XOMA Acquires Royalty and Milestone Economics to Phase 3 First-In-Class Orphan Disease Asset for Niemann-Pick Disease Type C (NPC) and Phase 2 Oncology Asset

22 Juin 2023 - 1:30PM

XOMA Corporation (NASDAQ: XOMA), announced today it has acquired

the royalty and milestone rights associated with two assets from

LadRx Corporation: arimoclomol, an oral therapeutic for

Niemann-Pick disease type C, and aldoxorubicin, an albumin-linked

formulation of doxorubicin.

Arimoclomol is a first-in-class investigational therapy that has

completed a randomized, placebo-controlled, multinational Phase 2/3

program in Niemann-Pick Disease Type C, an ultra-rare, genetic,

progressive neurogenerative disorder. The compound has

received Orphan Drug Designation for the treatment of NPC by the

Regulatory Authorities in the U.S. and EU. Additionally, the

U.S. Food and Drug Administration (FDA) has granted the compound

Fast-Track Designation, Breakthrough Therapy Designation and Rare

Pediatric Disease Designation. Zevra Therapeutics has

announced its intention to file a New Drug Application for

arimoclomol as early as the third quarter of 20231.

The second asset is aldoxorubicin, a Phase 2 program that is

being developed by ImmunityBio as a potential therapy for

pancreatic cancer. The FDA has granted aldoxorubicin Orphan

Drug Designation for the treatment of soft tissue sarcoma.

“This is a notable acquisition of the economics associated with

a therapy that has the potential to address a significant unmet

need in a devastating disease,” stated Owen Hughes, Executive

Chairman of XOMA. “This transaction is very much aligned with

our strategy of seeking assets that have the potential to establish

new standards of care for patients while driving cashflow

generation for XOMA shareholders.”

“NPC is an ultra-rare genetic disorder where patients can lose

their vision and hearing, their ability to walk and swallow, and it

leads to premature death. In the United States, there are no

approved treatments for NPC. Zevra is actively preparing to

file a New Drug Application1, as these patients clearly need access

to therapy as evidenced by over 150 patients receiving arimoclomol

therapy through expanded access,” stated Brad Sitko, Chief

Investment Officer at XOMA. “We provided a non-dilutive

capital solution to LadRx, which had been exploring strategic

alternatives. LadRx can now advance an internal pipeline of

new therapeutics to treat patients with high unmet needs.”

Under the terms of the agreement, XOMA will receive a mid-single

digit royalty on arimoclomol’s commercial sales upon approval and

up to $52.6 million, net, in potential milestone payments.

Should aldoxorubicin be approved for marketing, XOMA will receive a

mid-single-digit to mid-teens royalty rate on aldoxorubicin

commercial sales depending upon the indication, in addition to

potential milestone payments of up to $343 million in development

and commercial milestones. LadRx will be entitled to receive

up to $6 million in certain pre-specified milestones associated

with arimoclomol and aldoxorubicin. XOMA acquired these

royalty and milestone interests for $5 million.

XOMA was represented by Gibson Dunn & Crutcher LLP.

LadRx was represented by Roth Capital Partners and Haynes and Boone

LLP.

About XOMA CorporationXOMA is a biotechnology

royalty aggregator playing a distinctive role in helping biotech

companies achieve their goal of improving human health. XOMA

acquires the potential future economics associated with

pre-commercial therapeutic candidates that have been licensed to

pharmaceutical or biotechnology companies. When XOMA acquires

the future economics, the seller receives non-dilutive,

non-recourse funding they can use to advance their internal drug

candidate(s) or for general corporate purposes. The Company

has an extensive and growing portfolio with more than 70 assets

(asset defined as the right to receive potential future economics

associated with the advancement of an underlying therapeutic

candidate). For more information about the Company and its

portfolio, please visit www.xoma.com.

Forward-Looking Statements/Explanatory

NotesCertain statements contained in this press release

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, including statements regarding the timing and

amount of potential milestone and commercial payments to XOMA and

other developments related to arimoclomol and aldoxorubicin, and

the potential of XOMA’s portfolio of partnered programs and

licensed technologies generating substantial milestone and royalty

proceeds over time. In some cases, you can identify such

forward-looking statements by terminology such as “anticipate,”

“intend,” “believe,” “estimate,” “plan,” “seek,” “project,”

“expect,” “may,” “will,” “would,” “could” or “should,” the negative

of these terms or similar expressions. These forward-looking

statements are not a guarantee of XOMA’s performance, and you

should not place undue reliance on such statements. These

statements are based on assumptions that may not prove accurate,

and actual results could differ materially from those anticipated

due to certain risks inherent in the biotechnology industry,

including those related to the fact that our product candidates

subject to out-license agreements are still being developed, and

our licensees may require substantial funds to continue development

which may not be available; we do not know whether there will be,

or will continue to be, a viable market for the products in which

we have an ownership or royalty interest; if the therapeutic

product candidates to which we have a royalty interest do not

receive regulatory approval, our third-party licensees will not be

able to market them; and the impact to the global economy as a

result of the COVID-19 pandemic. Other potential risks to

XOMA meeting these expectations are described in more detail in

XOMA's most recent filing on Form 10-K and in other filings with

the Securities and Exchange Commission. Consider such risks

carefully when considering XOMA's prospects. Any

forward-looking statement in this press release represents XOMA's

beliefs and assumptions only as of the date of this press release

and should not be relied upon as representing its views as of any

subsequent date. XOMA disclaims any obligation to update any

forward-looking statement, except as required by applicable

law.

EXPLANATORY NOTE: Any references to “portfolio” in this press

release refer strictly to milestone and/or royalty rights

associated with a basket of drug products in development. Any

references to “assets” in this press release refer strictly to

milestone and/or royalty rights associated with individual drug

products in development.

As of the date of this press release, all assets in XOMA’s

milestone and royalty portfolio, except Vabysmo® and IXINITY®, are

investigational compounds. Efficacy and safety have not been

established. There is no guarantee that any of the investigational

compounds will become commercially available.

| XOMA

Investor Contact |

|

XOMA

Media Contact |

| Juliane Snowden |

|

Kathy Vincent |

| XOMA Corporation |

|

KV Consulting & Management |

| +1 646-438-9754 |

|

+1 310-403-8951 |

| juliane.snowden@xoma.com |

|

kathy@kathyvincent.com |

1

https://investors.zevra.com/news-releases/news-release-details/zevra-therapeutics-reports-corporate-updates-and-first-quarter

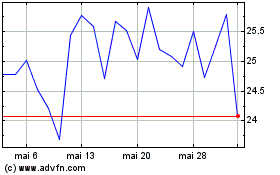

XOMA Royalty (NASDAQ:XOMA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

XOMA Royalty (NASDAQ:XOMA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024