ADDITIONAL INFORMATION ABOUT THE TRUSTEES

The Board believes that each Trustee's experience, qualifications, attributes and skills on an individual basis and in combination with those of the other Trustees lead to the conclusion that the Trustees possess the requisite experience, qualifications, attributes and skills to serve on the Board. The Board believes that the Trustees' ability to review critically, evaluate, question and discuss information provided to them; to interact effectively with the Investment Adviser, Sub-Adviser, other service providers, counsel and independent auditors; and to exercise effective business judgment in the performance of their duties, support this conclusion. The Board has also considered the contributions that each Trustee can make to the Board and to the Fund. A Trustee's ability to perform his or her duties effectively may have been attained through the Trustee's executive, business, consulting, and/or legal positions; experience from service as a Trustee of the Fund and other funds/portfolios in the abrdn complex, other investment funds, public companies, or non-profit entities or other organizations; educational background or professional training or practice; and/or other life experiences. In this regard, the following specific experience, qualifications, attributes and/or skills apply as to each Trustee in addition to the information set forth in the table above: Ms. Maasbach, financial and research analysis experience in and covering the Asia region and experience in world affairs; Mr. Malone, legal background and public service leadership experience, board experience with other public and private companies, and executive and business consulting experience; Mr. Sievwright, banking and accounting experience and experience as a board member of public companies; Mr. Takian, product development, marketing and management experience in investment management industry and Mr. Bird, Chief Executive Officer of abrdn and prior Chief Executive Officer of other public companies.

The Board believes that the significance of each Trustee's experience, qualifications, attributes or skills is an individual matter (meaning that experience important for one Trustee may not have the same value for another) and that these factors are best evaluated at the Board level, with no single Trustee, or particular factor, being indicative of Board effectiveness. In its periodic self-assessment of the effectiveness of the Board, the Board considers the complementary individual skills and experience of the individual Trustees in the broader context of the Board's overall composition so that the Board, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the business of the Fund. References to the qualifications, attributes and skills of Trustees are presented pursuant to disclosure requirements of the Securities and Exchange Commission ("SEC") and do not constitute holding out the Board or any Trustee as having any special expertise or experience, and shall not impose any greater responsibility or liability on any such person or on the Board by reason thereof.

OFFICERS

Name, Address and

Year of Birth |

|

Positions(s) Held

With Fund |

|

Term of Office

and Length of

Time Served* |

|

Principal Occupation(s) During the Past Five Years |

|

Joseph Andolina**

c/o abrdn Inc.,

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1978 |

|

Chief Compliance Officer and Vice President—

Compliance |

|

Since 2017 |

|

Currently, Chief Risk Officer—Americas for abrdn Inc. and serves as the Chief Compliance Officer for abrdn Inc. Prior to joining the Risk and Compliance Department, he was a member of abrdn Inc.'s Legal Department, where he served as US Counsel since 2012. |

|

Katherine Corey**

c/o abrdn Inc.,

1900 Market St, Suite 200

Philadelphia, PA 19103

Year of Birth: 1985 |

|

Vice President |

|

Since 2023 |

|

Currently, Senior Legal Counsel, Product Governance US for abrdn Inc. Ms. Corey joined abrdn Inc. as U.S. Counsel in 2013. |

|

Name, Address and

Year of Birth |

|

Positions(s) Held

With Fund |

|

Term of Office

and Length of

Time Served* |

|

Principal Occupation(s) During the Past Five Years |

|

Megan Kennedy**

c/o abrdn Inc.,

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1974 |

|

Vice President, Secretary |

|

Since 2017 |

|

Currently, Senior Director, Product Governance for abrdn Inc. Ms. Kennedy joined abrdn Inc. as a Senior Fund Administrator in 2005. |

|

Andrew Kim**

c/o abrdn Inc.,

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1983 |

|

Vice President |

|

Since 2022 |

|

Currently. Senior Product Governance Manager, Product Governance US for abrdn. Mr. Kim joined abrdn Inc. in 2013. |

|

Brian Kordeck**

c/o abrdn Inc.,

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1978 |

|

Vice President |

|

Since 2022 |

|

Currently, Senior Product Manager, Product Governance US for abrdn Inc. Mr. Kordeck joined abrdn Inc. in 2013. |

|

Michael Marsico**

c/o abrdn Inc.,

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1980 |

|

Vice President |

|

Since 2022 |

|

Currently, Senior Product Manager, Product Governance US for abrdn Inc. Mr. Marsico joined abrdn Inc. in 2014. |

|

Ben Pakenham

c/o abrdn Investments Limited

280 Bishopsgate

London EC2M 4AG

United Kingdom

United Kingdom

Year of Birth: 1973 |

|

Vice President |

|

Since 2017 |

|

Currently, Head of Euro High Yield and Loans. Mr. Pakenham joined abrdn in 2011 from Henderson Global Investors, where he was the lead fund manager on the Extra Monthly Income Bond Fund and a named manager on various other credit portfolios including the High Yield Monthly Income Bond Fund. |

|

Christian Pittard**

c/o abrdn Investments Limited

280 Bishopsgate

London EC2M 4AG

United Kingdom

Year of Birth: 1973 |

|

President |

|

Since 2017 |

|

Currently, Group Head of Product Opportunities and Director of abrdn plc since 2010. Mr. Pittard joined abrdn from KPMG in 1999. |

|

Lucia Sitar**

c/o abrdn Inc.,

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1971 |

|

Vice President |

|

Since 2017 |

|

Currently, Vice President and Head of Product Management and Governance for abrdn Inc.—since 2020. Previously, Ms. Sitar was Managing U.S. Counsel for abrdn Inc.. Ms. Sitar joined abrdn Inc. as U.S. Counsel in July 2007. |

|

* Officers hold their positions with the Fund until a successor has been duly elected and qualifies.

** Each Officer may hold officer position(s) in one or more other funds which are part of the Fund Complex.

12

Ownership of Securities

Set forth in the table below is the dollar range of equity securities in the Fund and the aggregate dollar range of equity securities in the abrdn Family of Investment Companies (as defined below) beneficially owned by each Trustee or nominee.

|

Name of Trustee or Nominee |

|

Dollar Range of Equity

Securities Owned in the Fund(1) |

|

Aggregate Dollar Range of Equity

Securities in All Funds Overseen by

Trustee or Nominee in the Family of

Investment Companies(2) |

|

|

Independent Trustees/Nominees: |

|

|

Nancy Yao Maasbach |

|

$1-$10,000 |

|

$50,001-$100,000 |

|

|

P. Gerald Malone |

|

$10,001-$50,000 |

|

$50,001-$100,000 |

|

|

John Sievwright |

|

$50,001-$100,000 |

|

over $100,000 |

|

|

Randolph Takian |

|

$10,001-$50,000 |

|

$10,001-$50,000 |

|

|

Interested Trustee: |

|

|

Stephen Bird |

|

$1-$10,000 |

|

$50,001-$100,000 |

|

(1) This information has been furnished by each Trustee as of October 31, 2022. "Beneficial ownership" is determined in accordance with Rule 16a-1(a)(2) promulgated under the Securities Exchange Act of 1934, as amended (the "1934 Act").

(2) "Family of Investment Companies" means those registered investment companies that are advised by the Investment Adviser or an affiliate and that hold themselves out to investors as related companies for purposes of investment and investor services.

As of October 31, 2022, the Trustees and officers, in the aggregate, owned less than 1% of the Fund's outstanding equity securities. As of October 31, 2022, none of the Independent Trustees or their immediate family members owned any shares of the Investment Adviser or Sub-Adviser or of any person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with the Investment Adviser or Sub-Adviser.

Mr. Pittard and Ms. Ferrari serve as executive officers of the Fund. As of October 31, 2022, Mr. Pittard and Ms. Ferrari did not own shares of the Fund.

BOARD AND COMMITTEE STRUCTURE

The Board is currently composed of four Independent Trustees and one Interested Trustee, Stephen Bird. The Fund's Charter provides that the Board shall be divided into three classes: Class I, Class II and Class III. The terms of office of the Trustees of the Fund in each class expire at the annual meeting of shareholders in the year indicated or thereafter in each case when their respective successors are elected and qualified: Class I in 2024, Class II in 2025 and Class III (if elected) in 2026.

The Board has appointed Mr. Malone, an Independent Trustee, as Chair. The Chair presides at meetings of the Trustees, participates in the preparation of the agenda for meetings of the Board, and acts as a liaison between the Trustees and management between Board meetings. Except for any duties specified herein, the designation of the Chair does not impose on such Trustee any duties, obligations or liability that is greater than the duties, obligations or liability imposed on such person as a member of the Board, generally.

The Board holds regular quarterly meetings each year to consider and address matters involving the Fund. The Board also may hold special meetings to address matters arising between regular meetings. The Independent Trustees

13

also meet outside the presence of management in executive session at least quarterly and have engaged separate, independent legal counsel to assist them in performing their oversight responsibilities.

The Board has established a committee structure that includes an Audit Committee and a Nominating and Corporate Governance Committee (each discussed in more detail below) to assist the Board in the oversight and direction of the business affairs of the Fund, and from time to time may establish informal ad hoc committees or working groups to review and address the practices of the Fund with respect to specific matters. The Committee system facilitates the timely and efficient consideration of matters by the Trustees, and facilitates effective oversight of compliance with legal and regulatory requirements and of the Fund's activities and associated risks. The standing Committees currently conduct an annual review of their charters, which includes a review of their responsibilities and operations. The Nominating and Corporate Governance Committee and the Board as a whole also conduct an annual self-assessment of the performance of the Board, including consideration of the effectiveness of the Board's Committee structure. Each Committee is comprised entirely of Independent Trustees. Each Committee member is also "independent" within the meaning of the New York Stock Exchange ("NYSE") listing standards. The Board reviews its structure regularly and believes that its leadership structure, including having a super-majority of Independent Trustees, coupled with an Independent Trustee as Chair, is appropriate because it allows the Board to exercise informed and independent judgment over the matters under its purview and it allocates areas of responsibility among the Committees and the full Board in a manner that enhances efficient and effective oversight.

Audit Committee

The Audit Committee, established in accordance with Section 3(a)(58)(A) of the 1934 Act, is responsible for the selection and engagement of the Fund's independent registered public accounting firm (subject to ratification by the Independent Trustees), pre-approves and reviews both the audit and non-audit work of the Fund's independent registered public accounting firm, and reviews compliance of the Fund with regulations of the SEC and the Internal Revenue Service, and other related matters. The members of the Fund's Audit Committee are Ms. Nancy Yao Maasbach and Messrs. P. Gerald Malone, Randolph Takian and John Sievwright.

The Board has adopted an Audit Committee Charter for its Audit Committee, the current copy of which is available on the Fund's website at http://www.abrdnacp.com.

Nominating and Corporate Governance Committee; Consideration of Potential Trustee Nominees

The Nominating and Corporate Governance Committee recommends nominations for membership on the Board and reviews and evaluates the effectiveness of the Board in its role in governing the Fund and overseeing the management of the Fund. It evaluates candidates' qualifications for Board membership and, with respect to nominees for positions as Independent Trustees, their independence from the Investment Adviser and Sub-Adviser, as appropriate, and other principal service providers. The Nominating and Corporate Governance Committee generally meets twice annually to identify and evaluate nominees for trustee and makes its recommendations to the Board at the time of the Board's December meeting. The Nominating and Corporate Governance Committee also periodically reviews trustee compensation and will recommend any appropriate changes to the Board. The Nominating and Corporate Governance Committee also reviews and may make recommendations to the Board relating to the effectiveness of the Board in carrying out its responsibilities in governing the Fund and overseeing the management of the Fund. The members of the Fund's Nominating and Corporate Governance Committee are Ms. Nancy Yao Maasbach and Messrs. P. Gerald Malone, Randolph Takian and John Sievwright.

The Board has adopted a Nominating and Corporate Governance Committee Charter, a copy of which is available on the Fund's website at http://www.abrdnacp.com.

The Nominating and Corporate Governance Committee may take into account a wide variety of factors in considering prospective trustee candidates, including (but not limited to): (i) availability (including availability to

14

attend to Board business on short notice) and commitment of a candidate to attend meetings and perform his or her responsibilities on the Board; (ii) relevant industry and related experience; (iii) educational background; (iv) reputation; (v) financial expertise; (vi) the candidate's ability, judgment and expertise; (vii) overall diversity of the Board's composition; and (viii) commitment to the representation of the interests of the Fund and its shareholders. The Nominating and Corporate Governance Committee also considers the effect of any relationships beyond those delineated in the 1940 Act that might impair independence, such as business, financial or family relationships with the Investment Adviser or Sub-Adviser or their affiliates, as appropriate. The Nominating and Corporate Governance Committee will consider potential trustee candidates, if any, recommended by Fund shareholders provided that the proposed candidates: (i) satisfy any minimum qualifications of the Fund for its trustees; (ii) are not "interested persons" of the Fund, as that term is defined in the 1940 Act; and (iii) are "independent" as defined in the listing standards of any exchange on which the Fund's shares are listed.

While the Nominating and Corporate Governance Committee has not adopted a particular definition of diversity or a particular policy with regard to the consideration of diversity in identifying candidates, when considering a candidate's and the Board's diversity, the Committee generally considers the manner in which each candidate's leadership, independence, interpersonal skills, financial acumen, integrity and professional ethics, educational and professional background, prior trustee or executive experience, industry knowledge, business judgment and specific experiences or expertise would complement or benefit the Board and, as a whole, contribute to the ability of the Board to oversee the Fund. The Committee may also consider other factors or attributes as they may determine appropriate in their judgment. The Committee believes that the significance of each candidate's background, experience, qualifications, attributes or skills must be considered in the context of the Board as a whole.

Pursuant to the Fund's bylaws, for any business to be properly brought before an annual meeting by a shareholder, including the nominating of persons for election as Trustees of the Fund, the shareholder must have given timely notice thereof in writing to the Secretary of the Fund and such business must otherwise be a proper matter for action by the shareholders. To be timely, a shareholder's notice must be delivered to the Secretary of the Fund at the principal executive offices of the Fund not later than the close of business on the ninetieth (90th) day, nor earlier than the close of business on the one hundred twentieth (120th) day, prior to the first anniversary of the preceding year's annual meeting; provided, however, that in the event that the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date, notice by the shareholder must be so delivered not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made by the Fund. In no event shall the public announcement of an adjournment or postponement of an annual meeting commence a new time period (or extend any time period) for the giving of a shareholder's notice as described above.

Any shareholder may obtain a copy of the Fund's Charter or bylaws by calling the Investor Relations department of abrdn Inc. toll-free at 1-800-522-5465, or by sending an e-mail to abrdn Inc. at Investor.Relations@abrdn.com.

Board Oversight of Risk Management

The Fund is subject to a number of risks, including, among others, investment, compliance, operational and valuation risks. Risk oversight forms part of the Board's general oversight of the Fund and is addressed as part of various Board and Committee activities. The Board has adopted, and periodically reviews, policies and procedures designed to address these risks. Different processes, procedures and controls are employed with respect to different types of risks. Day-to-day risk management functions are subsumed within the responsibilities of the Investment Adviser, who carries out the Fund's investment advisory and business affairs, and also by abrdn Inc. and other service providers in connection with the services they provide to the Fund. Each of the Investment Adviser and Sub-Adviser, as applicable, the Fund's administrator and other service providers have their own, independent interest

15

in risk management, and their policies and methods of risk management will depend on their functions and business models. As part of its regular oversight of the Fund, the Board, directly and/or through a Committee, interacts with and reviews reports from, among others, Investment Adviser and Sub-Adviser, as applicable, and the Fund's other service providers (including the Fund's transfer agent), the Fund's Chief Compliance Officer, the Fund's independent registered public accounting firm, legal counsel to the Fund, and internal auditors, as appropriate, relating to the operations of the Fund. The Board also requires the Investment Adviser to report to the Board on other matters relating to risk management on a regular and as-needed basis. The Board recognizes that it may not be possible to identify all of the risks that may affect the Fund or to develop processes and controls to eliminate or mitigate their occurrence or effects. The Board may, at any time and in its discretion, change the manner in which it conducts risk oversight.

Board and Committee Meetings in Fiscal Year 2022

During the Fund's fiscal year ended October 31, 2022, the Board held five meetings; the Audit Committee held three meetings; and the Nominating and Corporate Governance Committee held one meeting. During such period, each incumbent Trustee attended at least 75% of the aggregate number of meetings of the Board and of Committees of the Board on which he or she served.

Communications with the Board of Trustees

Shareholders who wish to communicate with Board members with respect to matters relating to the Fund may address their written correspondence to the Board as a whole or to individual Board members c/o abrdn Inc. (the "Administrator"), the Fund's administrator, at 1900 Market Street, Suite 200, Philadelphia, PA 19103, or via e-mail to the Trustee(s) c/o abrdn Inc. at Investor.Relations@abrdn.com.

Trustee Attendance at Annual Meetings of Shareholders

The Fund has not established a policy with respect to Trustees attendance at annual meetings of shareholders.

REPORTS OF THE AUDIT COMMITTEE; INFORMATION REGARDING THE FUND'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected, and the Independent Trustees have ratified the selection of, KPMG LLP ("KPMG"), 1601 Market Street, Philadelphia, PA 19103, an independent registered public accounting firm, to audit the financial statements of the Fund for the fiscal year ending October 31, 2022. Representatives from KPMG are not expected to be present at the Meeting to make a statement or respond to questions from shareholders. If requested by any shareholder by two (2) business days before the Meeting, a representative from KPMG will be present by telephone at the Meeting to respond to appropriate questions and will have an opportunity to make a statement if he or she chooses to do so.

The Audit Committee has received from KPMG the written disclosures and the letter required by the Public Company Accounting Oversight Board ("PCAOB") regarding KPMG's communications with the Audit Committee concerning independence and has discussed with KPMG its independence. The Audit Committee has also reviewed and discussed the audited financial statements with Fund management and KPMG, and discussed matters with KPMG required to be discussed by the applicable requirements of the PCAOB and the SEC. Based on the foregoing, the Audit Committee recommended to the Board that the Fund's audited financial statements be included in the Fund's annual report to shareholders for the fiscal year ended October 31, 2022.

16

The following table sets forth the aggregate fees billed for professional services rendered by KPMG during the Fund's two most recent fiscal years ended October 31:

|

|

|

2022 |

|

2021 |

|

|

Audit Fees(1) |

|

$ |

94,740 |

|

|

$ |

83,633 |

|

|

|

Audit-Related Fees(2) |

|

$ |

0 |

|

|

$ |

112,000 |

|

|

|

Tax Fees(3) |

|

$ |

83,633 |

|

|

$ |

11,605 |

|

|

|

All Other Fees(4) |

|

$ |

0 |

|

|

$ |

0 |

|

|

(1) "Audit Fees" are the aggregate fees billed for professional services for the audit of the Fund's annual financial statements and services provided in connection with statutory and regulatory filings or engagements.

(2) "Audit Related Fees" are the aggregate fees billed for assurance and related services reasonably related to the performance of the audit or review of financial statements that are not reported under "Audit Fees". These fees include offerings related to the Fund's common shares.

(3) "Tax Fees" are the aggregate fees billed for professional services for tax advice, tax compliance, and tax planning. These fees include: federal and state income tax returns, review of excise tax distribution calculations and federal excise tax return.

(4) "All Other Fees" are the aggregate fees billed for products and services other than "Audit Fees," "Audit-Related Fees" and "Tax Fees."

All of the services described in the table above were pre-approved by the Audit Committee.

The Audit Committee is responsible for pre-approving (i) all audit and permissible non-audit services to be provided by the independent registered public accounting firm to the Fund and (ii) all permissible non-audit services to be provided by the independent registered public accounting firm to the Fund's Investment Adviser, and any service provider to the Fund controlling, controlled by or under common control with the Fund's Investment Adviser that provided ongoing services to the Fund ("Covered Service Provider"), if the engagement relates directly to the operations and financial reporting of the Fund. The following table shows the amount of fees that KPMG billed during the Fund's last two fiscal years for non-audit services to the Fund, the Investment Adviser, and Covered Service Providers:

|

Fiscal Year Ended |

|

Total Non-Audit Fees

Billed to the Fund* |

|

Total Non-Audit Fees

billed to the Investment

Adviser and Covered Service

Providers (engagements

related directly to the

operations and financial

reporting of the Fund) |

|

Total Non-Audit Fees

billed to the Investment

Adviser and Covered Service

Providers (all other

engagements) |

|

Total |

|

|

October 31, 2022 |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

1,108,929 |

|

|

$ |

1,108,929 |

|

|

|

October 31, 2021 |

|

$ |

11,605 |

|

|

$ |

0 |

|

|

$ |

1,547,556 |

|

|

$ |

1,559,161 |

|

|

* "Total Non-Audit Fees billed to Fund" for both fiscal years represent "Tax Fees" and "All Other Fees" billed to the Fund in their respective amounts from the previous table.

The Audit Committee has adopted an Audit Committee Charter that provides that the Audit Committee shall annually select, retain or terminate, and recommend to the Audit Committee members of the Board and ratified by the entire Board, who are not "interested persons" (as that term is defined in Section 2(a)(19) of the 1940 Act), of the Fund for their ratification, the selection, retention or termination, the Fund's independent auditor and, in connection therewith, evaluate the terms of the engagement (including compensation of the auditor) and the

17

qualifications and independence of the independent auditor, including whether the independent auditor provides any consulting, auditing or tax services to the Investment Adviser or Sub-Adviser, if applicable, and receive the independent auditor's specific representations as to its independence, delineating all relationships between the independent auditor and the Fund, consistent with the Independent Standards Board ("ISB") Standard No. 1. The Audit Committee Charter also provides that the Committee shall review in advance, and consider approval of, any and all proposals by Fund management or the Investment Adviser that the Fund, Investment Adviser or their affiliated persons, employ the independent auditor to render "permissible non-audit services" to the Fund and to consider whether such services are consistent with the independent auditor's independence.

The Audit Committee has considered whether the provision of non-audit services that were rendered to the Investment Adviser or Sub-Adviser, if applicable, and any entity controlling, controlled by, or under common control with these entities that provides ongoing services to the Fund that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the accountant's independence and has concluded that it is independent.

COMPENSATION

The following table sets forth information regarding compensation of Trustees by the Fund and by the Fund Complex of which the Fund is a part for the fiscal year ended October 31, 2022. Officers of the Fund do not receive any compensation directly from the Fund or any other fund in the Fund Complex for performing their duties as officers.

|

Name of Trustee |

|

Aggregate Compensation

from Fund for

Fiscal Year Ended

October 31, 2022 |

|

Total Compensation

From Fund and Fund

Complex Paid

To Trustees* |

|

|

Nancy Yao Maasbach |

|

$ |

67,342 |

|

|

$ |

287,685 |

|

|

|

P. Gerald Malone |

|

$ |

84,011 |

|

|

$ |

583,729 |

|

|

|

John Sievwright |

|

$ |

75,011 |

|

|

$ |

231,196 |

|

|

|

Randolph Takian |

|

$ |

64,342 |

|

|

$ |

64,342 |

|

|

|

Stephen Bird |

|

$ |

0 |

|

|

$ |

0 |

|

|

* See the "Trustees" table for the number of funds within the Fund Complex that each Trustee serves.

Delinquent Section 16(a) Reports

Section 16(a) of the 1934 Act and Section 30(h) of the 1940 Act, as applied to the Fund, require the Fund's officers and Trustees, certain officers and directors of the Investment Adviser, Sub-Adviser, affiliates thereof, and persons who beneficially own more than 10% of the Fund's outstanding securities (collectively, the "Reporting Persons") to electronically file reports of ownership of the Fund's securities and changes in such ownership with the SEC and the NYSE.

Based solely on the Fund's review of such forms filed on EDGAR or written representations from Reporting Persons that all reportable transactions were reported, to the knowledge of the Fund, during the fiscal period ended October 31, 2022, the Fund's Reporting Persons timely filed all reports they were required to file under Section 16(a), except that: (i) Robert Hepp and Andrew Kim each filed a late Form 3 filing following their respective appointments as Vice Presidents of the Fund; and (ii) Grant Hotson and Neil Slater each filed a late Form 3 filing following their respective appointments as directors of the Investment Adviser.

18

Relationship of Trustees or Nominees with the Investment Adviser, Sub-Adviser and Administrator

abrdn Investments Limited serves as the investment adviser to the Fund pursuant to a management agreement dated as of December 1, 2017. The Investment Adviser, with its registered office at 10 Queen's Terrace, Aberdeen, Scotland AB10 1XL, is a corporation organized under the laws of Scotland and a U.S. registered investment adviser. abrdn Inc. serves as the Sub-Adviser to the Fund pursuant to a sub-advisory agreement dated as of December 1, 2017. The Sub-Adviser is a Delaware corporation with its registered offices located at 1900 Market Street, Suite 200, Philadelphia, PA 19103. abrdn Inc. also provides administrative services to the Fund under an administration agreement. The Investment Adviser, Sub-Adviser and Administrator are each indirect subsidiaries of abrdn plc, which has its registered offices at 1 George Street, Edinburgh, EH2 2LL, Scotland. Messrs. Andolina and Goodson and Mmes. Kennedy and Sitar, who serve as officers of the Fund, are also directors and/or officers of abrdn Inc.

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES, RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE PROPOSALS.

ADDITIONAL INFORMATION

Expenses. The expense of preparation, printing and mailing of the enclosed Proxy Card and accompanying Notice and Proxy Statement will be borne by the Fund. The Fund will reimburse banks, brokers and others for their reasonable expenses in forwarding proxy solicitation material to the beneficial owners of the shares of the Fund. In order to obtain the necessary quorum at the Meeting, supplementary solicitation may be made by mail, telephone, telegraph or personal interview. Such solicitation may be conducted by, among others, officers, Trustees and employees of the Fund, the Investment Adviser, the Sub-Adviser or the Administrator.

Georgeson LLC ("Georgeson") has been retained to assist in the solicitation of proxies and will receive an estimated fee of $2,000 and be reimbursed for its reasonable expenses.

Solicitation and Voting of Proxies. Solicitation of proxies is being made primarily by the mailing of this Proxy Statement with its enclosures on or about April 15, 2023. As mentioned above, Georgeson has been engaged to assist in the solicitation of proxies. As the date of the Meeting approaches, certain shareholders of the Fund may receive a call from a representative of Georgeson, if the Fund has not yet received their vote. Authorization to permit Georgeson to execute proxies may be obtained by telephonic instructions from shareholders of the Fund. Proxies that are obtained telephonically will be recorded in accordance with procedures that management of the Fund believes are reasonably designed to ensure that the identity of the shareholder casting the vote is accurately determined and that the voting instructions of the shareholder are accurately determined.

Beneficial Owners. Based upon filings made with the SEC, as of the dates indicated, the following table shows certain information concerning persons who may be deemed beneficial owners of 5% or more of a class of shares of the Fund because they possessed or shared voting or investment power with respect to the Fund's shares:

|

Class |

|

Name and Address |

|

Number of Shares

Beneficially Owned |

|

Percentage of Shares |

|

5.250% Series

A Perpetual

Preferred Shares

(Liquidation

Preference

$25.00) |

|

UBS Group AG*

UBS Securities LLC*

UBS Financial Services Inc.*

Bahnhofstrasse 45

PO Box CH-8021

Zurich, Switzerland |

|

|

496,215 |

|

|

|

31.01 |

% |

|

19

|

Class |

|

Name and Address |

|

Number of Shares

Beneficially Owned |

|

Percentage of Shares |

|

|

Common Stock |

|

First Trust Portfolios L.P.**

First Trust Advisors L.P.**

The Charger Corporation**

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187 |

|

|

2,796,619 |

|

|

|

11.27 |

% |

|

|

Common Stock |

|

Sit Investment Associates, Inc. and its affiliates***

3300 IDS Center 80 South Eighth

Street Minneapolis, MN 55402 |

|

|

3,005,271 |

|

|

|

12.11 |

% |

|

* These entities jointly filed a Schedule 13G for the share amount and percentage shown as of December 30, 2022.

** These entities jointly filed a Schedule 13G for the share amount and percentage shown as of December 31, 2022.

*** These entities jointly filed a Schedule 13G for the share amount and percentage shown as of March 27, 2023.

Shareholder Proposals. If a shareholder intends to present a proposal, including the nomination of a trustee, at the Annual Meeting of Shareholders of the Fund to be held in 2024 and desires to have the proposal included in the Fund's proxy statement and form of proxy for that meeting, the shareholder must deliver the proposal to the Secretary of the Fund at the office of the Funds, 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and such proposal must be received by the Secretary no later than December 17, 2023.

Shareholders wishing to present proposals, including the nomination of a trustee, at the Annual Meeting of Shareholders of the Fund to be held in 2024 which they do not wish to be included in the Fund's proxy materials must send written notice of such proposals to the Secretary of the Fund at the office of the Fund, 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and such notice must be received by the Secretary no sooner than January 26, 2024 and no later than 5:00 p.m., Eastern Time, on February 25, 2024 in the form prescribed from time to time in the Fund's bylaws.

SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING AND WHO WISH TO HAVE THEIR SHARES VOTED ARE REQUESTED TO DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

Delivery of Proxy Statement

Unless the Fund has received contrary instructions from shareholders, only one copy of this Proxy Statement may be mailed to households, even if more than one person in a household is a shareholder of record. If a shareholder needs an additional copy of this Proxy Statement, please contact the Fund at 1-800-522-5465. If any shareholder does not want the mailing of this Proxy Statement to be combined with those for other members of its household, please contact the Fund in writing at: 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103 or call the Fund at 1-800-522-5465.

20

Other Business

Management knows of no business to be presented at the Meeting, other than the Proposals set forth in this Proxy Statement, but should any other matter requiring the vote of shareholders arise, the proxies will vote thereon according to their discretion.

By order of the Board of Trustees,

Megan Kennedy, Vice President and Secretary

abrdn Income Credit Strategies Fund

21

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

ABRDN INCOME CREDIT STRATEGIES FUND

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 25, 2023

THIS PROXY IS BEING SOLICITED BY THE BOARD OF TRUSTEES

The undersigned shareholder(s) of ABRDN INCOME

CREDIT STRATEGIES FUND revoking previous proxies, hereby appoints Megan Kennedy, Andrew Kim and Robert Hepp, or any one

of them true and lawful attorneys with power of substitution of each, to vote all shares of abrdn Income Credit Strategies Fund which

the undersigned is entitled to vote, at the Annual Meeting of Shareholders to be held at the offices of abrdn Inc., located at 1900 Market

Street, Suite 200, Philadelphia, PA 19103, on Thursday, May 25, 2023, at 10:30 a.m. Eastern Time, and at any adjournment thereof as indicated

on the reverse side. Please refer to the Proxy Statement for a discussion of these matters, including instructions related to meeting

attendance.

In their discretion, the proxy holders named

above are authorized to vote upon such other matters as may properly come before the meeting or any adjournment thereof.

Receipt of the Notice of the Annual Meeting

and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions are given, the votes entitled

to be cast by the undersigned will be cast “FOR” Proposal 1 and 2.

+

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability

of Proxy Materials for the

ABRDN INCOME CREDIT STRATEGIES FUND

Shareholders Meeting to Be Held on Thursday,

May 25, 2023, at 10:30 a.m. (Eastern Time)

The Proxy Statement for this meeting is available

at: http://www.abrdnacp.com

ABRDN INCOMECREDIT STRATEGIES FUND

The Board of Trustees recommends a vote “FOR” the nominee.

In their discretion, the proxy holders are authorized to vote upon the

matters set forth in the Notice of Meeting and Proxy Statement and upon all other such

matters as may properly come before the meeting or any adjournment thereof.

TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE:

☒

| Proposals |

| 1. | To

elect the following Class III Nominee to The Board of Trustees: |

| |

Nominee: |

FOR

NOMINEE |

WITHHOLD FROM

NOMINEE |

|

| |

|

|

|

|

| |

P. Gerald Malone |

☐ |

☐ |

|

| 2. | In

their discretion, upon any other business that may properly come before the meeting. |

|

Authorized Signatures (this section must be completed for your vote to be counted): |

Note: Please sign exactly as your

name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing

as attorney, executor, administrator, trustee, guardian, officer of corporation or other entity or in another representative

capacity, please give the full title under the signature.

| Date

(mm/dd/yyyy) – Please print date below |

|

Signature

1 – Please keep signature within the box |

|

Signature

2 – Please keep signature within the box |

| / / |

|

|

|

|

| |

|

+

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

ABRDN INCOME CREDIT STRATEGIES FUND

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 25, 2023

THIS PROXY IS BEING SOLICITED BY THE BOARD OF TRUSTEES

The undersigned shareholder(s) of ABRDN INCOME

CREDIT STRATEGIES FUND revoking previous proxies, hereby appoints Megan Kennedy, Andrew Kim and Robert Hepp, or any one

of them true and lawful attorneys with power of substitution of each, to vote all shares of abrdn Income Credit Strategies Fund which

the undersigned is entitled to vote, at the Annual Meeting of Shareholders to be held at the offices of abrdn Inc., located at 1900 Market

Street, Suite 200, Philadelphia, PA 19103, on Thursday, May 25, 2023, at 10:30 a.m. Eastern Time, and at any adjournment thereof as indicated

on the reverse side. Please refer to the Proxy Statement for a discussion of these matters, including instructions related to meeting

attendance.

In their discretion, the proxy holders named

above are authorized to vote upon such other matters as may properly come before the meeting or any adjournment thereof.

Receipt of the Notice of the Annual Meeting

and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions are given, the votes entitled

to be cast by the undersigned will be cast “FOR” Proposal 1 and 2.

+

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability

of Proxy Materials for the

ABRDN INCOME CREDIT STRATEGIES FUND

Shareholders Meeting to Be Held on Thursday,

May 25, 2023, at 10:30 a.m. (Eastern Time)

The Proxy Statement for this meeting is available

at: http://www.abrdnacp.com

ABRDN INCOMECREDIT STRATEGIES FUND

The Board of Trustees recommends a vote “FOR” the nominees.

In their discretion, the proxy holders are authorized to vote upon the

matters set forth in the Notice of Meeting and Proxy Statement and upon all other such

matters as may properly come before the meeting or any adjournment thereof.

TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE:

☒

| Proposals |

| 1. | To

elect the following Class III Nominee to The Board of Trustees: |

| |

Nominee: |

FOR

NOMINEE |

WITHHOLD FROM

NOMINEE |

|

| |

|

|

|

|

| |

P. Gerald Malone |

☐ |

☐ |

|

| 2. | To elect the following Nominee for Preferred share Trustee of the Fund: |

| |

Nominee: |

FOR

NOMINEE |

WITHHOLD FROM

NOMINEE |

|

| |

|

|

|

|

| |

Randolph Takian |

☐ |

☐ |

|

| 3. | In

their discretion, upon any other business that may properly come before the meeting. |

|

Authorized Signatures (this section must be completed for your vote to be counted): |

Note: Please sign exactly as your

name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing

as attorney, executor, administrator, trustee, guardian, officer of corporation or other entity or in another representative

capacity, please give the full title under the signature.

| Date

(mm/dd/yyyy) – Please print date below |

|

Signature

1 – Please keep signature within the box |

|

Signature

2 – Please keep signature within the box |

| / / |

|

|

|

|

| |

|

+

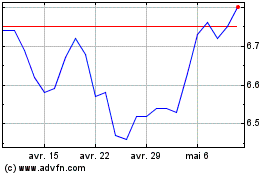

abrdn Income Credit Stra... (NYSE:ACP)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

abrdn Income Credit Stra... (NYSE:ACP)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025