New Executive Leadership Team Appointed to Accelerate XOMA’s Differentiated Royalty Monetization Strategy

04 Janvier 2023 - 1:30PM

XOMA Corporation (NASDAQ: XOMA), the Biotech Royalty Aggregator,

announced today Jim Neal has retired as Chief Executive Officer and

two finance and biotechnology industry veterans have joined in

newly created executive leadership roles to drive the Company’s

next phase of accelerated growth. Mr. Neal has resigned as a

director of the company effective January 1, 2023. The Board

of Directors has appointed Owen Hughes as Executive Chairman of the

Board and Brad Sitko as XOMA’s Chief Investment Officer.

“The Board recognized XOMA’s growth would be best served with a

leadership structure that reflects the unique demands of the

Company’s royalty aggregator strategy. We recruited Owen and

Brad to XOMA, knowing their investment and scaling expertise will

benefit XOMA and its stakeholders as we enter a new era for the

Company. The Board is fully committed to supporting their

efforts as they accelerate the expansion of XOMA’s royalty

portfolio,” stated W. Denman (Denny) Van Ness, Lead Independent

Director of XOMA.

“With guidance from the Board, Jim Neal and the team have spent

many years building on XOMA’s legacy of innovation and implementing

a royalty-focused business model with the potential to generate

sustained cashflows for shareholders well into the future,” said

Mr. Hughes. “I look forward to partnering with Brad and the

team to further establish XOMA’s emerging role as a capital

provider in the biotech ecosystem by effectively and efficiently

deploying our capital to generate positive, uncorrelated returns

for our shareholders.”

Mr. Sitko stated, “The XOMA team built a rich portfolio of over

70 royalty assets from XOMA’s out-licensing strategy and, more

recently, sourcing and acquiring the milestone and royalty

economics for 27 very promising external clinical candidates.

I am eager to infuse my experience in royalty monetization,

strategic planning, and portfolio management into an accelerated

royalty aggregation strategy and to build a broad portfolio

designed to generate outstanding risk-adjusted returns on these

investments for XOMA’s stockholders.”

Mr. Hughes is the Chief Executive Officer of Sail Bio, Inc., a

privately held company founded in 2022. His operational

experience includes prior roles as Chief Executive Officer,

Co-Founder, and member of the Board of Directors of Cullinan

Oncology and as Chief Business Officer and Head of Corporate

Development at Intarcia Therapeutics, Inc. Mr. Hughes also

brings 15 years in healthcare finance experience to XOMA, including

roles as Director at Bain Capital, LP, and Portfolio Manager at

Pyramis Global Advisors LLC, a Fidelity Investments Company.

He currently serves as the Chairman of the Board of Directors

of Ikena Oncology and was the former Chairman of Radius Health and

Lead Independent Director of Translate Bio until their sale to

Gurnet Point Capital and Sanofi, respectively. Mr. Hughes

holds a Bachelor’s in History from Dartmouth College.

Mr. Sitko joins XOMA from RTW Investments, LP, a leading life

sciences investment firm, where, as a Managing Director, he led the

firm's royalty transactions. He also served as a member of

the Board of Directors of the firm’s ICAV and was the founding

Chief Financial Officer of its incubated Shanghai-based biopharma

company. Mr. Sitko brings deep expertise in royalty

monetizations having been involved with the asset class for over 15

years as an investor, investment banker, and strategy consultant.

During his 20-year career in life sciences, Mr. Sitko has served as

Vice President, Finance, Operations & Corporate Development at

DNAnexus and as Director, Investment Banking at MTS Health

Partners. His biopharma consulting experience includes roles

with The Frankel Group / BioDevelopment Ventures and Datamonitor.

Mr. Sitko earned a Bachelor’s degree from the University of

Pennsylvania and an MBA in Finance, Healthcare and Pharmaceutical

Management from Columbia Business School.

About XOMA CorporationXOMA is a biotechnology

royalty aggregator playing a distinctive role in helping biotech

companies achieve their goal of improving human health. XOMA

acquires the potential future economics associated with

pre-commercial therapeutic candidates that have been licensed to

pharmaceutical or biotechnology companies. When XOMA acquires

the future economics, the seller receives non-dilutive,

non-recourse funding they can use to advance their internal drug

candidate(s) or for general corporate purposes. The Company

has an extensive and growing portfolio with more than 70 assets

(asset defined as the right to receive potential future economics

associated with the advancement of an underlying therapeutic

candidate). For more information about the Company and its

portfolio, please visit www.xoma.com.

Forward-Looking Statements/Explanatory Notes

Certain statements contained in this press release are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, including statements regarding the potential expansion

and accelerated growth of XOMA’s portfolio and the potential for

this portfolio to generate sustained cashflows and positive returns

over time. In some cases, you can identify such

forward-looking statements by terminology such as “anticipate,”

“intend,” “believe,” “estimate,” “plan,” “seek,” “project,”

“expect,” “may,” “will”, “would,” “could” or “should,” the negative

of these terms or similar expressions. These forward-looking

statements are not a guarantee of XOMA’s performance, and

you should not place undue reliance on such statements. These

statements are based on assumptions that may not prove accurate,

and actual results could differ materially from those anticipated

due to certain risks inherent in the biotechnology industry,

including those related to the fact that our product candidates

subject to out-license agreements are still being developed, and

our licensees may require substantial funds to continue development

which may not be available; we do not know whether there will be,

or will continue to be, a viable market for the products in which

we have an ownership or royalty interest; if the therapeutic

product candidates to which we have a royalty interest do not

receive regulatory approval, our third-party licensees will not be

able to market them; and the impact to the global economy as a

result of the COVID-19 pandemic. Other potential risks to

XOMA meeting these expectations are described in more detail in

XOMA's most recent filing on Form 10-K and in other filings with

the Securities and Exchange Commission. Consider such risks

carefully when considering XOMA's prospects. Any

forward-looking statement in this press release represents XOMA's

beliefs and assumptions only as of the date of this press release

and should not be relied upon as representing its views as of any

subsequent date. XOMA disclaims any obligation to update any

forward-looking statement, except as required by applicable

law.

EXPLANATORY NOTE: Any references to “portfolio” in this press

release refer strictly to milestone and/or royalty rights

associated with a basket of drug products in development. Any

references to “assets” in this press release refer strictly to

milestone and/or royalty rights associated with individual drug

products in development.

As of the date of this press release, all assets in XOMA’s

milestone and royalty portfolio, except Vabysmo® (faricimab), are

investigational compounds. Efficacy and safety have not been

established. There is no guarantee that any of the investigational

compounds will become commercially available.

|

XOMA Investor Contact |

XOMA Media Contact |

| Juliane Snowden |

Kathy Vincent |

| XOMA Corporation |

KV Consulting &

Management |

| +1 646-438-9754 |

+1 310-403-8951 |

| juliane.snowden@xoma.com |

kathy@kathyvincent.com |

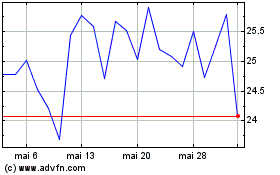

XOMA Royalty (NASDAQ:XOMA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

XOMA Royalty (NASDAQ:XOMA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024