false

0001852749

0001852749

2023-12-12

2023-12-12

0001852749

XFIN:UnitsEachConsistingOfOneShareOfClassaCommonStockAndOnehalfOfOneRedeemableWarrantMember

2023-12-12

2023-12-12

0001852749

us-gaap:CommonClassAMember

2023-12-12

2023-12-12

0001852749

XFIN:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfClassaCommonStockAtAnExercisePriceOfdollar11.50Member

2023-12-12

2023-12-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 12, 2023

ExcelFin Acquisition Corp.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40933 |

|

86-2933776 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification

No.) |

100 Kingsley Park Drive

Fort Mill, South Carolina |

|

29715 |

| (Address of principal executive offices) |

|

(Zip Code) |

(917) 209-8581

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities

Exchange Act of 1934:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Units,

each consisting of one share of Class A common stock and one-half of one redeemable warrant |

|

XFINU |

|

The Nasdaq Stock Market |

| Class

A common stock, par value $0.0001 per share |

|

XFIN |

|

The Nasdaq Stock Market |

| Redeemable

warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

XFINW |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD

Disclosure.

On June 26, 2023, ExcelFin Acquisition Corp. (“ExcelFin”),

Betters Medical Investment Holdings Limited (“Betters”), Baird Medical Investment Holdings Limited (“PubCo”),

Betters Medical Merger Sub, Inc. (“Merger Sub”) and Tycoon Choice Global Limited (“Tycoon”), entered into

a Business Combination Agreement (the “Business Combination Agreement”).

Furnished herewith as Exhibit 99.1 and incorporated

herein by reference is the updated investor presentation that will be used by ExcelFin and Betters with respect to the transactions described

in the Business Combination Agreement (the “Transactions”).

The information set forth in this Item 7.01, including

the exhibits attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18

of the U.S. Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise be subject to the liabilities of that

section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

Additional Information and Where to Find It

In connection with the proposed Transactions, PubCo

has filed with the SEC a registration statement on Form F-4 (Registration No. 333-274114), which includes a proxy statement/prospectus

and other relevant documents, which will be both the proxy statement to be distributed to ExcelFin’s stockholders in connection

with ExcelFin’s solicitation of proxies for the vote by ExcelFin’s stockholders with respect to the proposed business combination

and other matters as may be described in the registration statement, as well as the prospectus relating to the offer and sale of the securities

of PubCo to be issued in connection with the business combination. STOCKHOLDERS OF EXCELFIN ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND OTHER RELEVANT DOCUMENTS IN

CONNECTION WITH THE PROPOSED TRANSACTIONS THAT PUBCO AND EXCELFIN WILL FILE WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTIONS AND THE PARTIES TO THE PROPOSED TRANSACTIONS. Stockholders and investors

may obtain free copies of the proxy statement/prospectus and other relevant materials and other documents filed by PubCo and ExcelFin

at the SEC’s website at www.sec.gov. Copies of the proxy statement/prospectus and the filings incorporated by reference therein

may also be obtained, without charge, on ExcelFin’s website at www.excelfinacquisitioncorp.com or by directing a request to: ExcelFin

Acquisition Corp., 100 Kingsley Park Drive, Fort Mill, South Carolina 29715.

Participants in Solicitation

Each of PubCo, ExcelFin and Betters and their respective

directors, executive officers and certain employees, may be deemed, under SEC rules, to be participants in the solicitation of proxies

in respect of the proposed Transactions. Information regarding ExcelFin’s directors and executive officers, PubCo, Betters and the

other participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise,

is contained in the PubCo registration statement described and other relevant materials filed with the SEC. These documents can be obtained

free of charge from the sources indicated above.

Non-Solicitation

This Current Report on Form 8-K is not a proxy

statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Transactions

and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of ExcelFin, Betters, PubCo, or Tycoon,

nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful

prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS

NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS

OF THE PROPOSED TRANSACTIONS OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENSE.

Forward Looking Statements

This Current Report on Form 8-K (including certain

of the exhibits hereto) includes certain statements that are not historical facts but are forward-looking statements for purposes of the

safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally

relate to future events or ExcelFin’s, Betters’ or PubCo’s future financial or operating performance. In some cases,

you can identify forward-looking statements by terminology such as “may”, “could”, “should”, “expect”,

“intend”, “might”, “will”, “estimate”, “anticipate”, “believe”,

“budget”, “forecast”, “intend”, “plan”, “potential”, “predict”,

“potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Forward-looking

statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed

or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered

reasonable by ExcelFin and its management, and Betters and its management, as the case may be, are inherently uncertain. New risks and

uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. You should not place undue

reliance on forward-looking statements in this Current Report on Form 8-K, which speak only as of the date they are made and are

qualified in their entirety by reference to the cautionary statements herein. None of PubCo, ExcelFin, or Betters undertakes any duty

to update these forward-looking statements.

Actual results may vary materially from those expressed

or implied by forward-looking statements based on a number of factors, including, without limitation: (1) risks related to the consummation

of the proposed Transactions, including the risks that (a) the proposed Transactions may not be consummated within the anticipated

time period, or at all; (b) ExcelFin may fail to obtain stockholder approval of the proposed business combination; (c) the Parties

may fail to secure required regulatory approvals under applicable laws; and (d) other conditions to the consummation of the proposed

Transactions under the Business Combination Agreement may not be satisfied; (2) the effects that any termination of the Business

Combination Agreement may have on ExcelFin or Betters or their respective business, including the risks that ExcelFin’s share price

may decline significantly if the proposed Transactions are not completed; (3) the effects that the announcement or pendency of the

proposed Transactions may have on Betters’ and its business, including the risks that as a result (a) ExcelFin’s business,

operating results or stock price may suffer or (b) PubCo’s, ExcelFin’s or Betters’ current plans and operations

may be disrupted; (4) the inability to recognize the anticipated benefits of the proposed Transactions; (5) unexpected costs

resulting from the proposed Transactions; (6) changes in general economic conditions; (7) regulatory conditions and developments;

(8) changes in applicable laws or regulations; (9) the nature, cost and outcome of pending and future litigation and other legal

proceedings, including any such proceedings related to the proposed Transactions and instituted against PubCo, ExcelFin, Betters and others;

and (10) other risks and uncertainties indicated from time to time in the registration and proxy statement relating to the proposed

Transactions, including those under “Risk Factors” therein, and in ExcelFin’s other filings with the SEC.

The foregoing list of factors is not exclusive. Additional

information concerning certain of these and other risk factors is contained in ExcelFin’s most recent filings with the SEC and in

the registration statement described above filed by PubCo in connection with the proposed Transactions. All subsequent written and oral

forward-looking statements concerning ExcelFin, Betters, PubCo or Tycoon, the Transactions described herein or other matters attributable

to ExcelFin, Betters, PubCo, Tycoon or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements

above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Each

of ExcelFin, Betters, PubCo and Tycoon expressly disclaims any obligations or undertaking to release publicly any updates or revisions

to any forward-looking statements contained herein to reflect any change in their expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based.

Item 9.01. Financial

Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ExcelFin Acquisition Corp. |

| |

|

|

| Date: December 12, 2023 |

By: |

/s/ Joe Ragan |

| |

Name: |

Joe Ragan |

| |

Title: |

Chief Executive Officer & Chief Financial Officer |

Exhibit 99.1

Minimally Invasive Medical Technology for Tumor Removal INVESTOR PRESENTATION DECEMBER 2023 Traditional Method Baird Medical Method

Baird Medical This presentation (together with oral statements made in connection herewith, this “Presentation”) is for informational purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between ExcelFin Acquisition Corp . (“ExcelFin”) and Baird Medical Investment Holdings Limited ( “Baird Medical” 1 ) . The information contained herein does not purport to be all - inclusive, and none of ExcelFin, Baird Medical, Cohen & Company Capital Markets, a division of J . V . B . Financial Group, LLC (“Cohen”) and Exos Securities LLC (“Exos”), nor any of their respective affiliates nor any of its or their control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation . You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein ; and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision . The reader shall not rely upon any statement, representation or warranty made by any other person, firm or corporation (including, without limitation, Cohen and Exos or any of their respective affiliates or control persons, officers, directors and employees) in making its investment or decision to invest in ExcelFin or Baird Medical . None of ExcelFin, Baird Medical and Cohen and Exos, nor any of their respective affiliates nor any of its or their control persons, officers, directors, employees or representatives, shall be liable to the reader for any information set forth herein or any action taken or not taken by any reader, including any investment in ExcelFin or Baird Medical . Additional Information . In connection with the proposed Business Combination, Baird Medical has filed with the SEC a registration statement on Form F - 4 (Registration No . 333 - 274114 ) (the “Registration Statement”) containing a preliminary proxy statement/prospectus of ExcelFin, and if the Registration Statement is declared effective, ExcelFin will mail a definitive proxy statement/prospectus relating to the proposed Business Combination to its stockholders . This Presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination . All of the information contained in this Presentation is qualified by reference to the Registration Statement . ExcelFin’s stockholders and other interested persons are advised to read the preliminary proxy statement/prospectus and the amendments thereto and, when available, the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about ExcelFin, Baird Medical and the Business Combination . The definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to stockholders of ExcelFin as of a record date to be established for voting on the proposed Business Combination . Stockholders may obtain copies of the preliminary proxy statement/ prospectus and, when available, the definitive proxy statement/prospectus and other documents filed with the SEC, without charge, at the SEC’s website at www . sec . gov, or by directing a request to : ExcelFin Acquisition Corp . , 1 00 Kingsley Park Drive, Fort Mill, South Carolina 29715 . The information contained on, or that may be accessed through, the websites referenced in this document is not incorporated by reference into, and is not a part of, this document . Confidentiality . This meeting and any information communicated at this meeting, including this Presentation, are strictly confidential and should not be discussed outside your organization . Neither this Presentation nor any of its contents may be disclosed or used for any purposes other than information and discussion purposes without the prior written consent of Baird Medical and ExcelFin . Forward - Looking Statements . Certain statements in this Presentation may be considered forward - looking statements within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements generally relate to future events or ExcelFin’s or Baird Medical’s future financial or operating performance . In some cases, you can identify forward - looking statements by terminology such as “may”, “could”, “should”, “expect”, “intend”, “might”, “will”, “estimate”, “anticipate”, “believe”, “budget”, “forecast”, “intend”, “plan”, “potential”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology . Forward - looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements . These forward - looking statements are based upon estimates and assumptions that, while considered reasonable by ExcelFin and its management, and Baird Medical and its management, as the case may be, are inherently uncertain . New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties . You should not place undue reliance on forward - looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein . Neither ExcelFin nor Baird Medical undertakes any duty to update these forward - looking statements . For example, statements concerning the following include forward - looking statements : (i) the expected timing and likelihood of completion of the proposed Business Combination, including the risk that the proposed Business Combination may not close due to one or more closing conditions to the proposed Business Combination in the business combination agreement (the “Business Combination Agreement”) not being satisfied or waived on a timely basis or otherwise, or that the required approval of the Business Combination Agreement and related matters by the stockholders of ExcelFin may not be obtained ; (ii) ExcelFin’s potential failure to raise sufficient funds in one or more equity financings so as to meet the closing condition under the Business Combination Agreement that requires it to have $ 15 million of funds (including funds in its trust account, after deducing any amounts paid out for redemptions by ExcelFin stockholders) as of the closing ; (iii) the potential inability of Baird Medical to meet the initial listing standards of the applicable stock exchange following the proposed Business Combination, including due to excessive redemptions of ExcelFin’s public shares ; (iv) costs related to the proposed Business Combination ; (v) the potential occurrence of a material adverse change with respect to the financial position, performance, operations or prospects of ExcelFin or Baird Medical ; (vi) the potential disruption of Baird Medical’s management’s time from ongoing business operations due to the proposed Business Combination ; (vii) announcements relating to the proposed Business Combination potentially having an adverse effect on the market price of ExcelFin’s securities ; (viii) the potential effect of the proposed Business Combination and the announcement thereof on the ability of the Baird Medical to retain customers and hire key personnel and maintain relationships with its customers and suppliers and on its operating results and business generally ; (ix) risks relating to the growth of the Baird Medical’s business and its ability to realize expected results ; (x) risks relating to the viability of the Baird Medical’s growth strategy, including related capabilities ; (xi) the risk that Baird Medical may be adversely affected by other economic, business, and/or competitive factors, or adverse macroeconomic conditions, including inflation, supply chain delays and increasing interest rates ; (xiii) the lack of a third - party valuation in determining whether or not to pursue the proposed Business Combination ; and (xiv) other risks and uncertainties, including those identified in any proxy statement/prospectus in a Registration Statement on Form F - 4 relating to the proposed Business Combination (which is expected to be filed by Baird Medical with the SEC), the “Risk Factors” section of ExcelFin’s registration statement on Form S - 1 , other documents filed by ExcelFin from time to time with the SEC and any risk factors made available to you in connection with ExcelFin, Baird Medical and the proposed Business Combination . Disclaimer 2 1. The name of the post - closing, combined public company will be “Baird Medical Holdings Investment Limited.” All references herein to “Baird Medical” shall be deemed to refer (i) to Betters Medical Investment Holdings Limited (“Betters”) for any time periods or historical events occurring prior to the closing of the transaction and (ii) to Baird Medical Holdings Investment Lim ited for any time periods occurring after the closing of the transaction

Baird Medical No Offer or Solicitation . This Presentation and the information contained herein do not constitute (i) (a) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (b) an offer to sell or the solicitation of an offer to buy any security, commodity or instrument or related derivative, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction, or (ii) an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, or an exemption therefrom . The distribution of this Presentation may also be restricted by law and persons into whose possession this Presentation comes should inform themselves about and observe any such restrictions . The recipient acknowledges that it is (a) aware that the United States securities laws prohibit any person who has material, non - public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934 , as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that the recipient will neither use, nor cause any third party to use, this Presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10 b - 5 thereunder . NEITHER THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE OR TERRITORIAL SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE . Projections . This Presentation contains certain financial forecast information of Baird Medical, including, but not limited to, estimated results for fiscal year 2023 and 2024 and the Baird Medical's long - term business model . This presentation also contains certain forecast information with respect to future exchange rates between the United States dollar and Chinese yuan . Such financial forecast information and exchange rate forecast information constitute forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such financial forecast information and exchange rate forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties . See “Forward - Looking Statements” above . Actual results may differ materially from the results contemplated by the financial forecast information and exchange rate forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved . None of ExcelFin's nor Baird Medical's independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation ; and, accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation . In addition, the analyses of Baird Medical and ExcelFin contained herein are not, and do not purport to be, appraisals of the securities, assets or business of Baird Medical, ExcelFin or any other entity . In connection with the PCAOB audit of the financial statements of Tycoon (the Baird Medical subsidiary which is the target in the Business Combination), which was completed in August 2023 , certain adjustments were made to the historical financial statements that, among other things, moved the booking of items from one financial period to another or changed the characterization of items previously capitalized to require that they be expensed in the financial period in which they were incurred . (with such changes, the “Audit Adjustments”) . In connection with the review of Tycoon’s June 30 , 2023 financial statements, which was completed in November 2023 , adjustments were made to the historical financial statements that changed the characterization of research and development costs previously capitalized to require that they be expensed in the financial period in which they were incurred (with such changes, the “Restatement”) . The Restatement resulted in a restatement of Tycoon’s audited financial statements at December 31 , 2021 and 2022 and for the two years then ended . See “Note 20 — Restatement” to Tycoon’s audited financial statements included in the proxy statement/prospectus included in the Registration Statement for a description of the changes in Tycoon’s financial statements resulting from the Restatement . When the combined changes resulting from Audit Adjustments and the Restatement are applied to the model from which the projections included on slide 17 of this Presentation were derived, they result in a decrease of EBITDA of $ 2 . 8 million ( 18 % ) in 2021 , a decrease of EBITDA of $ 0 . 6 million ( 4 % ) in 2022 , a decrease of projected EBITDA of $ 2 . 5 million in 2023 ( 10 % ) and a decrease of projected EBITDA of $ 1 . 9 million ( 5 % ) in 2024 . The projections included on slide 17 of this Presentation reflect that information as it was provided to ExcelFin’s board of directors prior to its approval of the Business Combination, and such information has not been revised to reflect the changes indicated by the Audit Adjustments and the Restatement . Industry and Market Data . Certain information contained in this Presentation relates to or is based on studies, publications, surveys and the Baird Medical’s own internal estimates and research, including the “Global Market Study of Ablation Therapy - Independent Market Research Report” (the “Frost & Sullivan Report”) commissioned by Baird Medical and prepared by Frost & Sullivan, a third - party global research organization . The Frost & Sullivan Report was prepared based on various interviews conducted on a best - effort basis with industry experts and competitors . The study used 2021 as the base year for analysis and 2022 - 2024 for forecast . Certain figures from 2021 were not available from public statistical sources at the time of writing . In such cases, Frost & Sullivan used the latest information available or made projections based on historical trends . Under circumstances where information was not available, Frost & Sullivan’s in - house analysis was leveraged using appropriate models and indicators to arrive at an estimate . All of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions . You are cautioned not to give undue weight to this information . While Baird Medical believes its internal research is reliable, such research has not been verified by any independent source . Any data on past performance or modeling contained herein is not an indication as to future performance . ExcelFin and Baird Medical assume no obligation to update the information in this Presentation . Disclaimer (cont’d) 3

Baird Medical Trademarks . ExcelFin and Baird Medical own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses . This Presentation may also contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners . The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with ExcelFin or Baird Medical an endorsement or sponsorship by or of ExcelFin or Baird Medical . Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM, © or ® symbols, but such references are not intended to indicate, in any way, that ExcelFin or Baird Medical will not assert, to the fullest extent under applicable law, their rights or the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights . Non - GAAP Financial Measures . This Presentation includes adjusted EBITDA margin, which is not presented in accordance with generally accepted accounting principles (“GAAP”) . Non - GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Baird Medical’s financial results . You should be aware that the Baird Medical's presentation of these measures may not be comparable to similarly - titled measures used by other companies . Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP . Baird Medical believes non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Baird Medical's financial condition and results of operations . Baird Medical believes that the use of non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing Baird Medical's financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors . N on - GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non - GAAP financial measures . A reconciliation of historical adjusted EBITDA to net income is provided in the tables at the end of this Presentation . With respect to projected adjusted EBITDA and adjusted EBITDA margin, due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Baird Medical is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort . Consequently, no disclosure of estimated comparable GAAP measures is included . For the same reasons, Baird Medical is unable to address the probable significance of the unavailable information, which could be material to future results . Participants in the Solicitation . Baird Medical and ExcelFin and their respective directors and executive officers may be deemed participants in the solicitation of proxies from ExcelFin’s stockholders with respect to the proposed Business Combination . A list of the names of ExcelFin’s directors and executive officers and a description of their interests in ExcelFin is contained in ExcelFin’s final prospectus relating to its initial public offering, dated October 22 , 2021 , and in ExcelFin’s Annual Report on Form 10 - K, dated March 30 , 2023 , which were filed with the SEC and are available free of charge at the SEC’s web site at www . sec . gov, or by directing a request to ExcelFin Acquisition Corp . , 1 00 Kingsley Park Drive, Fort Mill, South Carolina 29715 . Other information regarding Baird Medical, and the other participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC . Investors and security holders of Baird Medical and ExcelFin are urged to read the proxy statement/prospectus and other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the proposed Business Combination . Investors and security holders will be able to obtain free copies of the proxy statement and other documents containing important information about Baird Medical and ExcelFin through the website maintained by the SEC at www . sec . gov . Copies of the documents filed with the SEC by ExcelFin can be obtained free of charge by directing a written request to ExcelFin Acquisition Corp . , 1 00 Kingsley Park Drive, Fort Mill, South Carolina 29715 . This document has been translated into Chinese and the information was not altered in any material way . Disclaimer (cont’d) 4

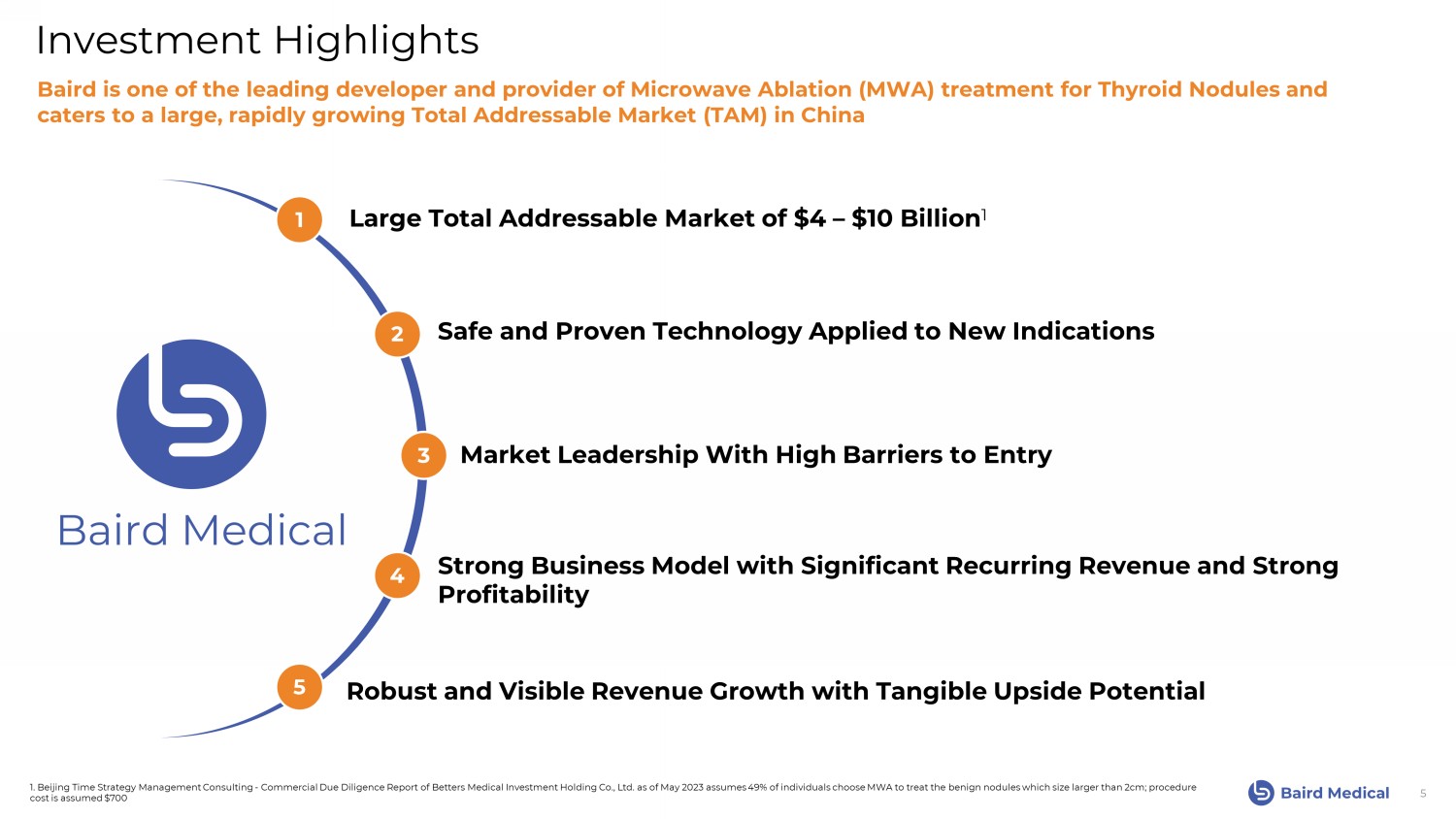

Baird Medical Market Leadership With High Barriers to Entry Strong Business Model with Significant Recurring Revenue and Strong Profitability Safe and Proven Technology Applied to New Indications Large Total Addressable Market of $4 – $10 Billion 1 Robust and Visible Revenue Growth with Tangible Upside Potential Investment Highlights 5 1 5 3 2 4 Baird Medical 1. Beijing Time Strategy Management Consulting - Commercial Due Diligence Report of Betters Medical Investment Holding Co., Ltd. as of May 2023 assumes 49% of individuals choose MWA to treat the benign nodules which size larger than 2cm; procedure cost is assumed $700 Baird is one of the leading developer and provider of Microwave Ablation (MWA) treatment for Thyroid Nodules and caters to a large, rapidly growing Total Addressable Market (TAM) in China

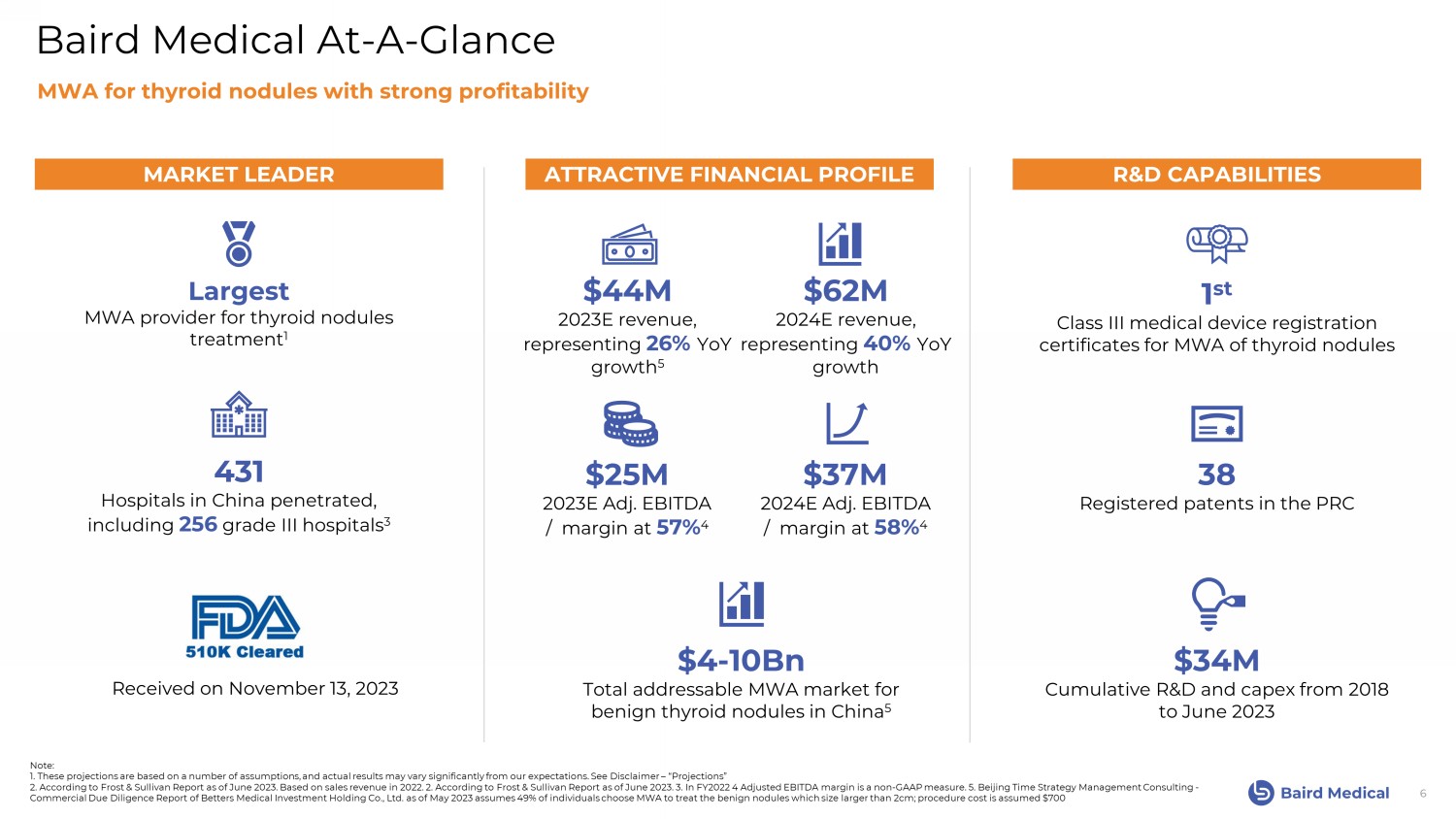

Baird Medical Baird Medical At - A - Glance 6 R&D CAPABILITIES Note: 1. These projections are based on a number of assumptions, and actual results may vary significantly from our expectations. See Dis claimer – “Projections” 2. According to Frost & Sullivan Report as of June 2023. Based on sales revenue in 2022. 2. According to Frost & Sullivan Rep ort as of June 2023. 3. In FY2022 4 Adjusted EBITDA margin is a non - GAAP measure. 5. Beijing Time Strategy Management Consulting - Commercial Due Diligence Report of Betters Medical Investment Holding Co., Ltd. as of May 2023 assumes 49% of individuals cho ose MWA to treat the benign nodules which size larger than 2cm; procedure cost is assumed $700 MARKET LEADER ATTRACTIVE FINANCIAL PROFILE 431 Hospitals in China penetrated, including 256 grade III hospitals 3 $4 - 10Bn Total addressable MWA market for benign thyroid nodules in China 5 1 st Class III medical device registration certificates for MWA of thyroid nodules $34M Cumulative R&D and capex from 2018 to June 2023 38 Registered patents in the PRC Largest MWA provider for thyroid nodules treatment 1 $25M 2023E Adj. EBITDA / margin at 57% 4 $44M 2023E revenue, representing 26 % YoY growth 5 $62M 2024E revenue, representing 4 0% YoY growth $37M 2024E Adj. EBITDA / margin at 58% 4 MWA for thyroid nodules with strong profitability Received on November 13, 2023

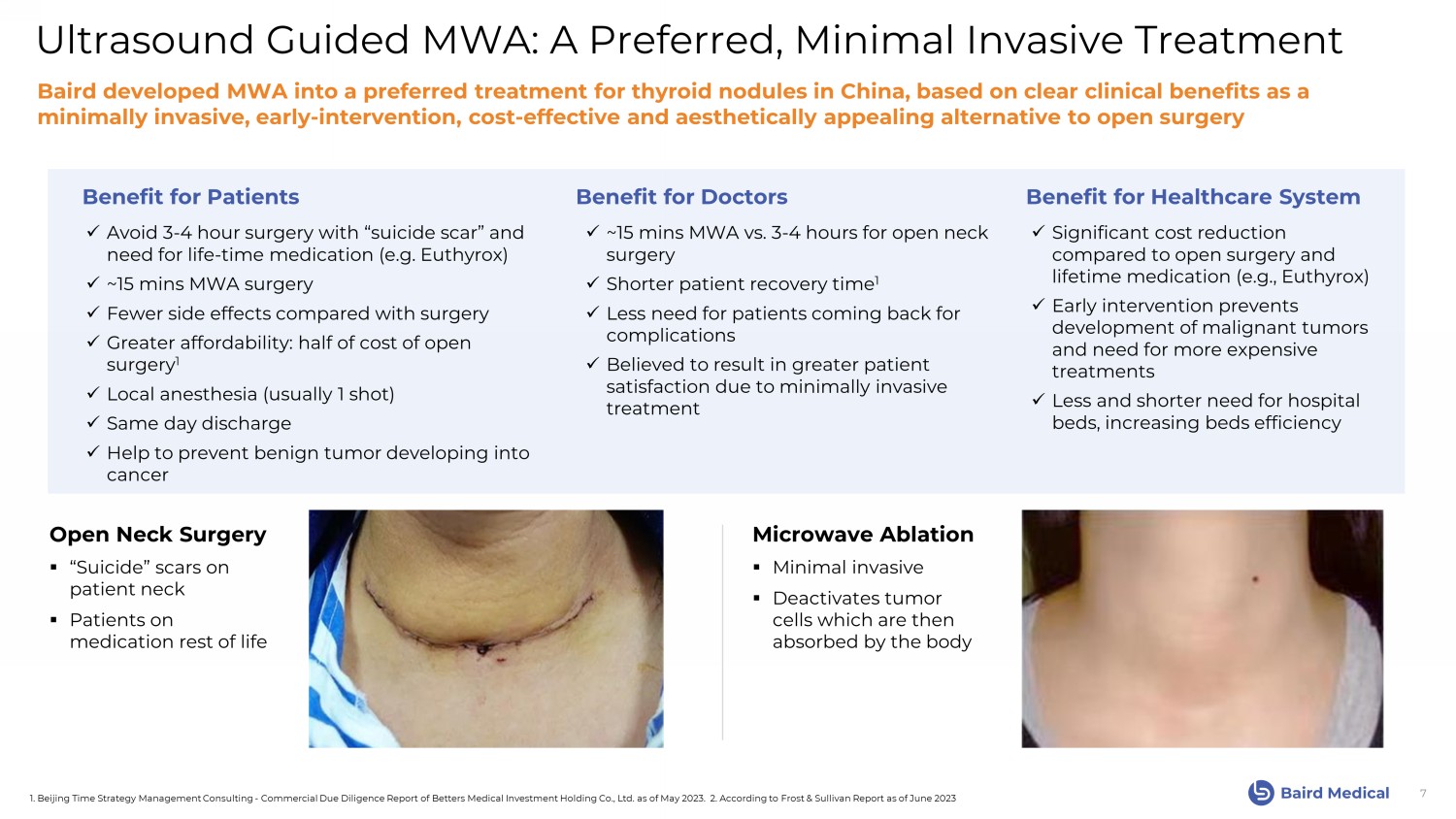

Baird Medical Ultrasound Guided MWA: A Preferred, Minimal Invasive Treatment 7 1. Beijing Time Strategy Management Consulting - Commercial Due Diligence Report of Betters Medical Investment Holding Co., Ltd. as of May 2023. 2. According to Frost & Sullivan Report as of June 2023 Baird developed MWA into a preferred treatment for thyroid nodules in China, based on clear clinical benefits as a minimally invasive, early - intervention, cost - effective and aesthetically appealing alternative to open surgery Open Neck Surgery ▪ “Suicide” scars on patient neck ▪ Patients on medication rest of life Microwave Ablation ▪ Minimal invasive ▪ Deactivates tumor cells which are then absorbed by the body x Avoid 3 - 4 hour surgery with “suicide scar” and need for life - time medication (e.g. Euthyrox ) x ~15 mins MWA surgery x Fewer side effects compared with surgery x Greater affordability: half of cost of open surgery 1 x Local anesthesia (usually 1 shot) x Same day discharge x Help to prevent benign tumor developing into cancer Benefit for Patients x ~15 mins MWA vs. 3 - 4 hours for open neck surgery x Shorter patient recovery time 1 x Less need for patients coming back for complications x Believed to result in greater patient satisfaction due to minimally invasive treatment Benefit for Doctors x Significant cost reduction compared to open surgery and lifetime medication (e.g., Euthyrox) x Early intervention prevents development of malignant tumors and need for more expensive treatments x Less and shorter need for hospital beds, increasing beds efficiency Benefit for Healthcare System

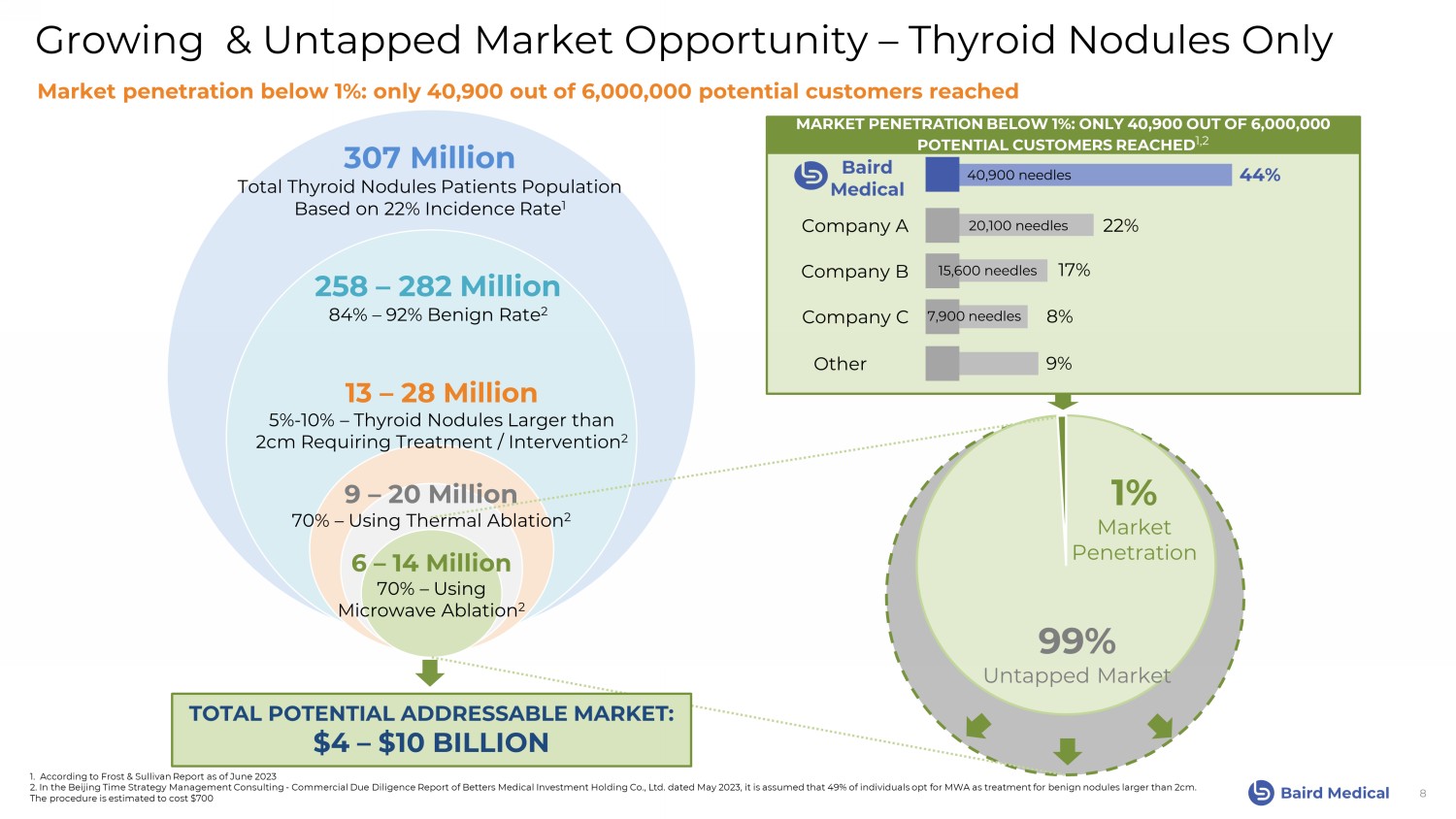

Baird Medical 8 13 – 28 Million 5% - 10% – Thyroid Nodules Larger than 2cm Requiring Treatment / Intervention 2 258 – 282 Million 84% – 92% Benign Rate 2 307 Million Total Thyroid Nodules Patients Population Based on 22% Incidence Rate 1 6 – 14 Million 70% – Using Microwave Ablation 2 9 – 20 Million 70% – Using Thermal Ablation 2 1. According to Frost & Sullivan Report as of June 2023 2. In the Beijing Time Strategy Management Consulting - Commercial Due Diligence Report of Betters Medical Investment Holding Co ., Ltd. dated May 2023, it is assumed that 49% of individuals opt for MWA as treatment for benign nodules larger than 2cm. The procedure is estimated to cost $700 Growing & Untapped Market Opportunity – Thyroid Nodules Only Baird Medical 44% Company A 22% Company C 8% Company B 17% Other 9% MARKET PENETRATION BELOW 1%: ONLY 40,900 OUT OF 6,000,000 POTENTIAL CUSTOMERS REACHED 1,2 99% Untapped Market TOTAL POTENTIAL ADDRESSABLE MARKET: $4 – $10 BILLION 40,900 needles 20,100 needles 15,600 needles 7,900 needles 1% Market Penetration Market penetration below 1%: only 40,900 out of 6,000,000 potential customers reached

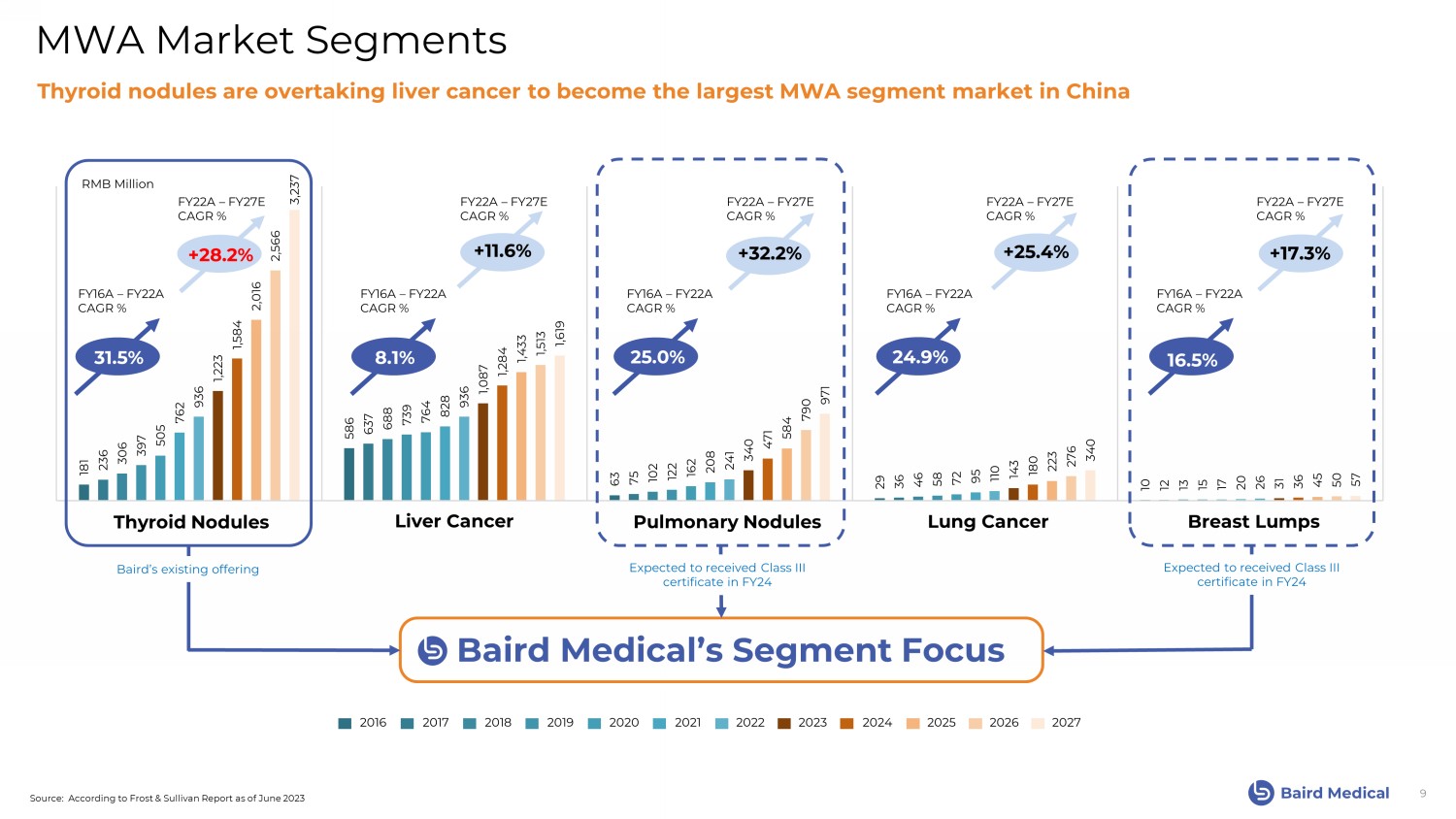

Baird Medical 181 586 63 29 10 236 637 75 36 12 306 688 102 46 13 397 739 122 58 15 505 764 162 72 17 762 828 208 95 20 936 936 241 110 26 1,223 1,087 340 143 31 1,584 1,284 471 180 36 2,016 1,433 584 223 45 2,566 1,513 790 276 50 3,237 1,619 971 340 57 Thyroid nodules are overtaking liver cancer to become the largest MWA segment market in China RMB Million +28.2% 31.5% 25.0% +11.6% +32.2% +25.4% +17.3% 8.1% 24.9% 16.5% FY16A – FY22A CAGR % FY22A – FY27E CAGR % Thyroid Nodules Liver Cancer Pulmonary Nodules Lung Cancer Breast Lumps Baird Medical’s Segment Focus MWA Market Segments Source: According to Frost & Sullivan Report as of June 2023 9 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 FY16A – FY22A CAGR % FY22A – FY27E CAGR % FY16A – FY22A CAGR % FY22A – FY27E CAGR % FY16A – FY22A CAGR % FY22A – FY27E CAGR % FY16A – FY22A CAGR % FY22A – FY27E CAGR % Baird’s existing offering Expected to received Class III certificate in FY24 Expected to received Class III certificate in FY24

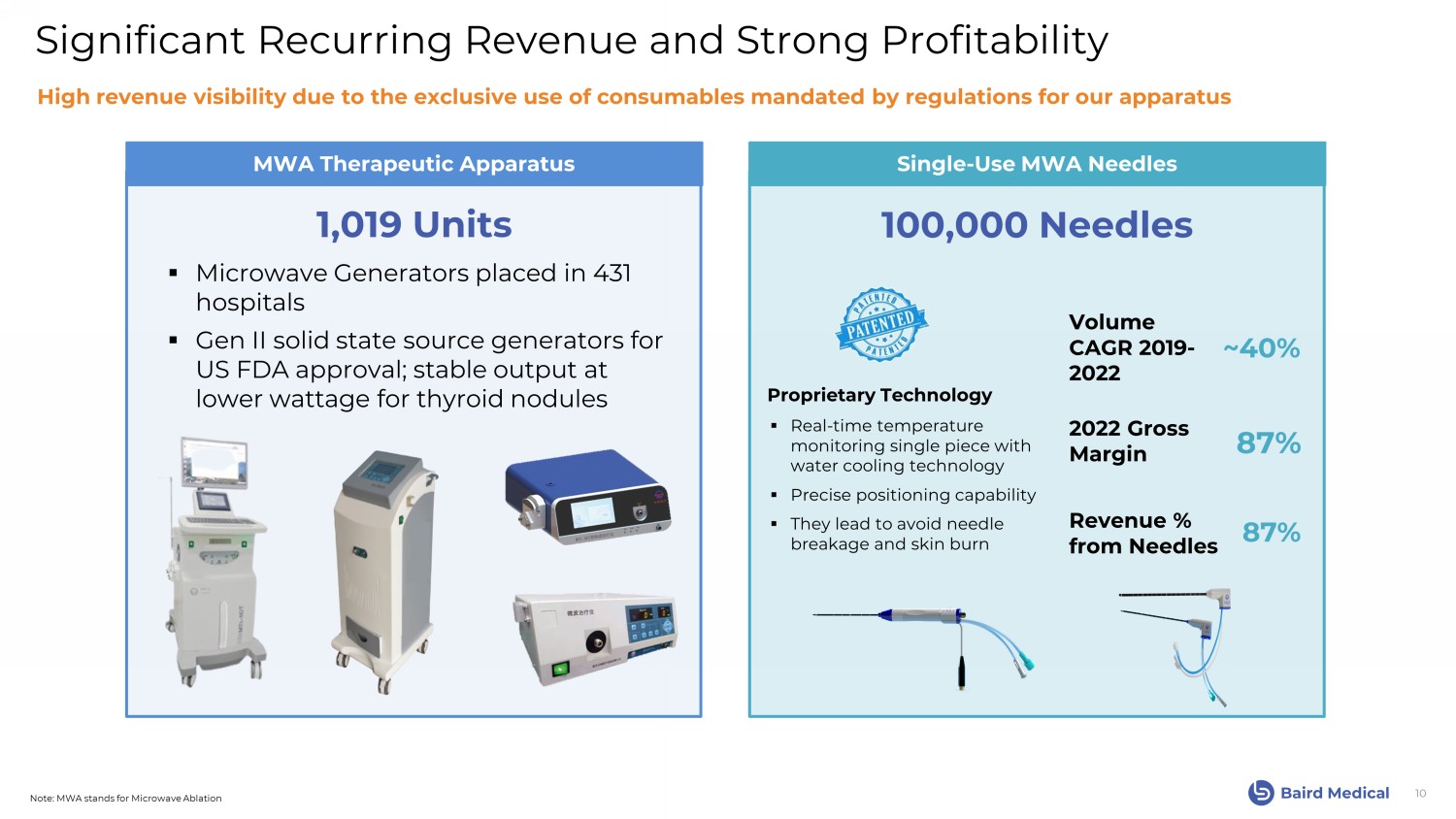

Baird Medical Single - Use MWA Needles Significant Recurring Revenue and Strong Profitability 10 MWA Therapeutic Apparatus 1,019 Units High revenue visibility due to the exclusive use of consumables mandated by regulations for our apparatus Note: MWA stands for Microwave Ablation 87% 2022 Gross Margin 87% Revenue % from Needles ~40% Volume CAGR 2019 - 2022 ▪ Real - time temperature monitoring single piece with water cooling technology ▪ Precise positioning capability ▪ They lead to avoid needle breakage and skin burn 100,000 Needles Proprietary Technology ▪ Microwave Generators placed in 431 hospitals ▪ Gen II solid state source generators for US FDA approval; stable output at lower wattage for thyroid nodules

Baird Medical Baird Medical’s China Management Team Drives Local Market Excellence 11 HAIMEI WU, MD Co - Founder, ED, Chairwoman of the Board and CEO • Over 20 years of experience in the medical devices industry , including working as a key distributor for Mindray, Johnson & Johnson and Abbott Laboratories in China • Completed advanced studies in financial investment and capital operation at Graduate School at Shenzhen, Tsinghua University RONGJIAN LU Co - Chief Technical Officer • Over 17 years as a lecturer in the Faculty of Mechanical and Electronic Engineering at Nanjing Forestry University KUN SENG CHRIS NG CFO and Company Secretary • Worked at RSM in Asia and held positions at companies listed in Hong Kong (Macau Legend Development, Galaxy Entertainment, REF Holdings) • Member of the Hong Kong Institute of CPAs WEI HOU Vice General Manager and Sales Director • Over 28 years of experience in management and sales in the medical and pharmaceutical industry • Previously at Chongqing Medical Administration as secretary of the hospital league Committee and Shanghai Pharmaceutical as General manager of the antitumor medicine department ZHITAO WU Vice President and Head of Legal • Formerly at the Shanghai branch of Longan Law Firm • Years of experience as a lawyer, specializing in corporate M&A, legal due diligence, handling litigation and courtroom proceedings WENYUAN WU, MD Co - Founder • Over 20 years of experience in pharmaceuticals and medical device production, sales, enterprise management, and strategic planning; formally surgery practitioner • Holds a degree in Clinical Medicine from Hubei Vocational and Technical College, an EMBA from Peking University School of Medicine; Currently pursuing education at the ICB China Business School, Hong Kong University

Baird Medical Cultivating Market Adoption, Penetration and Expansion 12 MEDICAL CONFERENCES DOCTORS EXCHANGE POINT - TO - POINT CONNECTIONS

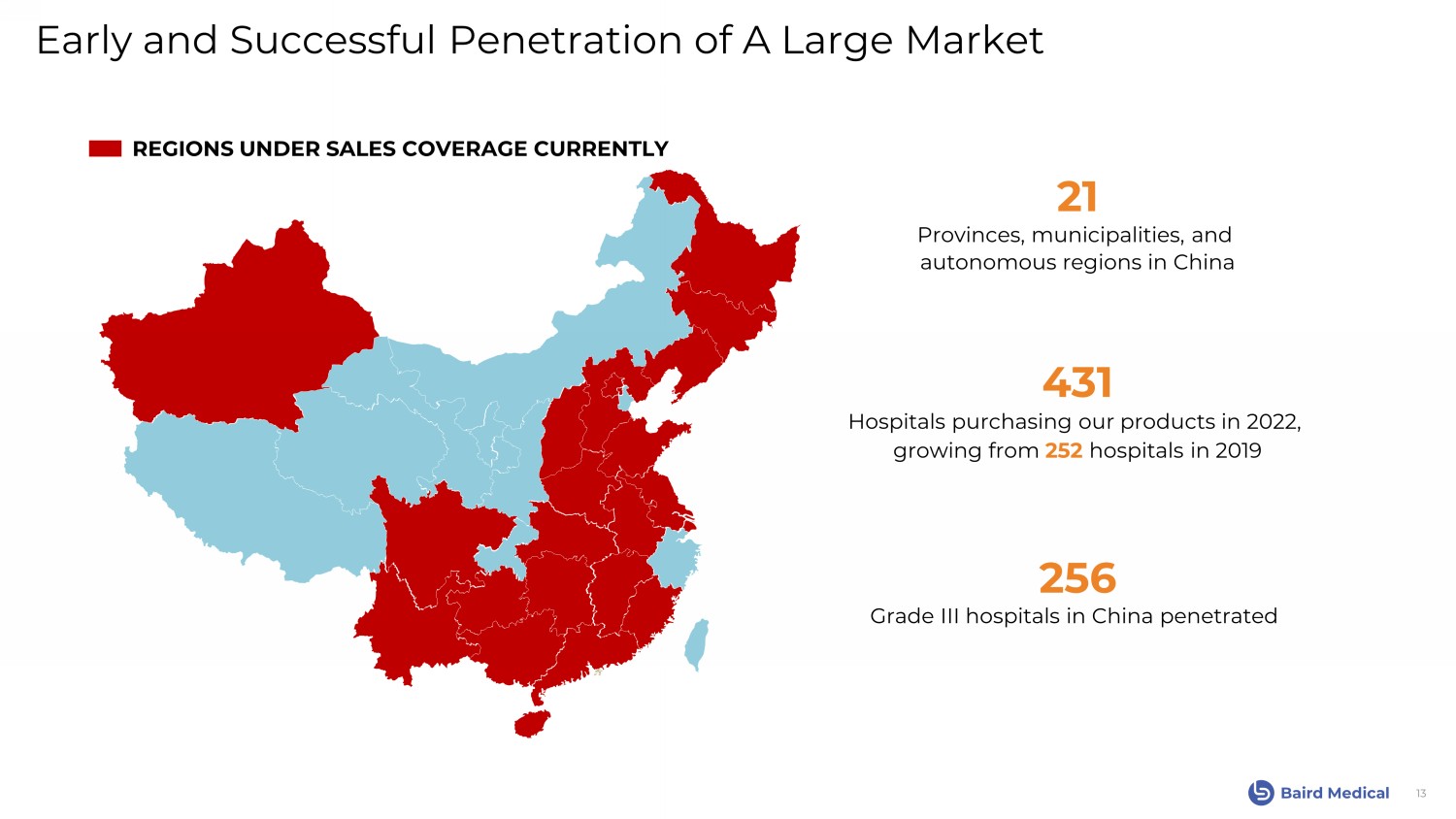

Baird Medical Early and Successful Penetration of A Large Market 13 431 Hospitals purchasing our products in 2022, growing from 252 hospitals in 2019 256 Grade III hospitals in China penetrated 21 Provinces, municipalities, and autonomous regions in China REGIONS UNDER SALES COVERAGE CURRENTLY

Baird Medical Esteemed and Renowned Client Base 14 No. 27 Sun Yat - Sen University Cancer Center Peking University First Hospital No. 12 West China Medical School, West China Hospital, Sichuan University No. 2 No. 31 The First Affiliated Hospital of Guangzhou Medical University Nanfang Hospital Southern Medical University No. 18 Zhongshan Hospital Affiliated to Fudan University No. 5 Guangdong General Hospital No. 34 Nineth People’s Hospital of Shanghai Jiao Tung University School of Medicine No. 23 The First Affiliated Hospital of Sun Yat - Sen University No. 9 No. 28 Fudan University Shanghai Cancer Center Xiangya Hospital of Central South University No. 15 Beijing No. 301 Hospital No. 3 No. 33 Shengjing Hospital Affiliated To China Medical University The Second Xiangya Hospital of Central South University No. 20 Wuhan Union Hospital of China No. 7 Source: Hospital Management Institute, Fudan University 32 out of Top 100 Hospitals are end users of Baird Medical’s products

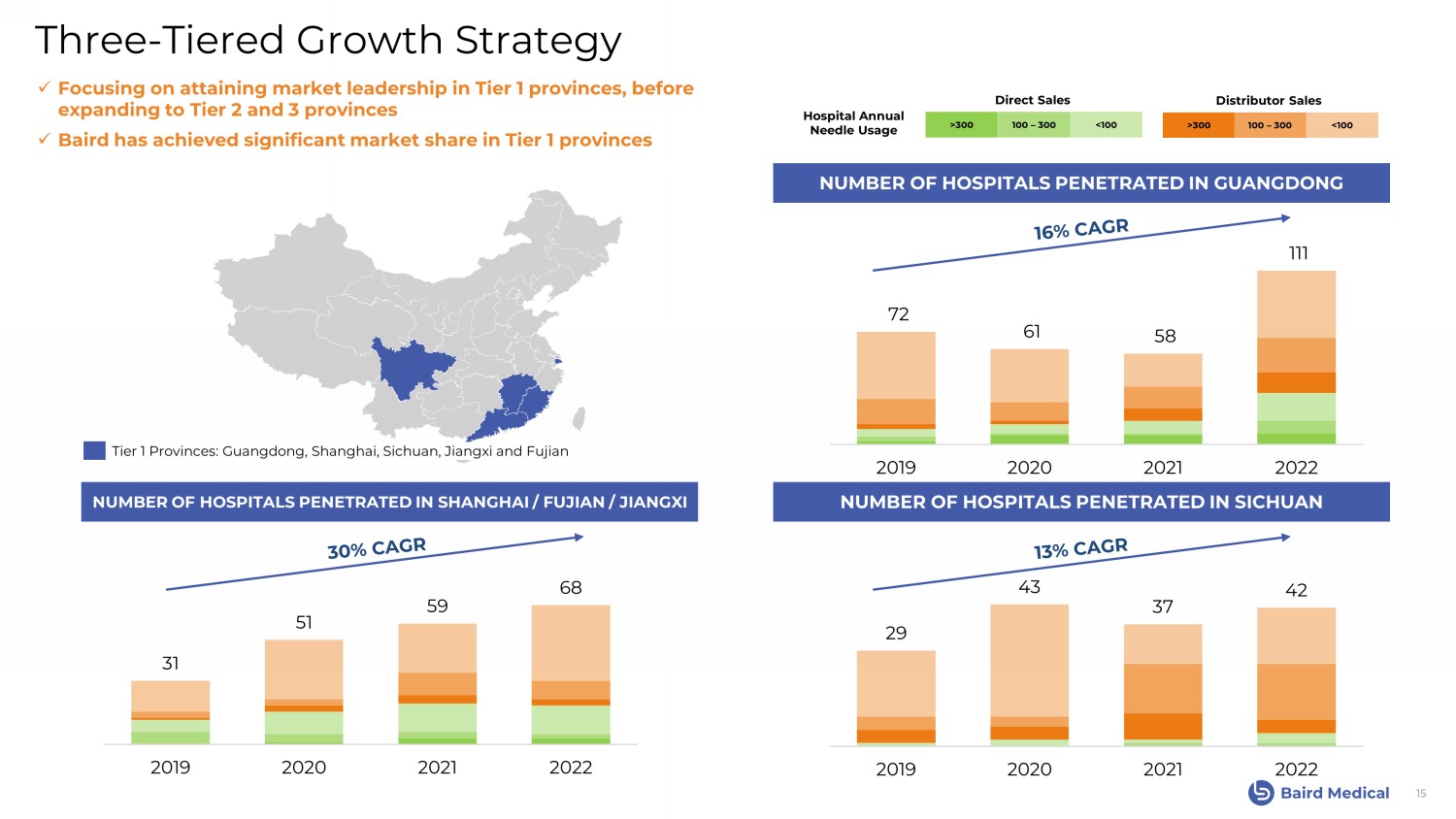

Baird Medical 31 51 59 68 2019 2020 2021 2022 29 43 37 42 2019 2020 2021 2022 72 61 58 111 2019 2020 2021 2022 NUMBER OF HOSPITALS PENETRATED IN GUANGDONG NUMBER OF HOSPITALS PENETRATED IN SHANGHAI / FUJIAN / JIANGXI Three - Tiered Growth Strategy 15 NUMBER OF HOSPITALS PENETRATED IN SICHUAN x Focusing on attaining market leadership in Tier 1 provinces, before expanding to Tier 2 and 3 provinces x Baird has achieved significant market share in Tier 1 provinces >300 100 – 300 <100 Direct Sales >300 100 – 300 <100 Distributor Sales Hospital Annual Needle Usage Tier 1 Provinces: Guangdong, Shanghai, Sichuan, Jiangxi and Fujian

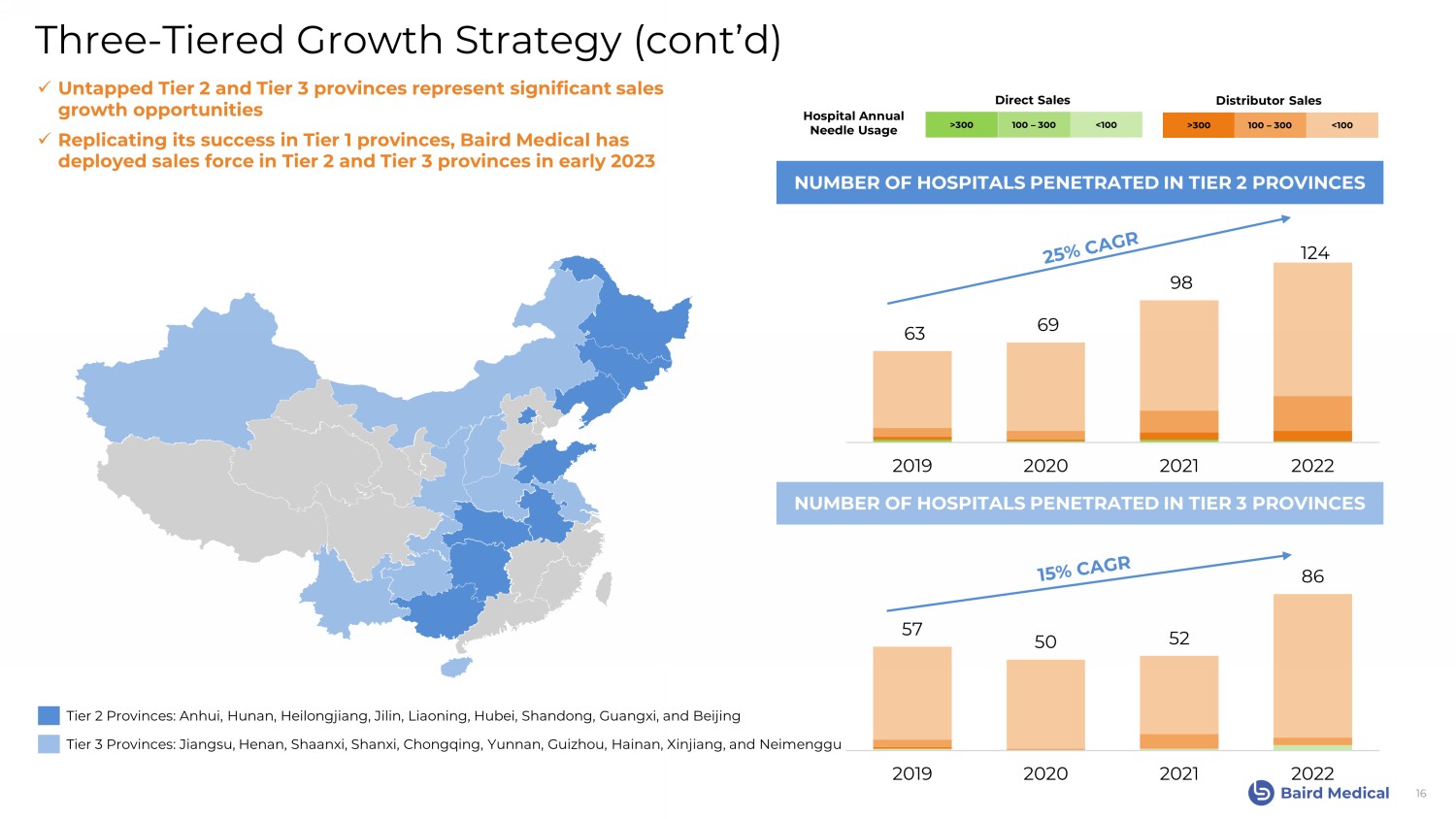

Baird Medical 57 50 52 86 2019 2020 2021 2022 63 69 98 124 2019 2020 2021 2022 Three - Tiered Growth Strategy (cont’d) 16 Tier 2 Provinces: Anhui, Hunan, Heilongjiang, Jilin, Liaoning, Hubei, Shandong, Guangxi, and Beijing Tier 3 Provinces: Jiangsu, Henan, Shaanxi, Shanxi, Chongqing, Yunnan, Guizhou, Hainan, Xinjiang, and Neimenggu x Untapped Tier 2 and Tier 3 provinces represent significant sales growth opportunities x Replicating its success in Tier 1 provinces, Baird Medical has deployed sales force in Tier 2 and Tier 3 provinces in early 2023 NUMBER OF HOSPITALS PENETRATED IN TIER 2 PROVINCES NUMBER OF HOSPITALS PENETRATED IN TIER 3 PROVINCES >300 100 – 300 <100 Direct Sales >300 100 – 300 <100 Distributor Sales Hospital Annual Needle Usage

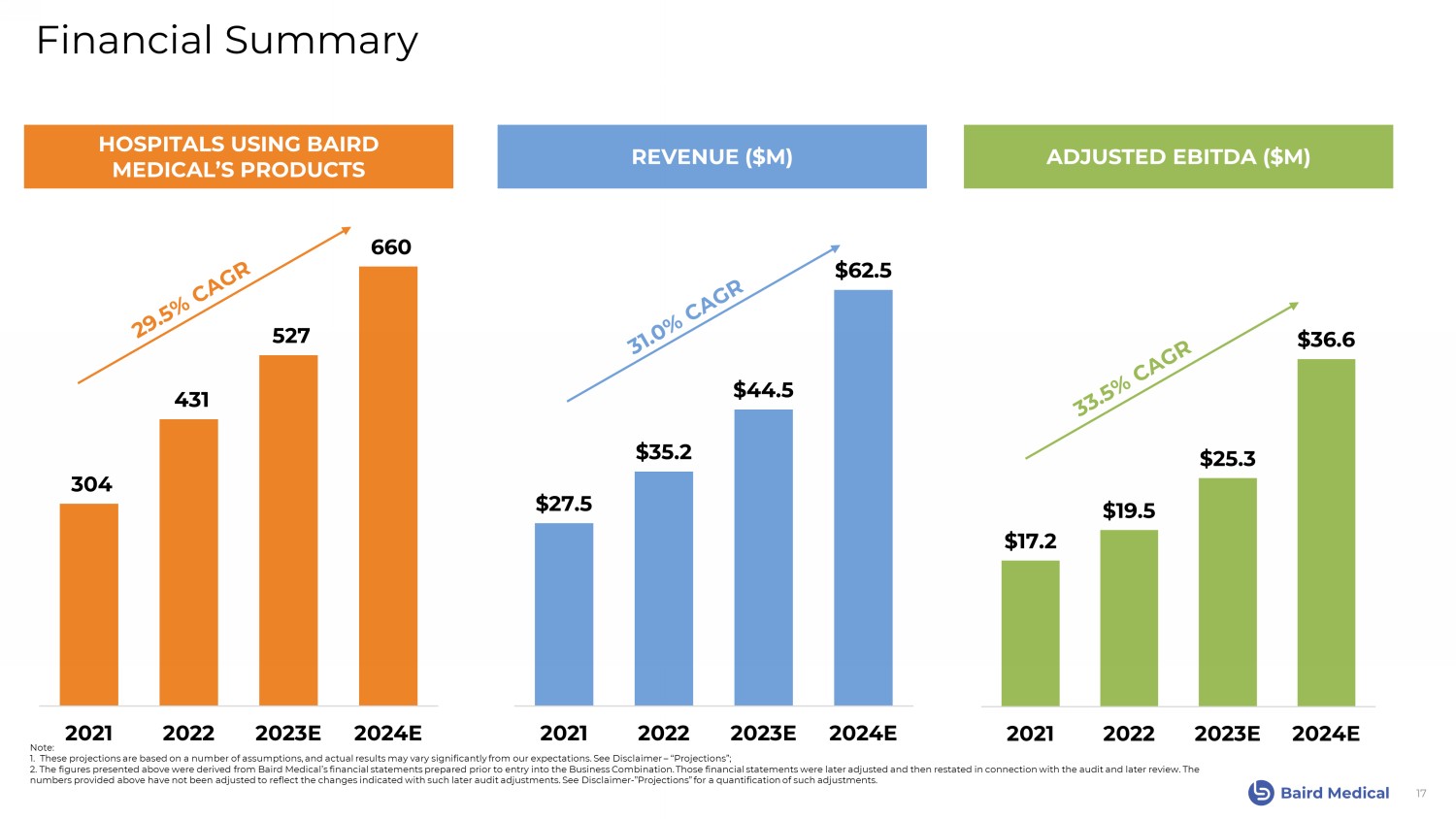

Baird Medical $27.5 $35.2 $44.5 $62.5 2021 2022 2023E 2024E $17.2 $19.5 $25.3 $36.6 2021 2022 2023E 2024E 304 431 527 660 2021 2022 2023E 2024E Financial Summary 17 HOSPITALS USING BAIRD MEDICAL’S PRODUCTS REVENUE ($M) ADJUSTED EBITDA ($M) Note: 1. These projections are based on a number of assumptions, and actual results may vary significantly from our expectations. See Disclaimer – “Projections”; 2. The figures presented above were derived from Baird Medical’s financial statements prepared prior to entry into the Busine ss Combination. Those financial statements were later adjusted and then restated in connection with the audit and later review. The numbers provided above have not been adjusted to reflect the changes indicated with such later audit adjustments. See Disclai mer - ”Projections” for a quantification of such adjustments.

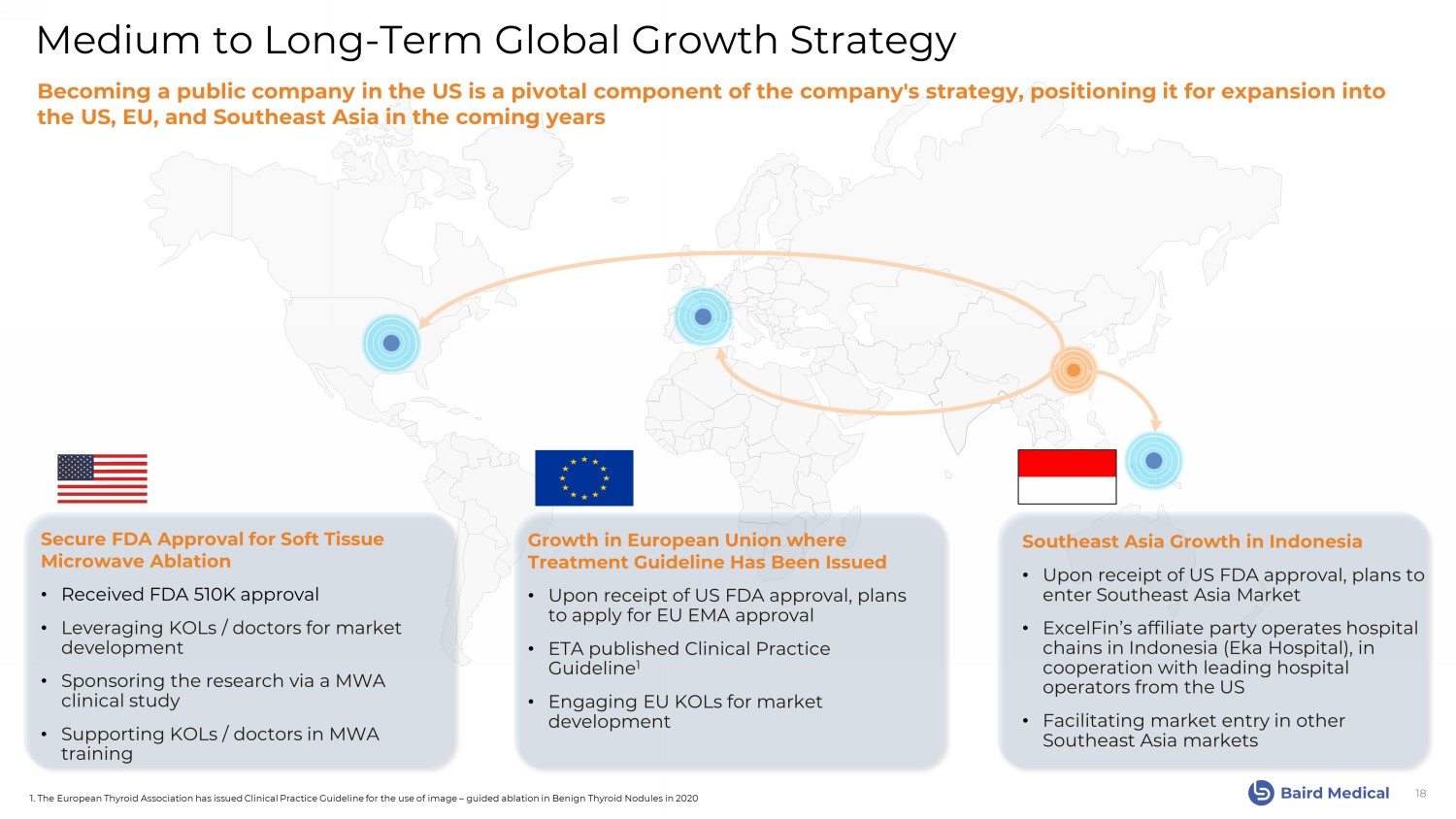

Baird Medical 18 Medium to Long - Term Global Growth Strategy Becoming a public company in the US is a pivotal component of the company's strategy, positioning it for expansion into the US, EU, and Southeast Asia in the coming years Secure FDA Approval for Soft Tissue Microwave Ablation • Received FDA 510K approval • Leveraging KOLs / doctors for market development • Sponsoring the research via a MWA clinical study • Supporting KOLs / doctors in MWA training Growth in European Union where Treatment Guideline Has Been Issued • Upon receipt of US FDA approval, plans to apply for EU EMA approval • ETA published Clinical Practice Guideline 1 • Engaging EU KOLs for market development Southeast Asia Growth in Indonesia • Upon receipt of US FDA approval, plans to enter Southeast Asia Market • ExcelFin’s affiliate party operates hospital chains in Indonesia (Eka Hospital), in cooperation with leading hospital operators from the US • Facilitating market entry in other Southeast Asia markets 1. The European Thyroid Association has issued Clinical Practice Guideline for the use of image – guided ablation in Benign Thyr oid Nodules in 2020

Baird Medical 19 Ideal Timing for Baird to Enter the US Market MWA products for thyroid nodules with rich clinical experience from 99,231 procedures with 684 doctors in PRC US physicians starting to accept MWA for thyroid nodules treatment. Johns Hopkins, Sanford, Tulane recently have conducted clinical trials with 620 subjects Underserved market by large MWA technology providers without clinical experience using MWA for thyroid nodules Planned clinical study with leading thyroid tumor research hospitals to establish clinical benefit through Head - to - Head comparison One - way conversion from radio frequency ablation to microwave ablation, proven by surgeon preference in PRC FDA 510(k) received on November 13, 2023 DR. MICHAEL MINGZHAO XING M.D., PH.D. Independen t Director, Baird Medical CHRISTIAN A. CHILCOTT Chief Commercial Officer, Americas

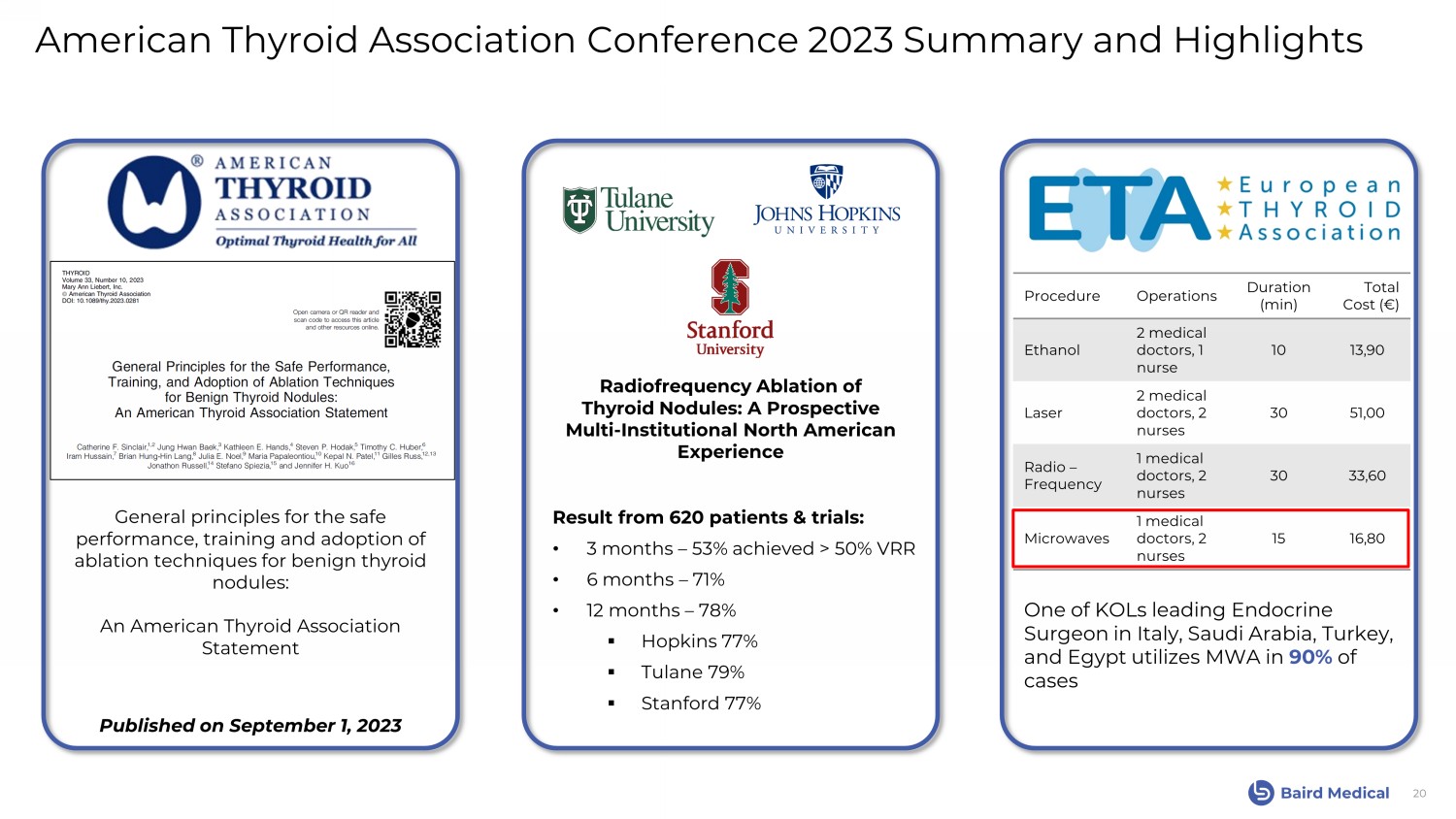

Baird Medical American Thyroid Association Conference 2023 Summary and Highlights 20 Result from 620 patients & trials: • 3 months – 53% achieved > 50% VRR • 6 months – 71% • 12 months – 78% ▪ Hopkins 77% ▪ Tulane 79% ▪ Stanford 77% General principles for the safe performance, training and adoption of ablation techniques for benign thyroid nodules: An American Thyroid Association Statement Radiofrequency Ablation of Thyroid Nodules: A Prospective Multi - Institutional North American Experience Procedure Operations Duration (min) Total Cost (€) Ethanol 2 medical doctors, 1 nurse 10 13,90 Laser 2 medical doctors, 2 nurses 30 51,00 Radio – Frequency 1 medical doctors, 2 nurses 30 33,60 Microwaves 1 medical doctors, 2 nurses 15 16,80 Published on September 1, 2023 One of KOLs leading Endocrine Surgeon in Italy, Saudi Arabia, Turkey, and Egypt utilizes MWA in 90% of cases

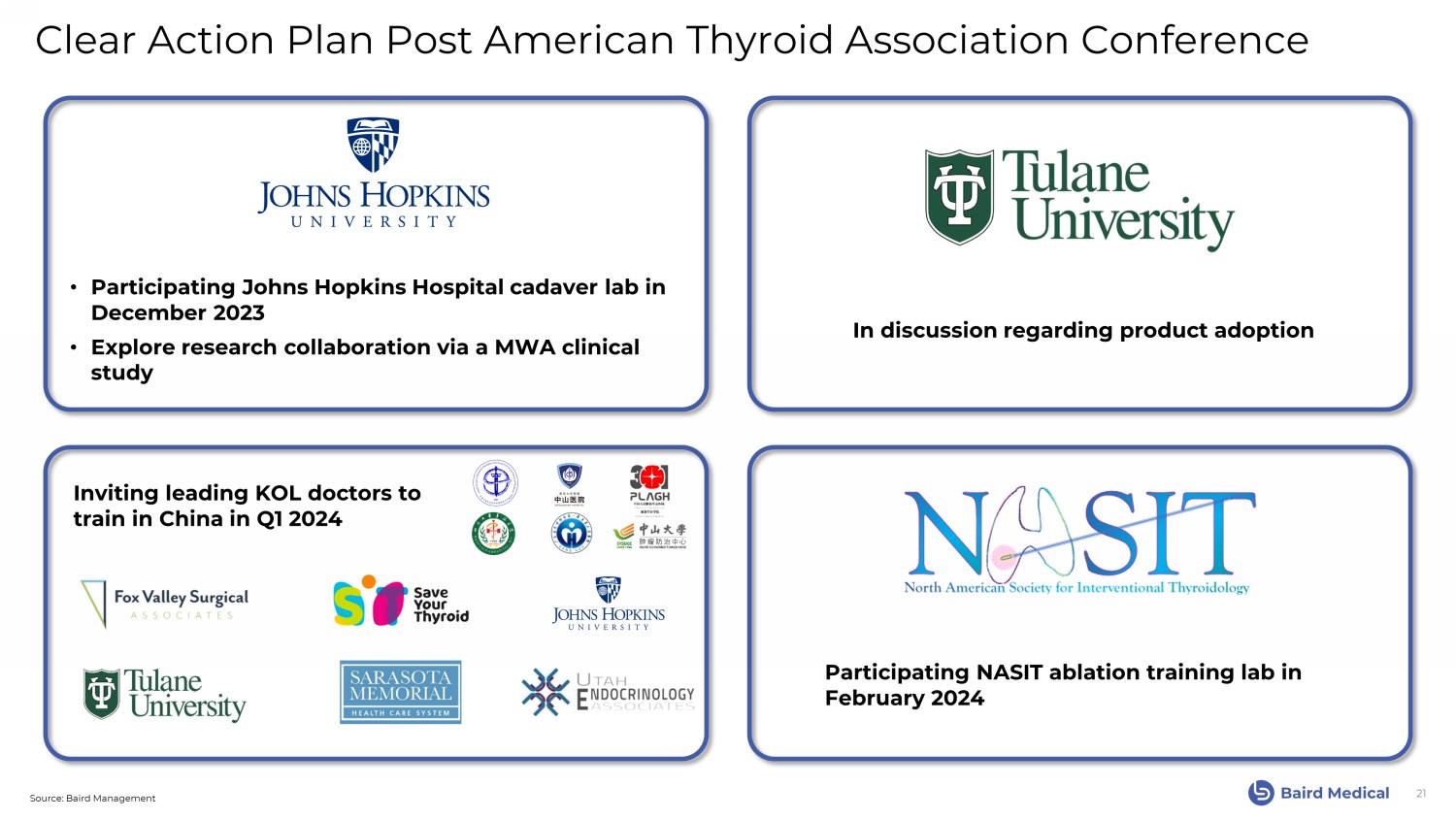

Baird Medical Clear Action Plan Post American Thyroid Association Conference 21 Inviting leading KOL doctors to train in China in Q1 2024 Participating NASIT ablation training lab in February 2024 In discussion regarding product adoption • Participating Johns Hopkins Hospital cadaver lab in December 2023 • Explore research collaboration via a MWA clinical study Source: Baird Management

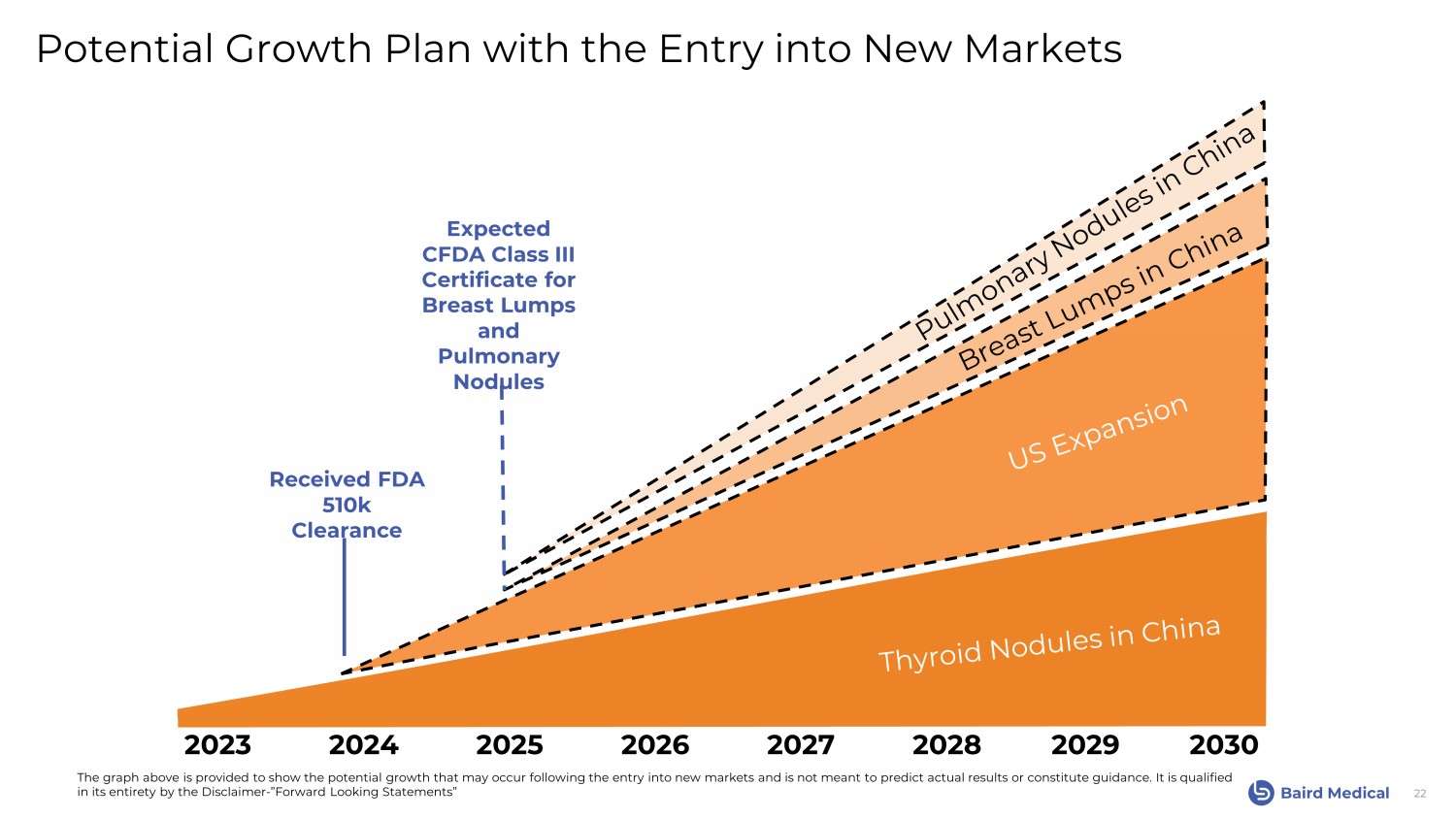

Baird Medical 22 2023 2024 2025 2026 2027 2028 2029 2030 Potential Growth Plan with the Entry into New Markets Expected CFDA Class III Certificate for Breast Lumps and Pulmonary Nodules Received FDA 510k Clearance The graph above is provided to show the potential growth that may occur following the entry into new markets and is not meant to predict actual results or constitute guidance. It is qualified in its entirety by the Disclaimer - ”Forward Looking Statements”

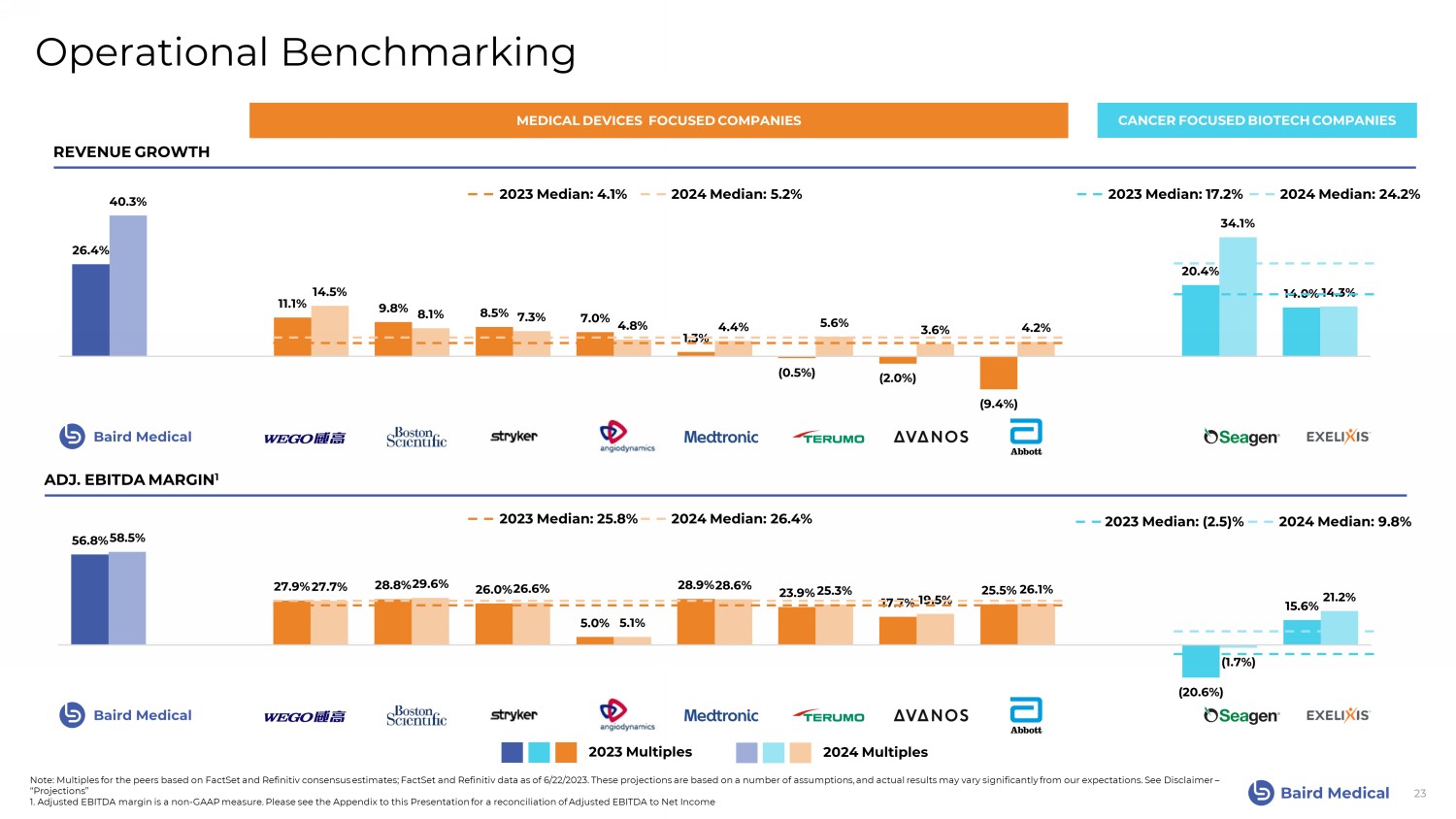

Baird Medical 56.8% 27.9% 28.8% 26.0% 5.0% 28.9% 23.9% 17.7% 25.5% (20.6%) 15.6% 58.5% 27.7% 29.6% 26.6% 5.1% 28.6% 25.3% 19.5% 26.1% (1.7%) 21.2% 26.4% 11.1% 9.8% 8.5% 7.0% 1.3% (0.5%) (2.0%) (9.4%) 20.4% 14.0% 40.3% 14.5% 8.1% 7.3% 4.8% 4.4% 5.6% 3.6% 4.2% 34.1% 14.3% Operational Benchmarking REVENUE GROWTH ADJ. EBITDA MARGIN 1 Note: Multiples for the peers based on FactSet and Refinitiv consensus estimates; FactSet and Refinitiv data as of 6/22/2023. Th ese projections are based on a number of assumptions, and actual results may vary significantly from our expectations. See Di scl aimer – “Projections” 1. Adjusted EBITDA margin is a non - GAAP measure. Please see the Appendix to this Presentation for a reconciliation of Adjusted E BITDA to Net Income 2023 Median: 4.1% 2024 Median: 5.2% 2023 Median: 25.8% 2024 Median: 26.4% 2023 Median: 17.2% 2024 Median: 24.2% 2023 Median: (2.5)% 2024 Median: 9.8% MEDICAL DEVICES FOCUSED COMPANIES CANCER FOCUSED BIOTECH COMPANIES 2023 Multiples 2024 Multiples 23 Baird Medical Baird Medical

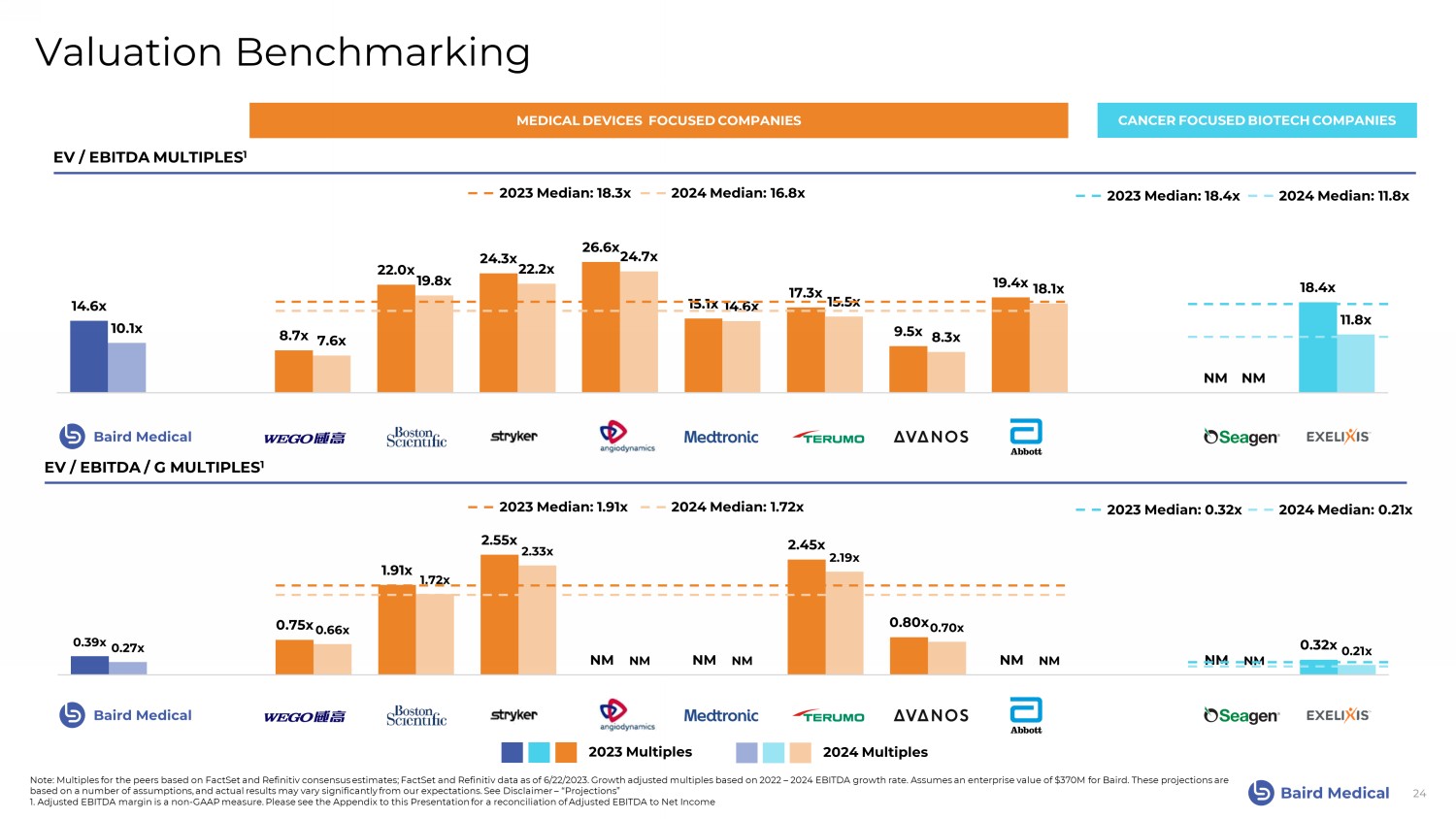

Baird Medical 14.6x 8.7x 22.0x 24.3x 26.6x 15.1x 17.3x 9.5x 19.4x NM 18.4x 10.1x 7.6x 19.8x 22.2x 24.7x 14.6x 15.5x 8.3x 18.1x NM 11.8x 0.39x 0.75x 1.91x 2.55x NM NM 2.45x 0.80x NM NM 0.32x 0.27x 0.66x 1.72x 2.33x NM NM 2.19x 0.70x NM NM 0.21x Valuation Benchmarking 2023 Multiples 2024 Multiples EV / EBITDA MULTIPLES 1 EV / EBITDA / G MULTIPLES 1 Note: Multiples for the peers based on FactSet and Refinitiv consensus estimates; FactSet and Refinitiv data as of 6/22/2023. Gr owth adjusted multiples based on 2022 – 2024 EBITDA growth rate. Assumes an enterprise value of $370M for Baird. These projectio ns are based on a number of assumptions, and actual results may vary significantly from our expectations. See Disclaimer – “Projections ” 1. Adjusted EBITDA margin is a non - GAAP measure. Please see the Appendix to this Presentation for a reconciliation of Adjusted E BITDA to Net Income 2023 Median: 18.3x 2024 Median: 16.8x 2023 Median: 18.4x 2024 Median: 11.8x 2023 Median: 1.91x 2024 Median: 1.72x 2023 Median: 0.32x 2024 Median: 0.21x 24 Baird Medical Baird Medical MEDICAL DEVICES FOCUSED COMPANIES CANCER FOCUSED BIOTECH COMPANIES

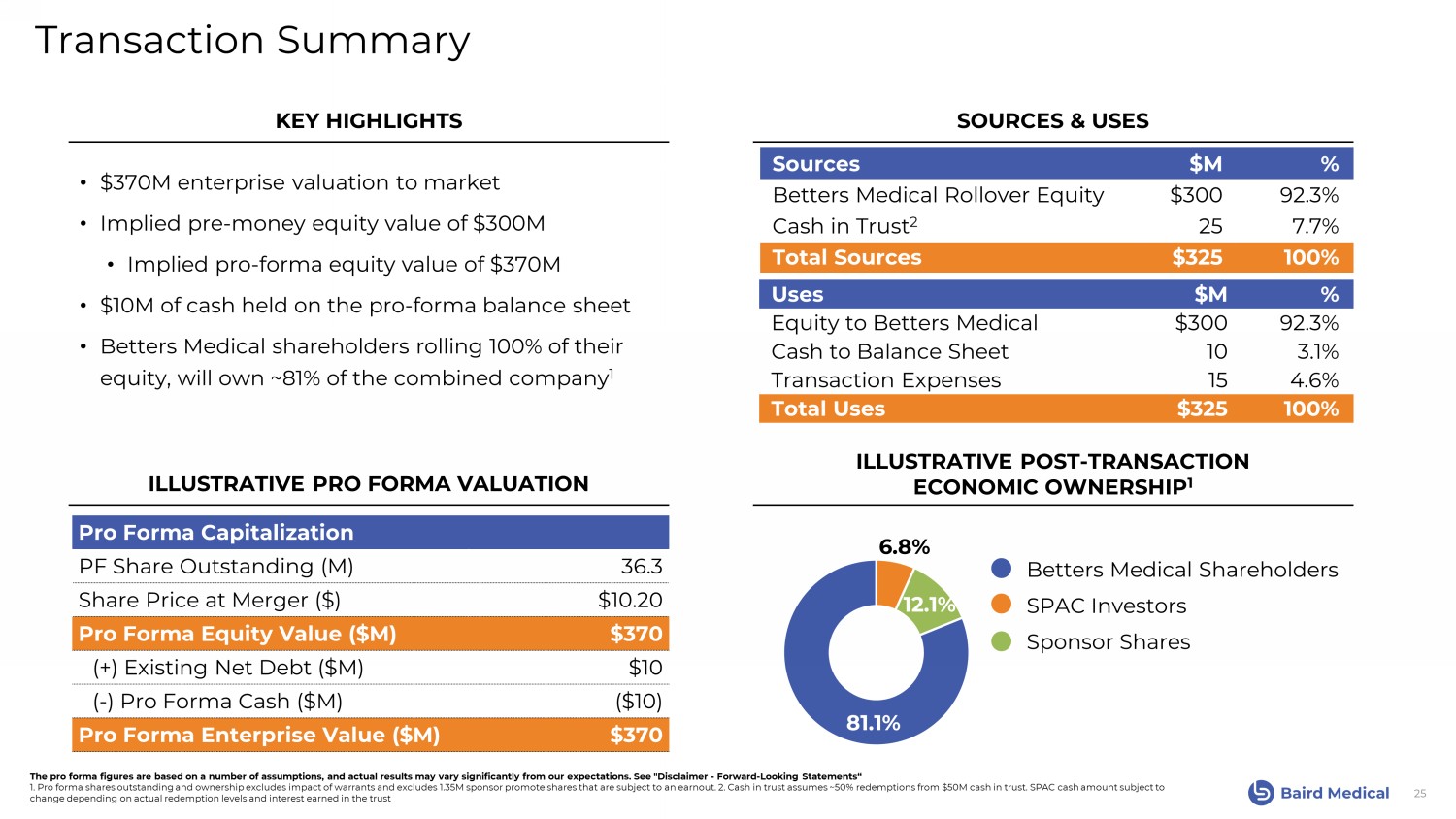

Baird Medical Betters Medical Shareholders SPAC Investors Sponsor Shares 6.8% 12.1% 81.1% Transaction Summary 25 SOURCES & USES KEY HIGHLIGHTS Pro Forma Capitalization PF Share Outstanding (M) 36.3 Share Price at Merger ($) $10.20 Pro Forma Equity Value ($M) $370 (+) Existing Net Debt ($M) $10 ( - ) Pro Forma Cash ($M) ($10) Pro Forma Enterprise Value ($M) $370 Sources $M % Betters Medical Rollover Equity $300 92.3% Cash in Trust 2 25 7.7% Total Sources $325 100% Uses $M % Equity to Betters Medical $300 92.3% Cash to Balance Sheet 10 3.1% Transaction Expenses 15 4.6% Total Uses $325 100% • $370M enterprise valuation to market • Implied pre - money equity value of $300M • Implied pro - forma equity value of $370M • $10M of cash held on the pro - forma balance sheet • Betters Medical shareholders rolling 100% of their equity, will own ~81% of the combined company 1 The pro forma figures are based on a number of assumptions, and actual results may vary significantly from our expectations. See "Disclaimer - Forward - Looking Statements“ 1. Pro forma shares outstanding and ownership excludes impact of warrants and excludes 1.35M sponsor promote shares that are sub ject to an earnout. 2. Cash in trust assumes ~50% redemptions from $50M cash in trust. SPAC cash amount subject to change depending on actual redemption levels and interest earned in the trust ILLUSTRATIVE PRO FORMA VALUATION ILLUSTRATIVE POST - TRANSACTION ECONOMIC OWNERSHIP 1

APPENDIX

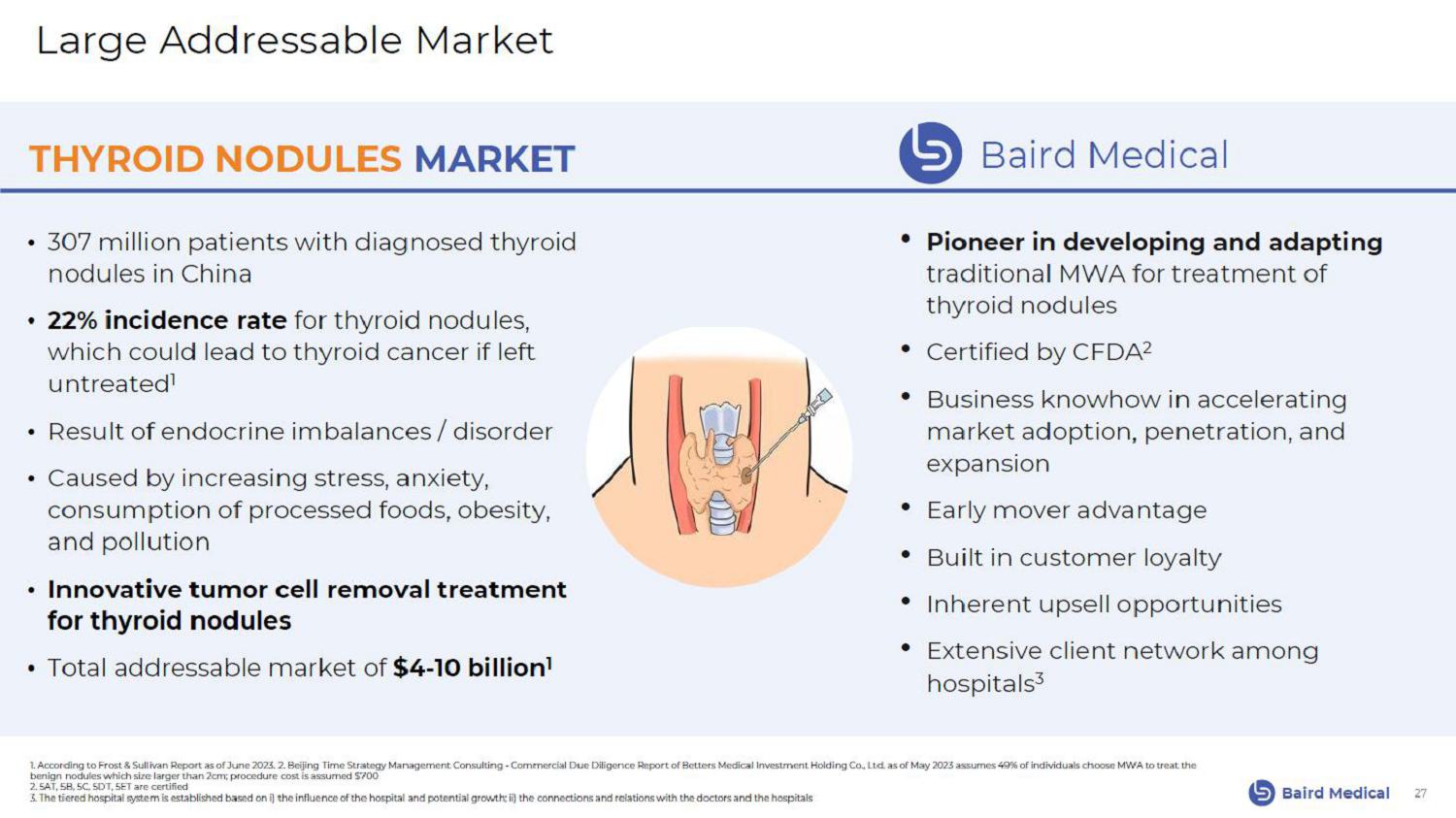

Baird Medical • 370 million patients with diagnosed thyroid nodules in China • 22% incidence rate for thyroid nodules, which could lead to thyroid cancer if left untreated 1 • Result of endocrine imbalances / disorder • Caused by increasing stress, anxiety, consumption of processed foods, obesity, and pollution • Innovative tumor cell removal treatment for thyroid nodules • Total addressable market of $4 - 10 billion 1 Large Addressable Market 27 THYROID NODULES MARKET Baird Medical 1. According to Frost & Sullivan Report as of June 2023. 2. Beijing Time Strategy Management Consulting - Commercial Due Diligen ce Report of Betters Medical Investment Holding Co., Ltd. as of May 2023 assumes 49% of individuals choose MWA to treat the benign nodules which size larger than 2cm; procedure cost is assumed $700 2. 5AT, 5B, 5C, 5DT, 5ET are certified 3. The tiered hospital system is established based on i) the influence of the hospital and potential growth; ii) the connecti ons and relations with the doctors and the hospitals • Pioneer in developing and adapting traditional MWA for treatment of thyroid nodules • Certified by CFDA 2 • Business knowhow in accelerating market adoption, penetration, and expansion • Early mover advantage • Built in customer loyalty • Inherent upsell opportunities • Extensive client network among hospitals 3

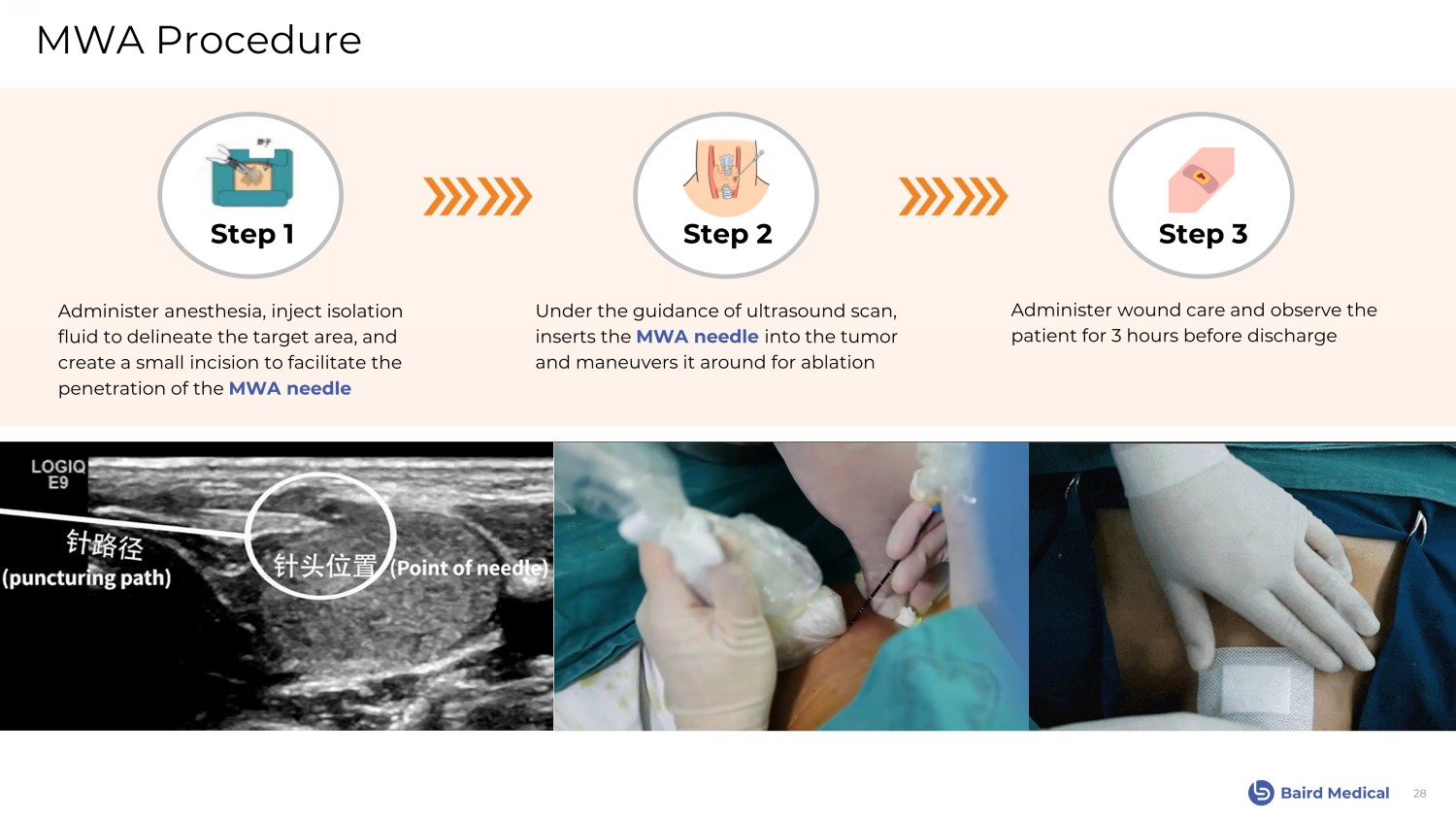

Baird Medical MWA Procedure Step 1 Administer anesthesia, inject isolation fluid to delineate the target area, and create a small incision to facilitate the penetration of the MWA needle Step 2 Under the guidance of ultrasound scan, inserts the MWA needle into the tumor and maneuvers it around for ablation Administer wound care and observe the patient for 3 hours before discharge Step 3 28

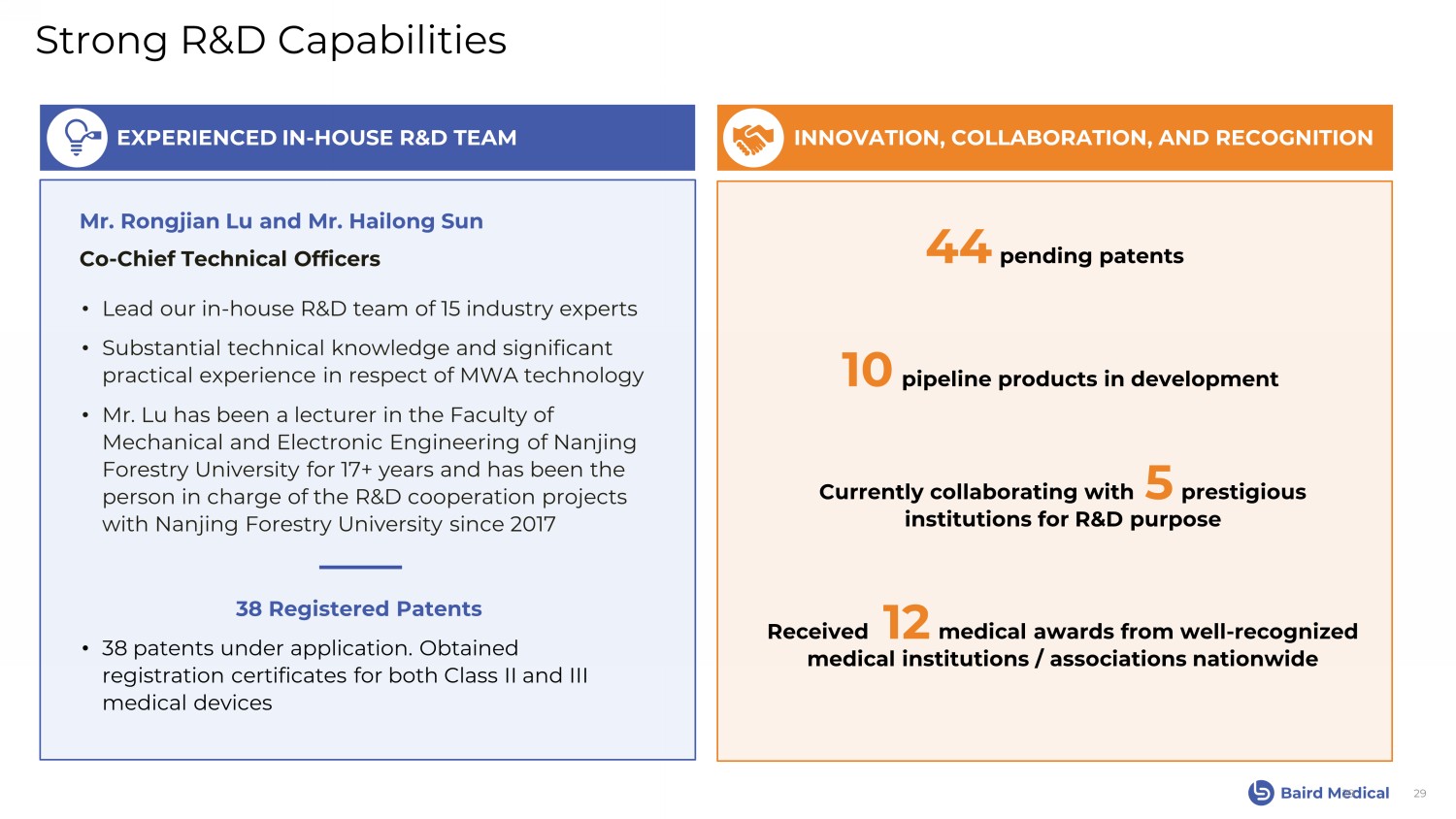

Baird Medical 38 Registered Patents • 38 patents under application. Obtained registration certificates for both Class II and III medical devices 29 INNOVATION, COLLABORATION, AND RECOGNITION EXPERIENCED IN - HOUSE R&D TEAM Strong R&D Capabilities Mr. Rongjian Lu and Mr. Hailong Sun Co - Chief Technical Officers • Lead our in - house R&D team of 15 industry experts • Substantial technical knowledge and significant practical experience in respect of MWA technology • Mr. Lu has been a lecturer in the Faculty of Mechanical and Electronic Engineering of Nanjing Forestry University for 17+ years and has been the person in charge of the R&D cooperation projects with Nanjing Forestry University since 2017 44 pending patents 10 pipeline products in development Currently collaborating with 5 prestigious institutions for R&D purpose Received 12 medical awards from well - recognized medical institutions / associations nationwide 29

Baird Medical Risk Factors 30 The summary of risk factors provided below should be carefully considered in conjunction with the risks and uncertainties des cri bed in the “Risk Factors” section of the Registration Statement ( Registration No. 333 - 274114) filed by Baird Medical Investment Holdings Limited (the “Combined Company” or “PubCo”) with the U.S. Securities and Exchange Com mission (the “SEC”) and other documents filed or that may be filed from time to time with the SEC by or on behalf of Baird Medical Investment Holdings Limi ted (“Baird Medical”), ExcelFin Acquisition Corp. (“ExcelFin”) or other relevant parties to the proposed business combination (the “Business Combination”) of ExcelFin and Baird Medical. Risk Factors Relating to Baird Medical's Business and Industry • Baird Medical's ability to maintain profitability depends on the commercial success of its microwave ablation (“MWA”) and rel ate d medical device products. • Baird Medical's success depends on maintaining its relationships with hospitals, key opinion leaders, and distributors and to ef fectively market to hospitals through public tender processes. • Potential quality defects in Baird Medical's products may cause safety issues, expose Baird Medical to potential product liab ili ty claims, government fines and reputational harm. • If Baird Medical is unable to keep up the demand for its MWA and related medical device products, physicians may turn to alte rna tive treatment methods. • Baird Medical may require additional capital to support its business plan and anticipated growth, and such capital may not be av ailable on acceptable terms, or at all. • Baird Medical's forecasts and projections (particularly those related to the size of the market, target populations for Baird Me dical's products and future exchange rates between the United States dollar and Chinese yuan) are based upon assumptions, analyses and estimates which may prove to be incorrect or inaccurate, wh ich could cause Baird Medical's actual results to differ materially from those forecasted or projected. • Baird Medical may be unable to obtain, maintain or renew the regulatory filings, registration certificates, permits, licenses an d other certifications and approvals (or to complete the testing of its products required to obtain the same) from regulatory authorities needed to commercialize its microwave medical devices and r equ ired for its business and operations in a timely manner, or at all. • Baird Medical may be unable to develop or successfully market new or commercially viable products and technologies or improve it s existing products and technologies in a timely manner, or at all, to respond to changes in market conditions, technological advancements, or the highly competitive industry in which it operates. • Future success depends on Baird Medical's ability to retain members of its management team and key personnel and to attract, ret ain and motivate qualified personnel at a cost - effective rate. • Baird Medical's related party transactions present possible conflicts of interest that could adversely impact on its business, financial conditions and results of opera ti ons. • Negative publicity and allegations involving Baird Medical, its shareholders, directors, officers, employees and business par tne rs may adversely affect Baird Medical's business. • If Baird Medical becomes subject to legal or contractual disputes, governmental investigations or administrative proceedings, it may incur substantial costs and its management team’s attention may be diverted. • Insurance coverage maintained by Baird Medical may be inadequate to protect Baird Medical from the liabilities that it may in cur . • Unfavorable global economic conditions, including inflation, recession, bank failures, and decreases in consumer spending pow er or confidence, including a severe or prolonged downturn in the PRC or global economy, could materially and adversely affect Baird Medical's business, financial condition or results of oper ati ons. • Betters may be required to repurchase its previously issued Series C convertible redeemable preference shares. • Intellectual property litigation and infringement claims by or against Baird Medical, including priority disputes, inventorsh ip disputes or similar proceedings, could cause Baird Medical to incur significant expenses, distract Baird Medical's management, require Baird Medical to redesign or discontinue selling the affec ted product, invalidate Baird Medical’s patents or trademarks, or harm Baird Medical’s business prospects and financial position. • Baird Medical may be unable to obtain and maintain effective or sufficiently broad patent and other intellectual property rig hts for its products and pipeline products. • The planned expansion of Baird Medical's business to additional and emerging markets internationally is expected to lead to i ncr eased exposure to market, regulatory, political, operational, financial and economic risks, including risks relating to China’s relationship with other countries. • Baird Medical's business is largely focused on a single technology (MWA) in a single geographic region (China), which could m agn ify the adverse impact of certain risks.

Baird Medical Risk Factors (cont’d) 31 Risks Related to Doing Business in China • Medical device manufacturers in China are subject to extensive safety regulations and requirements, which can lead to increas ed compliance costs and heightened risks of inadvertent incidents of noncompliance. Baird Medical may be subject to fines for its failure to comply with the relevant PRC laws and regulations rel ati ng to safety facilities. • The Chinese government has substantial influence over Baird Medical's activities and may intervene with its operations, which co uld cause the value of its securities to decline or become worthless. • PRC regulation on loans to, and direct investment in, Baird Medical's PRC subsidiary by offshore holding companies and govern men tal control in currency conversion may delay or prevent Baird Medical from using the proceeds of the Business Combination to make loans to or make additional capital contributions to Bair d M edical's PRC subsidiary. • The China Securities Regulatory Commission’s (“CSRC”) Trial Measures for China - based companies seeking to conduct overseas offer ing and listing in foreign markets could significantly limit or completely hinder Baird Medical's ability to offer or continue to offer its ordinary shares to investors and could cause the val ue of its ordinary shares to significantly decline or become worthless. • If Baird Medical fails to comply with environmental, health and safety laws and regulations, Baird Medical could be subject t o f ines or penalties or incur costs that could have a material adverse effect on the success of its business. • There are uncertainties under the EIT Law relating to withholding tax liabilities for PRC entities, and dividends payable by Bai rd Medical's PRC subsidiary may not qualify for certain treaty benefits. • Baird Medical may rely on dividends and other equity distributions paid by its PRC subsidiary to fund its cash and financing req uirements, and the PRC subsidiary’s restrictions on paying dividends or making other payments could restrict Baird Medical's ability to satisfy liquidity requirements and have a material and adv ers e effect on Baird Medical's business. Risks Related to Ownership of PubCo Ordinary Shares • Following the closing of the potential Business Combination, an active trading market for PubCo’s shares may not be available on a consistent basis to provide shareholders with adequate liquidity and may lead to significant volatility in the PubCo’s share price. • Concentration of ownership among existing executive officers, directors and their affiliates may prevent new investors from i nfl uencing significant corporate decisions. • The Combined Company does not expect to declare any dividends in the foreseeable future. Shareholders may not receive any ret urn on their investment unless they sell their shares. • Substantial sales of PubCo’s stock in the public market by existing shareholders, particularly after any lock - up period ends, co uld cause the PubCo’s share price to decline. • There can be no assurance that PubCo ordinary shares will be approved for listing on Nasdaq upon the Closing, or that PubCo w ill be able to comply with the continued listing standards of Nasdaq or any other applicable exchange listing standards, which could limit investors’ ability to make transactions in PubCo’s secu rit ies. • PubCo’s lack of public company experience and a lack of research or reports about PubCo, its business, or its market, or adve rse recommendations against PubCo Ordinary Shares by securities and industry analysts may adversely affect PubCo’s business and the price and trading volume of its ordinary shares. • PubCo’s issuance of additional capital stock in connection with financings, acquisitions, investments, stock incentive plans or otherwise will dilute all other stockholders Risks Relating to Redemption • The ability to execute ExcelFin’s strategic plan could be negatively impacted to the extent a significant number of stockhold ers choose to redeem their shares. • There is no guarantee that an ExcelFin stockholder’s decision to redeem their shares for a pro rata portion of the Trust Acco unt will economically benefit the stockholder. • Failure to comply with redemption requirements could prevent an ExcelFin stockholder from redeeming their shares of ExcelFin Cla ss A Common Stock. • If ExcelFin stockholders fail to properly demand redemption rights, they cannot convert their ExcelFin Class A Common Stock i nto a pro rata portion of the Trust Account. • Holders who redeem their public shares of ExcelFin Class A Common Stock may continue to hold or exercise any ExcelFin Public War rants that they own in accordance with their terms, which may result in additional dilution. • A new 1% U.S. federal excise tax could be imposed on ExcelFin in connection with redemptions by ExcelFin stockholders of Clas s A Common Stock in connection with the Business Combination.

Baird Medical Risk Factors (cont’d) 32 Risks Relating to ExcelFin, PubCo and the Business Combination • If ExcelFin does not consummate the Business Combination by the termination date of April 25, 2024, ExcelFin will have to cea se all operations except to wind up, redeem all of its public shares and liquidate, or seek approval of its stockholders to extend the termination date. • If the funds held outside of ExcelFin’s Trust Account are insufficient to allow ExcelFin to operate until at least April 25, 202 4 (or such later date as may be extended by means of an amendment to the ExcelFin Certificate of Incorporation), ExcelFin’s ability to complete the Business Combination may be adversely affected. • The working capital available to the Combined Company after the Business Combination will be reduced to the extent ExcelFin’s st ockholders exercise their redemption rights in connection with the Business Combination and will also be reduced to the extent of Baird Medical's and ExcelFin’s transaction expenses, which wi ll be payable by the Combined Company, which may adversely affect the future operations of the Combined Company. • The only significant asset of the Combined Company will be ownership of 100% of the Company Shares, and the Combined Company doe s not currently intend to pay dividends on its common stock, so your ability to achieve a return on your investment will depend on appreciation in the price of PubCo Ordinary Shares. • ExcelFin will incur significant transaction and transition costs in connection with the Business Combination, which could be sig nificantly higher than currently anticipated. If ExcelFin fails to consummate the Business Combination, it may not have sufficient cash available to pay such costs. • ExcelFin’s independent registered public accounting firm’s report contains an explanatory paragraph that expresses substantial doubt abo ut ExcelFin’s ability to continue as a going concern, since ExcelFin will cease all operations except for the purpose of liquidating if ExcelFin is unable to complete an initial business combination by April 25, 2024 (or such later date as may be extended by means of an amendment to the ExcelFin Certificate of Incorporation). • U.S. regulatory authorities, including the SEC, have recently enacted and proposed rules impacting special purpose acquisitio n c ompanies that could increase ExcelFin’s costs, cause the Business Combination to be less attractive to ExcelFin’s shareholders or constrain circumstances under which it could be completed. • Recent increases in inflation and interest rates in the United States and elsewhere could make it more difficult for ExcelFin to consummate the Business Combination. • ExcelFin and Baird Medical have no history operating as a combined company. The unaudited pro forma condensed consolidated co mbi ned financial information may not be an indication of the Combined Company’s financial condition or results of operations following the Business Combination or would have been, and ac cor dingly, you have limited financial information on which to evaluate Baird Medical and your investment decision. • The Business Combination remains subject to conditions that ExcelFin cannot control, which if not satisfied or waived, the Bu sin ess Combination may not be consummated. • The Business Combination may be completed even though material adverse effects may result from its announcement, industry - wide c hanges and other causes. • The exercise of ExcelFin’s discretion in agreeing to changes to or waivers of terms of the Business Combination may result in a conflict of interest when determining whether such changes or waivers of conditions are appropriate and in ExcelFin’s best interests. • The Sponsor, and ExcelFin’s directors and officers, have conflicts of interest in determining to pursue the Business Combinat ion with Baird Medical, since certain of their interests, and certain interests of their affiliates and associates, are different from or in addition to (and which may conflict with) the interest s o f ExcelFin’s stockholders. • ExcelFin’s Sponsor and affiliates will lose their entire investment of privately placed shares (consisting of founder shares) in ExcelFi n if the Business Combination is not completed and, therefore, they may have had a conflict of interest in identifying and selecting Baird Medical to close the Business Combination. • Since the Sponsor, and ExcelFin’s executive officers and directors will not be eligible for reimbursements of their out - of - pocke t expenses if the Business Combination is not completed, a conflict of interest may arise in determining whether Baird Medical is appropriate for ExcelFin’s initial business combination to close t he transaction. • Deferred underwriting fees in connection with the IPO will not be adjusted to account for redemptions by ExcelFin’s public stockholders; if ExcelFin’s public stockholders exercise their redemption rights, the amount of effective total underwriting commissions as a percentage of the aggregate proceeds from the IPO will in cre ase. • ExcelFin’s ability to successfully effect the Business Combination and the Combined Company’s ability to successfully operate th e business will be largely dependent upon the key personnel’s efforts.

Baird Medical Risk Factors (cont’d) 33 • The benefits of the potential Business Combination may not be realized to the extent currently anticipated by ExcelFin and Ba ird Medical, or at all. If the Business Combination’s benefits do not meet expectations of investors, stockholders or analysts, the market price of ExcelFin’s or PubCo’s securities may decline. • The Sponsor and ExcelFin’s directors and officers have agreed to vote in favor of its initial business combination, regardles s o f how ExcelFin’s public stockholders vote. • The Sponsor, ExcelFin’s directors and officers and advisors and their respective affiliates may elect to purchase shares from ho lders of ExcelFin’s public shares in connection with the Business Combination, which may influence the vote on the Business Combination and reduce the public “float” of ExcelFin Class A Commo n S tock. • The PubCo ordinary shares to be received by ExcelFin’s stockholders due to the Business Combination have different rights fro m E xcelFin Class A Common Stock. • ExcelFin’s stockholders will have a reduced ownership and voting interest and less influence over management after consummati on of the Business Combination. • Following the Business Combination, PubCo may be required to take write - downs or write - offs, restructuring and impairment or oth er charges that could have a significant negative effect on its financial condition, results of operations and stock price, which could cause you to lose some or all of your investment. • ExcelFin’s warrants and founder shares may have an adverse effect on the market price of ExcelFin Class A Common Stock and PubCo ordinar y shares. • If redemptions exceed the threshold allowable for ExcelFin to consummate the Business Combination, the ExcelFin Public Warrants will expire worthless. • If PubCo is characterized as a passive foreign investment company for U.S. federal income tax purposes, its U.S. shareholders ma y suffer adverse tax consequences. • There may be tax consequences of the Business Combination that adversely affect holders of ExcelFin Class A Common Stock or E xce lFin Public Warrants. • The IRS may not agree that PubCo should be treated as a non - U.S. corporation or a “surrogate foreign corporation” for U.S. feder al income tax purposes. • Future resales of PubCo ordinary shares may cause their market price to drop significantly. • Anti - takeover provisions in PubCo’s governing documents, by - laws and provisions of Cayman Islands Law could impair limit future share price and entrench management. • ExcelFin’s governing documents limit its stockholders’ choice of judicial forum to the Court of Chancery of the State of Dela war e for certain stockholder litigation matters against ExcelFin, and its directors, officers or stockholders. • If third parties bring claims against ExcelFin, the Trust Account proceeds could be reduced and the per - share redemption amount may be less than $10.20 per share. • ExcelFin directors may decide not to enforce indemnification obligations of ExcelFin’s Sponsor, reducing the funds in the Trust Account for distribution to ExcelFin’s public stockholders. • ExcelFin’s stockholders may be held liable for claims by third parties against ExcelFin to the extent of distributions receiv ed by them. • A securities class action and derivative lawsuits targeting ExcelFin could result in substantial costs and may delay or preve nt completion of the Business Combination. • The Sponsor and ExcelFin’s directors, officers, advisors or their affiliates may elect to purchase shares of ExcelFin Class A Co mmon Stock from ExcelFin’s stockholders, which may influence a vote on a proposed business combination and reduce the public float of ExcelFin’s issued and outstanding capital stock. • If a stockholder or a “group” of stockholders are deemed to hold in excess of 15% of ExcelFin Class A Common Stock, such stoc kho lder or group will lose the ability to redeem all such shares in excess of 15% of ExcelFin Class A Common Stock. • A voluntary or involuntary bankruptcy petition by or against ExcelFin prior to distributions may reduce the per share amount to be received by ExcelFin’s stockholders. • In completing the Business Combination, management’s focus and resources may be diverted from operational matters and other s tra tegic opportunities. • The Combined Company may incur successor liabilities due to conduct arising prior to the completion of the Business Combinati on. • The restatement of previously issued audited consolidated financial statements may affect investor confidence and raise reput ati onal issues and may subject us to additional risks and uncertainties, including increased professional costs and the increased possibility of legal proceedings and regulatory inquiries.

v3.23.3

Cover

|

Dec. 12, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 12, 2023

|

| Entity File Number |

001-40933

|

| Entity Registrant Name |

ExcelFin Acquisition Corp.

|

| Entity Central Index Key |

0001852749

|

| Entity Tax Identification Number |

86-2933776

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100 Kingsley Park Drive

|

| Entity Address, City or Town |

Fort Mill

|

| Entity Address, State or Province |

SC

|