Virco Mfg. Corporation (Nasdaq: VIRC), the largest manufacturer and

supplier of movable furniture and equipment for educational

environments in the United States, today reported financial results

for the period ended April 30, 2022 (first quarter of fiscal 2023).

Net sales were $32.1 million for the first quarter

of fiscal 2023, a 13% increase from $28.4 million for the same

period of the prior fiscal year.

Net loss was ($5.1 million), or ($0.32) per diluted

share for the first quarter of fiscal 2023, an increase of 30% from

($3.9 million), or ($0.25) per diluted share, for the same period

of the prior fiscal year. The increased loss in the first quarter

was driven by orders that shipped in the first quarter after

original booking and pricing before the current inflationary

period. These inflation-impacted orders have now largely been

cleared from the Company’s backlog. In addition, the Company

recently negotiated modifications to its public procurement

contracts allowing for more frequent price adjustments to offset

inflationary impacts in the future. Management believes this

modification will have positive material impacts on the Company’s

operating margins going forward.

The market for educational furniture and equipment

remains strong. As of May 31, 2022, the fiscal year-to-date

shipments plus unshipped backlog (“Shipments + Backlog”), the

Company’s preferred measure of current and future business

activity, reached $144.4 million, a 35% increase from $107.3

million on the same date in the prior year. More significantly,

Shipments + Backlog were 20% higher than the company’s prior record

level achieved in May 2000 (fiscal year-end 2001), one year before

China’s entry into the World Trade Organization.

Robert Virtue, Chairman and CEO of Virco, said, “We

continue to see very strong order flow driven by increased funding

for schools and many customers returning to Virco after years of

using foreign suppliers who can no longer reliably provide quality

furniture and equipment at a competitive price. The strong order

flow resulted in an increase in revenue over the prior year and

significant growth in Shipments + Backlog, which continues to be at

a record level. Many of the orders shipped during our fiscal first

quarter were booked prior to the price increases that were

implemented at the beginning of the year, and the inflationary

pressures that increased during the first quarter exacerbated the

impact on our profitability. Almost all of our current backlog

reflects orders booked following our price increase, and we have

recently renegotiated our major public procurement contracts to

allow for bi-annual price adjustments. The new pricing and ability

to implement more frequent price adjustments should enable us to

better manage the impact of inflationary pressures on our operating

margins and deliver improved profitability in the future.”

Doug Virtue, President of Virco, added, “After

twenty years of competitive headwinds, we now have the wind at our

back. And as more schools invest in the future of American

students, who are literally the future of the country, we believe

we are ideally positioned to support those investments and provide

a long overdue reward to our patient shareholders.”

“We are effectively increasing capacity utilization

within our 2.3 million square feet of integrated manufacturing and

distribution facilities with factory output increasing by 45% over

the first quarter of last fiscal year. The long-term trends that

are driving our strong order flow remain intact and should lead to

continued growth in revenue as more schools utilize their increased

funding to upgrade or replace older furniture and we take

additional market share by providing our customers with innovative,

high-quality products that are delivered in a shorter timeframe

than what can be offered by our competitors. With higher revenue,

the positive impact of our new pricing, and increased capacity

utilization, we believe that we are well positioned to deliver

improved financial performance and create greater value for our

shareholders in the future.”

FIRST QUARTER FISCAL 2023 FINANCIAL RESULTS

Net sales were $32.1 million for the first quarter

of fiscal 2023, a 13% increase from $28.4 million for the same

period of the prior fiscal year.

Gross margin was 30.3% for the first quarter of

fiscal 2023, compared with 27.1% in the same quarter of the prior

fiscal year. The improvement in gross margin was primarily

attributable to better overhead absorption in the Company’s U.S.

factories, which increased unit output 45% compared to the same

period in the prior year.

Selling, general and administrative expenses for

the three months ended April 30, 2022 increased by approximately

$2,468,000 compared to the same period last year. The increase in

selling, general and administrative expenses was attributable in

part to increased variable freight and service expense and by

increased selling expenses. In addition, the Company incurred

increased legal expenses in the first quarter of 2022 to enforce

its intellectual property rights against a competitor in the school

furniture market and for outside legal counsel to advise a special

committee of the Board of Directors formed in May 2021 and

terminated in May 2022. The special committee was formed to review

and advise the Board on an unsolicited acquisition proposal with

the assistance of independent legal counsel and an independent

financial advisor, which proposal was ultimately rejected as

inadequate and not in the best interests of shareholders.

Interest expense was $427,000 for the first quarter

of fiscal 2023, compared with $293,000 in the same period of the

prior fiscal year. The higher interest expense was related to the

financing of higher inventory levels to support higher order rates

and record backlog.

Income tax benefit was $282,000 for the first

quarter of fiscal 2023 compared with $1,185,000 for the same period

of the prior year, reflecting the effect of the Company recording a

valuation allowance against deferred tax assets in the fourth

quarter of the fiscal year ended January 31, 2022.

About Virco Mfg. Corporation

Founded in 1950, Virco Mfg. Corporation is the

largest manufacturer and supplier of moveable educational furniture

and equipment for the preschool through 12th grade market in the

United States. The Company manufactures a wide assortment of

products, including mobile tables, mobile storage equipment, desks,

computer furniture, chairs, activity tables, folding chairs and

folding tables. Along with serving customers in the education

market - which in addition to preschool through 12th grade public

and private schools includes: junior and community colleges;

four-year colleges and universities; trade, technical and

vocational schools - Virco is a furniture and equipment supplier

for convention centers and arenas; the hospitality industry with

respect to banquet and meeting facilities; government facilities at

the federal, state, county and municipal levels; and places of

worship. The Company also sells to wholesalers, distributors,

traditional retailers and catalog retailers that serve these same

markets. With operations entirely based in the United States, Virco

designs, manufactures, and ships its furniture and equipment from

one facility in Torrance, CA and three facilities in Conway, AR.

More information on the Company can be found at www.virco.com.

Contact:Virco Mfg. Corporation

(310) 533-0474Robert A. Virtue, Chairman and Chief Executive

OfficerDoug Virtue, PresidentRobert Dose, Chief Financial

Officer

Non-GAAP Financial Information

This press release includes a statement of

shipments plus unshipped backlog as of May 31, 2022 compared to the

same date in the prior fiscal years. Shipments represent the dollar

amount of net sales actually shipped during the period presented.

Unshipped backlog represents the dollar amount of net sales that we

expect to recognize in the future from sales orders that have been

received from customers in the ordinary course of business. The

Company considers shipments plus unshipped backlog a relevant and

preferred supplemental measure for production and delivery

planning. However, such measure has inherent limitations, is not

required to be uniformly applied or audited and other companies may

use methodologies to calculate similar measures that are not

comparable. Readers should be aware of these limitations and should

be cautious as to their use of such measure.

Statement Concerning Forward-Looking

Information

This news release contains “forward-looking

statements” as defined by the Private Securities Litigation Reform

Act of 1995. These statements include, but are not limited to,

statements regarding: market share, net sales and profitability in

future periods; the impact of the COVID-19 pandemic on our

business, customers, competitors, supply chain and workforce; the

anticipated recovery of our customers from COVID-19 and re-opening

of school districts; business strategies; market demand and product

development; estimates of unshipped backlog; order rates and trends

in seasonality; product relevance; economic conditions and

patterns; the educational furniture industry including the domestic

market for classroom furniture; state and municipal bond and/or tax

funding; the rate of completion of bond funded construction

projects; cost control initiatives; absorption rates; the relative

competitiveness of domestic vs. international supply chains; trends

in shipping costs; use of temporary workers; marketing initiatives;

and international or non K-12 markets. Forward-looking statements

are based on current expectations and beliefs about future events

or circumstances, and you should not place undue reliance on these

statements. Such statements involve known and unknown risks,

uncertainties, assumptions and other factors, many of which are out

of our control and difficult to forecast. These factors may cause

actual results to differ materially from those that are

anticipated. Such factors include, but are not limited to:

uncertainties surrounding the severity, duration and effects of the

COVID-19 pandemic; changes in general economic conditions including

raw material, energy and freight costs; state and municipal bond

funding; state, local, and municipal tax receipts; order rates; the

seasonality of our markets; the markets for school and office

furniture generally, the specific markets and customers with which

we conduct our principal business; the impact of cost-saving

initiatives on our business; the competitive landscape, including

responses of our competitors and customers to changes in our

prices; demographics; and the terms and conditions of available

funding sources. See our Annual Report on Form 10-K for the year

ended January 31, 2022, our Quarterly Reports on Form 10-Q, and

other reports and material that we file with the Securities and

Exchange Commission for a further description of these and other

risks and uncertainties applicable to our business. We assume no,

and hereby disclaim any, obligation to update any of our

forward-looking statements. We nonetheless reserve the right to

make such updates from time to time by press release, periodic

reports, or other methods of public disclosure without the need for

specific reference to this press release. No such update shall be

deemed to indicate that other statements which are not addressed by

such an update remain correct or create an obligation to provide

any other updates.

Financial Tables Follow

Virco Mfg. Corporation

Unaudited Consolidated Balance

Sheets

| |

4/30/2022 |

|

1/31/2022 |

|

4/30/2021 |

|

(In thousands) |

| |

|

|

|

|

|

| Assets |

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

Cash |

$ |

539 |

|

$ |

1,359 |

|

$ |

556 |

| Trade accounts receivables,

net |

|

13,326 |

|

|

17,769 |

|

|

14,334 |

| Other receivables |

|

85 |

|

|

118 |

|

|

39 |

| Income tax receivable |

|

135 |

|

|

152 |

|

|

85 |

| Inventories |

|

66,297 |

|

|

47,373 |

|

|

42,875 |

| Prepaid expenses and other

current assets |

|

2,156 |

|

|

2,076 |

|

|

2,099 |

| Total current assets |

|

82,538 |

|

|

68,847 |

|

|

59,988 |

| Non-current assets |

|

|

|

|

|

| Property, plant and

equipment |

|

|

|

|

|

|

Land |

|

3,731 |

|

|

3,731 |

|

|

3,731 |

|

Land improvements |

|

653 |

|

|

653 |

|

|

734 |

|

Buildings and building improvements |

|

51,375 |

|

|

51,334 |

|

|

51,262 |

|

Machinery and equipment |

|

113,901 |

|

|

113,315 |

|

|

111,779 |

|

Leasehold improvements |

|

1,009 |

|

|

1,009 |

|

|

989 |

| Total property, plant and

equipment |

|

170,669 |

|

|

170,042 |

|

|

168,495 |

|

Less accumulated depreciation and amortization |

|

135,844 |

|

|

134,715 |

|

|

132,392 |

| Net property, plant and

equipment |

|

34,825 |

|

|

35,327 |

|

|

36,103 |

| Operating lease right-of-use

assets |

|

12,892 |

|

|

13,870 |

|

|

16,682 |

| Deferred tax assets, net |

|

769 |

|

|

399 |

|

|

12,879 |

| Other assets, net |

|

8,383 |

|

|

8,002 |

|

|

8,020 |

| Total assets |

$ |

139,407 |

|

$ |

126,445 |

|

$ |

133,672 |

Virco Mfg. Corporation

Unaudited Condensed Consolidated Balance

Sheets

| |

4/30/2022 |

|

1/31/2022 |

|

4/30/2021 |

| |

(In thousands, except share and par value

data) |

| |

|

|

|

|

|

| Liabilities |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

19,437 |

|

$ |

19,785 |

|

$ |

12,976 |

| Accrued compensation and employee

benefits |

|

5,055 |

|

|

5,596 |

|

|

4,597 |

| Current portion of long-term

debt |

|

18,905 |

|

|

340 |

|

|

2,990 |

| Current portion operating lease

liability |

|

4,769 |

|

|

4,734 |

|

|

4,715 |

| Other accrued liabilities |

|

6,049 |

|

|

5,829 |

|

|

4,364 |

| Total current liabilities |

|

54,215 |

|

|

36,284 |

|

|

29,642 |

| Non-current liabilities |

|

|

|

|

|

| Accrued self-insurance

retention |

|

1,533 |

|

|

965 |

|

|

1,530 |

| Accrued pension expenses |

|

15,332 |

|

|

15,430 |

|

|

21,520 |

| Income tax payable |

|

76 |

|

|

71 |

|

|

71 |

| Long-term debt, less current

portion |

|

14,564 |

|

|

14,173 |

|

|

14,795 |

| Operating lease liability, less

current portion |

|

10,297 |

|

|

11,437 |

|

|

14,573 |

| Other long-term liabilities |

|

640 |

|

|

639 |

|

|

683 |

| Total non-current

liabilities |

|

42,442 |

|

|

42,715 |

|

|

53,172 |

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

| Preferred stock: |

|

|

|

|

|

| Authorized 3,000,000 shares,

$0.01 par value; none issued or outstanding |

|

— |

|

|

— |

|

|

— |

| Common stock: |

|

|

|

|

|

| Authorized 25,000,000 shares,

$0.01 par value; issued and outstanding 16,102,023 shares at

4/30/2022 and 1/31/2022 and 15,918,642 at 4/30/2021 |

|

161 |

|

|

161 |

|

|

159 |

| Additional paid-in capital |

|

120,745 |

|

|

120,492 |

|

|

119,908 |

| Accumulated deficit |

|

(72,262 |

|

|

(67,178 |

|

|

(55,951 |

| Accumulated other comprehensive

loss |

|

(5,894 |

|

|

(6,029 |

|

|

(13,258 |

| Total stockholders’ equity |

|

42,750 |

|

|

47,446 |

|

|

50,858 |

| Total liabilities and

stockholders’ equity |

$ |

139,407 |

|

$ |

126,445 |

|

$ |

133,672 |

Virco Mfg. Corporation

Unaudited Condensed Consolidated

Statements of Operations

| |

Three months ended |

| |

4/30/2022 |

|

4/30/2021 |

| |

(In thousands, except per share data) |

|

Net sales |

$ |

32,084 |

|

$ |

28,367 |

| Costs of goods sold |

|

22,377 |

|

|

20,679 |

| Gross profit |

|

9,707 |

|

|

7,688 |

| Selling, general and

administrative expenses |

|

14,451 |

|

|

11,983 |

| Operating loss |

|

(4,744) |

|

|

(4,295) |

| Pension expense |

|

195 |

|

|

506 |

| Interest expense |

|

427 |

|

|

293 |

| Loss before income taxes |

|

(5,366) |

|

|

(5,094) |

| Income tax benefits |

|

(282) |

|

|

(1,185) |

| Net loss |

$ |

(5,084) |

|

$ |

(3,909) |

| |

|

|

|

| |

|

|

|

| Net loss per common share: |

|

|

|

| Basic |

$ |

(0.32) |

|

$ |

(0.25) |

| Diluted |

$ |

(0.32) |

|

$ |

(0.25) |

| Weighted average shares of common

stock outstanding: |

|

|

|

| Basic |

|

16,033 |

|

|

15,824 |

| Diluted |

|

16,033 |

|

|

15,824 |

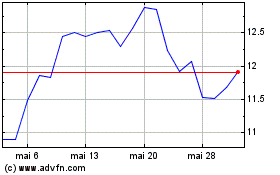

Virco Manufacturing (NASDAQ:VIRC)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Virco Manufacturing (NASDAQ:VIRC)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024