Virco Mfg. Corporation (NASDAQ: VIRC), a leading manufacturer and

supplier of movable furniture and equipment for educational

environments, announced results for the Company’s Second Quarter

and first six months ended July 31, 2024.

For the Second Quarter, including the months of May through

July, revenue increased 1.0% to $108,419,000 from $107,321,000 in

the same quarter of the prior year. For the first six months,

revenue was up 9.1% to $155,154,000 from $142,264,000 in the first

half of the prior year.

Gross profit for the second quarter improved to $50,218,000 from

$48,578,000 last year, on gross margin of 46.3% versus 45.3%.

Selling, General, and Administrative expenses increased slightly to

$28,324,000 or 26.1% of revenue, from $27,324,000 or 25.5% of

revenue in the same quarter of the prior year. The increase in

operating expense was due to a slightly higher number of

full-service orders and related installation expense.

Interest expenses for the second quarter were $322,000 compared

to $1,083,000 last year. Year-to-date, interest expenses were

$530,000 or 0.3% of sales compared to $1,795,000 or 1.3% of sales

last year. As of July 31, 2024 the Company was in a positive cash

position and was not utilizing any of the working capital available

to it through its seasonal credit facility with PNC Bank.

Management believes this is the first time in the Company’s 75-year

history that it has been debt-free in the middle of the summer

delivery season.

Operating Income for the second quarter improved to a record

$21,894,000 from $21,254,000 in the same quarter of the prior year.

This represents an operating margin of 20.2% vs. 19.8% last year.

For the first six months, including the Company’s traditionally

slower first quarter of February through April, Operating Income

was a record $24,865,000 compared to $19,942,000 in the prior year.

This improvement was driven by a combination of factors, including

higher factory output and related operating efficiencies as well as

a large counter-seasonal disaster recovery order that is currently

ongoing. This order is now blending into the Company’s normal

seasonal delivery pattern, which peaks in the second and third

quarters when schools are out of session. This particular customer

was able to take delivery earlier than usual, which had the highly

visible effect of boosting revenue and cash flow in the seasonally

light first quarter, contributing to a modest profit. Management

cautions that this unusual timing is unlikely to repeat itself, and

that the post-pandemic recovery of the school furniture market may

yet hold additional surprises—both positive and negative—that are

hard to predict.

In the Second Quarter the Company also completed a 5-year lease

renewal on its Torrance, California headquarters, factory, and

distribution center. The Company has occupied this facility, which

totals 560,000 square feet, since 1994. The Company also owns over

1,750,000 square feet of combined factory and distribution space in

Conway, Arkansas, where it has operations dating back to 1954.

These strategic geographies provide the Company with significant

logistical advantages in the highly seasonal market for bulky

school furniture. California remains the Company’s single largest

state by revenue, while states in the Southeast, serviced out of

Arkansas, comprise the fastest-growing region.

Following the pandemic there was a flurry of school reopening,

boosted somewhat by federal stimulus. Although most of that

stimulus was designated for personnel to address learning loss, a

small portion was directed to building improvements, including new

furniture. Management points out that over 85% of public school

funding still comes from state and local taxes and bonds, and that

these are not likely to be impacted by the end of federal stimulus,

which was recently extended to September, 2025 for ESSER funds

previously granted but still un-spent. However, the Company has

noted a slight softening in order rates as the current summer

progressed. While Shipments plus Backlog (Management’s preferred

forward-looking measure of business velocity) remains higher on a

year-over-year basis, the recent rate of growth in this metric may

in fact be slowing. Management believes the Company’s business

model is sufficiently flexible to respond to these fluctuations,

and that its current financial strength will continue to support

capital investments in new manufacturing equipment and service

extensions. Management also believes the Company is well-positioned

to take advantage of unforeseen opportunities that may present

themselves as the competitive landscape continues to evolve toward

a new, post-pandemic equilibrium.

Commenting on the strong quarter and year-to-date results, Virco

Chairman and CEO Robert Virtue said: “I’m very proud of our

performance, not just this summer, but over the last four years.

These years included the first-ever school closures in Virco’s

history, as well as an unprecedented surge in re-openings. The fact

that we could respond so effectively to challenges both up and down

is a testament to our staff and their dedication to serving

America’s students and educators.

“Next year will mark Virco’s 75th year in business, and the 99th

year that our family has been making furniture. We’ve experienced

some real surprises during those years, from the Great Depression

(1929-1939) and World War II (1940-1945), to The Baby Boom

(1946-1964) and its “Echo” (1976-2001), followed by the dot.com

stock market collapse (2001-2002) and the subsequent crisis in

public school funding (2002-2007). Also, at about the same time as

the Dot.com crisis, China was admitted to the World Trade

Organization, launching a twenty-year period of outsourcing when

American factories and their workers came to be seen as

liabilities, not assets.

“During all of these ups and downs we stayed committed to our

vision of service, quality, frugality, and loyalty to our

employees. We also continued investing in our U.S. factories and

warehouses, even as the “smart money” told us to stop manufacturing

here and relocate to Asia.

“Our view of the school furniture business is very long-term.

This applies to our customers, who are ultimately the American

taxpayers and their children, our long-term employees, our supplier

partners, and the communities where we’ve been privileged to

operate. It also applies to our conception of ourselves as

owner/managers.

“To be able to see all the pieces coming together after the

recent years of uncertainty is very gratifying. Many Americans now

fully appreciate that school really matters. We never lost sight of

this, nor our commitment to do whatever it took to remain a trusted

partner for educators and the families they serve. Our approach has

proven resilient through many different cycles and trends, and we

believe it will prove equally successful with whatever challenges

and opportunities lie ahead.

"Given the strength of our current position, we are actively

reviewing our options for capital allocation. Among these are fair

and equitable returns to shareholders in the form of dividends,

share repurchases—we still have $3.5 million remaining in

board-authorized funds for this purpose—and potential share price

appreciation. We are also reviewing possible acquisitions, although

as always we are quite careful in assessing the risks as well as

the likely net contributions of such actions. Finally, we continue

to invest in capital equipment, especially in processes and systems

that expand the scope of our present capabilities and give us

access to new and/or adjacent markets.

“I also want to personally recognize the support we’ve received

from our shareholders, many of whom share the same owner/manager

vision that we do. We look forward to using our financial strength

to continue serving students and educators as well as providing a

well-deserved return to the partners who have made our continuity

of service possible.”

Contact:Virco Mfg. Corporation (310)

533-0474Robert A. Virtue, Chairman and Chief Executive OfficerDoug

Virtue, PresidentRobert Dose, Chief Financial Officer

Statement Concerning Forward-Looking

Information

This news release contains “forward-looking statements” as

defined by the Private Securities Litigation Reform Act of 1995.

These statements include, but are not limited to, statements

regarding: our future financial results and growth in our business;

business strategies; market demand and product development;

estimates of unshipped backlog; order rates and trends in

seasonality; product relevance; economic conditions and patterns;

the educational furniture industry generally, including the

domestic market for classroom furniture; cost control initiatives;

absorption rates; and supply chain challenges. Forward-looking

statements are based on current expectations and beliefs about

future events or circumstances, and you should not place undue

reliance on these statements. Such statements involve known and

unknown risks, uncertainties, assumptions and other factors, many

of which are out of our control and difficult to forecast. These

factors may cause actual results to differ materially from those

that are anticipated. Such factors include, but are not limited to:

uncertainties surrounding the ongoing and long-term effects of the

COVID-19 pandemic; changes in general economic conditions including

raw material, energy and freight costs; state and municipal bond

funding; state, local, and municipal tax receipts; order rates; the

seasonality of our markets; the markets for school and office

furniture generally, the specific markets and customers with which

we conduct our principal business; the impact of cost-saving

initiatives on our business; the competitive landscape, including

responses of our competitors and customers to changes in our

prices; demographics; and the terms and conditions of available

funding sources. See our Annual Report on Form 10-K for the year

ended January 31, 2024, our Quarterly Reports on Form 10-Q, and

other reports and material that we file with the Securities and

Exchange Commission for a further description of these and other

risks and uncertainties applicable to our business. We assume no,

and hereby disclaim any, obligation to update any of our

forward-looking statements. We nonetheless reserve the right to

make such updates from time to time by press release, periodic

reports, or other methods of public disclosure without the need for

specific reference to this press release. No such update shall be

deemed to indicate that other statements which are not addressed by

such an update remain correct or create an obligation to provide

any other updates.

Financial Tables Follow

|

|

|

Virco Mfg. CorporationUnaudited Condensed

Consolidated Balance Sheets |

| |

| |

7/31/2024 |

|

1/31/2024 |

|

7/31/2023 |

|

(In thousands) |

| |

|

|

|

|

|

| Assets |

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

Cash |

$ |

7,771 |

|

|

$ |

5,286 |

|

|

$ |

1,600 |

|

| Trade accounts receivables,

net |

|

56,065 |

|

|

|

23,161 |

|

|

|

68,592 |

|

| Inventories |

|

58,574 |

|

|

|

58,371 |

|

|

|

71,853 |

|

| Prepaid expenses and other

current assets |

|

2,921 |

|

|

|

2,208 |

|

|

|

2,286 |

|

| Total current assets |

|

125,331 |

|

|

|

89,026 |

|

|

|

144,331 |

|

| Non-current assets |

|

|

|

|

|

| Property, plant and

equipment |

|

|

|

|

|

|

Land |

|

3,731 |

|

|

|

3,731 |

|

|

|

3,731 |

|

|

Land improvements |

|

697 |

|

|

|

694 |

|

|

|

686 |

|

|

Buildings and building improvements |

|

51,899 |

|

|

|

51,576 |

|

|

|

51,441 |

|

|

Machinery and equipment |

|

116,284 |

|

|

|

114,400 |

|

|

|

115,899 |

|

|

Leasehold improvements |

|

523 |

|

|

|

523 |

|

|

|

977 |

|

| Total property, plant and

equipment |

|

173,134 |

|

|

|

170,924 |

|

|

|

172,734 |

|

|

Less accumulated depreciation and amortization |

|

138,154 |

|

|

|

136,356 |

|

|

|

137,392 |

|

| Net property, plant and

equipment |

|

34,980 |

|

|

|

34,568 |

|

|

|

35,342 |

|

| Operating lease right-of-use

assets |

|

37,988 |

|

|

|

6,508 |

|

|

|

8,285 |

|

| Deferred tax assets, net |

|

6,682 |

|

|

|

6,634 |

|

|

|

7,100 |

|

| Other assets, net |

|

11,367 |

|

|

|

9,709 |

|

|

|

9,279 |

|

| Total assets |

$ |

216,348 |

|

|

$ |

146,445 |

|

|

$ |

204,337 |

|

| |

|

Virco Mfg. CorporationUnaudited Condensed

Consolidated Balance Sheets |

|

|

| |

7/31/2024 |

|

1/31/2024 |

|

7/31/2023 |

| |

(In thousands, except share and par value

data) |

| |

|

|

|

|

|

| Liabilities |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

26,085 |

|

|

$ |

12,945 |

|

|

$ |

27,854 |

|

| Accrued compensation and employee

benefits |

|

11,572 |

|

|

|

10,880 |

|

|

|

10,983 |

|

| Income tax payable |

|

3,648 |

|

|

|

145 |

|

|

|

3,325 |

|

| Current portion of long-term

debt |

|

253 |

|

|

|

248 |

|

|

|

32,256 |

|

| Current portion of operating

lease liability |

|

1,431 |

|

|

|

5,744 |

|

|

|

5,386 |

|

| Other accrued liabilities |

|

12,517 |

|

|

|

8,570 |

|

|

|

11,259 |

|

| Total current liabilities |

|

55,506 |

|

|

|

38,532 |

|

|

|

91,063 |

|

| Non-current liabilities |

|

|

|

|

|

| Accrued self-insurance

retention |

|

1,285 |

|

|

|

650 |

|

|

|

934 |

|

| Accrued pension expenses |

|

9,536 |

|

|

|

9,429 |

|

|

|

10,827 |

|

| Income tax payable, less current

portion |

|

232 |

|

|

|

128 |

|

|

|

— |

|

| Long-term debt, less current

portion |

|

4,008 |

|

|

|

4,136 |

|

|

|

14,261 |

|

| Operating lease liability, less

current portion |

|

37,204 |

|

|

|

1,829 |

|

|

|

4,317 |

|

| Other long-term liabilities |

|

765 |

|

|

|

562 |

|

|

|

640 |

|

| Total non-current

liabilities |

|

53,030 |

|

|

|

16,734 |

|

|

|

30,979 |

|

| Commitments and contingencies

(Notes 6, 7 and 13) |

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

| Preferred stock: |

|

|

|

|

|

| Authorized 3,000,000 shares,

$0.01 par value; none issued or outstanding |

|

— |

|

|

|

— |

|

|

|

— |

|

| Common stock: |

|

|

|

|

|

| Authorized 25,000,000 shares,

$0.01 par value; issued and outstanding 16,289,406 shares at

7/31/2024, and 16,347,314 at 1/31/2024 and 7/31/2023 |

|

163 |

|

|

|

164 |

|

|

|

164 |

|

| Additional paid-in capital |

|

119,734 |

|

|

|

121,373 |

|

|

|

121,030 |

|

| Accumulated deficit |

|

(10,728 |

) |

|

|

(29,048 |

) |

|

|

(36,539 |

) |

| Accumulated other comprehensive

loss |

|

(1,357 |

) |

|

|

(1,310 |

) |

|

|

(2,360 |

) |

| Total stockholders’ equity |

|

107,812 |

|

|

|

91,179 |

|

|

|

82,295 |

|

| Total liabilities and

stockholders’ equity |

$ |

216,348 |

|

|

$ |

146,445 |

|

|

$ |

204,337 |

|

| |

|

Virco Mfg. CorporationUnaudited Condensed

Consolidated Statements of Income |

|

|

| |

Three months ended |

| |

7/31/2024 |

|

7/31/2023 |

| |

(In thousands, except per share data) |

| |

|

|

|

|

Net sales |

$ |

108,419 |

|

|

$ |

107,321 |

|

| Costs of goods sold |

|

58,201 |

|

|

|

58,743 |

|

| Gross profit |

|

50,218 |

|

|

|

48,578 |

|

| Selling, general and

administrative expenses |

|

28,324 |

|

|

|

27,324 |

|

| Operating income |

|

21,894 |

|

|

|

21,254 |

|

| Unrealized gain on investment

in trust account |

|

(597 |

) |

|

|

(325 |

) |

| Pension expense |

|

107 |

|

|

|

161 |

|

| Interest expense |

|

322 |

|

|

|

1,083 |

|

| Income before income

taxes |

|

22,062 |

|

|

|

20,335 |

|

| Income tax expense |

|

5,229 |

|

|

|

4,801 |

|

| Net income |

$ |

16,833 |

|

|

$ |

15,534 |

|

| |

|

|

|

| Cash dividends declared per

common share: |

$ |

0.02 |

|

|

$ |

— |

|

| |

|

|

|

| Net income per common

share: |

|

|

|

| Basic |

$ |

1.04 |

|

|

$ |

0.95 |

|

| Diluted |

$ |

1.04 |

|

|

$ |

0.95 |

|

| Weighted average shares of

common stock outstanding: |

|

|

|

| Basic |

|

16,214 |

|

|

|

16,272 |

|

| Diluted |

|

16,215 |

|

|

|

16,294 |

|

| |

|

Virco Mfg. CorporationUnaudited Condensed

Consolidated Statements of Income |

| |

Six months ended |

| |

7/31/2024 |

|

7/31/2023 |

| |

(In thousands, except per share data) |

|

Net sales |

$ |

155,154 |

|

|

$ |

142,264 |

|

| Costs of goods sold |

|

84,589 |

|

|

|

80,484 |

|

| Gross profit |

|

70,565 |

|

|

|

61,780 |

|

| Selling, general and

administrative expenses |

|

45,700 |

|

|

|

41,838 |

|

| Operating income |

|

24,865 |

|

|

|

19,942 |

|

| Unrealized gain on investment

in trust account |

|

(812 |

) |

|

|

(624 |

) |

| Pension expense |

|

214 |

|

|

|

322 |

|

| Interest expense |

|

530 |

|

|

|

1,795 |

|

| Income before income

taxes |

|

24,933 |

|

|

|

18,449 |

|

| Income tax expense |

|

5,960 |

|

|

|

4,357 |

|

| Net income |

$ |

18,973 |

|

|

$ |

14,092 |

|

| |

|

|

|

| Cash dividends declared per

common share: |

$ |

0.04 |

|

|

$ |

— |

|

| |

|

|

|

| Net income per common

share: |

|

|

|

| Basic |

$ |

1.16 |

|

|

$ |

0.87 |

|

| Diluted |

$ |

1.16 |

|

|

$ |

0.87 |

|

| Weighted average shares of

common stock outstanding: |

|

|

|

| Basic |

|

16,305 |

|

|

|

16,242 |

|

| Diluted |

|

16,305 |

|

|

|

16,257 |

|

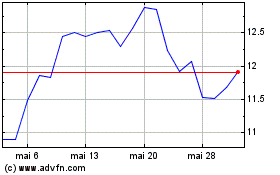

Virco Manufacturing (NASDAQ:VIRC)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Virco Manufacturing (NASDAQ:VIRC)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024