As

filed with the Securities and Exchange Commission on August 14, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Tenon

Medical, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware | | 3841 | | 45-5574718 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

104

Cooper Court

Los

Gatos, CA 95032

(408)

649-5760

(Address,

including zip code, and telephone number, including area code,

of

registrant’s principal executive offices)

Steven

M. Foster

Chief

Executive Officer and President

Tenon

Medical, Inc.

104

Cooper Court

Los

Gatos, CA 95032

(408)

649-5760

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

| Ross D. Carmel,

Esq. |

|

| Jeffrey P. Wofford, Esq. |

|

| Sichenzia Ross Ference

Carmel LLP |

|

| 1185 Avenue of Americas,

31st Floor |

|

| New York, New York 10036 |

|

| Telephone: (212) 930-9700 |

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ¨

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Commission acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting

an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT TO

COMPLETION |

DATED AUGUST

14, 2024 |

Up

to [*] shares of Common Stock

Common

Warrants to Purchase up to [*] shares of Common Stock

Pre-funded

Warrants to Purchase up to [*] shares of Common Stock

Up

to [*] shares of Common Stock underlying the Common Warrants

Up

to [*] shares of Common Stock underlying the Pre-funded Warrants

Tenon

Medical, Inc.

We

are offering on a best efforts basis up to [*] shares of our common stock, par value $0.001 per share, together with common warrants

to purchase up to [*] shares of common stock, (the “Common Warrants”), at an assumed combined public offering price of $[*]

per share and accompanying Common Warrant, based on the closing price of our common stock on The Nasdaq Capital Market, or Nasdaq, on

[*], 2024. Common Warrants are immediately exercisable on the date of issuance at an exercise price of $[*] per share (100% of the offering

price per share and accompanying Common Warrant) and will expire five years from the date of issuance. The shares of common stock and

Common Warrants are immediately separable and will be issued separately in this offering but must be purchased together in this offering.

We

are also offering pre-funded warrants (the “Pre-funded Warrants”) to purchase up to [*] shares of common stock to those purchasers

whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related

parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately

following the consummation of this offering, in lieu of shares of common stock that would result in beneficial ownership in excess of

4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each Pre-funded Warrant will be immediately exercisable,

is exercisable for one share of our common stock and has an exercise price of $0.0001 per share. The Pre-Funded Warrants will expire

when exercised in full. Each Pre-funded Warrant is being offered together with the Common Warrants. The Pre-funded Warrants and Common

Warrants are immediately separable and will be issued separately in this offering but must be purchased together in this offering. For

each Pre-funded Warrant that we sell, the number of shares of common stock we are offering will be reduced on a one-for-one basis.

Pursuant

to the registration statement related to this prospectus, we are also registering the shares of common stock issuable upon exercise of

the Common Warrants and the Pre-Funded Warrants.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “TNON.” The last reported sale price of our common stock

on The Nasdaq Capital Market on August, 2024 was $[*] per share.

We

do not intend to apply to list the Common Warrants or Pre-Funded Warrants on any national securities exchange or other nationally recognized

trading system. Without an active trading market, the liquidity of the Common Warrants and Pre-Funded Warrants will be limited.

The

public offering price for the securities in this offering will be determined at the time of pricing, and may be at a discount to the

current market price at the time. Therefore, the assumed public offering price used throughout this prospectus may not be indicative

of the final offering price. The final public offering price will be determined through negotiation between us, the placement agent and

the investors based upon a number of factors, including our history and our prospects, the industry in which we operate, our past and

present operating results, the previous experience of our executive officers and the general condition of the securities markets at the

time of this offering.

The

securities will be offered at a fixed price and are expected to be issued in a single closing. We expect this offering to be completed

not later than [one][two] business day[s] following the commencement of sales in this offering (the effective date of the registration

statement of which this prospectus forms a part) and we will deliver all securities to be issued in connection with this offering delivery

versus payment/receipt versus payment upon receipt of investor funds received by us. Accordingly, neither we nor the placement agent

have made any arrangements to place investor funds in an escrow account or trust account since the placement agent will not receive investor

funds in connection with the sale of the securities offered hereunder.

We

have engaged [*] (whom we refer to herein as “[*]” or the “Placement Agent”) as our exclusive placement agent

to use its reasonable best efforts to solicit offers to purchase our securities in this offering. The placement agent has no obligation

to purchase any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities.

Because there is no minimum offering amount required as a condition to closing in this offering, the actual public offering amount, placement

agent’s fee and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering

amounts set forth above and throughout this prospectus. We have agreed to pay the placement agent the placement agent fees set forth

in the table below. See “Plan of Distribution” in this prospectus for more information.

We

intend to use the proceeds from this offering for sales and marketing activities, including building a sales and marketing infrastructure,

training clinicians to use our products, clinical studies, and general corporate purposes, including working capital. See “Use

of Proceeds.”

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for

a discussion of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We

are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and we have elected

to comply with certain reduced public company reporting requirements.

| | |

Per

Share

And

Accompanying

Common

Warrant | | |

Per

Pre-funded

Warrant and

Accompanying

Common

Warrant | | |

Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Placement agent fees(1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds, before expenses,

to us(2) | |

$ | | | |

$ | | | |

$ | | |

| (1) |

Represents a cash fee equal

to [*]% of the aggregate purchase price paid by investors in this offering. See “Plan of Distribution” beginning

on page 112 of this prospectus for a description of the compensation to be received by the placement agent. |

| |

|

| (2) |

The amount of offering

proceeds to us presented in this table does not give effect to any exercise of the Common Warrants or Pre-Funded Warrants. |

We

anticipate that delivery of the securities against payment therefor will be made on or before ,

2024.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus or any prospectus supplement or amendment. Neither we, nor the placement

agent, have authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus.

If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the placement agent take

responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should

assume that the information contained in this prospectus, or any free writing prospectus is accurate only as of the date of this prospectus,

regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results

of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction in which

such offer is unlawful.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution

of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States

are required to inform themselves about and to observe any restrictions as to this public offering and the distribution of this prospectus

applicable to that jurisdiction.

ABOUT

THIS PROSPECTUS

Throughout

this prospectus, unless otherwise designated or the context suggests otherwise,

| ● | all

references to the “Tenon,” the “Company,” the “registrant,”

“we,” “our,” or “us” in this prospectus mean Tenon Medical,

Inc.; |

| ● | “year”

or “fiscal year” means the year ending December 31st; and |

| ● | all

dollar or $ references, when used in this prospectus, refer to United States dollars. |

Market

Data

Market

data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research,

consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry

surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from

sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. To our knowledge, certain third-party

industry data that includes projections for future periods does not consider the effects of the worldwide coronavirus pandemic. Accordingly,

those third-party projections may be overstated and should not be given undue weight. We have not independently verified any of the data

from third party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys,

industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry, have

not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition,

we do not necessarily know what assumptions regarding general economic growth were used in preparing the forecasts we cite. Statements

as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry

data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors,

including those discussed under the heading “Risk Factors” in this prospectus. We are, however, liable for the information

in the prospectus related to the market and industry data.

PROSPECTUS

SUMMARY

This

summary provides a brief overview of the key aspects of our business and our securities. The reader should read the entire prospectus

carefully, especially the risks of investing in our common stock discussed under “Risk Factors.” Some of the statements contained

in this prospectus, including statements under “Summary” and “Risk Factors” as well as those noted in the documents

incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. Our actual results

and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking

statements in this document, which speak only as of the date on the cover of this prospectus.

Introduction

The

Company was incorporated in the State of Delaware on June 19, 2012 and was headquartered in San Ramon, California until June 2021 when

it relocated to Los Gatos, California. The Company is a medical device company that has developed The Catamaran™ SI Joint Fusion

System (“The Catamaran System”) that offers a novel, less invasive approach to the sacroiliac joint (the “SI Joint”)

using a single, robust, titanium implant for treatment of the most common types of SI Joint disorders that cause lower back pain. The

Company received U.S. Food and Drug Administration (“FDA”) clearance in 2018 for The Catamaran System and is currently focused

on the US market. Since the national launch of The Catamaran System in October 2022, the Company is focused on three commercial opportunities:

1) Primary SI Joint procedures, 2) Revision procedures of failed SI Joint implants and 3) SI Joint fusion adjunct to a spine fusion construct.

The

Opportunity

We

estimate that over 30 million American adults have chronic lower back pain. Published clinical studies have shown that 15% to 30% of

all chronic lower back pain is associated with the SI-Joint. For patients whose chronic lower back pain stems from the Sacroiliac Joint

(“SI-Joint”), our experience in both clinical trials and commercial settings indicates the system to be introduced by Tenon

could be beneficial for patients who are properly diagnosed and screened for surgery by trained healthcare providers.

In

2019, approximately 475,000 patients in the United States were estimated to have received an aesthetic injection to temporarily alleviate

pain emanating from the SI-Joint and/or to diagnose SI-Joint pain. Additionally, several non-surgical technologies have been introduced

in the past 10 years to address patients who do not respond to conservative options, including systemic oral medications, opioids, physical

therapy and injection therapy.

To

date, the penetration of a surgical solution for this market has been relatively low (5-7%). We believe this is due to complex surgical

approaches and suboptimal implant design of existing options. The penetration of this market with an optimized surgical solution is Tenon’s

focus.

We

believe the SI-Joint is the last major joint to be successfully addressed by the spine implant industry. Studies have shown that disability

resulting from disease of the SI-Joint is comparable to the disability associated with a number of other serious spine conditions, such

as knee and hip arthritis and degenerative disc disease, each of which has surgical solutions where an implant is used, and a multi-billion-dollar

market exists.

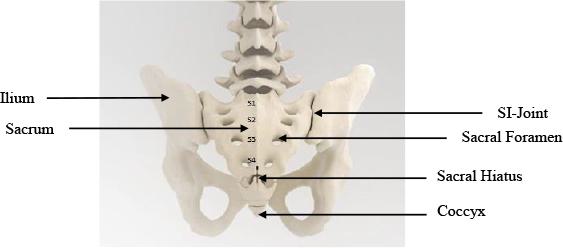

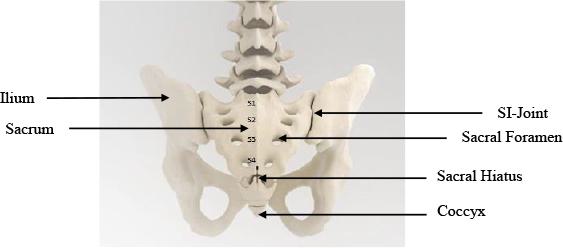

The SI-Joint

The

SI-Joint is a strong weight bearing synovial joint situated between the lumbar spine and the pelvis and is aligned along the longitudinal

load bearing axis of the human spine when in an upright posture. It functions as a force transfer conduit where it transfers axial loads

bi-directionally from the spine to the pelvis and lower extremities and allows forces to be transmitted from the extremities to the spine.

It also provides load sharing between the hip and spine to contribute towards attenuation of impact shock and stress from activities

of daily living.

The

SI-Joint is a relatively immobile joint that connects the sacrum (the spinal segment that is attached to the base of the lumbar spine

at the L5 vertebra) and the ilium of the pelvis. Each SI-Joint is approximately 2-4mm wide and irregularly shaped.

Motion

of the SI-Joint features vertical shear and rotation. Although the rotational forces about the SI-Joint are relatively low, repetitive

motions created by daily activities such as walking, jogging, twisting at the hips, and jumping can increase the stresses on the SI-Joint.

If the SI-Joint is compromised through injury or degeneration, the load bearing and motion restraints from the surrounding anatomical

structures of the SI-Joint will be compromised resulting in abnormal stress transfers across the joint to these structures, thereby further

augmenting the degenerative cascade of the SI-Joint. Eventual pain and cessation of an individual’s normal activities due to a

painful and unstable SI-Joint have led to an increase in the recent development of SI-Joint stabilization devices.

Non-Surgical

Treatment of Sacroiliac Joint Disease

Several

non-surgical treatments exist for suspected sacroiliac joint pain. These conservative steps often provide desired relief for the patient.

Non-surgical treatments include:

| ● | Drug

Therapy: including opiates and non-steroidal anti-inflammatory medications. |

| ● | Intra-Articular

Injections of Steroid Medications: which are typically performed by physicians who specialize

in pain treatment or anesthesia. |

| ● | Radiofrequency

Ablation: or the cauterizing of the lateral branches of the sacral nerve roots. |

When

conservative steps fail to deliver sustained pain relief and return to quality of life, specific diagnostic protocols are utilized to

explore if a surgical option should be considered.

Diagnosis

Historically,

diagnosing pain from the SI-Joint was not routinely a focus of orthopedic or neurosurgery training during medical school or residency

programs. Due to its invasiveness, post-operative pain, and muscle disruption along with a difficult procedure overall, the open SI-Joint

fusion procedure was rarely taught in these settings.

The

emergence of various SI-Joint surgical technologies has generated a renewed discussion of SI-Joint issues. Of particular focus is the

diagnostic protocol utilized to properly select patients for SI-Joint surgery. Patients with low back pain typically start with primary

care physicians who often refer to pain specialists. Here, the patient will undergo traditional physical therapy combined with oral medications

(anti-inflammatory, narcotic, etc.). If the patient fails to respond to these steps the pain specialist may move to therapeutic injections

of the SI-Joint. These injections may serve to lessen inflammation to the point that the patient is satisfied. However, the impact from

these injections is often transient. In this case the patient is often referred to a clinician to determine if the patient may be a candidate

for surgical intervention. A series of provocative tests in clinic, combined with a specific injection protocol to isolate the SI-Joint

as the pain generator is then utilized to confirm the need for surgical intervention. Published literature has shown this technique to

be a very effective step to determine the best treatment to alleviate pain.

Limitations

of Existing Treatment Options

Surgical

fixation and fusion of the SI-Joint with an open surgical technique was first reported in 1908, with further reports in the 1920s. The

open procedure uses plates and screws, requires a 6 to 12-inch incision and is extremely invasive. Due to the high invasiveness and associated

morbidity, the use of this procedure is limited to cases involving significant trauma, tumor, etc.

Less

invasive surgical options along with implant design began to emerge over the past 15 years. These options feature a variety of approaches

and implant designs and have been met with varying degrees of adoption. Lack of a standard and accepted diagnostic approach, complexity

of approach, high morbidity of approach, abnormally high complication rates and inability to radiographically confirm fusion have all

been cited as reasons for low adoption of these technologies.

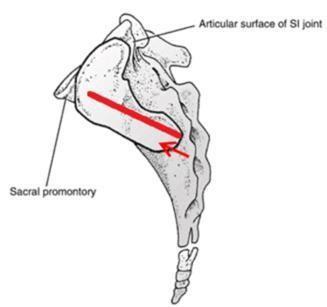

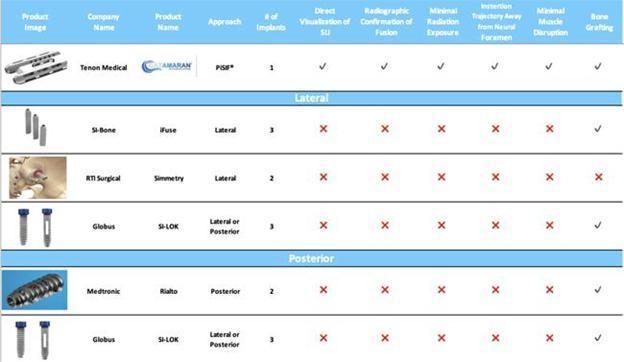

Commercialization

Tenon

initiated its national commercial launch of The Catamaran System in October 2022 to address what we believe is a large market opportunity.

The Catamaran System includes instruments and implants designed to prepare and fixate the SI-Joint for fusion. The Catamaran System is

distinct from other competitive offerings in the following ways:

| ● | Inferior

/ Posterior Sacroiliac Fusion Approach |

| ● | Reduced

Approach Morbidity |

| ● | Direct

And Visualized Approach to the SI-Joint |

| ● | Single

Implant Technique |

| ● | Insertion

Trajectory Away from the Neural Foramen |

| ● | Insertion

Trajectory Away from Major Lateral Vascular Structures |

| ● | Autologous

Bone Grafting in the Ilium, Sacrum and Bridge |

| ● | Radiographic

Confirmation of Bridging Bone Fusion of the SI-Joint |

The

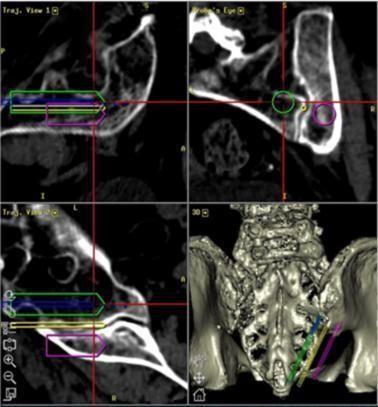

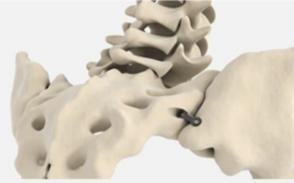

fixation device and its key features are shown below:

|

Key

Features

“Pontoon”

in the ilium

“Pontoon”

in the sacrum

“Pontoons

and Bridge” filled with autologous bone from drilling process

Leading

edge osteotome creates defect and facilitates ease of insertion |

The

Catamaran System is a singular implant designed with several proprietary components which allow for it to be explicitly formatted to

address the SI-Joint with a single approach and implant. This contrasts with several competitive implant systems that require multiple

approach pathways and implants to achieve fixation. In addition, the inferior-posterior approach is designed to be direct to the joint

and through limited anatomical structures which may minimize the morbidity of the approach. The implant features a patented dual pontoon

open cell design which enables the clinician to pack the pontoons with the patient’s own autologous bone designed to promote bone

fusion across the joint. The Catamaran System is designed specially to resist vertical shear and rotation of the joint in which it was

implanted, helping stabilize the joint in preparation for eventual fusion.

The

instruments we have developed are proprietary to The Catamaran System and specifically designed to transfix the SI-Joint and facilitate

an inferior-posterior approach that is unique to the system.

Tenon

also has developed a proprietary 2D placement protocol as well as a protocol for 3D navigation utilizing the latest techniques in spine

surgery. These Tenon advancements are intended to further enhance the safety of the procedure and encourage more physicians to adopt

the procedure.

In

October 2022, we received Institutional Review Board (“IRB”) approval from WCG IRB for two separate Tenon-sponsored post

market clinical studies of The Catamaran System. The approval by WCG allows designated Catamaran study centers to begin recruiting and

enrolling patients into the clinical studies. The first approval from WCG IRB will support a prospective, multi-center, single arm post

market study that will evaluate the clinical outcomes of patients with sacroiliac joint disruptions or degenerative sacroiliitis treated

with The Catamaran System. Patients will be followed out to 24 months assessing various patient reported outcomes, radiographic assessments,

and adverse events. The second prospective, multi-center, Catamaran study will evaluate 6-to-12-month radiographic outcomes to assess

fusion of patients that have already undergone treatment with The Catamaran System. In addition, retrospective and prospective clinical

outcomes will be evaluated. We anticipate completing enrollment by the end of the third quarter of 2024.

For

a description of the challenges, we face and the risks and limitations that could harm our prospects, see “Risk Factors.”

Recent

Developments

Increase

of shares subject to our Incentive Stock Option Plan

On

July 23, 2024, at our annual meeting of stockholders, our stockholders approved a 1.1 million share increase in the number of shares

subject to the Tenon Medical, Inc. 2022 Equity Incentive Plan (the “2022 Plan”). There are currently 1,408,959 shares reserved

for issuance under the 2022 Plan, of which 1,154,173 shares are available for future grants.

Retirement

of the Company’s Chief Financial Officer

On

July 31, 2024, Steven Van Dick retired from his positions as Executive Vice President, Finance and Administration, Chief Financial Officer

and Assistant Secretary. The Company is actively searching for a qualified candidate to fill the role of Chief Financial Officer. Mr.

Van Dick will continue as a part time advisor to the Company and continue to assist with the transition of his responsibilities and provide

strategic advice as requested until December 31, 2024.

Nasdaq

Notice of Failure to Comply with Continued Listing Standards

On

May 7, 2024, we received a letter from the Nasdaq Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”)

stating that for the 30 consecutive business day period between March 25, 2024 and May 6, 2024, our common stock had not maintained a

minimum closing bid price of $1.00 per share required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule

5550(a)(2) (the “Bid Price Rule”). Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), we were provided an initial period of 180

calendar days, or until November 4, 2024 (the “Compliance Period”), to regain compliance with the Bid Price Rule.

To

regain compliance, the closing bid price of our common stock must meet or exceed $1.00 per share for a minimum of 10 consecutive trading

days, unless extended by Nasdaq under Nasdaq Rule 5810(c)(3)(H), prior to November 4, 2024.

If

we do not regain compliance with the Bid Price Rule by November 4, 2024, we may be eligible for an additional 180-day period to regain

compliance if we meet all of the other Nasdaq listing criteria and if Nasdaq does not believe we will not be able to regain compliance

within such 180-day period. If we cannot regain compliance during the Compliance Period or any subsequently granted compliance period,

our common stock will be subject to delisting.

Our

common stock continues to be listed on The Nasdaq Capital Market under the symbol “TNON”. We are currently evaluating our

options for regaining compliance.

The

notice from Nasdaq has no immediate effect on the listing or trading of our common stock on The Nasdaq Capital Market and does not affect

our business, operations or reporting requirements with the SEC.

On

December 21, 2023, at a special meeting of our stockholders our stockholders approved an amendment to our Certificate of Incorporation

, at our annual meeting of stockholders, our stockholders approved to provide for a reverse stock split (the “Reverse Stock Split”)

of the Common Stock, that will be at a ratio ranging from one for two (1:2) to one for fifty (1:50), the final determination of which

shall be determined by the Board. We may effect the Reverse Stock split within the approved range to regain compliance with the Bid Price

Rule.

Exchange

Offer

On

April 8, 2024, we launched a one-time stock option exchange program (the “Option Exchange”) pursuant to which eligible participants

were able to exchange outstanding stock options for a lesser amount of new restricted stock units (“RSUs”). Our executive

officers, non-employee directors and consultants were eligible to participate in the Option Exchange. Employees, non-employee directors

and consultants received one RSU for every two shares of our common stock underlying the eligible options surrendered. This “exchange

ratio” (2-for-1) was applied on a grant-by-grant basis. The Option Exchange expired on May 6, 2024 at 11:59 p.m., Eastern Time.

At that time, stock options to purchase 83,391 shares of our common stock were surrendered and 41,698 new RSUs were issued under the

2022 Plan.

2024

Series A Offering

On

February 20, 2024, we entered into a Securities Purchase Agreement (the “Series A Purchase Agreement”) with certain investors

(the “Series A Investors”), pursuant to which the Company agreed to sell, issue and deliver to the Series A Investors, in

a private placement offering (the “Series A Offering”), a total of 172,239 shares of the Company’s Series A Preferred

Stock (the “Series A Preferred Stock”) and warrants (the “Series A Warrants”) to purchase 258,374 shares of common

stock, par value $0.001 per share, of the Company (“Common Stock”) at an exercise price equal to $1.2705 per share for an

aggregate offering price of $2,605,000. Under the Series A Purchase Agreement, each Series A Investor paid $15.125 for each share of

Series A Preferred Stock. In addition, each investor received Series A Warrants to purchase a number of shares of our common stock equal

to 15% of the number of shares of our common stock underlying the shares of Series A Preferred Stock purchased by such investor. In connection

with the offering of the Series A Preferred Stock the Company exchanged the Notes (as defined below) for 84,729 shares of Series A Preferred

Stock and Series A Warrants to purchase 157,094 shares of our common stock. There are a total of 256,968 shares of Series A Preferred

Stock outstanding as of August 13, 2024.

2023

Note Offering

On

November 21, 2023, we entered into securities purchase agreements with certain investors (the “Note Investors”), pursuant

to which we agreed to sell, issue and deliver to the Note Investors, in a private placement offering (the “Note Offering”),

a total of $1,250,000 in secured notes (the “Notes”) and warrants (the “Note Warrants”) to purchase 45,000 shares

of our common stock at an exercise price equal to $1.94 per share. The Company received $1,125,000 from the Note Offering after payment

of investor expenses. As described above, the Notes have been repaid in full and are no longer outstanding.

The

Note Warrants expire five (5) years from the issuance date of the Note Warrants. The Note Warrants contain a “cashless exercise”

feature and contain anti-dilution rights on subsequent issuances of equity or equity equivalents.

Summary

Risk Factors

Our

business is subject to numerous risks and uncertainties, any one of which could materially adversely affect our results of operations,

financial condition or business. These risks include, but are not limited to, those listed below. This list is not complete, and should

be read together with the section titled “Risk Factors” below:

| ● | We

have incurred losses in the past, our financial statements have been prepared on a going

concern basis and we may be unable to achieve or sustain profitability in the future; |

| ● | Practice

trends or other factors, may cause procedures to shift from the hospital environment to ambulatory

surgical centers (“ASCs”), where pressure on the prices of our products is generally

more acute; |

| ● | If

hospitals, clinicians, and other healthcare providers are unable to obtain and maintain coverage

and reimbursement from third-party payors for procedures performed using our products, adoption

of our products may be delayed, and it is unlikely that they will gain further acceptance; |

| ● | We

may not be able to convince physicians that The Catamaran System is an attractive alternative

to our competitors’ products and that our procedure is an attractive alternative to

existing surgical and non-surgical treatments of the SI-Joint; |

| ● | Clinicians

and payors may not find our clinical evidence to be compelling, which could limit our sales,

and ongoing and future research may prove our products to be less safe and effective than

initially anticipated; |

| ● | Pricing

pressure from our competitors, changes in third-party coverage and reimbursement, healthcare

provider consolidation, payor consolidation and the proliferation of “physician-owned

distributorships” may impact our ability to sell our product at prices necessary to

support our current business strategies; |

| ● | We

operate in a very competitive business environment and if we are unable to compete successfully

against our existing or potential competitors, our sales and operating results may be negatively

affected and we may not grow; |

| ● | We

currently manufacture (through third parties) and sell products used in a single procedure,

which could negatively affect our operations and financial condition; |

| ● | Our

sales volumes and our operating results may fluctuate over the course of the year; |

| ● | Various

factors outside our direct control may adversely affect manufacturing and distribution of

our product; |

| ● | We

are dependent on a limited number of contract manufacturers, some of them single-source and

some of them in single locations, for our product, and the loss of any of these contract

manufacturers, or their inability to provide us with an adequate supply of products in a

timely and cost-effective manner, could materially adversely affect our business; |

| ● | As

our sales grow, our contract manufacturers may encounter problems or delays in the manufacturing

of our product or fail to meet certain regulatory requirements which could result in an adverse

effect on our business and financial results; |

| ● | The

size and future growth in the market for the SI-Joint fixation market have not been established

based on market reports and our estimates are based on our own review and analysis of public

information and may be smaller than we estimate, possibly materially. In addition, our estimates

of cost savings to the economy and healthcare system as a result of The Catamaran System

procedure are based on our internal estimates and market research and could also be smaller

than we estimate, possibly materially. If our estimates and projections overestimate the

size of this market or cost savings, our sales growth may be adversely affected; |

| ● | If

we experience significant disruptions in our information technology systems, our business,

results of operations, and financial condition could be adversely affected; |

| ● | We

may seek to grow our business through acquisitions of or investments in new or complementary

businesses, products or technologies, and the failure to manage acquisitions or investments,

or the failure to integrate them with our existing business, could have a material adverse

effect on us; |

| ● | We

may enter into collaborations, in-licensing arrangements, joint ventures, strategic alliances,

or partnerships with third-parties that may not result in the development of commercially

viable products or the generation of significant future revenue; |

| ● | We

are increasingly dependent on information technology, and our systems and infrastructure

face certain risks, including cybersecurity and data leakage risks; |

| ● | Geopolitical

conditions, including trade disputes and direct or indirect acts of war or terrorism, could

have an adverse effect on our operations and financial results; |

| ● | Inflation

may adversely affect our operations and financial results; |

| ● | We

and our contract manufacturers are subject to extensive governmental regulation both in the

United States and abroad, and failure to comply with applicable requirements could cause

our business to suffer; |

| ● | Our

employees, independent contractors, consultants, contract manufacturers, and our independent

sales representatives may engage in misconduct or other improper activities, relating to

regulatory standards and requirements; |

| ● | We

are subject to environmental laws and regulations that can impose significant costs and expose

us to potential financial liabilities; |

| ● | Our

ability to protect our intellectual property and proprietary technology is uncertain; |

| ● | We

may not be able to protect our intellectual property rights throughout the world; |

| ● | The

sale or issuance of our common stock to Lincoln Park may cause dilution and the sale of the

shares of common stock acquired by Lincoln Park, or the perception that such sales may occur,

could cause the price of our common stock to fall; and |

| ● | Our

management will have broad discretion over the use of the net proceeds from our sale of shares

of common stock to Lincoln Park, and you may not agree with how we use the proceeds and the

proceeds may not be invested successfully. |

Corporate

Information

Our

principal executive offices are located at 104 Cooper Court, Los Gatos, CA 95032. Our website address is www.tenonmed.com. The information

included on our website is not part of this prospectus.

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”).

We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of

the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last

day of the fiscal year in which we have total annual gross revenues of $1.235 billion or more; (iii) the date on which we have issued

more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated

filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future, but cannot retain

our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before the last day of

the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration

statement under the Securities Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions

from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These

exemptions include:

| ● | being

permitted to provide only two years of audited financial statements, in addition to any required

unaudited interim financial statements, with correspondingly reduced “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| ● | not

being required to comply with the requirement of auditor attestation of our internal controls

over financial reporting; |

| ● | not

being required to comply with any requirement that may be adopted by the Public Company Accounting

Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s

report providing additional information about the audit and the financial statements; |

| ● | reduced

disclosure obligations regarding executive compensation; and |

| ● | not

being required to hold a nonbinding advisory vote on executive compensation and shareholder

approval of any golden parachute payments not previously approved. |

We

have taken advantage of certain reduced reporting requirements in this prospectus. Accordingly, the information contained herein may

be different than the information you receive from other public companies in which you hold stock.

An

emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for

complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting

standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended

transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption

of such standards is required for other public reporting companies.

We

are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

SUMMARY

OF THE OFFERING

| Securities

offered by us |

|

Up

to [*] shares of common stock and accompanying Common Warrants to purchase up to [*] shares of common stock at a assumed combined

public offering price of $[*] per share and Common Warrant, based on the closing price of our common stock on Nasdaq, on [*], 2024.

Each Warrant will have an exercise price of $[*] per share (100% of the combined public offering price per share and accompanying

Common Warrant), is exercisable immediately and will expire five years from the date of issuance. Each share of common stock and

accompanying Common Warrant is immediately separable upon issuance and will be issued separately in this offering. |

| |

|

|

| Pre-Funded

Warrants offered by us |

|

We are also offering to

those purchasers whose purchase of common stock in this offering would otherwise result in the purchaser, together with its affiliates

and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding

common stock immediately following the closing of this offering, in lieu of purchasing common stock, Pre-funded Warrants to purchase

up to an aggregate of [*] shares of our common stock. Each Pre-funded Warrant is exercisable for one share of our common stock. The

purchase price of each Pre-funded Warrant is equal to the price at which a share of common stock is being sold to the public in this

offering, minus $0.0001, and the exercise price of each Pre-funded Warrant is $0.0001 per share. The Pre-funded Warrants are exercisable

immediately and may be exercised at any time until all of the Pre-funded Warrants are exercised in full. This offering also relates

to the shares of common stock issuable upon exercise of any Pre-funded Warrants sold in this offering. For each Pre-funded Warrant

that we sell, the number of shares of common stock that we are offering will be reduced on a one-for-one basis |

| |

|

|

| Common

Warrants offered by us |

|

Each share of common stock

will be sold together with one Common Warrant. Each Common Warrant has an exercise price per share equal to 100% of the combined

public offering price per share and accompanying Common Warrant. the Common Warrant is exercisable immediately and will expire

five years from the date of issuance. Because we will issue a Common Warrant for each share of common stock and for each Pre-funded

Warrant sold in this offering, the number of Common Warrants sold in this offering will not change as a result of a change in the

mix of shares of Common Stock and Pre-Funded Warrants sold. See “Description of the Securities–Warrants”. |

| |

|

|

| Common

stock to be outstanding after the offering(1)(2) |

|

[*] shares (assuming no

exercise of the Common Warrants and no sale of Pre-funded Warrants). |

| Use of Proceeds |

|

We currently

intend to use the net proceeds to us from this offering to expand the commercial launch of our product including training clinicians

on The CATAMARAN System procedure, continuing clinical marketing studies that are focused on capturing post-market safety data, hire

additional employees, other marketing activities and for working capital and general corporate purposes. See the section of this

prospectus titled “Use of Proceeds” beginning on page 46. |

| |

|

|

| Listing |

|

Our

common stock and tradeable warrants (“Tradeable Warrants”) trade on The Nasdaq Capital Market under the symbols “TNON”

and “TNONW,” respectively.

There

is no established public trading market for the Warrants and Pre-Funded Warrants and we do not expect a market to develop. In addition,

we do not intend to apply to list the Pre-Funded Warrants on any national securities exchange or other nationally recognized trading

system. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited. |

| |

|

|

| Risk Factors |

|

You should carefully consider

the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors”

section beginning on page 11 of this prospectus before deciding whether or not to invest in shares of our common stock. |

| |

|

|

| Transfer Agent and registrar |

|

VStock Transfer, LLC. |

| |

|

|

| Reasonable best efforts |

|

We have agreed to offer

and sell the securities offered hereby to the purchasers through the placement agent. The placement agent is not required to buy

or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit

offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page 112 of this prospectus. |

| |

|

|

| Lock-up agreements |

|

We

have agreed for a period of [*] ([*]) days after the closing date not to [*].

Each

of our executive officers and directors have agreed with the placement agent not to [*]. For additional information regarding our

arrangement with the placement agent, please see “Plan of Distribution.” |

| (1) | The

number of shares of common stock to be outstanding after this offering is based on 3,951,767

shares of common stock outstanding as of August 13, 2024, and excludes: |

| ● | 256,968 shares of our common stock underlying our Series A Preferred

Stock, which are convertible into 2,569,680 shares of common stock and vote with the common stock at a ratio of 10 votes for every one

share of Series A Preferred Stock; |

| ● | 45,000

shares of our common stock underlying our Note Warrants, with a per share exercise price

equal to the offering price of one share of common stock and the accompanying Common Warrant; |

| ● | 415,468 shares of our common stock underlying our Series A Warrants,

with a per share exercise price equal to $1.2705; |

| ● | 72,563 shares of our common stock issuable pursuant to granted equity

awards per our equity incentive plan, with a weighted average exercise price of $3.12 per share; |

| ● | 136,690

shares of our common stock issuable pursuant to restricted stock units granted pursuant to

our equity incentive plan; and |

| ● | 9,600

shares of our common stock issuable upon the exercise of warrants issued to the underwriters

in our initial public offering that closed on April 29, 2022, with an exercise price of $50.00

per share. |

| (2) | Unless

otherwise indicated, this prospectus reflects and assumes the following: |

| ● | no

exercise of outstanding options or warrants described above; and |

| ● | no

exercise of the Common Warrants, and no sale of Pre-funded Warrants, which, if sold, would

reduce the number of shares of common stock that we are offering on a one-for-one basis. |

RISK

FACTORS

Our

business is subject to many risks and uncertainties, which may affect our future financial performance. If any of the events or circumstances

described below occur, our business and financial performance could be adversely affected, our actual results could differ materially

from our expectations, and the price of our stock could decline. The risks and uncertainties discussed below are not the only ones we

face. There may be additional risks and uncertainties not currently known to us or that we currently do not believe are material that

may adversely affect our business and financial performance. You should carefully consider the risks described below, together with all

other information included in this prospectus including our financial statements and related notes, before making an investment decision.

The statements contained in this prospectus that are not historic facts are forward-looking statements that are subject to risks and

uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements.

If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case,

the trading price of our common stock could decline, and investors in our securities may lose all or part of their investment.

Risks

Related to Our Business and Operations

We

have incurred losses in the past, our financial statements have been prepared on a going concern basis and we may be unable to achieve

or sustain profitability in the future.

To

date, we have financed our operations primarily through the issuance of public and private equity and convertible notes. We have devoted

substantially all of our resources to research and development, creating the infrastructure for a publicly traded medical device company,

preparing for our national commercial launch, and clinical and regulatory matters for our products. There can be no assurances that we

will be able to generate sufficient revenue from our existing products or from any future product candidates to transition to profitability

and generate consistent positive cash flows. We expect that our operating expenses will continue to increase as we continue to build

our commercial infrastructure, develop, enhance, and commercialize our existing and new products and incur additional operating and reporting

costs associated with being a public company. As a result, we expect to continue to incur operating losses for the foreseeable future

and may never achieve profitability. Furthermore, even if we do achieve profitability, we may not be able to sustain or increase profitability

on an ongoing basis. If we do not achieve profitability, it will be more difficult for us to finance our business and accomplish our

strategic objectives.

Our

recurring losses from operations and negative cash flows raise substantial doubt about our ability to continue as a going concern. As

a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements

for the fiscal year ended, December 31, 2023, describing the existence of substantial doubt about our ability to continue as a going

concern. Our expected future capital requirements may depend on many factors including expanding our clinician base, increasing the rate

at which we train clinicians, the number of additional clinical papers initiated, and the timing and extent of spending on the development

of our technology to increase our product offerings. We may need additional funding to fund our operations but additional funds may not

be available to us on acceptable terms on a timely basis, if at all. We may seek funds through borrowings or through additional rounds

of financing, including private or public equity or debt offerings. If we raise additional funds by issuing equity securities, our stockholders

may experience dilution. Any future debt financing into which we enter may impose upon us additional covenants that restrict our operations,

including limitations on our ability to incur liens or additional debt, pay dividends, repurchase our common stock, make certain investments,

and engage in certain merger, consolidation or asset sale transactions. Any future debt financing or additional equity that we raise

may contain terms that are not favorable to us or our stockholders. Furthermore, we cannot be certain that additional funding will be

available on acceptable terms, if at all. If we are unable to raise additional capital or generate sufficient cash from operations to

adequately fund our operations, we will need to curtail planned activities to reduce costs, which will likely harm our ability to execute

on our business plan and continue operations.

If

hospitals, clinicians, and other healthcare providers are unable to obtain coverage and reimbursement from third-party payors for procedures

performed using our products, adoption of our products may be delayed, and it is unlikely that they will gain further acceptance.

Growing

sales of our product depends on the availability of adequate coverage and reimbursement from third-party payors, including government

programs such as Medicare and Medicaid, private insurance plans, and managed care programs. Hospitals, clinicians, and other healthcare

providers that purchase or use medical devices generally rely on third-party payors to pay for all or part of the costs and fees associated

with the procedures performed with these devices.

Adequate

coverage and reimbursement for procedures performed with our products is central to the acceptance of our current and future products.

We may be unable to sell our products on a profitable basis if third-party payors deny coverage, continue to deny coverage or reduce

their current levels of payment, or if our costs for the product increase faster than increases in reimbursement levels.

Many

private payors refer to coverage decisions and payment amounts determined by the Centers for Medicare and Medicaid Services, or CMS,

which administers the Medicare program, as guidelines for setting their coverage and reimbursement policies. By June 30, 2016, all Medicare

Administrative Contractors were regularly reimbursing for minimally invasive and/or open SI-Joint fusion. Private payors that do not

follow the Medicare guidelines may adopt different coverage and reimbursement policies for procedures performed with our products. Private

commercial payors have been slower to adopt positive coverage policies for minimally invasive and/or open SI-Joint fusion, and many private

payors still have policies that treat the procedure as experimental or investigational and do not regularly reimburse for the procedure.

Future action by CMS or third-party payors may further reduce the availability of payments to physicians, outpatient surgery centers,

and/or hospitals for procedures using our products.

The

healthcare industry in the United States has experienced a trend toward cost containment as government and private insurers seek to control

healthcare costs. Payors are imposing lower payment rates and negotiating reduced contract rates with service providers and being increasingly

selective about the technologies and procedures they choose to cover. There can be no guarantee that we will be able to provide the scientific

and clinical data necessary to overcome these policies. Payors may adopt policies in the future restricting access to medical technologies

like ours and/or the procedures performed using such technologies. Therefore, we cannot be certain that the procedures performed with

each of our products will be reimbursed. There can be no guarantee that, should we introduce additional products in the future, payors

will cover those products or the procedures in which they are used.

If

the reimbursement provided by third-party payors to hospitals, clinicians, and other healthcare providers for procedures performed using

our products is insufficient, adoption and use of our products and the prices paid for our implants may decline.

When

a Tenon procedure utilizing The Catamaran System is performed, both the clinician and the healthcare facility, a hospital (inpatient

or outpatient clinic), submit claims for reimbursement to the patient’s insurer. Generally, the facility obtains a lump sum payment,

or facility fee, for SI-Joint fusions. Our products are purchased by the facility, along with other supplies used in the procedure. The

facility must also pay for its own fixed costs of operation, including certain operating room personnel involved in the procedure, and

other medical services care. If these costs exceed the facility reimbursement, the facility’s managers may discourage or restrict

clinicians from performing the procedure in the facility or using certain technologies, such as The Catamaran System, to perform the

procedure.

The

Medicare 2022 national average hospital inpatient payment ranges from approximately $25,000 to approximately $59,000 depending on the

procedural approach and the presence of Complication and Comorbidity (CC)/Major Complication and Comorbidity (MCC).

The

Medicare 2022 national average hospital outpatient clinic payment is $21,897. We believe that insurer payments to facilities are generally

adequate for these facilities to offer The Catamaran System. However, there can be no guarantee that these facility payments will not

decline in the future. The number of procedures performed, and the prices paid for our implants may in the future decline if payments

to facilities for SI-Joint fusions decline.

Clinicians

are reimbursed separately for their professional time and effort to perform a surgical procedure. Depending on the surgical approach,

the incision size, type and extent of imaging guidance, indication for procedure, and the insurer, The Catamaran System procedure may

be reported by the clinician using any one of the applicable following CPT® codes 27279, 27280, 27299. The Medicare 2022 national

average payment for CPT® 27279 is $807 and $1,325 for 27280. CPT® 27299 has no national valuation. Clinicians, however, can present

a crosswalk to another procedure believed to be fairly equivalent and/or comparison to a code for which there is an existing valuation.

For

some governmental programs, such as Medicaid, coverage and reimbursement differ from state to state, and some state Medicaid programs

may not pay an adequate amount for the procedures performed with our products, if any payment is made at all. Similar to Medicaid, many

private payors’ coverage and payment may differ from one payer to another as well.

We

believe that some clinicians view the current Medicare reimbursement amount as insufficient for the procedure, given the work effort

involved with the procedure, including the time to diagnose the patient and obtain prior authorization from the patient’s health

insurer when necessary. Many private payors require extensive documentation of a multi-step diagnosis before authorizing SI-Joint fusion

for a patient. We believe that some private payors apply their own coverage policies and criteria inconsistently, and clinicians may

experience difficulties in securing approval and coverage for sacroiliac fusion procedures. Additionally, many private payors limit coverage

for open SI-Joint fusion to trauma, tumors or extensive spine fusion procedures involving multiple levels. The perception by physicians

that the reimbursement for SI-Joint fusion is insufficient to compensate them for the work required, including diagnosis, documentation,

obtaining payor approval for the procedure, and burden on their office staff, may negatively affect the number of procedures performed

and may therefore impede the growth of our revenues or cause them to decline.

We

may not be able to convince physicians that The Catamaran System is an attractive alternative to our competitors’ products and

that our procedure is an attractive alternative to existing surgical and non-surgical treatments of the SI-Joint.

Clinicians

play the primary role in determining the course of treatment in consultation with their patients and, ultimately, the product that will

be used to treat a patient. In order for us to sell The Catamaran System successfully, we must convince clinicians through education

and training that treatment with The Catamaran System is beneficial, safe, and cost-effective for patients as compared to our competitors’

products. If we are not successful in convincing clinicians of the merits of The Catamaran System, they may not use our product, and

we will be unable to increase our sales and achieve or grow profitability.

Historically,

most spine clinicians did not include SI-Joint pain in their diagnostic work-up because they did not have an adequate surgical procedure

to perform for patients diagnosed with the condition. As a result, some patients with lower back pain resulting from SI-Joint dysfunction

are misdiagnosed. We believe that educating clinicians and other healthcare professionals about the clinical merits and patient benefits

of The Catamaran System is an important element of our growth. If we fail to effectively educate clinicians and other medical professionals,

they may not include a SI-Joint evaluation as part of their diagnosis and, as a result, those patients may continue to receive unnecessary

or only non-surgical treatment.

Clinicians

may also hesitate to change their medical treatment practices for other reasons, including the following:

| ● | lack

of experience with minimally invasive procedures; |

| ● | perceived

liability risks generally associated with the use of new products and procedures; |

| ● | costs

associated with the purchase of new products; and |

| ● | time

commitment that may be required for training. |

Furthermore,

we believe clinicians may not widely adopt The Catamaran System unless they determine, based on experience, clinical data, and published

peer-reviewed publications, that surgical intervention provides benefits or is an attractive alternative to non-surgical treatments of

SI-Joint dysfunction. In addition, we believe support of our products relies heavily on long-term data showing the benefits of using

our product. If we are unable to provide that data, clinicians may not use our product. In such circumstances, we may not achieve expected

sales and may be unable to achieve profitability.

Clinicians

and payors may not find our clinical evidence to be compelling, which could limit our sales, and on-going and future research may prove

our product to be less safe and effective than initially anticipated.

All

of the component parts of The Catamaran System have either received premarket clearance under Section 510(k) of the U.S. federal Food,

Drug, and Cosmetic Act, or FDCA, or are exempt from premarket review. The 510(k) clearance process of the U.S. Food and Drug Administration,

or FDA, requires us to document that our product is “substantially equivalent” to another 510(k) -cleared product. The 510(k)

process is shorter and typically requires the submission of less supporting documentation than other FDA approval processes, such as

a premarket approval, or PMA, and does not usually require pre-clinical or clinical studies. Additionally, to date, we have not been

required to complete clinical studies in connection with the sale of our product. For these reasons, clinicians may be slow to adopt

our product, third-party payors may be slow to provide coverage, and we may be subject to greater regulatory and product liability risks.

Further, future patient studies or clinical experience may indicate that treatment with our product does not improve patient outcomes.

Such results would slow the adoption of our product by clinicians, significantly reduce our ability to achieve expected sales, and could

prevent us from achieving profitability. Moreover, if future results and experience indicate that our product causes unexpected or serious

complications or other unforeseen negative effects, we could be subject to mandatory product recalls, suspension, or withdrawal of FDA

clearance.

Pricing

pressure from our competitors, changes in third-party coverage and reimbursement, healthcare provider consolidation, payor consolidation

and the proliferation of “physician-owned distributorships” may impact our ability to sell our product at prices necessary

to support our current business strategies.

If

competitive forces drive down the prices we are able to charge for our product, our profit margins will shrink, which will adversely

affect our ability to invest in and grow our business. The SI-Joint fusion market has attracted numerous new companies and technologies.

As a result of this increased competition, we believe there will be continued and increased pricing pressure, resulting in lower gross

margins, with respect to our product.

Even

to the extent our product and procedures using our product are currently covered and reimbursed by third-party private and public payors,

adverse changes in coverage and reimbursement policies that affect our product, discounts, and number of implants used may also drive

our prices down and harm our ability to market and sell our product.

We

are unable to predict what changes will be made to the reimbursement methodologies used by third-party payors. We cannot be certain that

under current and future payment systems, in which healthcare providers may be reimbursed a set amount based on the type of procedure

performed, such as those utilized by Medicare and in many privately managed care systems, the cost of our product will be justified and

incorporated into the overall cost of the procedure. In addition, to the extent there is a shift from inpatient setting to outpatient

settings, we may experience pricing pressure and a reduction in the number of The Catamaran System procedures performed.

Consolidation

in the healthcare industry, including both third-party payors and healthcare providers, could lead to demands for price concessions or

to the exclusion of some suppliers from certain of our markets, which could have an adverse effect on our business, results of operations,

or financial condition. Because healthcare costs have risen significantly over the past several years, numerous initiatives and reforms

initiated by legislators, regulators, and third-party payors to curb these costs have resulted in a consolidation trend in the healthcare

industry to aggregate purchasing power. As the healthcare industry consolidates, competition to provide products and services to industry

participants has become and will continue to become more intense. This in turn has resulted and will likely continue to result in greater

pricing pressures and the exclusion of certain suppliers from important market segments as group purchasing organizations, independent

delivery networks, and large single accounts continue to use their market power to consolidate purchasing decisions for hospitals. We

expect that market demand, government regulation, third-party coverage, and reimbursement policies and societal pressures will continue

to change the worldwide healthcare industry, resulting in further business consolidations and alliances among our customers, which may

reduce competition, exert further downward pressure on the price of our product, and adversely impact our business, results of operations,

or financial condition. As we continue to expand into international markets, we will face similar risks relating to adverse changes in

coverage and reimbursement procedures and policies in those markets.

We

operate in a very competitive business environment and if we are unable to compete successfully against our existing or potential competitors,

our sales and operating results may be negatively affected and we may not grow.

The

Catamaran System is subject to intense competition. Many of our competitors are major medical device companies that have substantially

greater financial, technical, and marketing resources than we do, and they may succeed in developing products that would render our product

obsolete or non-competitive. In addition, many of these competitors have significantly longer operating histories and more established

reputations than we do. Our field is intensely competitive, subject to rapid change and highly sensitive to the introduction of new products

or other market activities of industry participants. Our ability to compete successfully will depend on our ability to develop proprietary

products that reach the market in a timely manner, receive adequate coverage and reimbursement from third-party payors, and are safer,

less invasive, and more effective than alternatives available for similar purposes as demonstrated in peer-reviewed clinical publications.

Because of the size of the potential market, we anticipate that other companies will dedicate significant resources to developing competing

products.

In

the United States, we believe that our primary competitors are currently SI-bone, Inc., Globus Medical, Inc., Medtronic plc, XTant Medical

Holdings, Inc., and RTI Surgical, Inc. At any time, these or other industry participants may develop alternative treatments, products

or procedures for the treatment of the SI-Joint that compete directly or indirectly with our product. If alternative treatments are,

or are perceived to be, superior to our product, sales of our product and our results of operations could be negatively affected. Some

of our larger competitors are either publicly traded or divisions or subsidiaries of publicly traded companies. These competitors may

enjoy several competitive advantages over us, including:

| ● | greater

financial, human, and other resources for product research and development, sales and marketing, and legal matters; |

| ● | significantly

greater name recognition; |

| ● | established

relationships with clinicians, hospitals, and other healthcare providers; |

| ● | large

and established sales and marketing and distribution networks; |

| ● | greater

experience in obtaining and maintaining domestic and international regulatory clearances or approvals, or CE Certificates of Conformity

for products and product enhancements; |

| ● | more

expansive portfolios of intellectual property rights; and |

| ● | greater

ability to cross-sell their products or to incentivize hospitals or clinicians to use their products. |

New

participants have increasingly entered the medical device industry. Many of these new competitors specialize in a specific product or

focus on a particular market segment, making it more difficult for us to increase our overall market position. The frequent introduction

by competitors of products that are or claim to be superior to our product or that are alternatives to our existing or planned products

may make it difficult to differentiate the benefits of our product over competing products. In addition, the entry of multiple new products

and competitors may lead some of our competitors to employ pricing strategies that could adversely affect the pricing of our product

and pricing in the market generally.

As

a result, without the timely introduction of new products and enhancements, our product may become obsolete over time. If we are unable

to develop innovative new products, maintain competitive pricing, and offer products that clinicians and other physicians perceive to

be as reliable as those of our competitors, our sales or margins could decrease, thereby harming our business.

We

currently manufacture (through third parties) and sell products used in a single procedure, which could negatively affect our operations

and financial condition.

Presently

we do not sell any products other than The Catamaran System and related tools and instruments. Therefore, we are solely dependent on

widespread market adoption of The Catamaran System and we will continue to be dependent on the success of this single product for the

foreseeable future. There can be no assurance that The Catamaran System will gain a substantial degree of market acceptance among clinicians,

patients or healthcare providers. Our failure to successfully increase sales of The Catamaran System or any other event impeding our

ability to sell The Catamaran System would result in a material adverse effect on our results of operations, financial condition and

continuing operations.

We