |

| 118-121. |

The Internal Auditor |

19 |

| 122-125. |

The Auditor |

19 |

| 126-129. |

Validity of Actions and Approval of Ordinary Transactions |

19 |

| 130. |

Distributions |

20 |

| 131-138. |

Dividends and Bonus Shares |

20 |

| 139. |

Merger |

20 |

| 140-142. |

Protocols |

21 |

| 143-145. |

Shareholders’ Register |

21 |

| 146-150. |

Notices |

21-22 |

| 151. |

Liquidation of the Company |

22 |

| 152. |

Exemption from Liability |

22 |

| 153-154. |

Insuring Liability |

23 |

| 155-157. |

Indemnification |

23-24 |

| 158. |

The Company’s Charges |

24 |

| 159. |

Amending the Articles |

24 |

Interpretation

| 1. | In these Articles, the following terms and expression shall bear the meaning ascribed to them below, unless the context requires otherwise: |

| |

“Person” |

- |

Including

a corporation (unless otherwise stated in these Articles); |

| |

|

|

|

| |

“Shareholder” |

- |

Any

person registered and/or not registered as a shareholder. In the event that there is an effective date, as defined in section 182

of the Companies Law, the shareholder shall be deemed a shareholder as of the effective date for said matter; |

| |

|

|

|

| |

“Registered Shareholder” |

- |

A

shareholder registered as the holder of a share in the Company’s Shareholders’ Register. |

| |

|

|

|

| |

“Non-Registered

Shareholder” |

- |

A

shareholder whose right to a share is registered with a TASE member and the same share is included in the shares are registered in

the Company’s Shareholders’ Register on behalf of the listing company. |

| |

|

|

|

| |

“TASE” |

- |

Tel Aviv Stock Exchange

Ltd. |

| |

|

|

|

| |

The “Board of Directors” |

- |

A

duly selected board of directors in accordance with the provisions of these Articles. |

| |

|

|

|

| |

“Director” |

- |

A

member of the Board of Directors and who actually serves as a director, irrespective of his title. |

| |

|

|

|

| |

The “Companies

Law” |

- |

The

Companies Law, 5759 – 1999, as amended from time to time, and regulations promulgated and that may be promulgated by virtue

thereof. |

| |

|

|

|

| |

The “Securities

Law” |

- |

The

Securities Law, 5728 – 1968, as amended from time to time, and regulations promulgated and that may be promulgated by virtue

thereof. |

| |

|

|

|

| |

The “Law” |

- |

The

Companies Law, the Securities Law, as amended from time to time, and regulations promulgated and that may be promulgated by virtue

thereof, and any effective law in connection with companies applicable to the Company at such time. |

| |

|

|

|

| |

The “Company” |

- |

The aforementioned company. |

| |

|

|

|

| |

The “Register” |

- |

The

Shareholders’ register that must be managed in accordance with section 127 of the Companies Law and also if the Company conducts

any additional register outside of Israel – any additional register, in accordance with the circumstances. |

| |

|

|

|

| |

The “Office” |

- |

The

Company’s registered office, as shall be from time to time and which may be changed from time to time, as may be determined

by the Company’s Board of Directors. |

| |

|

|

|

| |

“In Writing” |

- |

Print,

lithography, photographed, telegram, telex, facsimile, electronic mail and any other created or embedded visible form of words. |

| |

|

|

|

| |

“Securities” |

- |

Including,

shares, debentures, capital notes, certificates and other documents affording a right to sell, convert or sell, etc. |

| |

|

|

|

| |

The “Companies

Ordinance” |

- |

The Companies Ordinance

[New Version], 5743 – 1983. |

| |

|

|

|

| |

The “Articles” |

- |

The

Company’s Articles in its current form or as may be amended. |

| 2. | The provisions of sections 2, 3, 4, 5, 6, 7, 8, 10 of the Interpretation Law, 5741- 1981 shall also apply to the interpretation of

these Articles, mutatis mutandis, and if there is no other provision in the subject matter in question or if there is nothing in

the subject matter in question or its context, which will not be consistent with applying the foregoing. |

| 3. | Save for the provisions in this section, every word and expression in the Articles shall have the meaning assigned thereto in the

Companies Law, unless there is a contradiction to the relevant provision or its content. |

| 4. | Provisions that may be stipulated upon shall apply to the Company, unless otherwise determined in these Articles and if there is any

contradiction between the said provisions of the Companies Law and these Articles, the provisions of these Articles shall apply. |

| 5. | If these Articles have been subjected to a certain provision in the Company Law, and said provision has been modified or repealed,

the said provision shall be deemed to be effective and constitute a portion of the Articles, unless otherwise prohibited by law. |

| 6. | If anywhere in these Articles there is no mention of the required majority for the adoption of a resolution by the General Meeting

or the Board of Directors, it shall be deemed that the required majority is an ordinary majority. |

The Company’s Name

| 7. | The Company’s name is as follows: |

In Hebrew: SAVERONE 2014 LTD. (written in Hebrew)

In English: SAVERONE2014 LTD.

The Company’s Purposes

| 8. | The Company’s may engage in any legal business, subject to the Company’s goals specified in the Company’s memorandum

of incorporation. |

The Company’s Goal

| 9. | The Company’s goal is to act according to business considerations to yield profits, however, the Company may contribute a reasonable

amount for a worthy cause, even if the contribution is not within the scope of its foregoing business considerations, according to the

discretion of the Company’s Board of Directors. |

The Registered Share Capital

| 10. | (a) |

The Company’s registered share capital is NIS 50,000,000 divided into 5,000,000,000 ordinary shares, par value NIS 0.01 each. |

| 10.1. | All the Ordinary Shares will be equal, for all intents and

purposes, and every Ordinary Share, with respect to which every call for share has been paid in full, shall afford its holder: |

| 10.1.1. | The right to be invited and participate in all the Company’s

General Meetings and each Ordinary Share in his possession, will grant him one vote, for each vote at the Company’s General Meeting

in which he is participating; |

| 10.1.2. | The right to receive dividends, if and when distributed,

and the right to receive bonus shares, if distributed; |

| 10.1.3. | the right to participate in the distribution of the Company’s

surplus assets in the event of liquidation. |

The Shareholders’ Liability

| 11. | The liability of the Shareholders will be limited, as specified in the Company’s memorandum of association and the Companies

Law. In this matter, every Shareholders will be responsible for the payment of the par value for his shares only. If the Company issued

shares for a consideration which is below the par value, the liability of all the Shareholders will be limited to the payment of the reduced

consideration for which each Share issued to him, as aforementioned. |

Public Company

| 12. | Subject to the provisions of the Companies Law, insofar as the Company’s Securities are listed for trade on the TASE or insofar

as the Company’s Securities offered to the public are held by the public, it shall be a public company. |

Shares

| 13. | Without derogating from any special rights previously granted to the Company’s existing Shareholders, the Company may issue

or allot other shares and securities with preferred rights or subsequent rights or issue from its equity, prior to the issuance of any

Redeemable Securities or issue other special preferred rights or restrictions in connection with the distribution of dividends, voting

rights, or in connection with other matters, as may be determined by the Company from time to time, by way of a resolution adopted by

a majority of shareholders at the General Meeting. |

| 14. | If at any time, the share capital shall be divided into different classes of Shares, the Company, by way of a resolution adopted by

an ordinary majority at the General Meeting, unless the issuance terms of the said class of shares stipulate otherwise, may convert, expand,

add or otherwise modify the rights, surplus rights, advantages, restrictions and provisions that are related or not related at such time

by one of the classes, or as shall be determined by way of an ordinary majority of the Shareholders of the same class at the General Meeting. |

| 15. | The special rights afforded to the holders of Shares or a certain class of Shares, that were issued, including shares with preferred

rights or other special rights, shall not be deemed to have been modified by way of the creation or issuance of additional shares at an

equal rank to them, unless the allotment terms have stipulated otherwise for those shares. The provisions of these Articles with respect

to General Meetings shall apply, mutatis mutandis, as the case may be on all of the aforementioned class meetings. |

| 16. | The Company’s unissued shares shall be under the Board of Directors’ supervision, who may allocate them to the cap of

the Company’s registered share capital, to the same people, in consideration of cash or in kind, with the same reservations and

conditions, at a higher rate than their par value (in accordance with the provisions of the Companies Law), in consideration for a price

lower than their par value, and on the same dates that the Board of Directors shall deem appropriate, and the Board of Directors shall

have the authority to submit a call on shares to any person for the payment of any of the aforementioned shares, at their par value, greater

than their par value or in consideration that is lower than their par value, during the same period and the same consideration and terms

that the Board of Directors shall deem appropriate. |

| 17. | Upon the allocation of Shares, the Board of Directors may impose differences between the Shareholders with respect to the amounts

for the calls on shares and/or their payment dates. |

| 18. | If under any of the allotment terms of any Shares, the consideration for the Share, will be in installments, in whole or in part,

every installment will be paid to the Company on the maturity date by the Person who is the registered owner of the Shares at such time

or by his guardian. |

| 19. | The Company may pay at any time any commission to any Person for his role as an underwrite his consent to act as an underwrite, irrespective

of whether it is contingent or not, for any Security, including a stock of the Company’s debentures or his consent to undersign,

irrespective of whether it is contingent or not, any Security, debenture, or stock bond of the Company. In each case, the commission can

be paid or paid off in cash or by the Company’s Securities, debentures, or stock bonds. |

Share Certificate/ Share Note

| 20. | Subject to and in accordance with the provisions of the Companies Law, a share certificate attesting to the proprietary right of the

Shares shall bear the Company’s stamp and printed name, together with the signature of a Director and the Secretary, or anyone else

appointed by the Company’s Board of Directors from time to time. |

| 21. | Every Registered Shareholder (including the listing company) shall be entitled to receive from the Company, pursuant to its request,

one share certificate for the Shares registered in his name, or if approved by the Board of Directors (after paying the amount to be determined

by the Board of Directors from time to time), several share certificates, each for one or more Shares; every share certificate will note

the number of shares with respect to which it was issued, the serial number of the shares, the par value of the shares, all subject to

the provisions of the Companies Law. |

| 22. | A share certificate registered in the name of two or more people shall be delivered to the person whose name appears first in the

Shareholders’ Register amongst the joint owners, with respect to the same Share, unless all the Registered Shareholders of the same

Share will instruct the Company, In Writing, to deliver it to another registered owner. |

| 23. | (A) |

The Company may deliver a share note with respect to the Shares whose full consideration was paid to the Company, which shall grant the

holder the rights to the noted shares and his right to transfer with the delivery of the shares and the provisions of these Articles

with respect to the transfer of shares shall not apply to the shares noted in such share note; |

| (B) | A Shareholder who duly holds a share note shall be entitled

to return it to the Company for the purposes of cancelling and transferring the share registered in his name; and he shall be entitled,

in consideration of the fees determined by the Board of Directors, that his name be registered in the Shareholders’ Register with

respect to the shares noted in the share note, and a share certificate will be issued in his name; |

| (C) | The holder of a share note may deposit the share note in

the Office, and as long as deposited therein, the depositor shall have the right to demand that the Company convene a meeting, in accordance

with and subject to the provisions of the Companies Law and these Articles, to be present and vote and use the other rights of Shareholders

at any meeting convened according to his aforementioned demand, 48 hours after the deposit, as though is name was registered in the Shareholders’

Register as the owner of the Shares included in the share note. Only one person shall be deemed the depositor of the Share, and the Company

must return the share note to the depositor if he so requested In Writing, at least two days in advance. |

| | | |

| | | If the aforementioned share note was not deposited, the

holder thereof shall not have the rights specified in this subclause (c), and subject to the provisions of these Articles, he shall have

all other rights afforded to the Company’s Shareholders. |

| 24. | If the Share Certificate or share note shall be lost or defaced or damaged, the Board of Directors may issue a new Share Certificate

or share note in their place, provided that the Share Certificate or share note was not cancelled by the Company, or it was proven to

the satisfaction of the Board of Directors that the Share Certificate or share note was lost or defaced, and the Company received guarantees

to the satisfaction of the Board of Directors, with respect to any possible damages, all in consideration for the payment, should the

Board of Directors decide to impose it. The provisions of sections 20 – 23 above shall also apply with respect to the issuance of

a new Share Certificate, mutatis mutandis. |

Calls on Shares

| 25. | The Board of Directors may from time to time, according to its discretion, submit, calls on shares to the Shareholders for any proceeds

not paid with respect to the Shares held by each of the Shareholders, and which according to the allocation terms of the Shares are not

payable on fixed dates, and each Shareholder must pay the Company the amounts set forth in the calls on shares submitted to him, at such

time and place that shall be determined by the Board of Directors. The calls on shares may be made in installments. The date for the calls

on shares will be on the date so decided by the Board of Directors with respect to the calls on shares. |

| 26. | Fourteen (14) days prior notice shall be delivered for every call on shares which will note the payment amount and place of payment.

Notwithstanding the aforementioned, prior to the payment date of any calls on shares, the Board of Directors may, by providing notice

In Writing to the Shareholders, to cancel the calls on shares or extend its payment date, provided that the aforementioned decision was

adopted before the payment date for the calls on shares. |

| 27. | Joint owners of a Share will be jointly liable for the payment of all amounts and installments for the calls on shares due for this

Share. |

| 28. | If the allocation terms of any Share, or otherwise, require the payment of the entire amount on the fixed date or installments on

fixed dates, the entire amount or installment shall be repaid, as though the calls on shares were duly submitted by the Board of Directors

and with respect to which notice was duly delivered, and the provisions of these Articles with respect to the calls on shares shall also

apply on such amount or such installment. |

| 29. | If the calls on shares or installment was not paid on or before the payment date, the person who, at such time, is the Shareholder

with respect to which the call on shares was submitted or with respect to which a certain installment is due, must pay interest on the

aforementioned interest, at such rate that shall be determined by the Board of Directors from time to time, or lawful permissible rate

at such time, from the date set for payment until the actual date of payment, however, the Board of Directors may waive the interest payment,

in whole or in part. |

| 30. | If deemed appropriate by the Board of Directors, it may receive from a Shareholder interested in advancing proceeds not yet called

upon or whose payment date has not yet matured and not yet paid on account of his shares, or any part thereof. The Board of Directors

may pay interest to the Shareholder the aforementioned proceeds that were advanced, or any part thereof, through the date the funds should

have been paid had they not been proceeded, according to the rate agreed upon between the Board of Directors and the Shareholders. |

Forfeiture and Lien on Shares

| 31. | If a Shareholder did not pay the consideration, he committed to pay, in whole or in part, on the date and terms set determined, whether

calls on shares were issued or not, the Board of Directors may at any time deliver notice to the Shareholders and demand that he pay the

amount not yet paid, plus interest accrued and all expenses borne by the Company with respect to non-payment. |

| 32. | The notice will set a date, which will be at least fourteen (14) days after the date of the notice, the

place, or places where the aforementioned calls on shares or installments, plus the aforementioned interest and expenses. The notice that

in the event of non-payment on the fixed date and the place noted in the notice, the Company may decide to forfeit the Shares with respect

to which the calls on shares were made or the payment installment date. |

| 33. | If all the demands in the aforementioned notice were not met, then anytime therefore, prior to the payment for the calls on share

or the installment, the interest, and the expenses due in connection with these Shares, the Board of Directors may, pursuant to a resolution

with respect to the subject matter, to forfeit the Shares with respect to which the aforementioned notice was provided. Forfeiture shall

also be applicable on declared dividends with respect to the forfeited Shares that were not actually paid in full before the forfeiture. |

| 34. | Any forfeited share shall be deemed the Company’s property, and the Board of Directors may, while considering the provisions

of these Articles, sell, reallocate, or otherwise transfer them as it shall deem appropriate, all subject to the provisions of the Companies

Law. |

| 35. | Forfeited shares that have not yet been sold shall be dormant shares and shall not grant any rights insofar as they are owned by the

Company. |

| 36. | The Board of Directors may at any time prior to the sale, reallocation or other transfer of any aforementioned forfeited share cancel

the forfeiture according to the terms that the Board of Directors shall deem appropriate. |

| (A) | A Shareholder whose Shares have been forfeited shall cease to be a Shareholder with respect to the forfeited Shares, however, shall

still be required to pay all the calls on shares, the payment installments, interest and expense sue on account of or for these Shares

prior to the forfeiture, plus interest on the amount due from the forfeiture date through the date of payment, at the maximum permissible

rate according to the law, unless the forfeited Shares were sold and the Company received the full consideration due from the Shareholder,

plus the ancillary expenses for the sale; |

| (B) | If the consideration received from the sale of the forfeited Shares was greater than the consideration due by the Shareholder of the

foregoing forfeited Shares, the Shareholder shall be entitled to a reimbursement of partial payment received with respect thereto, if

any, subject to the provisions of the allocation agreement, provided that the consideration that the Company shall receive shall not be

less than the full consideration amount which the Shareholder of the forfeited Shares committed to pay, plus the ancillary expenses to

the sale. |

| 37. | The provisions of these Articles concerning the forfeiture of the Shares shall also be applicable in the event of non-payment of an

amount known before the issuance terms of the Share with a fixed payment date, as though the amount due pursuant to the calls on shares

was delivered and notified with respect thereto. |

| 38. | The Company shall have the right to a first-ranking lien on the Shares registered in the name of every Shareholder, save for the Shares

paid in full, and every income from the sale and repayment of the debts and obligations of the same Shareholder to the Company, whether

alone or together with anyone else, whether the repayment date for these debts matured or not or any performance date for these obligations,

whether matured or not, irrespective of the sources of these debts, and no rights in equity shall not be created for the Share. The aforementioned

delay and lien shall apply on all dividends declared from time to time on these Shares. Unless otherwise decided, the registration by

the Company for the transfer of Shares shall be deemed a waive by the Company on the lien or delay (if any) of the Shares. |

| 39. | For the purposes of exercising the aforementioned lien, the Board of Directors may sell the pledged shares in a manner it shall deem

appropriate, at its discretion; however, no Share shall be sold unless the period noted in section 32 above has lapsed, and notice In

Writing was delivered to the Shareholder (or anyone entitled to this correspondence following his death or bankruptcy or liquidation or

receivership) indicating that the Company’s intends to sell the Share, and the Shareholder or anyone entitled to such Share did

not pay the aforementioned debts or did not meet or perform the aforementioned obligations during fourteen (14) days from the date the

notice was sent. |

| 40. | Income from such sale, after the repayment of the expenses of the sale, shall be used for the repayment of the debts and performance

of the obligations of such Shareholder (including, the debts, obligations, and engagements whose repayment date or performance date have

not yet matured) and the provisions of section 36(b) shall apply, mutatis mutandis. |

| 41. | In the event of a sale following the forfeiture or for the purposes of executing the lien by use of the powers granted above, the

Board of Directors may appoint a person to sign a transfer deed of the sold share and register the buyer in the Shareholders’ Register

as the Shareholder of the sold Shares, and after his name was registered in the Shareholders’ Register with respect to these Shares,

the effect of the sale shall not be appeal, and the remedy for any person injured by the sale shall solely be to seek damages from the

Company only. |

Transfer and Delivery of Shares

| 42. | Any transfer of Shares shall be registered in the Shareholders’ Register in the name of the Registered Shareholder, including

any transfer to or from a listing company, which shall be made In Writing, provided that the transfer deed be signed by hand only, by

the transferor and the transferee, alone or by a proxy, and signed by witnesses, and the transferor will continue to be deemed the Shareholder

of the transferred Shares until the registration of the transferee as the Shareholder of the transferred Shares in the Shareholders’

Register. Subject to the provisions of the Companies Law, no transfer of Shares shall be registered unless the transfer deed shall be

delivered to the Company’s Registered Office, as set forth below. |

| | |

| | The share transfer deed shall be prepared and completed

on the form below or similar manner, insofar as possible, or in an ordinary or customary manner that shall be approved by the Chairman

of the Board of Directors: |

“I,_____________,

of____________(the “Transferor”), in consideration of NIS ______________, paid to me by__________, of__________ (the “Transferee”)

do hereby transfer to the Transferee______________Shares, par value NIS ______, each, marked with the numbers__________through___________,

inclusive, of _________Ltd., which shall be held by the Transferee, the executor of his estate, guardian, and agent, according to the terms

held in my possession on the eve of the signing date of this deed, and I, the Transferee do hereby agree to receive the aforementioned

Shares according to the aforementioned terms.”

IN WITNESS THEREOF, WE HAVE SET

OUR HANDS HERETO ON__________.

| |

The

Transferor | | The

Transferee |

|

| |

| | |

|

| |

Witness for the Transferor’s

Signature | | Witness

for the Transferee’s Signature |

|

| 43. | The Company may close the Shareholders’ Register for a period that will be determined by the Board of Directors, provided that

it shall not exceed thirty (30) days in any given year. The Company shall notify the Shareholders that the Shareholders’ Register

is closed, in accordance with the provisions of these Articles concerning the delivery of notices to the Shareholders. |

| 44. | (A) |

A transfer deed shall be submitted to the Office for the purposes of registration, together with the share certificates for the Shares

being transferred, if issued, and any other proof that will be required by the Company’s Board of Directors. Registered transfer

deeds shall remain with the Company, however, any transfer deed that the Board of Directors refuses to register, shall be returned upon

demand to the person who submitted them, together with the share certificate (if submitted). If the Board of Directors refused to approve

the transfer of shares, they shall notify the transferor no later than thirty (30) days from the receipt date of the transfer deed; |

| (B) | The Company may demand the payment of fees for the registration

of the transfer which shall be determined by the Company’s Board of Directors. |

| 45. | The guardians of executors of an estate of a sole Shareholder who is deceased, or if there are no executors

of estate or guardians, the Persons who are entitled to be the deceased sole Shareholder’s successors, will be the individuals who

the Company shall recognize as the holder of the rights of the Share registered in the decedent’s name |

| 46. | If a Shares is registered in the name of two or more Shareholders of the Share, the Company shall recognize the surviving partner

or partners as the Persons with the right or benefit in the Shares, however this shall not exempt the estate of the estate joint holder’s

security from any debt with respect to the jointly held Security. If a Share was registered in the name of several joint holders, as aforementioned,

they shall be each entitled to transfer the right. |

| 47. | Any Person who shall become the rights holder of Shares following the death of a Shareholder, will be eligible, after providing proof

of a last will or the appointment of a guardian or provision of a probate order, attesting to such that he has the right to the Shares

of the deceased Shareholder, to be registered as the Shareholder of these Shares, or may, subject to the provisions of these Articles,

transfer these Shares. |

| 48. | The Company may recognize a receiver or liquidator of a Shareholder that is a corporation being dissolved or liquidated or a trustee

in bankruptcy proceedings or any receive of a bankrupt Shareholder as the holder of the rights of Shares registered in the name of such

Shareholder. |

| 49. | The receiver or liquidator of a Shareholder that is a corporation being dissolved or liquidated, or a trustee in bankruptcy proceedings

or the receiver of a bankrupt Shareholder, may, after providing attestations that shall be requested by the Board of Directors that attest

to the right of the dissolved or liquidated or bankrupt Shareholder, with the consent of the Board of Directors (and the Board of Directors

may refuse to provide its consent without providing any reason for its refusal), to be registered as a Shareholder, with respect to theses

Shares, or may, subject to the provisions of these Articles, transfer these Shares. |

| 50. | The foregoing provisions concerning the transfer of Shares shall also apply to the transfer of other Securities of the Company, mutatis

mutandis. |

Redeemable Securities

| 51. | The Company may issue or allocate redeemable Securities, subject to the provisions of these Articles concerning the issuance of Securities. |

| 52. | If the Company issued redeemable Securities may redeem them, and the provisions of Article II Section G of the Companies Law shall

not apply. |

| 53. | If the Company issued redeemable Securities, it may link their traits to Shares, including voting rights and the right to participate

right in profits. |

Alterations of Share Capital

| 54. | The Company may, from time to time, by way of a resolution adopted by an ordinary majority in a General Meeting, increase its registered

share capital with different classes of shares, as shall be determined. |

| 55. | Unless otherwise noted in the resolution approving the increase

of the share capital, as aforementioned, the provisions of these Articles shall apply to the new Shares. |

| 56. | Pursuant to the resolution adopted by an ordinary majority in the General Meeting, the Company may: |

| A. | Consolidate or redistribute its share capital into shares with a larger nominal value than the existing Shares, and if the Shares

did not have any nominal value – to capital composed of a smaller number of shares, provided that it shall not be sufficient to

modify the holdings of the Shareholders of the issued share capital. |

For the purposes of executing the aforementioned resolution,

the Board of Directors may at its discretion, settle any difficulty arising with respect thereto, inter alia, to issue certificates

with fractional shares or certificates in the names of the number of Shareholders who will eb included and are eligible to receive the

fractional shares due to them.

Without derogating from the Board of Directors’ power,

as aforementioned, in the event that as a result of the consolidation, there will be fractional shares following the consolidation of

the Shares of the Shareholders, the Board of Directors, with the approval by an ordinary majority in the General Meeting:

| (1) | To sell all fractional shares and for this purpose, appoint

a trustee and in his name share certificates that includes the fractional shares will be issued, and who will sell the fractional shares

and the consideration received less the fees and expenses shall be distributed amongst the eligible parties; or – |

| (2) | To allot to each Shareholder to whom following the consolidation had fractional shares, Shares from the

class of shares prior to the consolidation, paid in full, said number whose consolidation together with the fractional share would create

one whole Share and the allocation as aforementioned shall be deemed effective, prior to the consolidation; or – |

| (3) | To determine that the Shareholders will not be entitled to receive a whole consolidated share with respect to the fractional shares

from the consolidation, arising from the consolidation of half or less than the number of consolidated shares create one whole consolidated

share, and they shall be eligible to receive one whole consolidated shares for the fractional shares from the consolidation, arising from

the consolidation of more than half of the number of shares whose consolidation created one whole consolidated Share; |

| | | |

| | | In the event of any activity according to paragraphs (2)

or (3) above shall require issuing additional Shares, the repayment shall be made in such a manner permitting the repayment of bonus shares.

Consolidation and division, as aforementioned, shall not be deemed a change of rights of the Shares, subject to the consolidation and

division; |

| B. | To redistribute the existing Shares of the share capital,

in whole or in part, to shares with a lower nominal value of the nominal value of the existing Shares, and if the shares do not have

a nominal value – to issued share capital comprised of a greater number of Shares, provided that is shall not be sufficient to

modify the Shareholders’ holding in the issued share capital; |

| C. | To cancel the registered share capital on the date the resolution was adopted, prior to the allocation, provided that the Company

does not have any commitment, including any continent commitment, to allocate the Shares; |

| D. | To reduce the Shares in the Company’s issued share capital so that these Shares shall be cancelled, and the consideration paid

with respect to their nominal value shall be registered in the Company’s books, as a capital principal which shall be deemed for

all intents and purposes, as a premium paid for the Shares remaining in the Company’s issued share capital; |

| E. | To consolidate its share capital, in whole or in part, to one class of Shares, and the Company may decide to compensate the Company’s

Shareholders, in whole or in part, with respect to the consolidation of the capital, by way of allocating the bonus shares for the same

Shareholders. |

| F. | To reduce the nominal value of the Company’s Shares, and the provisions of subclause d above shall apply, mutatis mutandis,

also with respect to the reduce nominal value of the Company’s Shares, as aforementioned. |

General Meetings

| 57. | The Company shall convene an annual meeting every year no later

than fifteen (15) months following the last annual meeting. A General Meeting that is not an annual meeting shall be referred to as a

special meeting. |

| 58. | The agenda for the annual meeting will include the following issues: |

| (A) | A discussion of the Company’s periodic reports, including, inter alia, the Company’s audited financial statements

and the Board of Directors’ report for the status of the Company’s affairs, submitted to the General Meeting; |

| (B) | Appointment of Directors; |

| (C) | Appointment of the Company’s auditor and receipt of a report to determine the auditor’s salary; |

| (D) | Any issue that the Board of Directors decided to present to the General Meeting for a resolution. |

| 59. | Insofar as to the extent that it shall be deemed appropriate by the Board of Directors, it may convene a special meeting at its discretion,

and special meetings shall convene according to the demand of two Directors or one quarter of the Directors in office at such time or

according to the demand of one or more Shareholders, who hold at least five percent (5%) of the issued capital and at least one percent

(1%) of the voting rights in the Company, or one or more Shareholders who have at least five percent (5%) of the voting rights in the

Company. |

If the Board of Directors has been requested to convene

a special meeting, it shall convene the meeting within twenty one (21) days from the date the demand was submitted on such date that shall

be fixed for the special meeting set in the notice, as set forth in section 62(b) below, provided that the date to convene the meeting

shall not be more than thirty five (35) days from the date the notice was issued, subject to the provisions of the Law.

| 60. | If the Board of Directors did not convene a special meeting, as noted in section 59 above, the demanding party is entitled, and with

respect to Shareholders – also a part thereof holding more than half of their voting rights, to convene the meeting itself, provided

that the meeting shall not take place following the lapse of 3 months from the date the said demand was made, and the meeting shall be

convened, as closely as possible to the manner in which meetings are convened by the Board of Directors. |

| 61. | (A) |

The agenda of a General Meeting shall be determined by the Board of Directors and shall also include items due to which convening a special

meeting was demanded under section 59 above, as well as an item as detailed in subclause (b) below; |

| (B) | One or more Shareholder holdings at least one percent (1%)

of the voting rights in the General Meeting may request the Board of Directors to include an item in a future General Meeting’s

agenda, as long as it is an appropriate item to be discussed in a General Meeting, subject to the provisions of the Companies Law; |

| (C) | A request as detailed in subclause (b) above, shall be submitted

to the Company, In Writing, at least seven (7) days prior to the notice to convene a General Meeting, and the language of the resolution

proposed by the Shareholder shall be attached thereto, unless otherwise determined by any applicable law. |

| 62. | (A) |

Notice of a General Meeting shall be published in at least two daily circulated newspapers published in Hebrew or on the Company’s

website, as prescribed by law and on the dates prescribed under the law, and the Company shall not deliver any additional notice to the

Registered Shareholders in the Company’s Shareholders’ Register, unless otherwise required by law; |

| (B) | A notice to convene a General Meeting shall detail the type

of meeting, the place, date, and time where the General Meeting shall be convened, it will include the agenda, a summary of the proposed

resolutions, the majority required for adopting the resolutions, and the date determining all the Shareholders’ rights to vote

in the General Meeting. If a date has been set for a postponed meeting, that is not on the same day of the week, time and place, the

date shall be detailed in the notice. |

| 63. | The General Meeting may assume the powers granted to any other organ, for a certain matter or for a certain period that shall not

exceed the time required under the circumstances of the matter. If the General Meeting assumed the powers of the Company’s Board

of Directors, the Shareholders will be responsible and liable for the obligations and responsibility of the Board of Directors, pertaining

to the exercise of the powers, mutatis mutandis, and the provisions of Chapters Three, Four, and Five of Article Six of the Companies

Law, shall be applicable upon them, while considering their holdings in the Company, their participation in the meeting and the manner

of the vote. |

| 64. | A flaw made in good faith when convening or when conducting the General Meeting, including a flaw due to a failure to follow a provision

or a condition provided by the Companies Law or by these Articles, including with regard to the manner for convening or conducting the

General Meeting, will not lead to the dismissal of any resolution adopted by the General Meeting and shall not impair the discussions

held during said meeting, subject to the provisions of any law. |

Voting Rights

| 65. | A Shareholder interested in voting in the General Meeting shall prove to the Company his ownership of the Share, as required by any

applicable law. |

| 66. | (A) |

The Company may determine an effective date for the purposes of eligibility to participate and vote in the General Meeting, provided

that this date shall not exceed 21 days from the date set to convene the General Meeting and shall not be less than 4 days before the

meeting is convened; |

| (B) | Notwithstanding the provisions in subsection (a) above, a

General Meeting whose agenda shall include mattes enumerated in Section 87(a) of the Companies Law, the Company shall set an effective

date that shall not be greater than 40 days and no less than 28 days before the date the General Meeting is convened, unless the law

permits setting an earlier effective date. |

(C)

| 67. | A Shareholder who is a minor and any Shareholder with respect to whom the courts have declared as legally incompetent, may vote by

way of their guardians, and any guardian may vote by proxy. |

| 68. | Subject to the provisions of any applicable law, in the event of joint owners of a Share, each owner may vote in any Meeting, whether

in person or through an agent, with regard to the said Share, as if he was the sole owner thereof. In the event that more than one of

the joint owners in a Share participates in a Meeting, whether in person or through an agent, the owner whose name appears first in the

Shareholders’ Register with regard to the said Share or in the certificate of ownership or any other document determined by the

Board of Directors for such matters, shall vote, accordingly. Several guardians or several estate managers of a deceased Registered Shareholder

will be deemed, for the purposes of this section, as joint owners of the said Shares. |

| 69. | Shareholders may vote in person or by way of a proxy, as stipulated below. |

| 70. | If a Shareholder of the Company is a corporation, according to a resolution made by its directors or any other managing body, it may

appoint a Person that it deems appropriate to serve at its representative in every General Meeting. The aforementioned Person who is appointed

to serve as the corporation’s representative may use the same voting rights that the corporation itself may use, as though it was

a sole Shareholder. The Chairman of the Meeting may demand from every such appointed person reasonable proof that he is the corporation’s

authorized representative, as a condition for the Person’s participation in the Meeting. |

It is hereby clarified that the provisions of sections

71 – 75 below concerning the letter or appointment shall not apply to the authorized representative of the corporation, except

for the voting agent on behalf of the corporation.

| 71. | Any document appointing a voting agent (“Appointment Letter”) shall be executed In

Writing and signed by the appointing party or his agent who has power In Writing to do so, and if the appointing party is a corporation,

the Appointment Letter shall be executed In Writing and signed by the corporation’s authorized signatories and the corporation’s

stamp or signed by the authorized agent. |

| 72. | The Appointment Letter, or a certified copy thereof, which shall be to the satisfaction of the Board of Directors, shall be deposited

at the Office or in another place designated to convene the General Meeting, at least 48 hours prior to the set date for the commencement

of any Meeting in which the Person appointed in said Appointment Letter, intends to vote. Notwithstanding, the Chairman of the Meeting

may waive this demand with respect to all participants in any given Meeting, and receive their Appointment Letter, or a copy thereof,

to the satisfaction of the Chairman of the Meeting, upon the commencement of the Meeting. |

| 73. | A Shareholder who holds more than one Share, will be entitled to appoint more than one agent, subject the provisions below: |

| (A) | The Appointment Letter will note the class and the number of Shares for which it has been issued, and in cases required according

to the law, reference to the question of a personal matter of the Shareholder in the engagement of the General Meeting’s agenda; |

| (B) | If the Appointment Letter was issued with regard to a larger number of Shares than the number of Shares registered to one Shareholder

for the same class of Shares, he holds, all the Appointment Letter issued by the Shareholder for the surplus shares shall be cancelled,

and it shall not derogate from the validity of the vote for the shares he holds; |

| (C) | If the Shareholder appointed only a voting agent and the Appointment Letter did not state the number and class of Shares for which

it has been issued, the Appointment Letter shall be considered as though issued only for the Shares held by the Shareholder on the date

the Appointment Letter was deposited with the Company or on the date submitted to the Chairman of the Meeting, as the case may be. If

the Appointment Letter was issued with regard to a smaller number of Shares held by the Shareholder, the Shareholder shall be deemed as

being absent from the vote with regard to the remainder of his Shares and the Appointment Letter shall be in effect with regard to the

number of Shares listed therein. |

| 74. | The Appointment Letter for the General Meeting shall be executed in the form below or similar form insofar as possible or ordinary

or customary form approved by the Chairman of the Board of Directors: |

“I

,__________, of____________, a shareholder of____________Ltd., (the “Company”), do hereby appoint____________, the

holder of ID No.___________, of______________, or in his/her absence ___________, the holder of ID No. ____________ of

_______________, or in his/her absence ______________, the holder of ID No. _____________, of________________, to vote on my

behalf and in my name with respect to the class of ____________shares in my possession

at the Annual/ Special General Meeting of the Company/ class meeting of the ________________Shareholders, that shall convene on ______________,

and any adjourned meeting thereof.”

In witness whereof signed by me this day of________,_________

Signature

| 75. | A vote made in accordance with an Appointment Letter shall be in effect even if prior to the voting the appointing party had died,

or the Appointment Letter was cancelled or the Share for which the Appointment Letter had been issued was transferred, unless the Company’s

Office had received a notice In Writing, prior to the meeting, of the death, cancellation, or transfer or by the Chairman of the Meeting

prior to the vote. |

Discussions and Adopting Resolutions at General

Meetings

| 76. | A discussion in a General Meeting shall not begin unless the legal quorum is present within half an hour from the time scheduled to

start the meeting. Save for cases otherwise stipulated upon in the Companies Law or these Articles, quorum shall exist when at least two

(2) Shareholders, holding at least one quarter (1/4) of the voting rights in the Company, are present, whether in person or through an

agent. |

| 77. | If by the end of half an hour from the time scheduled for starting the Meeting a quorum had not been present, the Meeting shall be

postponed to the following week, on the same day, time and place, or to a later date if such date had been detailed in the notice of the

Meeting, and the agenda for which the first meeting was called will be discussed at the postponed meeting. If there is no quorum at the