- Record fourth quarter revenue of $1.7 billion rose 12% to

last year

- Aerie achieved all-time high fourth quarter revenue with

comps up 13%

- American Eagle comps increased 6% reflecting continued

sequential improvement

American Eagle Outfitters, Inc. (NYSE: AEO) today announced

financial results for the fourth quarter and full year fiscal 2023

ended February 3, 2024.

In a separate release today, the company also announced its new

Powering Profitable Growth long-term strategy structured to deliver

$5.7 to $6.0 billion in revenue and an approximate 10% operating

margin by the end of Fiscal 2026, implying a compounded annual

growth rate of mid-to-high teens for operating income and 3-5% for

revenue growth.

“I am proud of how the teams executed in the fourth quarter. As

our profit improvement initiatives took hold, we delivered a

material improvement in business, underscoring the power of our

brands, operations and strategic focus. Customers responded well to

our strong merchandise collections fueling positive results across

brands and channels,” commented Jay Schottenstein, AEO’s Executive

Chairman of the Board and Chief Executive Officer.

“We are entering 2024 with momentum and from a position of

strength with an exciting line-up of innovation and customer

engagement initiatives. Our balance sheet is healthy and we are

seeing early proof points of our new long-term strategy to deliver

industry-leading earnings growth and shareholder returns, which we

look forward to sharing today.”

Fourth Quarter 2023 Results compared to Fourth Quarter 2022

Results:

- Fourth quarter 2023 results are presented for the 14 weeks

ending February 3, 2024 compared to the 13 weeks ending January 28,

2023. Comparable sales metrics are presented for the 14 weeks

ending February 3, 2024 compared to the 14 weeks ending February 4,

2023.

- Total net revenue of $1.7 billion rose 12%. The 53rd week

contributed $57 million or approximately four points to revenue

growth in the quarter.

- Store revenue rose 10%. Total digital revenue increased

19%.

- Aerie revenue of $538 million rose 16% with comp sales up 13%.

American Eagle revenue of $1.1 billion increased 11% with comp

sales growing 6%.

- GAAP Gross profit of $615 million. Adjusted gross profit of

$626 million increased 23%. The adjusted gross margin rate of 37.3%

rose 340 basis points. Margin expansion was driven by strong

demand, lower product and transportation costs and continued

benefits from our profit improvement work including lower markdowns

and leverage on rent, distribution and warehousing and

delivery.

- Selling, general and administrative expense of $427 million was

up 22%. Aligned with strong business performance, roughly half of

the expense increase was due to incentive compensation against zero

accruals last year. Store and corporate compensation, advertising

as well as the 53rd week contributed to the increase.

- GAAP Operating income of $9 million. Adjusted Operating income

of $141 million. Adjusted operating margin of 8.4% expanded 200

basis points to last year.

- GAAP diluted earnings per share of $0.03. Adjusted diluted

earnings per share of $0.61. Average diluted shares outstanding

were 200 million.

Fiscal Year 2023 Results compared to Fiscal Year 2022

Results:

- Fiscal Year 2023 results are presented for the 53 weeks ending

February 3, 2024 compared to the 52 weeks ending January 28, 2023.

Comparable sales metrics are presented for the 53 weeks ending

February 3, 2024 compared to the 53 weeks ending February 4,

2023.

- Total net revenue of $5.3 billion rose 5%. The 53rd week

contributed $57 million or approximately one point to revenue

growth in the year.

- Store revenue rose 6%. Total digital revenue also increased

6%.

- Aerie revenue of $1.7 billion rose 11% with comp sales up 8%.

American Eagle revenue of $3.4 billion increased 3% with comp sales

growing 1%.

- GAAP Gross profit of $2 billion. Adjusted gross profit of $2

billion increased 17%. The adjusted gross margin rate of 38.7% rose

370 basis points. Margin expansion was driven by strong demand,

lower product and transportation costs, lower markdowns and

leverage on rent, distribution and warehousing and delivery.

- Selling, general and administrative expense of $1.4 billion was

up 13%. Roughly half of the expense increase was due to incentive

compensation against zero accruals last year. Store and corporate

compensation along with advertising also increased.

- GAAP Operating income of $223 million. Adjusted Operating

income of $375 million. Adjusted operating margin of 7.1% expanded

170 basis points to last year.

- GAAP diluted earnings per share of $0.86. Adjusted diluted

earnings per share of $1.52. Average diluted shares outstanding

were 197 million.

Inventory

Total ending inventory increased 9% to $641 million, with units

up 11%. Inventory levels are healthy and well positioned to fuel

growth initiatives.

Capital Expenditures

Capital expenditures totaled $39 million in the fourth quarter

and $174 million for the full-year. For Fiscal 2024, management

expects capital expenditures to approximate $200 to $250

million.

Restructuring and Impairment Charges

In the fourth quarter, the company recorded a $131 million

impairment and restructuring charge, of which $119 million was

non-cash. The company refocused the operations of Quiet Platforms

to better align with AEO's long term strategy and its core

capabilities as a regionalized fulfillment center network.

Additionally, as part of its profit improvement project, the

company took a number of steps to streamline strategic priorities

and strengthen the organization, including restructuring its

international operations. These actions will result in

approximately $20 million in annualized savings beginning in

2024.

Outlook

For Fiscal 2024, management expects operating income in the

range of $445 to $465 million. This reflects revenue up 2 to 4% to

last year, including an approximately one point headwind from one

less selling week due to the retail calendar shift.

Due to easier comparisons in the first half of the year, the

significance of the shifted retail calendar and one less selling

week in the fourth quarter, we expect revenue and profit growth to

be skewed to the first half of the year.

For the first quarter, management expects operating income in

the range of $65 to $70 million. This reflects revenue up

mid-single digits, including an approximately one point positive

impact from the retail calendar shift.

Webcast and Supplemental Financial Information

The company will discuss its financial results and long-term

strategy and targets in an extended call beginning at 11:00 AM ET.

The event will feature presentations and a question-and-answer

session with members of the company’s executive leadership team.

The event can be accessed in the Investor Relations section on

AEO’s website, www.aeo-inc.com. A replay of the webcast will

be archived and made available online on the company’s website.

About American Eagle Outfitters, Inc.

American Eagle Outfitters, Inc. (NYSE: AEO) is a leading global

specialty retailer offering high-quality, on-trend clothing,

accessories and personal care products at affordable prices under

its American Eagle® and Aerie® brands. Our purpose is to show the

world that there’s REAL power in the optimism of youth. The company

operates stores in the United States, Canada, Mexico, and Hong Kong

and ships to approximately 80 countries worldwide through its

websites. American Eagle and Aerie merchandise also is available at

more than 300 international locations operated by licensees in

approximately 30 countries. To learn more about AEO and the

company’s commitment to Planet, People and Practices, please visit

www.aeo-inc.com.

Non-GAAP Measures

This press release includes information on non-GAAP financial

measures (“non-GAAP” or “adjusted”), including consolidated

adjusted gross profit, operating income, net income, and net income

per diluted share, excluding non-GAAP items. These financial

measures are not based on any standardized methodology prescribed

by U.S. generally accepted accounting principles (“GAAP”) and are

not necessarily comparable to similar measures presented by other

companies. Non-GAAP information is provided as a supplement to, not

as a substitute for, or as superior to, measures of financial

performance prepared in accordance with GAAP. Management believes

that this non-GAAP information is useful for an alternate

presentation of the company’s performance, when reviewed in

conjunction with the company’s GAAP consolidated financial

statements and provides a higher degree of transparency.

These amounts are not determined in accordance with GAAP and

therefore, should not be used exclusively in evaluating the

company’s business and operations. We encourage investors and

others to review our financial information in its entirety, not to

rely on any single financial measure and to view these non-GAAP

financial measures in conjunction with the related GAAP financial

measures.

The tables included in this press release reconcile the GAAP

financial measures to the non-GAAP financial measures discussed

above.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995

This release and related statements by management contain

forward-looking statements (as such term is defined in the Private

Securities Litigation Reform Act of 1995), which represent

management’s expectations or beliefs concerning future events,

including first quarter and annual fiscal 2024 results as well as

anticipated strategy impact on revenue growth and operating margin

in 2025 and 2026. Words such as “outlook,” "estimate," "project,"

"plan," "believe," "expect," "anticipate," "intend," “may,”

“potential,” and similar expressions may identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. All forward-looking statements made by the

company are inherently uncertain because they are based on

assumptions and expectations concerning future events and are

subject to change based on many important factors, some of which

may be beyond the company’s control. Except as may be required by

applicable law, we undertake no obligation to publicly update or

revise any forward-looking statements whether as a result of new

information, future events or otherwise and even if experience or

future changes make it clear that any projected results expressed

or implied therein will not be realized. The following factors, in

addition to the risks disclosed in Item 1A., Risk Factors, of our

Annual Report on Form 10-K for the fiscal year ended January 28,

2023 and in any other filings that we may make with the Securities

and Exchange Commission in some cases have affected, and in the

future could affect, the company's financial performance and could

cause actual results to differ materially from those expressed or

implied in any of the forward-looking statements included in this

release or otherwise made by management: the risk that the

company’s operating, financial and capital plans may not be

achieved; our inability to anticipate customer demand and changing

fashion trends and to manage our inventory commensurately;

seasonality of our business; our inability to achieve planned store

financial performance; our inability to react to raw material cost,

labor and energy cost increases; our inability to gain market share

in the face of declining shopping center traffic; our inability to

respond to changes in e-commerce and leverage omni-channel demands;

our inability to expand internationally; difficulty with our

international merchandise sourcing strategies; challenges with

information technology systems, including safeguarding against

security breaches; and global economic, public health, social,

political and financial conditions, and the resulting impact on

consumer confidence and consumer spending, as well as other changes

in consumer discretionary spending habits, which could have a

material adverse effect on our business, results of operations and

liquidity.

AMERICAN EAGLE OUTFITTERS, INC. CONSOLIDATED BALANCE

SHEETS (Dollars in thousands) (unaudited)

February 3,

2024 January 28, 2023 Assets Current assets: Cash

and cash equivalents $

354,094

$

170,209

Short-term investments

100,000

-

Merchandise inventory

640,662

585,083

Accounts receivable, net

247,934

242,386

Prepaid expenses and other

90,660

102,563

Total current assets

1,433,350

1,100,241

Operating lease right-of-use assets

1,005,293

1,086,999

Property and equipment, at cost, net of accumulated depreciation

713,336

781,514

Goodwill, net

225,303

264,945

Non-current deferred income taxes

82,064

36,483

Intangible assets, net

46,109

94,536

Other assets

52,454

56,238

Total assets $

3,557,909

$

3,420,956

Liabilities and Stockholders' Equity Current liabilities:

Accounts payable $

268,308

$

234,340

Current portion of operating lease liabilities

284,508

337,258

Accrued compensation and payroll taxes

152,353

51,912

Unredeemed gift cards and gift certificates

66,285

67,618

Accrued income taxes and other

46,114

10,919

Other current liabilities and accrued expenses

73,604

66,901

Total current liabilities

891,172

768,948

Non-current liabilities: Non-current operating lease liabilities

901,122

1,021,200

Long-term debt, net

-

8,911

Other non-current liabilities

28,856

22,734

Total non-current liabilities

929,978

1,052,845

Commitments and contingencies

-

-

Stockholders' equity: Preferred stock

-

-

Common stock

2,496

2,496

Contributed capital

360,378

341,775

Accumulated other comprehensive loss

(16,410

)

(32,630

)

Retained earnings

2,214,159

2,137,126

Treasury stock

(823,864

)

(849,604

)

Total stockholders' equity

1,736,759

1,599,163

Total Liabilities and Stockholders' Equity $

3,557,909

$

3,420,956

Current ratio

1.61

1.43

AMERICAN EAGLE OUTFITTERS, INC. CONSOLIDATED STATEMENTS

OF OPERATIONS (Dollars and shares in thousands, except per

share amounts) (unaudited)

GAAP Basis Fourth

Quarter Ended February 3,2024 % ofRevenue

January 28,2023 % ofRevenue Total net revenue $

1,678,910

100.0

%

$

1,496,088

100.0

%

Cost of sales, including certain buying, occupancy and warehousing

expenses

1,064,324

63.4

%

988,656

66.1

%

Gross profit

614,586

36.6

%

507,432

33.9

%

Selling, general and administrative expenses

427,090

25.4

%

351,408

23.5

%

Impairment and restructuring charges

120,420

7.1

%

22,209

1.5

%

Depreciation and amortization expense

57,840

3.5

%

60,233

4.0

%

Operating income

9,236

0.6

%

73,582

4.9

%

Debt related charges

-

0.0

%

4,655

0.3

%

Interest (income) expense, net

(4,961

)

-0.3

%

2,409

0.2

%

Other (income), net

(1,505

)

-0.1

%

(4,964

)

-0.4

%

Income before income taxes

15,702

1.0

%

71,482

4.8

%

Provision for income taxes

9,386

0.6

%

16,891

1.2

%

Net income $

6,316

0.4

%

$

54,591

3.6

%

Net income per basic share $

0.03

$

0.29

Net income per diluted share $

0.03

$

0.28

Weighted average common shares outstanding - basic

197,524

190,621

Weighted average common shares outstanding - diluted

199,589

196,893

GAAP Basis Fiscal Year Ended February

3,2024 % ofRevenue January 28,2023 %

ofRevenue Total net revenue $

5,261,770

100.0

%

$

4,989,833

100.0

%

Cost of sales, including certain buying, occupancy and warehousing

expenses

3,237,192

61.5

3,244,585

65.0

%

Gross profit

2,024,578

38.5

%

1,745,248

35.0

%

Selling, general and administrative expenses

1,433,300

27.2

%

1,269,095

25.4

%

Impairment and restructuring charges

141,695

2.7

%

22,209

0.4

%

Depreciation and amortization expense

226,866

4.4

%

206,897

4.2

%

Operating income

222,717

4.2

%

247,047

5.0

%

Debt related charges

-

0.0

%

64,721

1.3

%

Interest (income) expense, net

(6,190

)

-0.1

%

14,297

0.3

%

Other (income), net

(10,951

)

-0.2

%

(10,465

)

-0.2

%

Income before income taxes

239,858

4.5

%

178,494

3.6

%

Provision for income taxes

69,820

1.3

%

53,358

1.1

%

Net income $

170,038

3.2

%

$

125,136

2.5

%

Net income per basic share

$

0.87

$

0.69

Net income per diluted share

$

0.86

$

0.64

Weighted average common shares outstanding - basic

195,646

181,778

Weighted average common shares outstanding - diluted

196,863

205,226

American Eagle Outfitters Inc. GAAP to Non-GAAP

Reconciliation (Dollars in thousands, except per share amounts)

14 Weeks Ended February 3, 2024 Gross

Operating Income Tax Effective Net

Earnings per Profit1 Income2 Expense

Tax Rate Income Diluted Share GAAP Basis

$

614,586

$

9,236

$

9,386

59.8

%

$

6,316

$

0.03

% of Revenue

36.6

%

0.6

%

0.4

%

Add: Impairment, Restructuring and Other Charges

$

10,950

$

131,370

$

115,081

$

0.58

Tax effect of the above3

$

16,289

(34.7

)%

Non-GAAP Basis

$

625,536

$

140,606

$

25,675

17.5

%

$

121,397

$

0.61

% of Revenue

37.3

%

8.4

%

7.2

%

The following footnotes relate to

impairment, restructuring, and other charges recorded in the 14

weeks ended February 3, 2024:

(1) $11.0 million of inventory write-down

charges related to our international businesses as further

described in footnote (2) below.

(2) Quiet Platforms: $98.3 million of

impairment and restructuring charges

- $40.5 million of intangible asset

impairment

- $39.6 million of goodwill impairment

- $13.9 million of long-term asset

impairment primarily related to technology which is no longer a

part of the long-term strategy

- $4.3 million of employee severance, based

on our revised strategy for Quiet Platforms

International: $10.9 million of impairment

and restructuring charges

- $4.7 million related to Japan operating

lease ROU assets and $3.6 million of Japan store property and

equipment related to the exit of the Japan market

- $1.3 million of Hong Kong operating lease

ROU assets

- $1.3 million of employee severance

Additionally, we recorded $11.0 million of

inventory write-down charges related to restructuring our

international operations, which was recorded separately in Cost of

Sales and discussed in note (1) above.

Corporate: $11.2 of impairment and

restructuring charges

- $6.0 million of employee severance

related to corporate realignment

- $5.2 million of other asset investment

impairment related to further strategic business changes

All impairments were recorded due to

insufficient prospective cash flows to support the asset value.

(3) The income tax impact of $16.3 million

is primarily caused by the non-deductibility of goodwill impairment

and international restructuring charges as well as the additional

tax expense on the overall mix of earnings in jurisdictions with

different tax rates.

American Eagle Outfitters Inc. GAAP to Non-GAAP

Reconciliation (Dollars in thousands, except per share amounts)

13 Weeks Ended January 28, 2023 Operating

Debt-related Income Tax Effective Net

Earnings per Income1 charges2 Expense

Tax Rate Income Diluted Share GAAP Basis

$

73,582

$

4,655

$

16,891

23.6

%

$

54,591

$

0.28

% of Revenue

4.9

%

3.6

%

Add: Impairment and restructuring charges

$

22,209

$

18,186

$

0.09

Less: Debt-related charges

$

(4,655

)

$

552

$

0.00

Tax effect of the above3

$

8,126

1.8

%

Non-GAAP Basis

$

95,791

$

-

$

25,017

25.4

%

$

73,329

$

0.37

% of Revenue

6.4

%

4.9

%

The following footnotes relate to impairment, restructuring and

debt-related charges recorded in the 13 weeks ended January 28,

2023:

(1) Quiet Platforms: $3.8 million of

impairment and restructuring charges

- $2.8 million consisting of $2.3 million

of operating lease ROU asset impairment and $0.5 million of

property and equipment impairment related to the closure of the

Jacksonville, FL distribution center

- $1.0 million of severance related to employees of that

distribution center

International: $8.0 million of impairment

and restructuring charges

- $7.5 million of store impairment

- $0.5 million of employee severance

related to downsizing our Hong Kong retail operations

U.S. and Canada: $10.4 million of

impairment charges

- $10.4 million of impairment charges,

consisting of $9.2 million of operating lease ROU assets and $1.2

million of store property and equipment"

All impairments were recorded due to

insufficient prospective cash flows to support the asset value.

(2) $4.7 million debt related charges

related primarily to the induced conversion expense on the exchange

of our convertible notes.

(3) The income tax impact of $8.1 million

related to impairment and restructuring charges is primarily caused

by the non-deductibility of the portion of the induced conversion

expense associated with the Note Exchanges. Furthermore, there was

additional tax expense on the overall mix of earnings in

jurisdictions with different tax rates.

American Eagle Outfitters Inc. GAAP to Non-GAAP

Reconciliation (Dollars in thousands, except per share amounts)

53 Weeks Ended February 3, 2024 Gross

Operating Income Tax Effective Net

Earnings per Profit1 Income1, 2 Expense

Tax Rate Income Diluted Share GAAP Basis

$

2,024,578

$

222,717

$

69,820

29.1

%

$

170,038

$

0.86

% of Revenue

38.5

%

4.2

%

3.2

%

Add: Impairment, Restructuring and Other Charges

$

10,950

$

152,645

$

129,875

$

0.66

Tax effect of the above3

$

22,770

(5.3

)%

Non-GAAP Basis

$

2,035,528

$

375,362

$

92,590

23.6

%

$

299,913

$

1.52

% of Revenue

38.7

%

7.1

%

5.7

%

The following footnotes relate to the

impairment, restructuring and other charges recorded in the 53

weeks ended February 3, 2024:

(1) $11.0 million of inventory write-down

charges related to our international businesses as further

described in footnote (2) below.

(2) Quiet Platforms: $119.6 million of

impairment, restructuring, and other charges

- $40.5 million of intangible asset

impairment

- $39.6 million of goodwill impairment

- $24.7 million of long-term asset

impairment primarily related to technology which is no longer a

part of the long-term strategy

- $9.9 million of employee severance based

on our revised strategy for Quiet Platforms

- $4.9 million of contract related

charges

International: $10.9 million of impairment

and restructuring charges

- $4.7 million related to Japan operating

lease ROU assets and $3.6 million of Japan store property and

equipment related to the exit of the Japan market

- $1.3 million of Hong Kong operating lease

ROU assets

- $1.3 million of employee severance

Additionally, we recorded $11.0 million of

inventory write-down charges related to restructuring our

international operations, which was recorded separately in Cost of

Sales and discussed in note (1) above.

Corporate: $11.2 million of impairment and

restructuring charges

- $6.0 million of employee severance

related to corporate realignment

- $5.2 million of other asset investment

impairment related to further strategic business changes

All impairments were recorded due to

insufficient prospective cash flows to support the asset value.

(3) The income tax impact of $22.8 million

is primarily caused by the non-deductibility of goodwill impairment

and international restructuring charges as well as the additional

tax expense on the overall mix of earnings in jurisdictions with

different tax rates.

American Eagle Outfitters Inc. GAAP to Non-GAAP

Reconciliation (Dollars in thousands, except per share amounts)

52 Weeks Ended January 28, 2023 Operating

Debt-related Income Tax Effective Net

Earnings per Income(1) charges(2)

Expense Tax Rate Income Diluted Share

GAAP Basis

$

247,047

$

64,721

$

53,358

29.9

%

$

125,136

$

0.64

% of Revenue

5.0

%

Add: Impairment and restructuring charges

22,209

18,221

$

0.09

Less: Debt-related charges

$

-

$

(64,721

)

49,679

$

0.24

Tax effect of the above3

$

19,030

(2.6

)%

Non-GAAP Basis

$

269,256

$

-

$

72,388

27.3

%

$

193,036

$

0.97

% of Revenue

5.4

%

3.9

%

The following footnotes relate to impairment, restructuring and

debt-related charges recorded in the 52 weeks ended January 28,

2023:

(1) Quiet Platforms: $3.8 million of

impairment and restructuring charges

- $2.8 million of impairment consisting of

$2.3 million of operating lease ROU asset impairment and $0.5

million of property and equipment impairment related to the closure

of the Jacksonville, FL distribution center

- $1.0 million of severance related to

employees of that distribution center.

International: $8.0 million of impairment

and restructuring charges

- $7.5 million of store impairment

- $0.5 million of employee severance

related to downsizing our Hong Kong retail operations

U.S. and Canada: $10.4 million of

impairment charges

- $10.4 million of impairment charges,

consisting of $9.2 million of store ROU assets and $1.2 million of

store property and equipment

All impairments were recorded due to

insufficient prospective cash flows to support the asset value.

(2) $64.7 million debt related charges

related primarily to the induced conversion expense on the exchange

of our convertible notes, along with certain other costs related to

actions we took to strengthen our capital structure.

(3) The income tax impact of $19.0 million

related to impairment and restructuring charges is primarily caused

by the non-deductibility of the portion of the induced conversion

expense associated with the Note Exchanges. Furthermore, there was

additional tax expense on the overall mix of earnings in

jurisdictions with different tax rates.

AMERICAN EAGLE OUTFITTERS, INC. RESULTS BY SEGMENT

(Dollars in thousands) (unaudited) Fourth Quarter Ended

Fiscal Year Ended February 3, 2024 January 28, 2023 February 3,

2024 January 28, 2023 Net Revenue: American Eagle

$

1,066,092

$

961,848

$

3,361,579

$

3,262,893

Aerie

$

537,462

$

463,663

$

1,670,000

$

1,506,798

Other (1)

$

159,576

$

154,039

$

489,056

$

469,371

Intersegment Elimination

$

(84,220

)

$

(83,462

)

$

(258,865

)

$

(249,229

)

Total Net Revenue

$

1,678,910

$

1,496,088

$

5,261,770

$

4,989,833

Operating Income: American Eagle

$

181,564

$

153,577

$

599,796

$

541,406

Aerie

$

87,090

$

56,671

$

275,862

$

167,467

Other(1)(3)

$

(2,087

)

$

(17,413

)

$

(36,124

)

$

(56,793

)

Intersegment Elimination

$

-

$

-

$

-

$

-

General corporate expenses (2)

$

(125,961

)

$

(97,044

)

$

(464,172

)

$

(382,824

)

Impairment, restructuring and other charges(3)

$

(131,370

)

$

(22,209

)

$

(152,645

)

$

(22,209

)

Total Operating Income

$

9,236

$

73,582

$

222,717

$

247,047

Debt related charges

$

-

$

4,655

$

-

$

64,721

Interest (income) expense, net

$

(4,961

)

$

2,409

$

(6,190

)

$

14,297

Other income, net

$

(1,505

)

$

(4,964

)

$

(10,951

)

$

(10,465

)

Income before income taxes

$

15,702

$

71,482

$

239,858

$

178,494

Capital Expenditures American Eagle

$

12,728

$

30,033

$

61,139

$

85,033

Aerie

$

9,170

$

21,421

$

40,746

$

107,084

Other (1)

$

10,745

$

2,763

$

44,183

$

32,717

General corporate expenditures (2)

$

6,879

$

6,797

$

28,369

$

35,544

Total Capital Expenditures

$

39,522

$

61,014

$

174,437

$

260,378

(1) The Todd Snyder brand, Unsubscribed brand, and Quiet Platforms

have been identified as separate operating segments; however, as

they do not meet the quantitative thresholds for separate

disclosure, they are presented under the Other caption. (2) General

corporate expenses are comprised of general and administrative

costs that management does not attribute to any of our operating

segments. These costs primarily relate to corporate administration,

information and technology resources, finance and human resources

functional and organizational costs, depreciation and amortization

of corporate assets, and other general and administrative expenses

resulting from corporate-level activities and projects. (3) Refer

to GAAP to Non-GAAP reconciliations for additional detail.

AMERICAN EAGLE OUTFITTERS, INC. STORE INFORMATION

(unaudited)

Fourth Quarter YTD Fourth Quarter

2023

2023

Consolidated stores at beginning of period

1,199

1,175

Consolidated stores opened during the period AE Brand (2)

3

18

Aerie (incl. OFFL/NE) (3)

4

17

Todd Snyder

2

6

Unsubscribed

1

1

Consolidated stores closed during the period AE Brand (2)

(25

)

(32

)

Aerie (incl. OFFL/NE) (3)

(1

)

(2

)

Unsubscribed

(1

)

(1

)

Total consolidated stores at end of period

1,182

1,182

Stores by Brand AE Brand (2)

851

Aerie (incl. OFFL/NE) (3)

310

Todd Snyder

16

Unsubscribed

5

Total consolidated stores at end of period

1,182

Total gross square footage at end of period (in '000)

7,391

7,391

International license locations at end of period (1)

310

310

(1) International license locations (retail stores and concessions)

are not included in the consolidated store data or the total gross

square footage calculation. (2) AE Brand includes AE stand alone

locations, AE/Aerie side-by side locations, AE/OFFL/NE side-by-side

locations, and AE/Aerie/OFFL/NE side-by-side locations. (3) Aerie

(incl. OFFL/NE) includes Aerie stand alone locations, OFFL/NE stand

alone locations, and Aerie/OFFL/NE side-by-side locations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306853640/en/

Line Media 412-432-3300 LineMedia@ae.com

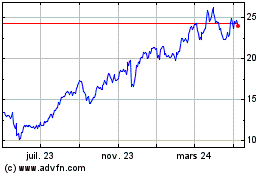

American Eagle Outfitters (NYSE:AEO)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

American Eagle Outfitters (NYSE:AEO)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025