UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023.

Commission File Number: 001-39071

ADC Therapeutics SA

(Exact name of registrant as specified in its

charter)

Biopôle

Route de la Corniche 3B

1066 Epalinges

Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

INFORMATION CONTAINED IN THIS REPORT ON FORM

6-K

On October 10, 2023, ADC Therapeutics SA (the “Company”)

received a notice from the New York Stock Exchange (“NYSE”) that the Company is not in compliance with the continued listing

minimum price criteria set forth in Section 802.01C of the NYSE Listed Company Manual, which requires listed companies to maintain an

average closing share price of at least $1.00 over a consecutive 30 trading-day period. In accordance with Section 802.01C of the NYSE

Listed Company Manual, the Company has a period of six months from receipt of the notice to regain compliance with the continued listing

minimum price criteria. The notice has no immediate impact on the listing of the Company’s common shares, which will remain listed

and traded on the NYSE during this period, subject to the Company’s compliance with the other continued listing requirements. The

Company can regain compliance at any time during the six-month cure period if on the last trading day of any calendar month during the

cure period the Company’s common shares have a closing share price of at least $1.00 and an average closing share price of at least

$1.00 over the 30 trading-day period ending on the last trading day of that month. The Company has notified the NYSE of its intent to

cure the deficiency, which may include, if necessary, effecting a reverse share split, subject to board and shareholder approval. There

can be no assurance that the Company will be able to regain compliance with NYSE’s continued listing minimum price criteria or remain

in compliance with other continued listing requirements or that the Company’s common shares will continue to be listed on the NYSE.

INCORPORATION BY REFERENCE

This Report on Form 6-K (other than Exhibit 99.1)

shall be deemed to be incorporated by reference into the registration statements on Form F-3 (Registration Nos. 333-267293, 333-267295

and 333-270570) of ADC Therapeutics SA and to be a part thereof from the date on which this report is filed, to the extent not superseded

by documents or reports subsequently filed or furnished.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ADC Therapeutics SA |

| Date: November 7, 2023 |

|

| |

|

| |

By: |

/s/ Peter J. Graham |

| |

Name: |

Peter J. Graham |

| |

Title: |

Chief Legal Officer |

EXHIBIT INDEX

Exhibit 99.1

ADC Therapeutics Receives NYSE Notice of Non-Compliance

With Continued Listing Standards

Lausanne, Switzerland, November 7, 2023

– ADC Therapeutics SA (NYSE: ADCT) today announced that on October 10, 2023, it received a notice from the New York Stock Exchange

(NYSE) that the Company is not in compliance with the continued listing minimum price criteria set forth in Section 802.01C of the NYSE

Listed Company Manual, which requires listed companies to maintain an average closing share price of at least $1.00 over a consecutive

30 trading-day period.

In accordance with Section 802.01C of the NYSE

Listed Company Manual, the Company has a cure period of six months from receipt of the notice to regain compliance with the continued

listing minimum price criteria. The notice has no immediate impact on the listing of the Company’s common shares, which will remain

listed and traded on the NYSE during this period, subject to the Company’s compliance with the other continued listing requirements.

The Company can regain compliance if on the last

trading day of any calendar month during the cure period the Company’s common shares have a closing share price of at least $1.00

and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month. The

Company has notified the NYSE of its intent to cure the deficiency, which may include, if necessary, effecting a reverse share split,

subject to board and shareholder approval.

About ADC Therapeutics

ADC Therapeutics (NYSE: ADCT) is a commercial-stage

global leader and pioneer in the field of antibody drug conjugates (ADCs). The Company is advancing its proprietary ADC technology to

transform the treatment paradigm for patients with hematologic malignancies and solid tumors.

ADC Therapeutics’ CD19-directed ADC ZYNLONTA

(loncastuximab tesirine-lpyl) received accelerated approval by the FDA and conditional approval from the European Commission for the treatment

of relapsed or refractory diffuse large B-cell lymphoma after two or more lines of systemic therapy. ZYNLONTA is also in development in

combination with other agents and in earlier lines of therapy. In addition to ZYNLONTA, ADC Therapeutics has multiple ADCs in ongoing

clinical and preclinical development.

ADC Therapeutics is based in Lausanne (Biopôle),

Switzerland and has operations in London, the San Francisco Bay Area and New Jersey. For more information, please visit https://www.adctherapeutics.com/

and follow the Company on LinkedIn.

ZYNLONTA® is a registered trademark of ADC

Therapeutics SA.

Forward-Looking Statements

This press release contains

forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In

some cases you can identify forward-looking statements by terminology such as “may”, “will”, “should”,

“would”, “expect”, “intend”, “plan”, “anticipate”, “believe”,

“estimate”, “predict”, “potential”, “seem”, “seek”, “future”,

“continue”, or “appear” or the negative of these terms or similar expressions, although not all forward-looking

statements contain these identifying words. Forward-looking statements are subject to certain risks and uncertainties that can cause actual

results to differ materially from those described. Factors that may cause such differences include, but are not limited to: the ability

of the Company to cure the deficiency and regain compliance with NYSE listing standards and for the Company’s common shares to remain

listed on the NYSE; the success of the Company’s updated corporate strategy including operating efficiencies, capital deployment

and portfolio prioritization; the Company’s ability to achieve the decrease in total operating expenses for 2023 and 2024, the expected

cash runway into the middle of 2025, the effectiveness of the new commercial go-to-market strategy, competition from new technologies,

the Company’s ability to continue to commercialize ZYNLONTA® in the United States and future revenue from the same; Swedish

Orphan Biovitrum AB (Sobi®) ability to successfully commercialize ZYNLONTA® in the European Economic Area and market acceptance,

adequate reimbursement coverage, and future revenue from the same; approval by the NMPA of the BLA for ZYNLONTA in China submitted by

Overland ADCT BioPharma and future revenue from the same, our strategic partners’, including Mitsubishi Tanabe Pharma Corporation,

ability to obtain regulatory approval for ZYNLONTA® in foreign jurisdictions, and the timing and amount of future revenue and payments

to us from such partnerships; the Company’s ability to market its products in compliance with applicable laws and regulations; the

Company’s expectations regarding the impact of the Infrastructure Investment and Jobs Act; the timing and results of the Company’s

or its partners’ research projects or clinical trials including LOTIS 5 and 7, ADCT 901, 601 and 602, the impact, if any, from discontinuation

of the LOTIS-9 study, actions by the FDA or foreign regulatory authorities with respect to the Company’s products or product candidates,

the timing and outcome of regulatory submissions for the Company’s products or product candidates; the ability to complete clinical

trials on expected timelines, if at all; projected revenue and expenses; the Company’s indebtedness, including Healthcare Royalty

Management and Blue Owl and Oaktree facilities, and the restrictions imposed on the Company’s activities by such indebtedness, the

ability to repay such indebtedness and the significant cash required to service such indebtedness; and the Company’s ability to

obtain financial and other resources for its research, development, clinical, and commercial activities. Additional information concerning

these and other factors that may cause actual results to differ materially from those anticipated in the forward-looking statements is

contained in the “Risk Factors” section of the Company's Annual Report on Form 20-F and in the Company's other periodic reports

and filings with the Securities and Exchange Commission. These statements involve known and unknown risks, uncertainties and other factors

that may cause actual results, performance, achievements or prospects to be materially different from any future results, performance,

achievements or prospects expressed in or implied by such forward-looking statements. The Company cautions investors not to place undue

reliance on the forward-looking statements contained in this document. The Company undertakes no obligation to revise or update these

forward-looking statements to reflect events or circumstances after the date of this press release, except as required by law.

CONTACTS:

Investors

Eugenia Litz

ADC Therapeutics

Eugenia.Litz@adctherapeutics.com

+44 7879 627205

+1 908-723-2350

Media

Nicole Riley

ADC Therapeutics

Nicole.Riley@adctherapeutics.com

+1 862-926-9040

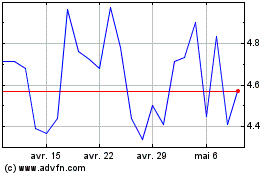

ADC Therapeutics (NYSE:ADCT)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

ADC Therapeutics (NYSE:ADCT)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024