UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Submitted Pursuant to Rule 14a-6(g)

(Amendment No. ____)

|

|

1.

|

Name of the Registrant:

Ashford Hospitality Trust, Inc.

|

|

|

2.

|

Name of Person Relying on Exemption:

Cygnus Capital, Inc.

|

|

|

3.

|

Address of Person Relying on the Exemption:

3060 Peachtree Road NW, Suite 1080

Atlanta, GA 30305

|

|

|

4.

|

Written Material. The following written materials are attached:

Press release, dated October 2, 2020.

|

* * *

Written materials are submitted voluntarily

pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934. This is not a solicitation of authority to

vote your proxy. Cygnus Capital, Inc. is not asking for your proxy card and will not accept proxy cards if sent. The cost of this

filing is being borne entirely by Cygnus Capital, Inc. and its affiliates.

PLEASE NOTE: Cygnus Capital, Inc. is

not asking for your proxy card and cannot accept your proxy card. Please DO NOT send us your proxy card.

(Written

material follows on next page)

Recent Forbearance Agreements at Ashford

Hospitality Trust, Inc. and Newly Released Data Showing Hospitality Industry Conditions Are Improving, Reinforce Cygnus Capital,

Inc.’s View that AHT’s Highly Dilutive Exchange Offers Are Premature

|

|

·

|

AHT has loan forbearance or modification agreements in place for approximately 69% of its current

outstanding mortgage debt balance.

|

|

|

·

|

STR released U.S. industry occupancy and RevPAR statistics for the week ending September 26, 2020,

showing continued positive recovery in the hospitality industry.

|

|

|

·

|

Cygnus Capital shocked by latest fees paid to its external manager’s subsidiary, Lismore,

for negotiating AHT’s recent forbearance agreements, continuing a concerning pattern of self-dealing.

|

|

|

·

|

Cygnus Capital, who recently increased its common stock ownership from 7.8% to 8.3%, urges AHT

common stockholders to vote AGAINST all proposals at AHT’s upcoming special meeting to prevent ~94% dilution

of common stockholders.

|

ATLANTA, GEORGIA, October 2, 2020 /PRNewswire/--

Cygnus Capital, Inc. (together with its affiliates, “Cygnus Capital”), one of the largest stockholders of Ashford Hospitality

Trust, Inc. (the “Company” or “AHT”) (NYSE:AHT), beneficially owning approximately 8.3% of the Company’s

outstanding common stock, today highlighted significant progress made by AHT in managing its debt obligations, as well as continued

improvements in the U.S. hospitality industry. Yet, while AHT tries to claim that it has a looming liquidity crisis to justify

the highly dilutive exchange offers of all of AHT’s preferred stock into common stock, AHT management continues to self-deal

and pay large advisory fees to its external manager, Ashford, Inc. (“AINC”), and certain related entities, which approximately

70.1% of AINC is owned by AHT’s Chairman, Monty Bennett, his father and AHT’s Chairman Emeritus, Archie Bennett, Jr.,

and other AHT insiders.

AHT common stockholders have the power

to stop the exchange offers by voting AGAINST the proposals to amend AHT’s corporate charter and issue common

stock in the exchange offers at AHT’s upcoming special meeting scheduled to be held on October 6, 2020 (the “special

meeting proposals”).

AHT is Taking Steps Toward Recovery.

|

|

·

|

AHT disclosed yesterday that they have entered into forbearance agreements representing 34 hotels

and approximately $1.2 billion of debt.

|

|

|

·

|

In total, AHT now has loan forbearance or modification agreements in place for 61 properties representing

approximately 69% of its current outstanding mortgage debt balance.

|

|

|

·

|

While the capital position of AHT remains fragile, Cygnus Capital believes these forbearance agreements

show that the Company is navigating the effect of COVID-19 and may likely be able to retain a significant portion of its assets

as the impact of COVID-19 wanes over time.

|

The Hospitality Industry Continues to

Show Increasingly Strong Signs of Recovery.

Despite the initial volatility brought

on by the COVID-19 pandemic, the hospitality industry is showing continued signs of improvement. Independent research analysts

and recent data suggest a stable and constant steady growth in revenue to 2019 levels.

According to Deutsche Bank, STR and analysis

by Cygnus Capital, occupancy and RevPAR of U.S. hotels continues a slow, but steady improvement. By projecting the trendline of

these weekly data points forward, a recovery for the U.S. hospitality industry in 2021 is possible, as shown in the graphs below.

Of course, the pace of recovery is unknown

and AHT’s assets are somewhat different than U.S. industry averages, but the point is that the U.S. hospitality industry,

in general, is recovering.

If There Truly Is a Liquidity Crisis

at AHT, the Independent Directors Should Stop Allowing AINC to Drain AHT’s Funds.

AHT disclosed yesterday that it paid approximately

$6.07 million in fees to Lismore Capital II LLC, a subsidiary of AINC, for the recent forbearance agreements. In Cygnus Capital’s

view, such payments show a clear disregard for the limited capital of AHT. AHT is already paying an “Advisory Fee”

and “Management Fee” to AINC, along with a host of other fees, related party services and cost reimbursements to AINC

and certain related entities, some of which is being investigated by the SEC. AINC should not be paid twice or three times for

the same job.

Cygnus Capital Has Increased its Ownership

of AHT Common Stock from 7.8% to 8.3%.

Despite all its concerns about the decisions

being made by management and the independent directors of AHT, Cygnus Capital continues to believe there is tremendous value in

AHT and that AHT will recover and grow. That is why Cygnus Capital continues to invest in AHT.

Many Alternatives Exist to Create Value

for Common and Preferred Stockholders

|

|

1.

|

Do Nothing. Cygnus Capital believes the Company has sufficient cash (~$249 million as of

Q2 2020) to ride out the impact of COVID-19. Cygnus Capital believes that approximately 30% of AHT’s hotels are likely at

or very near property level breakeven, including debt service. The remainder of AHT’s hotels appear to need just a 10-15%

increase in occupancy to achieve this goal. Industry trends are positive and, with the Company’s recently announced forbearance

agreements, AHT’s balance sheet is strengthening. If AHT is able to make it through this difficult period, the common and

preferred stock could dramatically recover. AHT Management themselves have said $1.6B in equity value recovery is possible.

Cygnus Capital agrees.

|

|

|

2.

|

Sell to a Stronger REIT. AHT Management says they can’t sell assets in an orderly

way or merge with a larger REIT because a termination fee to AINC might be due. Have the independent directors of AHT formed a

committee to explore a sale? Have the independent directors of AHT even asked AINC what the amount of the termination fee is? Have

they explored a middle ground where AINC would stay as a third party manager for AHT’s assets inside a stronger acquiring

REIT? Cygnus Capital believes many REITs or private equity firms would be interested in acquiring the AHT portfolio. AHT has quality

assets. Cygnus Capital questions whether the independent directors of AHT have performed their fiduciary duties to AHT stockholders

to seriously consider such options.

|

|

|

3.

|

Take on “Bridge Loan” at AHT Corporate Level. AHT Management says AHT may have

to go bankrupt if the common stockholders do not approve the special meeting proposals needed to consummate the dilutive exchange

offers. AHT’s share price is already down 95.5% from its 52 week high. Yet, Cygnus Capital has spoken with several capital

providers who would be willing to extend a working capital line to the Company secured by the Company’s assets as a bridge

loan. This line would likely carry a low double digit interest rate and standard industry covenants for a loan of this type,

but it would provide a bridge for the next few quarters to give the Company more time to get back to a cash flow positive position.

|

|

|

4.

|

Hold a Rights Offering for Common Stockholders. AHT could also raise capital without diluting

all stockholders or paying underwriting fees through a rights offering. Given the level of trading in AHT over the past few weeks,

Cygnus Capital believes there would be significant interest.

|

|

|

5.

|

Reduce/Forbear Fees to AINC. Has AHT requested a reduction or forbearance in its fees payable

to AINC? Why should AINC insiders and management get paid while AHT common stockholders get diluted? AINC was able to pay an ~$8M

quarterly dividend just two weeks ago to its Series D preferred stockholders, nearly all of which is owned by the Bennett family.

Yet AHT claims it is about to go broke. Follow the money, it doesn’t add up.

|

Cygnus Capital urges AHT common stockholders

to vote AGAINST all proposals at AHT’s special meeting of stockholder to prevent the consummation of AHT’s exchange

offers which will dilute common stockholders by ~94% dilution.

If you have already voted FOR the special

meeting proposals, you have every legal right to change your vote. Vote AGAINST all special meeting proposals today!

About Cygnus Capital, Inc.

Cygnus Capital, Inc. is an integrated real

estate investment and alternative asset management company focused on opportunistic, special situation, and distressed real estate

investments. Cygnus Capital targets long term, absolute returns for investors by applying a differentiated approach to real estate

investing. By placing an emphasis on the acquisition, workout, and disposition of real estate debt assets characterized by their

complexity, inefficiency, and niche qualities, Cygnus Capital is able to target superior, absolute returns for its investors. Cygnus

Capital and its affiliates own in the aggregate 58,489 shares of the Company’s Series D Preferred Stock, 135,564 shares of

the Company’s Series F Preferred Stock, 160,284 shares of the Company’s Series G Preferred Stock, 197,413 shares of

the Company’s Series H Preferred Stock, and 153,651 shares of the Company’s Series I Preferred Stock.

* * *

Written materials are submitted voluntarily

pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934. This is not a solicitation of authority to

vote your proxy. Cygnus Capital is not asking for your proxy card and will not accept proxy cards if sent. The cost of this filing

is being borne entirely by Cygnus Capital and its affiliates.

PLEASE NOTE: Cygnus Capital is not asking

for your proxy card and cannot accept your proxy card. Please DO NOT send us your proxy card.

Source:

Christopher Swann

CEO, Cygnus Capital, Inc.

cswann@cygnuscapital.com

(404) 465-3685

5

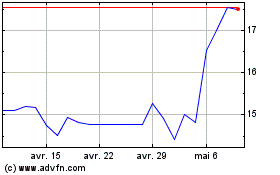

Ashford Hospitality (NYSE:AHT-G)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Ashford Hospitality (NYSE:AHT-G)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025