UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. ___)*

Adecoagro S.A.

(Name of Issuer)

Common Shares, par value $1.50

per share

(Title of Class of Securities)

L00849106

(CUSIP Number)

Tether Holdings Limited

c/o SHRM Trustees

Trinity Chambers

Tortola, Road Town

British Virgin Islands, VG1110

+443333355842

with a copy to:

Daniel Woodard

McDermott Will & Emery LLP

One Vanderbilt Avenue

New York, New York 10017

(212) 547-5400

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

August 9, 2024

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or

13d-1(g), check the following box ¨

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d -7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. L00849106 | | Page

3 of 12 |

| 1 |

NAME

OF REPORTING PERSON |

|

|

| |

Tether Holdings Limited |

|

|

| |

|

|

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

¨ |

| |

|

(b) |

¨ |

| |

|

|

|

| 3 |

SEC

USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE

OF FUNDS (See Instructions) |

|

|

| |

OO |

|

|

| |

|

|

|

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

x |

| |

|

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION |

|

|

| |

British Virgin Islands |

|

|

| |

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER |

|

|

| |

0 |

|

|

| |

|

|

|

| 8 |

SHARED

VOTING POWER |

|

|

| |

10,048,249 (1) |

|

|

| |

|

|

|

| 9 |

SOLE

DISPOSITIVE POWER |

|

|

| |

|

|

|

| |

|

|

|

| 10 |

SHARED

DISPOSITIVE POWER |

|

|

| |

10,048,249

(1) |

|

|

| |

|

|

|

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

10,048,249 (1) |

|

|

| |

|

|

|

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

¨ |

| |

|

|

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

9.8% (2) |

|

|

| |

|

|

|

| 14 |

TYPE

OF REPORTING PERSON (See Instructions) |

|

|

| |

CO |

|

|

| |

|

|

|

|

|

| (1) | Includes 10,048,249 common shares, par value $1.50 per share (“Common Shares”) of Adecoagro

S.A. held by Tether Investments Limited, a wholly owned subsidiary of Tether Holdings Limited. |

| (2) | This percentage is calculated based upon 102,461,382 Common Shares outstanding as of June 30, 2024 as

set forth in the Issuer's Form 6-K filed with the Securities and Exchange Commission on August 12, 2024. |

| CUSIP No. L00849106 | | Page

4 of 12 |

| 1 |

NAME

OF REPORTING PERSON |

|

|

| |

Tether Investments Limited |

|

|

| |

|

|

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

¨ |

| |

|

(b) |

¨ |

| |

|

|

|

| 3 |

SEC

USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE

OF FUNDS (See Instructions) |

|

|

| |

WC |

|

|

| |

|

|

|

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

¨ |

| |

|

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION |

|

|

| |

British Virgin Islands |

|

|

| |

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER |

|

|

| |

0 |

|

|

| |

|

|

|

| 8 |

SHARED

VOTING POWER |

|

|

| |

10,048,249 |

|

|

| |

|

|

|

| 9 |

SOLE

DISPOSITIVE POWER |

|

|

| |

|

|

|

| |

|

|

|

| 10 |

SHARED

DISPOSITIVE POWER |

|

|

| |

10,048,249 |

|

|

| |

|

|

|

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

10,048,249 |

|

|

| |

|

|

|

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

¨ |

| |

|

|

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

9.8% (1) |

|

|

| |

|

|

|

| 14 |

TYPE

OF REPORTING PERSON (See Instructions) |

|

|

| |

CO |

|

|

| |

|

|

|

|

|

| (1) | This percentage is calculated based upon 102,461,382 Common Shares outstanding as of June 30, 2024 as

set forth in the Issuer's Form 6-K filed with the Securities and Exchange Commission on August 12, 2024. |

| CUSIP No. L00849106 | | Page

5 of 12 |

| 1 |

NAME

OF REPORTING PERSON |

|

|

| |

Ludovicus Jan Van der Velde |

|

|

| |

|

|

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

¨ |

| |

|

(b) |

¨ |

| |

|

|

|

| 3 |

SEC

USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE

OF FUNDS (See Instructions) |

|

|

| |

OO |

|

|

| |

|

|

|

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

¨ |

| |

|

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION |

|

|

| |

Netherlands |

|

|

| |

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER |

|

|

| |

0 |

|

|

| |

|

|

|

| 8 |

SHARED

VOTING POWER |

|

|

| |

10,048,249 (1) |

|

|

| |

|

|

|

| 9 |

SOLE

DISPOSITIVE POWER |

|

|

| |

|

|

|

| |

|

|

|

| 10 |

SHARED

DISPOSITIVE POWER |

|

|

| |

10,048,249 (1) |

|

|

| |

|

|

|

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

10,048,249 (1) |

|

|

| |

|

|

|

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

¨ |

| |

|

|

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

9.8% (2) |

|

|

| |

|

|

|

| 14 |

TYPE

OF REPORTING PERSON (See Instructions) |

|

|

| |

IN |

|

|

| |

|

|

|

|

|

| (1) | Includes 10,048,249 Common Shares held by Tether Investments Limited, a wholly owned subsidiary of Tether

Holdings Limited. |

| (2) | This percentage is calculated based upon 102,461,382 Common Shares outstanding as of June 30, 2024 as

set forth in the Issuer's Form 6-K filed with the Securities and Exchange Commission on August 12, 2024. |

| CUSIP No. L00849106 | | Page

6 of 12 |

| 1 |

NAME

OF REPORTING PERSON |

|

|

| |

Giancarlo Devasini |

|

|

| |

|

|

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

¨ |

| |

|

(b) |

¨ |

| |

|

|

|

| 3 |

SEC

USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE

OF FUNDS (See Instructions) |

|

|

| |

OO |

|

|

| |

|

|

|

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

¨ |

| |

|

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION |

|

|

| |

Italy |

|

|

| |

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER |

|

|

| |

0 |

|

|

| |

|

|

|

| 8 |

SHARED

VOTING POWER |

|

|

| |

10,048,249 (1) |

|

|

| |

|

|

|

| 9 |

SOLE

DISPOSITIVE POWER |

|

|

| |

|

|

|

| |

|

|

|

| 10 |

SHARED

DISPOSITIVE POWER |

|

|

| |

10,048,249 (1) |

|

|

| |

|

|

|

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

10,048,249 (1) |

|

|

| |

|

|

|

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

¨ |

| |

|

|

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

9.8% (2) |

|

|

| |

|

|

|

| 14 |

TYPE

OF REPORTING PERSON (See Instructions) |

|

|

| |

IN |

|

|

| |

|

|

|

|

|

| (1) | Includes 10,048,249 Common Shares held by Tether Investments Limited, a wholly owned subsidiary of Tether

Holdings Limited. |

| (2) | This

percentage is calculated based upon 102,461,382 Common Shares outstanding as of June 30, 2024 as set forth in the Issuer's Form 6-K filed

with the Securities and Exchange Commission on August 12, 2024. |

Item 1. Security and Issuer

This statement on Schedule 13D relates to the

common shares, par value $1.50 per share (“Common Shares”) of Adecoagro S.A., a société anonyme under

the laws of the Grand Duchy of Luxembourg (the “Issuer”). The address of the principal executive offices of the Issuer is

Vertigo Naos Building, 6, Rue Eugène Ruppert, L - 2453 Luxembourg. The Common Shares are listed on the New York Stock Exchange

under the ticker symbol “AGRO”.

Item 2. Identity and Background

(a)(b)(c)(f) This statement is being filed by

Tether Holdings Limited, a British Virgin Islands business company, Tether Investments Limited, a British Virgin Islands business company,

Ludovicus Jan Van der Velde, a natural person and citizen of the Netherlands and Giancarlo Devasini, a natural person and citizen of Italy

(collectively, the “Reporting Persons”). The principal business address of the Reporting Persons is SHRM Trustees (BVI) Limited,

P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110. The principal business of Tether Investments Limited is primarily to make strategic investments in emerging technologies, such as artificial

intelligence and peer-to-peer platforms, sustainable Bitcoin mining operations, and digital education initiatives. Tether Investments

Limited is also involved in funding and supporting projects that enhance financial inclusion and build resilient financial infrastructure

worldwide. Tether Holdings Limited is the holding company

for the Tether Group. The principal occupation of each Ludovicus Jan Van der Velde and Giancarlo Devasini is to serve as a director of

Tether Holdings Limited.

Ludovicus Jan Van der Velde and Giancarlo Devasini

are the directors of Tether Holdings Limited and share voting and dispositive power with respect to the securities held by Tether Holdings

Limited, including securities held by Tether Investments Limited, its wholly owned subsidiary. Messrs. Van der Velde and Devasini each

disclaim beneficial ownership of the securities held by Tether Holdings Limited and Tether Investments Limited.

The Reporting Persons have agreed to file this

Schedule 13D jointly pursuant to Rule 13d-1(k) under the Securities Exchange Act of 1934.

(d) None.

(e) None.

Certain information regarding Tether Holdings

Limited, Tether Investments Limited and their respective executive officers and directors is set forth on Schedule A attached hereto.

Item 3. Source and Amount of Funds or Other Consideration

Tether Investments Limited used cash from its

own working capital to make the purchases of Common Shares listed on Schedule B hereto.

Item 4. Purpose of the Transaction

The information set forth in Item 3 of this Schedule

13D is incorporated by reference in its entirety into this Item 4.

The Reporting Persons have acquired the Common

Shares acquired to date for investment purposes, and may from time to time increase (through the acquisition of additional securities

of the Issuer) or decrease (through the sale of all or a portion of the Common Shares) their investment in the Issuer, depending upon

multiple factors, including the price and availability of the Issuer’s securities, subsequent developments affecting the Issuer,

the Issuer’s business and prospects, other investment and business opportunities available to the Reporting Persons, general stock

market and economic conditions, conditions in the industries and jurisdictions in which the Issuer and its subsidiaries operate, tax considerations

and other factors. The Reporting Persons intend to review the Reporting Persons’ investments in the Issuer from time to time and,

in the course of such review, the Reporting Persons may take any of the foregoing actions with respect to their investment in the Issuer,

or make other decisions or take other actions with respect to the Issuer. These decisions and actions may include communicating from time

to time with the board of directors of the Issuer (the “Board”), members of management of the Issuer, other stockholders of

the Issuer or other third parties with respect to the evaluation or implementation of strategic alternatives relating to the Issuer, engaging

legal, financial, regulatory, technical, industry and/or other advisors to assist in any review or in making recommendations with respect

to such decisions or actions, and taking steps to implement alternative courses of action relating to the Issuer, including courses of

action that may be recommended by such advisors. Such courses of action may involve, without limitation, the proposal of or support for

extraordinary corporate transactions (including an acquisition, merger, reorganization or other similar transaction or liquidation) involving

the Issuer or any of its subsidiaries, including a public offer for all or part of the Issuer’s securities, a business combination

involving the Issuer or any of its subsidiaries, a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries;

changes in the present business, operations, strategy, future plans or prospects of the Issuer, financial or governance matters, changes

to the Board (including board composition) or management of the Issuer, changes to the capitalization, ownership structure, dividend policy,

business or corporate structure or governance documents of the Issuer, or any action similar to those enumerated above. Such discussions

and actions may be preliminary and exploratory in nature, and not rise to the level of a plan or proposal.

Other than as described above, the Reporting Persons

do not currently have any plans or proposals that relate to, or may result in, any of the matters listed in subparagraphs (a) through

(j) of Item 4 of Schedule 13D. However, as part of their ongoing evaluation of this investment and investment alternatives, the Reporting

Persons may consider such matters and, subject to applicable law, may formulate a plan or proposal with respect to such matters, and,

from time to time, may hold discussions with or make formal proposals to the Board, members of management of the Issuer, other stockholders

of the Issuer or other third parties regarding such matters.

Item 5. Interest in Securities of Issuer

(a) The Reporting Persons beneficially own an aggregate of 10,048,249

shares of the Issuer’s Common Shares, representing 9.8% of the outstanding Common Shares.

(b) Each of the Reporting Persons has shared voting and dispositive

power with respect to the beneficially owned 10,048,249 shares. This percentage is calculated based upon 102,461,382 Common Shares outstanding

as of June 30, 2024 as set forth in the Issuer's Form 6-K filed with the Securities and Exchange Commission on August 12, 2024.

(c) Schedule B sets forth the transactions in the Common Shares

effected by the Reporting Persons during the past 60 days.

(d) None.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer

The information set forth in Item 4 of this Schedule 13D is incorporated

herein by reference.

Item 7. Material to be Filed as Exhibits

1. Agreement of filing persons relating to filing of joint statement per Rule 13d-1(k).

SIGNATURES

After reasonable inquiry and to the best of the knowledge and belief

of the undersigned, the undersigned certifies that the information set forth in this Statement on Schedule 13D is true, complete and correct.

| |

August 16, 2024 |

| |

|

| |

TETHER HOLDINGS LIMITED |

| |

|

| |

By: |

/s/ Ludovicus Jan Van der Velde |

| |

Name: Ludovicus Jan Van der Velde |

| |

Title: Director |

| |

Tether

Investments Limited |

| |

|

| |

By: |

/s/ Ludovicus Jan Van der Velde |

| |

Name: Ludovicus Jan Van der Velde |

| |

Title: Director |

| /s/ Ludovicus Jan Van der Velde |

| | Ludovicus Jan Van der Velde, individually |

| | |

| | /s/ Giancarlo Devasini |

| | Giancarlo Devasini, individually

|

Schedule A

Executive Officers and Directors

The following sets forth the name, country of citizenship, position

and principal occupation of each executive officer and member of the board of directors of Tether Holdings Limited and Tether Investments

Limited. Except as indicated below, none of the persons listed below has been convicted of a crime (other than traffic violations or similar

misdemeanors) or been subject to proceedings pertaining to violations of securities laws within the past 5 years.

Executive Officers and Directors of Tether Holdings Limited:

| Name and Citizenship |

Position and

Principal Occupation |

Beneficial Ownership |

Business Address |

Paolo Ardoino, citizen

of Italy |

Chief Executive Officer |

0 |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

Giancarlo Devasini,

citizen of Italy |

Chief Financial Officer and Director |

10,048,249 (1) |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

Ludovicus Jan Van der

Velde, citizen of the

Netherlands |

Director |

10,048,249 (1) |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

Executive Officers and Directors of Tether Investments Limited:

| Name and Citizenship |

Position

and

Principal Occupation |

Beneficial Ownership |

Business Address |

Paolo Ardoino, citizen

of Italy |

Chief Executive

Officer |

0 |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

Giancarlo Devasini,

citizen of Italy |

Chief Financial

Officer and Director |

10,048,249 (1) |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

Ludovicus Jan Van der

Velde, citizen of the

Netherlands |

Director |

10,048,249 (1) |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

| (1) | Includes 10,048,249 common shares, par value $1.50 per share (“Common Shares”) of Adecoagro

S.A. held by Tether Investments Limited, a wholly owned subsidiary of Tether Holdings Limited. |

In October 2021, the U.S. Commodity Futures Trading

Commission (CFTC) instituted and settled regulatory proceedings against Tether Holdings Limited, Tether Limited, Tether Operations Limited,

and Tether International Limited (collectively, “Tether”) by way of an order accepting Tether’s payment of a civil monetary

penalty of $41 million without admitting or denying any of the CFTC’s findings or conclusions. The order settled CFTC allegations

that, from June 2016 to February 2019, Tether made untrue or misleading statements and omissions of material fact or omitted to state

material facts necessary to make statements made not true or misleading in connection with, among other things, whether USDT was fully

backed by U.S. Dollars held in bank accounts in Tether’s name.

In February 2021, the Office of the Attorney General

of the State of New York (NYAG) entered into an agreement with Tether and several Bitfinex (a group of companies with which Tether is

affiliated) companies to settle a 2019 proceeding brought by NYAG seeking an injunction related to, among other things, the transfer of

certain funds by and among Bitfinex and Tether. Without admitting or denying NYAG’s findings, Bitfinex and Tether agreed to settle

the NYAG proceeding by paying $18.5 million in penalties to the State of New York. The agreement further required Bitfinex and Tether

to discontinue any trading activity with New York persons or entities and to submit to mandatory reporting on certain business functions.

Schedule B

The following table lists all transactions completed by the Reporting

Persons in the Common Shares since June 17, 2024, which were all completed through open market purchases.

Tether Investments Limited:

| Date |

Shares Bought |

Price |

| July 29, 2024 |

370,690 |

9.4464 |

| July 30, 2024 |

629,310 |

9.45 |

| July 31, 2024 |

3,800,000 |

9.62 |

| August 1, 2024 |

300,000 |

9.4506 |

| August 9, 2024 |

1,420,000 |

10.0658 |

| August 12, 2024 |

1,500,000 |

10.4506 |

| August 13, 2024 |

1,590,762 |

11.6623 |

| August

14, 2024 |

283,144 |

11.2663 |

| August 16, 2024 |

154,343 |

11.3962 |

EXHIBIT 1

Joint Filing Agreement

In accordance with Rule 13d-1(k) promulgated under

the Securities Exchange Act of 1934, as amended, each of the persons named below agrees to the joint filing of this Schedule 13D, including

further amendments thereto, with respect to the common shares, par value $1.50 per share, of Adecoagro S.A. and further agrees that this

Joint Filing Agreement be filed with the Securities and Exchange Commission as an exhibit to such filing; provided, however, that no person

shall be responsible for the completeness or accuracy of the information concerning the other persons making the filing unless such person

knows or has reason to believe such information is inaccurate (as provided in Rule 13d-1(k)(1)(ii)). This Joint Filing Agreement may be

executed in one or more counterparts, all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the persons named below have

executed this Joint Filing Agreement as of the date set forth below.

| |

August 16, 2024 |

| |

|

| |

TETHER HOLDINGS LIMITED |

| |

|

| |

By: |

/s/ Ludovicus Jan Van der Velde |

| |

Name: Ludovicus Jan Van der Velde |

| |

Title: Director |

| |

Tether

Investments Limited |

| |

|

| |

By: |

/s/ Ludovicus Jan Van der Velde |

| |

Name: Ludovicus Jan Van der Velde |

| |

Title: Director |

| /s/ Ludovicus Jan Van der Velde |

| | Ludovicus Jan Van der Velde, individually |

| | |

| | /s/ Giancarlo Devasini |

| | Giancarlo Devasini, individually

|

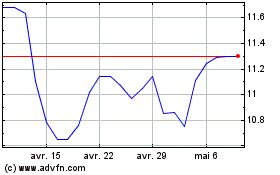

Adecoagro (NYSE:AGRO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Adecoagro (NYSE:AGRO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024